FINA 320 Module 4

1/69

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

70 Terms

Investment criteria

Does the decision adjust for the TVM?

Does the decision rule adjust for risk?

Does the decision rule provide info on whether we are creating value for the firm (value for shareholders?)

Net Present Value (NPV)

difference between the intrinsic value of a project and its cost

Intrinsic value > cost = NPV is positive

Intrinsic value < cost = NPV is negative

reason larger intrinsic value = positive NPV is bc it generates more value for shareholders

intrinsic value

the sum of the present values of all its future cash flows

How to estimate intrinsic value

Estimate future expected cash flows

Estimate the required rate of return

Find PV of cash flows & subtract initial investment

Project net PV

intrinsic value - cost

r also stands for

opportunity cost of capitala

What the variables stand for in the NPV equation

Co = initial CF (often negative)

C1 = CF at time 1

C2 = CF at time 2

Ct = CF at time t

t = time period of investment

r = opportunity cost of capital

Always make sure Co is

negative

NPV positive

NPV is negative

accept project

reject project

positive NPV features

project expected to add value to the firm & will increase the wealth of the owners

mutually exclusive

if you take one, can’t take the other, gotta pick between 2 projects

NPV measures

ADDITIONAL value added to project not just values (its not price, that’s why its low

NPV = 0 means

project has rate of return that exactly matches discount rate/ opportunity cost of capital. required rate of return

still profitable (like breakeven)

Relative attractiveness of mutually exclusive projects

are not fixed, they are effected by discount rate

NPV decreases when discount rate increases

Cross over point

when 2 NPVs profiles are the same

Payback method

how long does it take to get the initial cost back in nominal sense?

How to calculate payback method

estimate CFs

subtract cost - future CF’s until initial investment recovered

decision rule for payback method

accept if payback period is less than some present limit

payback period

# of years it takes to recover the initial investment

For calculating payback

subtract cash flow from Co until at last amt then divide remaining amt by CF and add the number of periods completed

discounted payback period

compute the PV of each cash flow then determine how long it takes to payback on a discounted basis

compare to a specific required period

decision rule for adjusted payback period

accept the project if it pays back on discounted basis within the specified time

discount payback always longer than

regular payback period

Internal rate of return (IRR)

most important alternative to NPV - it is the return that makes NPV = 0

based entirely on estimated cash flows + independent of int rates found elsewhere

and not affected by discount rate

decision rule for IRR

accept project if IRR is greater than the require return

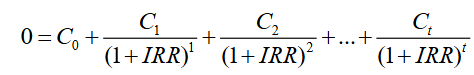

IRR equation

2 times when IRR is unreliable (when NPV is preferred)

non conventional cash flows - cash flow signs change more than once

Mutually exclusive projects

initial investments substantially different

timing of cash flows is substantially different

normal project

project where signs of the cash flow only change once

decision rules for IRR + mutually exclusive projects

NPV - choose the project with the higher NPV

IRR - choose the project with the higher IRR

NPV always trumps IRR in decision making

so if project a has high NPV and low IRR

and project b has low NPV and high IRR

choose project A

NPV directly measures

the increase in value to the firm

whenever there’s a conflict between NPV + another decision rule

always choose NPV

Profitability Index

NPV/ initial investment

Advantages and disadvantages of Payback

Advantages

easy to understand

adjusts for uncertainty of later cash flows

biased towards liquidity

Disadvantages

ignores TVM

may reject positive NPV investments

requires an arbitrary cut off point

biased against long term projects, such as R&D and new products

Advantages and disadvantages of discounted payback

Advantages

includes time value of money

easy to understand

adjusts for uncertainty of later cash flows

biased towards liquidity

Disadvantages

may reject positive NPV investments

requires an arbitrary cutoff point

ignores cash flows beyond the cutoff point

Biased against long term projects such as R&D and new products

IRR is the discounted rate that produces a 0 NPV or the specific discount rate at which the present value of the cost equals ___

a. the future value of the present cash flows

b. the present value of the future benefits or cash inflows

c. the present value of the cash outflow

d. the investment

b. the present value of the future benefits or cash inflows

The IRR is defined as the discount rate that produces a 0 NPV or the specific discount rate at which the present value of the cost (the investment or cash outflows) equals to present value of the future benefits (or cash inflows)

IRR and nonconventional cash flows

when the cash flows change signs more than once, there is more than 1 IRR

when you solve for IRR, you are solving for the root of an equation and when you cross the x axis more than once, there will be more than one return that solves the equation

if you have more than 1 IRR which one do you use to make your decision

Which of the statements below is false?

a. to account for the time value of money with the payback period model, you need to restate the future cash flow in current dollars

b. the discounted payback period method is the time it takes to recover the initial investment in future dollars

c. when we discount a future cash flow with our standard time value of money concepts, we inherently assume that the company received the entire cash flow at the end of the year

d. the discounted payback period method does not correct for the cash flow after the recovery of the initial outlflow

d. the discounted payback period method does not correct for the cash flow after the recovery of the initial outlflow

Normal projects C and D are mutually exclusive. Project C has a higher (positive) NPV if the cost of capital is less than 12%, whereas project D has a higher (positive) npv if the cost of capital exceeds 12% which of the following statements is most correct?

a. project D has a higher internal rate of return

b. project d and project c have a crossover rate of 12%

c. we should be indifferent between the two projects if the cost of capital is 12%

d. statements b and c are correct

e. all of the statements are correct

e. all of the statements are correct

Which of the following statements about the IRR and NPV is least accurate?

a. IRR is the discount rate that equates the pv of the cash inflows with the pv of the outflows

b. for mutually exclusive projects, if the npv rankings and the irr rankings give

incomplete

The discounted payback rule can be best stated as:

a. An investment is acceptable if its discounted payback period is greater than some

prespecified number of years.

b. An investment should be accepted if the discounted payback is positive and rejected

if it is negative.

c. An investment should be rejected if the discounted payback is positive and accepted

if it is negative.

d. An investment is acceptable if its discounted payback period is less than some

prespecified number of years

d. An investment is acceptable if its discounted payback period is less than some

prespecified number of years

Which of the following calculations ignores the impact of the time value of money?

I. Payback

II. IRR

III. Profitability index

a. I only

b. II only

c. III only

d. I and III only

a. I only

Project selection ambiguity can arise if one relies on IRR instead of NPV when:

a. The first cash flow is negative and the remaining cash flows are positive.

b. A project has more than one NPV.

c. The profitability index is greater than one.

d. Project cash flows are not conventional.

d. Project cash flows are not conventional.

A project whose NPV equals zero ____

a. does not make profits for its shareholder

b. has IRR less than its required rate of return

c. has a profitability index that is greater than one

d. has a discounted payback period that exactly matches the life of the project

d. has a discounted payback period that exactly matches the life of the project

Which of the following statements is true?

a. If a project has a profitability index less than one the project should be accepted.

b. If the cost of capital is greater than the IRR, the project should be accepted.

c. If a project has a payback which is longer than the company requires, the project

should be accepted.

d. If the NPV of a project is positive, it should be accepted

d. If the NPV of a project is positive, it should be accepted

___________ is at the heart of corporate finance because it is concerned with making the

best choices about project selection.

a. Capital budgeting

b. Capital structure

c. Payback period

d. Short-term budgeting

a. Capital budgeting

Which of the statements below is false?

a. To account for the time value of money with the payback period model, you need to

restate the future cash flow in current dollars.

b. The discounted payback period method is the time it takes to recover the initial

investment in future dollars.

c. When we discount a future cash flow with our standard time value of money

concepts, we inherently assume that the company received the entire cash flow at the

end of the year.

d. The discounted payback period method does not correct for the cash flow after the

recovery of the initial outflow

b. The discounted payback period method is the time it takes to recover the initial

investment in future dollars.

Initial after tax outlay or after tax cost also means

CF0

Annual depreciation equation

(Beginning Value - Ending Book Value) / (# of yrs)

Operating Cash Flow Equation

Revenue

- operating cost

- depreciation

= EBIT (rev-OC-dep)

*tax rate

= tax

Solve for OCF (EBIT + dep - tax)

Tax rate (for calculating operating cash flows)

Tax rate * EBIT

Operating cash flow individual mini equation

EBIT + Dep - tax

Net income equation

Sales

-variable costs

-fixed costs

-depreciation

=EBT

-taxes (tax rate *EBT)

= Net income

After tax salvage value

= salvage value - tax rate * capital gain

Capital gain = salvage - book value

EBIT other equation

Gross Profit - Depreciation

*Gross profit also called annual pretax cost savings)

changes in Net working capital are due to

increases in inventories

Beginning inventory balance

Ending inventory balance

current months sales projections * % of monthly projected sales

next months sales projection * % of monthly projected sales

increase in net working capital equation

ending inventory - beginning inventory * cost per unit