Chapter 18: Working Capital Management - Cash Control

1/19

Earn XP

Description and Tags

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

20 Terms

Reasons for Holding Cash

Transactions motive - cash required to meet day-to-day expenses (payroll, payment of suppliers).

Precautionary motive - cash held to give a cushion against unplanned expenditure (cash equivalent of buffer inventory).

Investment/speculative motive - cash kept available to take advantage of market investment opportunities.

Impact of Insufficient Cash Levels

Loss of settlement discounts

Loss of supplier goodwill

Trade suppliers refuse to offer further credit, charge higher prices or downgrade the priority with which orders are processes.

Poor industrial relations

If wages are not paid on time, industrial action may well result, damaging production in the short term and relationships and motivation in the medium term.

Potential liquidation

A court may be petitioned to wind up the entity if it consistently fails to pay bills as they fall due.

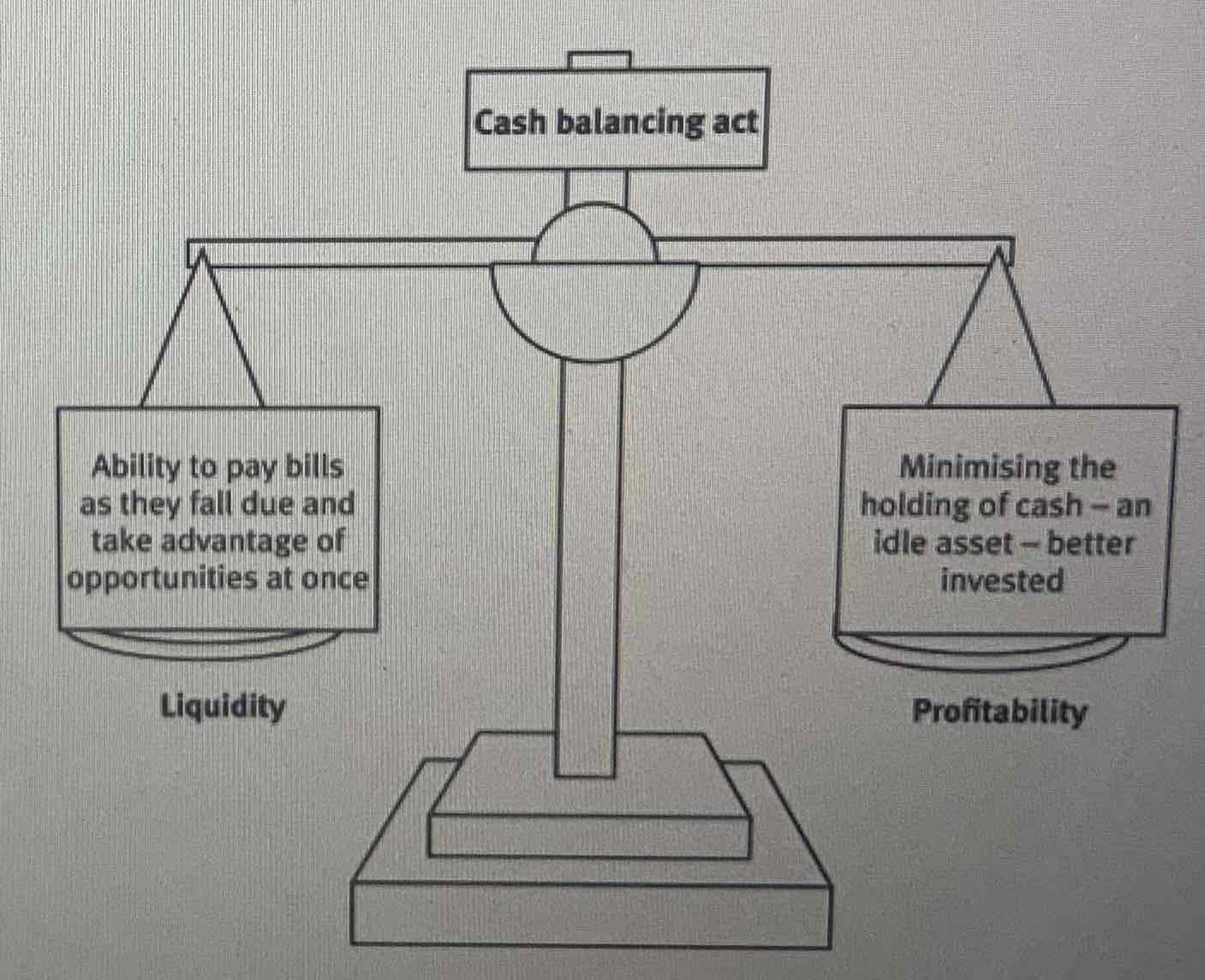

Cash Control

Balance between liquidity and profitability.

The amount of cash available to an entity at any given time mainly depends on the efficiency with which cash flows are managed.

Efficient Cash Management: Key Principles

Collect debts as quickly as possible

Pay suppliers as late as possible

Bank cash takings promptly

Cash Forecast

An estimate of cash receipts and payments for a future period under existing conditions.

Uses of Cash Forecasts

Assess and integrate operating budgets

Plan for cash shortages and surpluses

Compare with actual spending

Two Types of Cash Forecasts

A receipts and payments forecast

SFP forecast

Cash Budget

Is a commitment to plan for cash receipts and payments for a future period after taking any action necessary to bring the forecast into line with the overall business plan.

Uses of Cash Budgets

Identify cash surpluses

Identify cash deficits

Planning tool

Control tool

Receipts & Payments Forecast

A forecast of cash receipts and payments based on predictions of sales and cost of sales and the timings of the cash flows relating to these items.

SFP Forecast

Derived from predictions of future SFPs on all items except cash, derived as a balancing figure. The SFP method predicts the cash balance at the end of a given period.

SFP Forecast Requirements

This method will typically require forecasts of:

Changes to non-current assets (acquisitions and disposals)

Future inventory levels

Future receivables levels

Future payables levels

Changes to share capital and other long-term funding (bank loans)

Changes to retained profits

Interpretation of Cash Forecasts

Is the balance at the end of the period acceptable/matching expectations?

Does the cash balance become a deficit at any time in the period?

Is their sufficient finance (an overdraft) to cover any cash deficits?

Should new sources of finance be sought in advance?

What are the key causes of cash deficits?

Can/should discretionary expenditure be made in another period in order to stabilise the pattern of cash flows?

Is there a plan for dealing with cash surpluses (reinvestment)?

When is the best time to make discretionary expenditure?

Using Spreadsheets in Cash Forecasting

Time-saving: Once the basic model is built inserting figures and generating forecasts is quick and easy.

Reusable: The established model can be used for future forecasts.

What-if analysis: Allows for changing assumptions to produce alternative forecasts to help managers consider different outcomes.

Consolidation: Cash flows forecasts can forecasts from different divisions into a single, consolidated forecast.

Improving Cash Forecast Situation

Unsatisfactory cash flow, initial forecast may show a cash deficit.

Deficit cannot be covered by existing arrangements like a bank overdraft.

Steps must be taken to manage and improve future cash flows.

Questions to Ask: Improving Cash Forecast

Does the forecast indicate a continuing trend of an increasing surplus or an increasing cash deficit, or do net monthly balances move between surplus and deficit on a seasonal basis?

What size of cash surpluses are forecast (if any) and for how long will they be available?

Are the forecast cash deficits within the current overdraft facility?

Which cash flows are to some extent discretionary, either in size or timing?

Causes of Cash Deficits

Basic trading factors, issues like failing sales or rising costs.

Increase marketing, revise pricing policies or cut costs.

Working capital cycle deficiencies, problems like long inventory holding periods or delayed payments from credit customers.

Decisions to Deal with Cash Deficits

Additional short term borrowing

Negotiating a higher overdraft limit with the bank

The sale of short-term investments, if the entity has any

Using different forms of financing to reduce cash flows in the short term (leasing vs buying)

Changing the amount of discretionary cash flows, deferring expenditures or bringing forward revenues.

Actions to Deal with Cash Deficits

Reducing dividends to shareholders

Postponing non-essential capital expenditure

Bringing forward the planned disposal of NCAs

Reducing inventory levels perhaps using JIT techniques (takes time to implement)

Shortening the operating cycle by reducing receivable days, offering a discount or using a factor/invoice discounting.

Shortening the operating cycle by delaying payment to payables.

Cash Surpluses

Managed based on size and duration

Invest surplus cash to earn returns avoiding high risk investments

Use interest or returns to enhance overall cash flow

Ensure investments can be liquidated to cover forecast deficits

Consider uses like higher dividends or repaying debts