Section 4 Test MCQ

1/36

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

37 Terms

The level of output in the long run is known as

Potential Output

The blank curve shows the negative relationship between the aggregate price level and the quantity of aggregate output demanded in the economy.

Aggregate Demand

Transfer payments are payments which

governments make to households when government receives a good or service

As a recessionary gap is eliminated through self-correcting adjustment, the equilibrium price level and the equilibrium real output

Decreases, increases

in the basic equation of national income accounting, the government directly conta and influences

G:C and I

Fiscal policy involves

deliberate changes in taxation and/or guvernment spending

The current level of real GOP lies below potential GDP. An appropriate fiscal policy would be to which will shift the curve to the

increase government purchases, AD: right

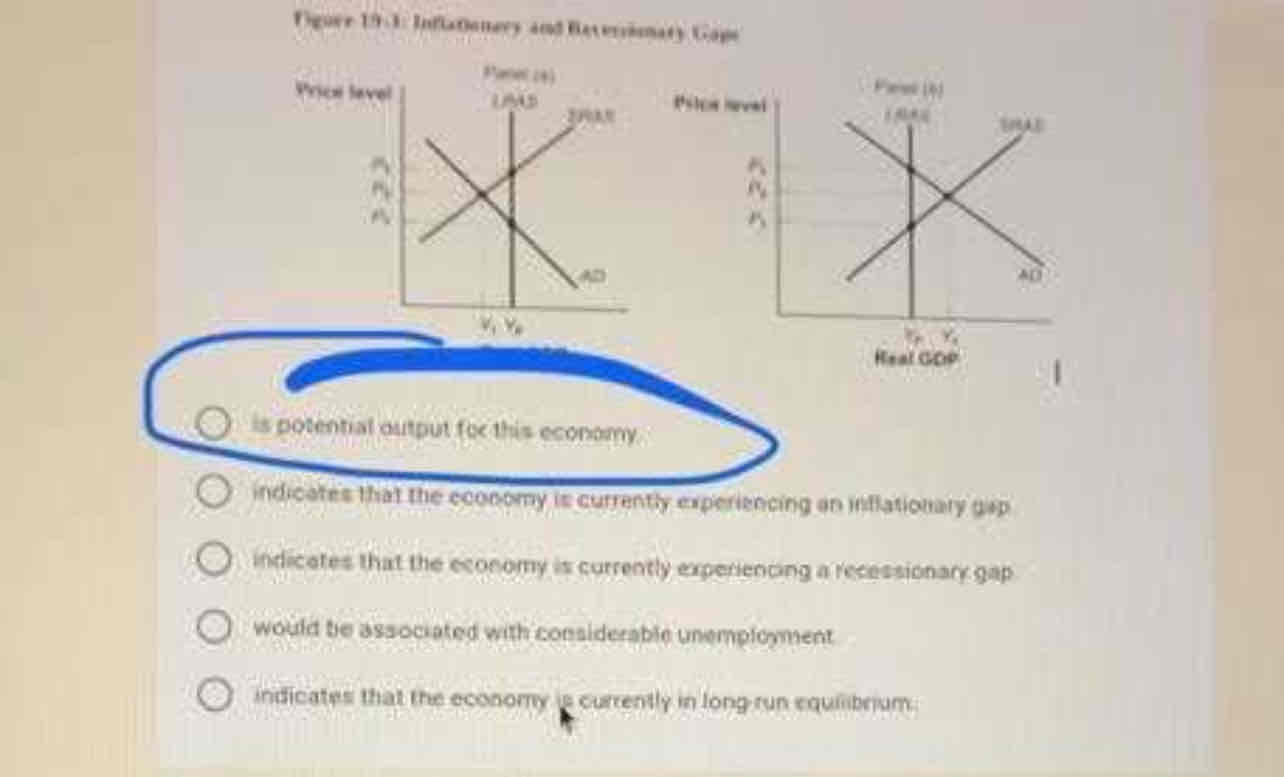

Is potential output for this economy

The long run in macroeconomics analysis is a period

In which nominal wages and other prices are flexible

The multiplier is equal to

1/(1-MPC)

The short run aggregate supply curve is positively sloped because

wages are sticky or don't readily adjust to changes in economic conditions in the short run

The multiplier process

is limited with the total change in real GDP dependent upon the size of the marginal propensity to consume

When the aggregate price level rises, this will, other things equal

result in a decrease in the quantity of aggregate output demanded

Suppose that a financial crisis decreases investment spending by $100 billion and the marginal propensity to consume is 0.80. Assuming no taxes and no trade, by how much will real GDP change

$500 billion decrease

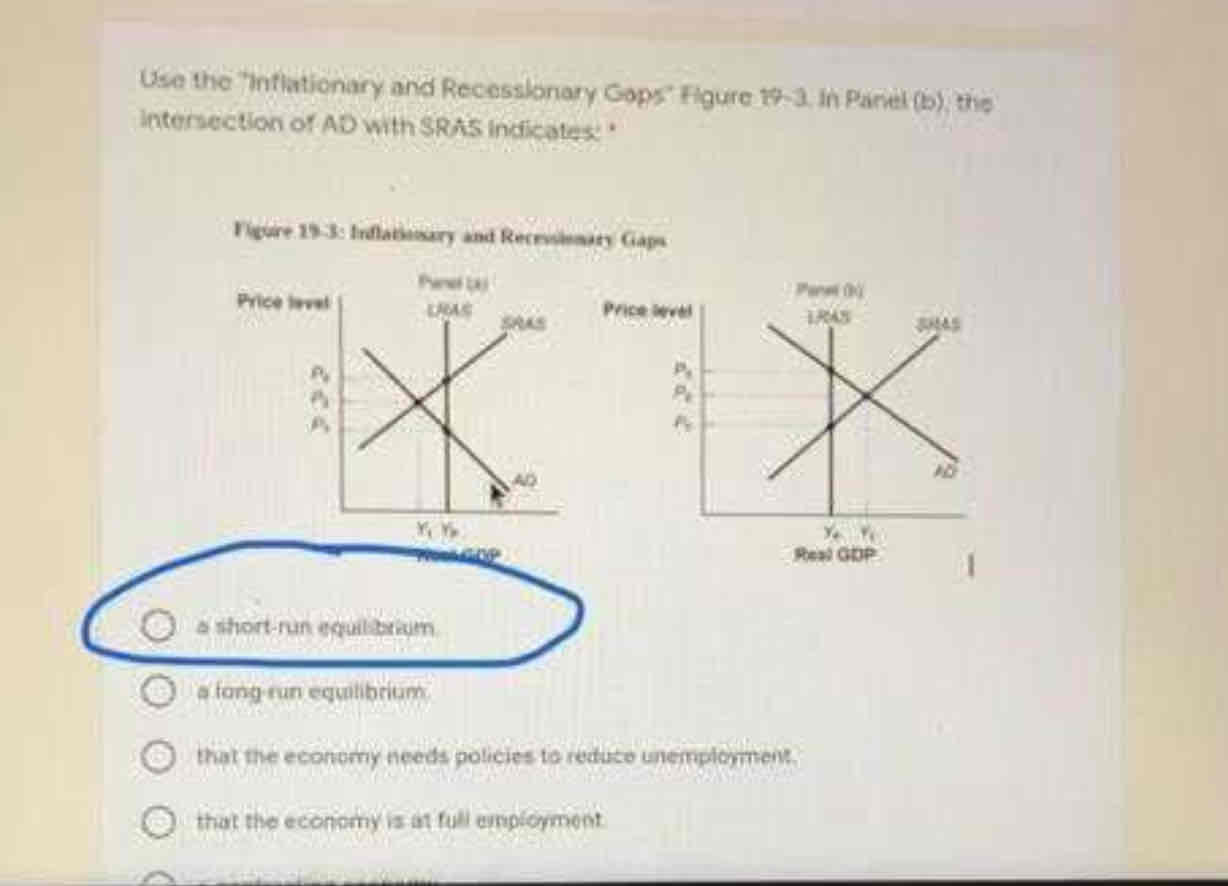

A short run equilibrium

Changes in short-run aggregate supply can be caused by changes in

Wages

When the economy is on the short-run aggregate supply curve and to the left of the long-run aggregate supply curve, actual aggregate output will eventually equal potential output as:

nominal wages fall and the sport run aggregate supply curve shifts to the right.

An example of an automatic stabilizer that works when the economy contracts is:

a rise in government transfers, as more people receive unemployment insurance benefits

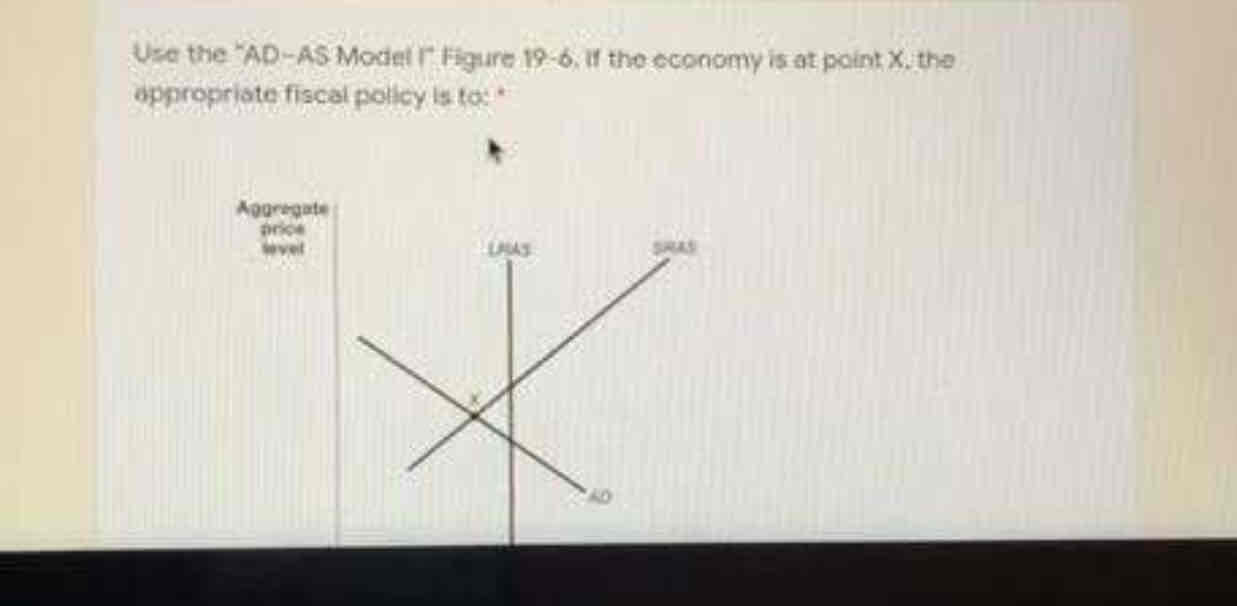

Decrease taxes and increase government spending

The consumption function will shift up if

households expect an incresse in the mininum wage in the future

If the marginal propensity to consume is 0.5, Individual autonomous consumption is $10,000, and disposable income is $40.000, then individual consumption spending is

$30,000

A recessionary gap

Stagflation may result from

A increase in the price of imported oil

A increase in the short aggregate supply curve may be caused by

A increase in productivity

Aggregate demand will increase if

The public becomes more optimistic about future income

Suppose the economy is experiencing a recessionary gap. To roove equilibrium aggregate output closer to the lever of potential output, the best fiscal policy option is to

Decrease taxes

A increase in the aggregate price level will increase

the quantity of aggregate output supplied in the short run

A autonomous increase in aggregate spending

Increases GDP by more than that amount

An example of an automatic stabilizer is

Tax reciepts rising when GDP rises

Other things being equal, expectations of lower disposable income in the future would and shift the consumption function

decrease autonomous consumption down

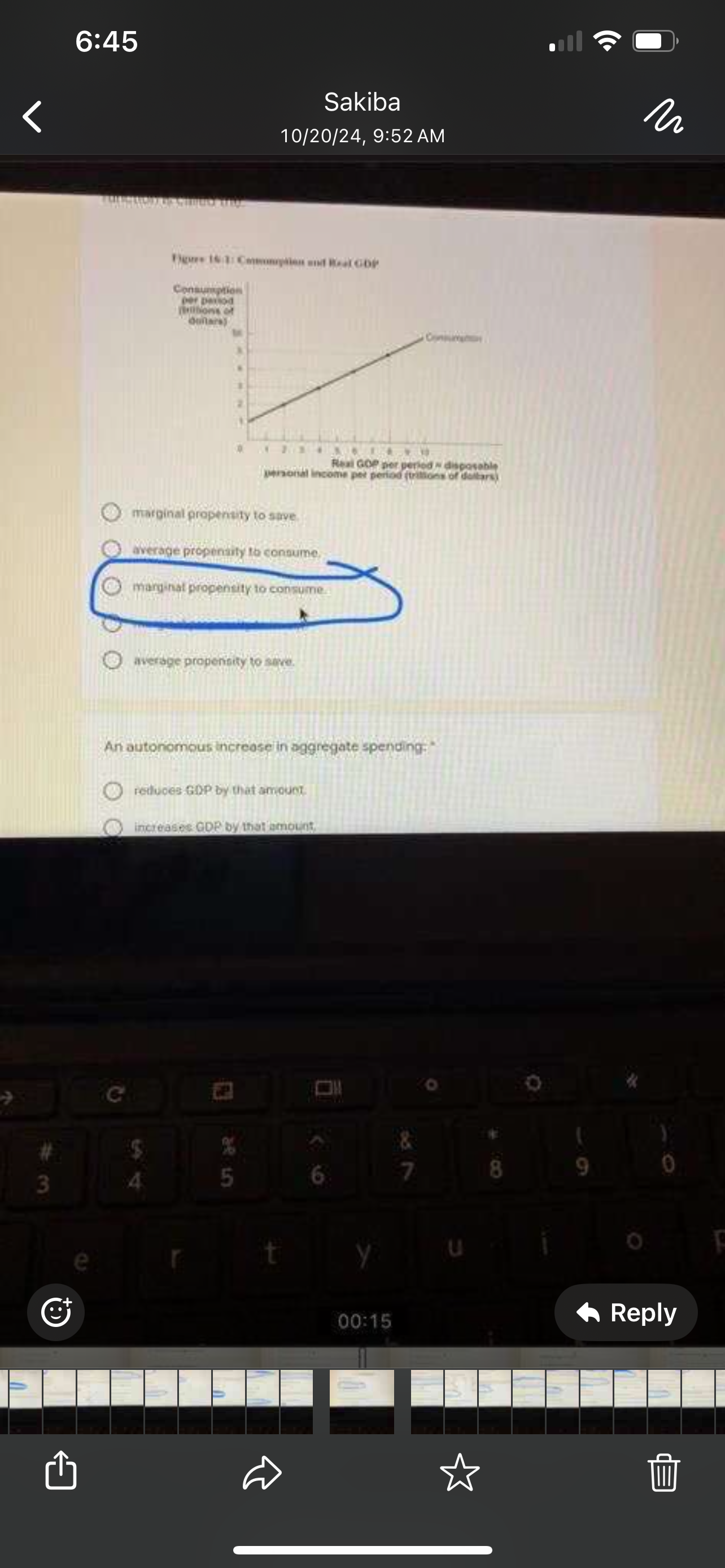

Use the "Consumption and Real GDP Figure 16-1. The slope of the consumption function is called the

Marginal propensity to consume

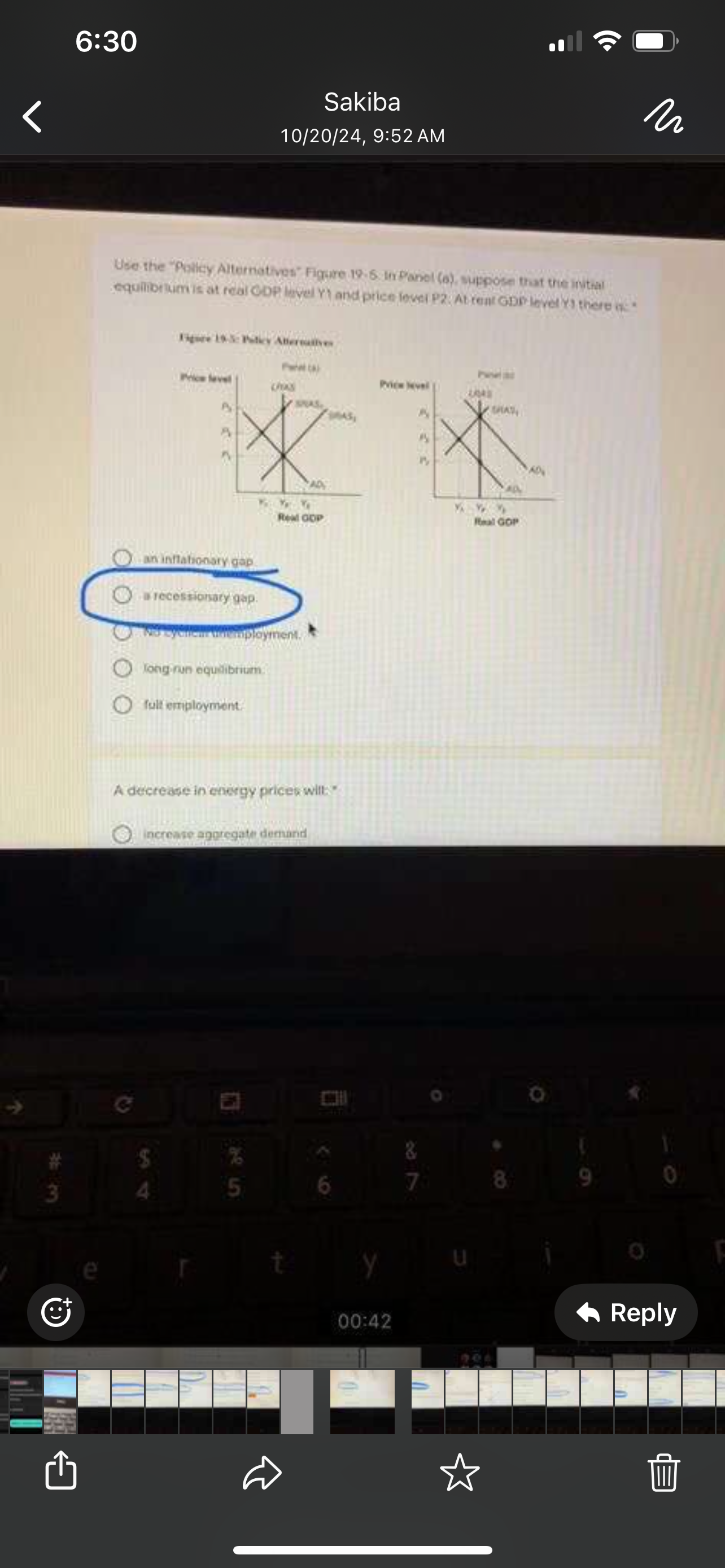

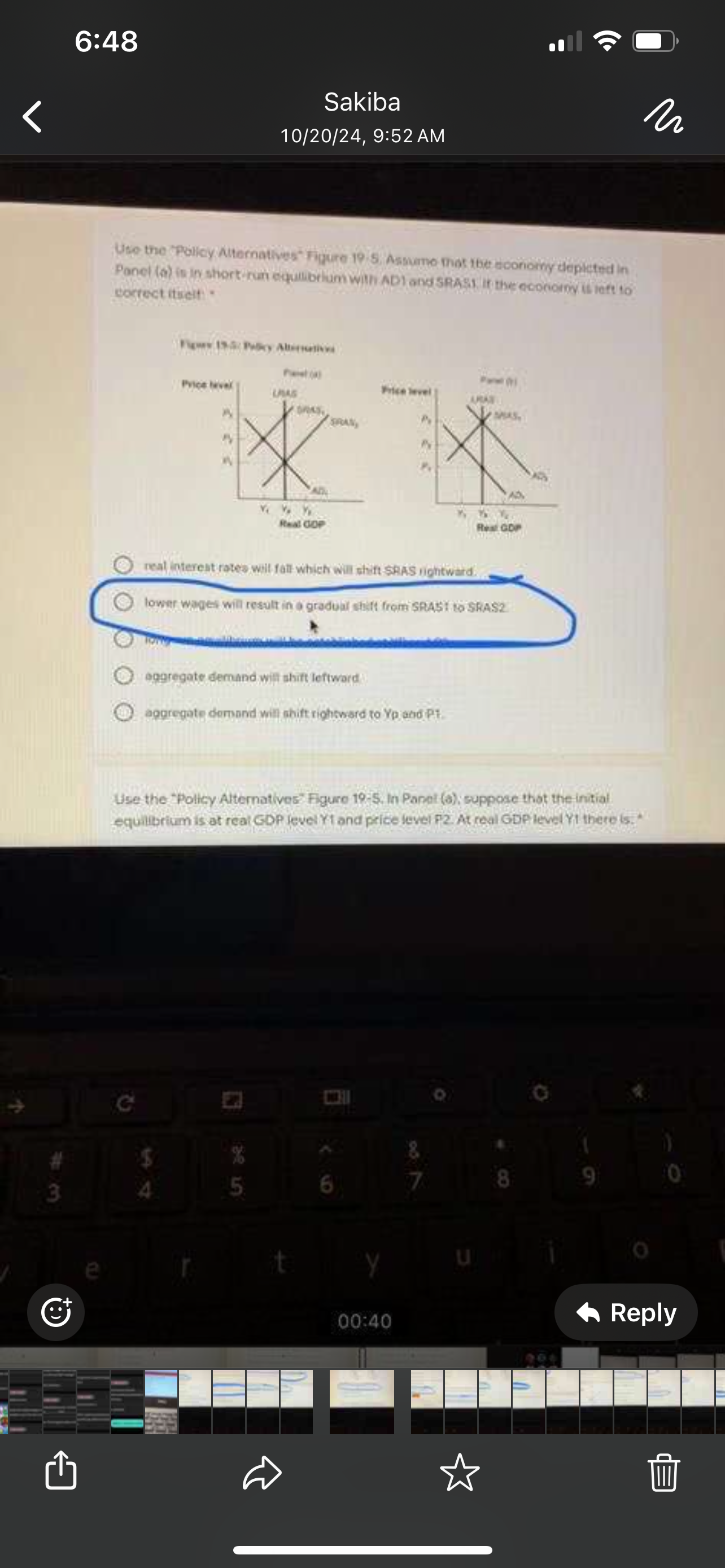

Use the "Policy Alternatives" Figure 19-5. Assume that the economy depicted in Panel (a) is in short-run equilibrium with AD1 and SRAST if the economy is left to correct itselt

lower wages will result in a gradual shift from SRAST1 to SRASZ2

According to the wealth effect, when the price level decreases, the purchasing power of assets

Increases and consumer spending increases

An economy is currently in the midst of a recession. An example of a government policy aimed at moving the economy back to potential GDP is:

an increase in goverment spending on enfrastructure improvements

An inflationary gap occurs when

Actual output exceeds potential output

Actual investment spending is equal to

the sum of planned investment spending and unplanned investment spending

A decrease in energy prices will

Increase short-run aggregate supply