Module 3

1/45

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

46 Terms

Acqurier (Or bidder)

The buyer of the firm

Target

The seller of the firm

Merger Waves

Peaks of heavy activity followed by quiet troughs of few transactions in the takeover markets

Types of Mergers

Horizontal Merger

Vertial Merger

Conglomerate Merger

Horizontal Merger

Target and acquirer are in the same industry

Vertical Merger

A merger of two companies in the same industry that make products required at different stages of production.

The benefit of this is greater coordination, but not always successfully pulled off

Conglomerate Merger

Target and acquirer operate in unrelated industries

Market Reaction and Laws surrounding takeovers

Law requires that shareholders of the target firm who are forced to sell their shares receive a fair value for their shares

This means the bidder (acquirer) is unlikely to get the target firm for less than the current market value, and most times, acquirers pay premiums to the current value

Acquisition Premium

Paid by acquirer in a takeover, it is the percentage difference between the acquisition price and the pre-merger price of a target firm

Reasons to Acquire

Large synergies are the most common reason bidders pay the acquisition premium for the target firm

Types of synergies

Cost reduction synergies: usually due to layoffs of overlapping employees and the elimination of redundant resources

Revenue enhancement synergies: Hard to achieve

Economies of Scale

The savings a large company enjoys from producing goods in high volumns not available to small companies

Economies of Scope

Savings large companies can realize that come from combining the marketing and distribution of different types of related products (basically packaging related products together to save money)

Reason for Mergers: Expertise

Idea that firms need expertise in certain areas to compete more efficiently, in areas like tech, for example, it can be hard to find experienced workers, so companies may purchase an existing firm that has divisions of talent experises

Reasons for Mergers: Monopoly Gains

Occur when a firm merges with or acquires a major rival to reduce competition in the industry, allowing increased profits from greater market share.

Key Points on Monopoly Gains

Reducing competition can increase industry wide profitability

Most countries have antitrust restrictions on mergers

All firms benefit from reduced competition; only the merging firms bear the cost of the mergers

Reasons for Mergers: Efficiency Gains

Another reason acquirers pay premiums for targets is for the efficiencies that can be achieved through the elimination of duplication.

Reasons for Mergers: Diversification Benefits

Risk Reduction

Debt Capacity and Borrowing Costs

Liquidity

Diversification: Risk Reduction

Mergers are justified based on the idea that larger firms bear less unsystematic risk, making the combined firm less risk

However argument ignores fact that investors can achieve diversification benefits on their own by just buying shares of both firms.

Diversification: Debt Capacity and Borrowing Costs

Larger firms are more diversifed which lowers the probability of default as the merged firm can increase its leverage and lower its costs of capital

Diversification Debt Capacity and Borrowing Costs Key Points

Due to Market imperfections such as bankruptcy costs, firms may increase debt and obtain greater tax savings without incurring significant financial distress

Any gains must be large enough to offset the disadvantages of operating a larger, less focused firm.

Diversifcation: Liqudity

Since shareholders of private companies have disproportionate shares of their wealth invested in the company, the liquidity that a bidder brings to the owners of private firms can be valuable and is an important incentive for the target shareholders to agree to the takeover.

Managerial Motives to Merge

Conflict of Interest

Overconfidence

Managerial Motives to Merge: Conflicts of Interest

Managers may prefer to run a larger company due to additional pay and prestige

Managerial Motives to Merge: Overconfidence

The hubris hypothesis says overconfident CEOs pursue mergers that have low chances of creating value because they believe their ability to manage is great enough to make it succeed

The Takover Process: Valuation

Key issues in takovers is quantifying and discounting the value added by the merger, referred to as takeover synergies

The price paid for a target = the target’s pre-bid market capitalization + acquisition premiums

The pre-bid market capitalization is viewed as the stand-alone value of the target

Takeover synergies

Any additional value created by a merger

When do bidder’s consider a takeover to be a postive NPV project

Only when the premium paid does not exceed the synergies created by the takeover.

The Takeover Process: The offer

Once the valuation is complete, they can make a tender offer, using two methods to pay for a target:

Cash transactions where the bidder pays for the target and any premiums in cash

Stock swap transactions where the bidder pays the target by issuing new stock and giving it to the target shareholders, swapping target stock for acquirer stock

Exchange Ratio in Stock Swaps

The number of bidder Shares recieved in exchange for each target share

When a Stock Swap Merger is considered a positive NPV investment for acquiring shareholders

If the share price of the merged firm exceeds the pre-merger share price of the acquiring firm, it is considered a positive NPV investment

Tax and Accounting Issues: Payment Methods

The way an acquirer pays for a target will affect the taxes paid by both the target shareholders and the combined firms.

Payment methods influence the tax consequences of a taxover, with tax effects differing depending on if payment was in cash or stock

Tax Effects of Cash Payments

The target shareholders will face an immediate tax liability

Target shareholders must pay capital gains tax on cash received

The capital gains are calculated as the difference between the takeover price and the original purchase price of the shares

Tax Effects of Stock Swap Payments

When a takeover uses bidder stock to pay the target, taxes for target shareholders are deferred until target shareholders actually sell their new shares.

Tax and Accounting Issues: Purchase Price Allocation

After a takeover, the combined firm must allocate the purchase price to the target’s assets on its financial statements based on their fair market value

Tax and Accounting Issues: Goodwill in Takeovers

Goodwill arises when the purchase price exceeds the fair market value of the target’s identifiable assets.

Goodwill is recorded on the Balance sheet and is tested annually for impairment

Board and Shareholder Approval

For mergers to proceed, both the target and the acquiring board of directors must approve the deal and then put it up to a vote for the shareholders of the target

Friendly Takeover

When a target’s board supports a merger and negotiates with the potential acquirers to then agree on a price that is put to a shareholder vote

Hostile Takeover

When an organization purchases a large portion of a target’s stock and in doing so gets enough votes to replace the target’s board of directors and CEO

Corporate Raider

THe acquirer in a hostile takeover

Reason Acquirers paid large takeover premiums: Competition

There is competition that exists in the takeover market, so once a acqurier starts bidding on a target company, and a clear significant gain exists in acquiring the target, other potential acquirers will start submitting their own bids.

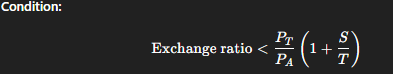

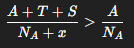

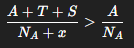

Condition for Acquirer Share Price Increases

After a stock swap acquisition, the acquirer’s share price increases only if the value per share after the merger exceeds the value per share before the merger

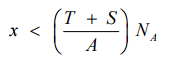

Stock Swap Offers Varible Names

A = Pre-merger Value of acquirer

T = Pre-merger value of the target

S = value of synergies created by the merger

Na = Number of acquirer Shares outstanding before the merger

x = number of new shares issued to acquire the target

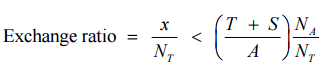

Maxmium Shares Issues (Postive NPV Condition

The maximum number of new shares the acquirer can issue while still achieving a positive NPV

Exchange Ratio for Share Based offers

The exchange ratio expresses the number of acquirer shares offered per target share

Exchange Ratio using Share Prices

Pt = T/Nt (Target Share Price)

Pa = A/Na (Acquirer Share Price)