Financial Accounting, Ch.3

1/41

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

42 Terms

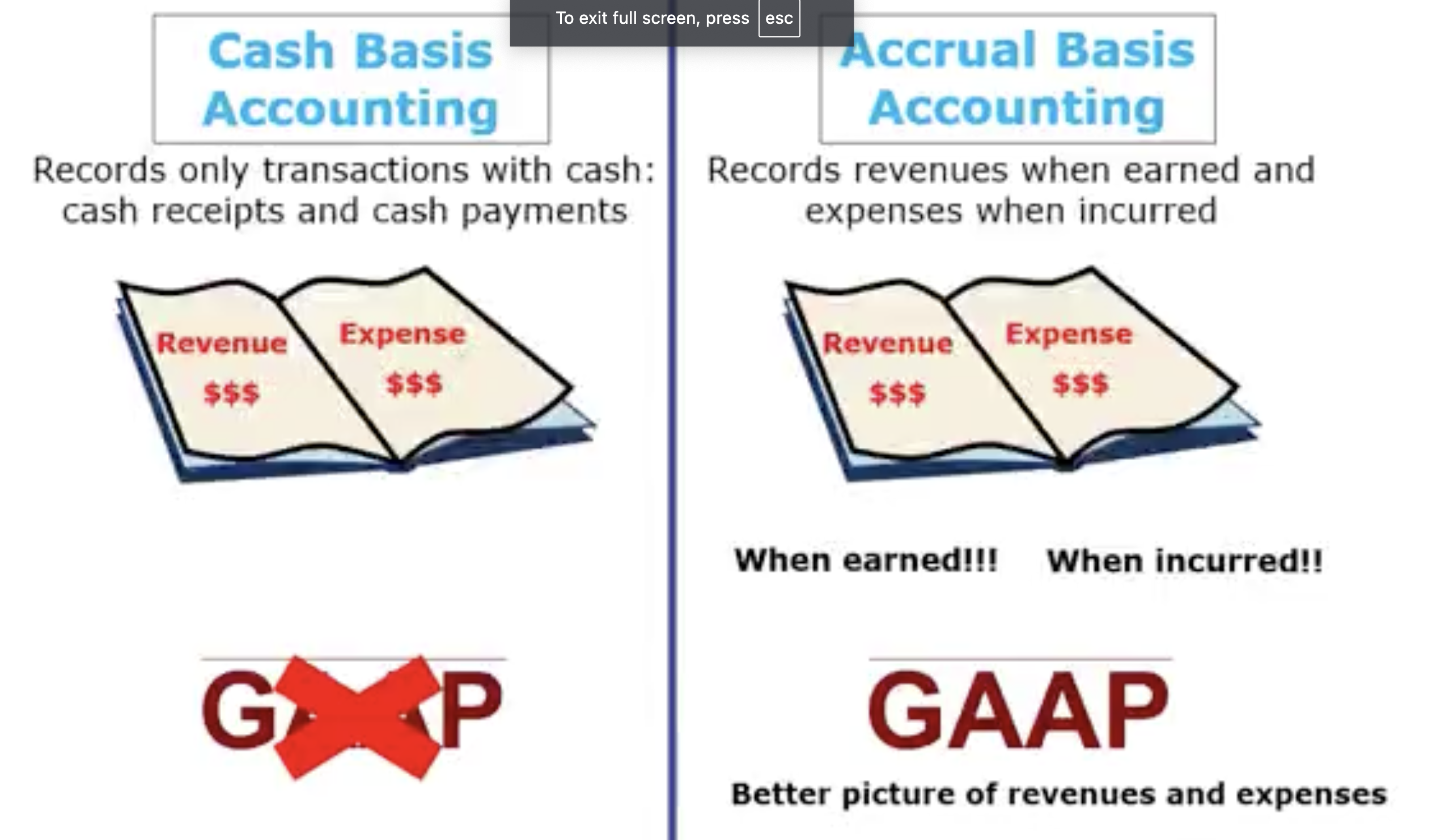

What is the Difference between Cash Basis Accounting and Accrual Basis Accounting:

Cash Basis: Records only transactions with cash— cash, receipts and cash payments.

Not an acceptable GAAP principle so it cannot be followed Cash Basis principle as a cooperation this where Accrual Basis Accounting comes in

Accrual Basis Accounting: Records revenues when earned and expenses when incurred

Required by GAAP bc it provides a better picture when Revenue is EARNED and when Expense is INCURRED during a period

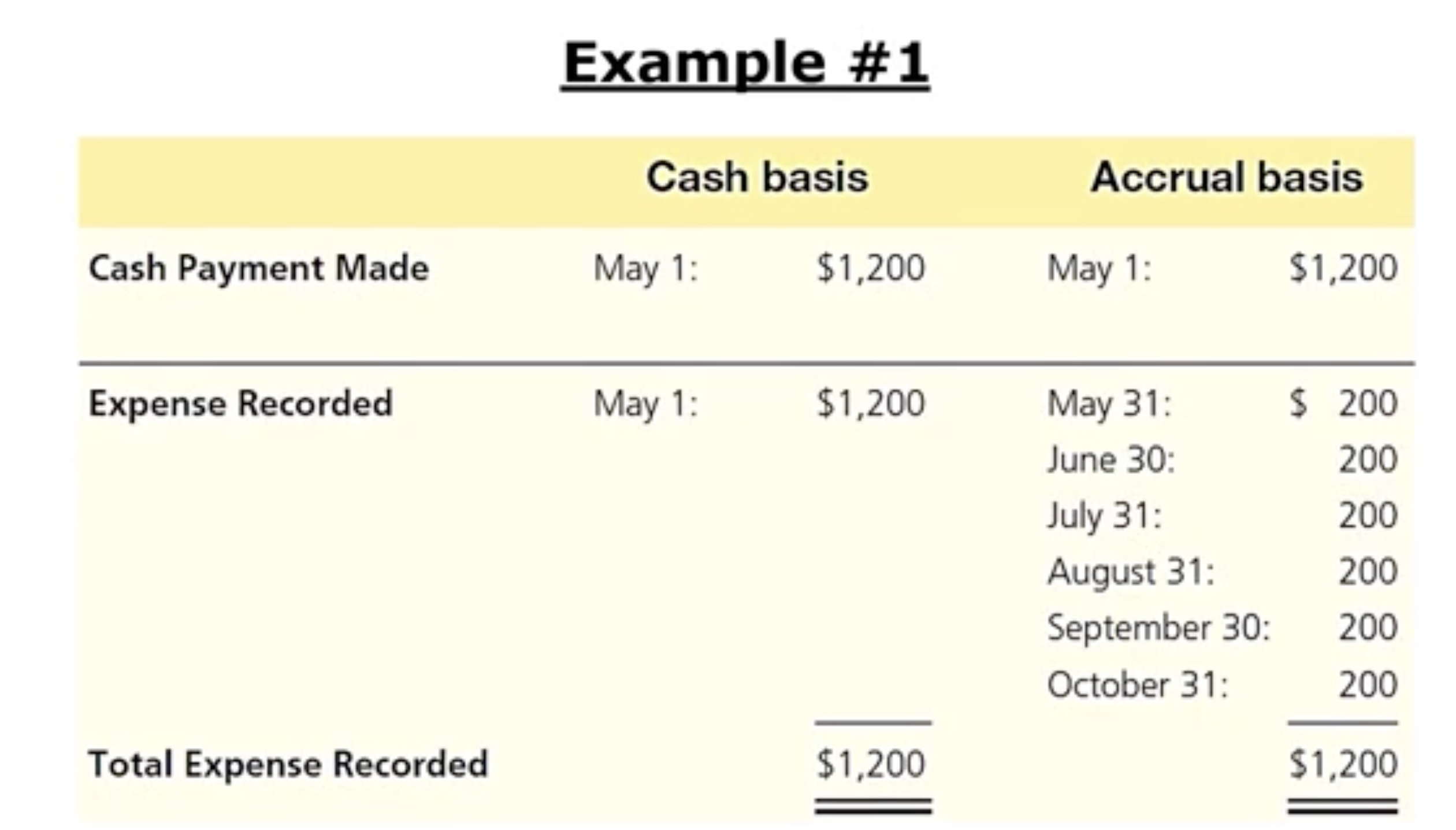

How do you use the Debt Ratio to Evaluate Business Performance: Example 1

(Expense is recorded all on May 1st for Cash Basis) (Expense is recorded spread out in which the time period is incurred for Accrual Basis).

What Concepts and Principles apply to Accrual Basis to Accrual Basis Accounting: Time Period Concept

Assumes that a business’s activities can be sliced into small time segments and that financial statements can be prepared for specific periods such as a month, quarter, or year (The Basic Accounting period is one year).

What Concepts and Principles apply to Accrual Basis to Accrual Basis Accounting: Fiscal Year

An accounting year of any 12 consecutive months that may or may not coincide with the calendar year.

Calendar year (Jan. 1- Dec. 31) = Fiscal Year

Ex: Walmart and JCpenney both have a Fiscal Year of Jan 31st. They do this bc its pretty busy around holiday season and wait one month during Jan before they end their Fiscal year.

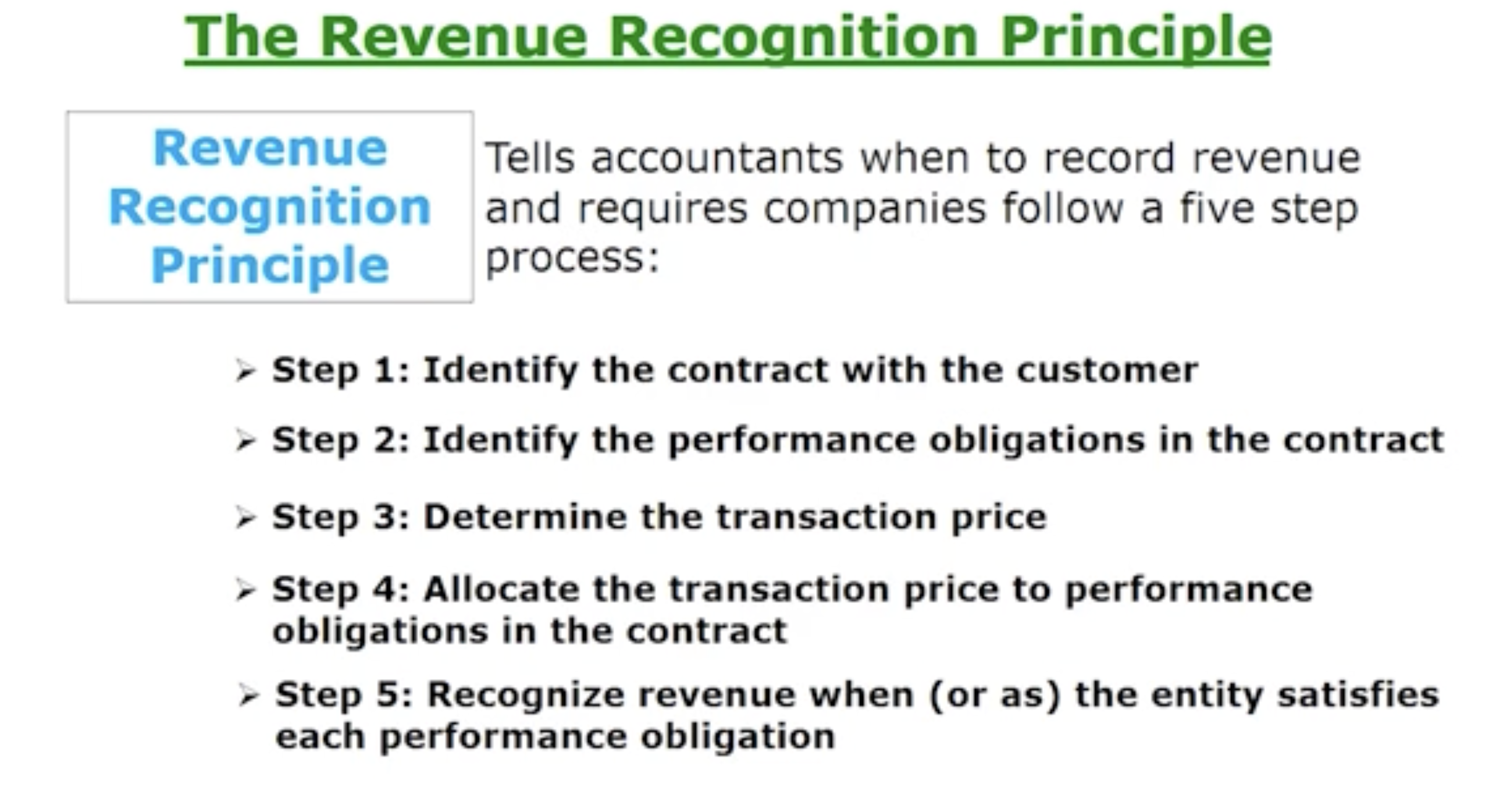

What Concepts and Principles apply to Accrual Basis to Accrual Basis Accounting: The Revenue Recognition Principle

Tells accountants when to record revenue and requires companies follow a five steep process.

What Concepts and Principles apply to Accrual Basis to Accrual Basis Accounting: The Matching Principle

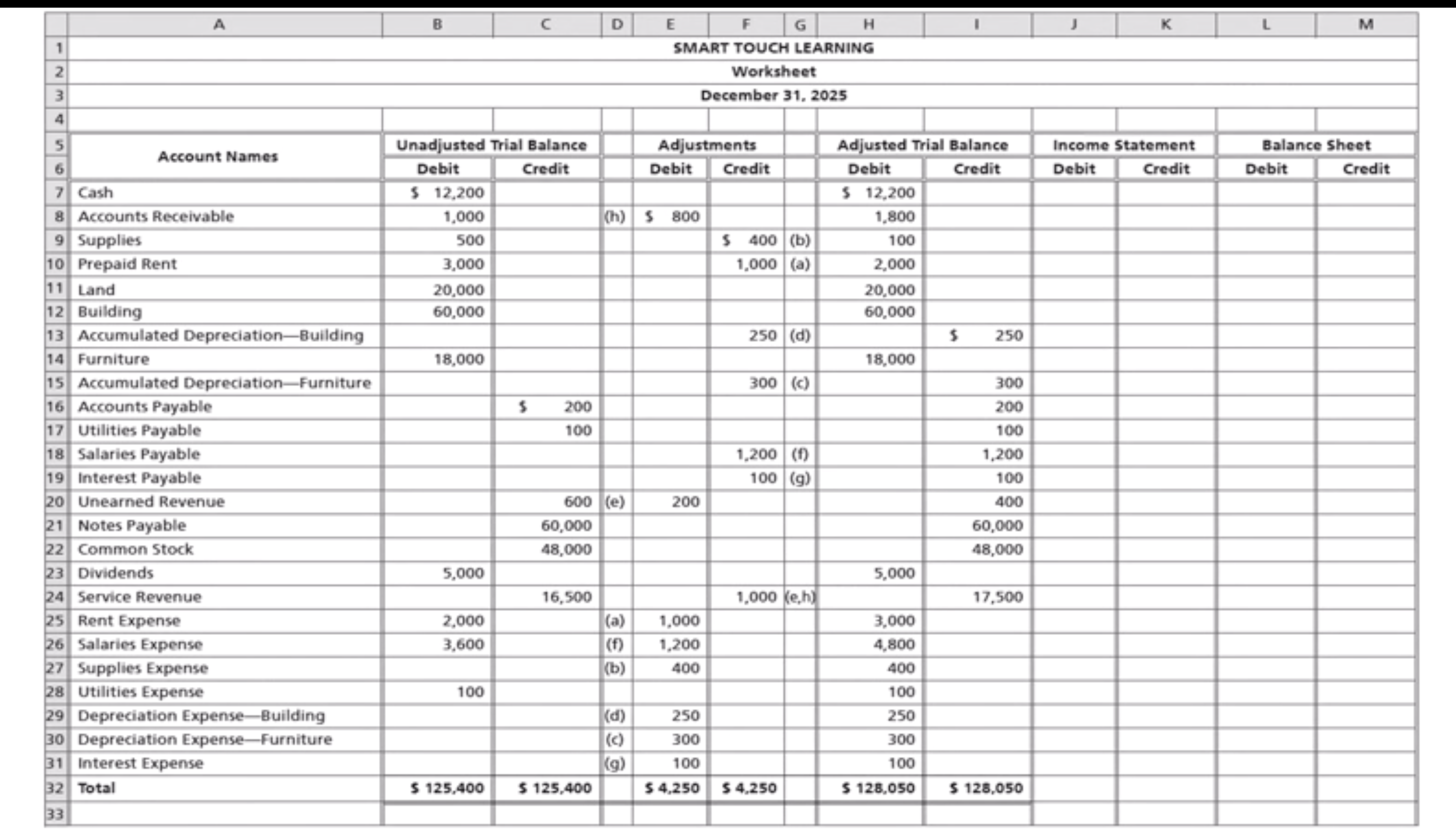

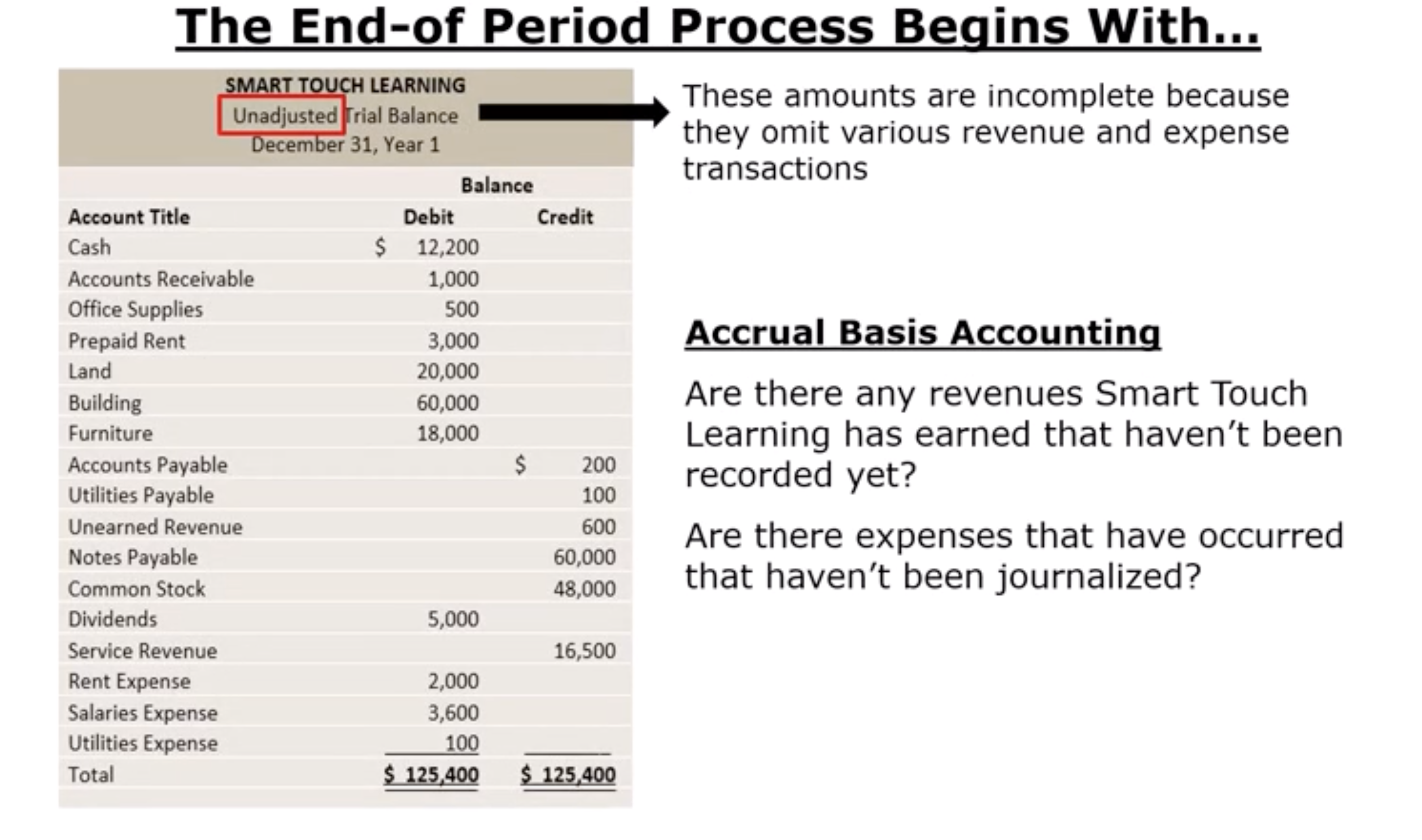

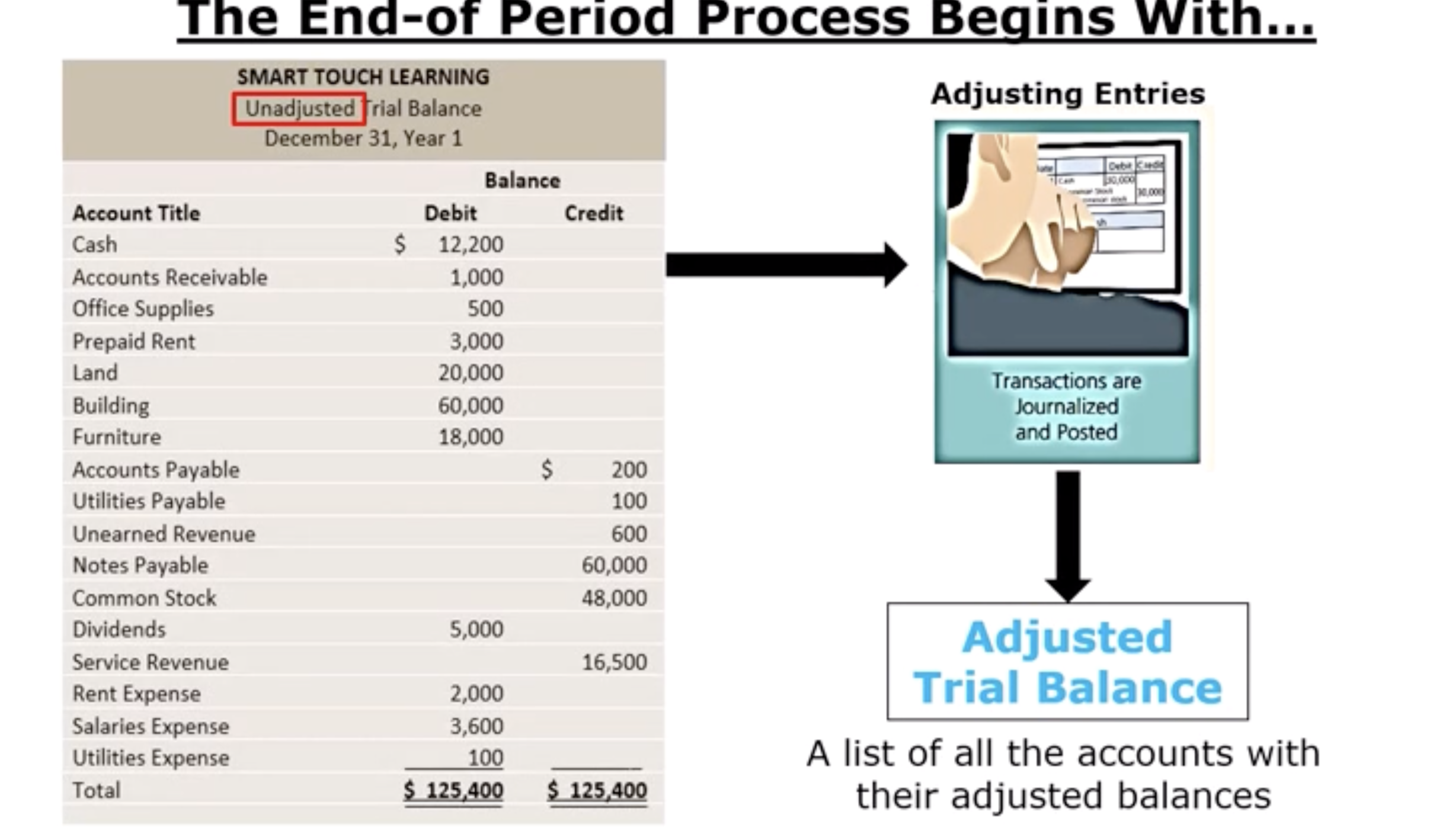

What are the Adjusting Entries for Deferrals, and How do We Record Them: The End- Of- Period Process Begins with

Unadjusted trial Balance for Smart TL bc they follow an Accrual Basis Accounting.

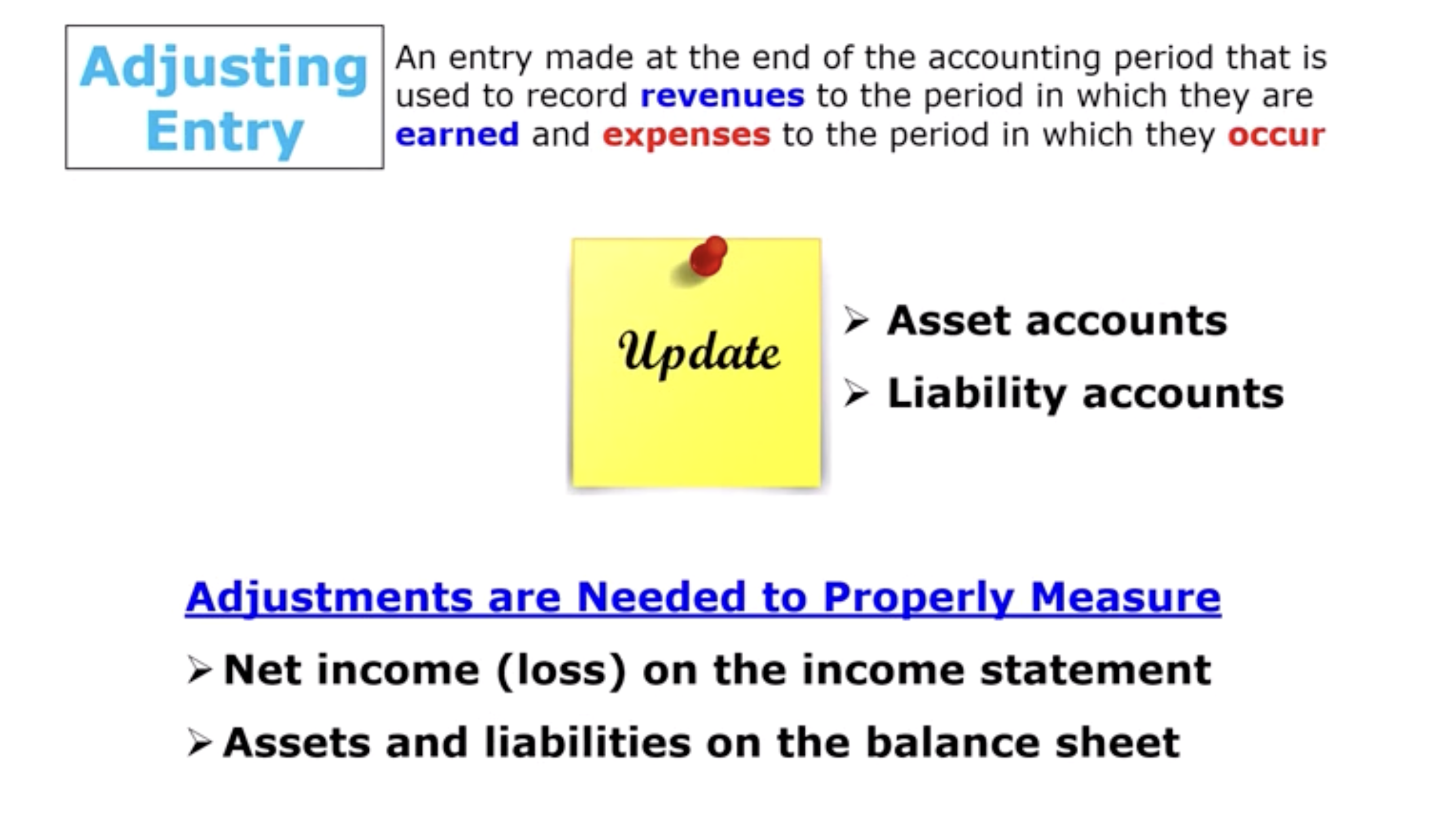

What Concepts and Principles apply to Accrual Basis to Accrual Basis Accounting: Adjusting Entry

Made at the ed of the accounting period that is used to record revenues to the period which they are earned and expenses to the period in which they occur.

Need to update Assets & Liability accounts in order to make sure we record revenues and expenses in the proper time period

Adjustments are needed to properly measure 2 thing: Net Income (loss) on the income statement. Assets & Liabilities on the balance sheet

What Concepts and Principles apply to Accrual Basis to Accrual Basis Accounting: Two Basic Categories of Adjusting Entries— Deferrals

Type 1= Cash payment occurs before an expense is incurred

Type 2= Cash receipt occurs before performance obligation met

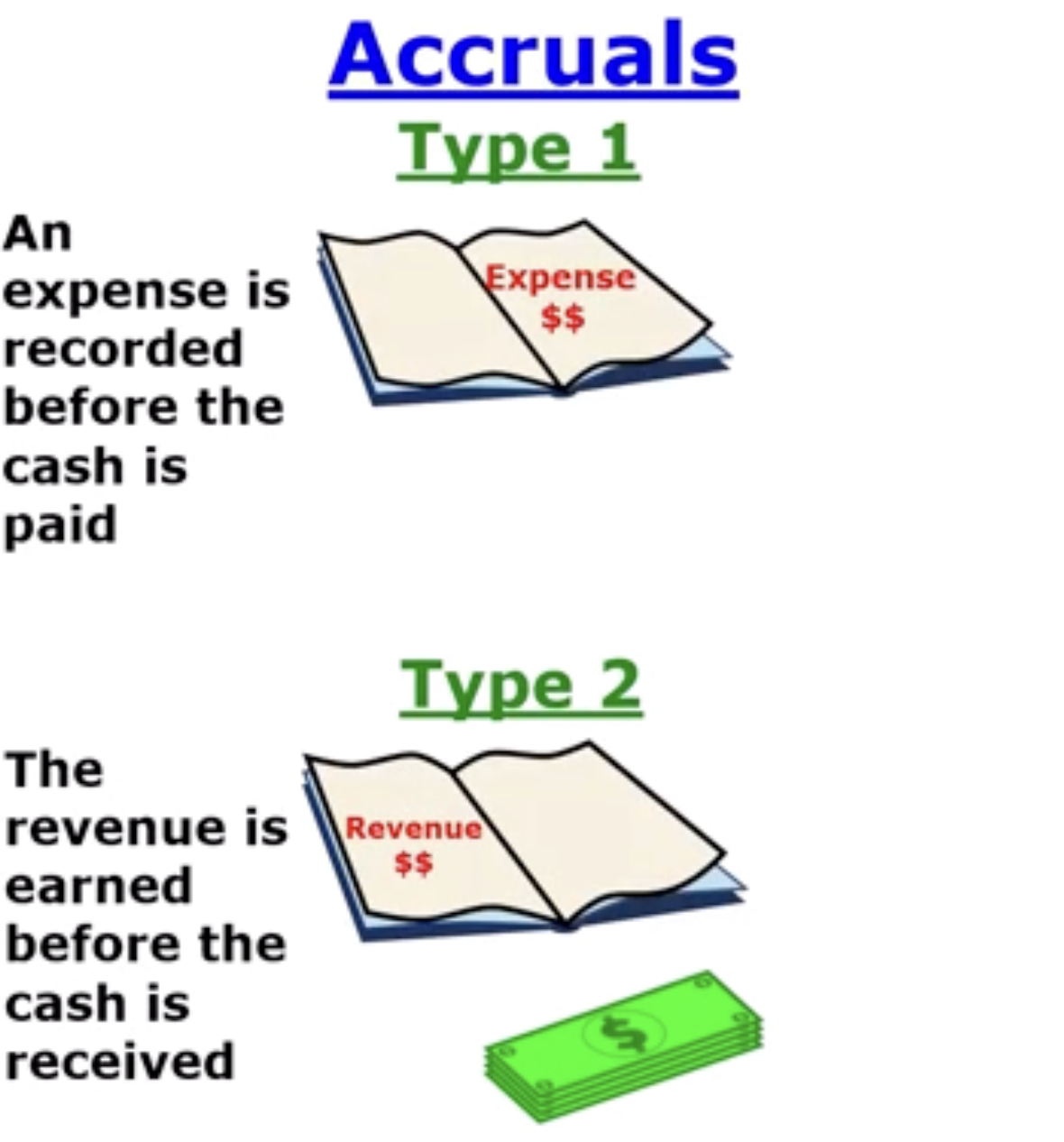

What Concepts and Principles apply to Accrual Basis to Accrual Basis Accounting: Two Basic Categories of Adjusting Entries— Accruals

Type 1= An expense is recorded before the cash is paid

Type 2= The revenue is earned before the cash is received

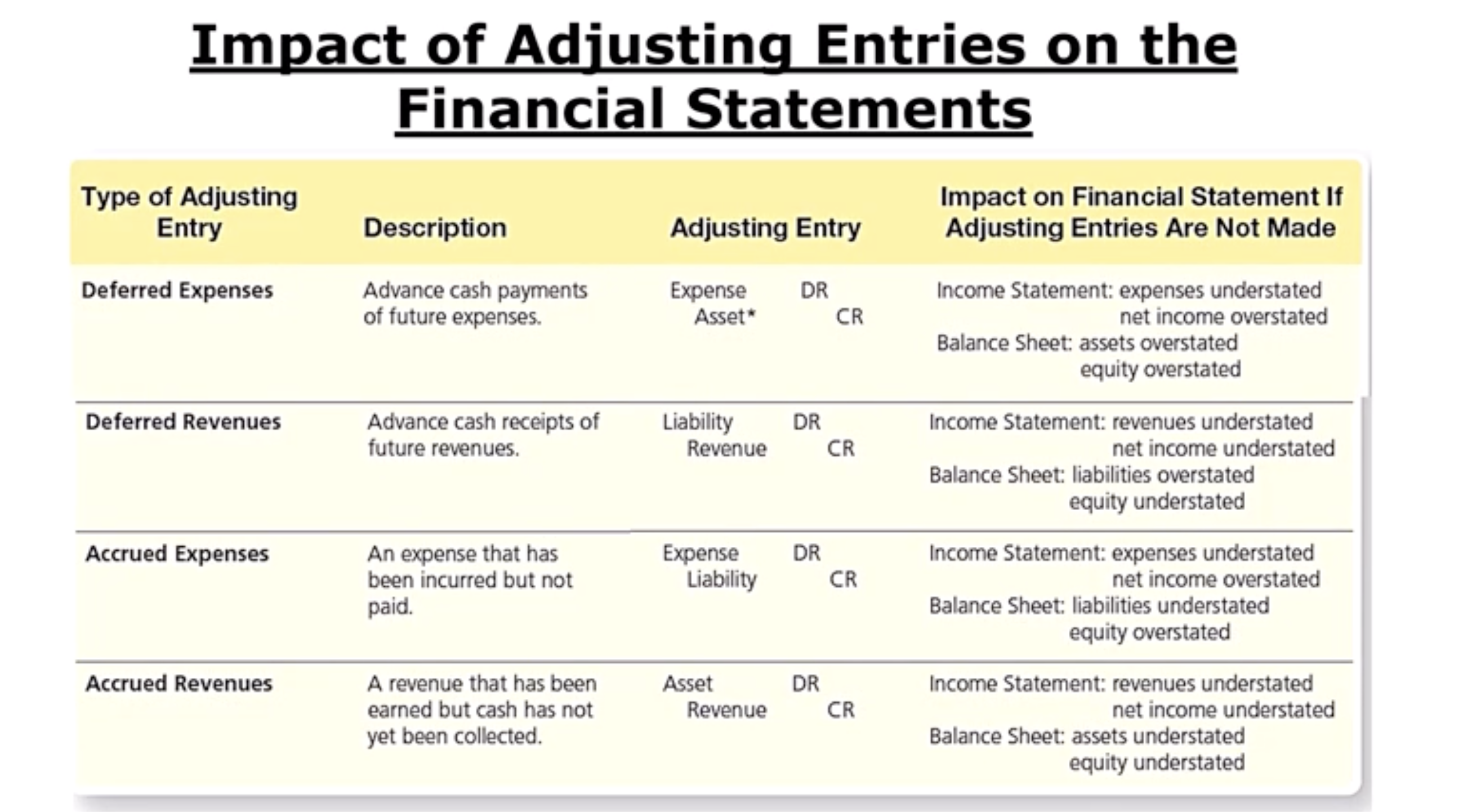

What Concepts and Principles apply to Accrual Basis to Accrual Basis Accounting: 4 Types of Adjusting Entries

Deferred Revenues (Deferral)

Deferred Expenses (Deferral)

Accrued Revenues (Accrual)

Accrued Expenses (Accrual)

What are the Adjusting Entries for Deferrals, and How do We Record Them: Deferred Revenues

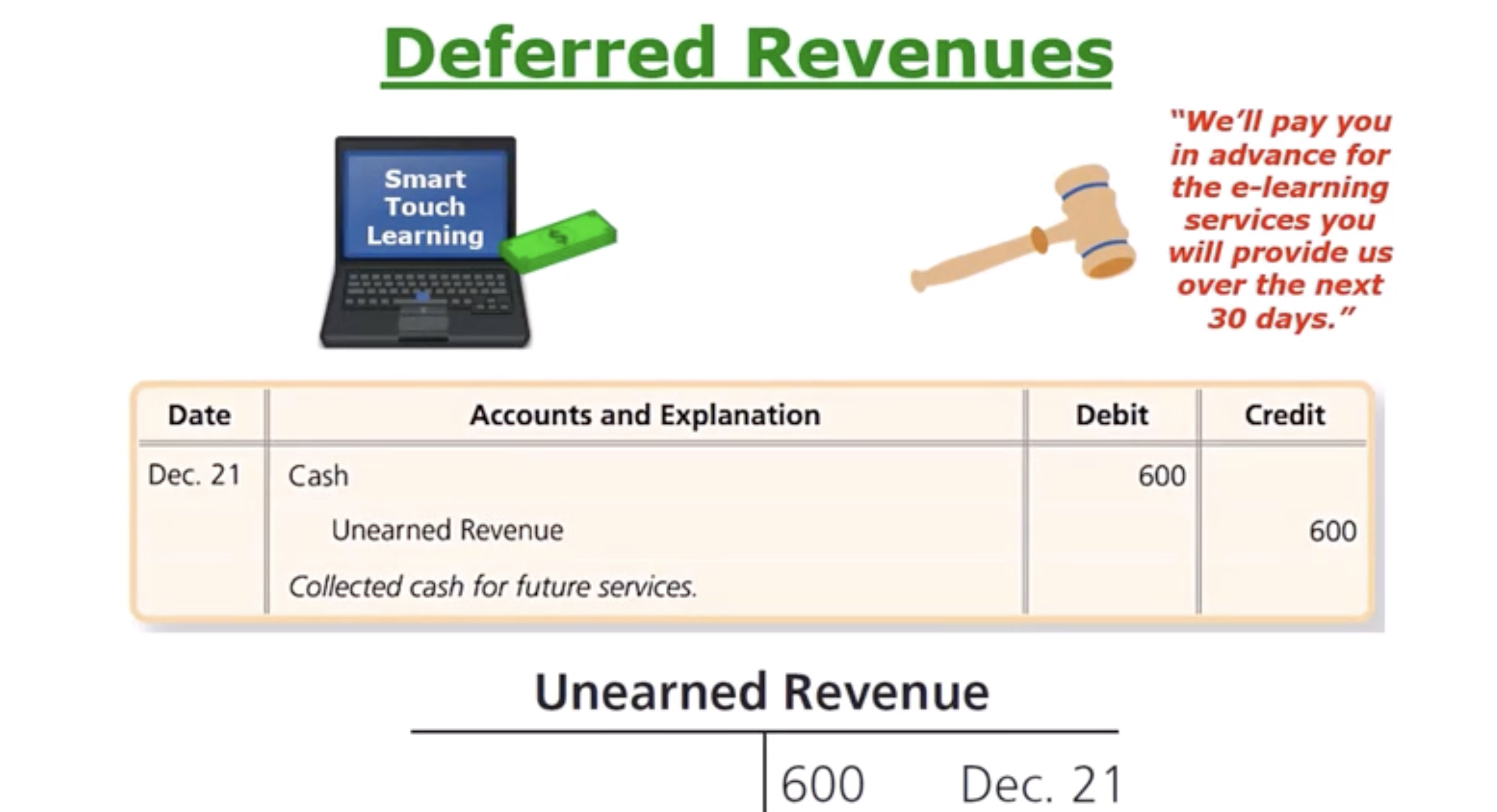

Is when we receive cash in ADVANCE for a service that we will perform or goods that we will deliver in the future but have not done so yet. We have to wait till the service is done before it gets record it as revenue in our journal and ledger.

Definition: A liability created when a business collects cash from customers in advance of completing a service or delivering a product

“Deferred until earned” (Deferral means later— we have to wait until we earned it by performing the service or delivering the good, then we can record the revenue in our journal and ledger)

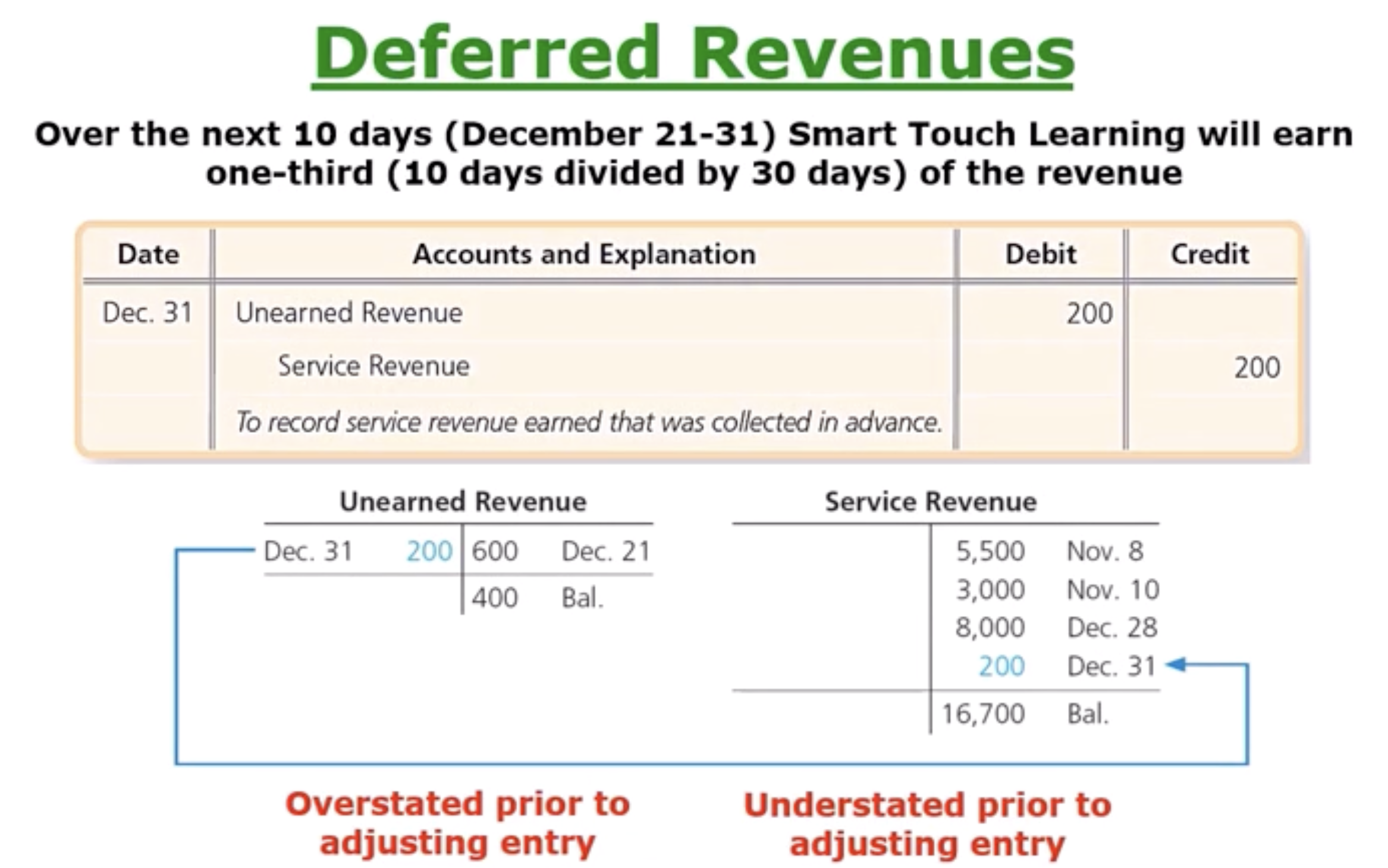

What are the Adjusting Entries for Deferrals, and How do We Record Them: Deferred Revenue Example, match the picture to the second part of the problem.

A law firm contacted Smart Touch Learning and said “we’ll pay u in advance now on Dec 21st. and pay you cash now for the e-learning service that you will provide us over the next 30 days”.

Cash an asset increases which is being debited

Unearned revenue gets credited (increased which is a liability)

Now Unearned Revenue is being decreased (liability decrease with DR) by $200— so it is on the debit side

Service Revenue is increasing $200— so it is on the credit side

IF SO STATEMENT: If we didnt do the Adjusting Entry, Unearned Rev. would be overstated and the Service Rev. would be understated. Overall, both the balance sheet (liab.)— Overstated & the Income statement (rev.)— Understated, would be affected

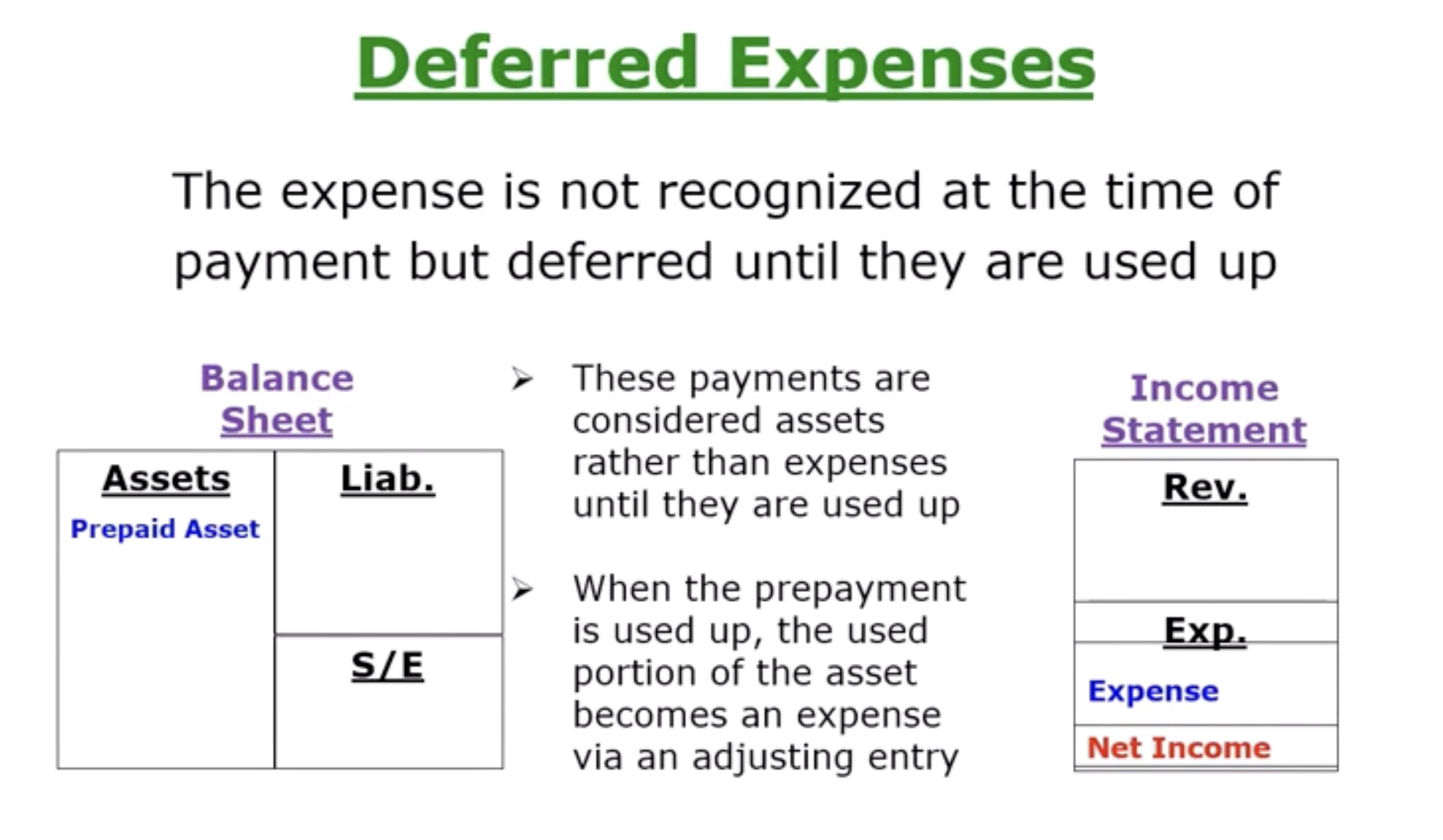

What are the Adjusting Entries for Deferrals, and How do We Record Them: Deferred Expenses

Can also be called “Prepaid Expenses”

Definition: Advance payments of future expenses

Cash payments occurs before an expense is incurred and before it is recorded in the accounting records

Expenses is not recognized at the time of payment but deferred (delayed) until they are used up:

-These payments are considered assets rather than expenses until they are used up.

-When the prepayment is used up, the used portion of the asset becomes an expense via an adjusting entry.

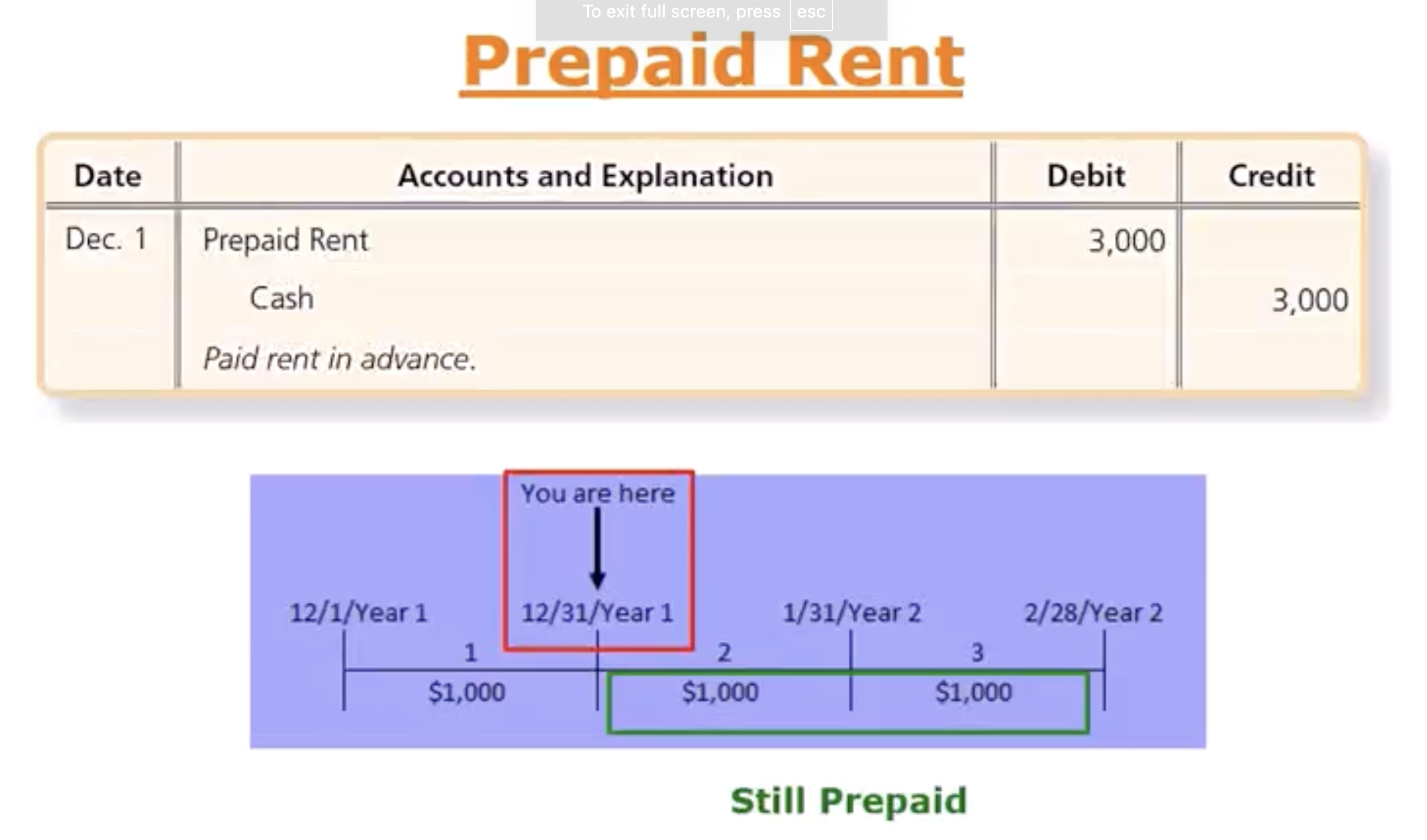

What are the Adjusting Entries for Deferrals, and How do We Record Them: Prepaid Rent Ex, match the picture to the adjusting entry pic

Smart TL prepaid their rent on Dec 1st for 3 months and make a 3k payment. So rent will equal to 1k per month. When they did this on Dec 1st—

Prepaid rent is an asset which is increasing— why it is on the debit side

Cash is an asset but it is decreasing which is why it is on the credit side

Notice the purple box up top, Year 1— only one month has gone by and two months have yet to be covered by our rent. So one month has been used up and the other two months are considered prepaid. Therefore to follow the matching principle & record expenses in the time period incurred we do the adjusting Entry.

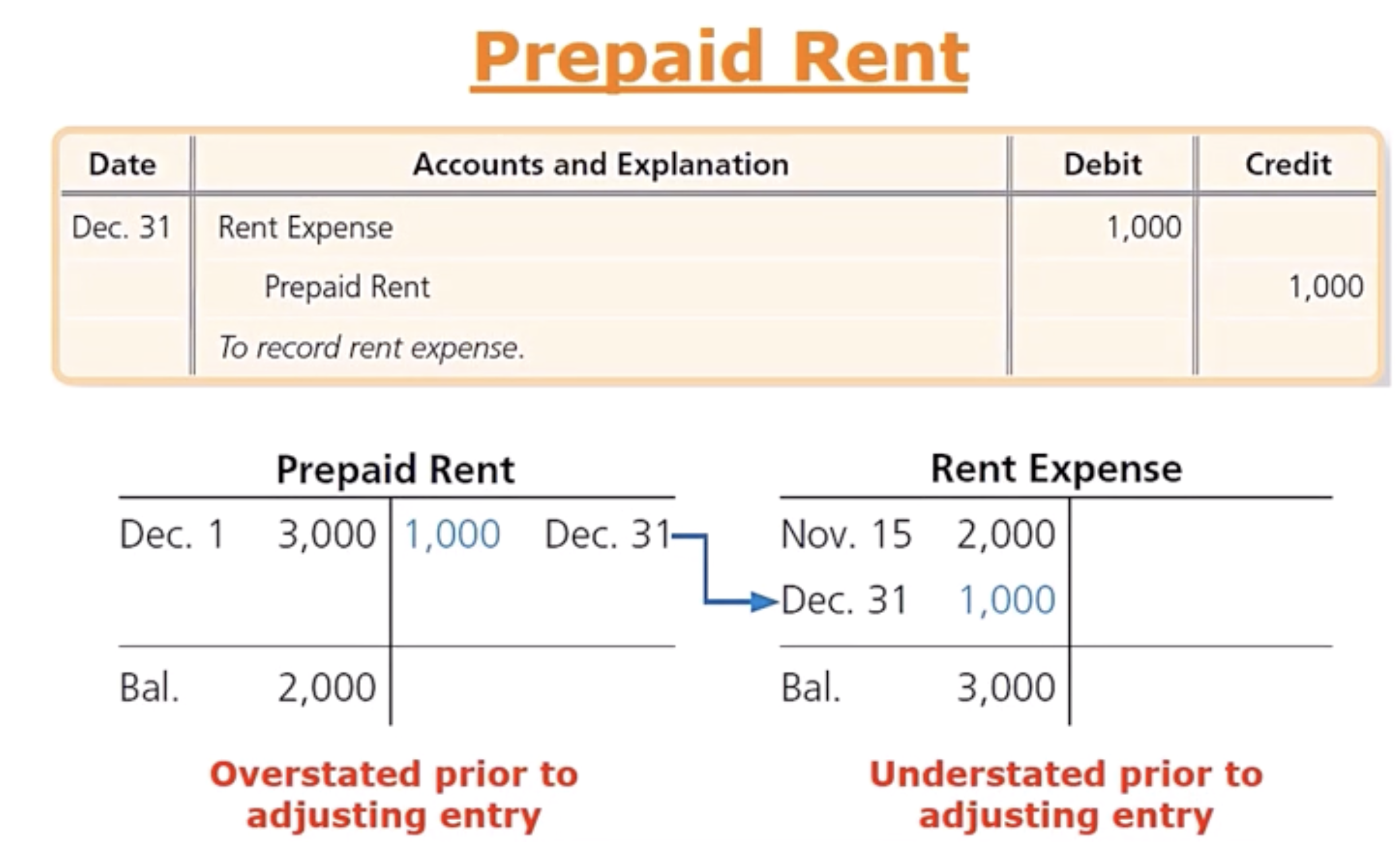

Adjusting Entry:

Rent expense that has been used up is on the debit side because it will always reduce equity which is why it acts like an asset in DR & CR terms on the income statement

Prepaid Rent is an asset which is decreasing— why it is on the CR side

IF SO STATEMENT: If the adjusting entry was not performed, it can screw up the net income

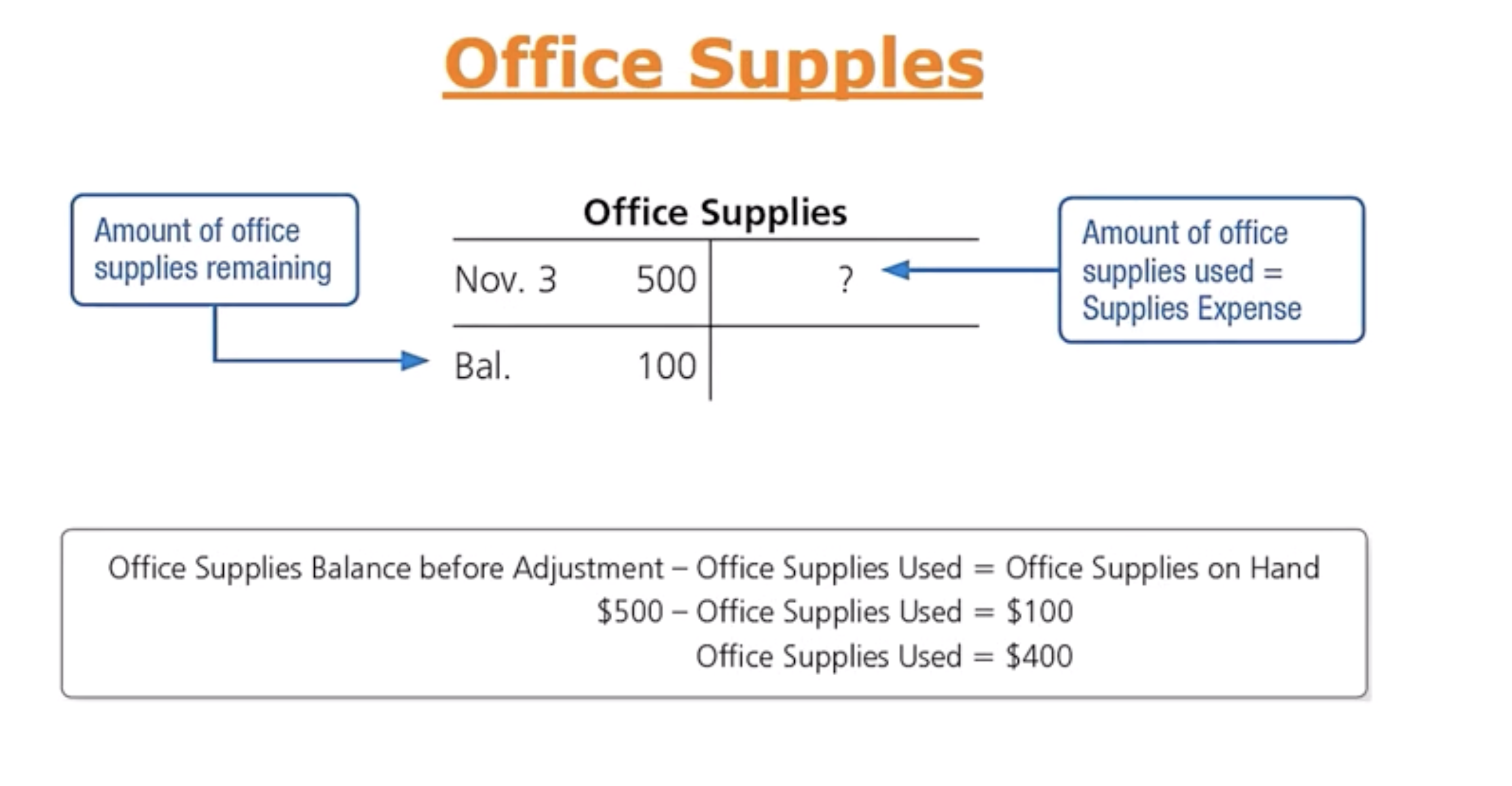

What are the Adjusting Entries for Deferrals, and How do We Record Them: Office Supplies ex, match the T- account to the Adjusting Entry

Previously Smart TL purchase $500 worth of supplies, now let’s say Smart TL counts up their supplies and only $100 of supplies remain on Dec 31. Meaning the $400 was used.

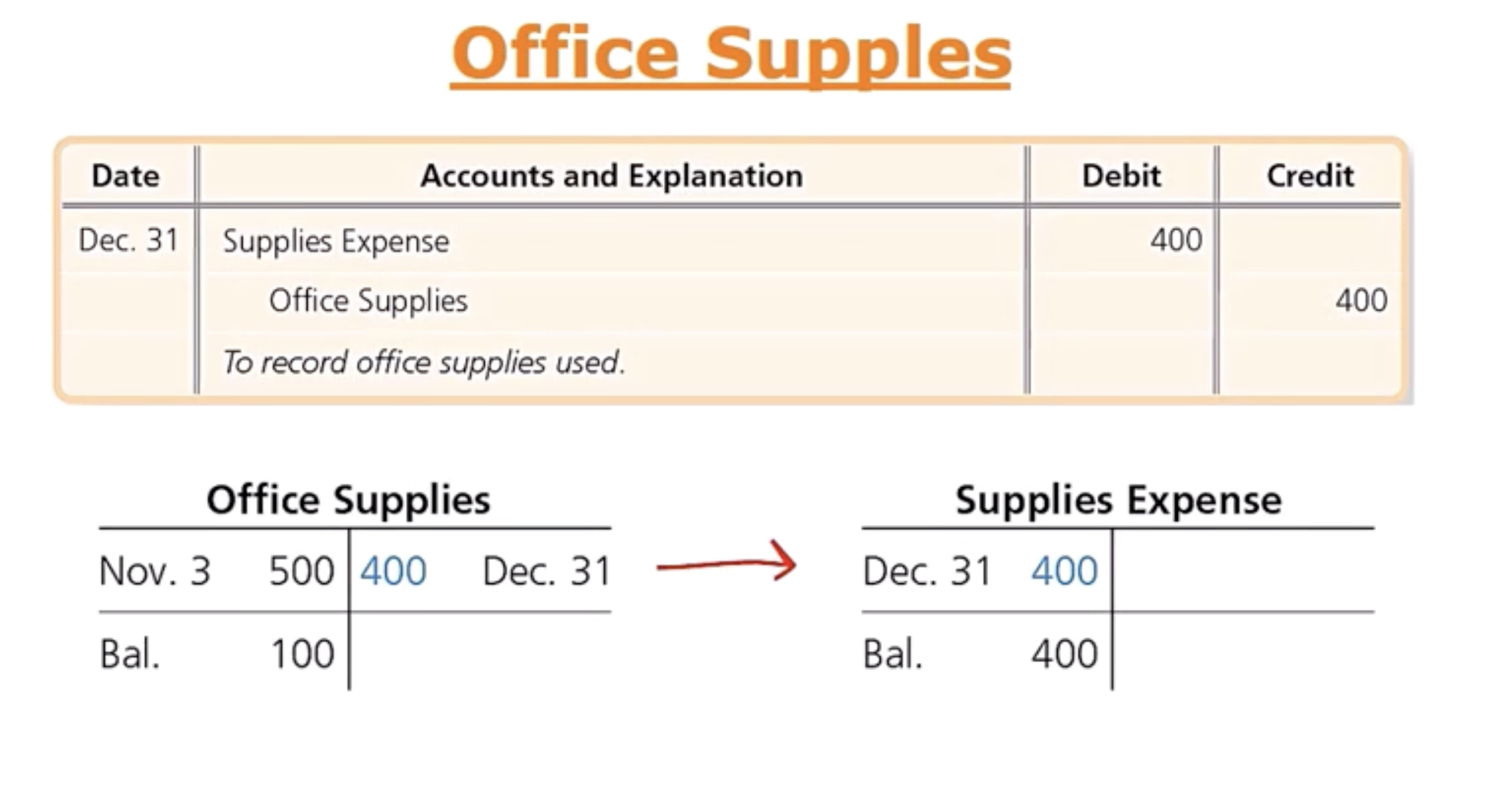

Adjusting Entry:

Supplies Expense is Debit $400 because all expenses increase on the Dr side (income statement)

Office Supplies is a credit because all assets decrease on the CR side

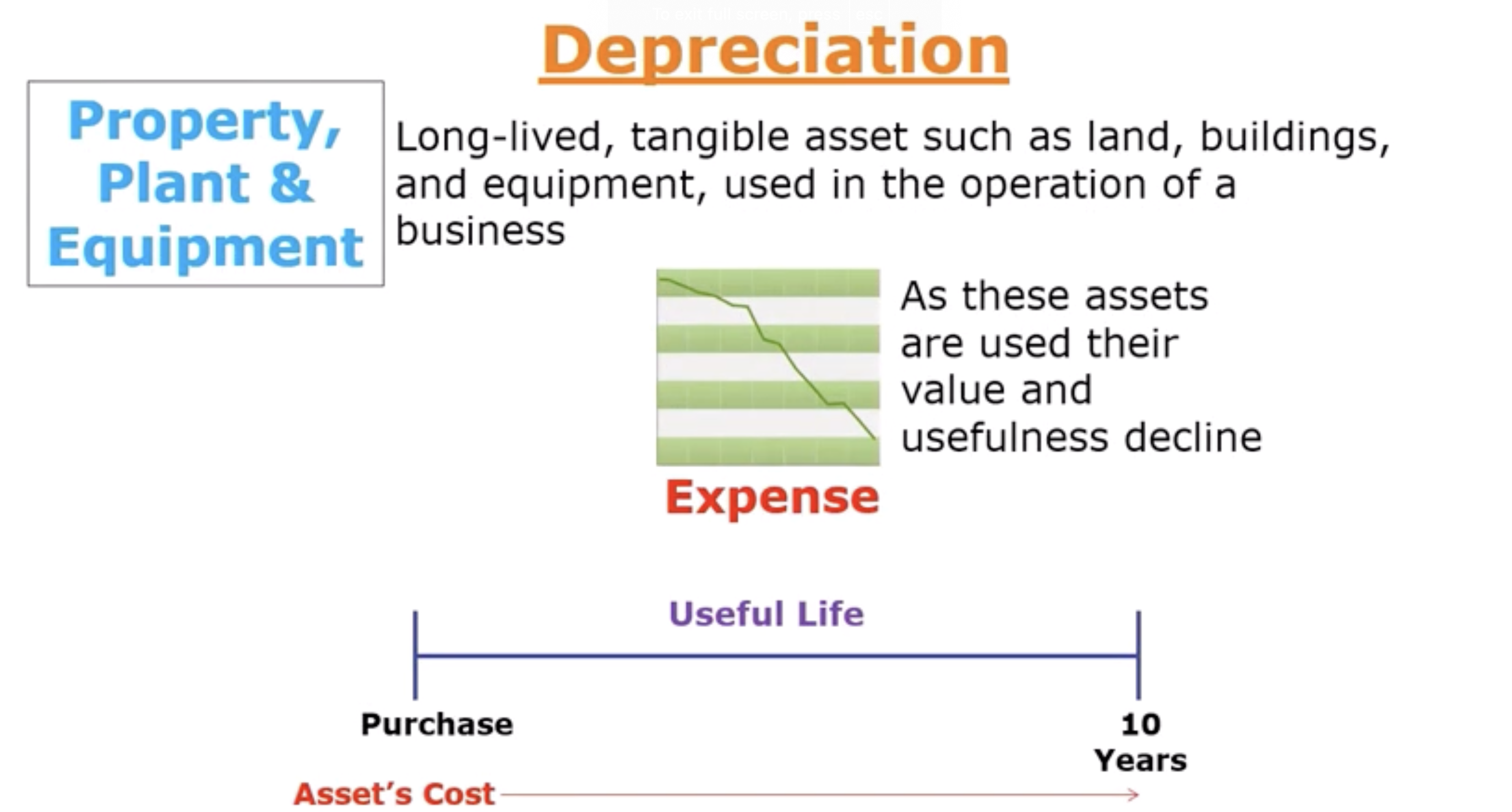

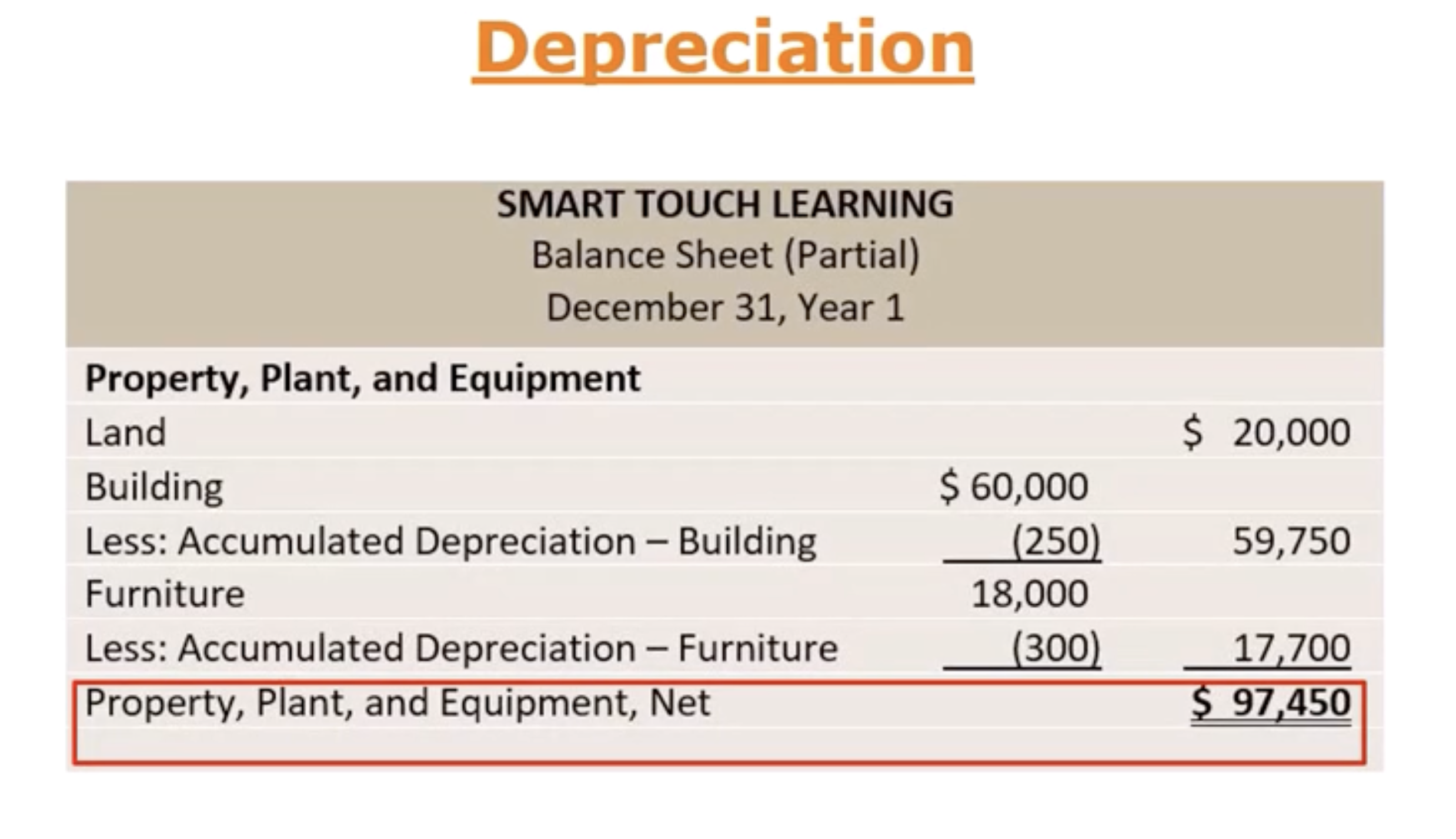

What are the Adjusting Entries for Deferrals, and How do We Record Them: Depreciation

This is linked with property, plant and equipment.

Property, Plant & Equipment: Long-lived, tangible asset such as land, buildings, and equipment, used in the operation a business

As these assets are used more, their value and usefulness decline, for ex— think of your own furniture, car and etc. which will be treated as an Expense.

The line chart: when the asset is purchased, it will be recorded as an asset on the balance sheet but then the cost will be spread out as an expense over the assets useful life and the useful life is our best guess estimate how long that asset will be used in a business. In the example— the asset will be used approx. 10 years.

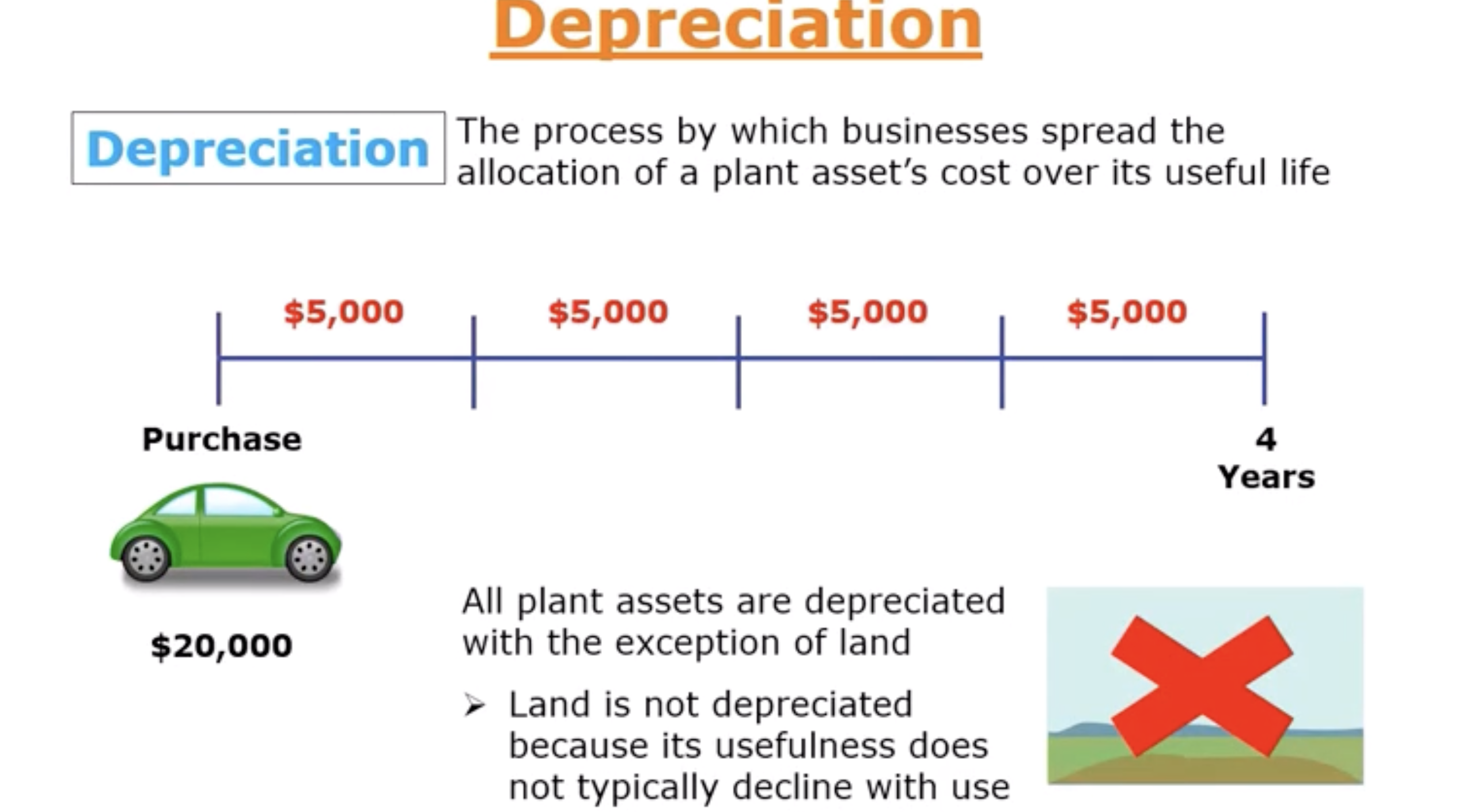

What are the Adjusting Entries for Deferrals, and How do We Record Them: Depreciation definition

The process by which businesses spread the allocation of a plant asset’s cost over its useful life.

Ex: Let’s say you or I purchase a car for 20k today. And we assume the car will be used in 4 years. If we take 20k and divide by 4— 5k in year 1,2,3,4. This called STRAIGHT-LINE DEPRECIATION.

Depreciation DOES NOT APPLY TO LAND but does apply to buildings, equipment and other types of property, plant & equipment.

Similar to Prepaid Expenses

What are the Adjusting Entries for Deferrals, and How do We Record Them: Depreciation Ex P.1 (Residual Value)

Smart TL believes the furniture will remain useful for five years, the furniture will be worthless at the end of five years. This is called Residual Value.

Residual Value: The expected value of a depreciable asset at the end of its useful life. Which will be 0 so they use the Straight- Line depreciation method.

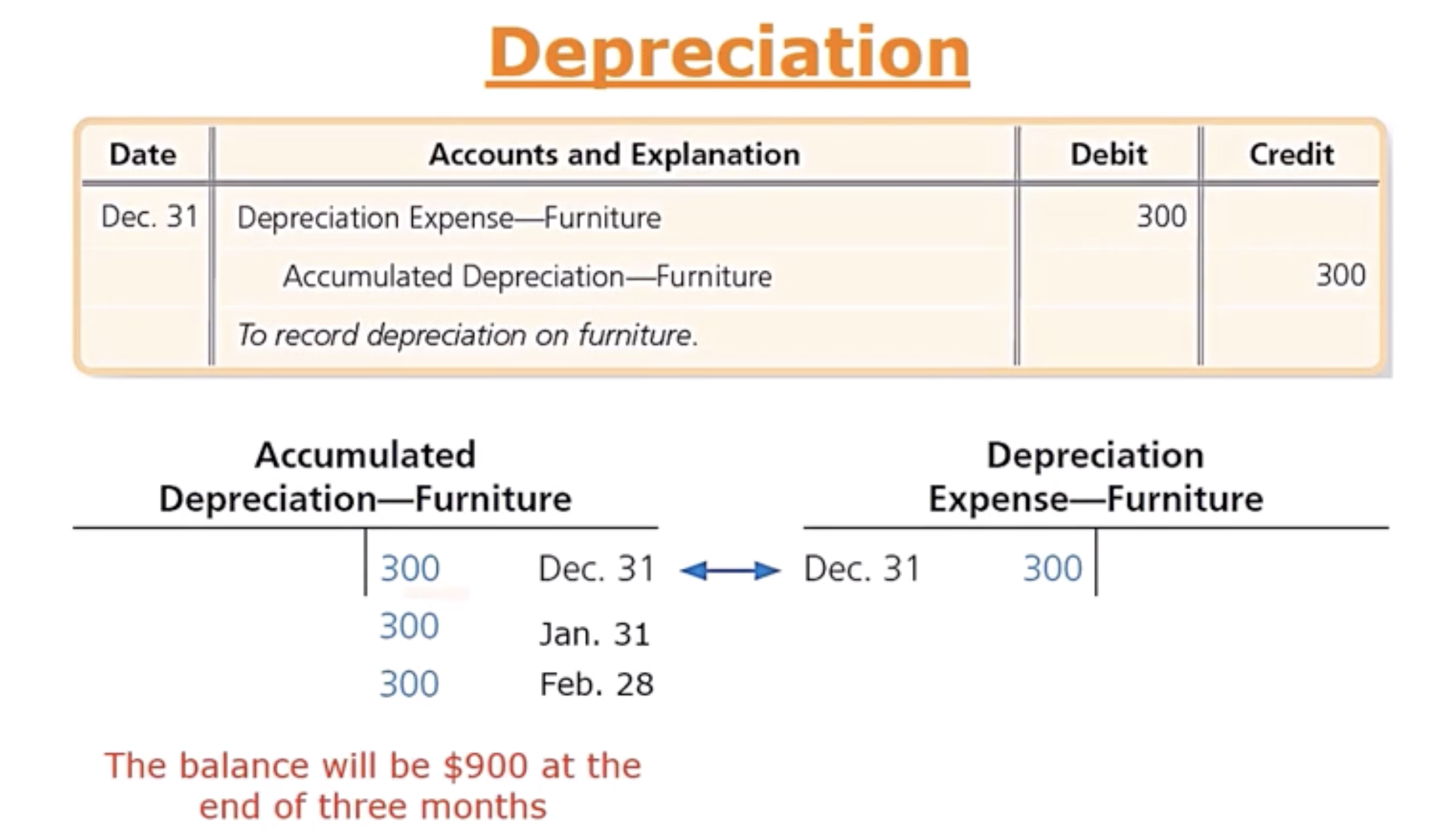

What are the Adjusting Entries for Deferrals, and How do We Record Them: Depreciation Ex P.2 (Straight- Line Depreciation)

A depreciation method that allocates an equal amount of depreciation each year

(Cost— Residual Value) / Useful life:

($18k-$0) / 5 years

= $3,600 per year / 12 months = $300 per month

Depreciation Expense Furniture is on the DR increasing (not an asset but acts like one when it comes to DR & CR).

Accumulated Depreciation Furniture is a Credit for $300. When recording depreciation— we have to follow the cost principle so when Smart TL received furniture on Dec 2nd, they recorded a 18k debit for that furniture and we need to keep that 18k in the account and not adjust so we always know the og cost of the furniture which is why we use the Accumulated Depreciation.

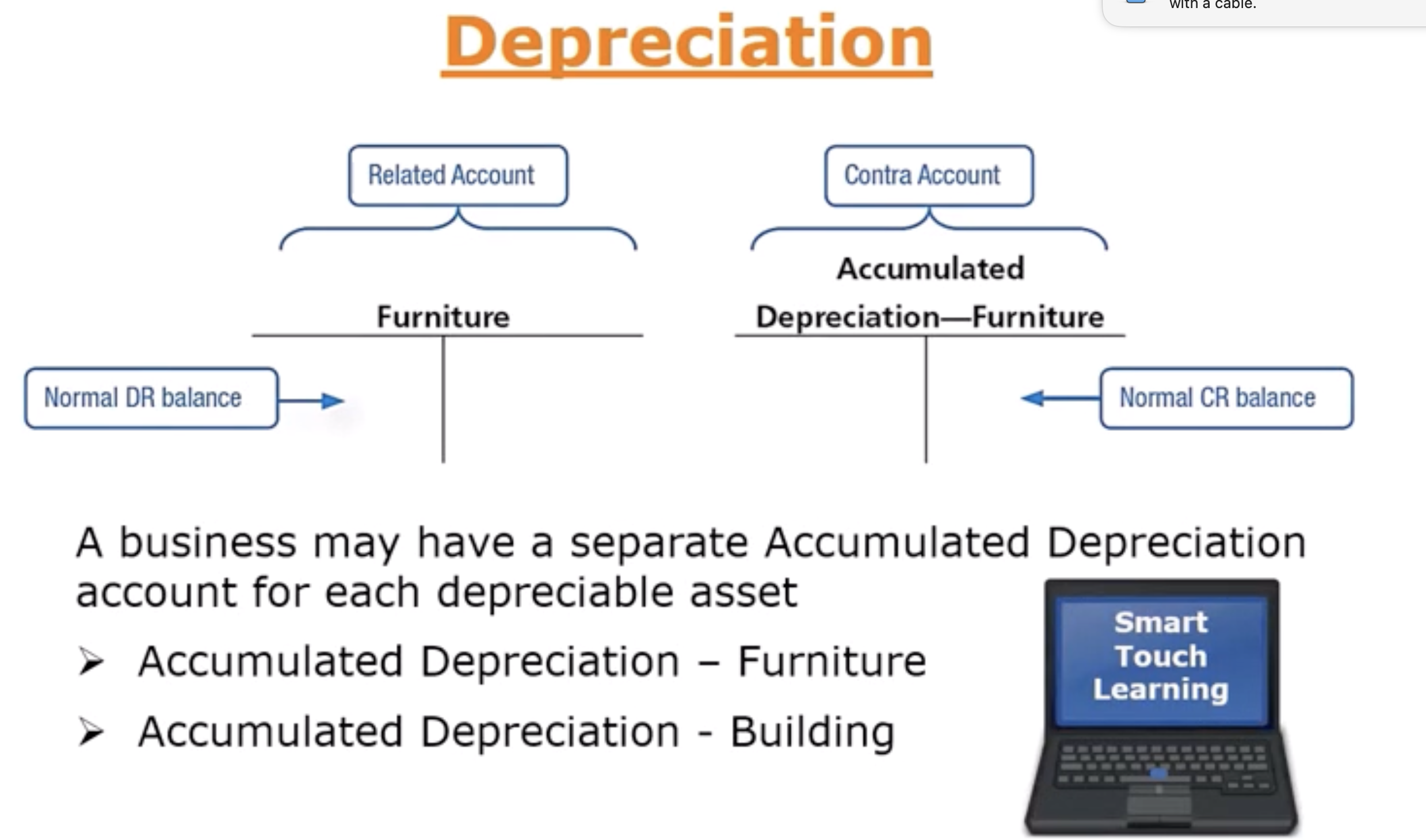

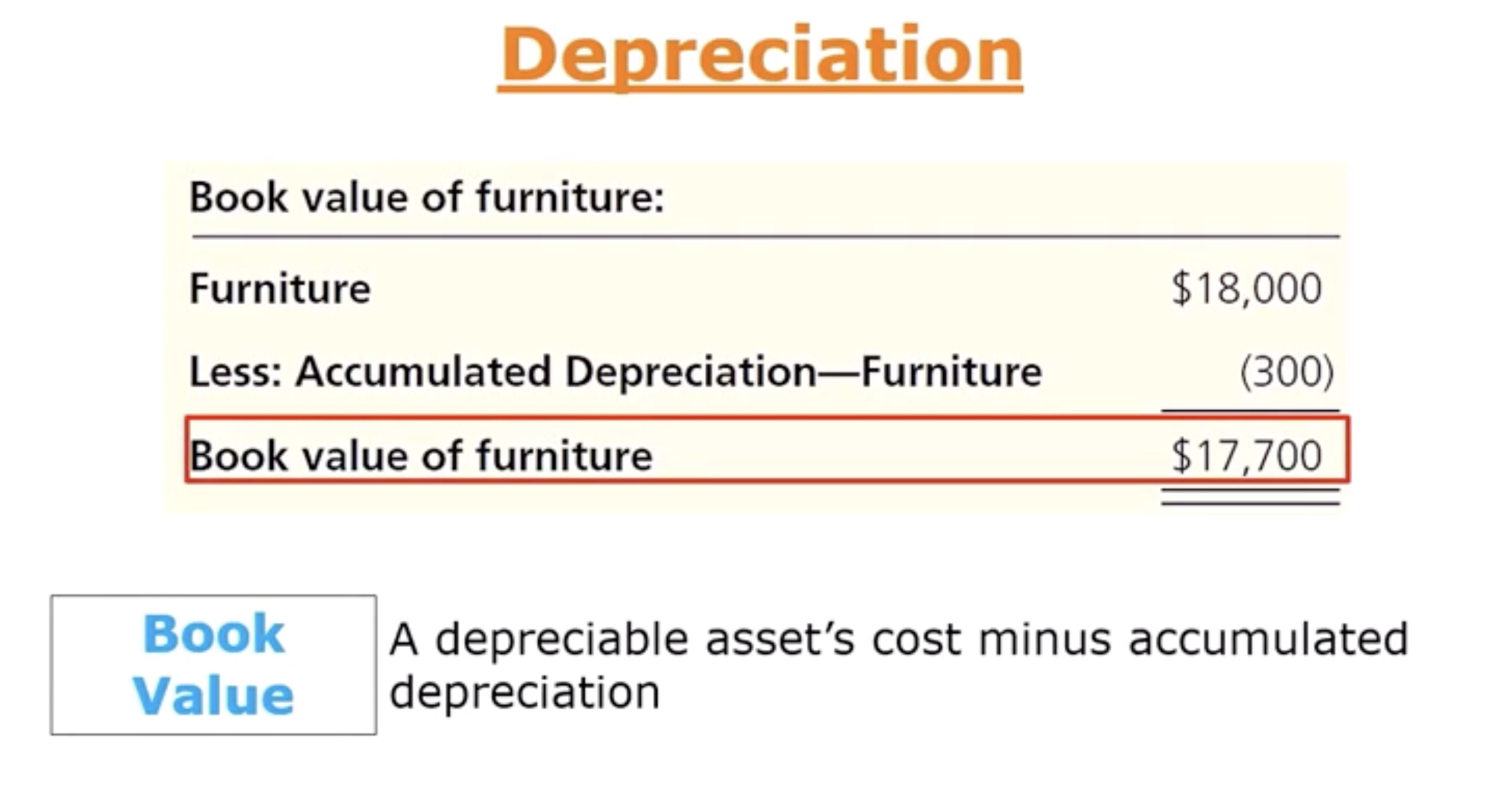

What are the Adjusting Entries for Deferrals, and How do We Record Them: Accumulated Depreciation P.1

Sum of all the depreciation expense recorded for a depreciable asset.

It will increase (accumulate) over time and call this Accumulate Depreciation a “Contra Asset” Account.

Contra Account: Has two main Characteristics— 1. Paired with and listed immediately after its related account in the chart of accounts and associated financial statement. 2. It has a normal balance— whether is DR or CR, that is the exact opposite of the normal balance of the related account.

What are the Adjusting Entries for Deferrals, and How do We Record Them: Accumulated Depreciation P.2 Adjusting Entry (voice recording, press edit and record left side)

What are the Adjusting Entries for Deferrals, and How do We Record Them: Accumulated Depreciation P.3 Balance sheet (voice recording, press edit and record left side)

Accumulated Depreciation P.4 Adjusting Entry (2) (voice recording, press edit and record left side)

Accumulated Depreciation P.5 Balance Sheet (voice recording, press edit and record left side)

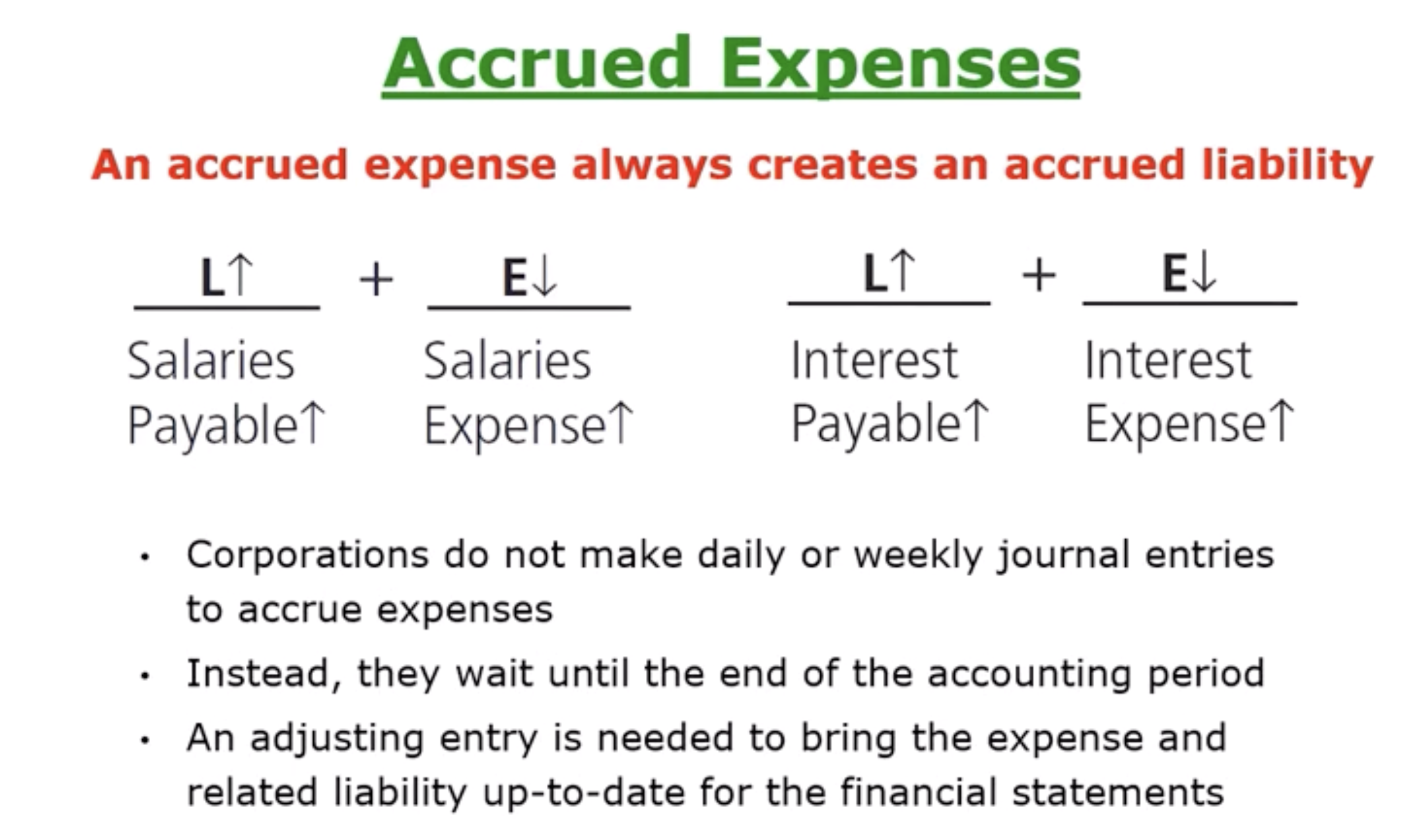

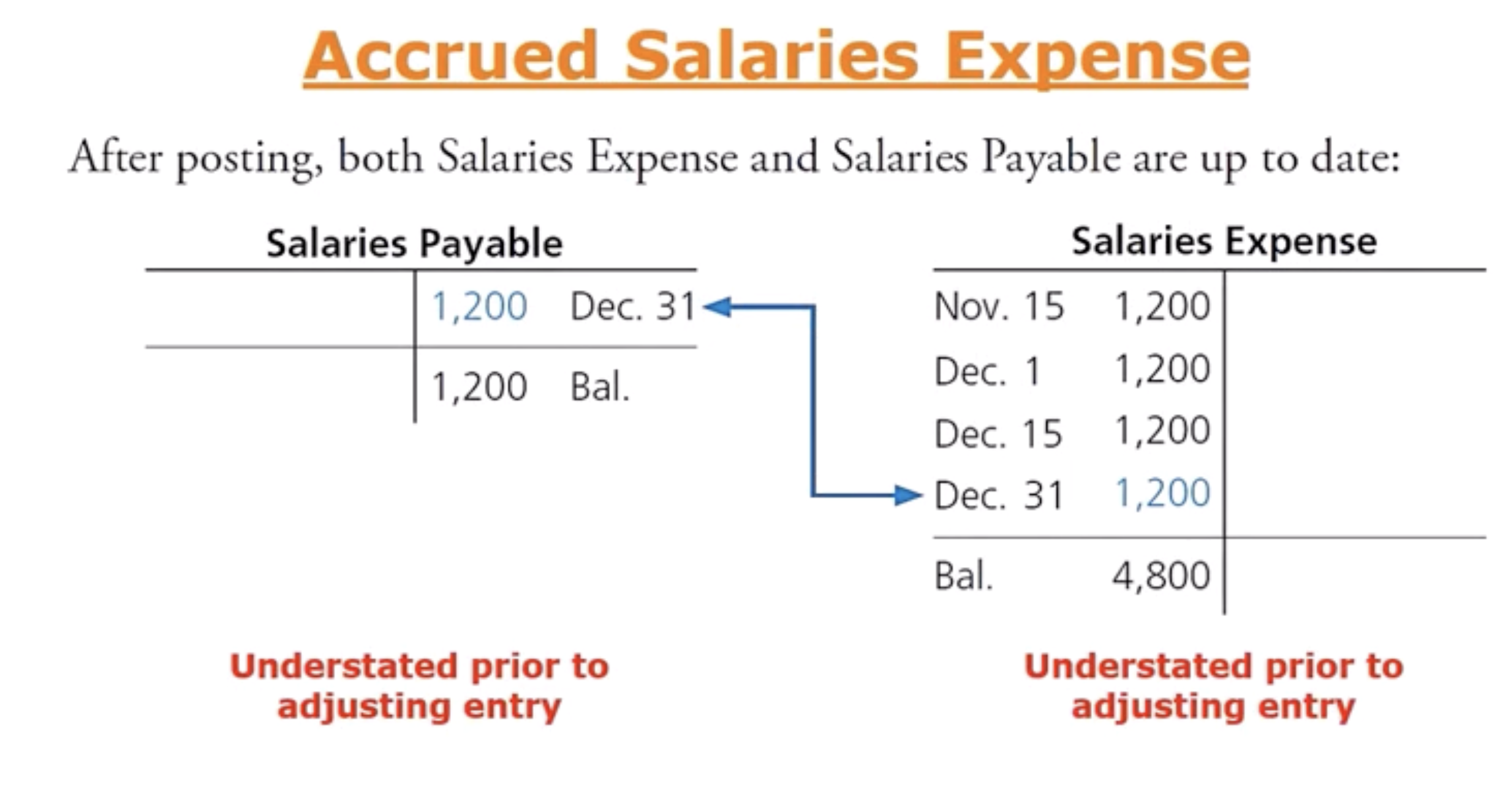

What are the Adjusting Entries for Accruals, and How do We record Them: Accrued Expenses

When the expense is recorded first and then cash is paid in a later date.

Definition: An Expense that the business has incurred but has not yet paid (incurred— something like an expense has been charged to us or happened to us, but it has not been paid yet).

Common Ex: Salaries Expense, Interest Expense

ALWAYS creates an ACCRUED LIABILITY

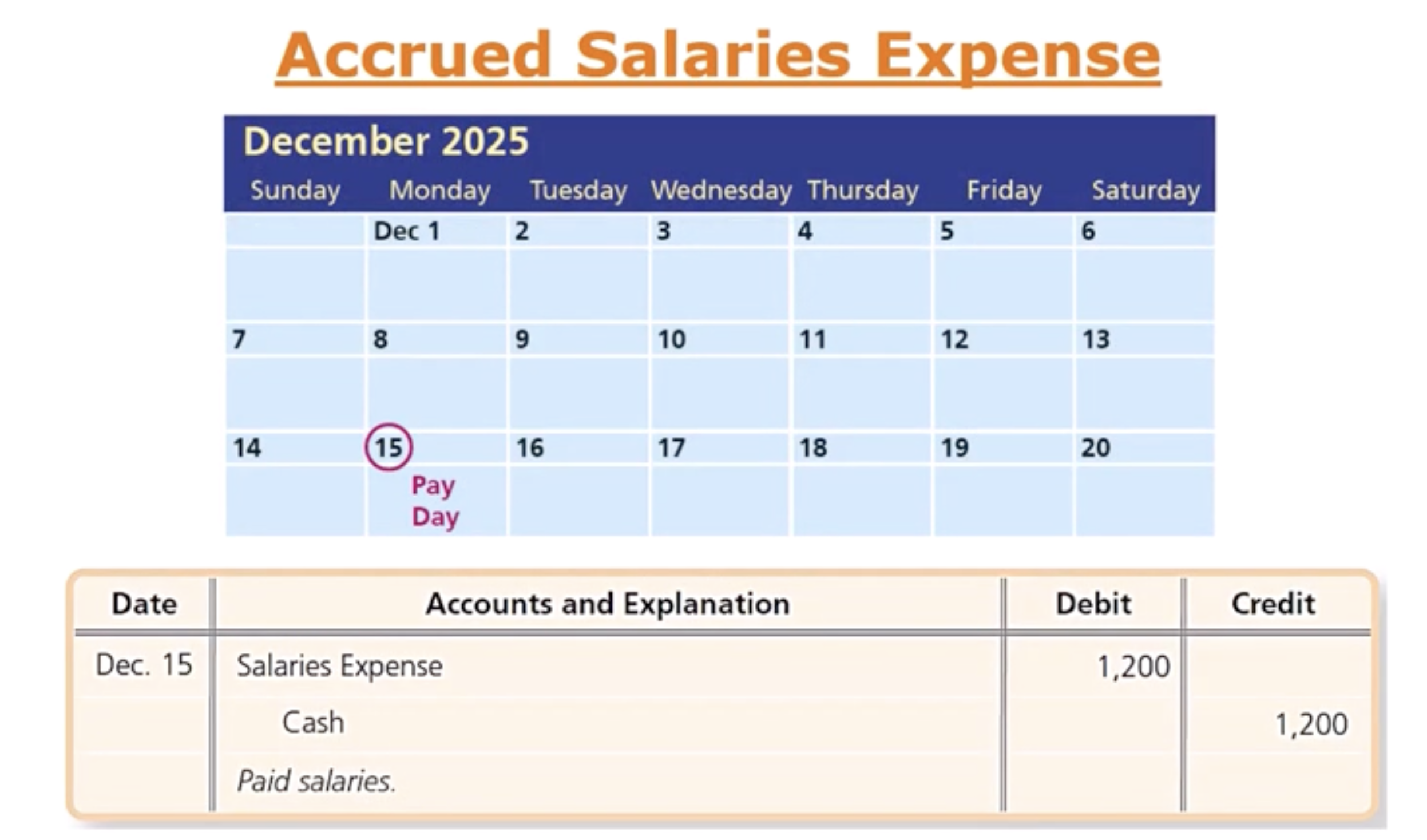

What are the Adjusting Entries for Accruals, and How do We record Them: Accrued Salaries Expense Ex P.1, match the image to the Accrued adjusting entry t- account

Pays its employees a monthly salary of $2,400 and they pay that salary twice per month— half of the first of that month and half on the fifteenth of the month.

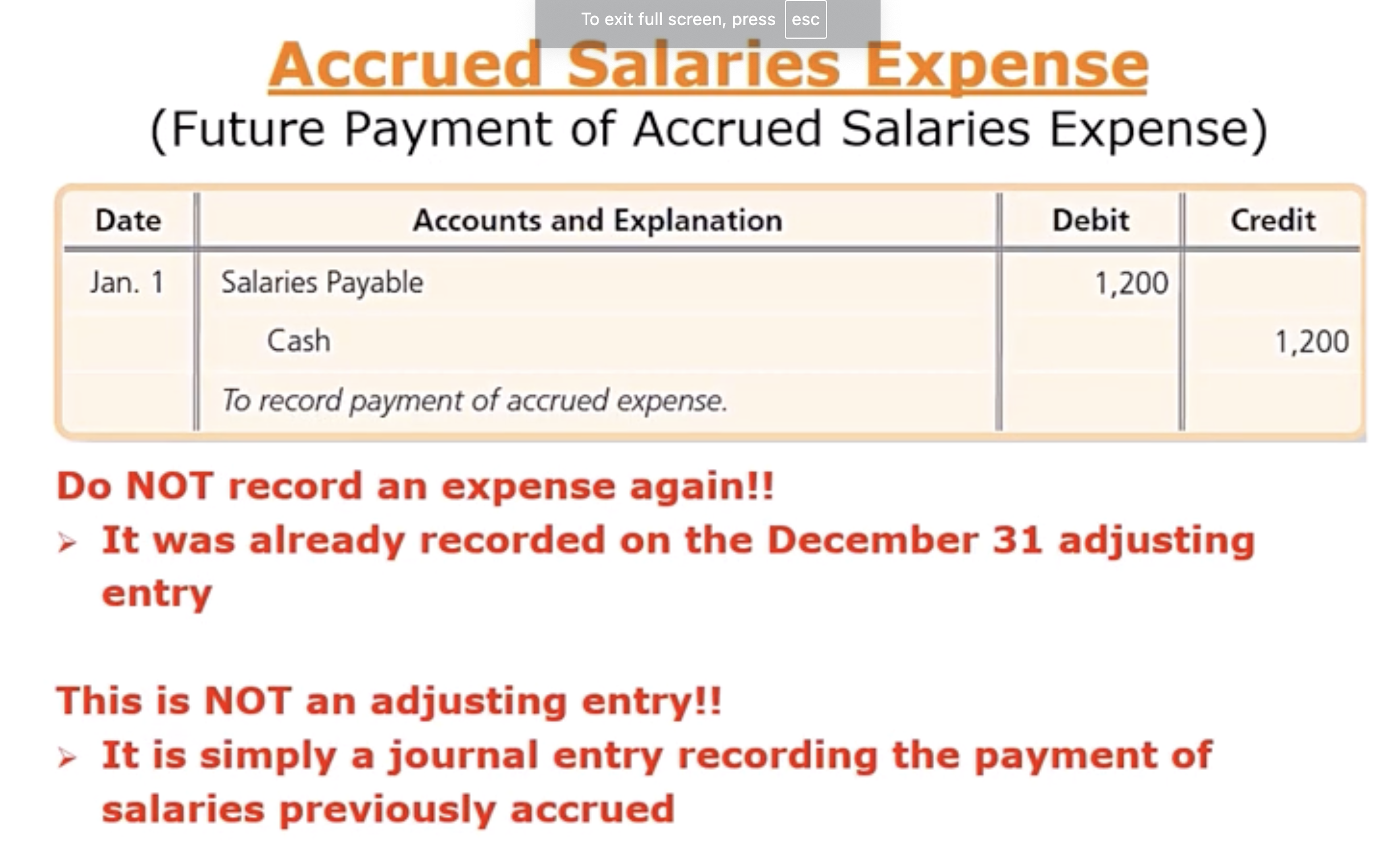

What are the Adjusting Entries for Accruals, and How do We record Them: Accrued Salaries Expense Ex P.2

This is not an ADJUSTING ENTRY! Only occur at the end accounting period and NEVER address cash

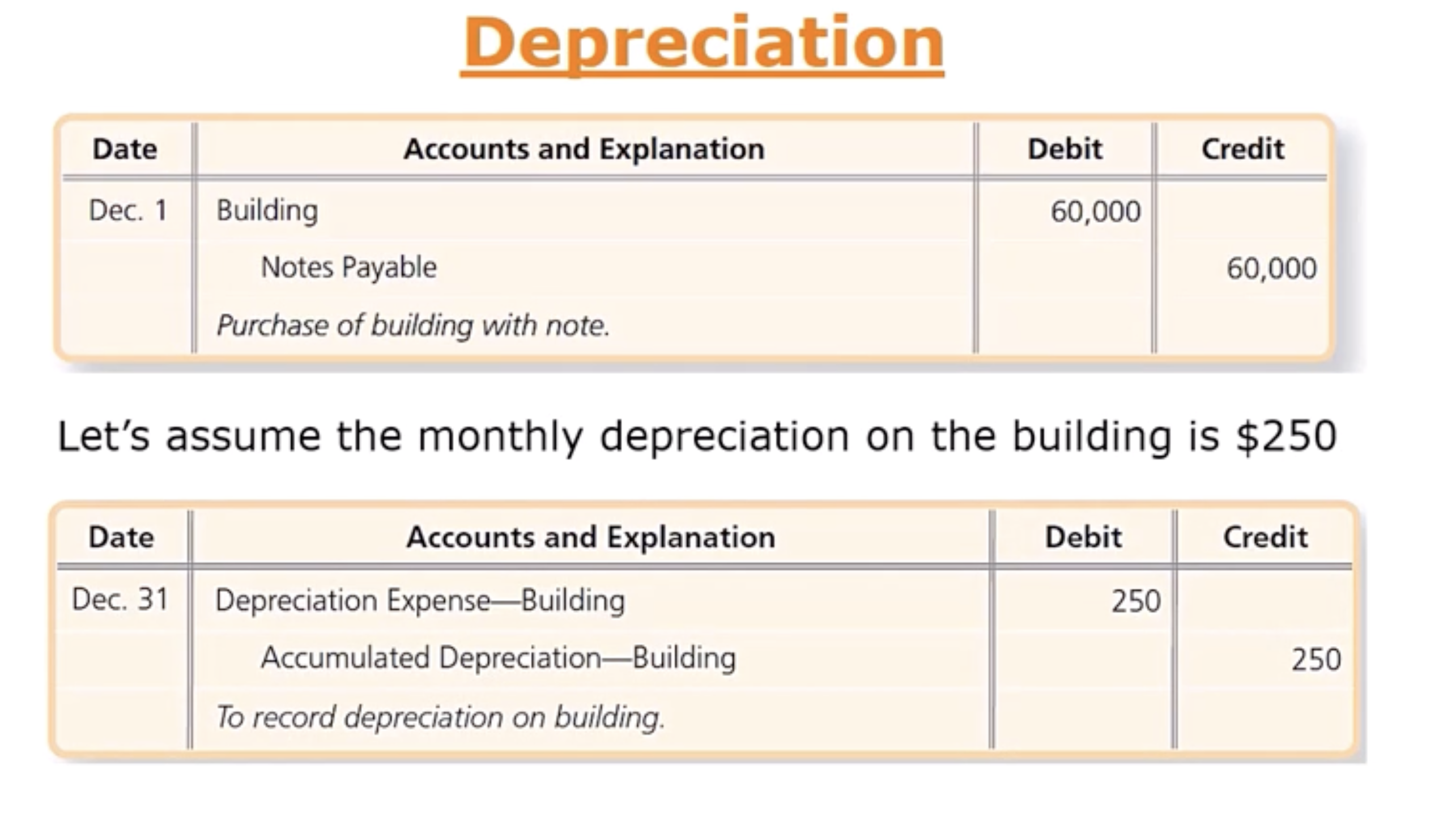

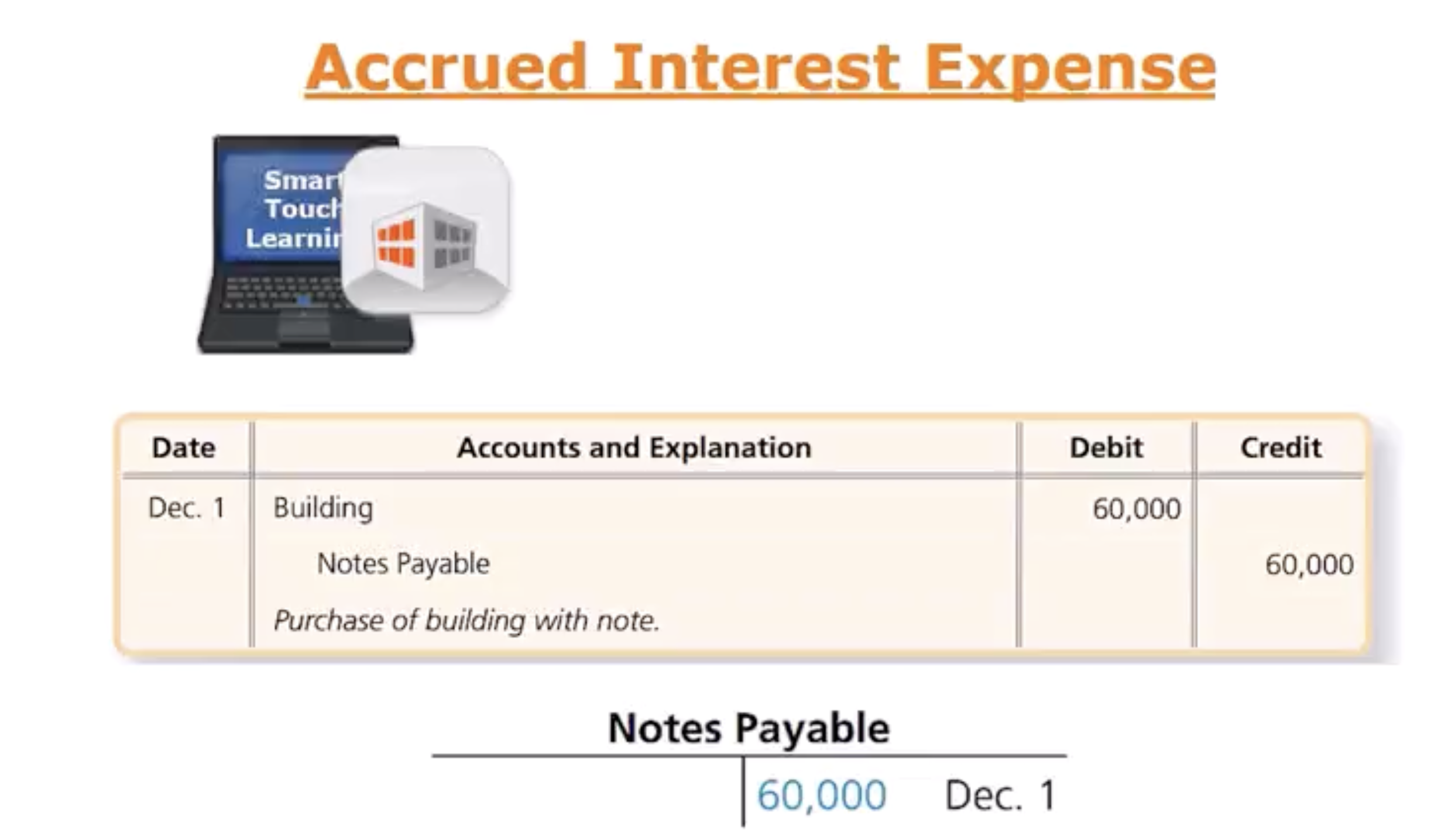

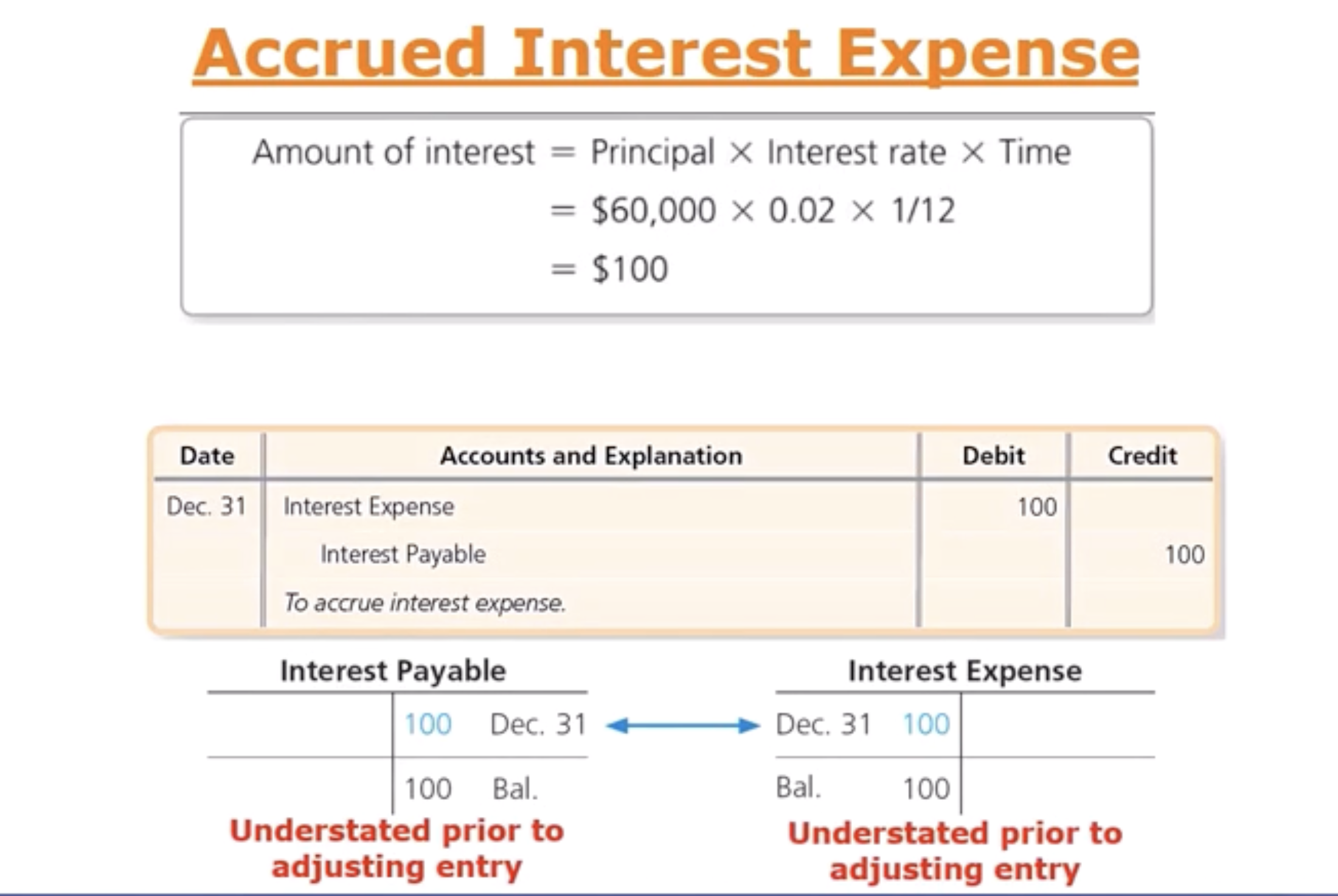

What are the Adjusting Entries for Accruals, and How do We record Them: Accrued Interest Expense Ex

Remember on Dec1st Smart TL recorded a promise sorry note for 60k, they didnt pay cash but they are going into debt promising to pay 60k in the future for an office building.

The asset account buildings is increasing with a Debt.

The liability, Notes payable is increasing with a Credit (has an interest pay but this ex doesnt have one)

What are the Adjusting Entries for Accruals, and How do We record Them: Accrued Interest Expense

If we don’t do this the, the interest payable and expense could be understated.

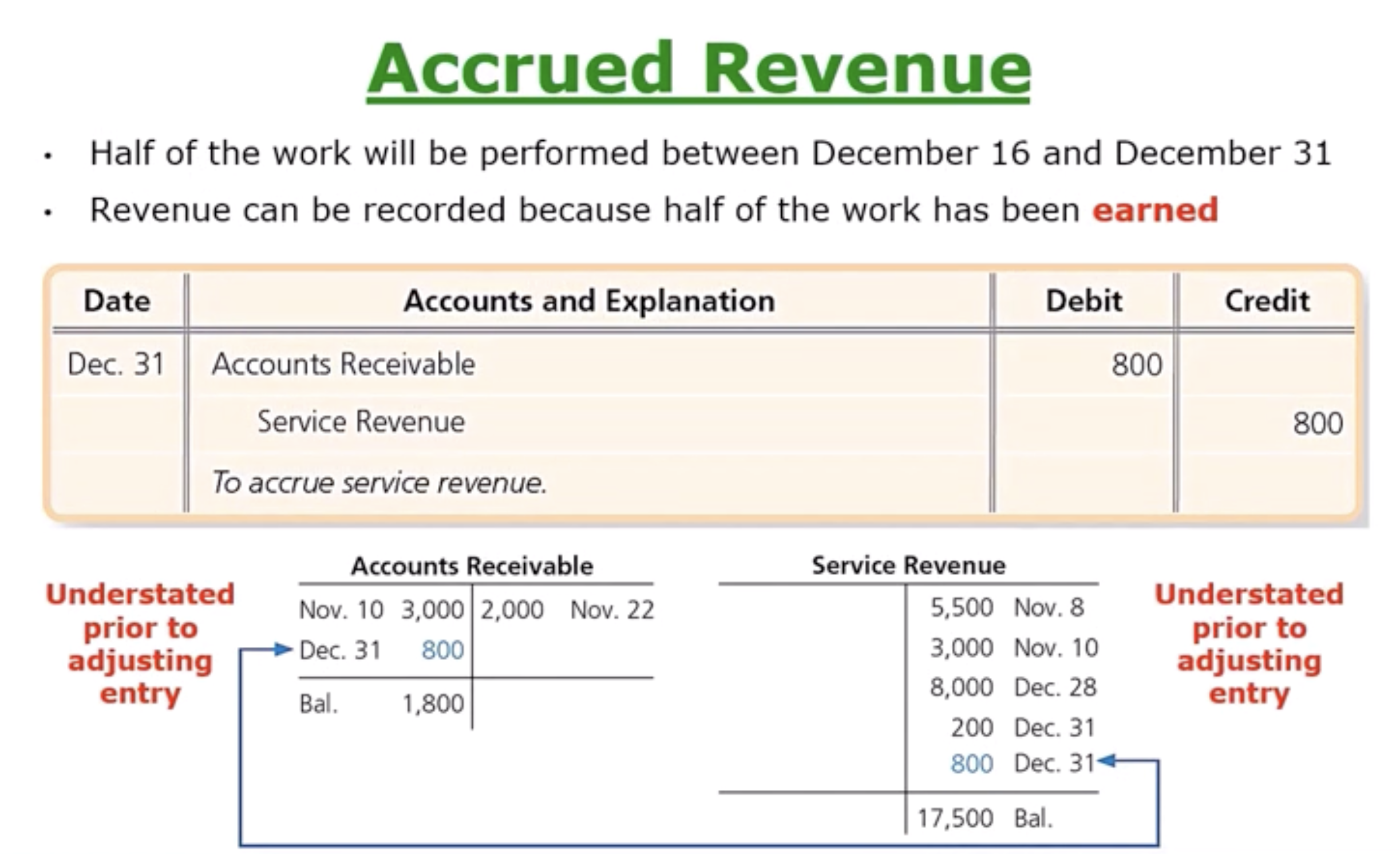

What are the Adjusting Entries for Accruals, and How do We record Them: Accrued Revenues

When we earn revenue and get to record it now in our accounting records but the cash receipt will come at a later date.

Definition: A revenue that has been earned but for which the cash has not yet been collected.

Common ex: services performed or goods delivered on account

What are the Adjusting Entries for Accruals, and How do We record Them: Accrued Revenue Ex P.1

Smart TL is hired on Dec. 16 to perform e-learning services, beginning on Dec. 16 and will earn $1,600 monthly. They will receive payment on January 15— when all the work is done one month later. Now no Journal Entry is recorded on Dec. 15 bc no work has been performed. Smart TL will start the work the next day Dec.16. By the end of the year half of the work will be performed between Dec16- 31. And received half of the contract from the client for 1600.

Revenue can be recorded bc half of the work has been earned

Journal Entry:

The Accounts Receivable was recorded as the Debit for $800, which the client gave us for half of the work

Service Revenue is going to be the Credit 800 to show what was earned

If this was not done, they both would be understated (Service Revenue was the income Statement Account, Account R. was the Balance Sheet Account)

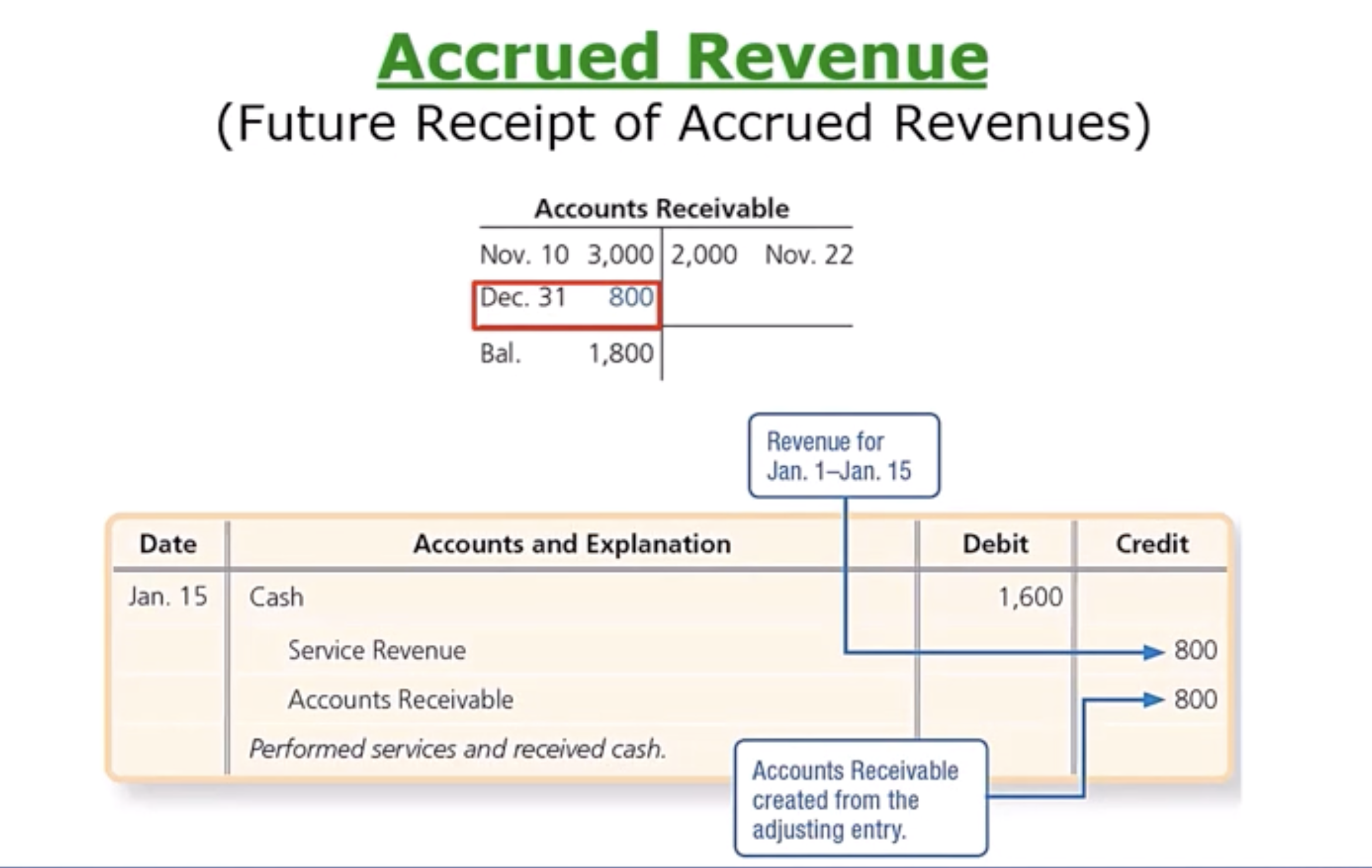

What are the Adjusting Entries for Accruals, and How do We record Them: Accrued Revenue Ex P.2 (Compound entry)

Notice in a Account R. it was updated from the adjusted entry to show the new total balance of 1.8k. the 800 represents the 800 we need receive from the particular client. This next Journal entry is compound.

On Jan. 15th, the client is going to pay Smart TL in full cash of 1.6k. The cash account (asset) is increasing with a Debit.

Notice that the Credits are separated half & half— between paying the Accounts Receivable. The Accounts Receivable from this client is going to be decreased with a credit of $800, but then the service revenue ($800) is recorded because we earned the $800 in Jan and it has not been recorded yet.

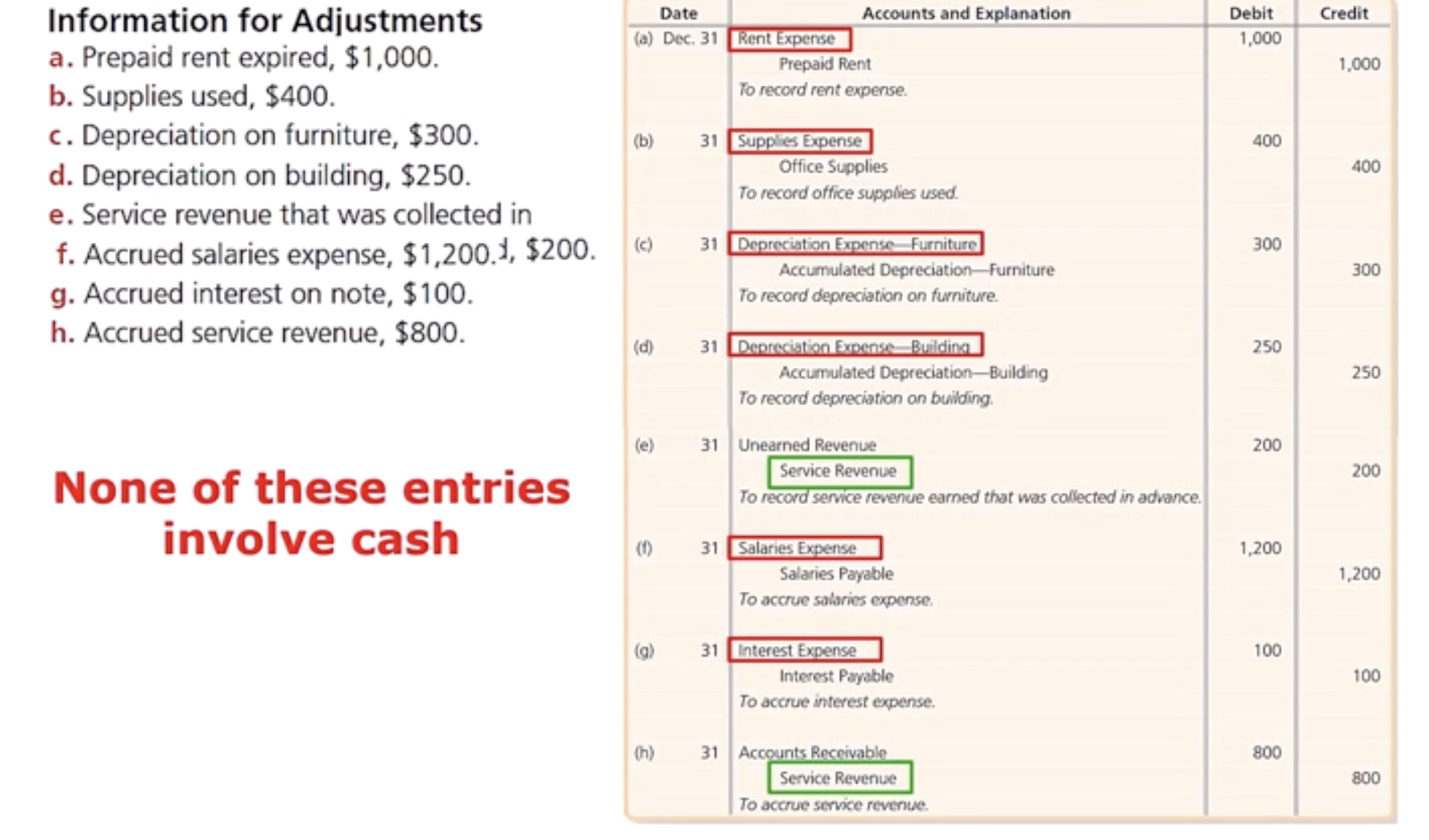

What is the purpose of the Adjusted Trial Balance, and How do We Prepare it: Information of Adjustments

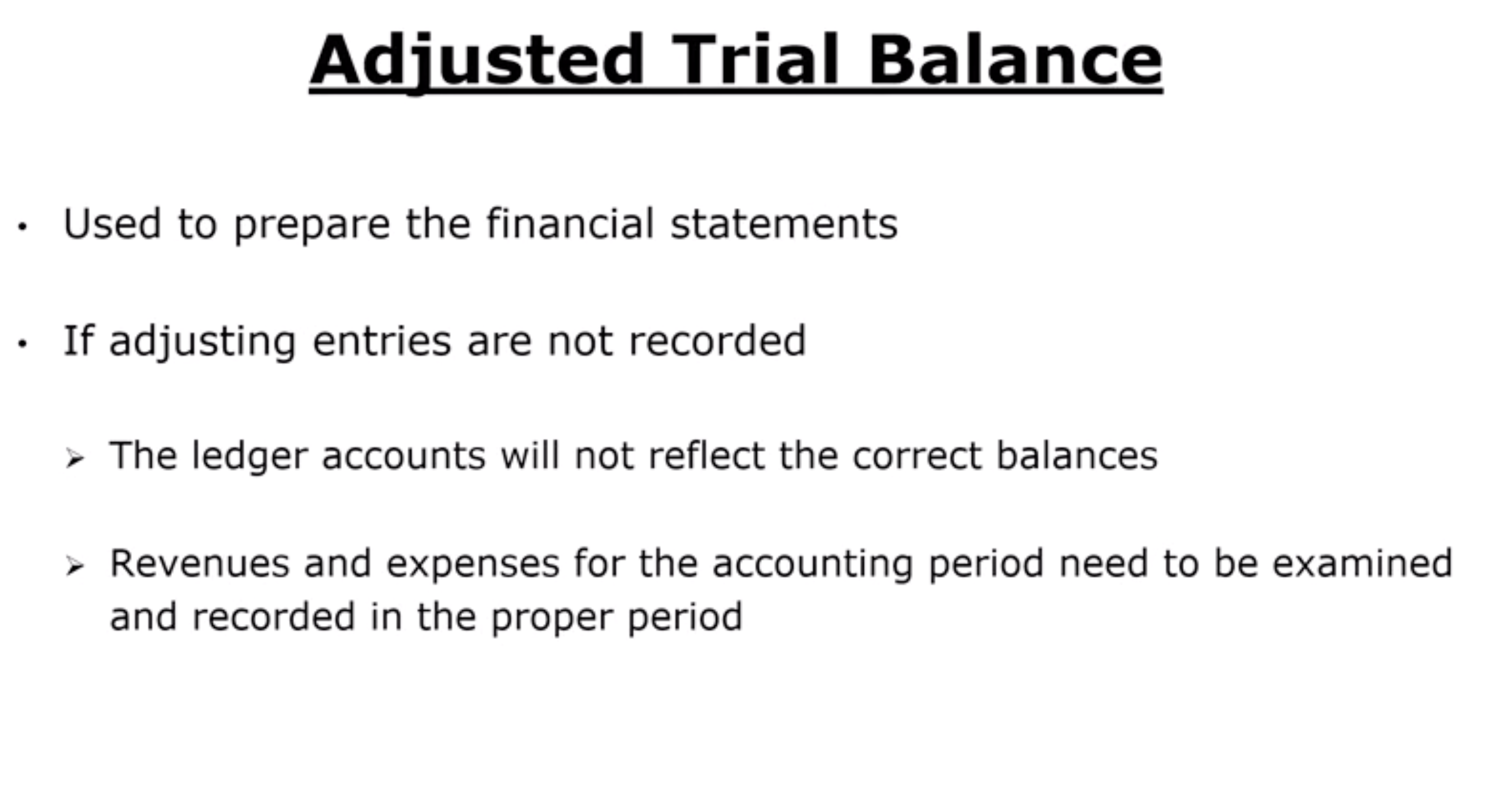

What is the purpose of the Adjusted Trial Balance, and How do We Prepare it: Adjusted Trial Balance

A list of all the accounts with their adjusted balances

What is the purpose of the Adjusted Trial Balance, and How do We Prepare it: Differences between Unadjusted and Adjusted Balance

In the Unadjusted Trial Balance, there is no depreciation expense anywhere but bc they were included in the Adjusted Entries, now see depreciation expense with furniture and building as part as the Adjusted Trial Balance

Secondly, notice that some of the balance has changed, Accounts Receivable in the Unadjusted Trial Balance use to be 1k. Since we recorded that Adjusted Entry for Accrued Revenue last lesson, now the Account Receivable 1.8k.

Another ex, is Office Supplies. In the Unadjusted Trial Balance, Office Supplies was $500 but recorded the Adjusted Entry to show that Smart TL used some supplies and now Office Supplies is at $100.

What is the purpose of the Adjusted Trial Balance, and How do We Prepare it: Trial Balance Reminders purpose

Ensure that total Debits equal total Credit

Even if it balances, that does not guarantee a mistake has not been made

Ex:

An adjusting entry may have been recorded for an incorrect amount

an adjusting entry may have been omitted (it means a necessary update to the accounting records wasn’t made at the end of the period. Adjusting entries are used to ensure that revenues and expenses are recorded in the correct period—following the accrual basis of accounting.)

What is the Impact of Adjusting Entries on the Financial Statements: Adjusted Trial Balance is used to

prepare the financial statements

Can take the balances off of the Adjusted Trial Balance and put them in each of the appropriate financial statements

What is the Impact of Adjusting Entries on the Financial Statements:

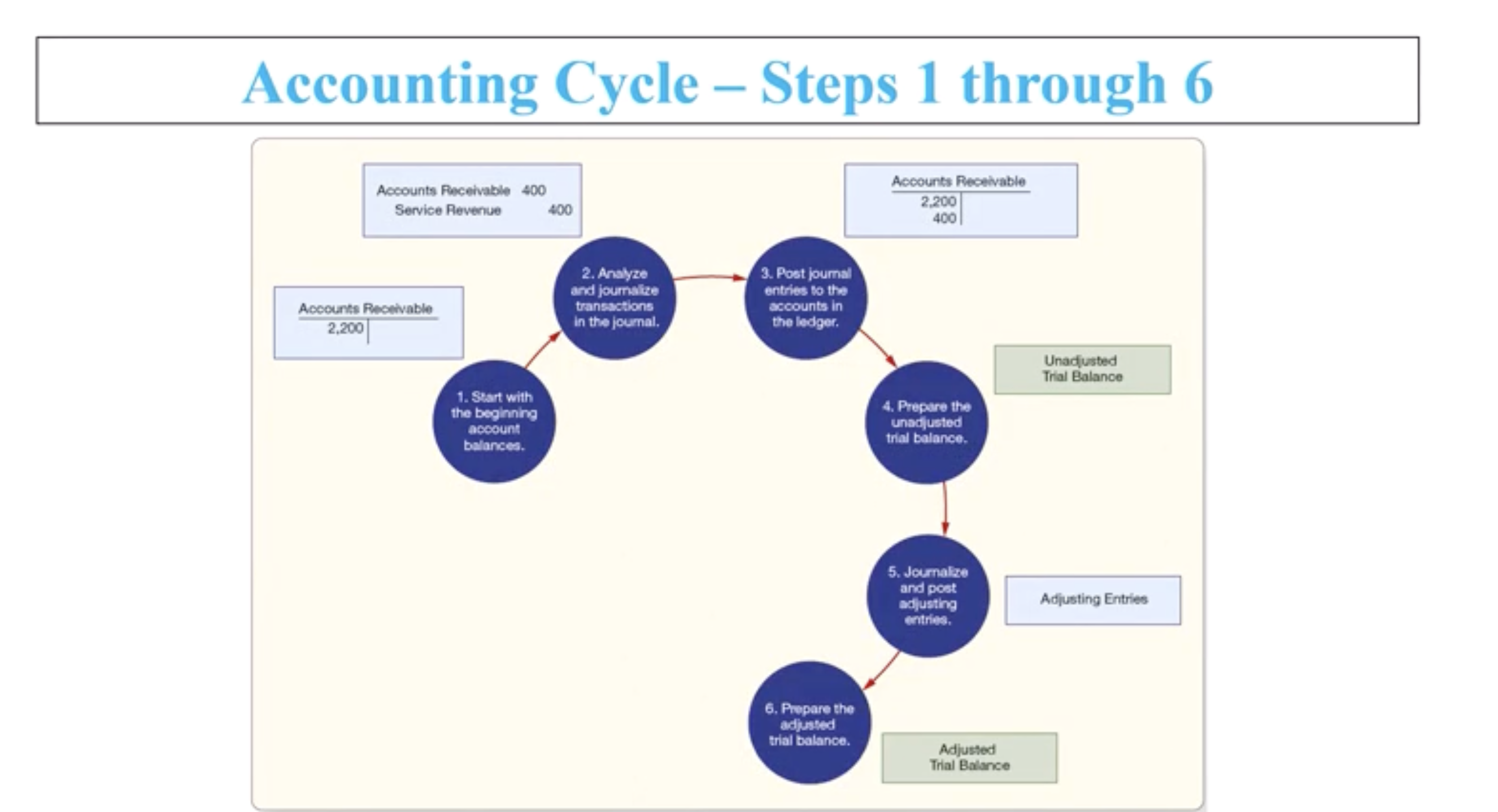

What is the Impact of Adjusting Entries on the Financial Statements: What are the Next Steps in the Accounting cycle & Definition for the Accounting cycle

Accounting Cycle: The process by which companies produce their financial statements for a specific period of time

How Could a Worksheet help in Preparing Adjusting Entries and the Adjusted Trial Balance: Worksheet

An internal document that helps summarize data for the preparation of financial statements, merely a summary device that helps identify the accounts that need adjustments and sometimes companies use worksheets to help them pair their financial statements

What is not a worksheet: Journal, Ledger, Financial Statements

How Could a Worksheet help in Preparing Adjusting Entries and the Adjusted Trial Balance: Ex of a worksheet

Press edit, and press the record button on the left side to hear the audio explanation. Holding off the income and balance sheet.