Maryland Life Chapter 3

1/89

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

90 Terms

Attained age

the insured's age at the time the policy is renewed or replaced

Deferred

withheld or postponed until a specified time or event in the future

Face amount

the amount of benefit stated in the life insurance policy

Fixed life insurance products

contracts that offer guaranteed minimum or fixed benefits

Lapse

policy termination due to nonpayment of premium

Level premium

the premium that does not change throughout the life of a policy

Nonforfeiture values

benefits in a life insurance policy that the policyowner cannot lose even if the policy is surrendered or lapses

Policy maturity

in life policies, the time when the face value is paid out

Securities

financial instruments that may trade for value (for example, stocks, bonds, options)

Variable life insurance products

contracts in which the cash values accumulate based upon a specific portfolio of stocks without guarantees of performance

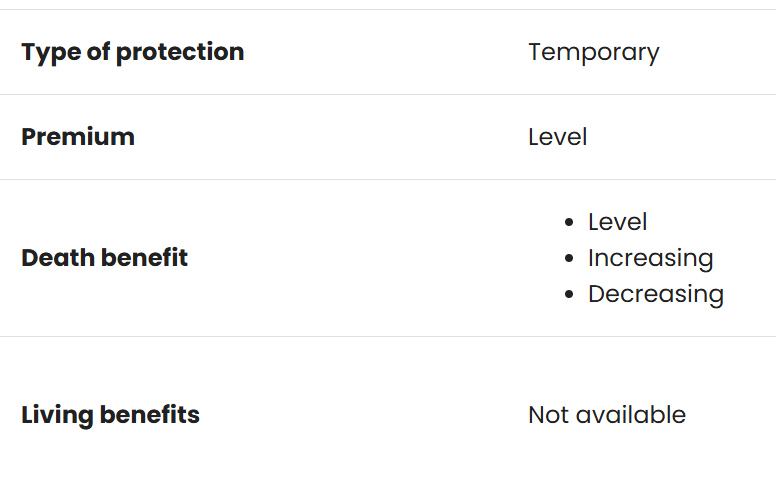

Term insurance

temporary protection because it only provides coverage for a specific period of time

greatest amount of coverage for the lowest premium as compared to any other form of protection

pure death protection

If the insured dies during this term, the policy pays the death benefit to the beneficiary;

If the policy is canceled or expires prior to the insured's death, nothing is payable at the end of the term; and

There is no cash value or other living benefits.

Know This

Term insurance provides the greatest amount of coverage for the lowest premium. Term insurance has no cash value.

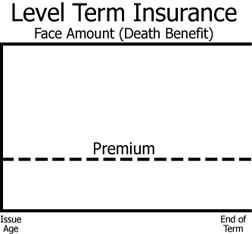

Level term insurance

most common type of temporary protection purchased

refers to the death benefit that does not change throughout the life of the policy.

Level premium term

provides a level death benefit and a level premium during the policy term

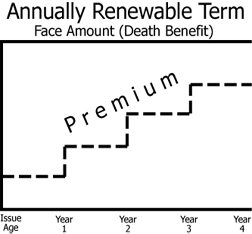

Annually renewable term

death benefit remains level (in that sense, it’s a level term policy), and the policy may be guaranteed to be renewable each year without proof of insurability, but the premium increases annually according to the attained age, as the probability of death increases

Convertible Term

provides the policyowner with the right to convert the policy to a permanent insurance policy without evidence of insurability. The premium will be based on the insured's attained age at the time of conversion

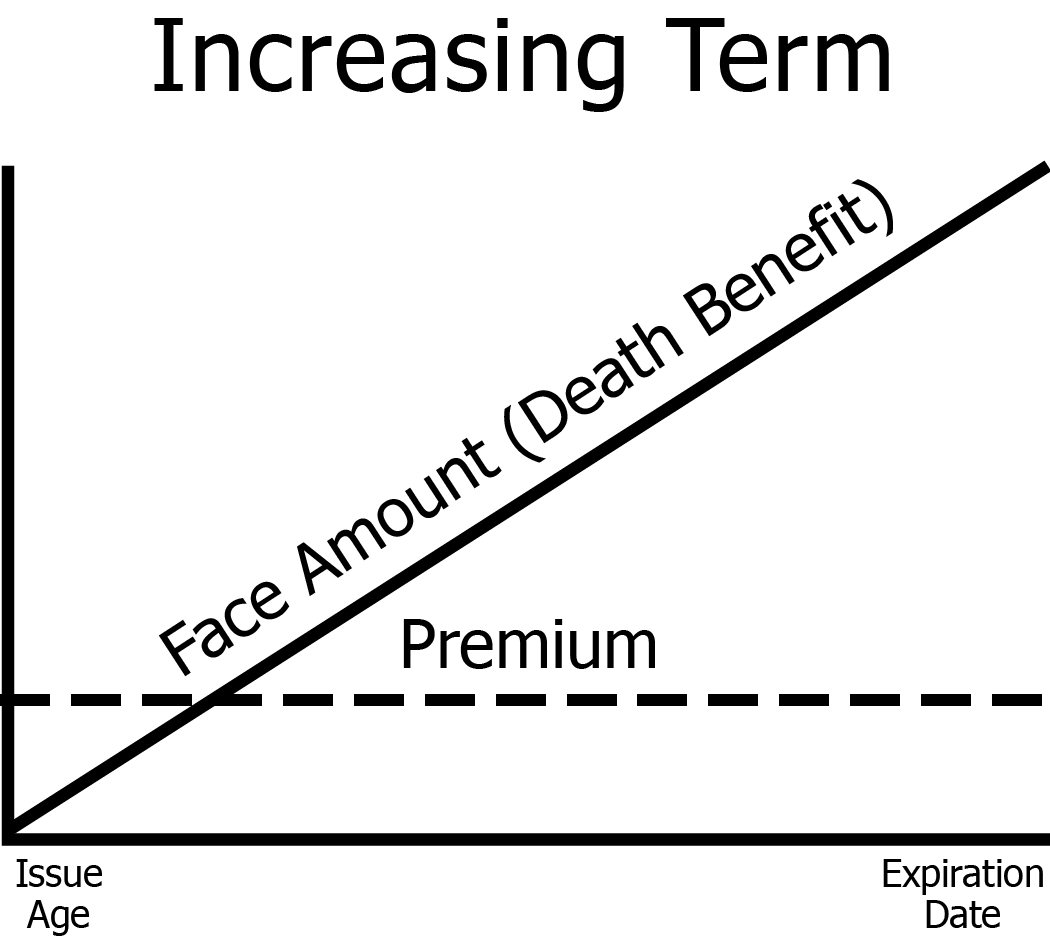

Increasing term

level premiums and a death benefit that increases each year over the duration of the policy term

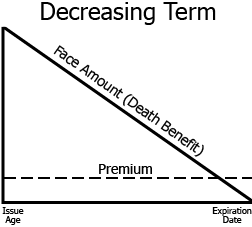

Decreasing term

policies feature a level premium and a death benefit that decreases each year over the duration of the policy term

Return of premium (ROP) life insurance

increasing term insurance policy that pays an additional death benefit to the beneficiary equal to the amount of the premiums paid

Permanent life insurance

refer to various forms of life insurance policies that build cash value and remain in effect for the entire life of the insured (or until age 100) as long as the premium is paid

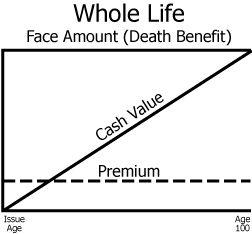

Whole life insurance

provides lifetime protection, and includes a savings element (or cash value)

Level premium

the premium for whole life policies is based on the issue age; therefore, it remains the same throughout the life of the policy

Death benefit

the death benefit is guaranteed and also remains level for life

Cash value

created by the accumulation of premium, is scheduled to equal the face amount of the policy when the insured reaches age 100 (the policy maturity date), and is paid out to the policyowner

Living benefits

the policyowner can borrow against the cash value while the policy is in effect, or can receive the cash value when the policy is surrendered

Know This

Whole life insurance provides lifetime (permanent) protection and accumulates cash value.

Continuous Premium (Straight Life)

the basic whole life policy (illustrated above). The policyowner pays the premium from the time the policy is issued until the insured’s death or age 100 (whichever occurs first)

will have the lowest annual premium

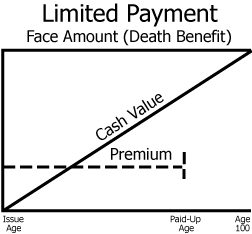

Limited Payment whole life

designed so that the premiums for coverage will be completely paid-up well before age 100

Single premium whole life (SPWL)

designed to provide a level death benefit to the insured's age 100 for a one-time, lump-sum payment. The policy is completely paid-up after one premium and generates immediate cash

TERM LIFE

Type of protection | Temporary |

Premium | Level |

Death benefit |

|

Living benefits | Not available |

WHOLE LIFE

Type of protection | Permanent until age 100 |

Premium | Level |

Death benefit | Level |

Living benefits |

|

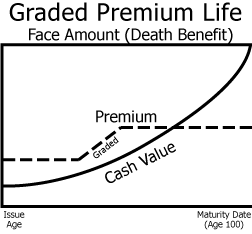

Graded-premium whole life

similar to modified life in that premiums start out relatively low and then level off at a point in the future

typically starts with a premium that is approximately 50% or lower than the premium of a straight life policy. The premium then gradually increases each year for a period of usually 5 or 10 years, and then remains level thereafter.

Interest-sensitive whole life

whole life policy that provides a guaranteed death benefit to age 100. The insurer sets the initial premium based on current assumptions about risk, interest and expense. If the actual values change, the company will lower or raise the premium at designated intervals

provides the same benefits as other traditional whole life policies with the added benefit of current interest rates, which may allow for either greater cash value accumulation or a shorter premium-paying period

indexed whole life

the cash value is dependent upon the performance of the equity index, such as S&P 500 although there is a guaranteed minimum interest rate

Adjustable Life

developed in an effort to provide the policyowner with the best of both worlds (term and permanent coverage)

can assume the form of either term insurance or permanent insurance. The insured typically determines how much coverage is needed and the affordable amount of premium. The insurer will then determine the appropriate type of insurance to meet the insured’s needs. As the insured’s needs change, the policyowner can make adjustments in the policy

Universal life insurance (flexible premium adjustable life)

implies that the policyowner has the flexibility to increase the amount of premium paid into the policy and to later decrease it again

minimum premium

amount needed to keep the policy in force for the current year

target premium

recommended amount that should be paid on a policy in order to cover the cost of insurance protection and to keep the policy in force throughout its lifetime

Know This

If an insured skips a premium payment on a universal life policy, the missing premium may be deducted from the policy’s cash value. The policy will NOT lapse.

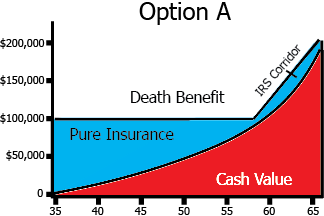

Option A (Level Death Benefit option)

death benefit remains level while the cash value gradually increases, thereby lowering the pure insurance with the insurer in the later years

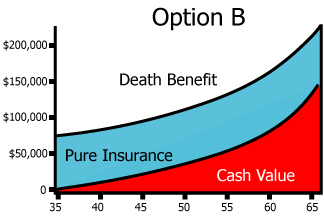

Option B (Increasing Death Benefit option)

death benefit includes the annual increase in cash value so that the death benefit gradually increases each year by the amount that the cash value increases

Variable life insurance

level, fixed premium, investment-based product

The cash value of the policy, however, is not guaranteed and fluctuates with the performance of the portfolio in which the premiums have been invested by the insurer. The policyowner bears the investment risk

Know This

In variable contracts, the policyowner bears the investment risk (assets in a separate account).

Variable universal life insurance

type of insurance that combines many features of the whole life with the flexible premium of universal life and the investment component of variable life, making it a securities version of the universal life insurance

A flexible premium that can be increased, decreased or skipped as long as there is enough value in the policy to fund the death benefit;

Increasing and decreasing the amount of insurance; and

Cash withdrawals or policy loans.

Unlike universal life, most of the investment vehicles in ______ policies do not guarantee return.

Agents selling variable life insurance products must:

Be registered with FINRA;

Be licensed by the state to sell life insurance; and

Have received a securities license.

Adjustable Life

Key Features: Can be Term or Whole Life; can convert from one to the other

Premium: Can be increased or decreased by policyowners

Face Amount: Flexible; set by policyowner with proof of insurability

Cash Value: Fixed rate of return; general account

Policy Loans: Can borrow cash value

Universal Life

Key Features: Permanent insurance with renewable term protection component

Premium: Flexible; minimum or target

Face Amount: Flexible; set by policyowner with proof of insurability

Cash Value: Guaranteed at a minimum level; general account

Policy Loans: Can borrow cash value

Variable Life

Key Features: Permanent insurance

Premium: Fixed (if Whole Life); flexible (if Universal Life)

Face Amount: Can increase or decrease to a stated minimum

Cash Value: Not guaranteed; separate account

Policy Loans: Can borrow cash value

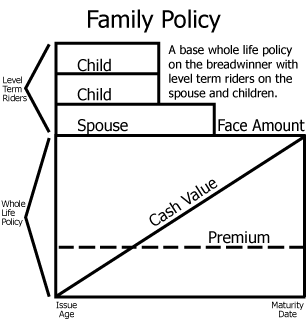

family protection or family policy

combines whole life with term insurance to cover family members in a single policy, providing coverage on every member of a family

Joint Life (First-to-die)

single policy that is designed to insure two or more lives

would be less than for the same type and amount of coverage on the same individuals

The premium is based on a joint average age that is between the ages of the insureds; and

The death benefit is paid upon the first death only.

Know This

Premium rates on a joint life policy are determined by averaging the ages of both insureds

Survivorship Life (Second-to-die)

insures two or more lives for a premium that is based on a joint age

pays on the last death rather than upon the first death

joint life expectancy in a sense is extended, resulting in a lower premium than that which is typically charged for joint life, which pays upon the first death. This type of policy is often used to offset the liability of the estate tax upon the death of the last insured.

Know This

Joint life = first to die; survivorship life = second to die (last survivor)

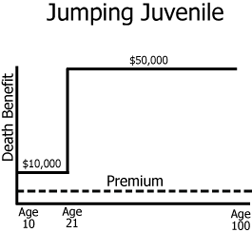

Juvenile life insurance

any life insurance written on the life of a minor

group life insurance

issued to the sponsoring organization, and covers the lives of more than one individual member of that group

written for employee-employer groups, but other types of groups are also eligible for coverage. It is usually written as annually renewable term insurance

Evidence of insurability is usually not required (unless an applicant is enrolling for coverage outside the normal enrollment period); and

Participants (insureds) under the plan do not receive a policy because they do not own or control the policy.

certificate of insurance

evidencing that they have coverage

master policy/contract

issued to the sponsor of the group, which is often an employer. The group sponsor is the policyholder and is the one that exercises control over the policy.

Know This

Group insurance is written as annually renewable term insurance. In group insurance, the master contract is for the employer, and certificates of insurance are for individual insureds

Purpose or nature of the group

The group must be created for a purpose other than to obtain group insurance

Size of the group

The larger the number of people in the group, the more accurate the projections of future loss experience will be. This is based on the Law of Large Numbers of similar risks.

Turnover of the group

From the underwriting perspective, a group should have a steady turnover: younger, lower-risk employees enter the group, and older, higher-risk employees leave

Financial strength of the group

Because group insurance is costly to administer, the underwriter should consider whether or not the group has the financial resources to pay the policy premiums, and whether or not it will be able to renew the coverage

Employer-Employee Groups

When a policy is issued to an employer, the employer or trustee will be the policyholder to insure employees of the employer for the benefit of persons other than the employer. A policy on which no part of the premium is paid by insured employees must insure all eligible employees, except those who reject such coverage in writing.

Debtor Groups

policy issued to a creditor or its parent holding company or to a trustee, trustees or agent designated by two or more creditors, which are deemed to be the policyholder, is subject to the following requirements:

The debtors eligible for insurance under the policy must all be the debtors of the creditor;

The premium for the policy must be paid either from the creditors funds, or from charges collected from the insured debtors, or from both;

An insurer may exclude any debtors as to whom evidence of individual insurability is not satisfactory to the insurer; and

The amount of insurance on the life of any debtor may at no time exceed the greater of the scheduled or actual amount of unpaid indebtedness to the creditor.

Labor Union Groups

insure members of the organization for the benefit of persons other than the union or organization are subject to the following requirements:

The members eligible for insurance under the policy must be all the members of the union or organization, or all of any class or classes thereof.

The premiums for the policy must be paid either from funds of the union, or from funds contributed by the insured members specifically for their insurance, or from both. A policy on which no part of the premiums is to be derived from funds contributed by the insured members specifically for their insurance must insure all eligible members, except those who reject such coverage in writing.

An insurer may exclude or limit the coverage on any person as to whom evidence of individual insurability is not satisfactory to the insurer.

Multiple-Employer Trust (MET)

made up of two or more employers in similar or related businesses who do not qualify for group insurance on their own because they have a small number of employees.

Credit Union or Credit Union Trusts

group life policy may be issued to a credit union or to a trustee, or trustees or agent designated by two or more credit unions to insure the lives of members of the credit unions for the benefit of persons other than the policyholder, subject to the following requirements:

All of the members of the credit union must be eligible for coverage;

The premium for the policy will be paid by the policyholder from the credit union's funds and must insure all eligible members; and

An insurer may exclude or limit coverage on any member as to whom evidence of individual insurability is not satisfactory to the insurer.

association group

can buy group insurance for its members. The group must have at least 100 members, be organized for a reason other than buying insurance, have been active for at least two years, have a constitution, by-laws, and must hold at least annual meetings. These groups include, but are not limited to, trade associations, professional associations, college alumni associations, veteran associations, customers of large retail chains, and saving account depositors, to name a few. ______ plans may be either contributory or noncontributory.

Dependent coverage

usually applies to the insured's spouse and children, but may also include dependent parents or anyone else on which dependency can be proven

noncontributory plan

When an employer pays all of the premiums, the plan is referred to as a __________

contributory plan

When the premiums for group insurance are shared between the employer and employees, the plan is referred to as a _________

characteristic of group insurance

Conversion to Individual Policy

employee has the right to convert to an individual policy without proving insurability at a standard rate, based on the individual's attained age

Know This

When converting from group life to individual life insurance, evidence of insurability is not required

Credit Life Insurance

special type of coverage written to insure the life of the debtor and pay off the balance of a loan in the event of the death of the debtor

usually written as decreasing term insurance, and it may be written as an individual policy or as a group plan

Know This

Credit life insurance cannot pay out more than the balance of the debt

General Characteristics: TERM LIFE

Pure protection

Lasts for specific term

No cash value

Level Premium Term

Level death benefit and level premium

Annually Renewable Term

Renews each year without proof of insurability

Premiums increase due to attained age

Decreasing Term

Coverage decreases at predetermined times gradually; best used when the need for protection declines from year to year

General Characteristics: WHOLE LIFE

Permanent protection

Guaranteed elements (face amount, premium, and cash value) until death or age 100

Level premium

Cash value and other living benefits

Straight Life (Continuous Premium)

Basic policy

Level death benefit

Insured pays premiums for life or until age 100

Limited Payment

Premiums are paid until a certain age or time; coverage in effect to age 100

Single Payment

Premiums paid in one lump sum and coverage continues to age 100

General Characteristics: FLEXIBLE PREMIUM

Types of whole life insurance

Flexible premium

Adjustable Life

Policyowner may adjust the premium and premium-paying period, the face amount, and the period of protection.

Can be converted from term to whole life and vice versa

Cash value only develops if the premiums paid are more than the cost of the policy

Universal Life

Has an insurance component in the form of annually renewable term

2 death benefit options: Option A - level death benefit, and Option B - increasing death benefit

Can make partial surrender/cash withdrawal

Flexibility through unbundling (separating)

Variable Life

Fixed premium, minimum death benefit

Cash value and the actual amount of death benefit are not guaranteed

Assets in separate accounts

Agents must be dually licensed in insurance and in securities

Group Life

Master Contract goes to the sponsor, usually employer

Certificate of Insurance goes to member

Underwritten as a group

If coverage after open enrollment-proof of insurability is required

Conversion to individual policy in 31 days - same face amount but higher premiums due to attained age