ECO 202 Module 11: Monopoly and Antitrust Policy

1/23

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

24 Terms

monopoly

a firm that is the only seller of a good or service for which there is not a close substitute

barriers to entry

for a firm to be a monopoly, there must be barriers to entry preventing other firms coming in and competing with it

government restrictions on entry

control of a key resource

network externalities

natural monopoly

government restrictions on entry

patents: given to newly developed products for the exclusive legal right to product a product for a period of 20 years

copyrights: provide exclusive right to produce and sell creative works like books and films

trademarks: offer protection for brand names, symbols, and some characteristics

public franchises: government designation that a firm is the only legal provider of a good or service

control of a key resource

e.g natural resources, raw materials

network externalities

situation in which the usefulness of a product increases with the number of consumers who use it

auction sites, social media, etc

natural monopoly

situation in which economies of scale are so large that one firm can supply the enire market at a lower average total cost than can two or more firms

most likely when fixed costs are high

how do monopolies choose price and output

seek to maximize profit by choosing a quantity to produce

face a downward-sloping demand curve

the difference is barriers to entry will prevent other firms from competing away their economic profit

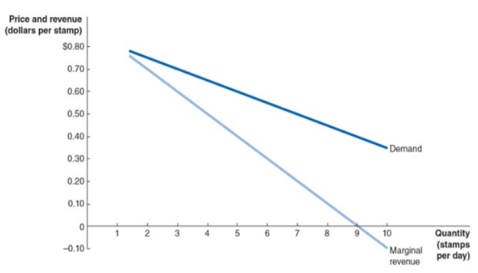

calculating a monopoly’s revenue

firms will sell a product as long as its marginal revenue exceeds its marginal cost

as a firm decreases price to expand output:

revenue increases from selling an extra unit of output at the new price

revenue decreases because the price reduction is shared with existing customers

so, marginal revenue is always below demand for a monopolist

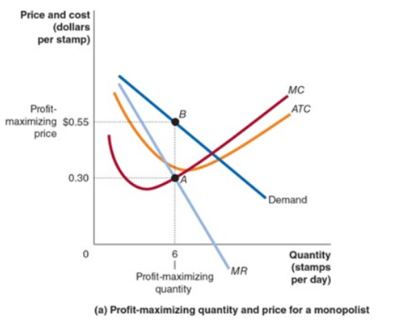

profit-maximizing price and output

maximize profit by producing the quantity where the additional revenue from the last usit (MR) just equals the additional cost incurred from its production (MC)

at this quantity:

market demand curve detemines price

average total cost curve determines average cost

profit is the difference between these times quantity

profit = (P-ATC) *Q

short run vs long run profits

since there are barriers to entry, additional firms can’t enter the market, so there is no distinction between short run and long run in a monopoly

we expect monopolists to continue to earn profits in the long run

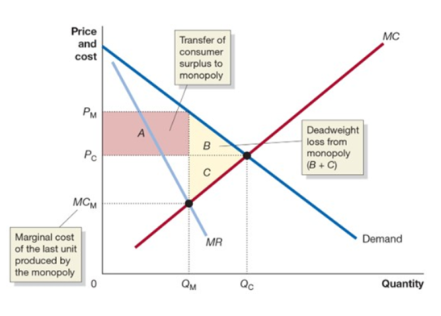

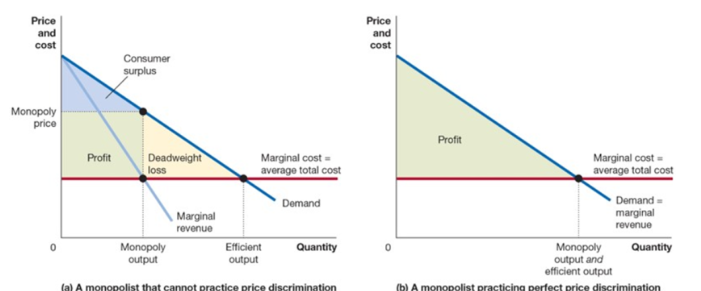

monopolies and economic efficiency

a monopoly will produce a smaller quantity and change a higher price than would a PCM

consumer surplus will fall with higher price

producer surplus must rise, otherwise the firm would’ve chosen the perfectly competitive price and quantity

economic surplus is reduced and there is deadweight loss

the marginal cost of the next unit is less than the price consumers are willing to pay so it should be produced, but it would decrease the monopoly’s profit, so it won’t be

market power

the ability of a firm to charge a price greater than marginal cost

some say market power drives firms to innovate and create new products using their profits

size of efficiency losses

every firm, other than those in perfect competition, have market power, so some loss of efficiency occurs in the market for nearly every good and service

overall loss of economic efficiency is small because most firms face competition

price discrimination

charging different prices to different customers for the same good or service when the price differences are not due to differences in cost

ex) student discount, senior discount

is possible when:

firms possess market power (otherwise they would be price takers)

identifiable groups of consumers have different willingness to pay for the product

arbitrage (buying a product at a low price and selling it for a high price) is not possible either because reselling is not logically possible or because transaction costs are high

increases profits for firms and decreases consumer surplus

perfect price discrimination

charging every consumer a price exactly equal to their willingness to pay for it

every consumer would by the product, but consumer surplus would be zero, the firm would extract all surplus from the market

shows that price discrimination might increase economic efficiency

antitrust laws

laws aimed at eliminating collusion and promoting competition among firms

collusion

an agreement among firms to charge the same price or otherwise not compete — ILLEGAL

horizontal mergers

mergers between firms in the same industry

vertical mergers

between firms at different stages of the production process (we are less concerned with vertical mergers)

DOJ and FTC Merger guidelines

market definition

measure of concentration

merger standards

market definition

the more broadly defined the market, the smaller (and more harmless) the merger appears

“appropriate market” the smallest market containing the firms’ products for which an overall price rise within the market would result in total market profits increasing

if profits would decrease, there must be adequate substitutes available, hence the market is too broadly defined

measure of concentration

market is concentrated if a relatively small number of firms have a large share of total sales inn the market

merger standards

based on the Herfindahl-Hirschman Index value, the DOJ and FTC will apply standards to decide whether the challenge is a merger

challenged mergers must show that their merger would result in substantial efficiency gains

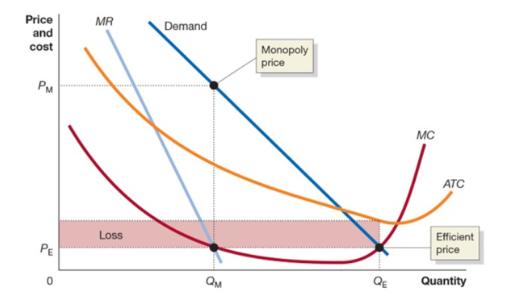

regulating natural monopolies

local and/or state regulatory commissions typically set prices for natural monopolies instead of allowing them to set their own price

to achieve economic efficiency, regulators should require monopolies to charge a price equal to its marginal cost, but the monopoly will suffer a loss, so regularots set the price equal to average total cost