Indirect Taxes and Subsidies

1/15

Earn XP

Description and Tags

Government Intervention

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

16 Terms

What is an indirect tax?

A tax paid on the consumption of goods/services, which the tax burden is passed from producers to consumers

Why may the government impose a indirect tax?

Discourage consumption of demerit goods

Raise government revenue

How is the indirect taxes transferred?

Governments put the tax on producers → why the supply curve shifts

Producers put it on their products which then is paid by the consumers

What are the two types of indirect taxes?

Ad valorem

Specific

What is a specific tax?

A fixed tax per unit of output (specific amount)

What is tax incidence?

The share/burden of the total tax to be paid

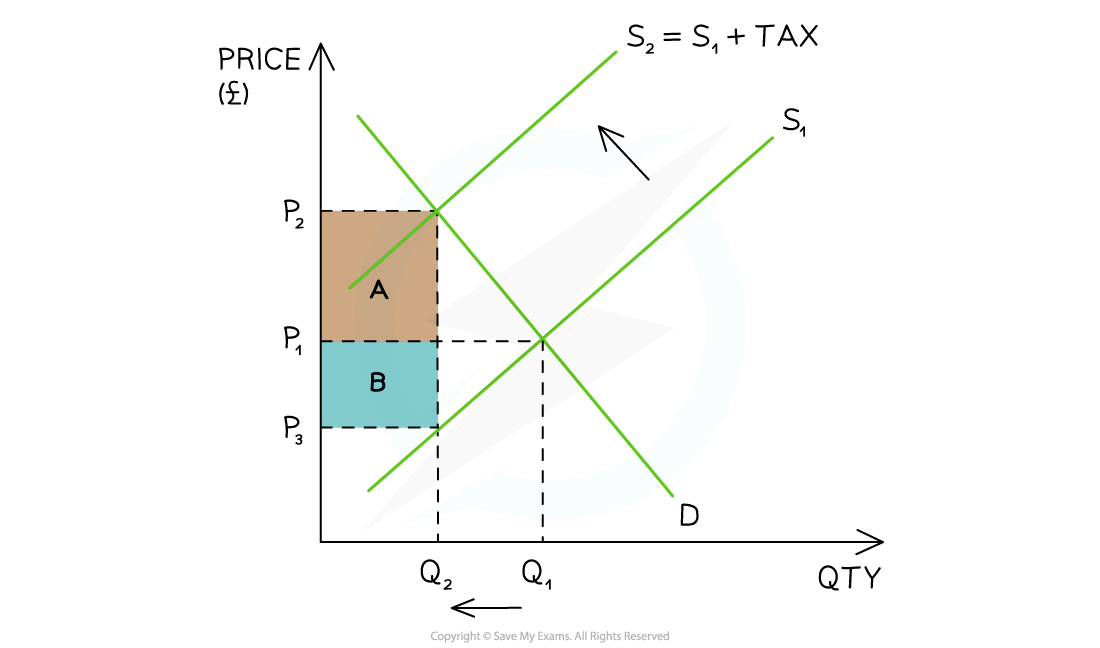

In this diagram, what is the consumer incidence (share) and producer incidence (share) of the tax?

Consumer incidence: AREA A = P2-P2 x Q2

Producer incidence: AREA B = P1-P3 x Q2

What is a ad valorem tax?

A tax that is a percentage of the purchase price

The more goods/services consumed, the larger the tax bill

Causes supply curve to diverge from original supply curve

Raises significant government revenue

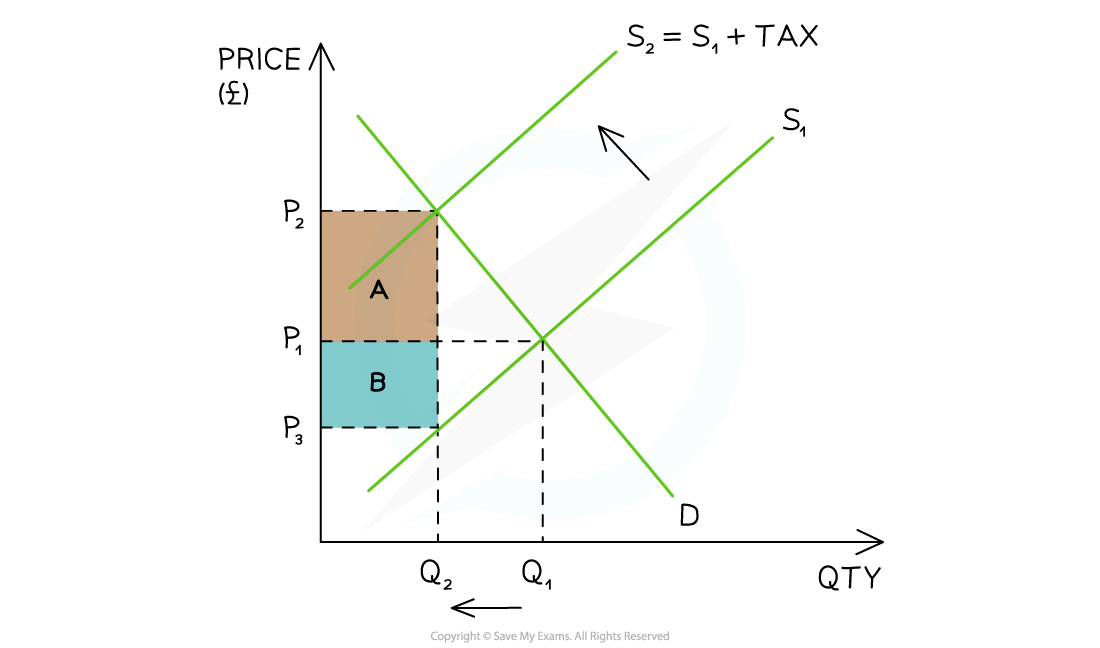

In this diagram, what is consumer and producer incidence?

Consumer incidence: Area A = P2-P1 x Q2

Producer incidence = Area B = P1-P3 x Q2

What are the advantages of indirect taxes?

Raise the price and reduces the QD of demerit goods

Reduces external costs of consumption and production

Raises revenue for government programs

What are the disadvantages of indirect taxes?

The effectiveness of the tax in reducing the use of demerit foods depends on the PED

Many consumers who purchase products that are price inelastic will continue to do so

It may help create illegal markets as consumers seek to avoid paying the taxes

Producers may be forced to lay off some workers as output falls due to the higher prices

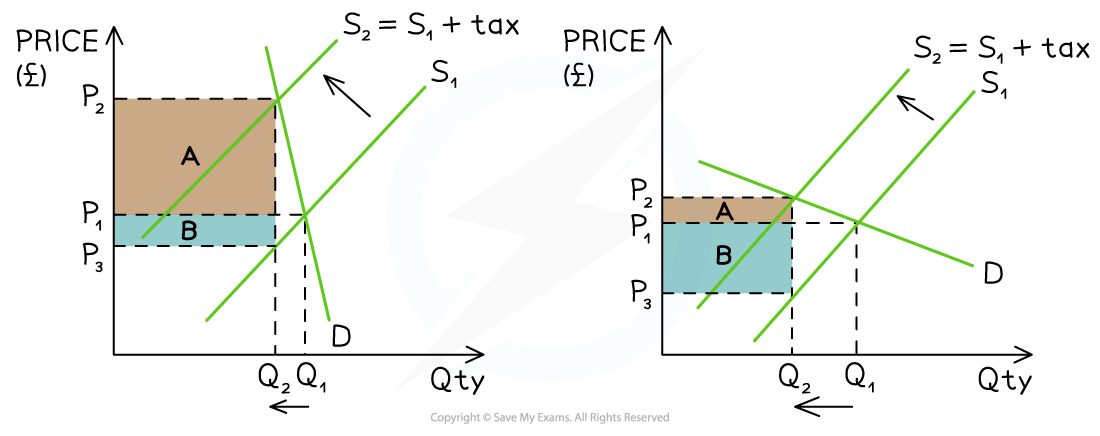

How does PED influence the effectiveness of indirect taxes?

Inelastic goods:

Curve is steep

Producers pass on much higher proportion of the tax to consumers and pay the rest themselves

QD decreases but in a much smaller proportion compared to the increase in price

Elastic goods:

Curve is flatter

Producers pass on a much smaller proportion of the tax to consumers and pay the rest themselves

QD decreases but by a much larger proportion in comparison to the increase in price

Both goods:

Increase in price and decrease in QD

Tax revenue is collected

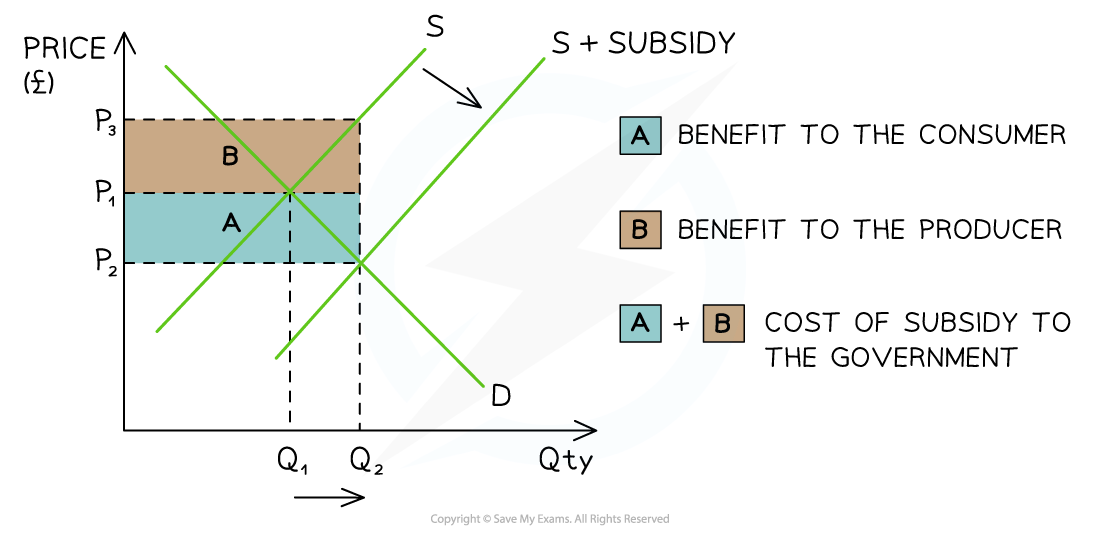

What are subsidies?

The per unit amount of money given to a firm by the government to increase production or increase the provision of a merit good

How is a subsidy shared between producers and consumers?

Producers keep some of the subsidy

Pass the rest to consumers in the form of lower prices

Determined by the PED of the product

What are the advantages of producer subsidies?

Can be targeted to helping specific domestic industries

Lower prices and increases demand for merit goods

Helps to change destructive consumer behaviour over a longer period of time

Can be used to help domestic firms compete internationally

What are the disadvantages of producer subsidies?

Distorts the allocation of resources in markets

There is an opportunity cost associated with the government expenditure

Subsidies are prone to political pressure and lobbying by powerful business interests

Subsidies can disincentives firms from becoming more efficient or competitive as they provide extra funds which reduce the need to be more competitive