AP Macroeconomics Vocabulary

1/99

Earn XP

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

100 Terms

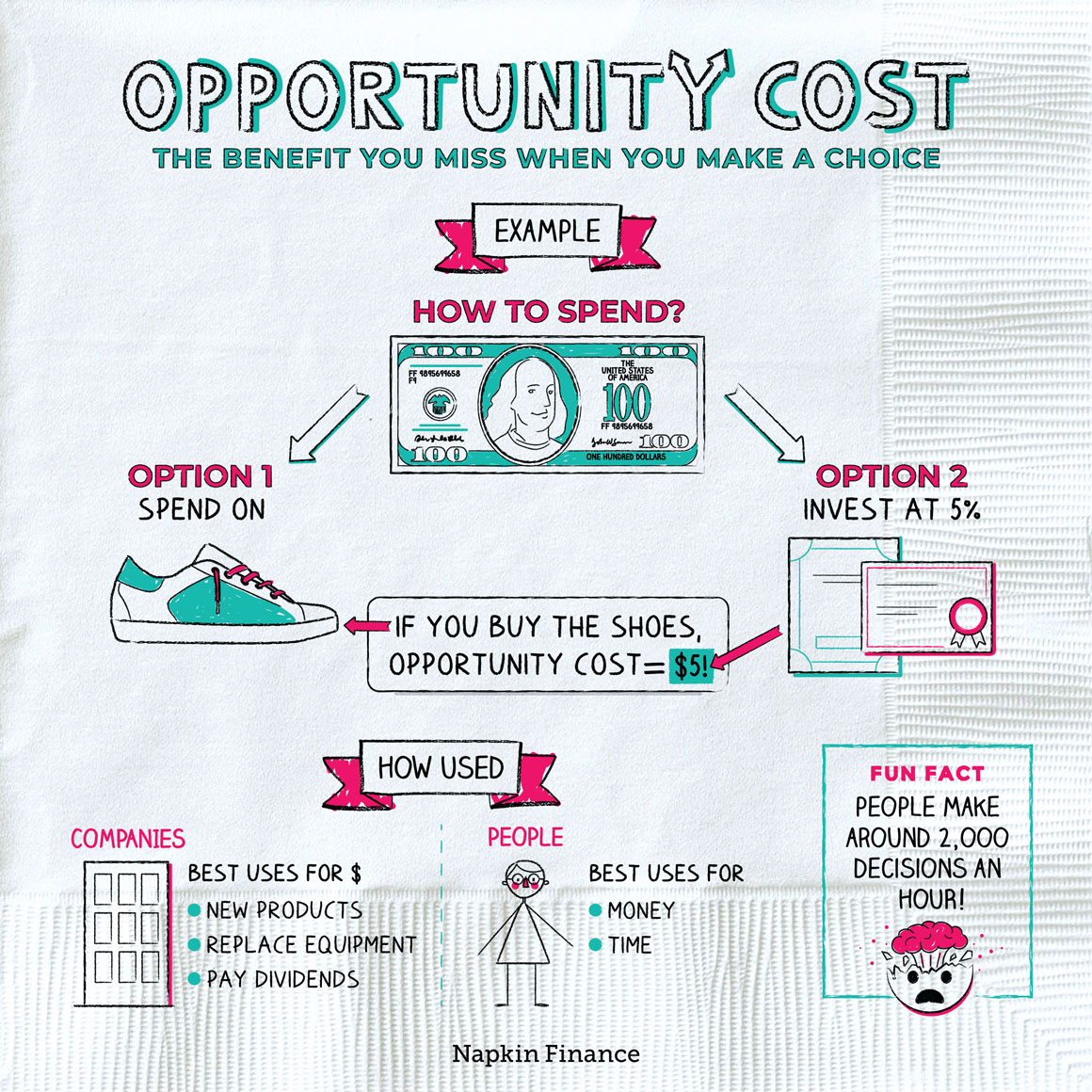

Opportunity Cost

The value of what you must give up when you make a particular choice.

Utility

The satisfaction received from consuming a good or service.

Marginal Analysis

When you focus on the additional cost or benefit associated with a decision.

Microeconomics

The study of the economy of a region or individual business.

Macroeconomics

The study of the economy of a nation.

The basic economic problem.

Having unlimited wants with limited resources.

Economic Resources

Land, Labor, Capital, and Entrepreneurial Ability

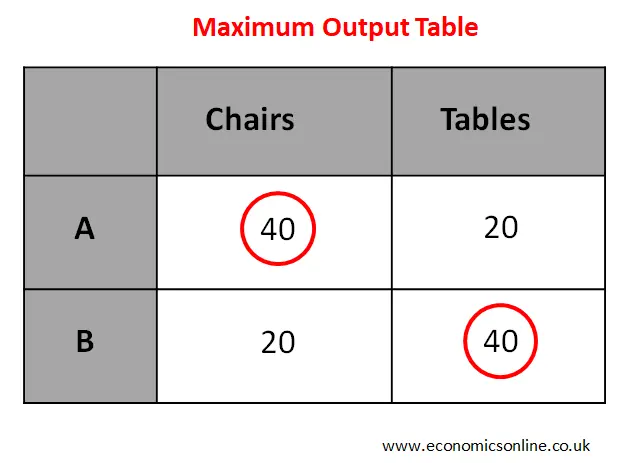

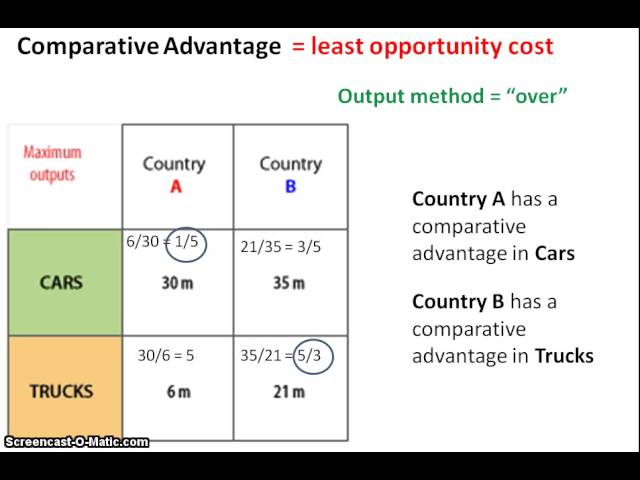

Absolute Advantage

When a country can produce more of an item than its trading partner

Comparative Advantage

When a country loses less when producing an item compared to its trading partner

Market System

Consumers hold the power to direct the course of the economy

Command Economy

Government coordinates economic activities

Physical Capital

Factories, tools, and equipment used to produce items

Land

Natural resources used to produce goods and services

Labor

People’s physical and mental efforts used to help make goods

Entrepreneur

Risk taker and owner that uses other resources to produce goods or services

Economic Investment

Spending to accumulate capital equipment to increase production

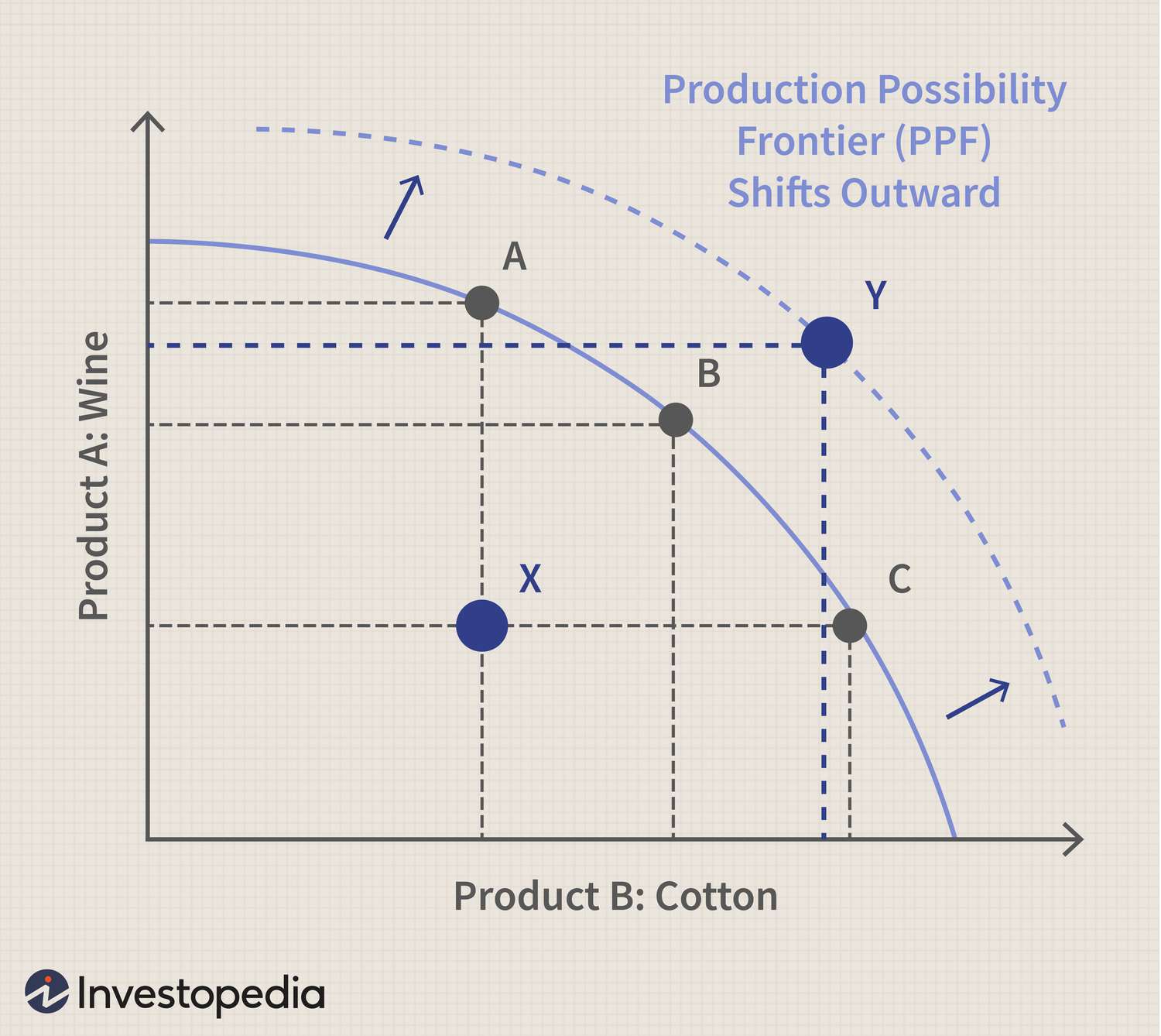

Production Possibilities Curve (PPC)

Model of the economy that shows consequences of tradeoffs in the economy

Law of increasing opportunity cost

When productions of one good result in more and more sacrifices of another good

Economic Growth

Producing more with finite resources. Shown by outward shift on PPC.

Law of Demand

an increased price results in a decrease of demand (inverse relationship)

Law of supply

an increase in price increases the amount supplied (direct correlation)

Law of diminishing marginal utility

as a consumer increases consumption of a good, the resulting satisfaction decreases

Income Effect

The change in a quantity demanded resulting from a change in real income or purchasing power

Substitution

The change in quantity demanded resulting from a price change in a related product

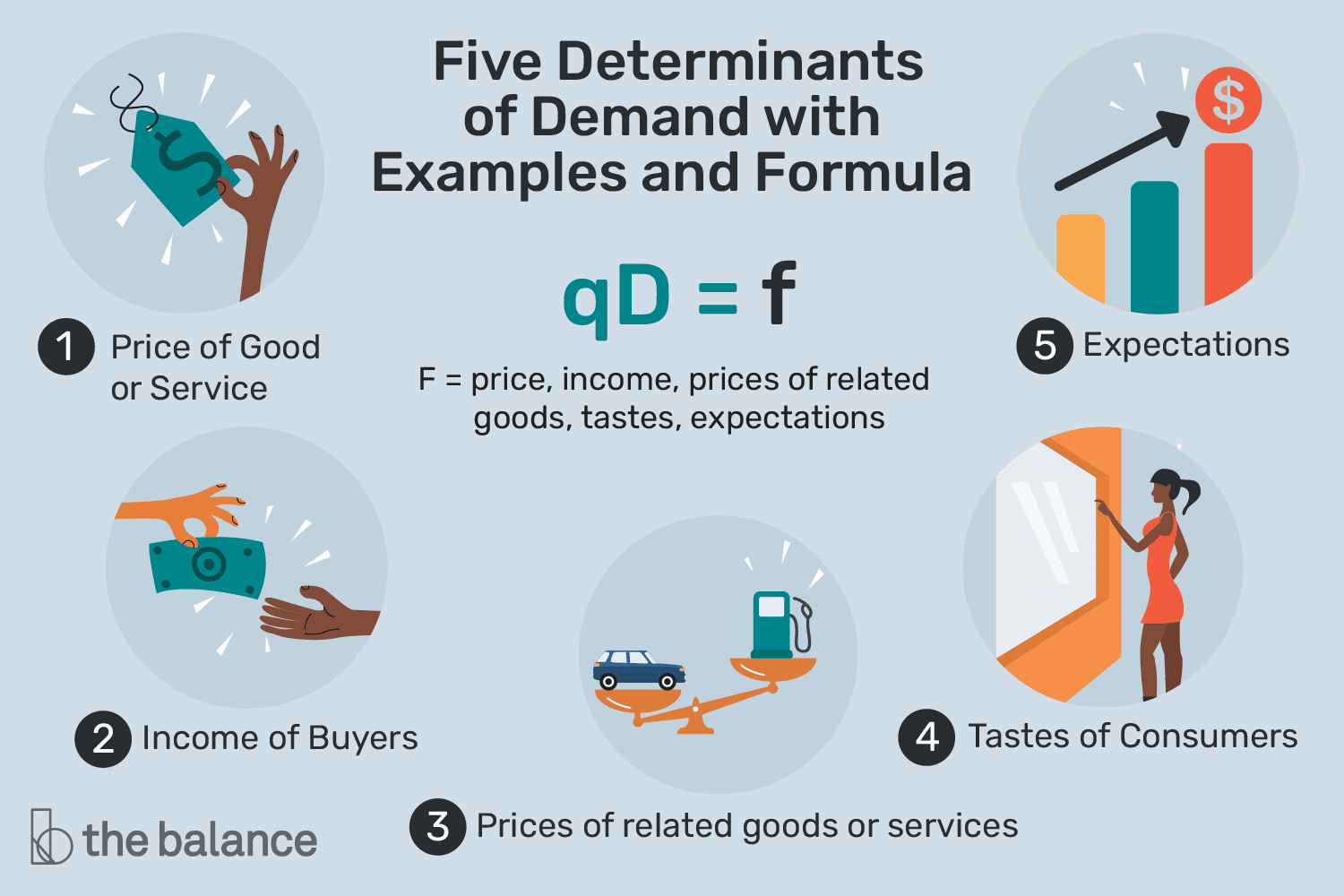

Determinants of Demand

factors that determine demand

Inferior Good

A good whose demand will go up following a decrease in income

Normal Good

A good whose demand will go down following a decrease in income

Complimentary goods

Products often used together

Substitute Goods

Goods that can be used in place of each other

Productive Efficiency

Production of goods in the least costly way

Allocative efficiency

Distribution of resources to produce goods in high demand

Surplus

Supply exceeds demand

Shortage

Demand exceeds supply

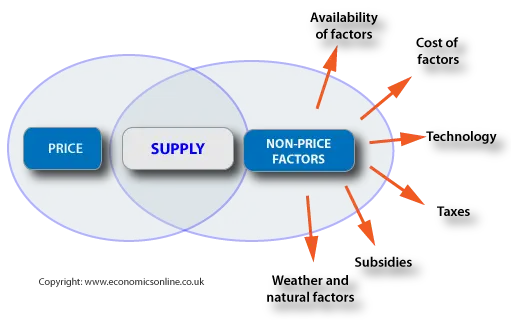

Determinants of Supply

Factors that determine the supply of a good

GDP

The total market values of the final goods and services produced annually in the U.S.

Expenditure Approach

Measuring GDP by all the spending in a year

(C+I+G+(x-M)

Income Approach

Measuring GDP by all the income earned from spending in a year (W+P+i+R)

Real GDP

The measure of GDP accounting for change in the price level.

Nominal GDP

A measure of GDP not adjusted for inflation. (Measures in current year’s $)

Consumption of fixed capital - Depreciation

The amount of capital equipment that is worn out in producing a level of GDP.

Net Private Domestic Investment

Business spending minus depreciation

Gross Private Domestic Investment

Business Spending

(CPI) Consumer Price Index

Measure of a market basket of goods and services indicating inflation/deflation

Business Cycle

The general ups and downs of an economy. Increases and decreases in economic activities.

Unemployment Rate

Percent of unemployed labor force

Frictional Unemployment

Unemployment from workers being fired, quitting, or those looking for work.

Cyclical Unemployment

Unemployment due to insufficient spending or business activity in the economy (Due to recessions)

Structural Unemployment

Unemployed because of skills not being in demand/being replaced by machinery

Demand Pull Inflation

Increase in price level due to excess spending

Trough/Recession

Temporary minimum in business cycle, declining RGDP

GDP Gap

The amount RGDP falls short of potential GDP

Cost Push inflation

increase in price level from increased cost of doing business

Natural Unemployment Rate

5%; unemployment rate without Cyclical unemployment

Recovery

RGDP increase after decline in business cycle

Peak

Economy at temporary maximum; inflation will occur

Real Interest Rate

Interest rate adjusted for inflation

Nominal Interest rate

Advertised interest rate not adjusted for inflation

Disinflation

CPI/Price levels increase, just at a slower rate

Aggregate Demand

The amount that domestic consumers, businesses, the government, and the rest of the world is willing to purchase at a given price level.

Real Balance/Wealth Effect

When the price level increases thus reducing purchasing power

Interest Rate Effects

When the price level increases thus increasing the demand for money and interest rates

Foreign Purchase/Net export effect

When the price level rises thus making our exports less desirable

Leakages

Money withdrawn from the economy

Injections

Money put into the economy

tax multiplier

Used to figure out the larger impact of an increase/decrease in taxes

Simplified Spending Multiplier

Used to figure out the larger impact of an increase/decrease in government spending

Balanced Budget Multiplier

Used to figure out the larger impact of increasing/decreasing taxes and government spending respectively

Sticky Wages

Prevents Economy from self correcting

Short Run Aggregate Supply

The amount producers are willing/able to produce at a given price

Fiscal Policy

When government increases/decreases spending and raises/lowers taxes to influence the economy

National Debt

The accumulation of all deficits

Budget Deficit

When government spends more than it takes in

Structural Deficit

A planned deficit to pay for government program obligations

Cyclical deficit

unplanned deficit due to recession

Expansionary fiscal policy

Used for recession, gov spending up, taxes down

Contractionary Fiscal Policy

Used during inflation, gov spending down, taxes up

Built in/automatic stabilizer

Automatic fiscal adjustments to fix the economy without need for deliberate government action

Budget Surplus

When the government brings in more tax revenue than it spends

Crowding Out Effect

When the government deficit spending causes raised interest rates during recessions

M0 (Monetary Base)

Includes currency in circulation, checkable deposits, and savings accounts

M1

M0+Bank Reserves

M2

M0+M1+Money Market accounts, deposits under 100k

Unit of Account/Measure of Value

function of money that is used to compare the value of goods to each other

Demand Deposit

A deposit you can withdraw anytime

Medium of Exchange

the function of money that provides a way to exchange goods and services

Store of value

the function of money that serves as a way to set aside money for future use

Asset Demand

The amount of money people want to hold onto as a store of value

Transaction Demand

The amount of money people hold onto to exchange

Monetary Policy

A central bank’s changing of the money supply to influence interest rates

Contractionary Monetary Policy

Decreases money supply by selling bonds (omo down), increasing RRR, and increasing DR

Expansionary Monetary Policy

increasing money supply by buying bonds (omo up), decreasing RRR, and decreasing DR

Required Reserve Ratio

The fraction of checkable deposits a bank must hold in reserve. Set by the FED

Loanable Funds Market

Graph of borrowed money, borrowers, and savers

Required Reserves

the amount banks must hold onto to meet the RRR

Equation of exchange - Quantity Theory of Money

Formula used to argue that the value of money is determined by the quantity of money

Total/Actual Reserves

The amount that banks are currently holding onto (excess + required)

Federal Funds Rate

The interest rate banks charge each other on overnight loans

Discount Rate

The interest rate the FED charges banks for loans

Excess reserves

The amount a bank’s total reserve exceeds the required reserves (loanable money)

Money Multiplier

The multiple that 1 bank can increase the money supply with excess reserves (1/RRR)