1.4 Government Intervention (EDEXCEL A LEVEL ECONOMICS)

1/33

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

34 Terms

rule of law, property rights

correction of market failure

equitable distribution of income

improve performance of the economy

Reasons for government intervention

correcting market failure due to negative externalities

INDIRECT TAX:

increases cost of production so less supply, pushes up price so consumers demand less- if equal to social cost then quantity will move to socially optimal levels

regressive

hard to get right

incidence of tax depends on elasticity

reduction in trade depends on elasticity

costs of administration

inflation

main objective of tax

Evaluation of tax to correct market failure

Correcting market failure due to positive externalities

SUBSIDIES:

costs of production are funded so producers increase supply, this pushes down price so consumers demand more- if it is equal to social benefits then quantity will move to socially optimal levels

incidence depends on elasticities

hard to get right

increase in trade depends on elasticities

resources reallocated from other causes (XED)

opportunity cost

Evaluation of subsidies to correct market failure

price control

legally imposed maximum or minimum prices from the government

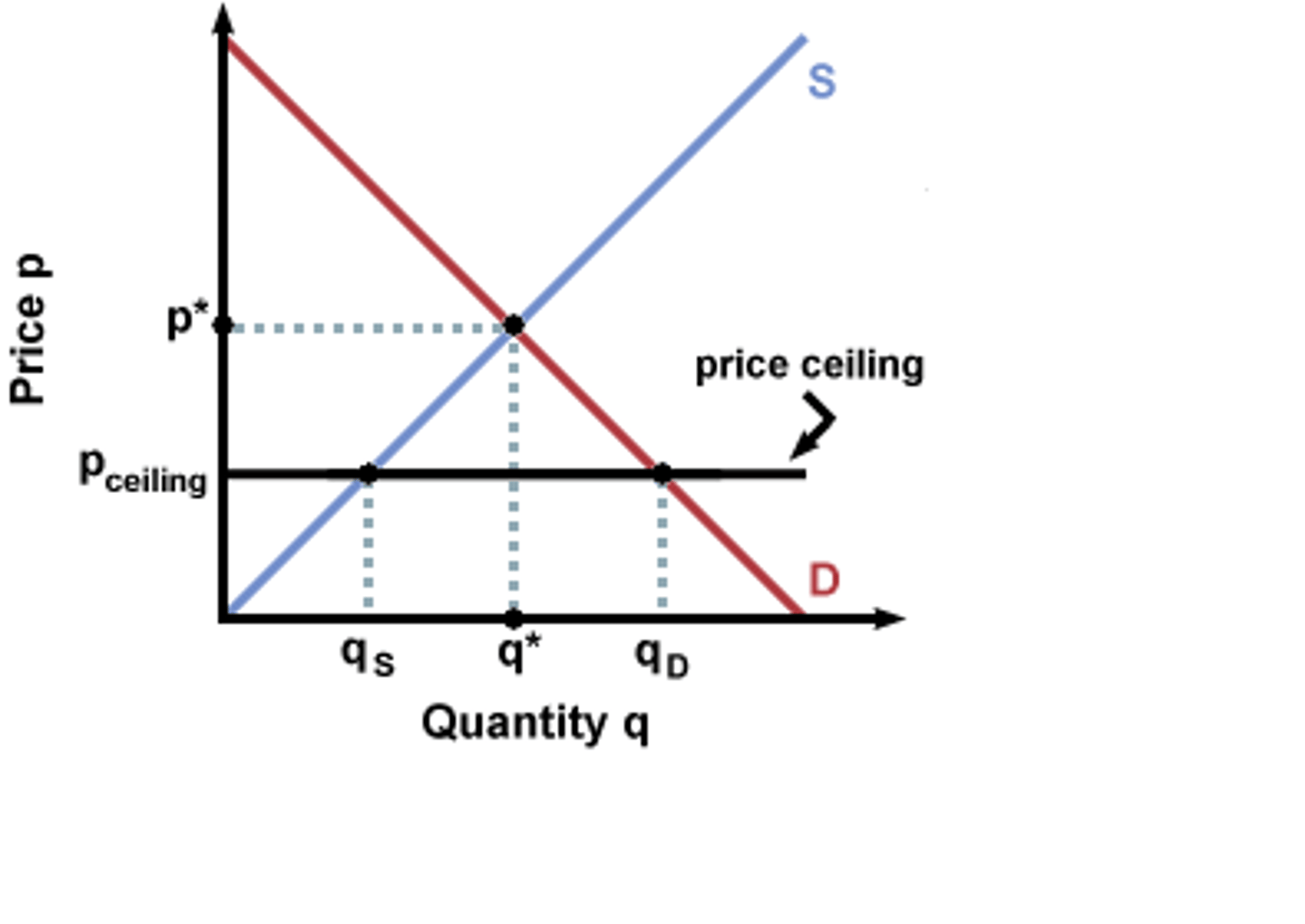

price ceiling

legally imposed maximum price, imposed when prices rise faster than wages and supports the population so they can afford necessities, only makes sense below equilibrium price

shortage

other means of rationing

hoarding

black market

deteriorating quality

Problems with the price ceiling

low prices

other rationing

low quality

shortage

black market

analysis of price ceilings: consumers

low prices

reduced surplus

less jobs

reduced fund for innovation and growth

analysis of price ceilings: producers

deal with shortages:

subsidies

black market

enforcement

analysis of price ceilings: government

depends on difference between cap and market price

depends on PES and PED

inefficient use of resources by consumers (buying more than needed)

evaluation of price ceilings

price ceilings and elasticities

the more inelastic the less the impact of price ceilings

price floors

legally imposed minimum price

only makes sense above equilibrium price

imposed if price of labour falls (ensures people have enough money)

protects industries and jobs

reduces consumption of demerit goods

high price

less choice

less surplus

depends on elasticities

have less money to spend elsewhere

analysis of price floors: consumers

increased surplus (if bought by gov)

excess supply

less profits

increased revenues

less incentive to innovate

analysis of price floors: producers

have to deal with excess supply:

intervention buying

opportunity cost of this

analysis of price floors: government

price increase fully passed to consumer

excess supply on black market

cross border shopping (bad for local business)

reformulation of bad goods

harmful substitutes

no tax revenue

expensive to enforce

should be set at a level to reduce to socially optimal quantity

evaluation of price floors

tradable pollution permits: why not tax

no guarantee to reduce pollution

unlikely to have significant effect as energy has inelastic demand due to it being an essential

rich firms can cover cost and carry on polluting

tradable pollution permits

limits place on carbon emissions through permits which can be freely traded

fines imposed if limits exceeded

those who underproduce can sell excess permits

internalises external costs

biggest polluters pay the most to pollute, most compensation for negative externalities

advantages of tradable pollution permits

incentives to reduce pollution (can profit off it)

market based (pollution reduced at the lowest cost)

firms decide their most efficient solution

disadvantages of tradable pollution permits

hard to decide appropriate levels

administration costs

difficult to set the right amount of fines

restriction to competition

uneven geographical pollution

requires international cooperation

no tax revenues

decreasing tradable pollution permits

the government reduces the amount of permits supplied each year, this causes the price of permits to increase each year until eventually it is cheaper to reduce pollution than to buy more permits

command and control intervention

legally enforced rules on producers and consumers to regulate their behaviour

reduce external costs or increase external benefits

best suited to inelastic PED where taxes have little effect

restricted choice

maximising MPB is limited

analysis of command and control: consumers

cost of regulation

barriers to entry-reduced competition

analysis of command and control: producers

cost of enforcement

regulatory capture

analysis of command and control: government

provision of information

government led initiative to inform producers and consumers of the true costs and benefits of their activity

reduce or increase demand

improve health

better choices

analysis of provision of information: consumers

respond to changes in preference

analysis of provision of information: producers

minimise cost and maximise benefit

cost of campaigns

analysis of provision of information: government

may be expensive

cost benefit analysis of who to target

evaluation of provision of information

government provision of public goods

normative issue

provided on grounds of: need (eliminate free riders), fairness, efficiency (economies of scale- larger scale= smaller cost per unit), social welfare

evaluation of government provision of public goods

lack of competition

no incentive to innovate

private sector crowded out- loss of innovation and employment