Econ - Unit 5 (LT:2)

1/19

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

20 Terms

fiscal year

a one year period that companies and governments use for financial reporting and budgeting.

budget deficit

If the government spends more than it takes in with taxes for the year

budget surplus

If the government spends less than it takes in with taxes for the year. VERY rare for our federal government.

fiscal policy

when the government changes taxes and spending to achieve an economic or social goal.

Ex. economic goal - helping out during recession, social goal - reducing green house gas emissions

excise

tax on a few specific goods. Car rentals, hotel rooms,Tobacco, alcohol, gasoline.

REGRESSIVE

sin tax

tax placed on a specific good that is genuinely deemed as bad for the person, but not illegal. (cigarettes, alcohol, sugary drinks, fast food). REGRESSIVE

social security tax

tax that all people pay from their paycheck to the gov’t to pay for older/retired Americans. PROPORTIONAL

sales tax

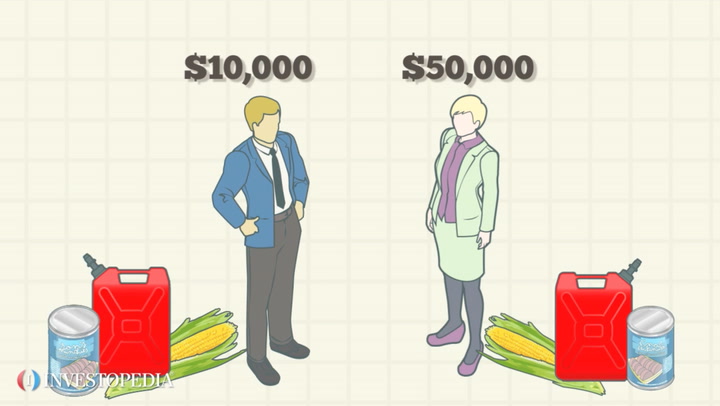

tax placed on many/broad range of goods. REGRESSIVE

property tax

tax on value of property (home, business…)

Individual Income Tax

tax that people pay from their paycheck to the gov’t. The largest part of all the taxes paid to our government

PROGRESSIVE

crowding out

the more the government gets involved in the economy the less the private sector(households) get involved. (the more the government does for people, the less likely they are to do it themselves)

crowding in

the less the government gets involved, the more the private sector does for itself.

aggregate supply

the total supply of goods and services produced within an economy at a given overall price in a given period

expansionary fiscal policy (taxes)

Goverment cuts taxes on people/businesses to allow them to have more money to spend (increases agg. demand and helps businesses hire more workers)

Downside: usually means deficit and adds to national debt

contractionary fiscal policy (taxes)

government raises taxes and causes people to have less money to spend (decreases agg.demand)

expansionary fiscal policy (spending)

government may spend more money to try to stimulate growth (increasing spending on project like building roads, bridges, and other big items)

Downside: means deficit and adds to national debt

contractionary fiscal policy (spending)

The government may spend less money, or may cut federal budgets to lower the amount of money it is pumping into the economy

regressive tax

a tax that has a higher level of impact on people who earn lower incomes

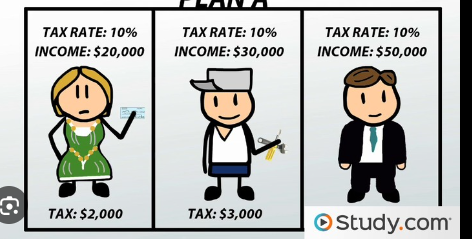

proportional taxes

everyone pays the same percentage of their income in taxes no matter if you make a lot or a little in income.

progressive taxes

as you make more money, you will pay a higher percentage of your income in taxes