CAPE May/June Paper 03 2010

1/7

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

8 Terms

List THREE reasons why financial statements such as income statements and balance sheets are important to business owners?

Budgeting/Forecasting - Financial statements assist in developing realistic budgets and projections for future growth.

Performance evaluation - Displays the business's profitability over time. It informs the owner whether the business is profitable, breakeven, or losing money.

Decision making - These statements help make informed decisions about spending, investing, expanding, or cutting costs.

One objective of every business is to operate profitably. State ONE other primary objective that must be met for a business to survive and outline the importance of this objective.

Aside from being profitable, the primary goal of any business is to maintain positive cash flow. This means having enough cash on hand to cover day-to-day expenses such as wages, bills, and inventory. Regardless of how profitable a business appears on paper, it may struggle to operate, go bankrupt, or even close down if it does not have enough cash flow.

State the purpose for which EACH of the following persons or institutions uses the financial statements of a company: (i) Potential investor (ii) Labour union (iii) Creditor (iv) Bank (v) Government agencies.

Potential investor - to evaluate the business's potential for growth and profitability before making an investment.

Labour union - to assess the company's ability to meet wage demands, provide benefits, and guarantee job security for employees.

Creditor - to evaluate the level of financial risk and the company's ability to make timely debt repayments before granting credit.

Bank - to analyse the business's financial stability and creditworthiness before approving loans

Government agencies - to confirm that the business complies with financial reporting standards, tax laws, and regulations.

List FOUR factors that contribute to the reliability of financial statements.

Accuracy, consistency, transparency, and compliance with accounting standards.

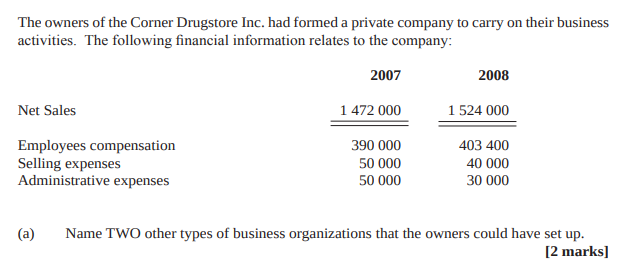

A partnership, and or, a sole proprietorship.

What is the difference between operating income and net income?

Operating profit is a business's profit after deducting all costs, excluding taxes, debt repayment, and one-time expenses, while net income shows the remaining profit after deducting expenses from sales revenue.

List THREE items that may have been combined to form the compensation expenses

Salaries, wages, and benefits for employees.

Comment on the trend in the categories of expenses calculated in (e) above and the movement in Net Sales.

Net sales - In 2007, net sales were 1,472,000; in 2008, they were 1,524,000. During this time, the company's sales increased moderately.

Employees compensation - Percentage decreased slightly from 26.49% in 2007 to 26.47% in 2008. This suggests the company maintained consistent staffing costs relative to revenue growth.

Selling expenses - Decreased significantly from 3.40% in 2007 to 2.62% in 2008. This indicates improved efficiency in selling activities or potential cost-cutting measures.

Administrative expenses - Decreased substantially from 3.40% in 2007 to 1.97% in 2008. This points to a major restructuring or control of administrative costs.