Chapters 28.7-28.8: Money, banking, financial institutions

The Policy Response to the Financial Crisis

The Treasury Bailout: TARP

- In late 2008, Congress passed the Troubled Asset Relief Program (TARP)

- allocated $700 billion to the U.S. Treasury to make emergency loans to critical financial and other U.S. firms

- major recipients: AIG, Citibank, Bank of America, JPMorgan Chase, and Goldman Sachs

- TARP saved financial institutions whose bankruptcy would’ve brought down other financial firms and frozen credit throughout the economy

- demonstrated moral hazard

- moral hazard::

- the tendency for financial investors and financial services firms to take on greater risks because they assume they are at least partially insured against losses

- large firms assumed they were simply too big for government to let them fail which gave them the incentive to make riskier investments

The Fed’s Lender-of-Last-Resort Activities

- Under Fed Chair Ben Bernanke, the Fed designed and implemented new lender-of-last-resort facilities to pump liquidity into the financial system

- this was in addition to both the TARP efforts by the U.S. Treasury and the Fed’s use of standard tools of monetary policy designed to reduce interest rates.

- All the new Fed facilities had the single purpose and desired outcome of keeping credit flowing.

- the Fed bought securities from financial institutions

- The purpose was to ^^increase liquidity in the financial system^^ by exchanging illiquid bonds (that the firms could not easily sell during the crisis) for cash, the most liquid of all assets

- Total Fed assets rose from $885 billion in February 2008 to $1,903 billion in March 2009

- Many economists believe that TARP and the Fed’s actions helped to avert a second Great Depression.

- But they also ^^intensified the moral hazard problem^^ by limiting the losses that would have resulted from bad financial assumptions and decisions

The Postcrisis U.S. Financial Services Industry

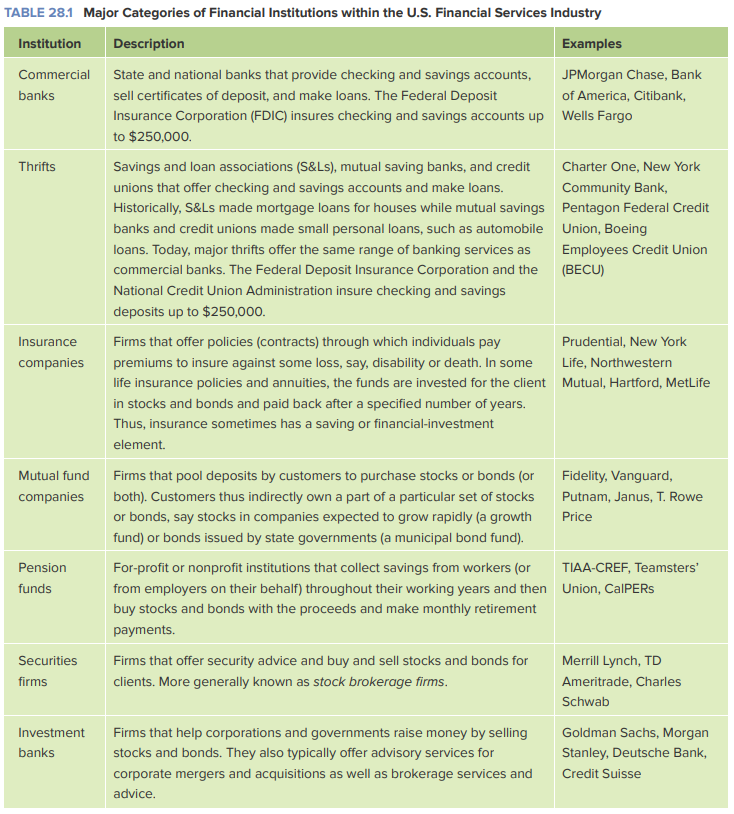

the main categories of the financial services industry are

- commercial banks

- thrifts

- insurance companies

- mutual fund companies

- pension funds

- security firms

- investment banks

financial services industry::

- The broad category of firms that provide financial products and services to help households and businesses earn interest, receive dividends, obtain capital gains, insure against losses, and plan for retirement.

before the financial crisis of 2007–2008, the financial services industry was consolidating into fewer, larger firms, each offering a wider spectrum of services.

- In 1999, Congress ended the Depression-era prohibition against banks selling stocks, bonds, and mutual funds.

even when institutions take on services in more than 1 category, the main lines of a firm’s businesses often are in one category or another

- ex. even though Goldman Sachs is licensed and regulated as a bank, it is first and foremost an investment company

In mid-2010 Congress passed and the president signed the Wall Street Reform and Consumer Protection Act which included:

- Eliminate the Office of Thrift Supervision and give broader authority to the Federal Reserve to regulate all large financial institutions.

- Create a Financial Stability Oversight Council to be on the lookout for risks to the financial system.

- Establish a process for the federal government to liquidate (sell off) the assets of failing nonbank financial institutions, much like the FDIC does with failing banks.

- Provide federal regulatory oversight of mortgage-backed securities and other derivatives and require that they be traded on public exchanges.

- Require companies selling asset-backed securities to retain a portion of those securities so the sellers share part of the risk.

- Establish a stronger consumer financial protection role for the Fed through creation of the Bureau of Consumer Financial Protection.

Proponents of the law say that it will help prevent many of the practices that led up to the financial crisis of 2007–2008

- sends a warning to stockholders, bondholders, and executives of large financial firms that they’ll suffer high losses if they get into financial trouble again

Skeptics of the law say that regulators already had all the tools they needed to prevent the financial crisis.

- government’s own efforts to promote home ownership, via quasi-government institutions that purchased mortgage-backed securities, greatly contributed to the financial crisis

Critics of the law say that it will simply impose heavy new regulatory costs on the financial industry while doing little to prevent future government bailouts