Econ 26 - Chapters 1 - 4

1/46

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

47 Terms

Trade

Basis is diversity in resources and wants

Gains from trade

Specialization, efficiency, mutual benefit.

Forms of trade

Goods/services, lending, insurance, forward transactions

Life-cycle saving

Borrow when young, save in middle age, dissave in retirement

Precautionary reserves

Assets held against income/spending fluctuations

Investment types

Working capital: Funds for day-to-day operations.

Fixed capital: Long-term investments in equipment/facilities.

Gains from lending

Borrowers fund investments; lenders earn interest

Insurance

Reciprocal insurance: Mutual aid within a community.

External insurance: Third-party assumes risk for a premium.

Forward transactions: Agreement to buy/sell at a future date at a preset price.

Price risk: Uncertainty in future prices.

Speculators: Trade to profit from price changes.

Reliance on promises

Default risk

Incentive problems

Moral hazard: Insured takes more risks.

Adverse selection: High-risk individuals more likely to buy insurance.

Liquidity

Ease of converting assets to cash

Transactions costs

Costs of information, contracting, monitoring

Warehouse bank

Stores cash, facilitates payments via checks

Fractional reserve bank

Holds only a fraction of deposits as reserves; creates money through lending.

Clearinghouse

Nets checks between banks to reduce cash transfers.

Direct lending: Through financial markets (stocks, bonds).

Primary market: New securities.

Secondary market: Existing securities.

Dealers vs. brokers: Dealers buy/sell; brokers arrange trades.

Indirect lending: Through financial intermediaries (banks, insurance companies).

Advantages: Lower risk, better liquidity, diversification, expertise.

Insurance companies risk

Pool risks, charge premiums.

Futures markets

Standardized forward contracts; exchange guarantees performance

Forward intermediaries (e.g., banks)

Offer forward contracts in currencies, commodities.

Four Basic Techniques of Financial Systems

Delegation: Assign tasks to specialists.

Credit substitution: Replace borrower’s credit with intermediary’s credit.

Pooling: Combine assets/liabilities to reduce risk or improve liquidity.

Netting: Offset transactions to reduce settlement volume.

Gains from lending

Net benefit after transactions costs

Conditions for efficiency

Competitive pricing: Price = cost.

Minimum transactions costs.

Integration: Similar loans available on similar terms everywhere.

Market failure

Inefficiency due to lack of competition, economies of scale, or natural monopoly.

Types of instability

Banking panics: Runs on many banks simultaneously.

Securities market crashes: Sharp fall in asset prices.

Price-level instability: Inflation/deflation.

Causes of instability

Composition problems, externalities, excessive risk-taking.

To promote competition

Antitrust laws, regulate monopolies

To promote stability

Regulation (e.g., deposit insurance, lender of last resort).

Consumer protection

Truth-in-Lending Act, disclosure laws

Social policy

Equal credit access, community reinvestment

Government failure

Intervention can be costly, ineffective, or serve special interests.

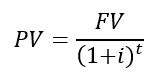

Present Value (PV)

Value today of a future sum

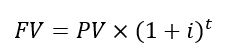

Future Value (FV)

Value in the future of a sum invested today

Compounding

Earning interest on interest

Market yield

Interest rate that equates PV of future payments to market price

Zero-coupon bond (Zero)

Single payment at maturity

Yield to maturity (YTM)

Single discount rate that equates PV of all bond payments to its price.

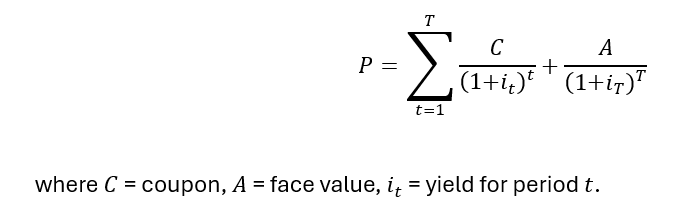

Coupon bond price:

Selling at discount, premium, or par

Based on coupon vs. market yield

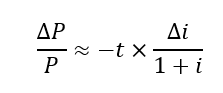

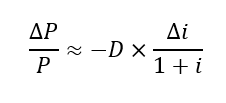

Price sensitivity

for a zero-coupon bond

Duration

Weighted average maturity of a bond’s cash flows; measures sensitivity to interest rate changes

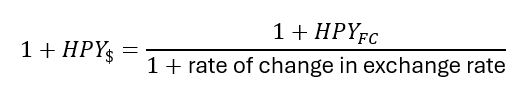

Holding period yield in dollars

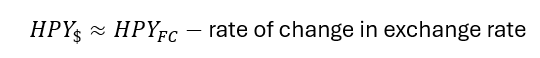

Approximation (Holding period yield)

Consumer Price Index (CPI)

Measures price changes

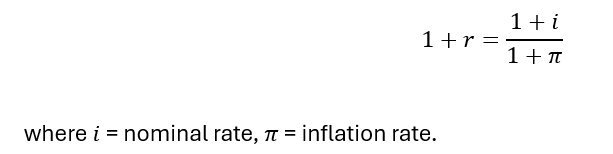

Real interest rate

Approximation (real interest rate)