Comm 295 - Plant and Intangible Assets

1/32

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

33 Terms

Acquisition cost

- purchase price

- legal fees

- transportation

- installation/setup

land improvements

- to improve and not needed

- depreciated

- limited life

-----------------------

- fencing

- lighting

- parking lots

- paving

- landscaping

Land

needed to run first

- not depreciated

- unlimited life

-----------------------

- purchasing price

- legal fees

- grading

- demolition (less salvage)

- site cleaning

Revenue Expenditures

- reduce current income

- expense immediately

- maintains asset

------------------------------

repairs, cleaning

Dr. Revenue Expenditure

Cr. Cash

example

Dr. Maintenance expense

Cr. Cash

Capital Expenditures

Increase asset, affect income later

- add to asset and depreciated

- extend/improve useful life and capacity

-----------------------------------------------

building

Dr. Capital Expenditure

Cr. Cash

example

Dr. Stadium

Cr. Cash

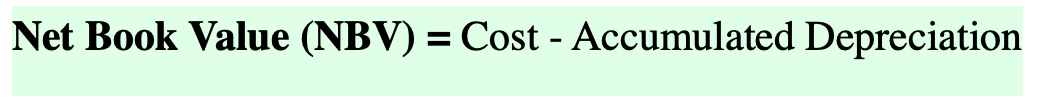

Depreciation Basic - NBV

- not a measure of market decline

- allocates asset over useful life

follows MATCHING PRINCIPLE

(exp = rev over time)

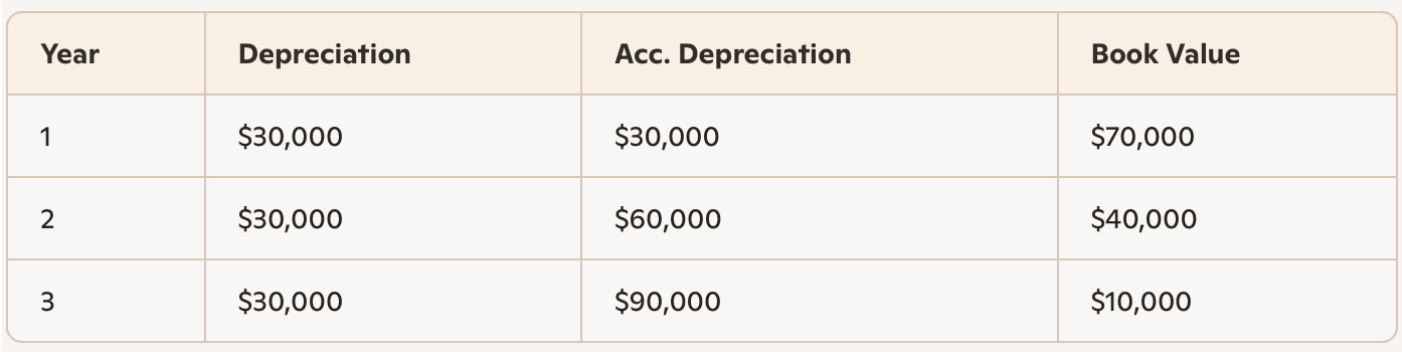

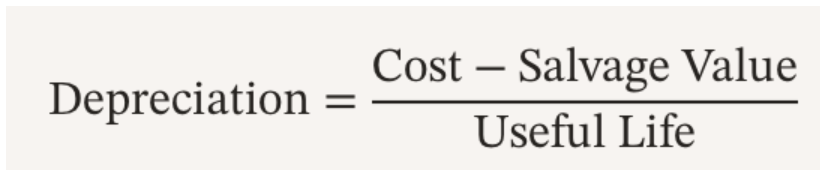

Straight-Line Method

Even depreciation every year

book value at the end of the year is just the salvage

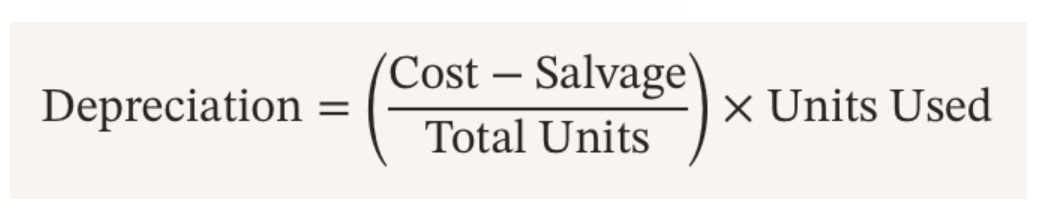

Units of activity method

Depreciation based on usage/output

first half is cost per unit

ending book value = salvage price

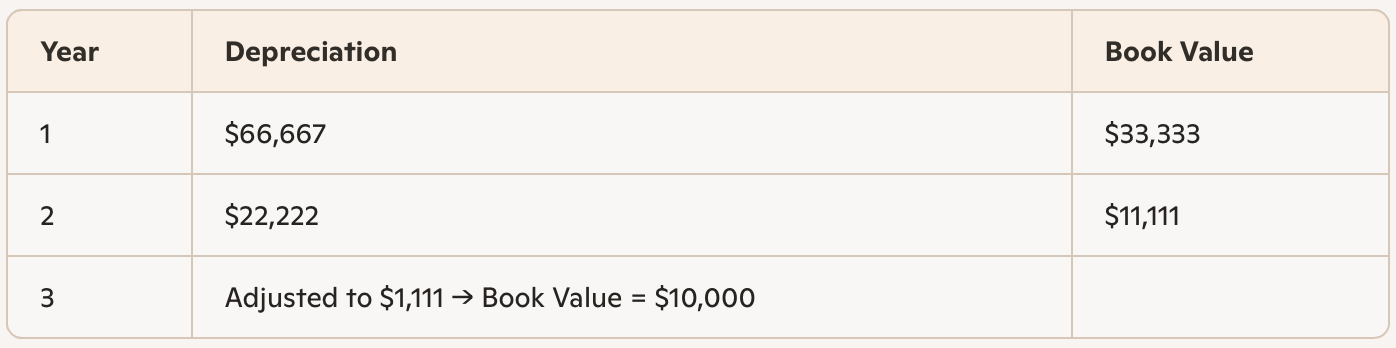

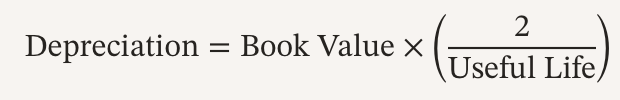

Double declining balance method

accelerated depreciation → more expense early

book value = beginning of year value

Ignore salvage at first

Stop depreciating once NBV = salvage

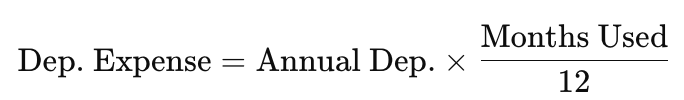

Partial year depreciation

if asset purchased mid-year

Fully depreciated asset

can still be used even if fully depreciated

No further depreciation recorded

Asset & accumulated depreciation remain on books

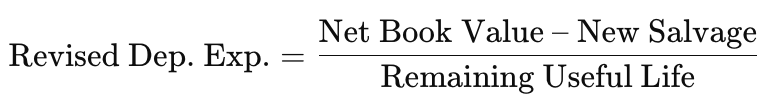

Changes in Depreciation Estimates

revise only for current and future years

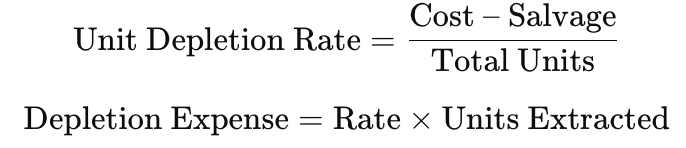

Natural Resources Equation

long-lived assets extracted from nature

Use depletion instead of depreciation

Natural Resources Journal Entries

1. Record Depletion

Dr. Inventory $XX

Cr. Accumulated Depletion $XX

2. When sold

Dr. COGS $XX

Cr. Inventory $XX

Dr. Cash $XX

Cr. Sales Revenue $XX

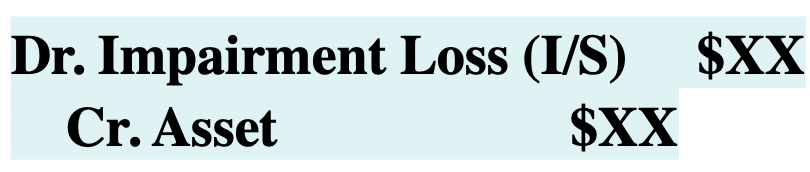

Asset Impairment equation and journal entries

Occurs when: BOOK VALUE > FAIR VALUE (due to damage, obsolescence…)

Impairment Loss = Book Value – Fair Value

Disposal of Assets (steps)

Depreciate to sale date

Calculate Net Book Value = Cost - Acc. Dep.

Compare NBV to sale price → gain vs loss

If proceeds > NBV → Gain

If proceeds < NBV → Loss

Disposal of assets (journal entries)

GAIN

Dr. Cash $XX

Dr. Accumulated Depreciation $XX

Cr. Asset $XX

Cr. Gain on Disposal (I/S) $XX

LOSS

Dr. Cash $XX

Dr. Accumulated Depreciation $XX

Dr. Loss on Disposal (I/S) $XX

Cr. Asset $XX

Fixed Asset Turnover

Net Sales / Avg. Net PPE

How efficiently PPE generates sales (is used)

Asset Turnover

Net Sales / Avg. Total Assets

Efficiency of all asset usage

Return on Assets (ROA)

Net Income / Avg. Total Assets

Profitability per dollar of assets

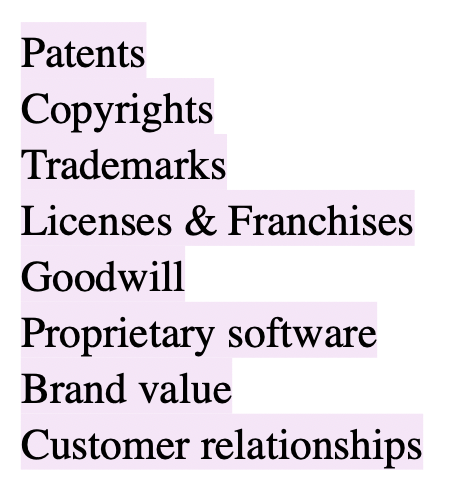

Intangible Assets

no physical substance that provide future benefits

Arise from legal or contractual rights

Can be sold, licensed, or transferred

Provide economic benefits over time

Research & Development (R&D)

not an intangible asset itself but leads to one

Research

expense immediately

Dr. R&D Expense $XXX

Cr. Cash $XXX

Development Costs

capitalize only if feasible and measurable future benefits are proven

Dr. Development Costs (Asset) $XXX

Cr. Cash $XXX

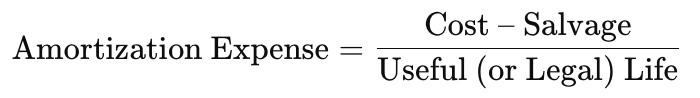

Definite / Finite life

Amortized (similar to depreciation) over useful or legal life (whichever shorter).

uses straight line method

salvage life assumed to be 0

Amortize over shorter of legal or useful life

Patents, Copyrights, Licenses, Franchises

Dr. Intangible Asset

Cr. CashP

Patents

Exclusive legal right (20 yrs in Canada).

Protects inventions; encourages innovation.

Amortized over shorter of useful life or legal life.

Copyrights

Protect artistic/literary works.

Legal life: life of creator + 50 years.

Example: Disney’s “Mickey Mouse”.

Franchises & Licenses

Legal right to operate or distribute goods/services (private or government).

Accounted for same as patents/copyrights.

Amortization (Straight-Line only):

Dr. Amortization Expense XXX

Cr. Accumulated Amortization XXX

No salvage value usually.

Innovation

Can produce intangible assets like patents

Most innovation costs -> expensed (research, testing)

Input: R&D spending

Output: patents, trademarks, new products, trade secrets

Indefinite Life Intangibles

IMPAIRMENT

test annually

If book value > fair value, record impairment loss

Dr. Impairment Loss (I/S) $YY

Cr. Asset $YY

Trademarks

not amortized

Tested annually for impairment

Renewable indefinitely (10-year terms)

Legal rights to use name/slogo/logo (not own)

Goodwill

unidentifiable intangible asset

Arises from acquistion of a business

Arises when a company buys another for > fair value of net assets

Represents premium paid for:

Brand reputation

Skilled employees

Customer relationships

Location

Dr. Assets (e.g., Equipment, Inventory, Intangibles)

Dr. Goodwill

Cr. Liabilities

Cr. Cash