macroeconomics chapters 13-17

0.0(0)

Card Sorting

1/121

Earn XP

Description and Tags

Last updated 7:17 PM on 12/22/22

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

122 Terms

1

New cards

labor force equation

number of employed + number of unemployed

2

New cards

unemployment rate

number of unemployed / labor force

3

New cards

what makes someone considered out of the labor force?

when a person stops looking for work

4

New cards

frictional unemployment

unemployment that occurs when people take time to find a job or are transitioning between jobs

5

New cards

structural unemployment

unemployment that occurs due to changes in the structure of the economy, resulting in significant loss of jobs in industries

6

New cards

cyclical unemployment

unemployment that occurs due to recessions and depressions

7

New cards

what happens to the wage rate when there is an excess supply of labor?

the wage rate will fall until a new equilibrium is reached. everyone who wants a job at a lower wage rate will have one.

8

New cards

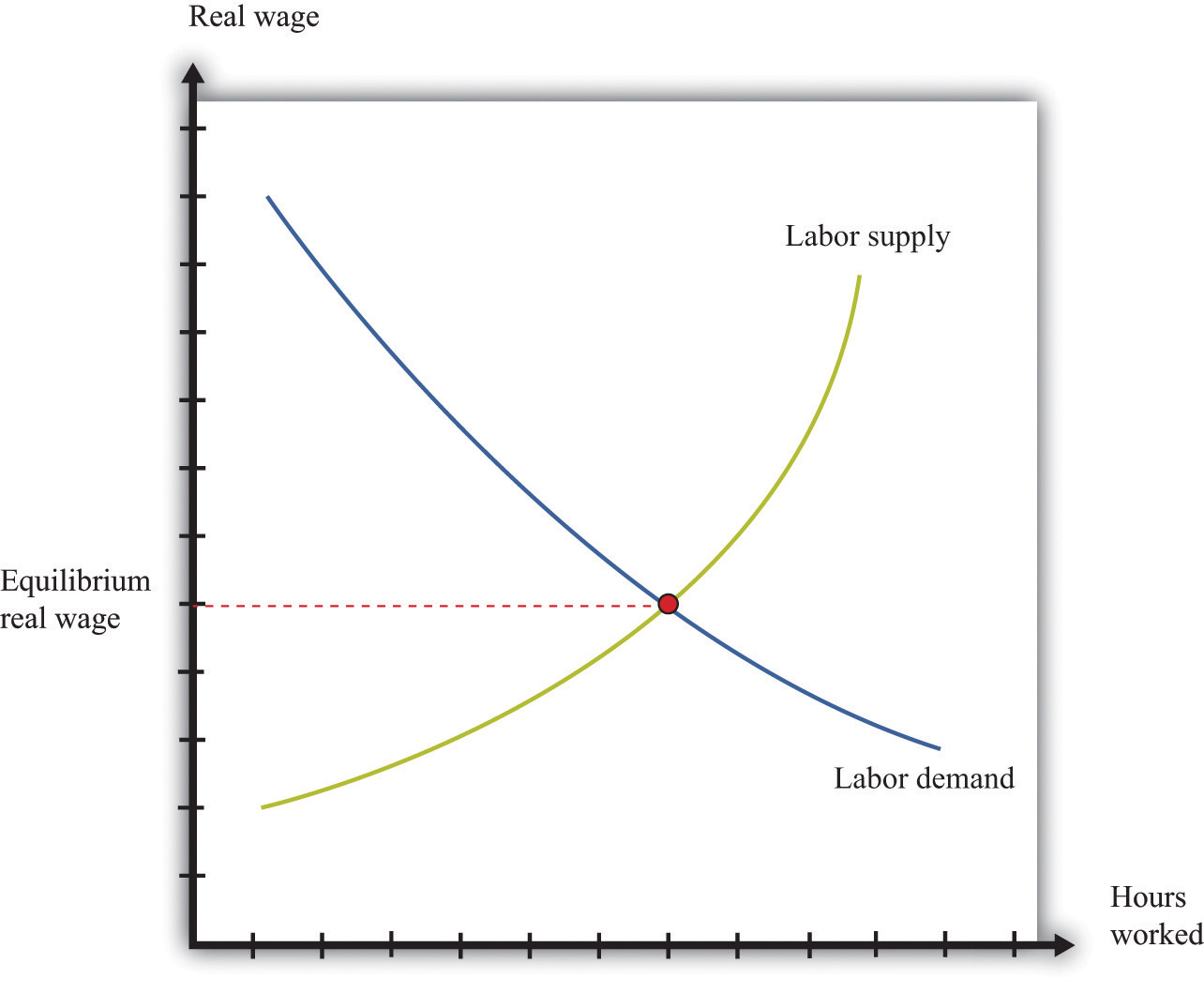

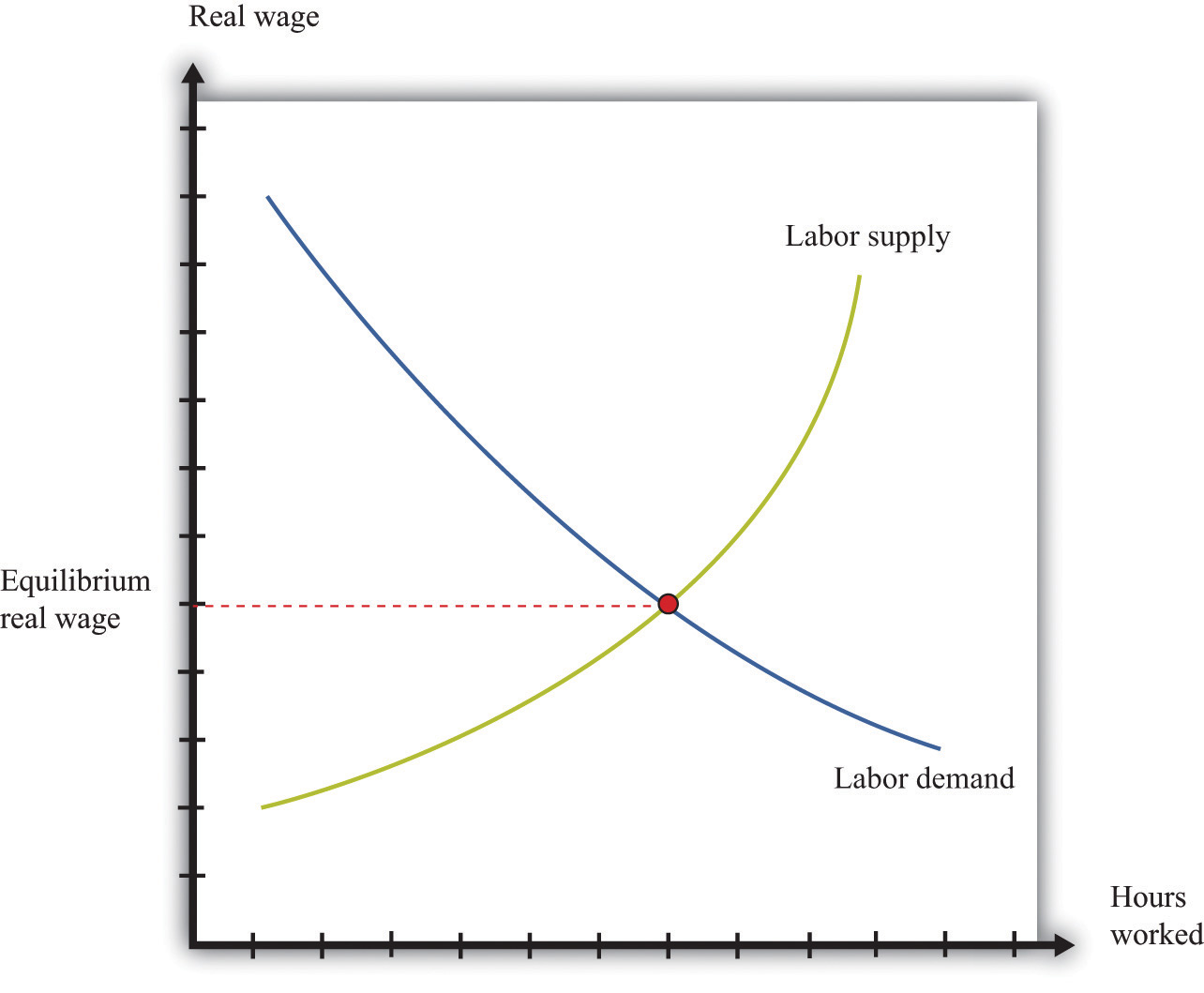

labor demand curve

a graph that illustrates the amount of labor that firms want to employ at each given wage rate

9

New cards

labor supply curve

a graph that illustrates the amount of labor that households want to supply at each given wage rate

10

New cards

what happens at equilibrium with the labor supply and labor demand curve?

people who are not working have chosen not to work that that market wage, so there is always full employment.

11

New cards

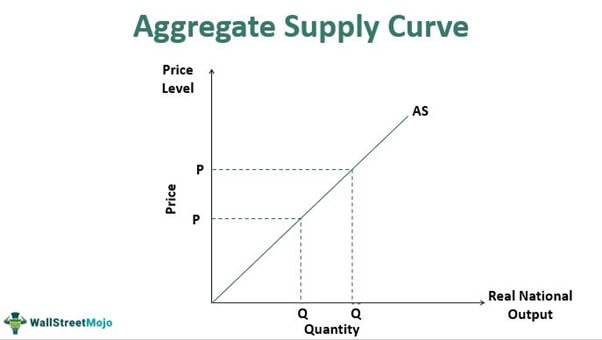

what happens to the aggregate supply curve when there are no sticky wages?

the aggregate supply curve is vertical

12

New cards

if there are no sticky wages, monetary and fiscal policy have [blank] effect on real output.

no

13

New cards

what happens to wages when the labor demand curve shifts to the left?

the wage decreases

14

New cards

three common arguments for the existence of frictional or structural unemployment

efficiency wage theory \n imperfect information \n minimum wage laws

15

New cards

imperfect information

firms may not have enough information at their disposal to know what the market-clearing wage is

16

New cards

minimum wage laws

laws that set a floor for wage rates, that is, a minimum hourly rate for any kind of labor

17

New cards

efficiency wage theory

the productivity of workers increases with the wage rate. firms are incentivized to pay wages above the market-clearing rate

18

New cards

imperfect information

firms may not have enough information at their disposal to know what the market-clearing wage is

19

New cards

minimum wage laws

laws that set a floor for wage rates, that is, a minimum hourly rate for any kind of labor

20

New cards

sticky wages

the downward rigidity of wages as an explanation for the existence of unemployment

21

New cards

social or implicit contracts

unspoken agreements between workers and firms that firms will not cut wages

22

New cards

relative-wage explanation of unemployment

An explanation for sticky wages (and therefore unemployment): If workers are concerned about their wages relative to other workers in other firms and industries, they may be unwilling to accept a wage cut unless they know that all other workers are receiving similar cuts.

23

New cards

explicit contracts

employment contracts that stipulate workers' wages, usually for a period of 1 to 3 years

24

New cards

cost-of-living adjustments (COLAs)

contract provisions that tie wages to changes in the cost of living. the greater the inflation rate, the more wages are raised

25

New cards

inflation rate

the percentage change in the price level

26

New cards

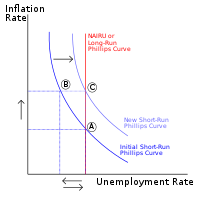

phillips curve

a curve showing the relationship between the inflation rate and the unemployment rate

27

New cards

on the aggregate supply curve, there is a positive relationship between the [blank] and [blank]

price level (P) ; income (Y)

28

New cards

what kind of relationship is on the phillips curve?

negative

29

New cards

on the phillips curve, as the unemployment rate decreases, what happens to the price level?

it increases, since it is moving closer to capacity output

30

New cards

![the aggregate demand curve shifts to the [blank] if there is a positive relationship between price wage and income.](https://knowt-user-attachments.s3.amazonaws.com/1e4e246004ba4acebba7140bdc99a02e.jpeg)

the aggregate demand curve shifts to the [blank] if there is a positive relationship between price wage and income.

right

31

New cards

the aggregate supply curve shifts to the [blank] if there is a negative relationship between price wage and income.

left

32

New cards

what does it mean for the relationship between price wage and income if both the aggregate demand and aggregate supply curve are shifting?

there is no systematic relationship

33

New cards

the phillips curve will shift to the [blank] if inflationary expectations increase

right

34

New cards

the phillips curve will shift to the [blank] if inflationary expectations decrease

left

35

New cards

natural rate of unemployment

the unemployment that occurs as a normal part of the functioning of the economy. sometimes taken as a sum of frictional unemployment and structural employment

36

New cards

how is the phillips curve formed if the aggregate supply curve is vertical in the long run?

it is also vertical

37

New cards

in the long run, the phillips curve corresponds to...

the natural rate of unemployment

38

New cards

NAIRU

non-accelerating inflation rate of unemployment

39

New cards

what happens to the change in inflation rate if the actual unemployment rate is below the NAIRU?

the change in the inflation rate will be positive and accelerates

40

New cards

what happens to the price level changing rate if the unemployment rate is equal to the NAIRU

there is no change in the rate

41

New cards

stock

a certificate that certifies ownership of a certain portion of a firm

42

New cards

capital gain

an increase in the value of an asset

43

New cards

realized capital gain

the gain that occurs when the owner of a asset actually sells it for more than he or she paid for it

44

New cards

yield to maturity formula

c/1+i, c/(1+i)^2, c/(1+i)^3… c/(1+i)^n, f/(1+i)^n

45

New cards

what happens to the current stock price as the expected future dividends increase?

the price increases as well

46

New cards

the price of the stock is equal to...

the discounted value of its expected future dividends

47

New cards

dow jones industrial average

an index based on the stock prices of 30 actively traded large companies. the oldest and most widely followed index of the stock market performance

48

New cards

nasdaq (national association of securities dealers automated quotation system) composite

an index based on the stock prices of more than 5000 companies traded on the nasdaq stock market.

49

New cards

standard & poor's 500 (s&p 500)

an index based on the stock prices of 500 of the largest firms by market value

50

New cards

hyman minsky

stability breeds instability

51

New cards

stabilization policy

describes both monetary and fiscal policy, the goals of which are to smooth out fluctuations in output and employment and to keep prices as stable as possible

52

New cards

time lags

delays in the economy's response to stabilization policies

53

New cards

recognition lag

the time it takes for policymakers to recognize the existence of a boom or a slump

54

New cards

implementation lag

the time it takes to put the desired policy into effect once economists and policymakers recognize that the economy is in a boom or a slump

55

New cards

response lag

the time it takes for the economy to adjust to the new conditions after a new policy is implemented; the lag that occurs because of the operation of the economy itself

56

New cards

there is a lag between the time a fiscal policy action is initiated and the time [blank]

the full change in gdp is realized

57

New cards

response lags are longer for monetary policy or fiscal policy?

monetary

58

New cards

deficits in recessions are

temporary and do not impose any long-run problems

59

New cards

deficits at full employment are

able to have negative long-run consequences

60

New cards

gramm-rudman-hollings act

passed by the us congress and signed by president reagan in 1986, this law set out to reduce the federal deficit by $36 billion per year, with a deficit of zero slated for 1991

61

New cards

automatic stabilizers

revenue and expenditure items in the federal budget that automatically change with the economy in such a way as to stabilize gdp

62

New cards

automatic destabilizers

revenue and expenditure items in the federal budget that automatically change with the economy in such a way to destabilize gdp

63

New cards

life-cycle theory of consumption

a theory of household consumption: households make lifetime consumption decisions based on their expectations of lifetime income

64

New cards

permanent income

the average level of a person's expected future income stream

65

New cards

in early working and retirement years, people consume [blank] than they earn

more

66

New cards

in between early working and retirement years, people [blank] to pay off [blank] from borrowing and to accumulate savings for retirement

save; debts

67

New cards

substitution effect of a wage rate increase

a higher wage leads to a larger quantity of labor supplied

68

New cards

income effect of a wage rate increase

people with higher income will spend some of it on leisure by working less, since leisure is a normal good.

69

New cards

nominal wage rate

the wage rate in current dollars

70

New cards

real wage rate

the amount the nominal wage rate can buy in terms of goods and services

71

New cards

nonlabor, or nonwage, income

any income received from sources other than working-- inheritances, interest, dividends, transfer payments, and so on

72

New cards

an unexpected increase in wealth or nonlabor income leads to...

a decrease in labor supply

73

New cards

substitution effect of interest rate and consumption

a rise in the interest rate leads you to consume less and save more

74

New cards

income effect of interest rate and income

a fall in the interest rate leads to a fall in interest income when

75

New cards

unconstrained supply of labor

the amount of a household would like to work within a given period at the current wage rate if it could find the work

76

New cards

constrained supply of labor

the amount a household actually works in a given period at the current wage rate

77

New cards

keynesian theory

current income determines current consumption

78

New cards

factors that affect household consumption and labor supply decisions

current and expected future real wages \n \n initial value of wealth \n \n current and expected future nonlabor income \n \n interest rates \n \n current and expected future tax rates and transfer payments

79

New cards

animal spirits of entrepreneurs

a term coined by keynes to describe investors' feelings

80

New cards

accelerator effect

the tendency for investment to increase when aggregate output increase and to decrease when output decreases, accelerating the growth or decline of output

81

New cards

excess labor, excess capital

labor and capital that are not needed to produce the firm's current level of output

82

New cards

adjustment costs

the costs that a firm incurs when it changes its production level (administration costs of laying off employees or the training costs of hiring new workers)

83

New cards

inventory investment

the changes in the stock of inventories

84

New cards

desired, or optimal, level of inventories

the level of inventory at which the extra cost (in lost sales) from lowering inventories by a small amount is just equal to the extra gain (in interest revenue and decreased storage costs)

85

New cards

factors that affect firms' investment and employment decisions

firms' expectations of future output \n \n wage rate and cost of capital \n \n amount of excess labor and excess capital on hand

86

New cards

productivity or labor productivity

output per worker hour

87

New cards

okun's law

the short run the unemployment rate decrease about 1 percentage point for every 3% increase in real gdp

88

New cards

discouraged-worker effect

The decline in the measured unemployment rate that results when people who want to work but cannot find jobs grow discouraged and stop looking, thus dropping out of the ranks of the unemployed and the labor force.

89

New cards

effects that decrease the size of the multiplier

automatic stabilizers \n \n interest rate \n \n response of the price level \n \n excess capital and excess labor \n \n inventories \n \n people's expectations about the future

90

New cards

output growth

the growth rate of the output of the entire economy

91

New cards

per-capita output growth

the growth rate of output per person in the economy

92

New cards

labor productivity growth

the growth rate of output per worker

93

New cards

catch-up

the growth rates of less developed countries will exceed the growth rates of developed countries, allowing the less developed countries to catch up

94

New cards

convergence theory

the idea that gaps in national incomes tend to close over time

95

New cards

advantages of backwardness

the phenomenon of less developed countries leaping ahead by borrowing technology from more developed countries

96

New cards

aggregate production function

An equation that shows the relationship stating that total gdp depends on the total amount of labor used and the total amount of capital used

97

New cards

diminishing returns

as labor increases, less and less output will be added by each new worker

98

New cards

foreign direct investment (fdi)

investment in enterprises made in a country by residents outside that country

99

New cards

as the quality of labor increases through more education, the labor productivity...

increases

100

New cards

embodied technical change

technical change that results in an improvement in quality of capital