Banking and the financial system - Commercial Banks - Capital adequacy

1/42

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

43 Terms

What is the primary means of protection against insolvency for a financial institution?

Capital - it helps protect the institution against the risk of insovlency.

What are the five main functions of capital?

Absorb unanticipated losses and preserve confidence

Protect uninsured liability holders

Protect FI insurance funds and taxpayers

Protect FI owners against increases in insurance premiums

Acquire real investments to provide financial services

What is the economists’ definition of capital

Net worth - the market value of assets minus market value of liabilities

What is the regulators definition of capital?

Assets minus liabilities in book value terms (historical values)

Why do market value and book value of capital differ?

Book values reflect historical values from when loans were made or securities purchased while market values reflect current conditions including changes in credit risk and interest rates.

When was Basel I establised and what did it require?

1988 it established rules requiring bank capital equal to or greater than 8% of risk-adjusted assets.

What are the three pillars of basel regulations?

Minimum capital requirements (credit, market, operational risks)

Regulatory review and internal processes

Disclosure of capital structure, risk exposure, and capital adequacy

What are the three important additions in Basel III compared to Basel II?

Leverage restrictions supplementing risk based capital requirements

Three capital buffers (conservation, countercyclical, systemic surcharge)

Liquidity requirements for high-quality liquid assets

What is Tier I (Common Equity tier I) capital?

Common equity plus retained earnings.

What is additional tier I capital?

Other loss-absorbing options beyond common equity, such as noncumulative perpetual preferred stock.

What is Tier II capital?

Secondary “equity-like” capital resources including loan loss reserves, convertible debt, and subordinated debt.

What is the formula for total capital?

Total Capital = Core Tier I + Additional Tier I + Tier II

What is the minimum capital to risk weighted assets ratio under basel III

8% capital to risk-weighted assets (RWA)

What is the formula for risk-weighted assets?

RWA = Risk-Weighted on-balance-sheet assets + Risk-weighted off-balance-sheet assets

What risk weight is assigned to cash and government securities

0% risk weight

What risk weight is assigned to US depository institutions and OECD banks with CRC 0-1?

20% risk weight.

What risk weight is assigned to residential mortgages (Category 1)

50% risk weight.

What risk weight is assigned to residential mortgages (Category 1)

50% risk weight.

What risk weight is assigned to corporate exposures and consumer loans?

100% risk weight.

What risk weight is assigned to high volatility commercial real estate (HVRCE)?

150% risk weight.

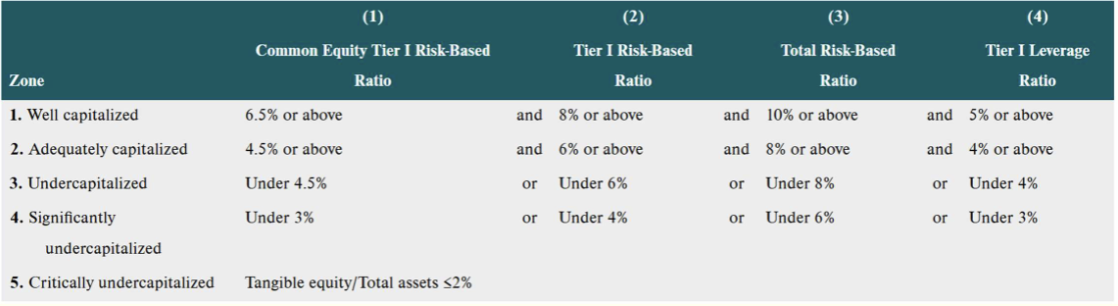

What are the minimum requirements to be “adequately capitalised?”

CET1 risk-based ratio: ≥4.5%

Tier I risk-based ratio: ≥6%

Total risk-based ratio: ≥8%

Tier I leverage ratio: ≥4%

What are the requirements to be "well capitalized"?

CET1 risk-based ratio: ≥6.5%

Tier I risk-based ratio: ≥8%

Total risk-based ratio: ≥10%

Tier I leverage ratio: ≥5%

What is the CET1 risk-based capital ratio formula?

CET1 capital / Total RWA

What is the Tier I risk-based capital ratio formula?

Tier I capital / Total RWA

What is the total risk-based capital ratio formula?

Total capital / Total RWA

What is the leverage ratio formula?

Tier I capital / Total exposure (on and off balance sheet)

How are off-balance-sheet items converted to risk-weighted assets?

Two-step process:

Apply conversion factor to get credit equivalent amount

Multiply credit equivalent amount by appropriate risk weight

What is the conversion factor for direct-credit substitute/standby letters of credit?

100%

What is the conversion factor for unsused loan commitments with maturity >1 year?

50%

What is the conversion factor for commercial letters of credit?

20%

What is the conversion factor for commercial letters of credit?

20%

What is the credit equivalent amount formula for derivative contracts?

Potential future exposure + Current exposure

What is the capital conservation buffer requirement?

Greater than 2.5% of total risk-weighted assets (must be CET1 capital).

What happens if a bank’s capital conservation buffer falls below 2.5%

Constraints on earnings payouts (dividends, share buybacks, bonus payments) are imposed.

What is the countercyclical capital buffer range?

Between 0% and 2.5% of risk-weighted assets, declared during excess credit growth.

How much time do banks have to adjust to countercyclical buffer requirements?

12 months.

What is the G-SIB additional capital requirement range?

Additional CET1 capital ranging from 1% to 3.5% of RWA, depending on bucket classification.

What are the main criticisms of risk-based capital ratios?

Risk weight categories don't reflect true credit risk

Reliance on rating agencies

Ignores credit risk portfolio diversification

Excessive complexity

Heavy demands on regulators (Pillar 2)

Issues with leverage, liquidity, and specialness

What would happen if a financial institution were closed by regulators before its net worth became zero or negative?

Neither liability holders nor those regulators guaranteeing the claims of liability holders

would stand to lose.

What does the book value of capital comprise of?

i) par value of shares?

ii) surplus value of shares

iii) retained earnings

iv) loan loss reserve

What will happen if a bank falls below well capitalised?

• Suspend dividends

• Require capital restoration plan

• Restrict asset growth

• Approval required for acquisitions, branching, and new activities

• Restriction on executives’ compensation package

What do off balance sheet activities represent?

OBS activities represent contingent rather than actual claims.