All Unit 3 type shizzle. Business Management HL IB DP COURSE 2023 - 2025 🤬🤬🤬

1/42

Earn XP

Description and Tags

money making MACHINE FYI: the acronym "PIE" in the flashcards will always mean "Provided in Exam".

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

43 Terms

Capital Expenditure

Money spent on fixed assets and shi

Revenue Expenditure

Money spent on costs to maintain the daily running of a business

Expenditure

the action of spending funds (google def)

Internal Source of Foinance

Sources of foinance that a firm gets from their own assets and profits to fund or sustain projects and investments

External Source of Foinance

Sources of foinance that a firm obtains oustide of their own business. Like loans, bank overdrafts, or if they are extremely lucky… Shark Tank (Business Angels).

CAPITAL

anything that confers value or benefit to its owners, such as a factory and its machinery, intellectual property like patents, or the financial assets of a business or an individual.

Revenue

Price x Units Sold

Gross Profit

Sales Revenue - Cost of Sales

Cost of Sales (COGS)

opening stock + purchases - closing stocks

Net (Profit)

Gross Profit - Expenses

Expenses

BOTH direct costs and indirect costsinvolved in production

Assets

Items that re owned by a business that are valuable

Current Assets

cash or liquidiable (money makeable) asset that can be turned into cash within 12 months

Non - Current Assets

Assets that are bought for business use. Like copy rights, brands, trademars, machinery, property etc. Medium to Long term ish

Liabilities 😒

Money owed by a business

Current Liabilities

Debts that must be settled within a year

Non - Current liabilities

Debts that can or are due repaid after one year

Net Assets

TWO FORMULAS:

1. Net Assets = (Non Current assets + Current Assets) - (Non Current liabilities + Current Liabilities).

OR

2. Net Assets = Total Assets - Total Liabilities (preferred formula 😀)

Equity

The amount of money that goes to the shareholders after all costs are calculated.

Balancing

Net Assets = Total Equity.

THEY BOTH SHOULD BE THE SAME AND BALANCED OR ELSE YOU DID SOMETHING WRONG

Appreciation 😁

Increasing in value over time.

Depreciation 😟

Decreasing in value over time

Straight Line Method (Depreciation formula nomor 1)

Annual Depreciation = Purchase Cost - Salvage Value/Lifespan of Use

Residual Value

Estimated value of the asset at the end of its use

Units of Production Method

1st: Calculate Units of Production rate

Units of Production rate = (Cost of asset - Salvage value) / Estimated units of production

2nd: calculate depreciation expense

Depreciation Expense = Units of Production rate x Actual units produced

Profitability

An organizations profit making ability

Gross Profit Margin (PIE)

Gross Profit / Sales Revenue x 100

the percentage is then compared to other firms to determine the profitability

Profit Margin (PIE)

Profit before interest and tax / Sales revenue x 100

The profit margin is a profitability ratio that measures a firm’s overall profit (after all costs of production have been deducted) as a percentage of its sales revenue.

Liquidity

Liquidity in IB DP Business Management HL refers to the ease with which an asset or security can be converted into cash without causing a significant impact on its market price. It is a measure of how quickly and easily an asset can be bought or sold in the market. High liquidity implies that an asset can be easily converted into cash, while low liquidity suggests that it may be difficult to sell the asset quickly without affecting its value. (AI definition 🤖)

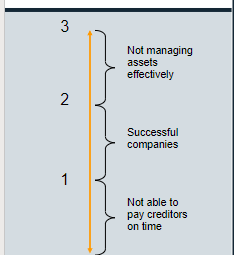

Current Ratio

Current Assets / Current Liabilities

Favorable Ratio for Current Ratio

A Ratio of around 1.5 to 2.0 would be favorable. If the ratio is 1 or below, the short term debt of the business is larger than its liquid assets. Whereas a higher current ratio would suggest that there is too much cash, debtors, or inventory.

Methods of improving Current Ratio

Increase current assets by selling non - current assets for cash

Decrease current liabilities by using long - term Sources of Finance instead of Short term

Acid Test Ratio

Current Assets - Stock / Current Liabilities

Favorable Ratio for Acid Test

1:1. Anything less than 1:1 means the firm is experiencing working capital difficulties, and could risk having a liquidity crisis. (Meaning the firm is unable to pay its short term debts.)

Methods of improving Acid Test

Basically same thing as current ratio, decrease current liabilities, increase current assets etc etc etc

Working Capital

Also known as Net Current Assets. The cash or assets that are availabl to a business for daily operations.

Cash Inflow

All the revenue sources coming into the business

Cash Outflow

All potential costs going out of the business

Net Cash Flow

Cash inflows - Cash outflows. A negative net cash flow would mean there is a liquidity problem. Its preferred to have a positive number on the cash flow forecast.

Investment Appraisal

Evaluating the profitability of an investment project,

Payback Period (NOT ON FORMULA SHEET)

Length of time taken to repay the initial capital cost.

1st: Initial Investment cost / Contribution per month

2nd: Additional cash inflow needed / Annual Cash flow in the next year x12 months

Average Rate of Return or ARR (PIE)

Calculates the average Annual Profit of an investment project in a percentage of the initial amount of money invested in the project.

(Total returns - capital cost)/years of use / capital cost x 100

or

average annual profit/initial investment cost x 100

Higher = Better

NPV Net present value (PIE)

Sum of present value - cost of investment