Restrictions on free trade 4.

1/46

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

47 Terms

Define free trade

When people can trade without any barriers or restrictions

What are the 4 trade barriers/restrictions on free trade

Tariffs

Quotas

Subsidies to domestic producers

Non tarrif barriers

Define a tariff

A tax on imported goods

Who are tariffs imposed by

Governments

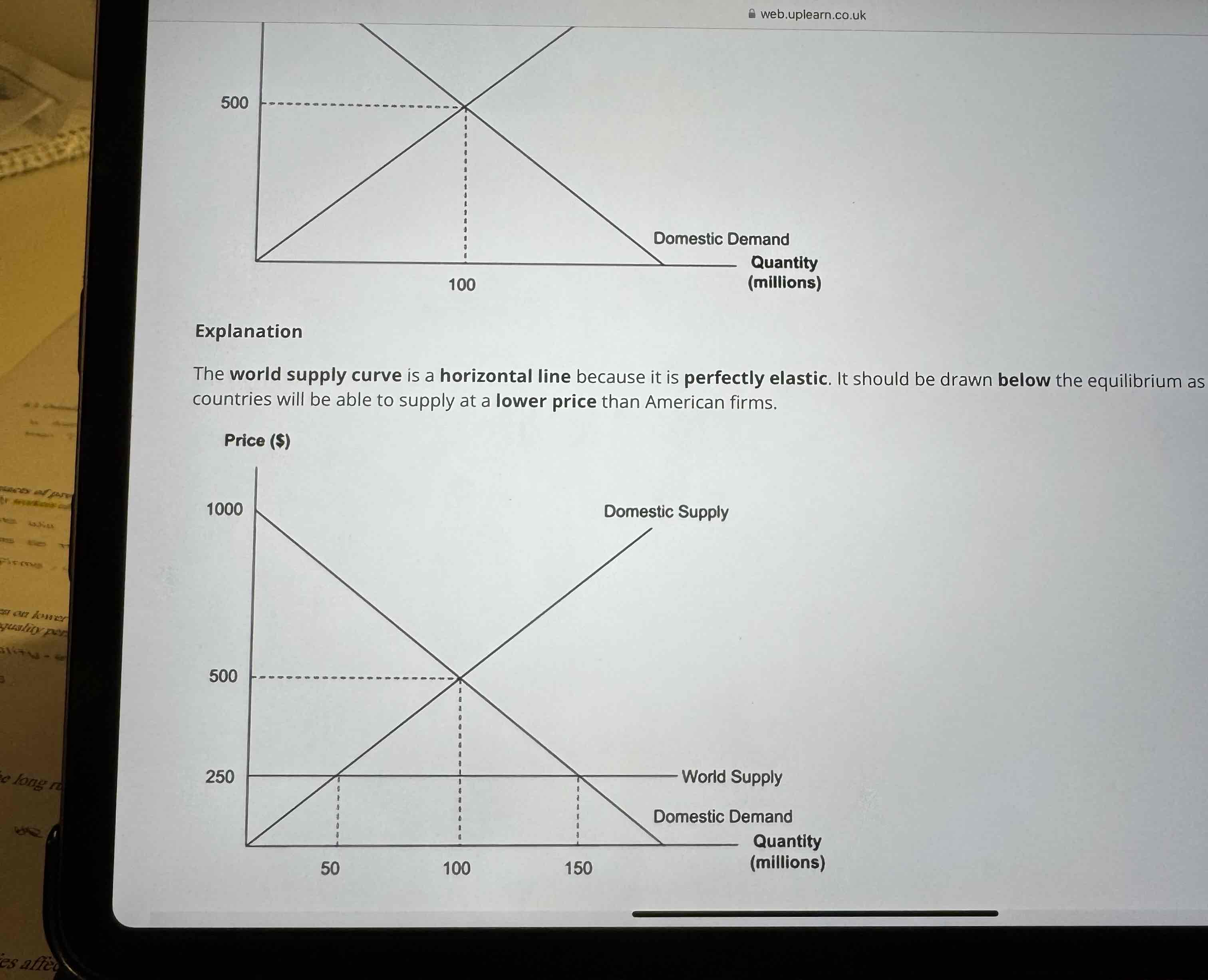

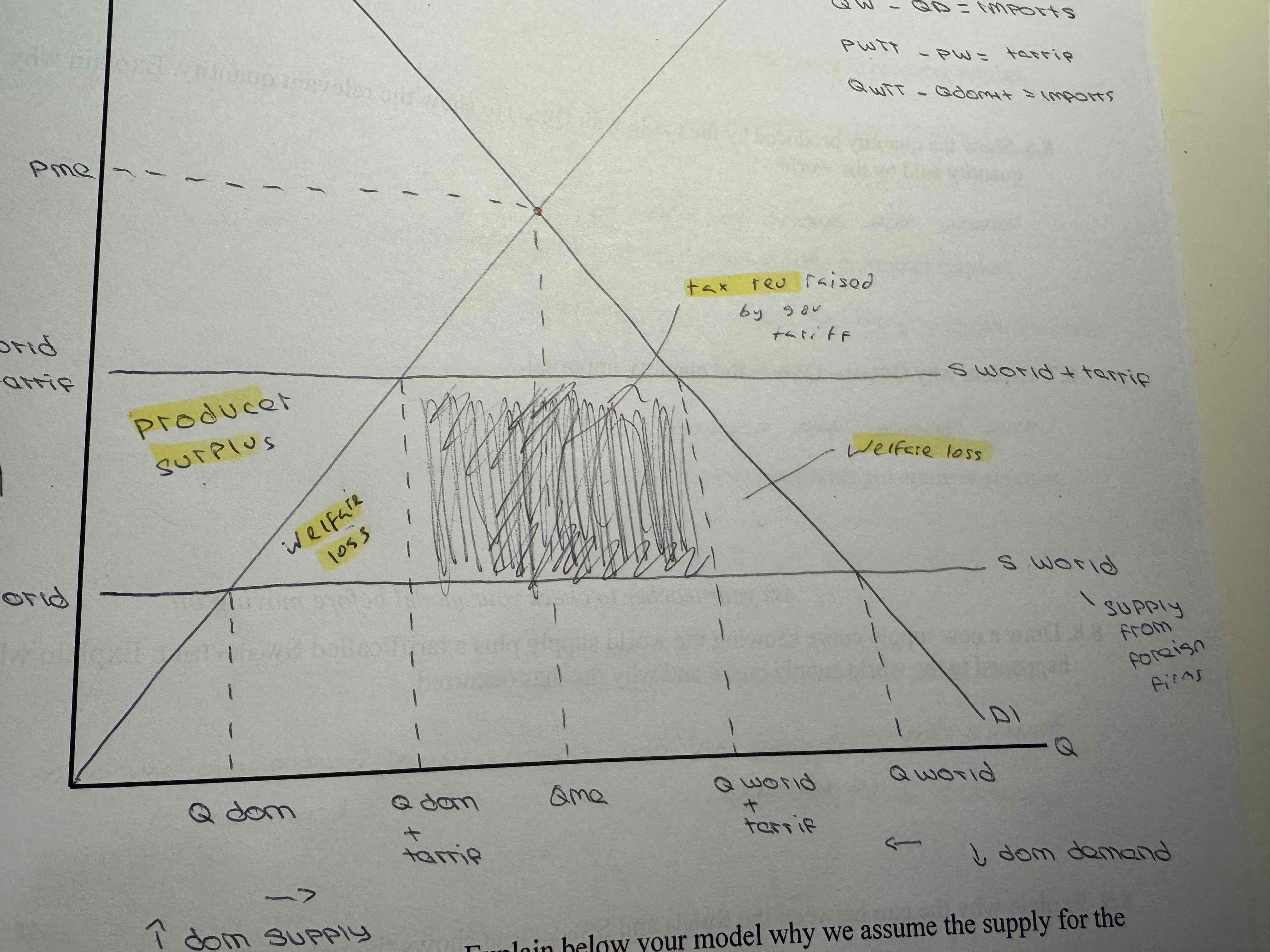

Show a tarrif diagram which has world supply and domestic supply

World supply curve is drawn below the equilibrium as we assume other countries will be able to supply at a lower price than American firms

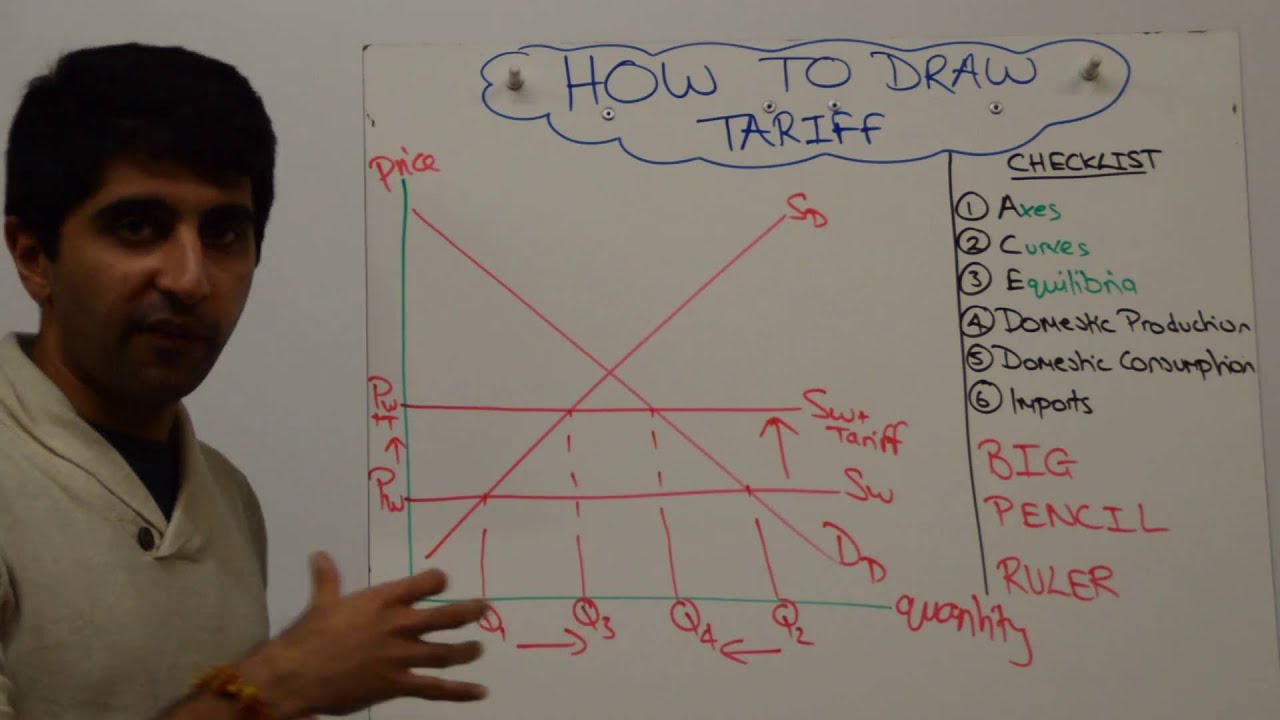

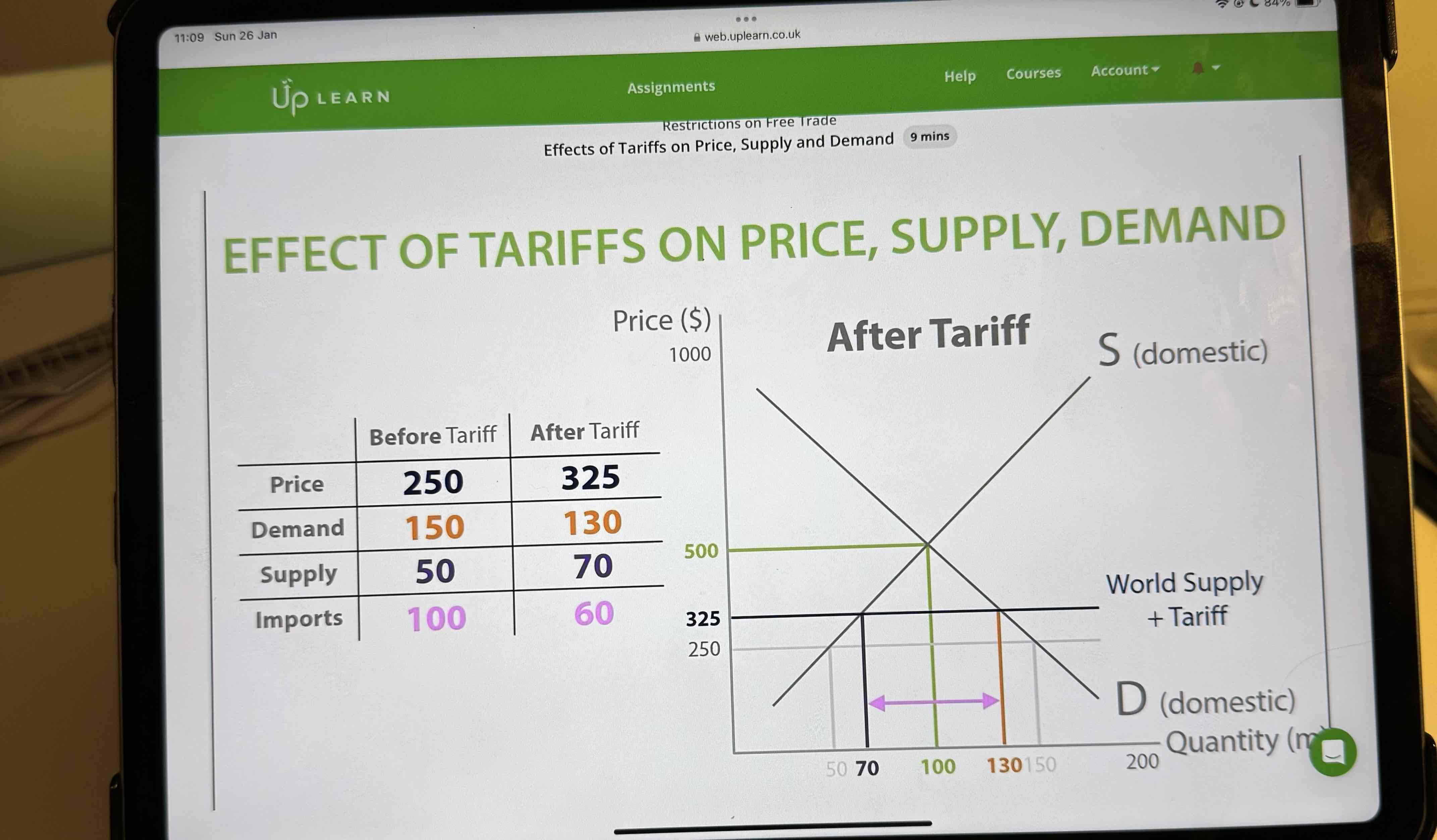

Show a tariff diagram

How do you find out the quantity of imports

the difference between domestic demand and domestic supply, it’s what they get from foreign firms

Using the picture, what’s the quantity of imports

100mill units which is 150-50

What’s the effect of a tarrif on price

Increase

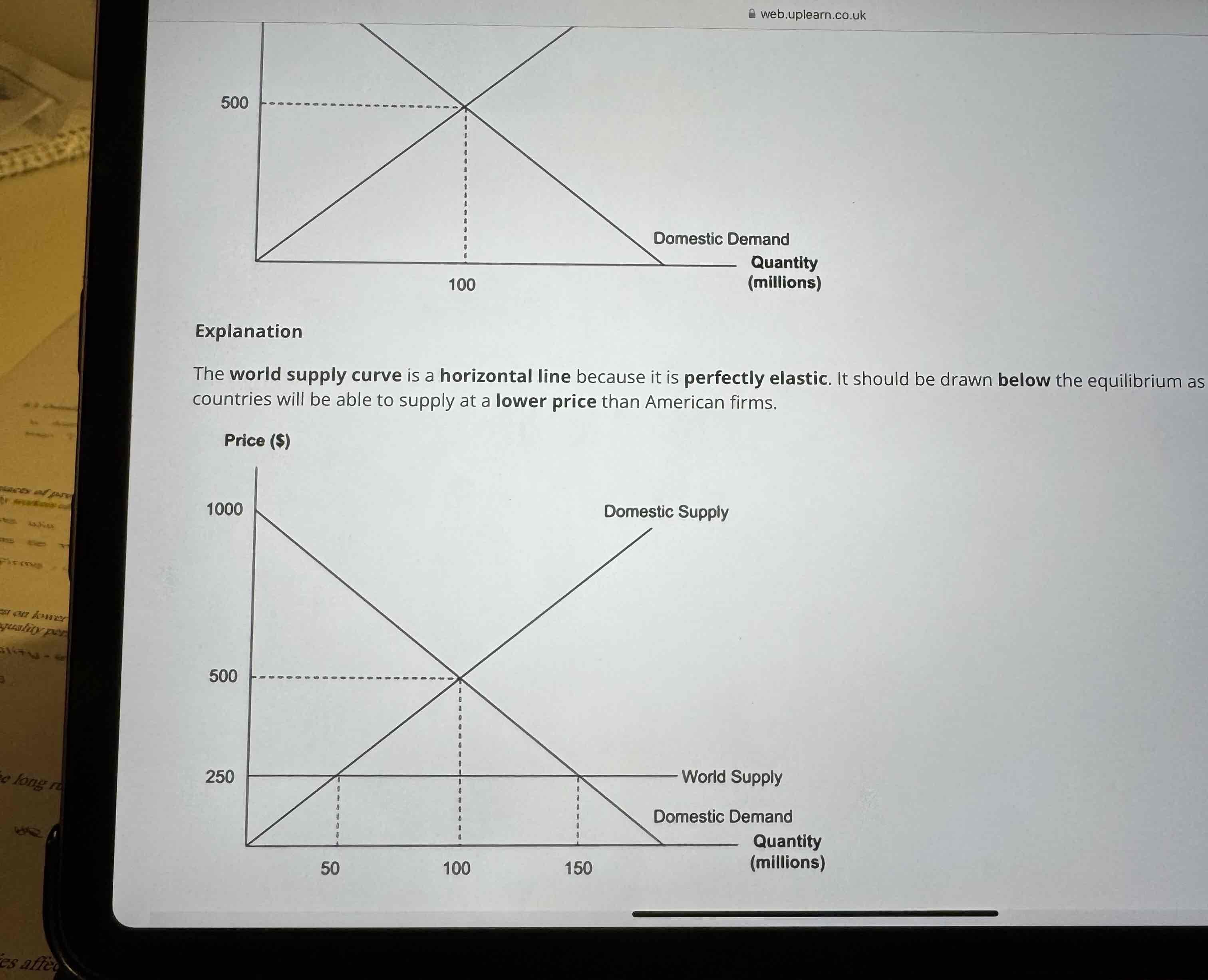

What’s the effect of tarrifs on supply and demand

demand decreased after tariff was introduced and supply increased after tariff and the quantity of imports decreased

Show this effect on a table

A tariff is a tax and so it will increase the price of the imported good and shift the world supply curve up. This will lead to an extension (increase) in domestic supply as domestic producers are willing to sell more at a higher price - remember they don't have to pay the tariff. There will be a contraction (decrease) in domestic demand as consumers don't want to pay a higher price.

If domestic consumers are demanding less and domestic producers are supplying more, there will be a reduction in imports.

Who pays the tarrif

The importer is responsible to pay this which goes to the government. This can raise prices which the consumer pays

Show the area of producer surplus, welfare loss and tax rev

What’s the effect of a tariff on producer and consumer surplus

Producer surplus has increased as they’ll be supplying more at higher prices

Consumer surplus decreased as there paying higher prices

What’s the effect of tariff on gov tax rev

It increased tax rev

Overall what’s the effect of a tariff

Protect domestic industry, domestic producers and gov have benefited

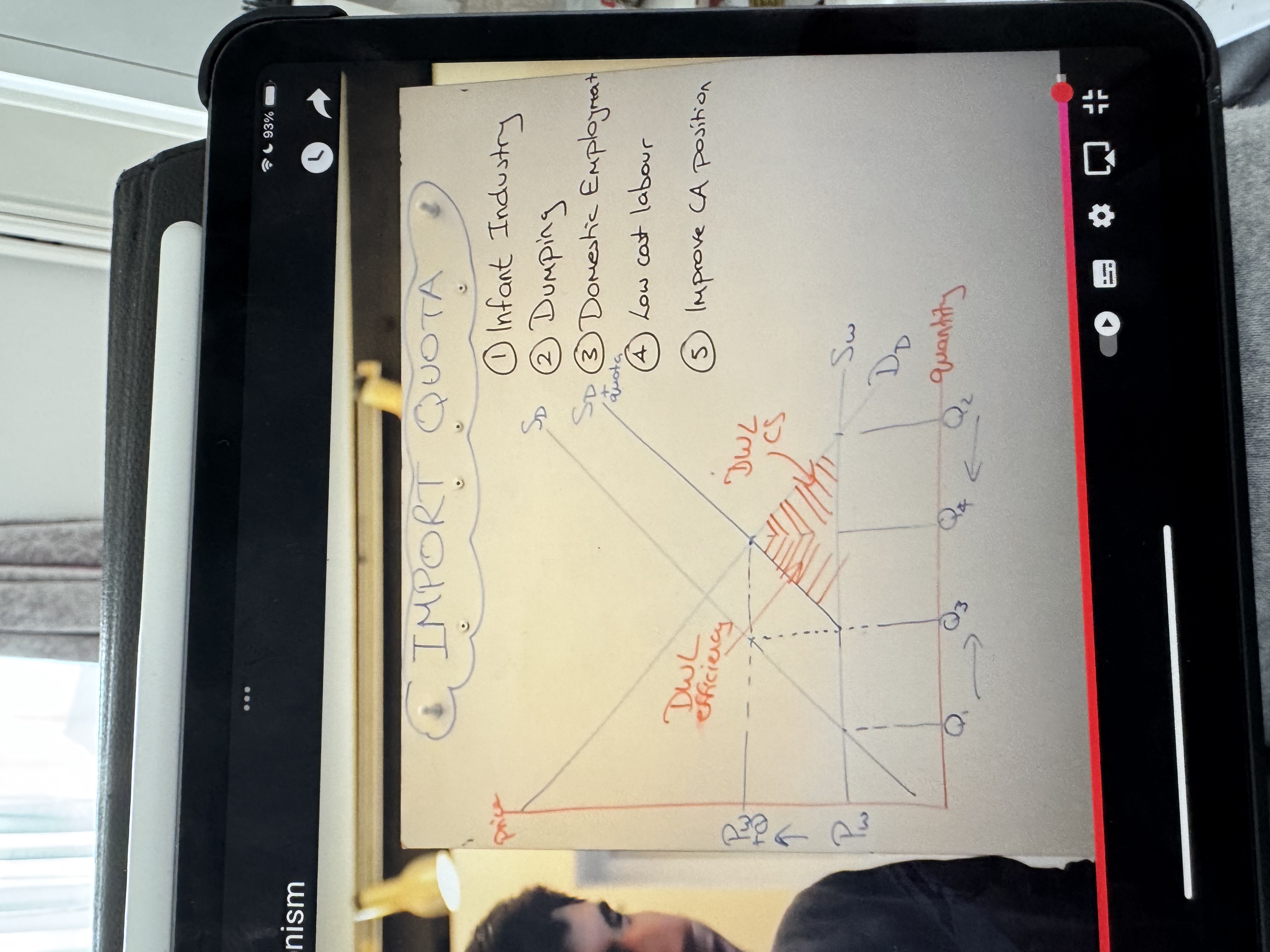

What’s a quota

Is a physical limit on the quantity of imported goods

What are the two main drawbacks of quotas

They don’t raise any tax revenue because there’s no tax placed on imports only a limit

They create shortages - Quotas completely restrict imported goods once the limit of imports are met

Give an example of a quota

Us limiting the number of Japanese car imports to 2 million a year

What’s the effect of quotas on domestic firms

Quotas will reduce imports and help domestic suppliers they also gain more revenue due to higher prices supplying more

What’s the effect on producer

Producer surplus increases as they benefit from higher prices and reduced competition which leads to more profits/investments

What’s the effect of quotas on world supply

World exporters will make less revenue – unless demand is very inelastic, meaning increase in price is greater than fall in quantity.

What’s the effect on employment

dom firms will be able to supply more this may increase the level of employment for domestic firms

Whats the effect on consumer surplus

Reduced consumer surplus as they’ll have to pay higher prices

What’s the effect on welfare loss in society

There will be a net welfare loss to society because the increase in producer surplus is outweighs the decline in consumer welfare

Show a quota graph

Dom demand decreases, domestic supply increases

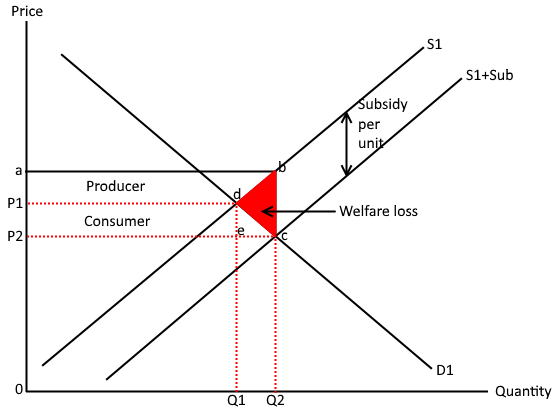

What are subsidies to domestic producers

When a government gives a grant to producers to increase supply

What’s the effect of a subsidy on price and quantity

A decrease in the cost of production will shift supply to the right this decreases price and increases quantity

Why are subsidies given to domestic producers

To make domestic goods relatively cheap compared to imports, it encourages domestic production to increase making it more competitive

What’s the effect on consumers

As domestic goods will be cheaper they should switch to their domestic goods reducing the demand for imports from abroad

What’s downside of using a subsidy

expensive for government

In the long run firms may become inefficient as they will rely on the subsidy

if supply is inelastic producers benefit more as they can maintain production levels whilst benefiting from lower costs, increasing rev

If it’s elastic

Consumers will only benefit slightly as there’s lower prices

How can a subsidy make a firm more internationally competitive

If firms are able to meet all of the domestic demand than the excess supply may be exported and dom employment can increase

What type of goods are subsidised

Merit goods usually such as agriculture, transport, housing, healthcare exc

What’s an example in the Uk that’s subsidies

Uk steel industry

Show a subsidy model

What’s a non tariff barrier

Any measure other than a customs tariff that acts as a barrier to free trade

What do non tariff barriers include

Non tariff barrier include regulations regarding health and safety, eviromental regulations and correct labelling of products which restrict free trade.

What’s customs duty

Another word for tariffs

What are the reasons to restrict free trade

Preventing dumping, protecting domestic employment, protecting infant industry, health and safety

What are trade barriers also known as

Protectionist barriers

What’s dumping

selling goods in a foreign market at a very low price, usually lower than the cost of production. This aims to increase market share and drive out competitors

How can a trade barrier be used to prevent dumping

A tariff will increase the price of an imported goods so that foreign firms won’t be able to undercut domestic firms by charging lower prices

How can trade barriers be used to protect domestic jobs

A restriction on imports will increase demand for domestic goods, this will increase the derived demand for labour and increase employment

What’s an infant industry

A newly established or developing industry which need protection from foreign markets as there unable to compete

What can be done to protect infant industry

restrictions on free trade so reduced production costs and decreased prices eg subsidy

How can health and safety be protected

The use of non tariff barriers such as health and safety regulations which doesn’t allow unsafe products to be imported

Analysis/ disadvantages of tariffs/ protectism

A tariff, causes market distortion. the price increases with an imposition of a tariff causes a decrease in consumer surplus not only with price but choice in the market so satisfaction loss.

Production inefficiency, allocation of resources can worsen.Dead weight welfare loss.

Cause Retaliation, The cost of the retaliation may be a lot higher than the benefits incurred from the tariff.

Size of tariff ? Impact, elasticity of demand and supply, aims to reduce imports so if there both inelastic the Q may increase but not by very much and contraction in demand not very much.