Profits

1/18

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

19 Terms

Types of profit

Type | Definition | Condition / Formula | Meaning |

|---|---|---|---|

Supernormal (abnormal) | Profit > normal profit | TR > TC (including opportunity cost) | Occurs when firms earn more than minimum required return |

Normal profit | Minimum profit to keep resources in current use | TR = TC (including implicit costs) | Break-even point |

Subnormal profit (loss) | Profit < normal profit | TR < TC | Firm making a loss but may stay in market short run if TR ≥ VC |

Accounting profit | TR − explicit costs | Ignores opportunity cost | |

Economic profit | TR − (explicit + implicit costs) | Used in theory — includes opportunity cost |

Normal, supernormal profits and losses

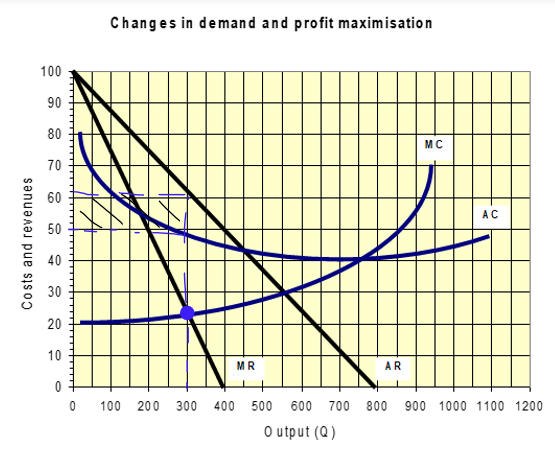

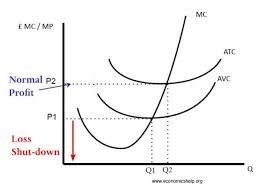

Long run shut down condition = ATC > AR

Short run shut down condition = AVC > AR

Short run condition

Why a firm should not shut down in the short run when AR > AVC but AR < ATC

In the short run, a firm has fixed costs, which must be paid whether it produces or not.

When AR < ATC, the firm is making a loss because total cost per unit exceeds revenue per unit.

However, when AR > AVC, the firm is covering all of its variable costs.

This means there is revenue left over after paying variable costs, equal to (AR − AVC) × Q, which contributes towards fixed costs.

If the firm shuts down in the short run, it earns zero revenue and avoids variable costs, but it must still pay all fixed costs, making a loss equal to total fixed costs (TFC).

If the firm continues producing, it still makes a loss, but this loss is smaller than TFC, because some fixed costs are being paid using revenue above AVC.

Therefore, the firm should continue producing in the short run to minimise losses.

Why the firm does shut down in the long run when AR < ATC

In the long run, all costs are variable — there are no fixed costs.

If AR < ATC in the long run, the firm cannot cover its total costs at any level of output.

Continuing to produce would therefore result in persistent losses with no unavoidable costs to justify staying.

Unlike in the short run, shutting down in the long run allows the firm to avoid all costs, reducing losses to zero.

As a result, it is rational for the firm to exit the industry in the long run when AR < ATC.

⭐ Killer one-line comparison (perfect for evaluation)

In the short run, firms continue producing to cover variable costs and reduce unavoidable fixed costs, but in the long run, when all costs are avoidable, firms exit the industry if AR is below ATC.

Short run shut down condition

In the short run, a firm must decide whether to continue producing or shut down, and this decision depends on the relationship between Average Revenue (AR), Average Variable Cost (AVC), and Average Total Cost (ATC).

When AR < ATC, the firm is making a loss because revenue per unit is less than total cost per unit.

However, when AR > AVC, the firm is still covering all of its variable costs of production.

At output Q₁, the difference (AR − AVC) represents revenue above variable costs per unit.

Therefore, total revenue above AVC, (AR − AVC) × Q₁, can be used to contribute towards the firm’s fixed costs, which must be paid regardless of output.

If the firm shuts down in the short run, output falls to zero, revenue becomes zero, and variable costs are avoided.

However, fixed costs are unavoidable in the short run, so the firm would make a loss equal to total fixed costs (TFC) if it exits production.

If the firm continues to produce at Q₁, it will still make a loss because AR < ATC, equal to (ATC − AR) × Q₁.

Crucially, this loss is smaller than TFC because the firm is using revenue above AVC to pay part of its fixed costs.

Since fixed costs are greater than the loss from continuing production, remaining in production minimises losses.

Therefore, it is rational for the firm to continue producing in the short run when AR > AVC but AR < ATC, even though it is making a loss.

When should a firm shut down

A firm should shut down in the short run when it is unable to cover its variable costs of production, even if it can still contribute nothing towards its fixed costs. This occurs when price (P) falls below average variable cost (AVC) at the profit-maximising output where marginal cost (MC) = marginal revenue (MR). In this case, each additional unit produced adds more to the firm’s losses than it contributes in revenue, making continued production economically irrational. By ceasing production, the firm minimises its losses to the level of fixed costs only, rather than incurring both variable and fixed costs. Conversely, if the price is above AVC but below average total cost (ATC), the firm will continue to produce in the short run, since it can still cover variable costs and part of fixed costs, reducing overall losses. In the long run, however, all costs are variable, and the firm will exit the market if it cannot make normal profit (i.e. if P < ATC), as continued operation would yield a lower return than could be earned elsewhere. Therefore, the shutdown decision reflects a firm’s ability to cover its costs in different time frames: short-run survival depends on covering variable costs, while long-run survival requires covering total costs and earning at least normal profit.

All different types of markets:

1. Perfect Competition

Definition:

A market with many small firms, identical (homogeneous) products, and no barriers to entry or exit. Firms are price takers, meaning they must accept the market price.

Key features:

Many buyers and sellers

Identical products (no differentiation)

Perfect information (everyone knows prices & quality)

Free entry and exit

Firms are price takers

Example: Agricultural markets (like wheat or milk, in theory).

Efficiency:

✅ Productively and allocatively efficient in the long run.

2. Monopolistic Competition

Definition:

A market with many firms selling slightly differentiated products. Firms have some control over price because of branding or quality differences.

Key features:

Many firms

Differentiated products (e.g. by style, brand, quality)

Some price-setting power

Low barriers to entry and exit

Examples: Restaurants, clothing brands, hairdressers.

Efficiency:

❌ Not productively or allocatively efficient (due to excess capacity and markup over marginal cost).

3. Oligopoly

Definition:

A market dominated by a few large firms that are interdependent — meaning each firm’s actions affect others. Products may be identical or differentiated.

Key features:

Few large firms dominate

High barriers to entry

Possible collusion or price-fixing

Firms are interdependent (strategic behaviour)

Non-price competition (advertising, branding, innovation)

Examples: Car industry, supermarkets, phone networks, airlines.

Efficiency:

❌ Often inefficient (collusion or price rigidity can reduce competition).

✅ Can be productively efficient if firms achieve economies of scale.

4. Monopoly

Definition:

A market with one firm that is the sole producer of a product with no close substitutes. The firm is a price maker.

Key features:

Single seller

Unique product (no substitutes)

High barriers to entry (legal, technological, or resource-based)

Significant price-setting power

Examples: Water supply, rail networks, electricity distribution (often regulated monopolies).

Efficiency:

❌ Usually not productively or allocatively efficient (higher prices, less output).

✅ Can achieve economies of scale if very large.

Short run vs long run

Period | Key difference | Profit possible |

|---|---|---|

Short run | At least one factor fixed | Firms can make supernormal, normal, or subnormal profit |

Long run (perfect competition) | All factors variable; entry/exit possible | Only normal profit in equilibrium (new entry erodes supernormal profit) |

Long run (imperfect competition) | Barriers to entry may allow sustained supernormal profit |

Proficiency and efficiency links

Productive efficiency - Productive efficiency means producing goods or services at the lowest possible cost — that is, using the fewest resources to make the maximum output.

Allocative Efficiency |

|

|---|---|

Productive Efficiency |

|

Dynamic Efficiency |

|

X-inefficiency |

|

Profit and market structures

Market Structure | Number of Firms | Product Type | Barriers to Entry | Price Control | Example |

|---|---|---|---|---|---|

Perfect Competition | Many | Identical | None | None (price takers) | Wheat, milk |

Monopolistic Competition | Many | Differentiated | Low | Some | Restaurants, clothes |

Oligopoly | Few | Identical or Differentiated | High | Considerable | Airlines, supermarkets |

Monopoly | One | Unique | Very High | Total | Water supply |

Market Structure | Typical Profit (Short Run) | Long Run Profit | Reason |

|---|---|---|---|

Perfect competition | Can make supernormal | Normal | Entry removes supernormal |

Monopolistic competition | Can make supernormal | Normal | Low entry barriers |

Oligopoly | Likely supernormal | Possibly sustained | High barriers + collusion |

Monopoly | Supernormal possible | Supernormal sustained | High barriers to entry |

why is this? High barriers to entry prevent new firms from entering the market.

That means existing firms don’t face new competition — so they can keep earning supernormal (above normal) profits in the long run.

🧩 Step-by-step explanation:

In the short run:

A firm (in any market) might earn supernormal profit — total revenue exceeds total costs (including opportunity cost).

Normally, this attracts new firms to enter the market.

In markets with low barriers (like perfect or monopolistic competition):

New firms enter easily, increasing supply.

This drives prices down, until firms only earn normal profit (where TR = TC).

→ Long-run equilibrium = normal profit.

In markets with high barriers to entry (like oligopoly or monopoly):

New firms cannot enter, even if profits are high.

Barriers can include:

Legal restrictions (patents, licenses)

High startup costs

Control of key resources

Economies of scale

Brand loyalty / advertising power

Because no new competitors arrive to push prices down, the incumbent firm can keep prices high and output low, sustaining supernormal profits indefinitely.

⚙ Example:

A pharmaceutical company with a patent on a drug has legal protection.

→ No other firm can make the same drug.

→ The firm faces no new competition.

→ It can charge high prices and earn supernormal profit for as long as the patent lasts.

📈 In short:

High entry barriers = no new competition → price stays high → supernormal profit persists in long run.

Profit area:

Found between AR and AC at chosen output.

Per unit profit = AR − AC

Total profit = (AR − AC) × Q

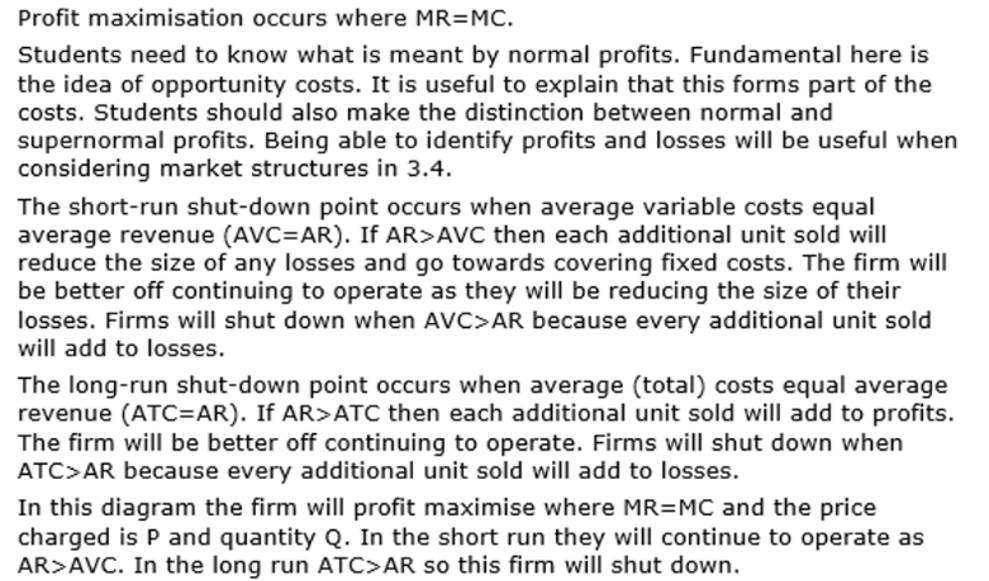

Profit maximisatin is where MR=MC

Then you extrapolate line up to AC and then AR

Graph:

AC: U-shaped

AR: downward sloping (except perfect competition: horizontal)

Supernormal profit: AR above AC

Normal profit: AR = AC

Subnormal profit: AR below AC

Role and importance of profit

Role | Explanation |

|---|---|

Signal & incentive | High profits attract new firms → resource reallocation |

Reward for risk-taking | Entrepreneurs compensated for uncertainty |

Source of finance | Retained profits fund investment & R&D |

Indicator of efficiency | High profits can show productive use of resources |

Government tax revenue | Profits subject to corporation tax |

Why profit may vary from firm to firm

Factor | Explanation |

|---|---|

Market power | Monopolies can set higher prices |

Cost efficiency | Lower AC → higher profit margins |

Barriers to entry | Restrict competition → sustain profits |

Elasticity of demand | Inelastic demand → higher mark-ups possible |

Objectives | Some firms prioritise sales or growth over profit |

Innovation / R&D | Successful innovation can create monopoly power → higher profit |

External factors | Regulation, tax, exchange rates, demand shocks |

Profit Maximisation vs Revenue Maximisation

Feature | Profit Max | Revenue Max |

|---|---|---|

Condition | MR = MC | MR = 0 |

Output | Lower | Higher |

Price | Higher | Lower |

Profit level | Highest possible | Lower (sub-optimal) |

Reason | Owners’ goal | Managers’ goal (sales, prestige, market share) |

Diagram | MR & MC intersect at profit-max point | MR = 0 at TR peak |

Shut-Down Condition

Condition | Meaning |

|---|---|

TR ≥ TVC | Firm covers variable costs → continues to operate (even if making loss) |

TR < TVC | Firm should shut down immediately (can’t cover variable costs) |

At shut-down point: | P = AVCₘᵢₙ |

Summary

Firms maximise profit where MR = MC; total profit is maximised when the difference between TR and TC is greatest. Supernormal profit attracts new entry in competitive markets, while barriers to entry allow it to persist.

Application

The UK government attempted to liberalise the UK energy market and break the monopoly of the “Big Six” suppliers. Many new firms entered the market but tens of them collapsed from 2021 onwards as European wholesale energy prices soared well above the retail energy price cap imposed by regulator OFGEM. In this sense, a price cap may have made the market less contestable over time.