Chapter 23: Fiscal Policy and the Federal Budget

- Non discretionary government spending is determined by current obligations, policies, and demographics, rather than by policymaker discretion.

- ^^Nondiscretionary spending accounts for about 60 percent of the federal budget.^^

- The other 40 percent of spending in the federal budget is discretionary government spending. Policymakers can make choices about the amount to fund discretionary programs. Discretionary spending items include spending on national defense, transportation, and education.

- ^^A tax is a financial obligation placed on taxpayers.^^

- Income taxes are taxes imposed as a percentage of income earned.

- The U.S. has a progressive income tax system, which means that as your income rises, you are required to pay a larger percentage of that income as taxes.

- There are currently six income tax brackets that are taxed at different rates.

- Each of these income tax brackets is charged a different marginal tax rate.

- The marginal tax rate is the tax rate on income within a tax bracket.

- Corporate income tax revenues come from similar taxes imposed on U.S. corporations, although corporate tax bracket values differ from individual tax brackets.

- Other taxes that provide revenue for the federal government include social insurance and retirement taxes and excise taxes.

- ^^Social insurance and retirement taxes include the taxes we pay for Social Security, Medicare, and unemployment insurance.^^

- ^^Excise taxes are primarily taxes on the production and sale of certain goods, including gasoline, tobacco, and alcohol.^^

- ^^The Social Security Trust Fund is the fund where the government keeps money that bas been paid as Social Security taxes but is not yet required to pay for Social Security benefits.^^

- A budget deficit occurs when the amount of government spending in a given period is larger than the amount of government revenue from taxes and earnings during that period.

- A budget surplus occurs when the amount of government spending in a given period is less than the amount of government revenue from taxes and earnings during that period.

- The federal debt is the accumulated federal deficit borrowing that has not been paid off.

- Because the government can borrow money from the public and from itself, ^^the total debt can be split into publically-held debt and government-held debt.^^

- <<Publically held debt is the portion of the federal debt that is owed to public lenders, including individuals, businesses, foreign governments, and other investors.<<

- <<Government held debt is the portion of the federal debt that is owed to U.S. government agencies including the Social Security Trust Fund, the Federal Housing Administration, and federal employees' retirement trust funds.<<

- <<Publically held debt is the largest component of the federal debt.<<

- The choice to allow government deficits and debts involves trade-offs. On the one hand, federal government borrowing can be used to smooth federal spending and increase economic stability during economic downturns or during periods of high demand on government spending (wartime, for example). On the other hand, we have to pay interest payments on our debt, and those interest payments have opportunity costs.

- INCOME INEQUALITY:

- when the government borrows money from its own citizens, it generates a liability and an asset.

- The liability comes because taxpayers must make interest payments and repay the principal to die debt holders.

- The debt is an asset to the debt holders because lenders earn interest in exchange for their willingness and ability to loan money to the government.

- When debt holders arc US. citizens, payments on the debt cause a transfer of income from taxpayers to debt holders.

- Because the average US. taxpayer tends to have lower income than the average debt holder, the income transfer from taxpayers to debt holders transfers money from those with lower incomes to those with higher incomes.

- As a result, government borrowing can cause the gap between those with more income and those with less income to grow over time.

- One signal of a country's ability to repay its debt is its debt-to-GDP ratio.

- The debt-to-GDP ratio measures the size of a country's debt as a percentage of the country's gross domestic product.

- ^^A low debt-to-GDP ratio is an indicator that a country is producing enough to pay back its debts relatively quickly if necessary, or that its productivity is enough to sustain its debt level into the future.^^

- ^^A high debt-to-GDP ratio indicates that a country would have a more difficult time paying back its debt.^^

- Another controversy surrounding government debt stems from the impact of debt payments on future generations.

- In order to make interest payments on its debt, the government can choose to borrow more money, increase taxes, or spend less.

- More borrowing involves a higher interest burden in the future. Reducing government spending is difficult politically, particularly for nondiscretionary government spending.

- Higher taxes make people's take-home pay smaller, reducing their ability to spend on goods and services, invest in businesses, or save for the future.

- ^^If investment in business and infrastructure is lowered today, future generations will have less capital and technology available than they would have had otherwise.^^

- Crowding out occurs when government borrowing pushes up interest rates, which causes a reduction in private consumption and investment.

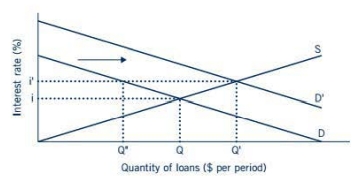

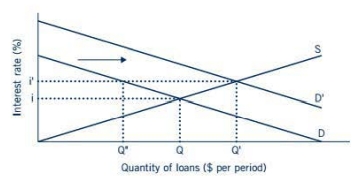

- The figure below illustrates the market for loans.

- The price of loans, measured on the vertical axis, is the interest rate that borrowers must pay in order to take out a loan.

- The quantity of loans, measured on the horizontal axis, reflects the amount of money borrowed and lent per period.

- The supply of loans (S) comes from savers and investors who are willing to lend their money to borrowers.

- The demand for loans (D) comes from individuals and businesses who want to borrow money.

- The demand for loans also comes from federal government borrowing.

- The intersection of the supply (S) and demand (D) for loans determines the equilibrium interest rate (i) and quantity of loans made in the market (Q).

- Suppose that an increase in government borrowing causes an increase in the demand for loans from D to D'.

- The increase in demand causes the interest rate to rise from i to i'.

- The higher interest rate reduces the ability of businesses and individuals to borrow and invest in new technologies and machinery or borrow to spend on consumption.

- Faced with higher interest rates, businesses and individuals will borrow less than they would have otherwise, as shown by the movement from Q to Q" on the original demand curve (D).

- This reduction in private borrowing results in crowding out because government borrowing causes a reduction in private sector borrowing and investment.

- Fiscal policy is the use of government spending and taxation to influence the economy.

- Discretionary fiscal policy is when policymakers actively change government spending or taxation in response to changes in the economy.

- Non discretionary fiscal policy is an automatic fiscal policy that stabilizes economic activity without active policy changes.

- Expansionary fiscal policy is used to increase aggregate demand.

- Contractionary fiscal policy is used to decrease aggregate demand.

- The time delay between an actual change in economic activity and the ability for policymakers and others to discern the change is called the recognition lag.

- The economy may be well into a downturn before we have the data to recognize that fiscal policy may be warranted.

- Once policymakers recognize the downturn they must decide what to do about it.

- The time it takes for Congress and the president to agree on what fiscal policy to use is called the administration lag.

- Finally, once the policy is enacted, it takes time for the policy to have an impact.

- Each of these lags can vary in length depending on the complexity of the fiscal policy and the degree to which politicians can reach agreement and compromise.

- ^^If expansionary fiscal policy comes after the economy has stabilized from a recession and started growing, it can exacerbate that growth and cause unnecessary inflation.^^

- ^^Alternatively, if contractionary fiscal policy arrives as the economy has moved from a period of expansion into stability or into recession, fiscal policy can make the recession worse.^^