Slides - 5. Inventory & COGS

1/40

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

41 Terms

Purchase merchandise for resale, Sell Merchandise and Deliver to Customer, Receive cash from Customer Toward Accounts Receivable

Operating Cycle

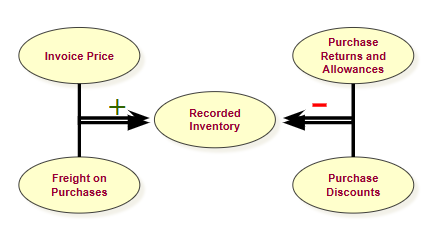

Draw Expenditures included in inventory

y

Purchase transactions are recorded directly in an inventory account.

Perpetual inventory

is always being updated every time a purchase/sale is made

Perpetual inventory

Sales require two entries to record: (1) the retail sale and (2) the cost of goods sold.

Perpetual inventory

No up-to-date record of inventory is maintained during the year.

Periodic Inventory

is only updated at the end of the period

Periodic Inventory

Sales require one entry to record the retail sale. Cost of goods sold is calculated.

Periodic Inventory

Beginning Inventory + Purchases =

Goods Available for Sale

Goods Available for Sale =

Beginning Inventory + Purchases

Goods Available for Sale - Ending Inventory =

COGS

COGS =

Goods Available for Sale - Ending Inventory

Inventory Cost Flow Assumptions

1. Specific Identification

2. First-in, First-out (FIFO)

3. Last-in, First-out (LIFO)

4. Weighted-Average Cost

When units are sold, the specific cost of the unit sold is added to cost of goods sold

specific identification

Most commonly used in businesses that have low sales volume of high dollar items

specific identification

Impractical when large quantities of similar items are stocked.

Specific identification

like putting new produce at the back with oldest produce in the front

FIFO

Best approximates physical flow for many businesses

FIFO

The newest stuff that we bought we are going to assume that is sold and then we are going to build our inventory based on older stuff

LIFO

Each unit in cost of goods sold and each unit in ending inventory has the (BLANK) average cost.

same

Weighted Average Cost =

Cost of Goods Available for Sale/Number of Units Available for Sale

Specific Identification or FIFO inventory values are the (BLANK) regardless of whether computed on a perpetual or periodic basis

same

In periods of rising prices, (BLANK) LIFO yields lower taxes than (BLANK) LIFO

periodic, perpetual

Weighted average perpetual inventory (BLANK) the weighted average cost after each inventory purchase

recalculates

In periods of rising prices, results in higher net income

FIFO

In periods of rising prices, results in lower taxes

LIFO

Smooths out effects of price changes.

Weighted Average

If using LIFO for tax, must also use for financial reporting

LIFO Conformity Rule

Ending inventory is reported at the

lower of cost or net realizable value (LCNRV)

Net Realizable Value =

Selling Price - Cost to sell

causes the recognition of ‘holding loss’ when inventory value drops prior to sale

Conservatism

Overstatement of ending inventory

Understates COGS, Overstates net income

Understatement of ending inventory

Overstates COGS, understates net income

Inventory turnover ratio =

COGS/Average Inventory

Days’ sales in inventory =

365/inventory turnover

the (BLANK) the inventory turnover ratio the better

higher

the (BLANK) the days’ sales in inventory the better

lower

LIFO Reserve =

Ending inventory (FIFO) - Ending Inventory (LIFO)

FIFO COGS =

LIFO COGS - the change in the LIFO reserve

Required disclosure if company reports using LIFO

LIFO Reserve

Useful in comparing companies using LIFO vs. FIFO

LIFO Reserve