IB Strategy Exam 1

1/55

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

56 Terms

Strategic Planning

The main goal behind strategic planning is the sustainable growth of the firm.

Strategic planning is process that is concerned with the overall performance of the firm, relative to other competitors in the industry.

Hence, competition is a key aspect of strategic planning since a firm’s performance is evaluated relative to other competitors in the same industry.

Strategic planning takes into consideration many variables that affect the firm’s performance and growth potentials. Since many of these variables change over time, it become imperative that strategic planning is a continuous effort to evaluate the firm’s position.

A firm’s strategy is partly planned and partly action A Business/corporate strategy is NOT crisis management.

A Business corporate strategy is NOT marketing strategy.

A Business corporate strategy is broader than a business models, it goes beyond the numerical figures of gains and losses.

Decisions makes plan a strategy within limits of bounded rationality. Hence, every strategy works for a specific firm, under a specific set of circumstances and during a specific period.

Strategic planning has three stages

1- Justification and Analysis :

a. External Analysis

b. Internal Analysis

c. Institutional Analysis

2- Formulation of the strategic plan

3- Implementation of the strategic plan

a. Structure

b. Performance measures

c. Corporate governance

d. Strategic leadership

How do we assess growth:

-Objectives and results

-KPI’s (key performance indicators) are necessary depending on each company (small products vs bigger)

Growth

progress, improvement, metrics, relative to others, relative to past performances, net profit

-Growth is looking at the better corporate performance (aka Sustainable Competitive Advantage)

-Sustainable = over an extended period of time

- Competitive = (relative to competitors)

-Advantage = better than the past or others

Sustainable Competitive Advantage

Since the main goal of strategic planning is better performance of the firm relative to other competitors, Sustainable competitive advantage is a main measure of how well a strategy is working.

The definition of sustainable competitive advantage is a better position in the industry relative to other competitors and that can be sustained over an extended period of time.

In a sense, sustainable competitive advantage is the ultimate goal of any firm, and hence, strategic planning is imperative to achieve so.

Sustainable competitive advantage can be achieved by a well-crafted strategic plan and a good implementation of the strategy. Since sustainable competitive advantage is a market position relative to other competitors, it cannot be measured with only one performance measure.

Therefore, for a firm to assess how well it is doing relative to other competitors, multiple measures of performance should be applied to give managers a clear picture of the overall firm’s performance.

Performance measures to assess the firm’s competitive position:

1- Accounting based measures

2- Marketing based measures

-Performance measures

Accounting based measures

-ROA = return on asset (what you can generate from those assets)

-ROE = return on equity (generating profit)

-ROI = return on investment (the investments are worth it or less)

-EPS =

-Net profit =

-COGS =

-Profit margin

Market Based measures

-Market share

-Perceived quality

-Tools to analyze

-Cross sectional

-Time series

Justification

Choosing a strategic option (Come up with a good plan), and a good implement strategy = sustainable competitive advantage

-Data driven (looking and evaluating the past and present data)

-Analysis and predictions (facts and figures)

What do we analyze (everything)

Strategy is an ongoing process

Three boxes of analysis:

1.External environment analysis (Ch 2)

2.Internal environment analysis (Ch 3)

3.Institutional environment analysis (Ch 4)

Ex: wanting to be a millionaire, started casting for reality shows, what you need to due: being discovered (choose the right approach to being discovered)

-External: look for opportunities (amazing race, the challenge, survivor, wheel of fortune, etc.) and looking out for threats

-Internal: deep dive into what do I have (do I have what it takes to be a millionaire) (I can’t sing or talent, so its American idol is out, but I am strong and have a toxic personality, so survivor is a possibility)

-Core competences

-Institutional: legality (morals and culture may not be able to due survivor, so amazing race is better)

Options to grow:

-International markets (Ch 6)

-Go to other industries (Cha 9)

-Strategic alliances (Ch 7)

-Inorganic growth (Ch 9)

-In one country and one industry

-A combination of markets and industries (Ch 9)

Global competition (Ch 8)

Implement:

-Structure (Ch 10)

-Corporate governance (Ch 11)

-Strategic leadership

-performance measure (Ch 1)

HQ: example China

Structure:

-a/c

-Market

-Manufactory

-Production

-International division (more of operations and not strategy, 15% revenue from china) predicting that in the coming years going to be 30% in the future (can not efforted to lose the Chinese consumer and need to get closer to them since 30 percent is so high, building a factory in china) Before going to china you need the proper structure to run multi-national operations.

Chief architect

(advantage: control)

- everyone feels relevant

Everyone in the decisions (feels ownership of their decisions) Problems (longer decisions, conflict)

Bounded rationality:

-Ability to analyze and predict is limited

-Universal concept

-There is a risk (no from malpractice)

Every strategy works for:

-A specific firm (my firm vs someone elses)

-Under a specific set of circumstances (in china vs india)

-During a specific period of time (what worked 5 years ago might not work today)

How do firms choose a strategic plan to gain and sustain competitive advantage?

-External environment a strategic choice -> sustainable competitive advantage

The question of how firms can improve their performance relative to their competitors is at the core of strategic planning. In other words, firms continuously examine the variables that have the biggest impact on their performance.

Firms gain and sustain their competitive advantage when

1 they can choose a good strategic plan that is justified from an external, internal and institutional perspective.

2- Have a good implementation of their

strategy.

Ex: why did you come to slu?

-Financial aid/ capabilities

-Location

-Quality of education

-Ranking

-Comparative analysis

I/O model: industrial organization model

-S: structure leads to

-C: conduct leads to

-P: performance

How should you behave in an environment that is full of threats and opportunities

Assumptions:

-Resources we highly mobile

-Managers are rational decision makers

-Every firms actions leads others to react

Firms gain and maintain competitive advantage the structure is full of opportunities and threats, I have to do something about it and make a choice to. (Choose a strategy that captures external opportunities and hedges against external threats)

Ex: one firm has software and hardware and got rid of systems (want to be a firm with cheap products) need to sell a lot for cheap.

-Ceres: GDP per capita 300/year, pop: 1 billion, pop growth: exp. 10% (better opportunity because of the population and the rate of growth) (want people who don’t have money, and value)

-Abendland: GDP per capita 150k /year, pop: 50 million, pop growth: exp. 2% (bad idea, people are expecting more bc they have the money to buy, not ideal for this strategy)

-Enigma: GDP per capita 200/year, pop: 100 million, pop growth: exp. 5%

-Domestica

-Borealis

Opportunities + threat

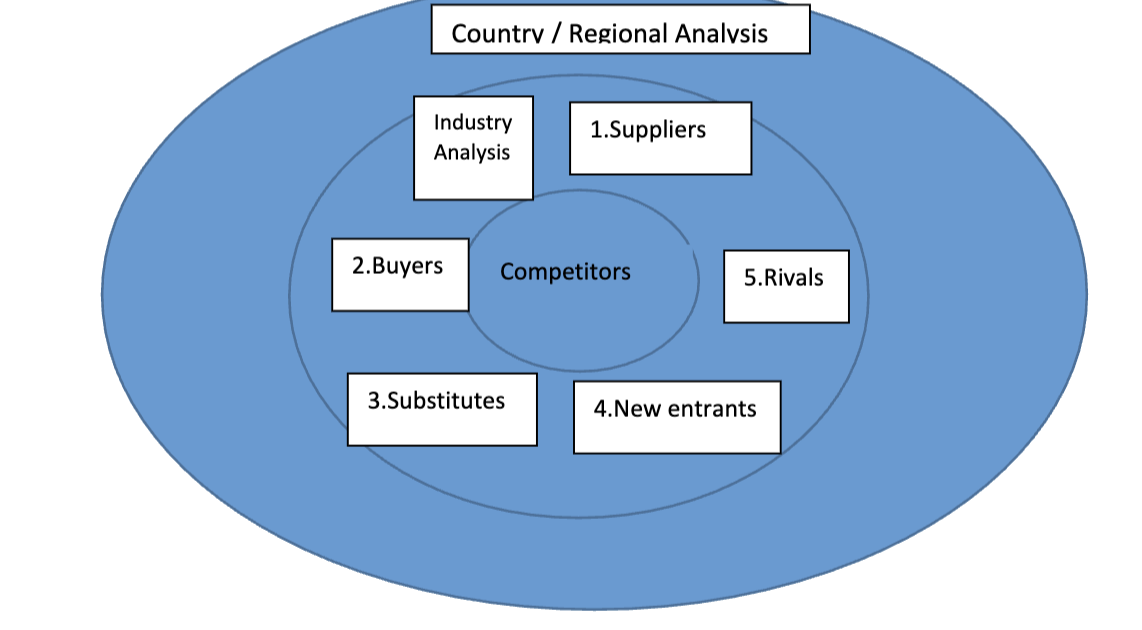

Outer circle: market/region/country (market protentional/threats analysis)

-economic forces

-Political

-Legal

-Environment

-Culture

-Socio economic

-Infrastructure

-Labor

Middle circle: industry

Inner circle: Direct Competition

Ex: You sell TV (plasma) = 15 k per unit (cheapest)

-Thinking of going to inda (gdp/capita 3 thousand per year, population: 1.6 billion, growth:

-Legal stable, infrastructure good (just want to sell products)

-Cultural: pluralistic society (generational homes) additional income together (combined 18k)

-Socioeconomic: 15% pop make more than 200 k gdp (240 million people) , 85% make 100 k gdp

Need more information before you decide on a region

Country/region: market risk assessment

External analysis:

Externally: To analyze the firm’s external environment and capture the opportunities and hedge against the threats

Outer layer: labor, cultural, financial, socio economic, tech., economic, infrastructure, geo

Middle layer: industry (going deeper) industry assessment

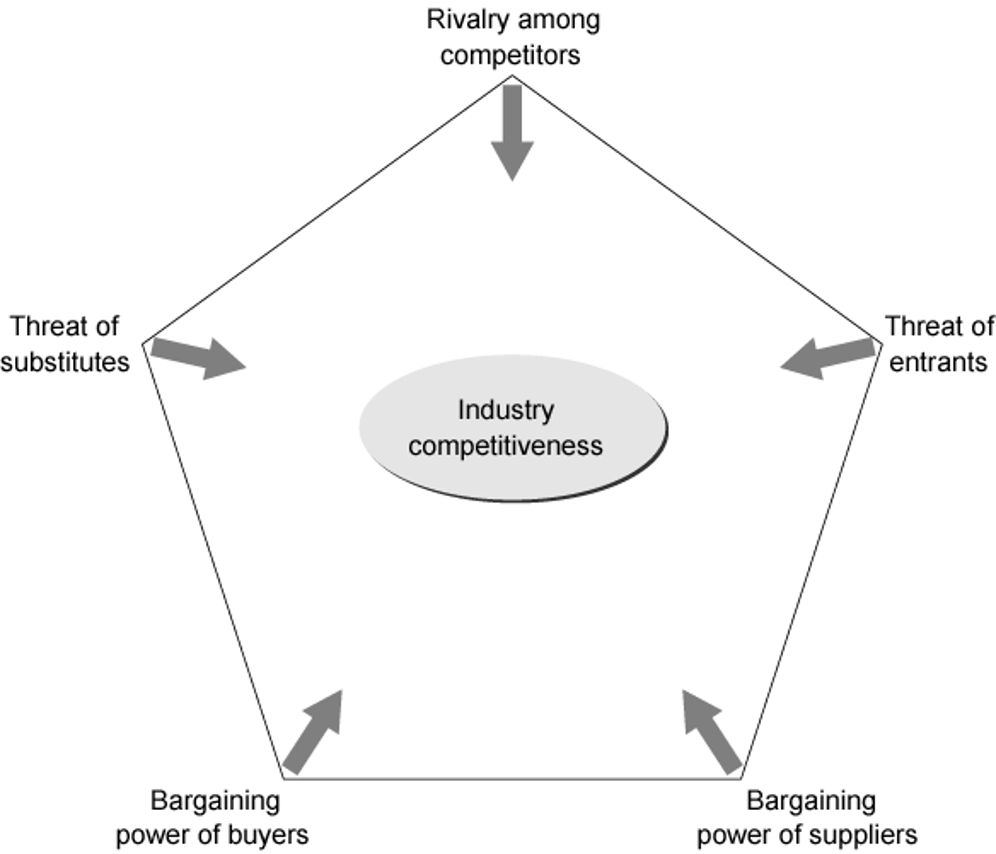

Five competitive forces: how well you do in the industry is how well you respond to five competitive forces

1.Bargaining power of suppliers

Ex: north American: car industry need steel (Steel industry supplies to us) (in all of American there are only 2 steel man. One is 65% of industry and the other is 25% (the biggest is going to give you the best price given the amount of products) you don’t want to mess up with the relationship with the steel company given that there is so little and the other option will up the price (job is not to fight but to build strong relationships with them given the power of their bargaining power)

2. Bargaining power of buyers (buyers can have power as well, ex; Walmart is a major player without them) best thing to do is to collaborate and create an equal relationship

3. Bargaining power of substitute (ex: cars, the competitor is public transportation, bikes, walking, rideshares (different locations/regions (walking in stl vs walking in nyc) assess the industry of the substitute (have to understand how it operates)

4. Threat of new entrants/entry and exit barriers (high vs low entrance (more bakers or more airplane construction) price to enter the industry) making barriers very high so that new entrances can’t come in

5. Rivalry among existing firms (looking rivals and understand the differences) ex: mega luxgery

There are several assumptions for this model:

1- Resources are highly mobile

2- Managers are rational decision makes that decide on the firm’s actions within the limits of “bounded rationality” '

3- One firm’s actions will have implications on other firms

The main goal of external analysis is to identify the firm’s external opportunities and threats. Then plan a strategy that will hedge against the threats and will take advantage of the external opportunities. By choosing a strategy in this fashion, firms can gain competitive advantage over their competitors

Regional/ Country Analysis:

Opportunities and threats exist on the county/regional level. Market Risk/Potential Analysis allows decisions makers to identify opps and threats within every market they may consider for their international strategy

Industry Analysis:

Embedded in the Country/regional analysis is the industry analysis to identify opps and threats on the industry level. Porter’s competitive forces analysis provides a good framework to analyze the forces in the industry that can affect the firm’s competitive position.

The 5 forces are:

1- Bargaining power of suppliers

2- Bargaining power of buyers

3- Power of substitutes

4- Threat of new entrants

5- Rivalry among existing firms

Competitor Analysis:

Embedded in the industry analysis is a thorough understanding of the firm’s direct competitors. Not all firms in one industry compete against all other firms; hence, it is important to identify and analyze the firm’s direct competitors.

Strategic Group Mapping

is a good analytical tool to analyze the firm’s direct competitors.

1- Generic Competitive Strategies

A- Cost Leadership strategy

a. Lowest cost of production.

b. Useful in markets that have a large population

c. The key to having this strategy profitable is by having huge market share and low profit margin

B- Differentiation Strategy

a. A unique feature that will capture the customers’ loyalty

b. Useful in markets that have high GDP/Capita and is willing to pay extra for added features

c. The key to having this strategy profitable is by having a high profit margin and a market share enough to make the firm profitable

C- Best Cost Producer Strategy

a. Somewhere in between cost leadership and differentiation

b. Added features at the lowest cost

c. Continuous addition of products to follow all the differentiated companies

D- Focused Strategy

a. Market niche that is profitable enough for the firm

Internal Analysis

Our discussion continues to focus on how firms can gain and sustain their competitive advantage; However, in this chapter we will focus internally within the firm on the factors that will help improve the firm’s performance.

Hence, from an internal perspective, the focus starts with the firm’s resources. Ultimately, firms can improve their performance when they develop and deploy core competencies and choose a strategic plan that utilizes these core competencies.

Internal analysis

Core competencies

Theoretical background:

Resource based view (of competitive advantage)

Firms should choose a strategy that capitalizes on core competencies (develop and deploy)

Assumptions:

Resources are highly immobile (starts with resources)

Each firm is a unique bundle of resources

Firms Resources: Tangible / intangible

Labor

Capital

Culture

Facilities + assets

Inventory

Patents

Name

Establish:

Ex: banana bread resources- banana, flour (ingredients etc.), mixing utilities, packaging, labor, oven, recipe. (The best ingredients, doesn’t always make the best product, especially if you don’t have a good process to making the bread)

How you come up with the formula of how to make a process that will work for your firm the best

Resource Based View:

The resource based view is the theoretical framework that supports the internal analysis. RBV stresses the importance of the firm’s Internal resources to build the performance of the firm. RBV has two important assumptions:

a- Resources are highly immobile.

b- Each firm is a unique bundle of resources.

Hence for firms to build and sustain competitive advantage, they must understand and evaluate the importance of the resources they possess.

Resources: Tangible and Intangible resources. Resources are important but they are not the source of competitive advantage.

Capabilities: Capabilities are the bundling of resources. Each firm combines resources to build capabilities

Resources—> capabilities (using the resources and then having the capability to make the bread) what is the best combo for my firm (best banana bread not just in flavor but also in the process)

Core Competencies:

Core competencies are unique capabilities that give the firm competitive advantage over their competitors. For capabilities to become core competencies, they must meet the VRIO criteria:

1- Valuable

2- Rare

3- Inimitable

4- Organizational Value

A strength may become a weakness overtime; an example is IBM in the 1990’s (their historical expertise in hardware). Hence, continuous strategic renewal is the only insurance against irrelevance

Ex: Airlines (Spirit)

Discount airlines

Culture

No hubs (city to city rather than big hubs)

23 minute gate time

1 type of plane (hedging fuel price)

Friendly culture

Ex: Del computers

Built to sell

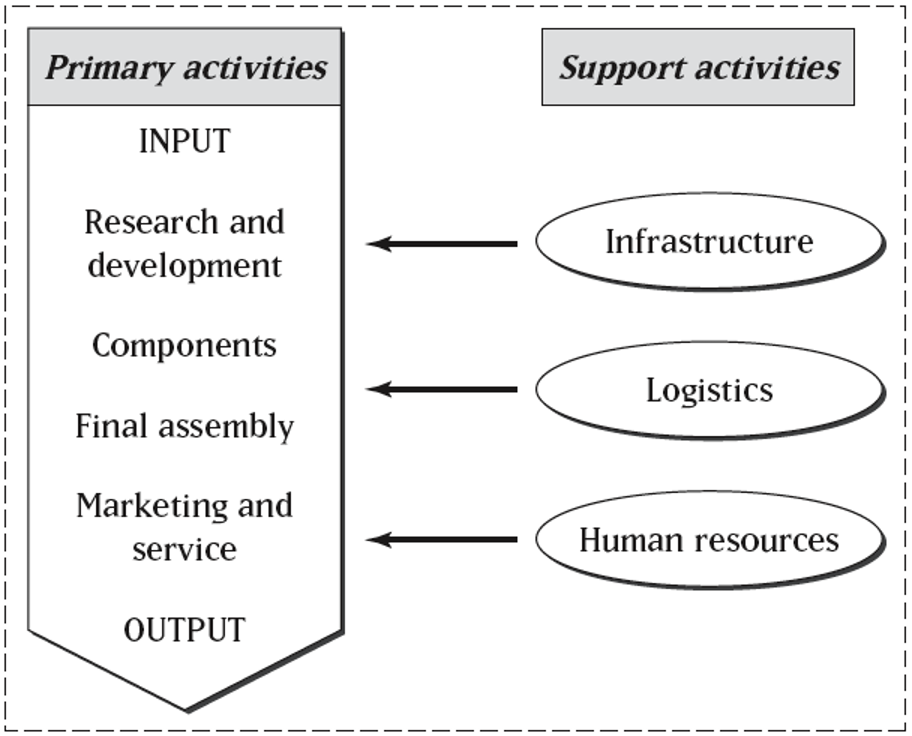

Value Chain Analysis (VCA)

VCA is an internal exercise that allows firms to understand their overall cost structure and identify areas that are at a cost disadvantage relative to competitors.

VCA is an analysis of all the activities a firm does to create value to the end consumer and associate costs for each activity. Value chain activities are divided into:

1- Primary activities: Activities that directly add value to the end consumer

Inbound logistics: getting raw materials and managing inventory

Operations: turning materials into finished products

Outbound logistics: storing and distributing the products

Marketing and sales: promoting and selling products

Service: after-sale support like repairs or customer service

2- Supporting activities: activities that does not have a direct impact on the value for the consumer but support the primary activities.

Firm infrastructure: management, finance, planning

Human resource management: hiring, training, and employee support

Technology development: improving products or processes

Procurement: buying resources needed for production

Example: HR, IT .

(Bottle ex: purchasing → manufacturing → packaging → distrubtion) Goal: to produce a bottle of beer (chain of activities that add value to the end consumer)

Primary Activities

First step: procurement (raw materials)

Second step: brewing (actual manufacturing)

Third step: Bottling

Outsources (cost reduction) (having others bottle costs the production cost)

Offshoring (cost reduction also can be manufacturing in a different location, cheaper labor)

Upgrade (High defect rate, outdated facility = higher defects and higher cost)

Reexamine (recognition, look at the company)

Fourth step: Packaging

Fifth step: distribution

Towards the end the collection of these adds value to the product for the consumer

Offshoring Vs. Outsourcing

Offshoring: Operating in a location outside your home country

Outsourcing: Having another company do the activity for you

There are several pros and cons for offshoring and outsourcing. The main benefit is to reduce costs and access specialized skills. The main drawbacks for these strategies are the loss of quality control and other environmental risks.

Institutional Theory and Institutional Economics (Transaction Cost Economics):

The main premise of institutional theory is that institutions affect strategic behavior of companies by providing guidelines for corporate conduct. They signal what is legitimate and legal. They provide the “Rules of the game”.

While the question is still the same “How do firms gain and sustain competitive advantage?”, it is important to address the question from a third perspective; that is the effect of institutions (formal and informal) on strategic choices

Institutional analysis and strategic choice

Survival

Ex: How do firms gain and substance competitive advantage

Law firm (nice office vs eh office) legitimacy & legality => survival => isomorphic

Types of Institutions:

Institutions are humanly devised constraints that structure human interactions. Hence, reduce opportunistic behavior ie, interest with guile

Without institutions, certain transactions can be costlier and riskier to implement. Hence, institutions, by reducing u certainty, they reduce the cost of transactions.

There are two types of institutions:

1- Formal ( laws, rules , regulations) they signal what is legal or not through Arm’s length transactions i.e. third party enforcement.

2- Informal institutions ( Culture, norms, habits, beliefs) they signal what is legitimate or not through relational contracting.

Managers and firms rationally pursue their interests and make strategic choices within institutional constraints

While formal and informal constraints combine to govern firm behavior, when formal constraints fail, informal constraints play a larger role

Institutional analysis

(aka how do firms choose a strategy to gain sustain comp advantage)

Institutional theory & transaction cost economics

Institutional theory = isomorphic behavior = higher survival

Institutions are needed because they lower the cost of transactions

Institutions:

Laws (tangible bc you have to read it follow the rules) Legality

Norms (tangible) Legality

Regulations (intangible) Legitimacy

Religion (intangible) Legitimacy

Culture (intangible) Legitimacy

These institutions are tangible and intangible

Institutions signal what is acceptable (reduce/limit opportunism = reducing uncertainty = leading to reducing cost)

Tangible (arms length transactions)

Intangible (relational contracting) (ex: greeting someone in a different culture with not knowing it was disrespectful but there is no one to sue you only you lose credibility)

When formal institutions are weak = informal institutions kick in and become the guide

Ex: weak corrupt gov. we look towards culture and religion for law and rules

Formal institutions

Informal institutions are the ones we have to understand so that we don’t offend each other

Culture

CQ:

Competitive advantage of nations

Instead of industries came up with the diamond industry

4 core ideas that interact with each other

Ex: cars you need four things (supplier market, buyers market, supporting industries, and strategy and structure)

This doesn’t work (doesn’t take into account the laws or the social view of the company)

Lacks the role of institutions

Culture (mistakes can be very deadly)

Hofstede’s Cultural Dimensions

Power Distance: Distinguishes the levels of hierarchy accepted by society.

Individualism versus Collectivism: Focuses on the importance of the individual versus the group in social and business situations.

Individual society is your decisions are solely based on your factors (you get to make the decision)

Collectivism society is the collective communities goal is more emphasized then personal

Masculinity versus femininity: Measures the degree of sex role differentiation.

Feminine is about building relationships over competition, intuitive (small-scale customized manufacturing)

Masculine is about goals and metrics, aggressive (mass manufacturing)

Uncertainty Avoidance: Identifies the tolerance for ambiguity.

Managers in low uncertainty avoidance countries (e.g., Great Britain) rely on experience and training.

Managers in high uncertainty avoidance countries (e.g., China) rely more on rules and procedures.

Long-term Orientation: Emphasizes perseverance and savings for future betterment

*All of these effect our strategy (strategy-> choice->impact -> growth)

Non-market strategy

Institutional changes

Reactive (Deny/denying responsibility)

Defensive (admit/low budget and admit bare minimum)

Accommodative (accept responsibility/doing the most to accommodate fully)

Proactive (anticipate/responsibility and fixing it before there are negative effects)

Ethical Imperialism vs Ethical Relativism

Ethical standards are different around the world

Ethical relativism: When in Rome, do as the Romans do

Ethical imperialism: There is only one set of good Ethics, and we have it!

Your ethical lens applies to you and it may not for other people

Ethical imperialism is a no no

Ethical pluralism is fine

Strategic Responses to Institutional Change

1- Reactive – Deny Responsibility

2- Defensive- Admit Responsibility

3- Accommodative – Accept Responsibility

4- Proactive – Anticipate Responsibility

Analysis

External

Opportunities and threats

Internal

Core competencies

Institutional

Legal and legitimate

All of this goes into choosing a strategic plan (global growth journey)

Entering Foreign Markets (Options to grow)

Why go abroad: reach larger economies of scale by selling to more customers in other countries. To reduce the risk of over dependence on one country by spreading sales in multiple countries. To replicate the success at home in new settings

1- Why

2- Where

3- When

4- How

Reactive Reasons

Globalization of competitors

Trade barriers

Regulations and restrictions

Customer demands

Proactive Reasons

Economies of scale

Growth opportunities

Resource access and cost savings

Incentives

The Liability of Foreignness

The inherent disadvantage foreign firms experience in host countries because of their non-native status

The Propensity to go abroad

Not every firm is ready for going abroad.

Factors underlying the motivation to go abroad:

Size of the firm

Size of the domestic market

Why?

Why: Market growth, diversify (reduce risk), cost reduction, competitive reasons, Taxes reason (anti-trust laws) (all of these are just some reasons to why)

WHERE?

There are three schools of thoughts on how to decide where to go for the firm’s international expansion

1- Cultural and Institutional Proximity

Cultural Distance → Differences in values and behavior between societies.

Institutional Distance → Differences in legal, social, and cognitive systems.

2- Geographical Proximity

3- Strategic Goal and location specific advantage

a. Market

b. Resources

c. Efficiency

d. Innovation

Where: geographical proximity, institutional proximity, location specific adv.

Cultural Distance

The difference between two cultures along some identifiable dimensions (such as power distance).

Institutional Distance

The extent of similarity or dissimilarity between the regulatory, normative, and cognitive institutions of two countries.

Firms from common-law countries are more likely to be interested in other common-law countries

Colony-colonizer links boost trade by 900%

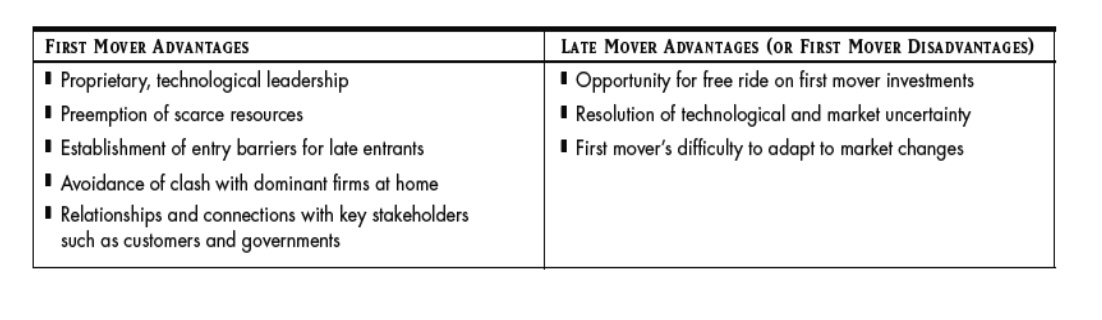

When?

1st mover vs 2nd mover

When: domestic manufacture and size of your firm (you need to go now is a large firm in a small market aka enthusiastic markets), followers (small market small firm), slow internationalizers (large firm and large market (not really worth going abroad), occasional (small firm, large market): Born Global firms (exceptions, ex: instagram)

While evidence supports first mover advantages, there is also evidence supporting a late mover strategy.

Although first movers may have an opportunity to gain advantage, pioneering status is not a birthright for success

How?

There are two important factors in deciding on how to enter

How: scope (limited vs extensive), FDI (merges, ventures) vs non FDI (exporting, franchising) = OLI (ownership location)

A- Scale of entry

a. Large (Organizational Learning) vs. Small (Strategic commitment)

large-scale entry.

Benefits:

Shows strong commitment to the market.

Signals to customers, suppliers, and competitors that the firm is there to stay.

Builds trust and confidence among local partners and stakeholders.

Can deter potential competitors from entering because it shows the firm’s seriousness and financial strength.

💡 Example: Large-scale entry can make a company seem powerful and reliable — like when a global brand builds a major production plant in a new country.

Drawbacks:

Reduces flexibility — once the firm commits large resources, it’s harder to pull out or change direction.

High financial risk — if the market doesn’t perform well, the firm could face big losses.

Locks resources that could have been used in other markets or opportunities.

Small-Scale Entries

Benefits

Less costly if entry is unsuccessful.

Organization learns through hands-on experience in host countries.

Drawbacks

A lack of strong strategic commitment, which may lead to difficulties in building market share and capturing first mover advantages.

B- Entry Mode

a. FDI v.s Non FDI

The benefits of FDI entry mode is exhibited in the OLI model

O= Ownership (better management and coordination internationally)

L= Location (location where to enter)

I= Internalization (replacing arm-length market transactions, which usually have high transaction costs internationally with internal relationships among MNE subsidiaries in different countries)

*LOF = liability of foreignness (cost disadvantage relative to domestic firms)

Three leading perspectives on strategy

Industrial based competition

firm specific resources and capability

Institutional conditions and transactions

Structure-Conduct-Performance (SCP) model

The primary contribution of the Industrial Organization (IO) economics model

Structure: Structural attributes of an industry

Conduct: The firm’s actions

Performance: The result of the firm’s conduct in response to industry structure

Goal of IO

original goal of IO economics is not to help firms compete; instead, it is to help policymakers better understand how firms compete in order to properly regulate them and ensure competition.

Five forces framework

The focal firm’s performance critically depends on the degree of competitiveness of the five forces within an industry.

The stronger and more competitive these forces are, the less likely the focal firm is able to earn above-average return, and vice versa

Rivalry among competitors

· A large number of competing firms

· Rivals are similar in size, influence, and product offerings

· High-price, low-frequency purchases

· Capacity is added in large increments

· Industry slow growth or decline

· High exit costs

Threat of potential entry (economies of scale)

· Little scale-based low-cost advantages

· Little non-scale-based low-cost advantages

· Insufficient product differentiation

· Little fear of retaliation

· No government policy banning or discouraging entry

Bargaining power of suppliers

• A small number of suppliers

• Suppliers provide unique, differentiated products

• Focal firm is not an important customer of suppliers

• Suppliers are willing and able to vertically integrate forward

Bargaining power of buyers

• A small number of buyers

• Products provide little cost savings or quality of life enhancement

• Buyers purchase standard, undifferentiated products from focal firm

• Buyers are having economic difficulties

• Buyers are willing and able to vertically integrate backward

Threat of substitutes

• Substitutes superior to existing products in quality and quality and function

• Switching costs to use substitutes are low

three generic strategies

Cost leadership: centers on low costs and prices.

ØA high-volume, low-margin approach.

vFirms undertaking this strategy are often very innovative on the production process side of the business.

ØThe advantage for a cost leader (such as Wal-Mart) is to minimize the threats from the five forces.

ØMany companies try to become cost leaders, however, only a few succeed.

•Drawbacks:

ØThe danger of being outcompeted on costs.

This forces the leader to continuously search for ways to further reduce costs.

In the relentless drive to cut costs, a cost leader may make trade-offs that compromise the value customers perceive in its products or services and hurt sales.

•Differentiation:

ØStrategically focusing on how to deliver products that are perceived to be valuable and different.

A low-volume, high-margin approach in targeting smaller, well-defined customer segments willing to pay premium prices.

Research/development and marketing/sales are important functional areas.

The less a differentiator resembles its rivals, the more protected its products are.

•The Strategic Requirement:

ØDifferentiated products must have truly or perceived unique attributes such as quality, sophistication, prestige, and luxury (see Closing Case on cosmetics firms, which try to brag about their uniqueness).

•The Challenge:

ØTo identify these attributes and deliver value centered on them for each market segment.

•Drawbacks:

ØA differentiator can have difficulty sustaining the basis of its differentiation over the long run.

Customers may decide that the price differential between the differentiator’s and cost leader’s products is not worth paying for.

The differentiator also has to confront relentless efforts of competitive imitation.

ØAs the overall quality of the industry increases, brand loyalty to differentiators may decline

•Focus Strategy:

ØServing the needs of a particular segment or niche of an industry such as a geographical market, type of customer, or product line.

vA specialized differentiator has a smaller, narrower, and sharper focus than a large differentiator.

–A specialized cost leader deals with a narrower segment compared with the traditional cost leader.

Focusing may be successful when a firm possesses intimate knowledge about a particular segment (A focus strategy means serving a small market really well, rather than serving the whole market a little bit.)

VRIO

ØAn analysis of the “sticky” nature of resources and capabilities of a firm and the difficulty of their replication elsewhere.

•Two Key Assumptions:

ØResource heterogeneity

Each firm has a unique combination of resources and capabilities such that no two firms are “twins.”

Every firm has a unique mix of resources and capabilities.

No two companies are exactly alike — even if they’re in the same industry.

Example: Apple and Samsung both make smartphones, but Apple’s brand and design process are unique resources.

ØResource immobility

Resources and capabilities unique to one firm cannot easily migrate to competing firms.

Certain resources can’t easily move or be transferred between firms.

These unique skills, culture, or processes stay “stuck” within one company.

Example: Disney’s creative culture and storytelling capabilities can’t simply be copied by another studio.

Once competitors develop similar resources or skills, the advantage disappears — no firm remains distinctive.

💡 In short:

To gain an edge, a firm’s resources must be both valuable and rare — otherwise, it just stays on par with everyone else.

AKA = valuable, rare, hard to imitate, and well-organized

Culture

The collective programming of the mind which distinguishes the members of one group or category of people from another” (Hofstede)

Is the most informal and least codified part of a country’s institutional framework.

Impacts the strategy of firms.

Firms must understand cultural rule sets of the society in which they are doing business just as they must understand its legal regulations and professional and commercial norms.

Ethics

Norms, principles, and standards of conduct governing individual and firm behavior

Ethics: Not only an important part of informal institutions, but also deeply reflected in formal laws and regulations

What is illegal is typically unethical

What is legal may be unethical (e.g., mass lay-off downsizing)

What is unethical is not always necessarily illegal

Ethics views

A negative view

Firms are forced to jump on the ethics “bandwagon” under social pressures while not necessarily becoming more ethical.

A positive view

Firms want to do it right regardless of social pressures.

An instrumental view

Ethics: A useful instrument for good profits

The value of ethical reputation is magnified during a crisis

Institution-based explanation

All of the above may be accurate, for some firms

See the Strategic Response Framework