Corporate Finance [Lectures] PART 2

1/104

Earn XP

Description and Tags

| 1-14 -> Lecture 6 (with WC) | 15-43 -> Lecture 7 | 44-75 -> Lecture 8 | 76-105 -> Lecture 9 || - -> Lecture 10 |

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

105 Terms

Working Capital (WC)

other names for it are Net Working Capital (NWC) or net current assets

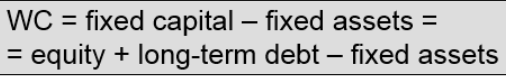

Methods of calculating Working Capital

capital and asset approach

capital approach

asset approach

Level and structure of WC

part of current assets that remain in the entity after settlement of current liabilities; or part of current assets, which is not financed by current liabilities but with fixed capital

Working Capital can appear as -

posivite, zero and negative

The size of WC, and in particular its increase in absolute and relative quantities, indicates the strengthening of the comapny's [BLANK]

financial position

WC is necessary to [BLANK] arising from the financing of working assets

limit the risk

too much WC, however, indicates [BLANK]

excessive current assets

need for WC depends on the length of the [BLANK] and the [BLANK] of current assets

operating cycle; rapidity of operation

WC may be higher in entities which can not easily [BLANK]

take out current loans

Functions of Working Capital

liquidity reserve for payment of liabilities; economic reserve generating profits

Internal Factors of WC

borrowing and investing positions/activities/capacities; company size and growth rates; organizational structure; sophistication of WC management

External Factors of WC

banking services; competitors; interest rates; new technologies and products; the economy

Measuring and managing LIQUIDITY

the extent to which a company can meet its short-term obligations using assets that can be readily transformed into cash

Dimensions of an asset’s liquidity

Type of assets and speed at which the asset can be converted to cash

Sources of liquidity

Primary and secondary

Primary sources of liquidity

Represent the most readily accessible resources available; Using these sources is not likely to affect the normal operations of the company; They may be held as cash or near-cash securities; These sources represent liquidity that is typical for most companies; These sources represent funds that are readily accessible at relatively low cost

Secondary sources of liquidity

Using these sources may result in a change in the company's financial and operating positions; Using these sources may signal a company’s deteriorating financial health and provide liquidity at a high price (the cost of giving up a company asset to produce emergency cash)

Example of PRIMARY liquidity sources

short-term fuds, which may include trade credit, and short-term investment portfolio; ready cash balances, which has cash available in bank accounts, resulting from payment collection (investment income, liquidation or near-cash security), and other cash flows; negotiating debt contracts, relieving pressures from high interest payments or principal repayments

Example of SECONDARY liquidity sources

liquidating assets, which depend on the degree to which short-term and (or) long-term assets can be liquidated and coverted into cash without substantial loss in value; filling for bankruptcy protection and reorganization

DRAG on liquidity

when receipts occur infrequently, especially after payments are made; a [BLANK] on liquidity occurs due to the decreased availability of funds

PULL on liquidity

when disbursements are paid too early; an [BLANK] on liquidity occurs because companies will be forced to spend money prior to recieving funds from sales which cover their obligations

A measure of Liquidity - liquidity contributes to a company’s [BLANK]

creditwhorthiness

Creditworthiness allows the company to:

obtain lower borrowing costs; obtain better terms for trade credit; have greater investment flexibility; exploit profitable opportunities

Immediate sources of funds for paying bills

cash on hand; proceeds from the sale of marketable securities; collection of accounts receivables

Additional liquidity

sales of inventory directly converted into cash; sales of inventory indirectly converted into cash credit sales

Liquidity Ratio

measures of company’s ability to meet short-term obligations to creditors as they mature or come due

CURRENT RATIO

an ideal ratio is 1.0; less than 1.5 means the firm may not have enough CA to pay bills within 12 months; much higher than 2.0 means the firm may have to many recourses tied up and not used effectively

QUICK RATIO

an ideal ration is 1.0; less than 1.0 means the firm may not have enough QA to pay bills within about 3 months; much higher than 1.0 means the firm may have too many liquid assets in relation to CL

Turnover Ratio

measure how well key current assets are managed over time

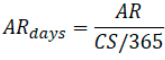

the ratio indicates how many, on average, accounts receivable are created by credit sales and collected during the fiscal policy

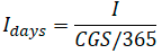

the ratio indicates how much, on average, inventory is created or acquired and sold during the fiscal policy

the ratio indicates how many days, on average, it takes to collect on the credit accounts

the ratio indicates the average length of time that the inventory remains within the company during the fiscal period

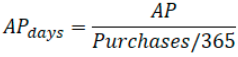

the ratio is a measure of how long on average, it takes the company to pay its suppliers

Managing the CASH POSITIONS

the amount of cash that a company holds on its books at any point in time; in addition to cash, it also takes highly liquid assets as marketable securities; certificate of deposit and other cash equivalents

Interest-bearing securities

the investor pays the face value amount and receives back that same amount plus the interest on the security

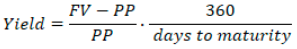

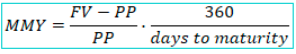

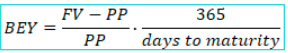

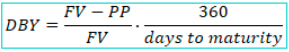

yield on short-term investments

The factor that is used to annualized the yield depend on

type of security, the traditions for quoting yield

money market yield; annualizing ratio of 360 to the number of days to maturity

bound equivalent yield; annualizing ratio of 365 to the number of days to maturity

discount basis yield; face value basis and annualizing ratio of 360 to the number of days to maturity

Types of INVESTMENT RISKS

credit (default); market (interest rate); foreign exchange; liquidity

Attributes of CREDIT RISK

issuer may default; issues could be adversely affected by economy or market; little secondary market

Attributes of MARKET RISK

price or rate changes may adversely affect return; there is no market to sell the maturity to, or there is only a small secondary amrket

Attributes of LIQUIDITY RISK

security is difficult or impossible to (re) sell; security must be held to maturity and cannot be liquidated until then

Attributes of FOREIGN EXCHANGE RISK

adverse general market movement against our currency

Safety measures of CREDIT RISK

minimize amount; keep maturities short; watch for “questionable” anmes; emphasize government securities

Safety measures of MARKET RISK

keep maturities short; keep portfolio diverse in terms of maturity and issuer

Safety measures of LIQUIDITY RISK

stick with government securities; look for good secondary market; keep maturities short

Safety measures of FOREIGN EXCHANGE RISK

hedge regularly; keep most in our currency and domestic market to avoid foreign exchange

Securities issued at a discount

the investors invests less than the face value (FV) of the security and received the FV back at maturity

What are the active strategies for short-term investments?

matching, mismatching, laddering

Matching Strategy

the strategy can use T-bills as an investment type; it’s more conservative and allows for the instrument to be encashed, should market condition turn adverse

Mismatching Strategy

the strategy is riskier and more likely to use investment tools like derivatives, which can prove dangerous if the company has little or no experience in dealing with them

Laddering Strategy

a more balanced strategy, which has characteristics of passive and matching strategy; in this strategy the maturity of the investments are scheduled at systematic intervals

Primary activities in accounts receivable management

Granting credit and processing transactions, measuring the performance of the credit function, monitoring credit balances

Granting credit and processing transactions

Requires posting customers' payments to the account receivables account by applying the payment against the customer's outstanding balance; Requires recording credit sales

Monitoring

Requires a regular reposting of outstanding receivable balances and notifing the collection managers of past due situations

Measuring the performance of the credit function

This entails preparing and disturbing key performance measurement reports, including an account receivable agein schedule; Involves the day’s sales outstanding reports

Efficient processing and maintaining accurate, up-to-date records that are available to [BLANK]

Credit managers and other interested parties as soon as possible after payments have been received

Control of accounts receivable and assuring that accounts receivable records are current and that [BLANK]

No unauthorized entry into the accounts receivable file has occured

Collection of accounts and coordination with [BLANK]

The treasury management function

Preparation of regular [BLANK]

Performance measurements reports

Companies may achieve scale economics by centralizing the accounts receivables function by using a

Captive financial subsidiary

Captive Financial Subsidiary

A wholly owned subsidiary of the company that is established to provide financing for the sales of the parent company

Challengers in accounts receivable management

Monitoring receivables, collecting on accounts

Many companies resorted to outsourcing the accounts receivables function to

Increase the account collection; credit evaluation provide service; apply the most recent technologies

Major types of credit accounts

Open book, documentary (with or without lines of credit), instalment credit, revolving credit

Open book

A form of trade credit in which sellers ship merchandise on faith that payment will be forthcoming; the most common

Documentary (with or without lines of credit)

A credit arrangement, in which a bank undertakes to pay for a shipment, provided the exported submits the required documentation within a specified period

Instalment credit

A line of credit where the customer pays a commitment fee and is then allowed to use the funds when they are needed

Revolving credit

A loan for a fixed amount of money; the borrower agrees to make a set number of monthly payments at a specific amount

The types of credit terms offered vary depending on

Type of customer; Relative financial strength of customer; Type of credit terms the competition is offering

Credit Scoring Models

statistical models used to classify borrowers according to their credit-worthiness or predict late payers; offer an opportunity for a company to make fast decisions on the basis of simple data

Appreciate Credit Scoring Model

Organization type, with corporations, rated higher than sole-proprietorships or partnerships; Ready cash (e.g. high checking account balances; Being current in supplier payments, as indicated by financial services;

Panelised Credit Scoring Model

Previous personal bankruptcy or tax lines (carries over from person to company); High-risk categories: food service, hospitality industries; Heavy use of personal credit cards (no reserves or reduced reserves available); Proper late payment behaviour or defaults (payment patterns are habitual);

Motives for Holding Inventory

transaction, precautionary, speculative motive

Transaction Motive

Reflects the need for inventory as part of the routine production-sales cycle; inventory need is equal to the planned manufacturing activity

Precautionary Motive

Related to the desire to avoid stock-out losses, which are profits lost from not having sufficient inventory on hand to satisfy demand

Speculative Motive

Related to the reasons such as ensuring the availability and pricing of inventory; aimed at benefiting from out-of-ordinary purchases

Approaches to Managing Inventory

minimising inventory levels and maintaining high inventory level

Minimising Inventory Levels

Requires accurate forecasting of market supply and demand; Storing only the supplies necessary for current operations; Minimises inventory maintenance costs; Increases the risk of losing sales

Maintaining a High Inventory Level

Prevents shortages that lead to a decrease in the current and future turnover; Increases the level of customer service; Desirable because companies operate in uncertain conditions and are not able to make error-free predictions

Inventory consists of:

Materials used for production and used for own needs; Semi-finished product and work in progress; Finished products; Goods intended for resale

AIM of Managing Inventory

Optimizing inventory level by balancing benefits related to keeping inventories with costs of maintaining them (achieved by order frequency control and the volume of delivery)

ABC Method

approach involving the division of stocks into 3 groups: A, B, C (or more)

Group A includes

inventories of this group are subject to more detailed monitoring and they are kept at a relatively low level

Group B includes

a group of stocks between A and C

Group C includes

stocks in this group - due to their key importance, and at the same time low cost - are ordered and maintained in large amount

SIMPLE methods of inventory management

red-line and two-bin method

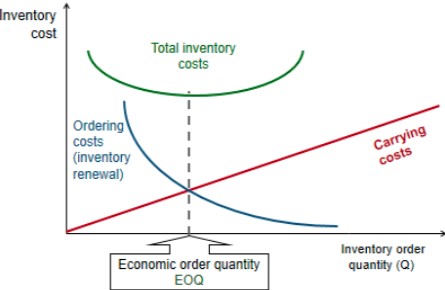

Economic Order Quantity

model of inventory management, in which the optimal volume of delivery is determined, guaranteeing the minimisation of total inventory costs

FAVOURABLE CONDITIONS for JIT

Mass production; Multi-phase production process (product complexity); Stable market; Well-developed transport network; Efficient communication system in the company; Qualified employees

UNFAVOURABLE CONDITIONS for JIT

Unitary production; Simple production process (low complexity of product); Unstable market; Poorly functioning transport; Disruptions in the communication process; Lack of qualified employees

ADVANTAGES of JIT

Reduction of inventory-related costs; Release of some working capital used for financing inventory; Increase in work efficiency; Increasing the quality of products

DISADVANTAGES of JIT

Risk of losses caused by production stoppage due to lack of materials; Risk of losing sales, and even losing clients as a result of the lack of goods or products

Stretching Payables

pushing on payables when it stretch beyond the due date and taking advantage of vendor grace periods

Credit Risk Analysis

the procedure of determining the contractor’s default probability

Receivables Collection Policy

the procedure to deal with the situation, when the receivables are not paid on time