COMM 1800 Exam #1

1/113

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

114 Terms

What is a business?

An organization that provides goods or services to consumers for the purpose of making a profit.

Revenue

The money a company receives by providing services or selling goods to customers.

Profit

The money left over after all costs are paid.

Goods

tangible items manufactured by businesses

Services

intangible offerings of businesses that can’t be held, touched, or stored

not for profit

an organization that exists to achieve some goal other than the usual business goal of profit

Risk

The potential to lose time and money or otherwise not be able to accomplish an organization’s goals. The greater the risks, the greater the potential for profit (or loss).

Who participates in a business?

Owners = invest money

Owners and employees depend on customers. The goal of business is to satisfy the needs of its customers in order to generate a profit.

Stakeholders

Those with a legitimate interest in the success or failure of the business and the policies it adopts; include customers, clients, employees, shareholders, communities, the environment, the government, and the media, among others. Stakeholders interests’ may conflict with each other

Functional Areas of Business

Management:

Planning for, organizing, leading, and controlling a company’s resources so that it can achieve its goals. Responsible for work performance of other people.

Design controls for assessing the success of plans and decisions and take corrective action when needed

Operations:

The business function that designs and oversees the transformation of resources into goods or services.

Marketing:

Everything that a company does to identify customers’ needs (i.e., market research) and design products to meet those needs.

Accounting

The process of collecting, recording, classifying, summarizing, reporting, and analyzing financial activities.

Finance

Planning for, obtaining, and managing a company’s funds.

Acronym: MOM AF

Types of Accounting (Functional Areas of Business)

Financial accountants prepare financial statements to help users, both inside and outside the organization, assess the financial strength of the company. Managerial accountants prepare information, such as reports on the cost of materials used in the production process, for internal use only.

Macro environment

Aspects of a company's external environment that can impact the business but over which the company generally has little direct control, such as the economy and political activity.

External factors: economy, government, consumer trends, tech developments, public pressure to act as good corporate citizens

What is the stock market?

The stock market provides a venue where companies raise capital by selling shares of stock, or equity, to investors. Several exchanges in which shares of publicly held companies are bought and sold. Stocks give shareholders voting rights as well as a residual claim on corporate earnings in the form of capital gains and dividends. Shareholder investment helps company grow. As demand for stocks increase, so does their price, and the value of the company’s stocks people already own.

Securities

Investment certificates that represent either equity (ownership in the issuing organization) or debt (a loan to the issuer). stock is a type of security = equity

Corporations and the government raise capital by selling securities to investors, who in turn take on a certain amount of risk with the hope of receiving a profit from their investment.

Individual vs Institutional Investor

Individual Investors: invest their own money to achieve their personal financial goals

Institutional investors: Investment professionals who are paid to manage other people’s money

They work at banks, mutual funds, insurance companies

They control large sums of money, often buying stock in 10,000-share blocks and they account for about half of the dollar volume of equities traded

What is a Public Company?

A company that is subject to public reporting requirements and whose securities trade on public markets. Public companies must keep their shareholders informed by filing periodic reports and materials with the SEC.

Companies are subject to public reporting requirements if they…

Sell securities publicly like an initial public offering (IPO)

Allow their investor base to reach a certain size

Voluntarily register with the Securities and Exchange Commission (SEC)

Required reports filed by US public companies:

Annual Reports on Form 10-K:

This report includes the company’s audited annual financial statements and a discussion of the company’s business results.

Quarterly Reports on Form 10-Q:

Public companies must file this report for each of the first three quarters of their fiscal year. The quarterly report includes unaudited financial statements and information about the company’s business and results for the previous three months and for the year to date. The quarterly report compares the company’s performance in the current quarter and year to date to the same periods in the previous year.

Current Reports on Form 8-K:

Companies file this report with the SEC to announce major events that shareholders should know about, including bankruptcy proceedings, a change in corporate leadership (such as a new director or high-level officer), and preliminary earnings announcements.

Proxy Statements:

Shareholder voting constitutes one of the key rights of shareholders. They may elect members of the board of directors, cast non-binding votes on executive compensation, approve or reject proposed mergers and acquisitions, or vote on other important topics. Proxy statements describe the matters to be voted upon and often disclose information on the company’s executive compensation policies and practices.

Other Disclosures:

These include proposed mergers, acquisitions and tender offers, securities transactions by company insiders, and beneficial ownership by a person or group that reaches or exceeds five percent of the company’s outstanding shares.

IPO

Initial Public Offering: The very first sale of a stock issued by a company on the public market. A private company is turned into a public company. A public company is able to be owned by a large number of people. Going public can raise a lot of cash for a company, allowing the company to scale up and grow the company. Going public is a tedious process. The company will start with finding an underwriting firm, which is typically an investment bank or several. Then, the firm will put up the money to fund the IPO, essentially “buying” the shares before they’re actually listed anywhere. The company also has to register with the SEC. The underwriter’s goal is to sell shares to the public for more than it paid the company.

Downside: owners give up more ownership in the business and are now subject to many SEC regulatory requirements

Primary Market

The securities market where new securities are sold to the public, usually with the help of investment bankers

The issuer of the security gets the proceeds

Only sold once

Secondary Markets

The securities market where old (already issued) securities are bought and sold, or traded, among investors; includes broker markets, dealer markets, the over-the-counter market, and the commodities exchanges.

Issuers generally are not involved in these transactions

Vast majority of securities transactions

Investment Bank

Firms that act as intermediaries, buying securities from corporations and governments and reselling them to the public. This process is called underwriting.

Investment bankers want to acquire the security for an agreed upon price and hope to resell it at a higher price to make a profit.

IB’s advise clients on the pricing and structure of new securities offerings, as well as on mergers, acquisitions, and other financing.

Stockbroker

a person who is licensed to buy and sell securities on behalf of clients

Also called account executives, they work for brokerage firms and execute the orders customers place for stocks, bonds, mutual funds, and other securities.

Brokerage firms are paid commissions depending on value of transaction and the number of shares involved

Types of secondary markets:

Broker Markets

Consists of national and regional securities exchanges that bring buyers and sellers together through brokers on a centralized trading floor

In the broker market, the buyer purchases the securities directly from the seller through the broker. Broker markets account for about 60 percent of the total dollar volume of all shares traded in the U.S. securities markets.

Ex: New York Stock Exchange (NYSE)

Dealer Markets

Unlike broker markets, dealer markets do not operate on centralized trading floors but instead use sophisticated telecommunications networks that link dealers throughout the United States.

Buyers and sellers do not trade securities directly like in broker markets; they work through securities dealers called market makers. Market makers make markets in one or more securities and offer to buy or sell securities at stated prices.

A security transaction in the dealer market has two parts: the selling investor sells his or her securities to one dealer, and the buyer purchases the securities from another dealer (or in some cases, the same dealer).

National Association of Securities Dealers Automated Quotation system (NASDAQ) is the largest dealer market. The NASDAQ’s sophisticated electronic communication system provides faster transaction speeds than traditional floor markets.

NASDAQ

National Association of Securities Dealers Automated Quotation - largest dealer market. The NASDAQ’s sophisticated electronic communication system provides faster transaction speeds than traditional floor markets and links dealers throughout the United States.

NYSE

The oldest and most prestigious broker market, which has existed since 1792 and is located on Wall Street in downtown New York City.

Mutual Funds

By investing in a mutual fund, you can buy shares in a large, professionally managed portfolio, or group, of stocks and bonds. A mutual fund is a financial-service company that pools its investors’ funds to buy a selection of securities—marketable securities, stocks, bonds, or a combination of securities—that meet its stated investment goals.

Mutual funds are appealing because:

Maintains diversified (less risky) portfolio. Buying shares in a mutual fund lets investors own part of a portfolio that may contain 100 or more securities.

Professionally managed

May offer higher returns than individual investors could achieve on their own

Actively Managed

Exchange-Traded Funds (ETF)

ETFs are similar to mutual funds because they hold a broad basket of stocks with a common theme, giving investors instant diversification. ETFs trade on stock exchanges, so their prices change throughout the day, whereas mutual fund share prices, called net asset values (NAVs), are calculated once a day, at the end of trading. ETFs have very low expense ratios, but because they trade as stocks, investors may pay commissions to buy and sell ETF shares. Ex: S&P500

Passively Managed

SEC: Why was SEC formed?

Securities Exchange Commission - Purpose is to enforce the law against market manipulation. SEC was created in the aftermath of the Great Depression. SEC protects investors by requiring full disclosure of information about new securities issues. Securities Exchange Act of 1934 formally gave the SEC power to regulate securities exchanges. The act was amended in 1964 to give the SEC authority over the dealer markets as well. The amendment included rules for operating the stock exchanges and granted the SEC control over all participants (exchange members, brokers, dealers) and the securities traded in these markets. It also banned insider trading, which is the use of information that is not available to the general public to make profits on securities transactions. Insider trading still occurred.

Insider Trading

The use of information that is not available to the general public to make profits on securities transactions.

Circuit Breakers

Procedures for coordinated cross-market trading halts if a severe market price decline reaches levels that may exhaust market liquidity. These procedures, known as market-wide circuit breakers, may halt trading temporarily or, under extreme circumstances, close the markets before the normal close of the trading session.

Growth stocks

Earnings from these stocks grow at a faster rate than the market average. They rarely pay dividends; investors buy them in the hope of capital appreciation (occurs when a stock rises in price). Growth stock example: Start up company

Income stocks

pays dividends (earnings the company distributes to the stockholders) consistently. Investors buy them for the income they generate. Income stock example: established utility company

Value stocks

have low price-to-earnings (PE) ratio, which means they are cheaper to buy than stocks with a a higher PE. Value stocks can be growth or income stocks. The lower PE may indicate that some investors are not interested anymore. People buy value stocks in the hope that the market has overreacted and that the stock’s price will rebound.

Blue-chip stocks

shares in large well known companies with a solid history of growth. These stocks generally pay dividends.

What are the regular trading hours for the NYSE and NASDAQ?

9:30 AM to 4 PM Eastern on weekdays

Why do stock exchanges have “core hours?”

Exchanges have core hours due to liquidity.

Liquidity: how much buying and selling is going on at a given time. The more liquidity in a particular security, the more likely to get a fair price

They want max amount of traders buying and selling at the same time.

What is market capitalization and how is it calculated?

Market capitalization is the total dollar market value of a company’s outstanding stock shares. The term outstanding shares refers to a company's stock currently held by all its shareholders. This is used to determine a company’s size instead of sales or total asset figures. To calculate, multiply the number of outstanding shares by the current market value of one share.

What are the main three labels used to distinguish among stock from different sizes of companies?

a. Large-cap: market value between $10B-200B

b. Mid-cap: market value between $2B-10B

c. Small-cap: market value between $250M-2B

What is an entrepreneur?

Someone who identifies and acts on an idea or problem that no one else has identified or acted on in quite the same way. An entrepreneurial venture is the creation of any business, organization, project, or operation of interest that includes a level of risk in acting on an opportunity that has not previously been established. Can be for profit or can be focused on social needs/nonprofit

Entrepreneurial Opportunity

Entrepreneurial opportunity is the point at which identifiable consumer demand meets the feasibility of satisfying the requested product or service and meets the following conditions: significant market demand, significant market structure and size, significant margins, and resources to support the venture’s success.

Opportunities are sometimes found through a deliberate search, especially when developing new tech. Sometimes opportunities emerge through chance.

*Margin: the difference between a product or service's selling price and the cost of production, or the ratio of profit to revenue.

Product-market fit/problem-solution fit

The degree to which a product satisfies a strong market demand.

Business Plan

A formal document that typically describes the business and industry, market strategies, sales potential, and competitive analysis, as well as the company’s long-term goals and objectives. Investors usually request a formal business plan as it is an integral part of their evaluation.

Some components:

Describe industry, market strategies, sales potential, and competitive analysis, as well as the company’s long-term goals and objectives.

Projects financial data over a three-year period; typically required by banks or other investors to secure funding

Common sources of entrepreneurial financing/funding:

Funds: necessary capital to get a business or idea off the ground

Securing funding is one of the first steps for starting a business (but cannot make up for a lack of experience, poor management, or a product with no viable market).

Companies get their funds from their own savings, credit cards, friends and family, banks (fund very few), venture capitalists

Financing: the process of raising money for an intended purpose.

Typically, those who can provide financing want to be assured that they could, at least potentially, be repaid in a short period of time, which requires a way that investors and business owners can communicate how that financing would happen.

Entrepreneurial Funding Stages

Seed-stage: company is the earliest point in its lifecycle. It is based on a founder’s idea for a new product or service. Nurtured correctly, it will eventually grow into an operational business.

Ventures at this stage are typically not yet generating revenue, and the founders haven’t yet converted their idea into a salable product

Seed funding comprises generally of personal savings of the founder plus perhaps a few small investments from family members

Before an outsider will invest in a business, they will expect an entrepreneur to have exhausted F&F financing (friends and family) to reduce risk and instill confidence in the business’s potential success

Early Stage: Company lifecycle stage in which the product or service has begun development.

May be a first gen model of product that is securing some sales but requires modifications for large scale production and manufacturing

The company may now include outside investors, including venture capitalists

Mature Stage: Company lifecycle stage in which the business has reached commercial viability

Operating in the manner described in the business plan: providing value to customers, generating sales, and collecting customer payments in a timely manner

Self sufficient companies, requiring little to no outside investment to maintain current operations

Manufacturing a product at scale (very large volumes)

Consistent level of sales, but may seek to expand into new markets or regions (requires significant investment); can double size of business

To access more money, mature companies may consider selling a portion of the company, either to a private equity group or through an IPO

Acronym:

SEM like Semester

Angel Investors

Wealthy, private individual seeking investment options with a greater potential return than is generally available with traditional publicly traded stocks, albeit with much greater risk.

Angel investors must be accredited by the SEC and must meet a net worth or income test

Angel investors look at start ups and early stage companies

Venture Capitalists

an individual or investment firm that specializes in funding early stage companies.

How are angel investors and venture capitalists different?

1. a venture capital firm typically operates as a full-time active investment business, whereas an angel investor may be a retired executive or business owner with significant savings to invest.

2. venture capital firms operate at a higher level of sophistication, often specializing in certain industries and with the ability to leverage industry expertise to invest with more know-how. Typically, venture capitalists will invest higher amounts than angel investors, although this trend may be shifting as larger angel groups and “super angels” begin to invest in venture rounds

Types of Financing

Debt Financing

The process of borrowing funds from another party; the money must be repaid to the lender, usually with interest

Money can come from banks, credit cards, family and friends

Advantage: the debtor pays back a specific amount. When repaid, the creditor releases all claims to its ownership in the business

Disadvantage: the repayment of the loan typically begins immediately or after a short grace period; the startup is faced with a fairly quick cash outflow requirement, which can be challenging + interest

One source of debt financing: Small Business Administration (SBA), a government agency founded as a part of the Small Business Act of 1963

The SBA partners with lending institutions such as banks and credit unions to guarantee loans for small businesses; the SBA takes on some of the risk that the bank would normally be exposed to, providing more incentive to the lending institution to finance an entrepreneurial venture

Equity Financing

Involves purchasing an ownership stake in a company, usually through shares of stock in a corporation.

Equity financing can come from many different sources.

This type of investing is on Shark Tank.

Advantage: There is no immediate cash flow requirement to repay the funds, as there is with debt financing. Drawback: the investor is entitled to a portion of the profits for all future years unless the business owner repurchases the ownership interest, typically at a much higher valuation

Valuation

an estimate of worth, usually described in relation to the price an investor would pay to acquire the entire company

What is a Business Model?

NOT THE SAME AS BUSINESS PLAN.

A plan for how the venture will be funded; how the venture creates value for its stakeholders, including customers; how the venture’s offerings are made and distributed to the end users; and how income will be generated through this process. (business design)

Addresses desirability, feasibility, and viability of company/product/service

Address revenue streams, value proposition, and customer segments

“Describes the rationale of how an organization creates, delivers and captures value”

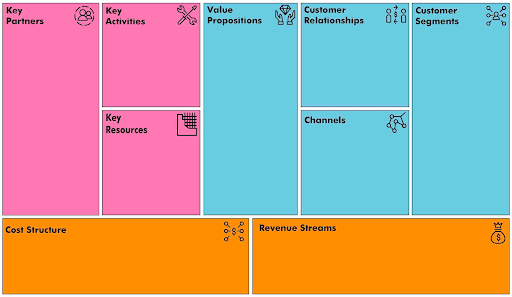

Business Model Canvas (BMC)

Customer Segments:

Businesses must identify and understand their customers, and they can group these customers into segments with common characteristics.

Customer Relationships:

strong customer relationships retain customers and boost sales. Categories include personal assistance, self-service, automated service, user communities, and cocreation

Channels:

bring the value proposition to the customers through communication, distribution, and sales. Companies can reach their customer segments through a mix of channels, both direct (e.g., through sales force and web sales) and indirect (e.g., through own stores, partner stores, and wholesalers), to raise awareness, allow for purchase and delivery, provide customer support, and support other important functions of the business.

Revenue Streams:

revenue from one-time customers and revenues from ongoing payments. Revenue pricing mechanisms vary from fixed (e.g., predefined prices based on static variables) to dynamic (e.g., price changes based on market conditions). Revenue streams can be generated through asset sales (e.g., selling a physical product), usage fees, subscription fees, licensing, brokerage fees, advertising, and temporarily selling the use of a particular asset (e.g., lending, renting, or leasing).

Value Propositions:

the reason why customers choose the product over another. Customers may value: newness, performance, customization, design, brand, price, cost reduction, risk reduction, accessibility, and convenience.

Key Partners:

Companies build partnerships to optimize their business, reduce risk, or gain resources. There are four main types of partnerships: strategic alliances between noncompetitors, coopetition—strategic alliances between competitors, joint ventures, and buyer-supplier relationships.

Key Activities:

Key activities are the critical tasks that a company does to succeed and operate successfully. Different companies focus on different activities in categories such as production, problem-solving, and platform/network.

Key Resources:

Any business needs resources—physical, financial, intellectual, and/or human—to function. These resources enable the company to provide their products or services to their customers.

Cost Structure:

All businesses incur costs through operation, whether fixed or variable. They may also face economies of scale and scope. Companies consider their cost structures in two strategies—cost-driven, where all costs are reduced wherever possible, and value-driven, where the focus is on greater value creation. Cost structures will often consider fixed costs, variable costs, economies of scale, and economies of scope.

Acronym: CRRAPS RVC

Economies of scale

mass producing one product, aiming to reduce costs

Economies of Scope

producing different types of products using same resources

BMC - Front Stage vs Back Stage

Front Stage: customer-facing side of the business (right side of canvas)

Represents value to customers, and what they are willing to pay for

Back Stage: Business Facing side

Drives cost

revenue>cost = profit

What is Strategy?

Making choices about what an organization will and won’t do to achieve goals and competitive advantage

Business model = how business RUNS; competitive strategy = how to beat RIVALS

Generic Business Strategies + Scope

Cost Leadership

Product price is primary competitive edge, minimizing its cost to enable it to provide an acceptable product while still maintain a positive margin

Effective in industries where there is limited possibility of product differentiation; buyers are price sensitive

More likely to generate increases in market share

DELL, amazon, Walmart

Focused low-cost

A low-cost, narrowly-focused market strategy in which a company focuses on a specific segment, such as a particular buyer segment or a particular geographic segment.

People must be willing to forgo extras to pay a lower price

Company cost is reduced by providing little service, no frills, low-cost distribution method

Broad Differentiation

Involves offering a unique product; price is not the most significant factor; consumers may be willing to pay a high price for something that seems different

More likely to generate higher profits than a cost-leadership strategy due to stronger entry barriers

Harley Davidson, Apple

Focused Differentiation

Marketing of a differentiated product to a narrow market

Ducati motorcycles, Ferrari

Challenges in Each Business Strategy

Low-Cost:

Lower profitability; prices must be cut by less than the size of the cost advantage or the added volume is large enough to bring in a bigger total profit despite lower margins per unit sold

Techniques and methods can easily be copied by rivals; also changes in technology

Becoming too fixated on cost reduction, leading to lower quality of good

Differentiation:

It is hard to avoid copycats; firms must search out sources of uniqueness that are burdensome for rivals to match

Buyers may see little value in the unique attributes of a company’s product “so what”

Overspending on differentiation can erode profitability

Companies need to keep the costs of achieving differentiation below the price premium the differentiating attributes can command in the marketplace, or sell more additional units to increase total profits

Best-Cost Provider Strategy

Some research suggests that a combination strategy — also known as a best-cost provider strategy — is a recipe for below-average profitability compared to the industry, and that such a strategy indicates that the firm’s managers have not made necessary choices about the business and its strategy.

Trends suggest that highly complex environments do not have the luxury of choosing exclusively one strategy over another. The hospital industry may represent such an environment, as hospitals must compete on a variety of fronts.

For instance, reimbursement to diagnosis-related groups, and the continual lowering of reimbursement ceilings have forced hospitals to compete on the basis of cost. At the same time, many of them jockey for position with differentiation based on such features as technology and birthing rooms.

Best-cost provider strategies are a hybrid of low-cost provider and differentiation strategies that aim at satisfying buyer expectations on key quality, feature, performance, or service attributes and beating customer expectations on price.

When does a Best-Cost Provider Strategy work best?

A best-cost provider strategy works best in markets where product differentiation is the norm and attractively large numbers of value-conscious buyers can be induced to purchase midrange products rather than the basic products of low-cost producers or the expensive products of top-of-the-line differentiators.

Mid product x low price or good product x slightly high price

Works well in recessionary times

Challenges in pursuing a best-cost provider strategy

A company’s biggest vulnerability in employing a best-cost provider strategy is not having the requisite core competencies and efficiencies in managing value chain activities to support the addition of differentiating features without significantly increasing costs.

a successful best-cost provider must offer buyers significantly better product attributes to justify a price above what low-cost leaders are charging. Likewise, it has to achieve significantly lower costs in providing upscale features so that it can outcompete high-end differentiators on the basis of a significantly lower price.

Strategy Diamond (Facets of Strategy)

A framework for checking and communicating a strategy.

Arenas

Where the firm will be active and with how much emphasis

Organization can make choices about the value-creation strategies

Differentiators

Things that are unique to the firm that give it a competitive advantage

Can be asset based

Tangible asset: something of value that physically exists: land, machines, equipment

Intangible asset: a nonphysical resource that provides advantages: brands, copyrights, software, logos, patents

Economic Logic

How will the firm make money above its cost of capital

Must earn enough profit to keep investors willing to continue to fund

A firm performs well when its differentiators are well-aligned with its chosen arenas

Vehicles

If arenas and differentiators show where an organization wants to go, then vehicles communicates how the strategy will get it there

vehicles refer to how an organization might pursue a new arena through internal means, through help from a new partner or some other outside source, or even through acquisition.

Organic growth: growth rate of a company excluding any growth from takeovers, acquisitions, or mergers

Acquisitive growth: refers precisely to any growth from takeovers, acquisitions, or mergers

Staging and Pacing

Reflect the sequence and speed of strategic moves

Helps organization think of next steps and timing

Acronym: DAVES

Levels of Management in a Company

Top Managers

Highest level of management: responsible for setting objectives; scanning the environment for opportunities and threats, and planning and decision making

Represent the company in important dealings with other businesses

Middle Managers

Report to top management and oversee the activities of frontline managers

Allocate resources, and develop and implement activities

Job titles include operations manager, division manager, plant manager, and branch manager

Frontline Managers:

Lowest level of management; report to middle managers; coordinate activities, supervise employees, and are involved in day-to-day operations

Titles: manager, group leader, office manager, foreman, and supervisor

What is Company Organizational Structure?

the various roles within an organization, which positions report to which, and how an organization will departmentalize its work (an arrangement of positions that’s most appropriate for a company at a specific point in time)

Specialization

Organizing activities into clusters of related tasks that can be handled by certain individuals or groups

Leads to efficiency, jobs that are easier to learn and roles that are clearer to employees

Sometimes leads to boredom, may lead to decreased performance and increased absenteeism, and decreased turnover (the rate at which workers who leave an organization must be replaced)

Departmentalization

Grouping Specialized Jobs into meaningful units

Functional Organizations

groups together people who have comparable skills and perform similar tasks.

Typical for small to medium-size companies

Each unit is headed by an individual with expertise in the unit’s particular function

Examples: human resources, operations, marketing, finance

Advantage: simplicity; Disadvantage: homogeneity can hinder communication and decision making between units and even promote interdepartmental conflict

Divisional Organizations: A form of departmentalization in which each division contains most of the functional areas (production, marketing, accounting, finance, human resources); in other words, divisions are similar to stand-alone companies, and they function relatively autonomously. Advantage: enhances the ability to respond to changes in a firm’s environment. Disadvantage: services must be duplicated across units, costs will be higher. In addition, some companies have found that units tend to focus on their own needs and goals at the expense of the organization as a whole.

Product Divisions: a company is structured according to its product lines, allowing individuals in the division to focus all their efforts on the products produced by their division; results in higher costs as corporate support services are duplicated in each of the four divisions

Customer Divisions: based on customer segments, enabling company to better serve their various categories of customers

Process Divisions: based on distinct stages of the production process

Geographical Divisions: based on geographical location; enables companies that operate in several locations to be responsive to customers at a local level

Acronym: PCPG

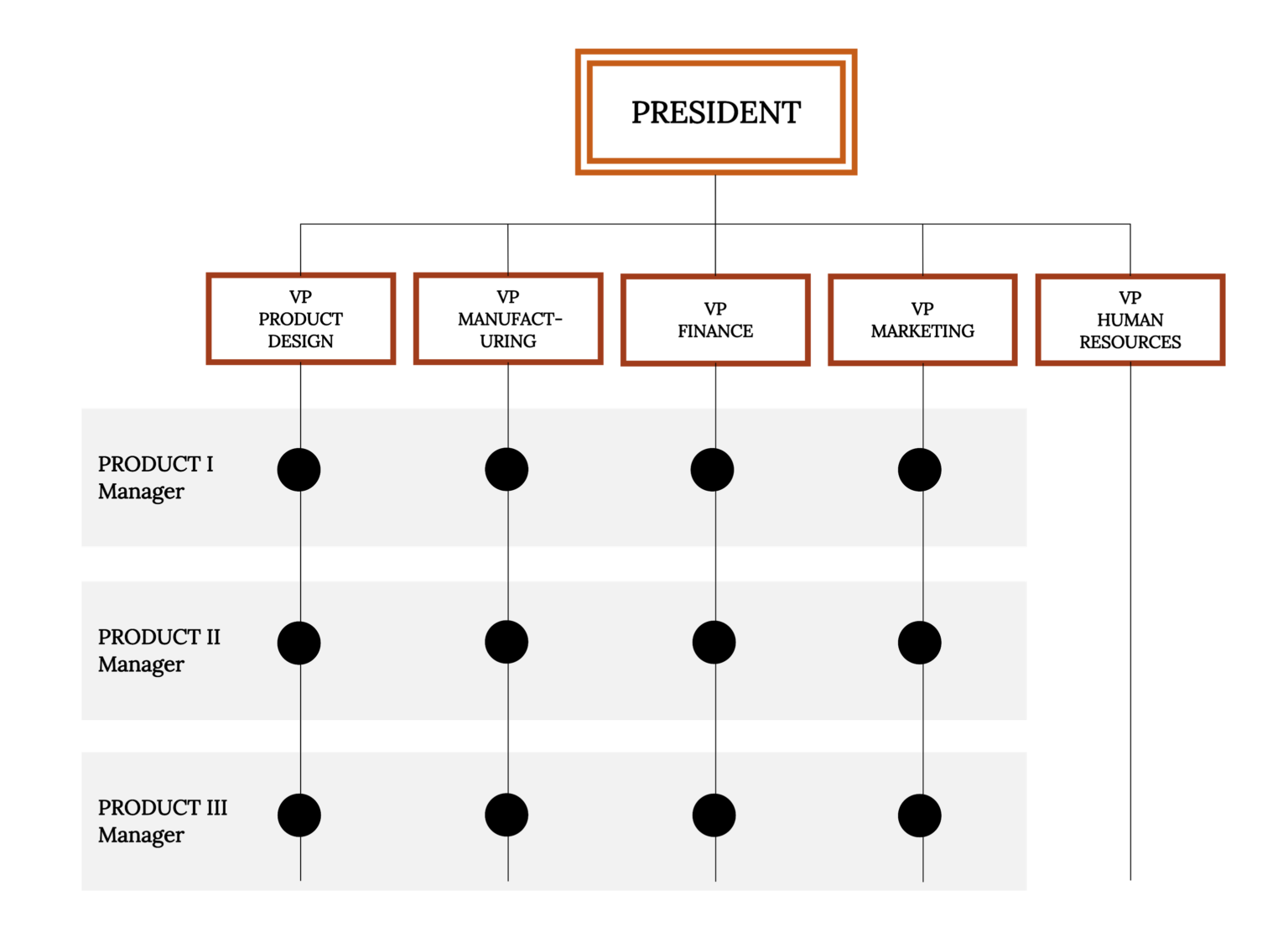

Matrix Structure

a form of departmentalization that combines elements of functional and divisional structures. Violates Unity of command principle. Teams report to multiple leaders.

Chain of Command

The authority relationships among people working at different levels of the organization (who reports to whom)

Unity of Command: occurs when each employee reports to only one supervisor.

Span of Control

The number of layers between the top managerial position and the lowest managerial level is crucial to chain of command

new organizations have only a few layers of management—an organizational structure that’s often called flat.

As a company grows, however, it tends to add more layers between the top and the bottom; that is, it gets taller.

Can slow down communication and decision making, causing the organization to become less efficient and productive

Companies determine trade-offs between the advantages and disadvantages of flat and tall organizations according to span of control (the number of people reporting to a particular manager).

Ex: if you remove layers of management to make your organization flatter, you end up increasing the number of people reporting to a particular supervisor

Narrow span of control (has few direct reports) or wide span of control (with many direct reports)

A company should implement which one based on these factors: frequency and type of interaction, proximity of subordinates, competence of both supervisor and subordinates, and the nature of the work being supervised.

Centralization vs Decentralization

Delegation: Given the tendency toward flatter organizations and wider spans of control, managers must learn how to handle delegation, the process of entrusting work to subordinates.

Centralization:

In organizational structure, where decision making is concentrated at the top of the organizational hierarchy.

Advantage: Consistency in decision-making, more quick decisions

Disadvantage: lower level managers may feel under-utilized and not develop decision making skills that would help them become promotable; might fail to consider info that front-line employees have or delay decision making

Decentralization:

In organizational structure, where decision making is delegated to lower-level employees.

Hierarchy is needed, balance must be found

Organizational Life Cycle

Entrepreneurship Phase

the organization is usually very small and agile, focusing on new products and markets. The founders typically focus on a variety of responsibilities, and they often share frequent and informal communication with all employees in the new company. Employees enjoy a very informal relationship, and the work assignments are very flexible. Usually, there is a loose, organic organizational structure in this phase.

Survival and Early Success Phase

organization begins to scale up and find continuing success. The organization develops more formal structures around more specialized job assignments. Incentives and work standards are adopted. The communication shifts to a more formal tone with the introduction of hierarchy with upper- and lower-level managers.

Sustained Success or Maturity Phase

the organization expands and the hierarchy deepens, now with multiple levels of employees. Lower-level managers are given greater responsibility, and managers for significant areas of responsibility may be identified. Top executives begin to rely almost exclusively on lower-level leaders to handle administrative issues so that they can focus on strategic decisions that affect the overall organization.

Renewal or Decline Phase

an organization expands to the point that its operations are complex and need to operate somewhat autonomously. At times it becomes necessary for the organization to be reorganized or restructured to achieve higher levels of coordination between and among different groups or subunits. Managers may need to address fundamental questions about the overall direction and administration of the organization.

What is professionalism?

Arriving on time for work and managing time effectively

Taking responsibility for own behavior, high quality work standards, honesty, and integrity

Dressed appropriately

RESPECT, having ability to listen

Self awareness

Ways to demonstrate professionalism, according to NACE:

Acting equitably with integrity and accountability to self, others, and the organization.

Maintaining a positive personal brand in alignment with organization and personal career values.

Being present and prepared.

Demonstrating dependability (e.g., consistently showing up for work or meetings).

Prioritizing and completing tasks to accomplish organizational goals.

Consistently meeting or exceeding goals and expectations.

Having an attention to detail, resulting in few if any errors in their work.

Showing a high level of dedication toward doing a good job

How does professionalism relate to college and the real world?

In its 2022 Job Outlook Survey, NACE found that “while 86.9% of responding employers say professionalism is very or extremely important, just 44.2% of employers indicate that new college graduates are very or extremely proficient in it. ”In other words, despite the importance of professionalism in the workplace, many college graduates fall short of demonstrating it at the level employers are expecting.

Some students assume they can wait until they are in “the real world” to practice and develop professional behaviors. But there is no better time than college to do so.

Why do good communication skills matter?

Short emails, complex reports, private chats, impassioned pitches, formal presentations, and team meetings circulate information and ideas, define strategy, and drive decisions. Professional communication includes understanding another’s point of view, delivering bad news clearly but diplomatically, maintaining trust through ethical and honest messaging, and using language to encourage and motivate a team.

Clear and concise writing leads to action, good writing demonstrates clear thinking

Powerful communication matters:

Clear and concise writing gets noticed and leads to action.

Demonstrated communication skills improve your job prospects.

Powerful communication enables you to inspire and guide others.

Well-crafted messages keep you visible (in a positive way) on social media.

Plain Language

Plain language is a term used to describe clear, concise writing. To revise traditionally dense, hard-to-understand text, many private and public organizations follow plain-language principles.

Email etiquette principles

In the workplace, email remains the dominant form of collaborative communication between departments and (especially) with external audiences like suppliers and customers. For now, being a savvy emailer is an important aspect of achieving career success.

Professional emails should be short and direct, subject line should be informative, friendly but not gushy tone.

Use paragraphs

Use visual signposts and topic sentences, bold texts, bullet lists, indent

Include supporting info like hyperlinks or attachments

Bounded Rationality

the idea that for complex issues, we cannot be completely rational because we cannot fully grasp all the possible alternatives, nor can we understand all the implications of every possible alternative.

Escalation of Commitment

the tendency of decision makers to remain committed to poor decisions, even when doing so leads to negative outcomes. Once we commit to a decision, we may find it difficult to reevaluate that decision rationally

Confirmation Bias

tendency people have to process new information in a way that is heavily influenced by their existing beliefs

The brain excels at organizing information into categories, and it doesn’t like to expend the effort to re-arrange once the categories are established.

Leads people to interpret evidence in ways that support their pre-existing beliefs, expectations or hypotheses

Even scientists who commit to a theory tend to disregard inconsistent facts, concluding that the facts are wrong, not the theory

Attribution Theory

The cognitive process by which people interpret the reasons or causes for their behavior.

People who feel they have control over what happens to them are more likely to accept responsibility for their actions than those who feel control of events is out of their hands.

Based on work of Fritz Heider: behavior is determined by a combination of internal forces (abilities, effort) and external forces (task difficulty or luck).

Fundamental Attribution Error:

The tendency to underestimate the effects of external or situational causes of behavior and to overestimate the effects of internal or personal causes. (in judging others behavior) For example, if we observe a major problem within another department, we are more likely to blame people rather than events or situations.

We judge others more harsh than we judge ourselves; we let ourselves off the - hook and blame situation instead of internal factors

Self-serving Bias

The tendency for individuals to attribute their successes to their own actions while attributing their failures to others.

Blinds us to the ways in which we are prejudiced in favor of ourselves

Self-fulfilling prophecy

an expectation held by a person that alters their behavior in a way that tends to make it true.

For example, when we hold stereotypes about a person, we tend to treat the person according to our expectations. This treatment can influence the person to act according to our stereotypic expectations, thus confirming our stereotypic beliefs.

In-groups/out-groups

An in-group is a group that we identify with or see ourselves as belonging to. A group that we don’t belong to, or an out-group, is a group that we view as fundamentally different from us.

We typically develop an in-group bias, a preference for our own group over other groups

Can result in prejudice and discrimination

Scapegoating is the act of blaming an out-group when the in-group experiences frustration or is blocked from obtaining a goal

Conscious and thoughtful reflection is important, the expression of empathy, the acknowledgment of past suffering on both sides, and the halt of destructive behaviors.

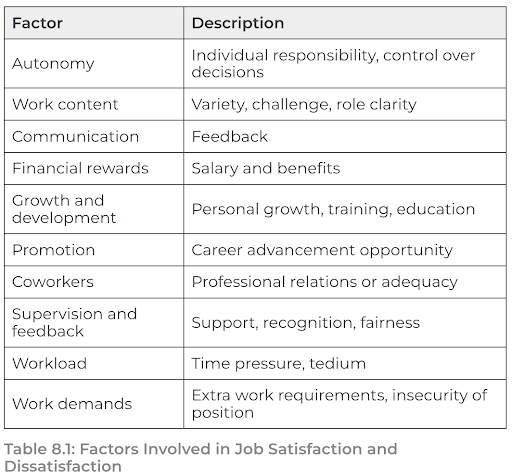

Job satisfaction

The degree to which individuals enjoy their job

Job satisfaction is typically measured after a change in an organization, such as a shift in the management model, to assess how the change affects employees. It may also be routinely measured by an organization to assess one of many factors expected to affect the organization’s performance.

What is Motivation?

The set of forces that prompt a person to release energy, or exert effort, in a certain direction. Motivation is a need and want satisfying process. It results in some kind of reward.

Needs and Wants

Need: the gap between what is and what is required

Want: gap between what is and what is desired

Intrinsic vs Extrinsic Motivation and Rewards

Intrinsic: come from within the individual—things like satisfaction, contentment, sense of accomplishment, confidence, and pride.

Extrinsic: come from outside the individual—things like pay raises, promotions, bonuses, and prestigious assignments.

Expectancy Theory

According to expectancy theory, the probability of an individual acting in a particular way depends on the strength of that individual’s belief that the act will have a particular outcome and on whether the individual values that outcome.

Expectancy Link: (link between effort and performance) → the strength of the individual’s expectation that a certain amount of effort will lead to a certain level of performance.

Instrumentality Link: (link between performance and outcome) → the strength of the expectation that a certain level of performance will lead to a particular outcome.

Valence: (outcome) → the degree to which the individual expects the anticipated outcome to satisfy personal needs or wants. Some outcomes have more valence, or value, for individuals than others do.

Managers should offer rewards that employees value, set performance levels that they can reach, and ensure a strong link between performance and reward.

Equity Theory

A theory of motivation that holds that worker satisfaction is influenced by employees’ perceptions about how fairly they are treated compared with their coworkers.

Your determination of the fairness of the situation would depend on how you felt you compared to the other person, or referent.

Managers can use equity theory to improve worker satisfaction. Knowing that every employee seeks equitable and fair treatment, managers can make an effort to understand an employee’s perceptions of fairness and take steps to reduce concerns about inequity.

What might someone do if he or she perceives an inequity in the workplace?

Change their work habits (exert less effort on the job)

Change their job benefits and income (ask for a raise, steal from the employer)

Distort their perception of themselves (“I always thought I was smart, but now I realize I’m a lot smarter than my coworkers.”)

Distort their perceptions of others (“Joe’s position is really much less flexible than mine.”)

Look at the situation from a different perspective (“I don’t make as much as the other department heads, but I make a lot more than most graphic artists.”)

Leave the situation (quit the job)

Organizational Justice

Employee perceptions of fairness in the workplace, encompassing three distinct forms of justice: distributive (fair outcomes), procedural (fair process), and interactional (the manner in which a person is treated).

Acronym: DPI (Don’t Pee Inside)

Goal Setting Theory

A theory of motivation based on the premise that an individual’s intention to work toward a goal is a primary source of motivation.

People with goals are more motivated. People will attempt to achieve those goals that they intend to achieve.

Difficult goals result in better performance than easy goals.

Specific goals are better than vague goals.

People must accept the goal. People must commit to the goal.

Drawbacks of goal-setting theory

Setting goals in one area can lead people to neglect other areas

May cause unhealthy competition

Managers may manipulate employees by setting impossible goals; too much quantified measures of performance

Reinforcement Theory

A theory of motivation that holds that people do things because they know that certain consequences will follow.

Reinforcement occurs when a consequence makes it more likely the response/behavior will be repeated in the future. There are three ways to make a response more likely to recur: positive reinforcement, negative reinforcement, and avoidance learning. In addition, there are two ways to make a response less likely to recur: nonreinforcement and punishment.

Making a Response more likely (Reward)

Positive reinforcement: A desirable consequence that satisfies an active need or that removes a barrier to need satisfaction.

Negative reinforcement: When a behavior causes something undesirable to be taken away, the behavior is more likely to be repeated in the future. NOT PUNISHMENT. Punishment, unlike reinforcement (negative or positive), is intended to make a particular behavior go away (not be repeated). Negative reinforcement, like positive reinforcement, is intended to make a behavior more likely to be repeated in the future.

Avoidance Learning: Learning to behave in a certain way to avoid encountering an undesired or unpleasant consequence.

Making a response less likely (Punishment)

Punishment is an aversive consequence that follows a behavior and makes it less likely to reoccur. Punishment does not tell them what they should do.

Note that managers have another alternative, known as nonreinforcement, in which they provide no consequence at all following a worker’s response. Nonreinforcement eventually reduces the likelihood of that response reoccurring, which means that managers who fail to reinforce a worker’s desirable behavior are also likely to see that desirable behavior less often.

Reward is anything that increases a specific behavior. Punishment is anything that decreases a specific behavior.

Empowerment

Formal recognition of superior effort by individuals or groups in the workplace is one way to enhance employee motivation. Recognition serves as positive feedback and reinforcement, letting employees know what they have done well and that their contribution is valued by the organization.

Employee empowerment, sometimes called employee involvement or participative management, involves delegating decision-making authority to employees at all levels of the organization, trusting employees to make the right decision. Employees are given greater responsibility for planning, implementing, and evaluating the results of decisions. Empowerment means giving employees increased autonomy and discretion to make their own decisions, as well as control over the resources needed to implement those decisions.

Maintenance and Task Needs

Effective leadership helps individuals and groups achieve their goals by focusing on maintenance needs and task needs.

Maintenance Needs: Needs related to interpersonal interactions and relationships. For instance, a leader attending to maintenance needs may help manage conflict or decision-making by reducing tension and encouraging full participation.

Task Needs: Needs related to task completion or goal achievement. For instance, a leader attending to task needs may help analyze problems, distribute assignments, gather information, make sure everyone is heard from, keep the group focused, and facilitate the group reaching a consensus or final recommendations.

Management vs Leadership

Leadership: The process of guiding and motivating others toward the achievement of organizational goals.

Management: The process of guiding the development, maintenance, and allocation of resources to attain organizational goals.

Leadership pursues change and challenges the status quo, whereas management seeks to control and provide stability within the existing circumstances.

What is the Leadership Process?

The Leader

Leaders are people who take charge of or guide the activities of others. They are often seen as the focus or orchestrater of group activity, the people who set the tone of the group so that it can move forward to attain its goals.

The Follower

The follower perceives the situation and comes to define the needs that the leader must fulfill. Follower either accepts or rejects leadership and surrenders power.

Follower behavior determines style of leadership

The Context

refers to the situation that surrounds the leader and the followers. For example, is the task structured or unstructured? Are the goals of the group clear or ambiguous? Is there agreement or disagreement about goals? Is there a body of knowledge that can guide task performance? Is the task boring? Frustrating? Intrinsically satisfying? Is the environment complex or simple, stable or unstable?

The Process

The process is a complex, interactive, and dynamic working relationship between leader and followers.

Thus, the leader influences the followers and the followers influence the leader, the context influences the leader and the followers, and both leader and followers influence the context.

The Consequences/Outcomes

Have the group’s maintenance needs been fulfilled? That is, do members of the group like and get along with one another, do they have a shared set of norms and values, and have they developed a good working relationship? Have individuals’ needs been fulfilled as reflected in attendance, motivation, performance, satisfaction, citizenship, trust, and maintenance of the group membership?

Have the group’s task needs been met? That is, has the group accomplished the work it set out to do? Has the group reached its goals or achieved its purpose?

Acronym: POC FL

What are the three aspects of leadership effectiveness?

Achieving (or exceeding) objective performance metrics

Helping individual team member improve skills and abilities

Creating a positive work environment

Respect

collaboration

psychological safety: people feel comfortable speaking up and sharing ideas

ABCs of Leadership

What makes a successful leader?

A = Attitudes/Traits —> extraversion, conscientiousness

B = Behaviors/Styles —> maintenance needs, task needs, change oriented

C = Context/Situation

Formal vs Informal Leadership

Formal leadership: A leadership role that is officially recognized.

Informal Leadership: Leadership that is exhibited without an official position.

Valuable trait for employee to have