8.1 Strategic direction

1/16

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

17 Terms

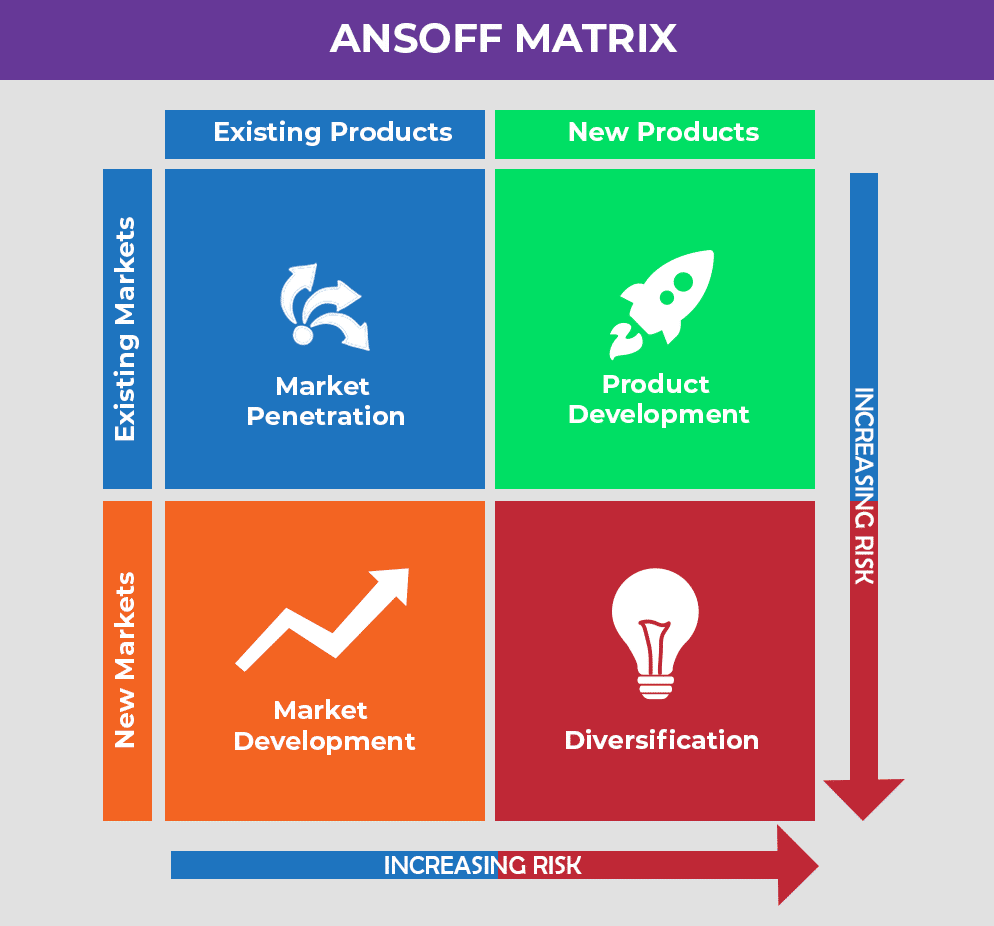

Ansoff matrix- strategic direction

market penetration

selling more of an existing product to an existing market

low risk low reward

approaches

gain MS from competitors

encourage customers to buy or consume more

changes to marketing mix

extension strategies

ADV market pentration

low risk – uses what the business already knows

quick results – easier to increase sales to current customers

builds brand loyalty – strengthens position in the market

efficient use of resources – no need for new product development

DIS market penetration

competitors reactions

short term

market may already be saturated

may not be cost effective

market development

attracting new markets to buy existing products

approaches

enter a new international markets (risky)

move from B2B to retail

move to a new market segment

ADV market development

expands customer base – reaches new regions or demographics

increases revenue potential – opens up new sales opportunities

spreads risk – not dependent on one market

can be cost-effective – if using the same product with small changes

DIS market development

lack of knowledge of customers

product may not be accepted, desired or understood

business may not understand new market

alienation of current customers (separation)

product development

selling new products to existing customers

must be a proactive market leader for this

approaches

launch improved version of existing product

introduce complementary product to develop a range

adapt product to suit a target market within a market

ADV product development

meets changing customer needs – keeps business relevant

builds on existing relationships – easier to sell to loyal customers

can increase customer spend – offering more to the same audience

improves brand image – seen as innovative

DIS product development

high R and D cost

competitor reactions

risk of cannibalisation (decreased in demand for a company’s original product in favour of its new product)

may shorten product life cycle

diversification

selling new products to a new market

high risk high reward

related diversification - potential synergies

unrelated diversification - no relation between markets

approaches

R and D into new products and market research

take over of another business

ADV diversification

high growth potential – taps into entirely new opportunities

spreads risk – not tied to one product or market

can boost brand reach – if successful, increases visibility

can take advantage of trends – enters fast-growing areas

DIS diversification

high risk as 2 elements are unknown

relies on heavy investment

cultural differences may exist

brand image diluted

limitations of Ansoff

some categories are grey areas

assumes 2 diagonal strategies have equal risk

may not take external factors into account

strategic direct

the markets a business chooses to compete in and the products/services it offers

factors effecting which markets a business should compete in

market size and growth potential – bigger or growing markets offer more opportunities

customer needs and behaviour – must match what the business can offer

level of competition – high competition may reduce chances of success

economic conditions – stable economies are often safer for investment

cultural factors – values, habits, and preferences must align

accessibility – includes transport, communication, and distribution channels

factors that influence which products to offer

customer demand – products should solve a real need or problem

company strengths and resources – products must match what the business can do well

profitability – should have good profit margins and sales potential

competition – must offer something better or different than rivals

technology trends – products should keep up with or use new technologies

cost of production – must be affordable to make and sell

brand fit – products should match the company’s image and values