3.2 Demand, Supply, & Gov Policies

1/18

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

19 Terms

Consumer Surplus

= WTP (value of buyers) - P (amount paid by buyers)

= buyers’ gains from participating in the market

Producer Surplus

= P (amount received by sellers) - (cost to sellers)

= sellers’ gains from participating in the market

Total Surplus

CS + PS

= total net gains from trade in a market

= (value to buyers) - (cost to sellers)

Efficiency means

The goods are consumed by the buyers who value them most highly

The goods are produced by the producers with the lowest costs

Raising or lowering the quantity of a good would not increase total surplus

Economic Efficiency

A market outcome in which the marginal benefit to consumers of the last unit produced is equal to its marginal cost of production and in which the total surplus is at a maximum.

Government Policies

such as price controls - legal restrictions on a market price may go- or taxes alter the private market outcome.

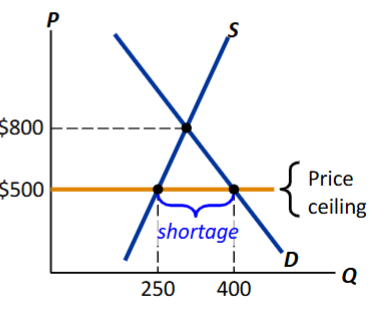

Price Ceiling

a legal maximum price sellers are allowed to charge for a good or service (usually set BELOW the equilibrium)

Ex. rent control

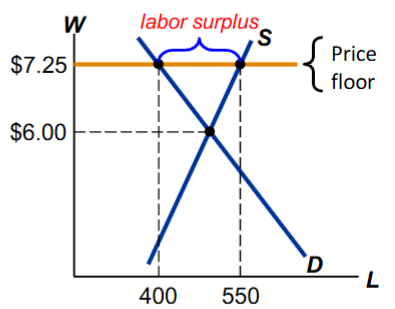

Price Floor

a legal minimum price that buyers are required to pay for a good or service (usually set ABOVE the equilibrium)

Ex. minimum wage

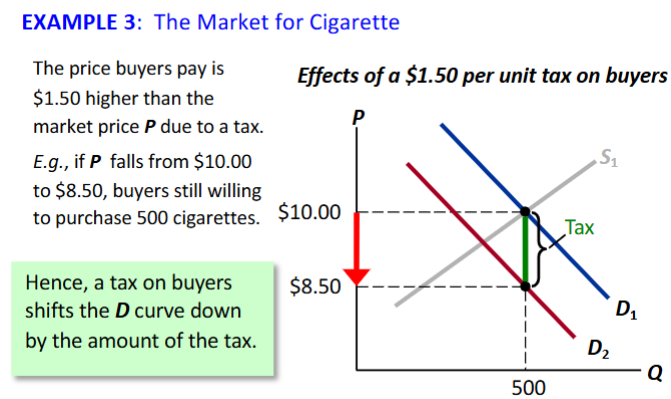

Taxes

The government can make buyers or sellers pay a specific amount on each unit

Price Ceilings Example

The equilibrium price ($800) is above the ceiling and therefore, illegal

The ceiling is a binding constraint on the price, causing a shortage

Price Floor Example

The equilibrium wage ($6) is below the floor and therefore illegal.

The floor is a binding constraint on the wage, causing a surplus = unemployment

Deadweight loss

is the loss in total surplus that occurs

Whenever an action or a policy reduces the quantity transacted below the efficient market equilibrium

quantity

excise tax

a tax charged on each unit of a good or service that is sold

When the tax is levied on sellers, When the tax is levied on buyers

analyze the effects of the excise tax, and we’ll graph two scenarios:

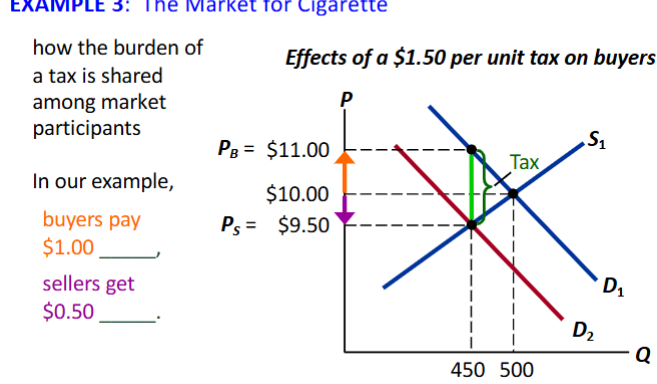

incidence of tax

a measure of who really pays it.

Tax on Buyers

Pb = Ps + Tax

Incidence of tax

Buyers pay $1 more, sellers get $.50

Those with the smallest deadweight loss

Which goods or services should gov’t tax to raise the revenue it needs?