ACCT 3210 - Exam 1

1/109

Earn XP

Description and Tags

Brian Rohrs - BGSU

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

110 Terms

____ provides relevant financial information to various external users

financial accounting

______ are financial analysts, stockbrokers, mutual fund managers, credit rating organizations

External users

What is the primary focus of financial accounting

financial information provided by profit-oriented companies to their present and potential investors and creditors

The primary means of conveying financial information to investors, creditors, and other external users is through _______

financial statements

What are the 4 financial statements

Balance Sheet

Income Statement

Statement of Cash Flows

Statements of Shareholders’ Equity

______ are mechanisms to help an economy allocate resources efficiently

capital markets

What are the 3 primary forms of business organizations

sole proprietorship

partnership

corporation

In the U.S., ______ and _______ outnumber _________

sole proprietorships and partnerships; corporations

______ is the dominant form of business organization that acquires capital from investors in exchange for ownership interest and from credits by borrowing

Corporation

What is the similarity between investors and creditors

They are both willing to provide capital to a corporation (buy stocks or bonds) only if they expect to receive more cash in return at some time in the future

_____ measures income according to the entity’s accomplishments and resources sacrifices during the period from transactions related to providing goods and services to customers, regardless of when cash is received or paid

Accrual Accounting

_______ measures income as the difference between cash receipts and cash disbursements during a reporting period from transactions related to providing goods and services to customers

Cash-Basis Accounting

________ is the difference between cash receipts and cash disbursements from transactions related to providing goods and services to customers during a reporting period

Net Operating Cash Flow

_____ is not indicative of a company’s long-run cash-generating ability

Cash-Basis Accounting

_____ is all revenues and gains minus all expenses and losses reported in the income statement

Net Income

_____ is a set of both broad and specific guidelines that companies should follow when measuring and reporting the information in their financial statements and related notes

Generally Accepted Accounting Principles (GAAP)

Why did people want a uniform accounting standards after the stock market crash of 1929?

They believed the insufficient and misleading financial statement information led to inflated stock prices —> causing the stock market crash and depression

________ were created to restore investor confidence

1933 Securities Act and 1934 Securities Exchange Act

The 1934 Act created the _____

Securities and Exchange Commission (SEC)

____ has the authority to set accounting standards for companies, but it relies on the private sector to do so

Securities and Exchange Commission (SEC)

Congress gave the SEC the authority to set accounting and reporting standards, but the SEC (a government appointed body) has delegated the task of setting accounting standards to the _____

private sector

The SEC still has the power, and if it does not agree with a particular standard issued by the private sector, it can ______

force a change in the standard

______ was the 1st private-sector to assume the task of setting accounting standards

Committee on Accounting Procedure (CAP)

Committee on Accounting Procedure (CAP) was a committee of the _______

American Institute of Accountants (AIA)

_______ is the national organization of professional public accountants

American Institute of Accountants (AIA)

American Institute of Accountants (AIA) renamed to the ______________ in 1957

American Institute of Certified Public Accountants (AICPA)

In 1959, the ________ replaced Committee on Accounting Procedure (CAP)

Accounting Principles Board (APB)

_________ was the 2nd private sector body delegated the task of setting accounting standards

Accounting Principles Board (APB)

The Accounting Principles Board (APB) suffered from many problems:

never established a conceptual framework

members served on a voluntary, part-time basis

perceived lack of independence

_______ is the current private sector body that has been delegated the task of setting accounting standards, created in 1973

Financial Accounting Standards Board (FASB)

The Financial Accounting Standards Board (FASB) is composed of ___ full-time members including:

7 members:

auditors

profit-oriented companies

accounting educators

financial analysts

government

The Financial Accounting Standards Board (FASB) is supported by its parent organization, the _________

Financial Accounting Foundation (FAF)

__________ is responsible for selecting members of the Financial Accounting Standards Board (FASB) and its Financial Accounting Standards Advisory Council (FASAC), ensuring adequate funding of FASB activities, and exercising general oversight of the FASB’s activites

The Financial Accounting Foundation (FAF)

In 1984, the FASB’s _______ was formed

Emerging Issues Task Force (EITF)

_____ is responsible for providing timely responses to emerging financial reporting issues within the framework of existing GAAP

Emerging Issues Task Force (EITF)

List the Hierarchy of Standard Setting Authority

Congress —> SEC —> Private Sector —> FASB

______ deals with theoretical and conceptual issues and provides an underlying structure for current and future accounting and reporting standards

Conceptual Framework

To simplify the task of researching an accounting topic, in 2009 the FASB implemented the _______

FASB Accounting Standards Codification

__________ integrates and topically organizes all relevant accounting pronouncements coprising GAAP is a searchable, online database

FASB Accounting Standards Codification

The FASB Accounting Standards Codification is organized into ___ main topics and approximately _____ subtopics

9; 90

Created in 1984, ______ is responsible for developing accounting standards for governmental units such as states and cities; overseen by the FAF

Governmental Accounting Standards Board (GASB)

In 1973, the ___________ was established to develop global accounting standards

International Accounting Standards Committee (IASC)

International Accounting Standards Committee (IASC) reorganized itself in 2001 and created a new standard-setting body called ________

International Accounting Standards Board (IASB)

_______ objectives are to develop a single set of high-quality, understandable global accounting standards to promote the use of those standards, and to bring about the convergence of national accounting standards and International Accounting Standards

International Accounting Standards Board (IASB)

Before issuing an Accounting Standards Update (ADU), FASB gathers information through:

open hearings

deliberations

written comments from interested parties

FASB has dealt with intense political pressure over controversial accounting standards and sometimes _____

has changed them

It is the responsibility of _____ to apply GAAP appropriately

management

_______ are independent professionals who render an opinion about whether the financial statements fairly present the company’s financial position, performance, and cash flows in compliance with GAAP

Auditors

_____ add credibility to the financial statements

Audits

_____ are licensed individuals who can represent that the financial statements have been audited in accordance with generally accepted auditing standards

Certified Public Accountants (CPAs)

The credibility of accounting profession, as well as corporate America, itself was called into question after the dramatic collapse of _______ in 2001, and the dismantling on the international public accounting firm of ______ in 2002

Enron; Arthur Anderson

Driven by Enron and Arthur Anderson scandals, Congress acted swiftly and passed ______

Sarbanes-Oxley Act of 2002

What was the purpose of SOX

provide penalties for violators

require accountability of corporate executives

regulate auditors

addresses conflicts of interests

One consequence on the Enron scandal was rekindled debate over _____ vs. _______ accounting standards

objectives-oriented vs. rules-based

_____ stresses professional judgement to standard setting

objectives-oriented/principles-based

_____ standards that specify appropriate accounting treatments using precise thresholds or definitions and requiring little professional judgement for interpretation

rules-based

_____ is a code or moral system that provides criteria for evaluating right and wrong

ethics

The conceptual framework is described as the “___________”

Accounting Constitution

The conceptual framework provides structure and direction to financial accounting and reporting but does not _______

directly prescribe GAAP

What is the objective of financial reporting

To provide financial information about companies that is useful to capital providers in making decisions

Investors and Creditors are interested in the __________ of a company’s future cash flows

amount, timing, and uncertainty

_____ is the quality of being useful to decision making

decision usefulness

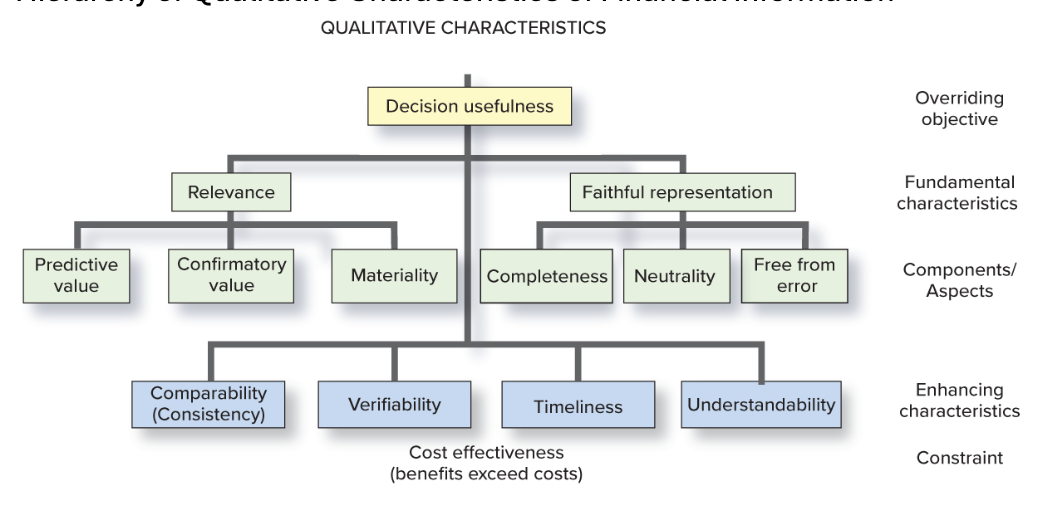

What is the Hierarchy of Qualitative Characteristics of Financial Information

For financial information to be useful it must be _____ and _____

relevant and faithfully represented

______ is one of the primary decision-specific qualities that make accounting information useful

relevant

Relevant is made up of ________

predictive value, confirmatory value, and materiality

Information is relevant it\f it has the potential to _____

affect a decision

________ helps predict future cash flows

predictive value

_______ helps confirm or adjust prior assessments of a company’s ability to generate cash flows

confirmatory value

______ has qualitative characteristics that make it matter for decision making

material

materiality is an aspect of _______

relevance

if information is immaterial, it’s not ____

relevant

The threshold for materiality has been left to the subjective judgement of the _______

company preparing the financial statements and its auditors

______ exists when there is agreement between a measure of description and the phenomenon it purports to represent

faithful representation

In order for information to be faithfully represented, it must be:

complete

neutral

free from error

_____ is if it includes all information necessary for faithful representation

complete

_______ implies freedom from bias

neutral

_____ information that contains no errors or omissions in the description of the amount or the process used to report the amount

free from error

_____ are common, and some inaccuracy is likely

estimates

An ______ is represented faithfully if its described clearly and accurately as being an estimate

estimate

What are the enhancing characteristics of decision usefulness

comparability (including consistency)

verifiability

timeliness

understandability

____ information helps users see similarities and differences among events and conditions

comparable

_____ information permits valid comparisons if measured and reported the same way each time

consistent

______ considers if different knowledgeable and independent measures would reach consensus about whether information is represented faithfully

verifiable

_____ information that is available to users early enough to allow its use in the decision process

timely

_____ information within the context of the decision being made that users can comprehend

understandable

What is a key constraint

cost effectiveness

_______ is the perceived benefit of increased decisions usefulness exceeds the anticipated cost of providing that information

cost effectiveness

What are the 4 basic assumptions that underlie GAAP (not emphasized in the FASB’s concepts statements)

economic entity assumption

going concern assumption

periodicity assumption

monetary unit assumption

_________ presumes that economic events can be identified specifically with an economic entity

economic entity assumption

Ex: For a sole proprietorship, the owner’s personal residence is not an asset of the business

economic entity assumption

_______ is the absence of information to the contrary, it is anticipated that a business will operate indefinitely

going concern assumption

_______ allows the life of a company to be divided into artificial time periods to provide timely information

periodicity assumption

_____ states that financial statements elements should be measured in a particular monetary unit (U.S. dollar)

monetary unit assumption

______ is the process of admitting information into the basic financial statements

recognition

_______ is the process of associating numerical amounts with the elements

measurement

_______ includes relevant information in the financial statements and accompanying notes

disclosure

According to SFAC 8, an item should be recognized it it meets 3 criteria:

definition

measurability

faithful representation

_______ is the inflow or other enhancements of assets or settlements of liabilities (or both) from delivering or producing goods, rendering services, or carrying other activities

revenues

Revenue is recognized when the _______________________

seller transfers goods or services to a customer (not necessarily at the same time of payment)