How to trade a Trading Range

1/24

Earn XP

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

25 Terms

TR maxim

Buy low sell high

Think of your trades as scalps

Take small profits and don't expect breakout to get FT

PULLBACKS after you enter and before you take profits

5-10 bars and done

Just a few to get profitable

How many setups per day?

ALs mate - scalping in TRD

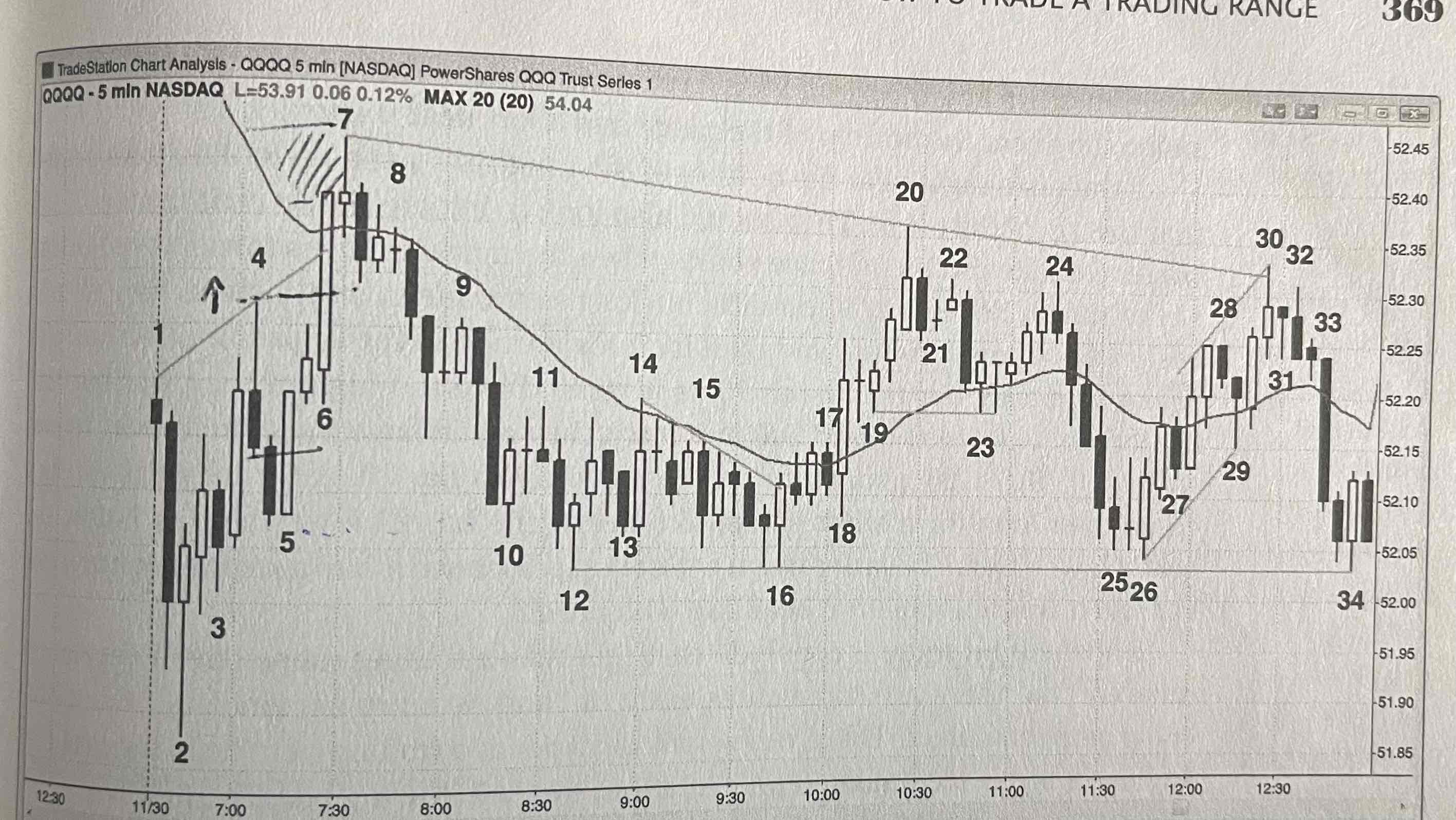

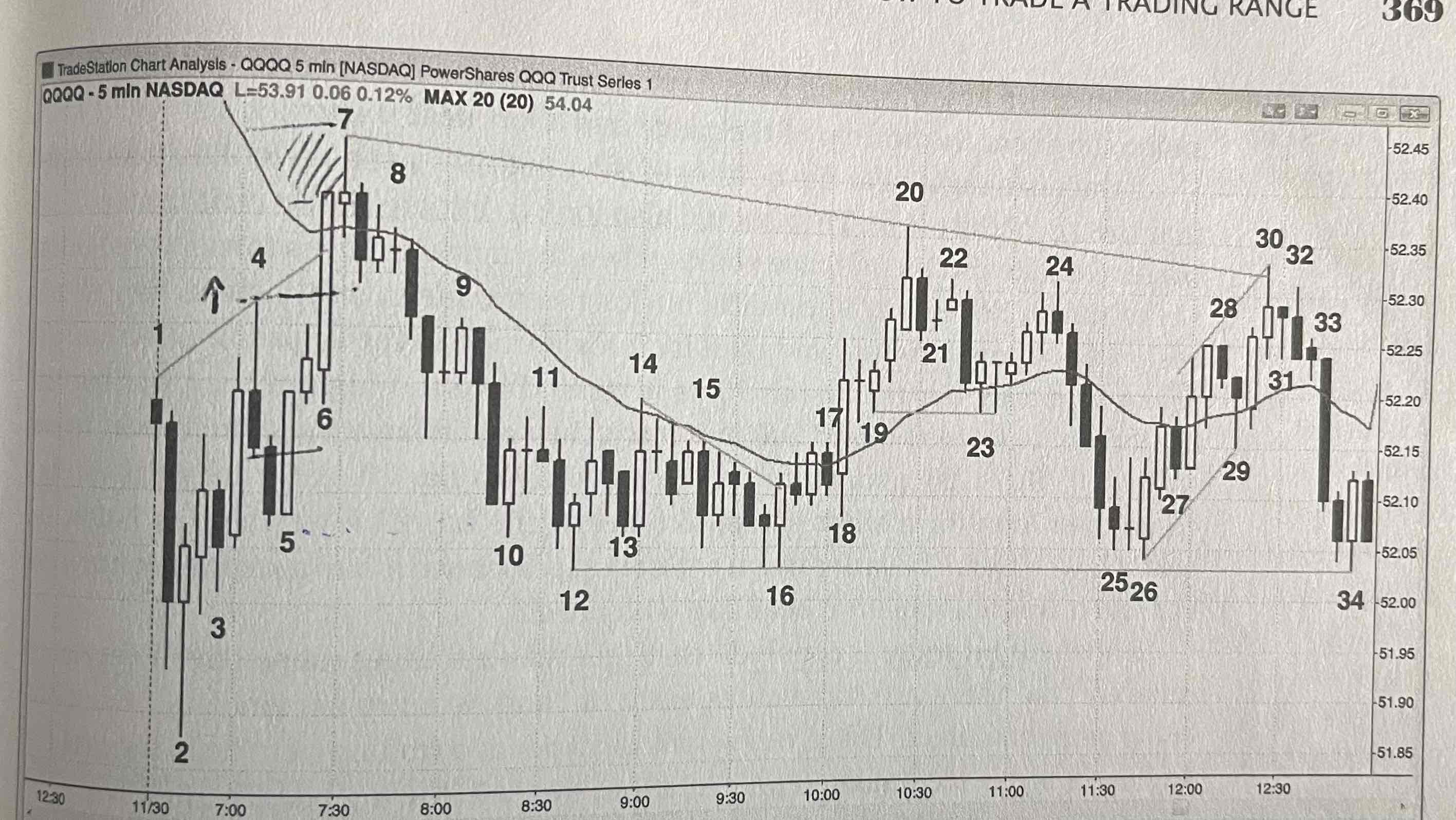

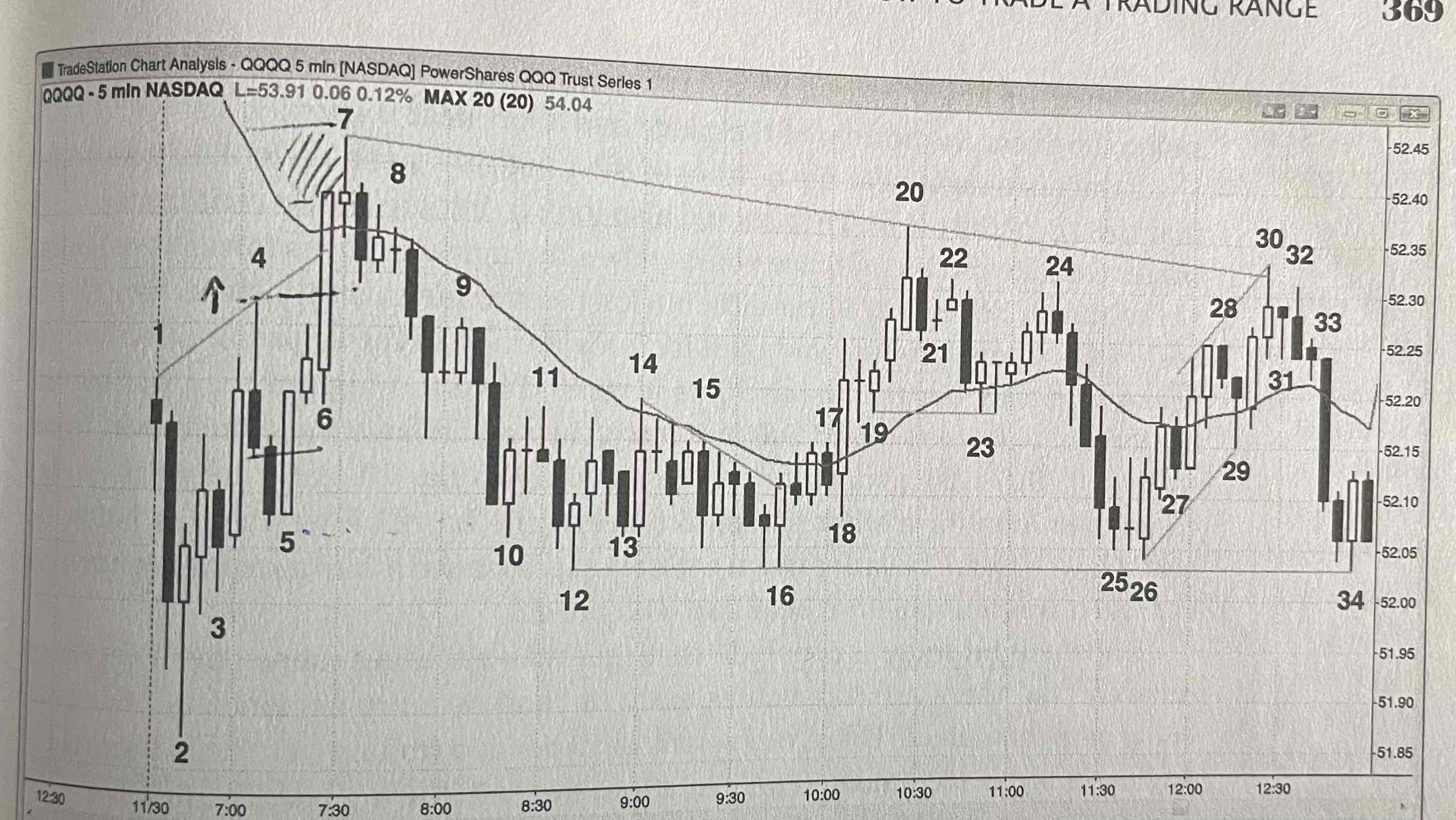

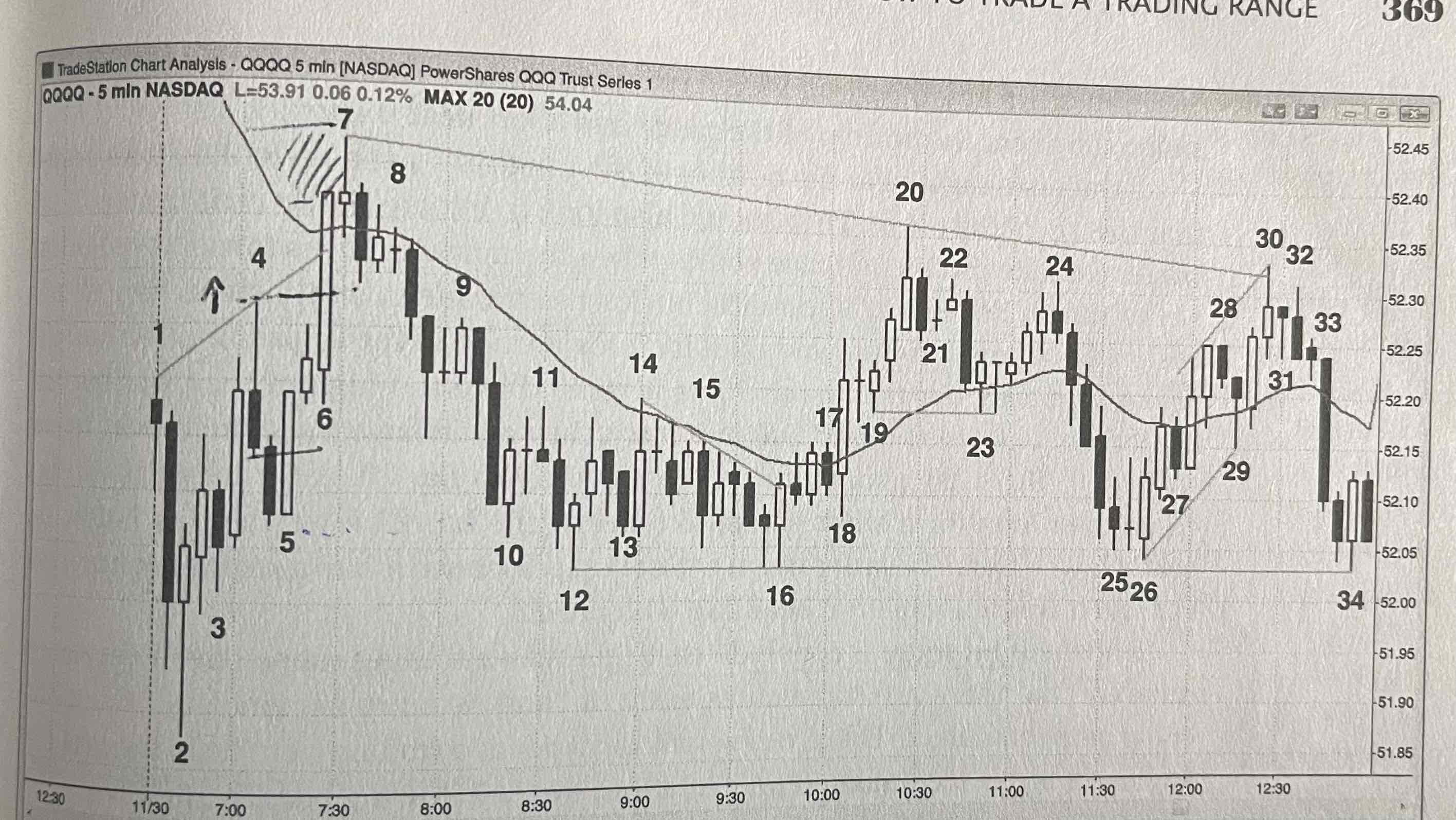

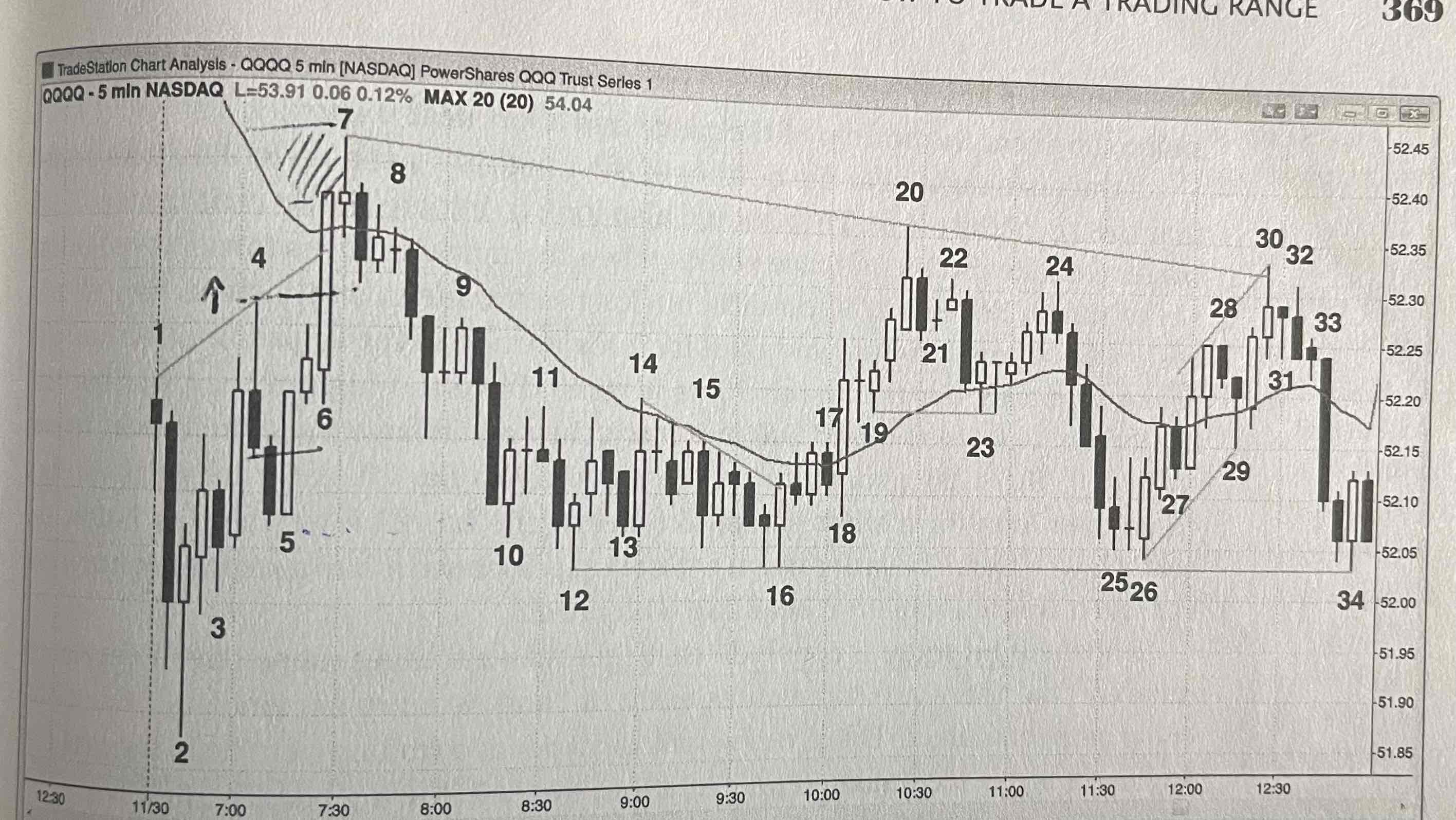

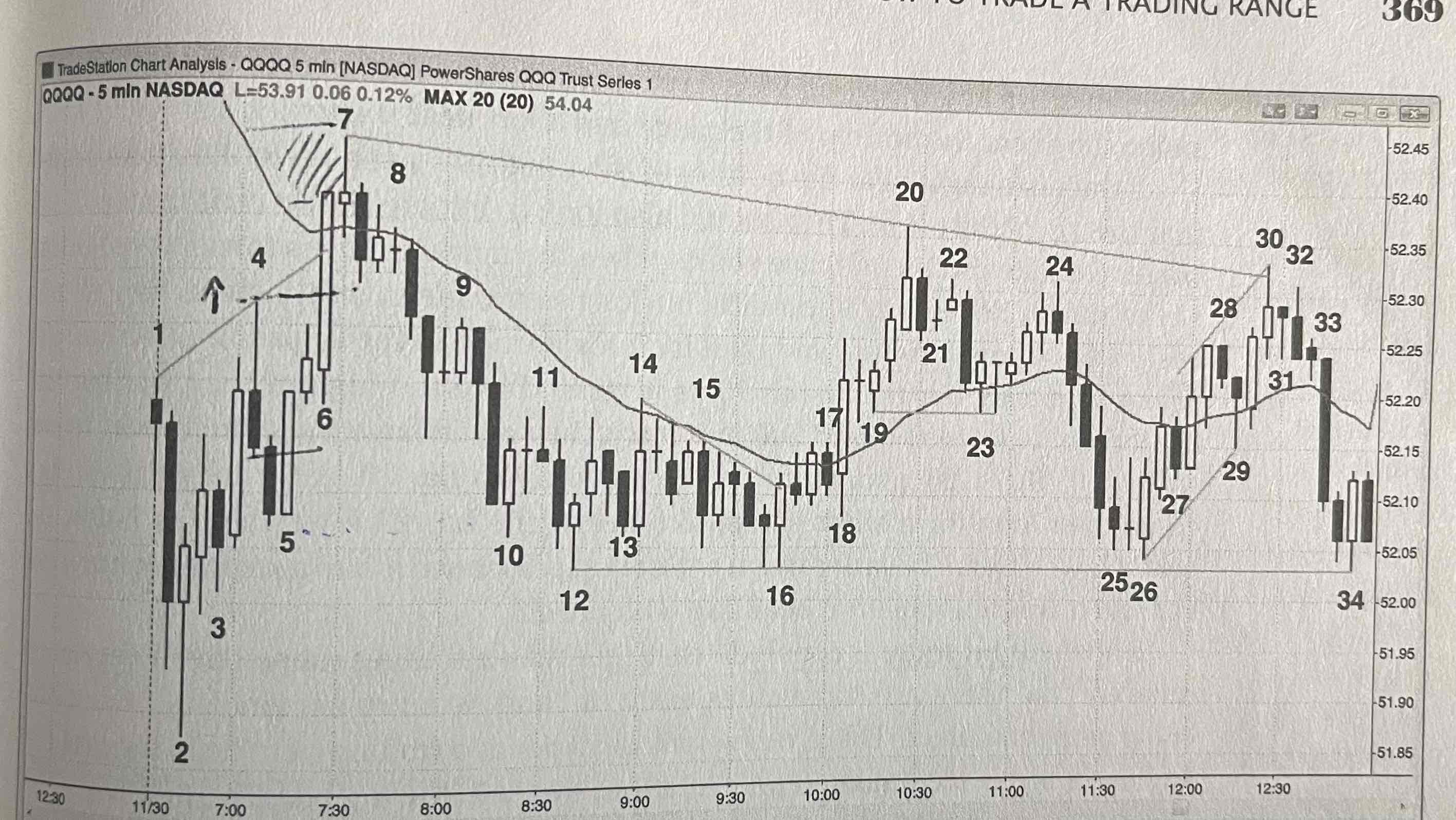

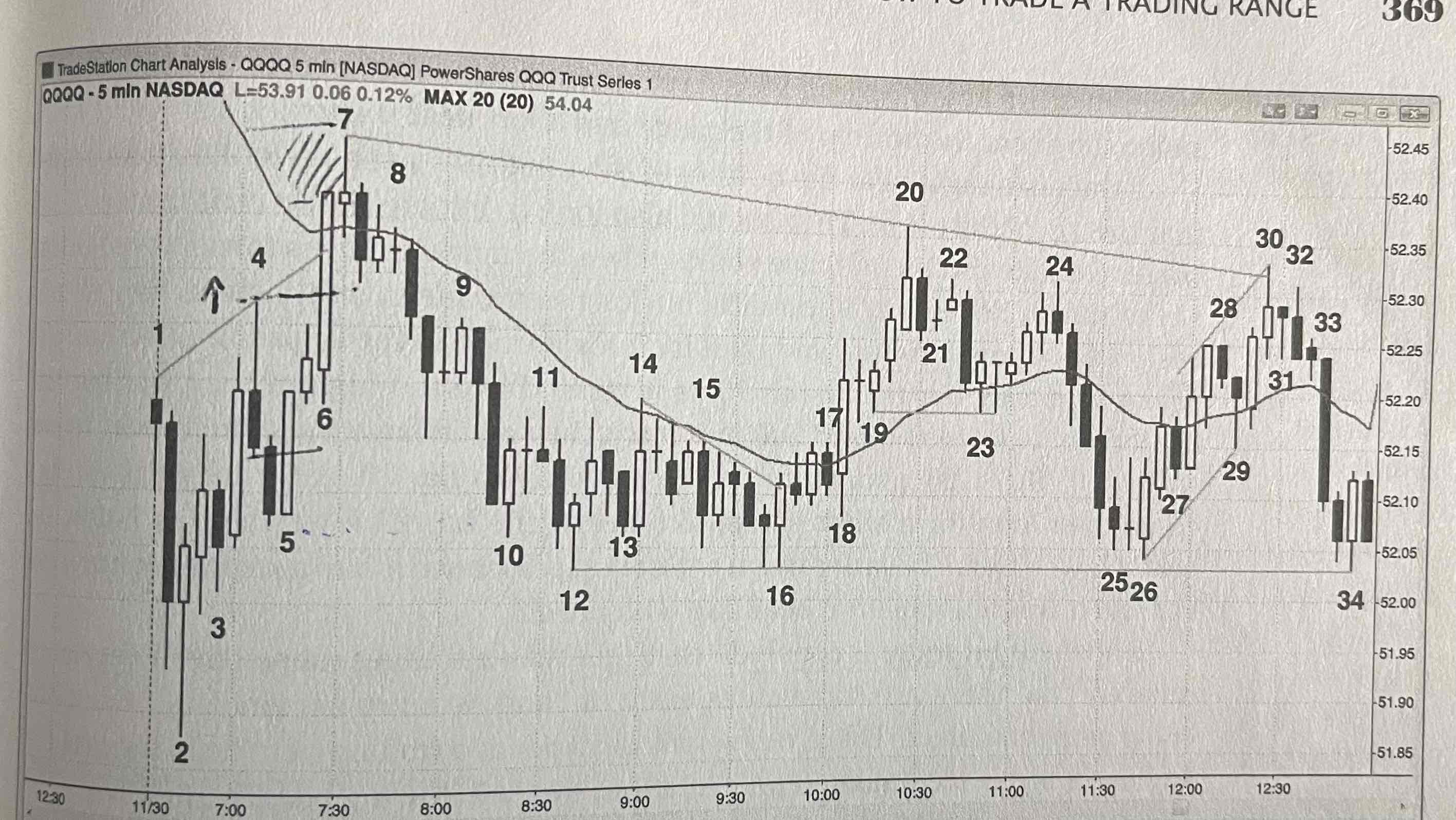

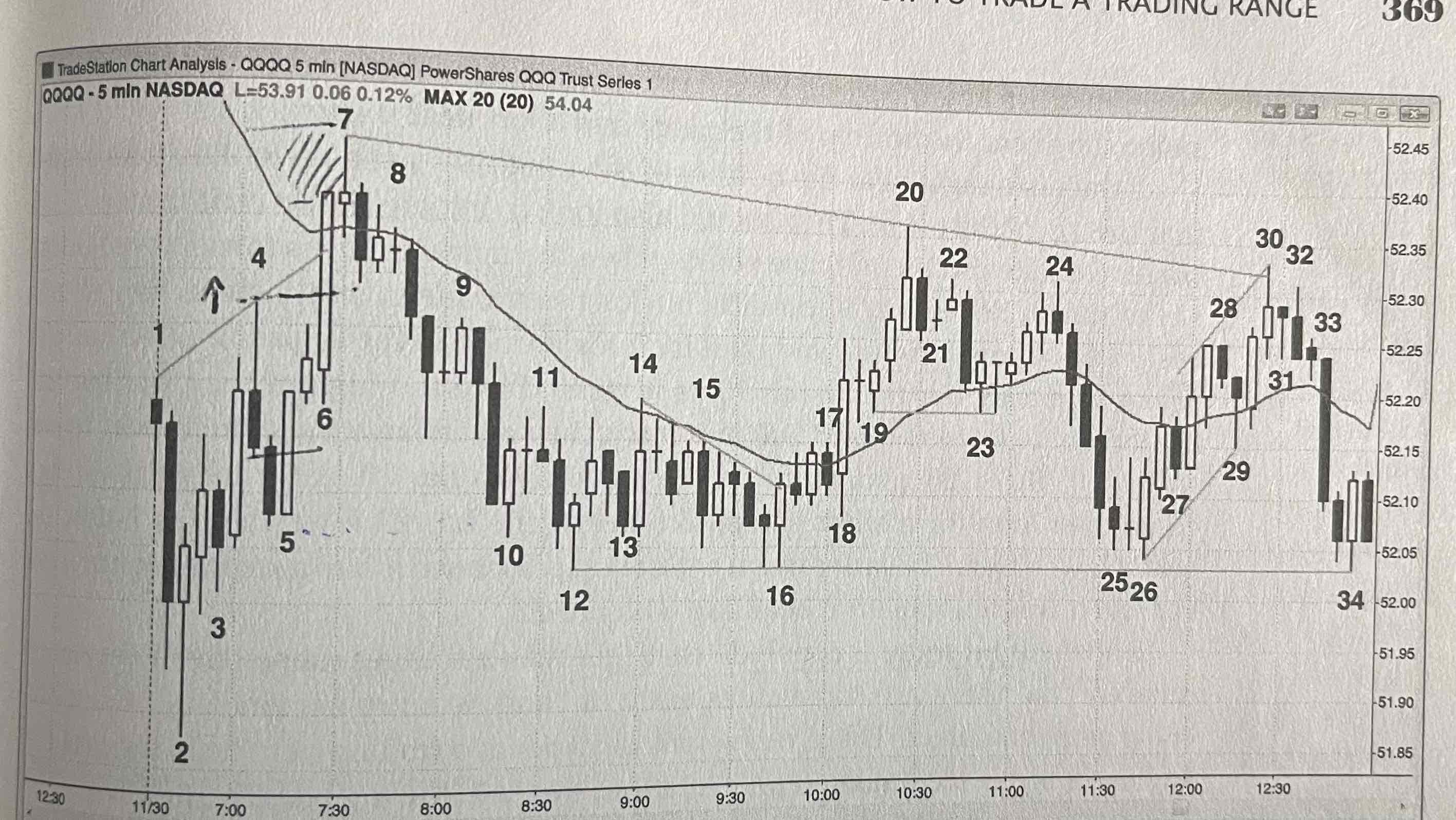

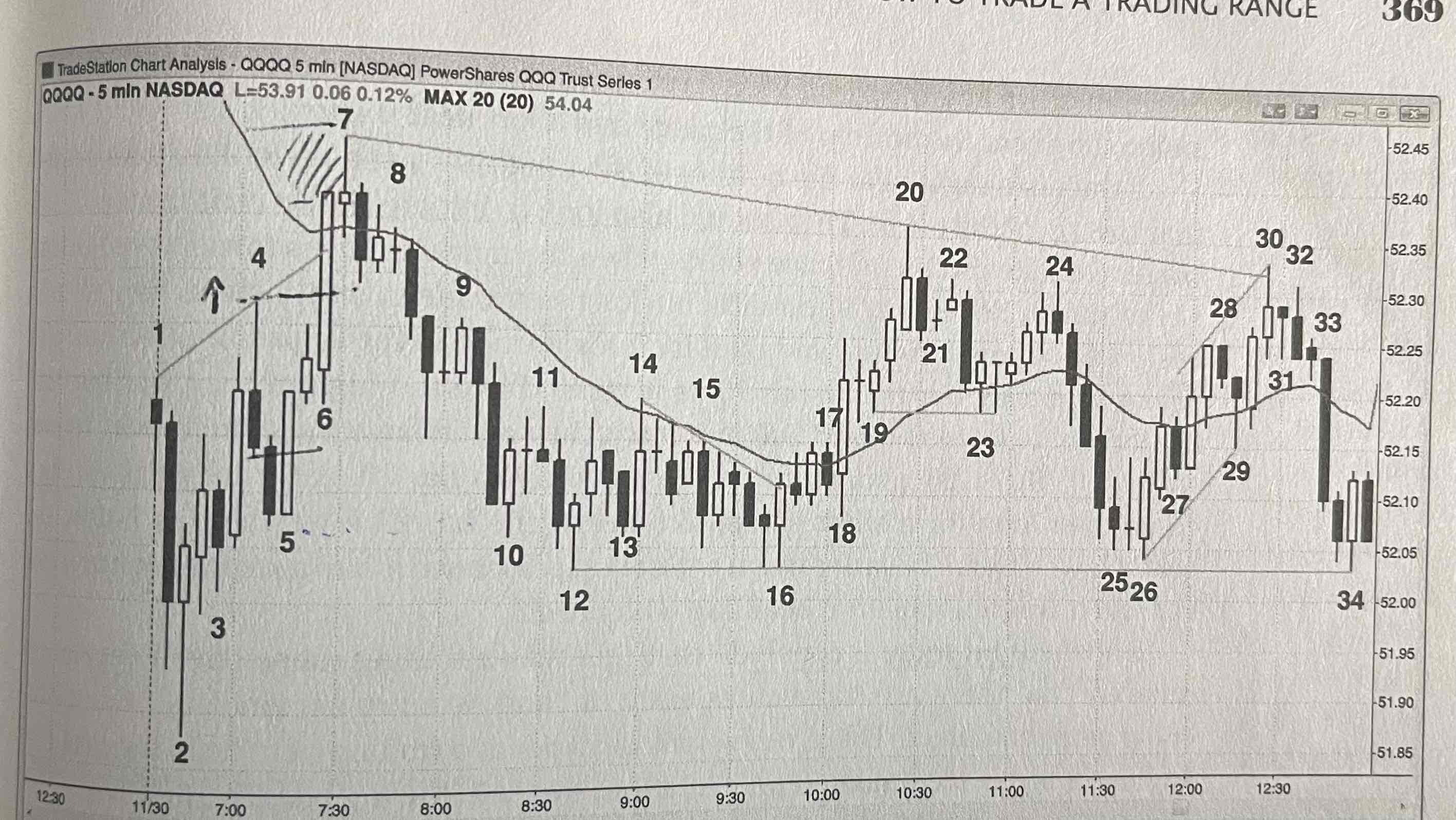

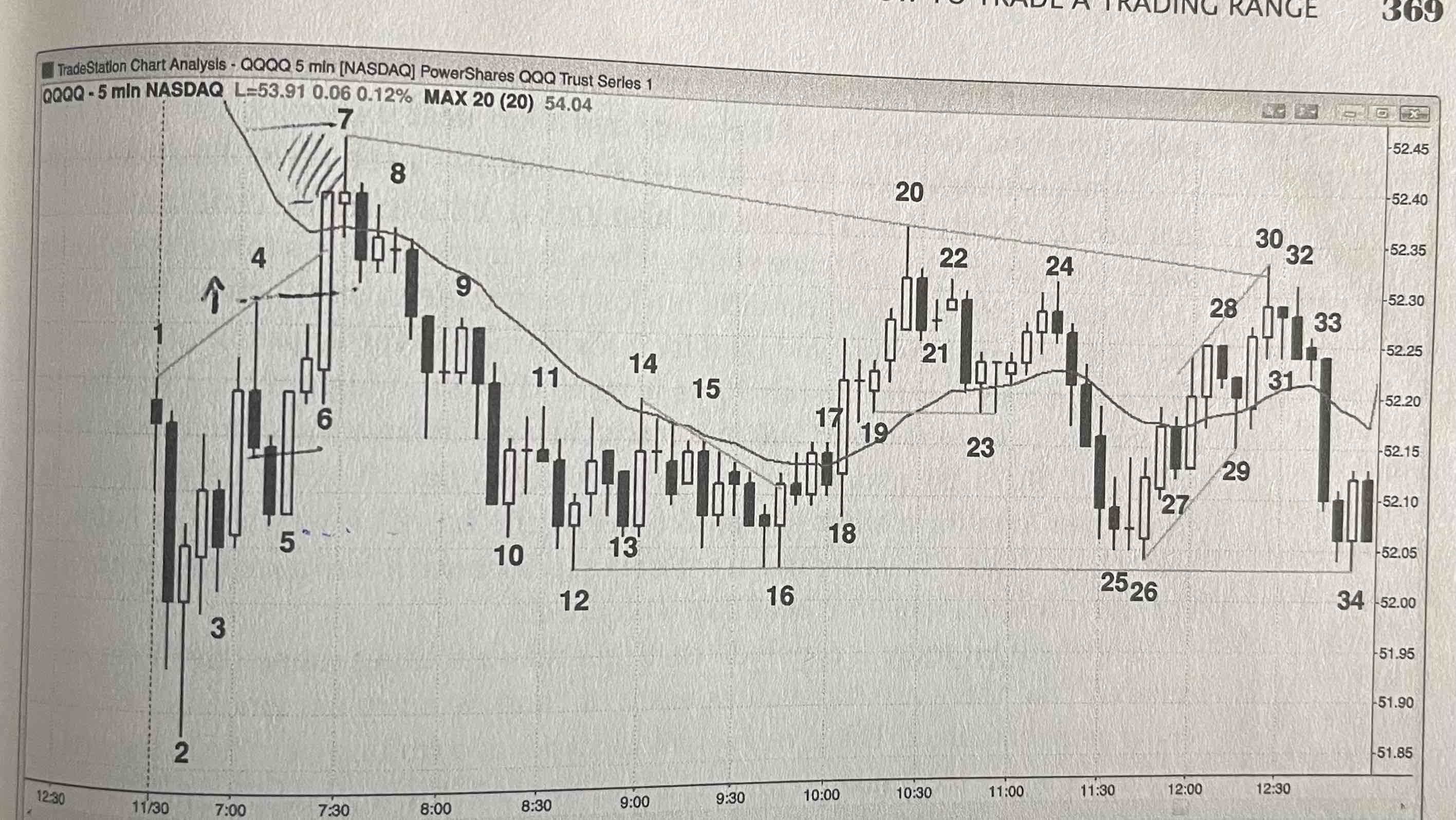

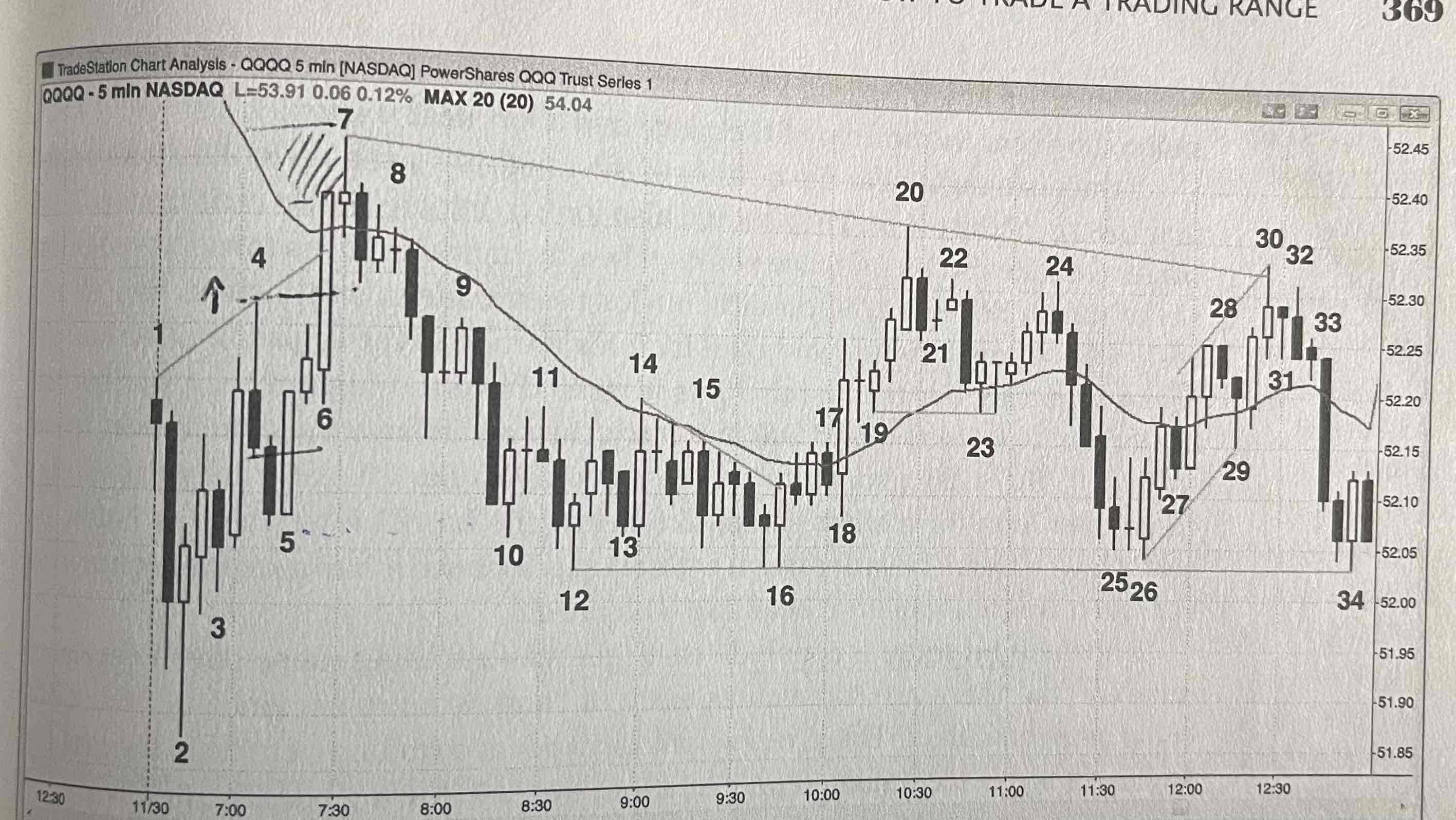

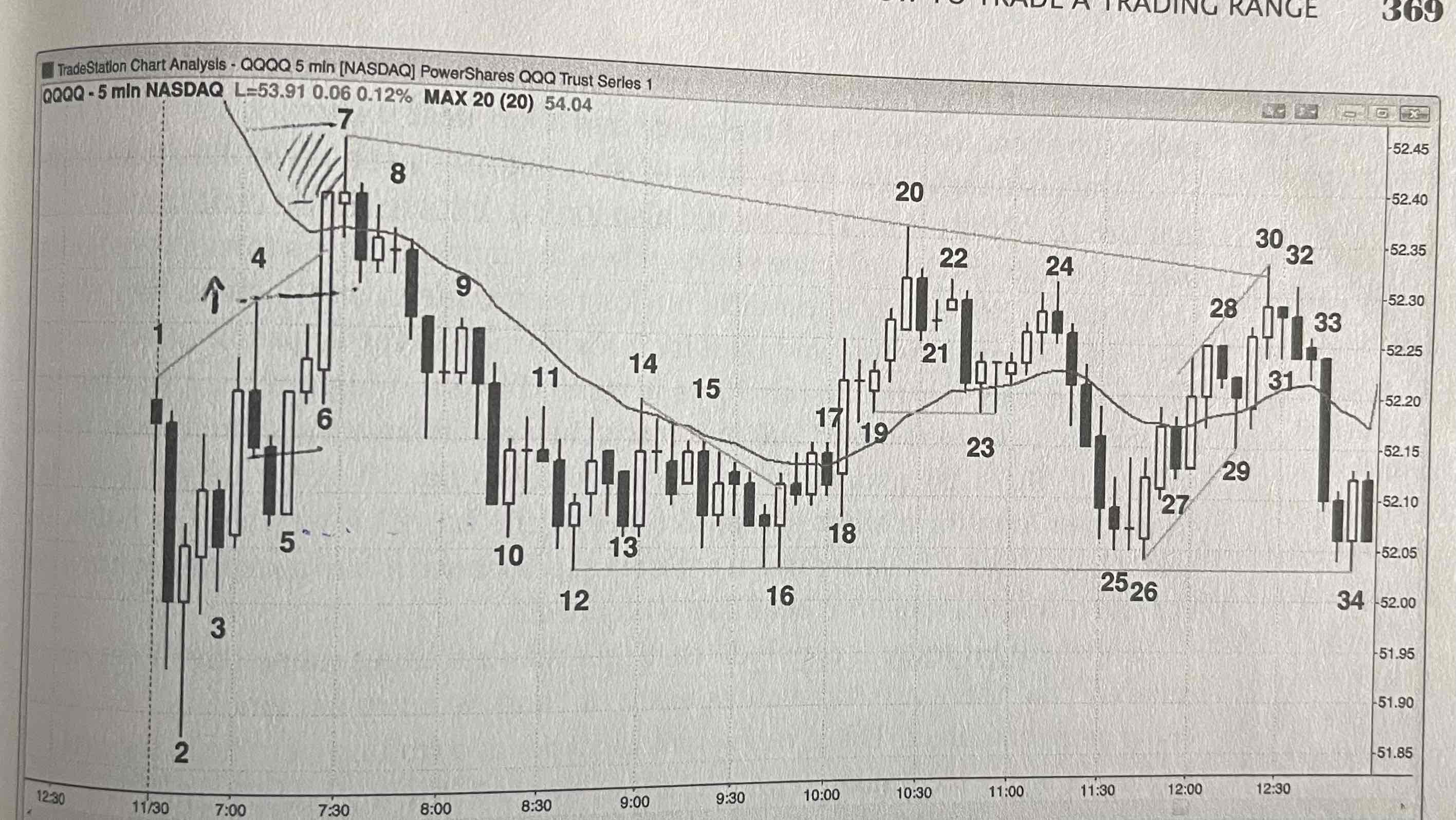

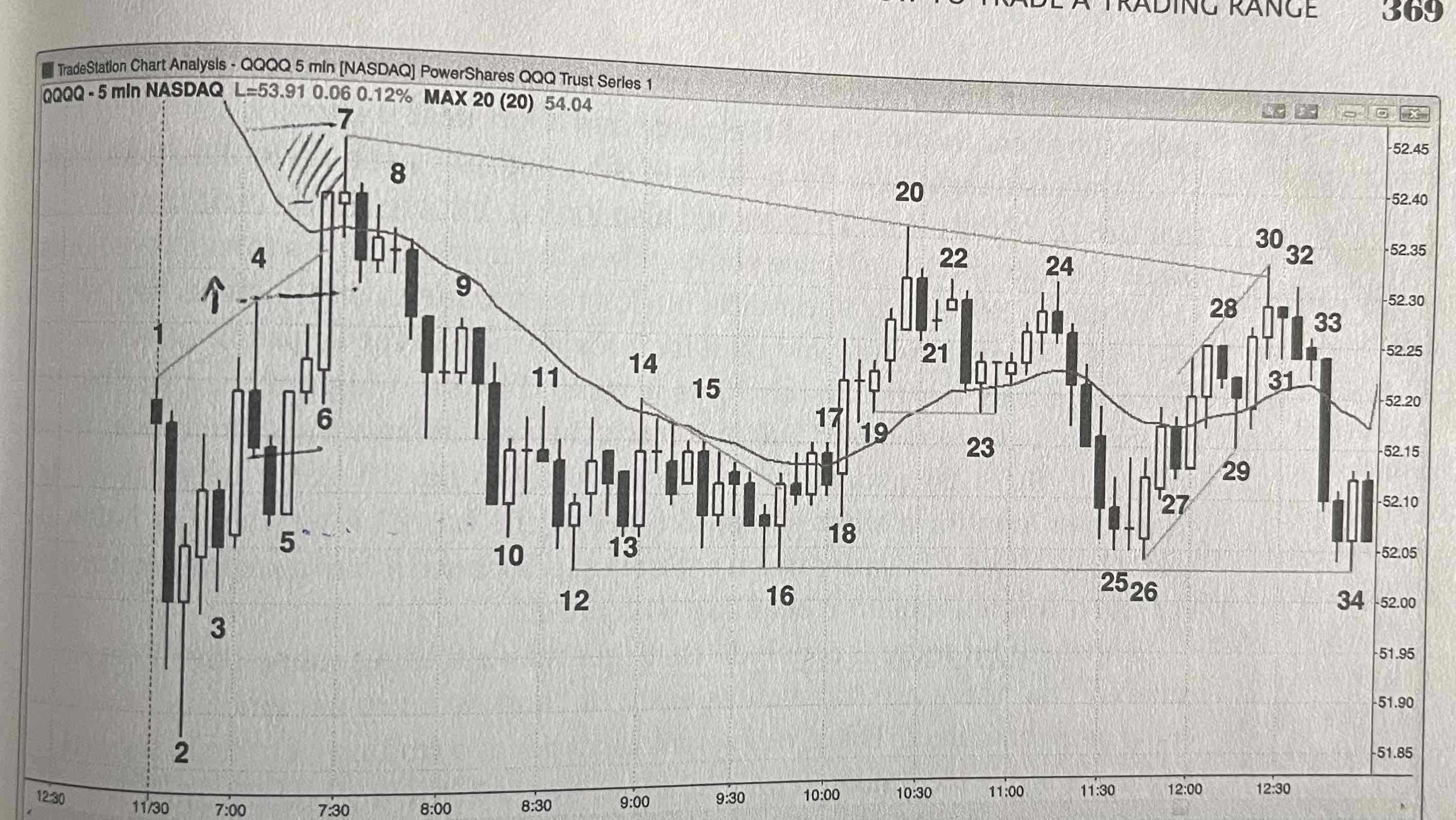

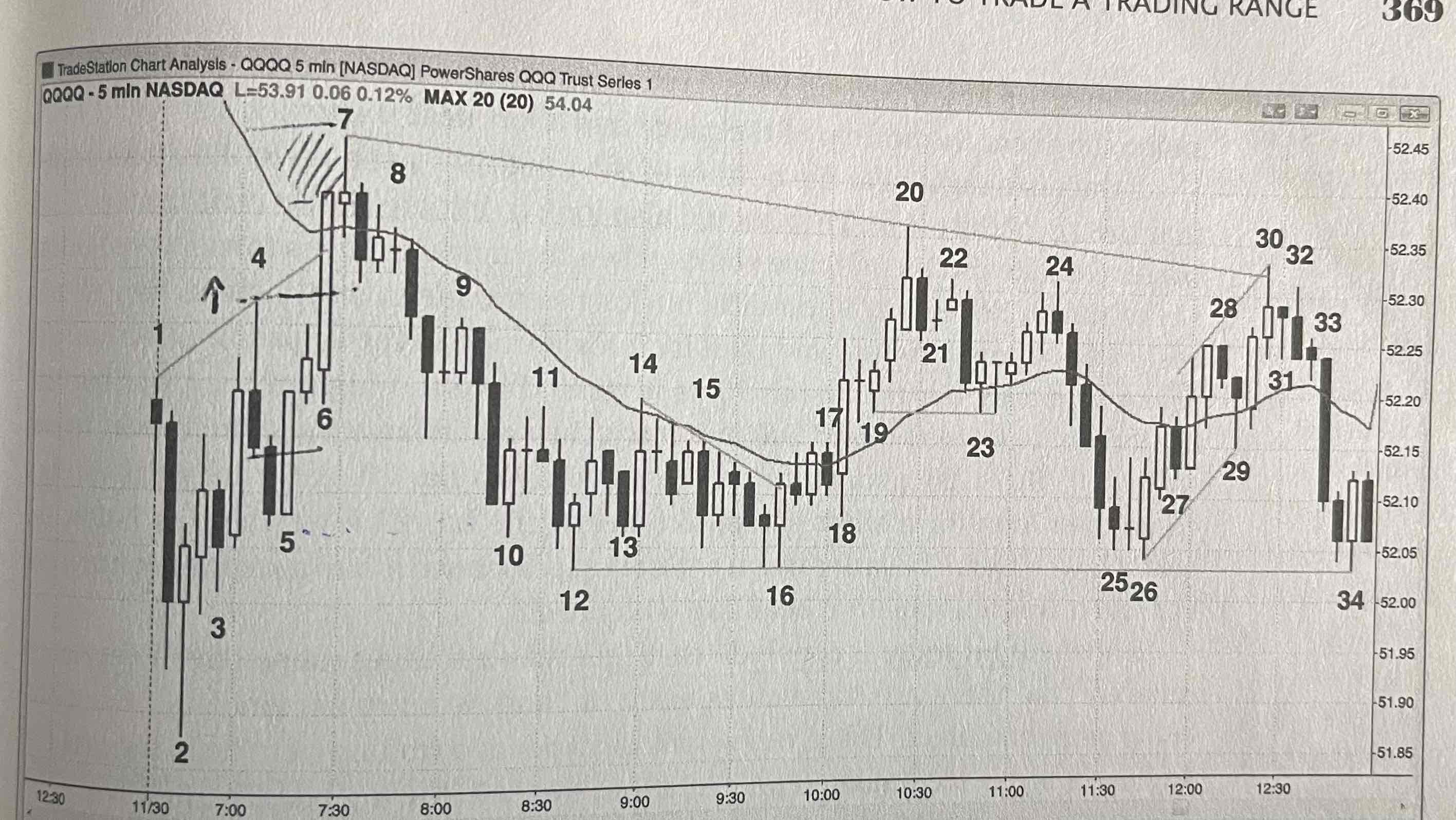

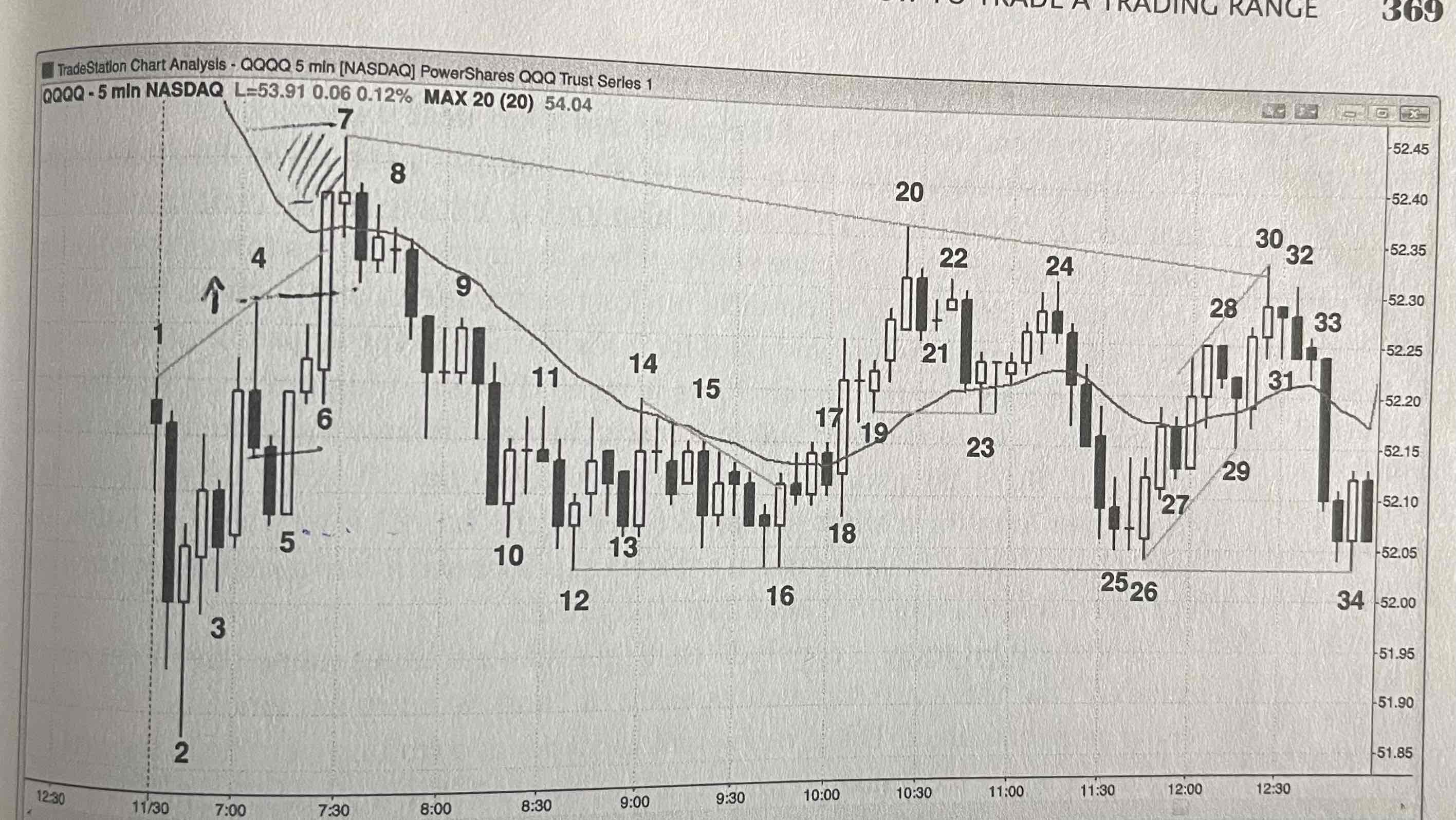

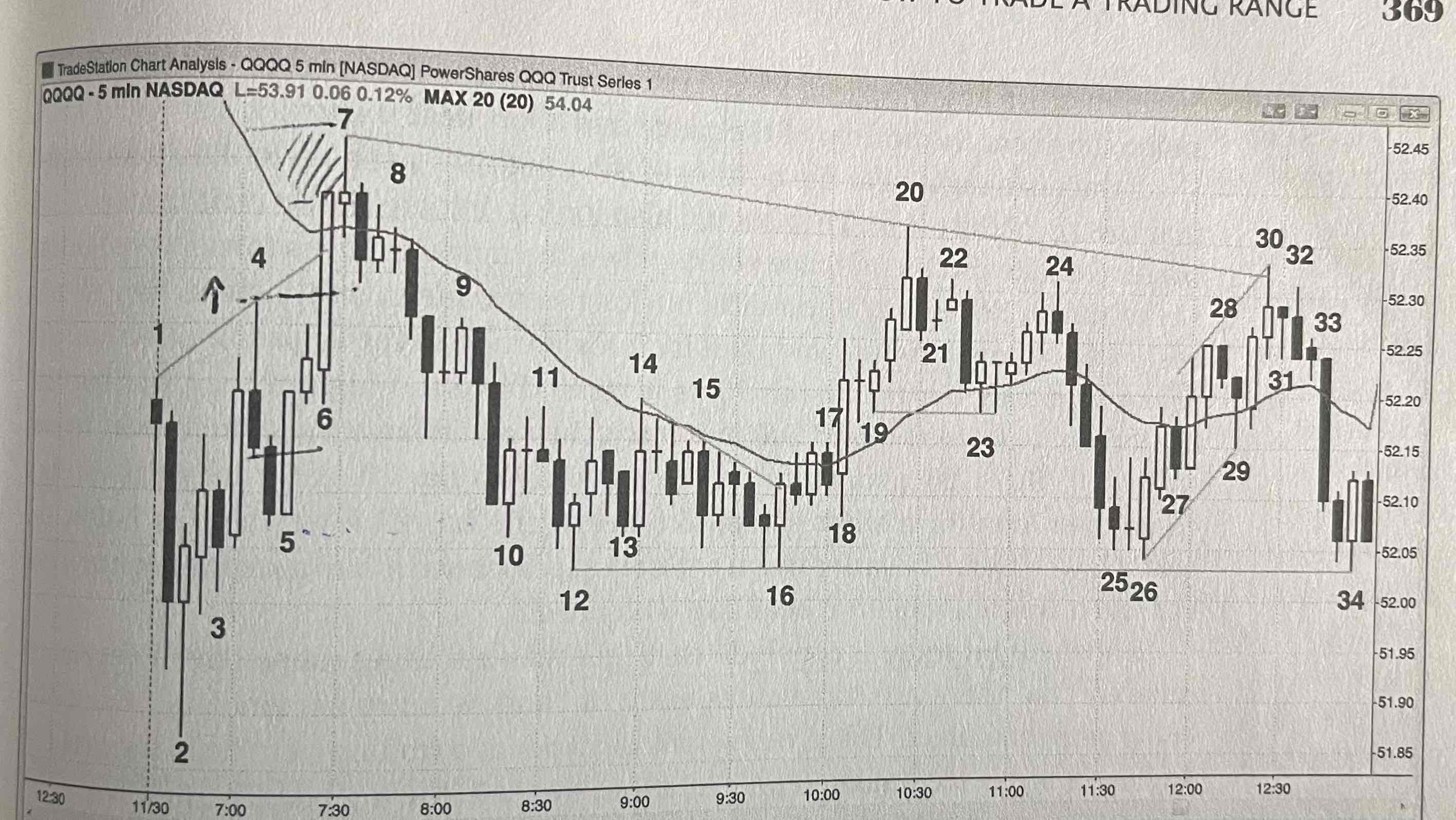

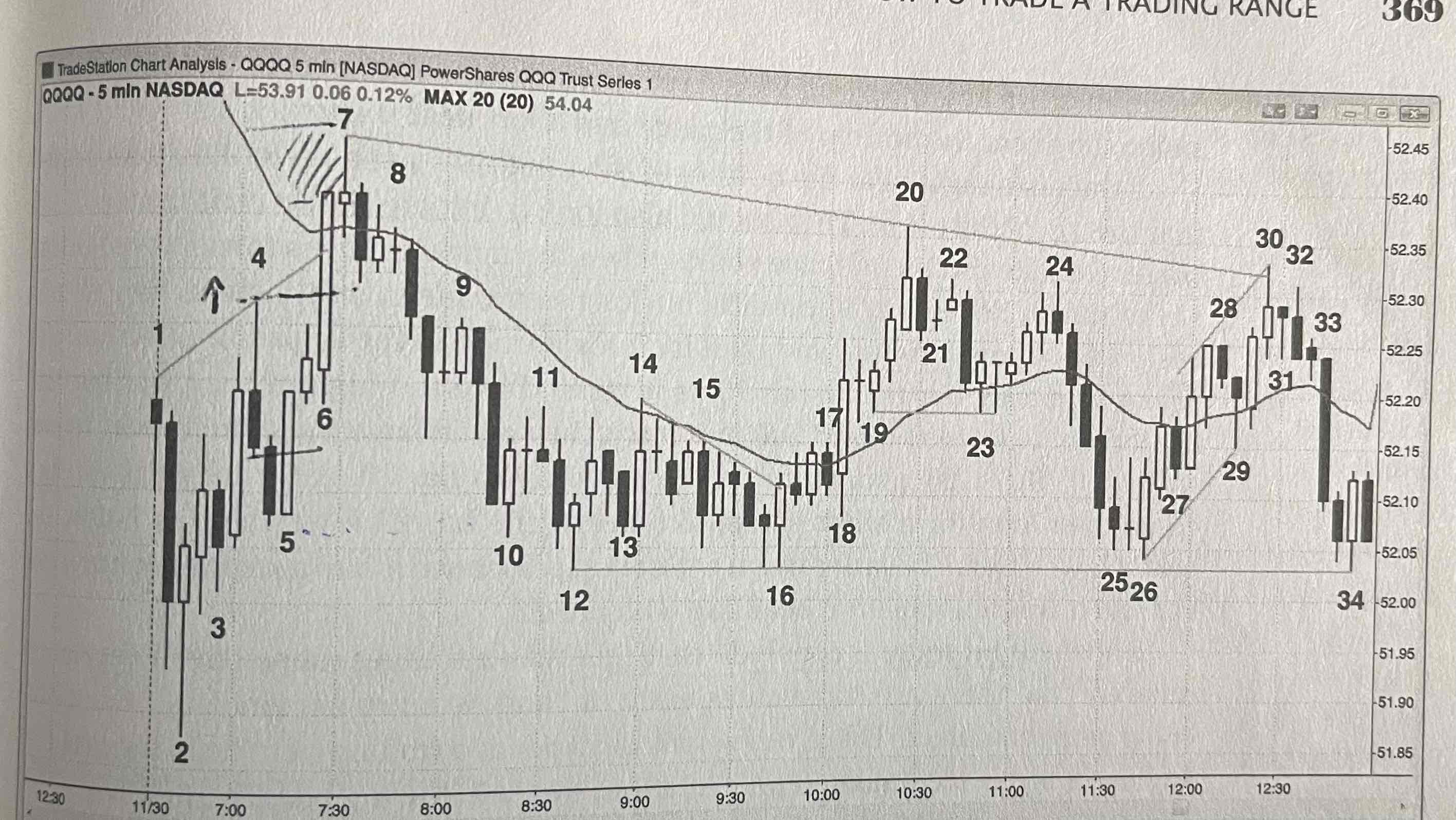

He would take about 15 profitable one-point scalps on a day like this, all based on fades.

For example, in the bar 10 to bar 18 area, he would try to buy with limit orders below everything, like as the market fell below bar 10, as bar 13 went below the bear bar before it, and as bar 15 fell below the bar before it, and he would have added on as it fell below bar 13.

He would have bought more as the market dipped below bar 15 and tried to buy if the market fell below bar 12.

It is important to remember that he is a very experienced trader who can spot trades with a 70 to 80 percent chance of success.

Few traders have that ability, so beginners should not be scalping for one point while risking about two points.

Bar 1

B3 reversed but bad FT

Tails first few bars

Overlap

4-5 reversals in 1st hour

When do you conclude it's a TR day?

GOOD BAR BAD FT

TR FT

Open - GD

Sell off then

strong bull reversal

Was Bar 2 good long? Why?

The channel in a SPCH is the first leg of a TR

10-20 bars TR

Test start CH

2,4,7 SPWCh expect what?

TR test SPCH starts all day

Possible OR BO Up

Possible LoD attempt

MA test

Too far from MA

Buy above 2 why?

Scalp plus 1 tick below

Or below bull entry bar after 2

LMT order to buy 1 tick under 4 - where's stop?

Stop location above / below good entry bar

Rather than distance

Money stop vs PA stop?

Bears worried about MA

Wouldn't scale in so stop above - in case ORBO

Or stop wide so scalp up high %

Why buy scalp above 4?

LOT - Limit Order Trading

Scale ins

If sell 6 at MA

see 7, sell more

On open, what happens when FT weak?

Give examples

Strong bulls

Limit bulls order 1 tick above bear bar low / close

get filled - what does that mean?

Below ii 8

Below bear bar before it

Where did most bears shorts on the open?

Breakout test - 2 H

Around 12

Come back to entry bar what is it called?

Tight BR channel, so most traders scale in

Likely buy more above 2nd signal

Where do weak bulls place their stop? Scalp down - so they buy there also

Exit on strong BR BO

10 is a good buy signal - 3 legs down but how to manage it?

9 high

2 legs

Top of channel

Buying 10-12 where is your target?

WB BOPB long

Can also buy 17

Lots of sideways, if no good BR then gap closing likely

Why buy under 17?

Failed H1

Test

TRD after few legs up

Why sell 22-24?

Exit below it

TRD but reasonable to try

Notice after 23 hesitation not a big bar so prob scalp only

If enter long 23,

how do you manage it?

Tested TTR In A TR magnet and failed to BO below

26 gets good FT

27 traders bought the close - did not go 1 tick below

So traders buy above the bar

What happened 26-28?

3 legs up duelling lines pattern so good for profit taking

High of a bear spike in a TRD

Why exit 30?

Open - YD EoD, MM range expansion

Often 60m TR

Top of a BR up

Low of a BL down

What is this behaviour?

Ugly MM

Will be clear in hindsight what traders used

Focus on Always in