Money and Banking Final Exam Flashcard Study

1/503

Earn XP

Description and Tags

Flashcards for money and banking chapter 12-18 and 20

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

504 Terms

What are Bank assets?

uses of funds

What is the accounting equation for banks?

total bank assets = total bank liabilities + bank capital

What represents the owner’s stake in the bank?

Bank Capital is the owner’s stake in the bank

What represents a bank’s net worth?

Bank Capital

The difference between a bank’s asset and liabilities is ______.

Bank Capital

Assets are what banks do with _____________.

The funds they have

What is included in the asset side of a bank’s balance sheet?

Cash

Securities

loans

buildings and equipment

there are ___ types of cash items

three

What are the 3 types of cash items?

reserves

cash items in the process of collections

correspondent banking

What is the most important type of cash item?

Reserves

What are reserves?

Cash in the bank’s vault as well as its deposits are the federal reserve

What is the equation for reserves?

Reserves = vault cash + fed deposits

Paycheck funds that the bank is waiting to receive would be considered ______

Cash items in the process of collections

what are cash items in the process of collections?

uncollected funds the bank expects to receive

Balances of accounts that banks hold at other banks are called?

Correspondent banking

T or F: correspondent banking is considered cash

The second largest component of bank assets

securities

T or F: Since banks cannot hold stock, many american banks have bonds as their form of securities

What are the different types of securities?

US treasury securities

state government bonds

local government bonds

Why are securities sometimes called ‘secondary reserves”?

highly liquid

can be sold quickly and easily

can serve as backup reserves

What accounts for ½ of a bank’s assets

loans

loans are the primary asset of _______

Modern commercial banks

What loans do commercial banks offer?

business loans

Commercial and Industry (C&I)

real estate loans

consumer loans

interbank loans

loans for purchase of other securities

What is the primary difference among various types of depository institutions?

The composition of their loan portfolio

Where may commercial banks loan to?

businesses

credit unions

individuals

governments

T or F: banks can use funds (assets) to have reserves, buy securities, funds not yet received from depositors, and make loans to businesses and individuals

What are the two broad categories of liabilities?

Deposit Accounts

Borrowings

What are the bank’s sources of funds?

liabilities

From who does the bank gets its sources of funds?

Savers and borrowers

_______ _______ allow customers to withdraw funds w/o notice on a 1st come 1st serve basis

Demand Deposits

What are checkable deposits?

A typical bank will offer 6 or more types of checking accounts that allow customers to write checks and access funds immediately.

why have the number of checkable deposits declined over the years?

these accounts pay low interest rates

These include savings and time deposits

non-transaction deposits

non-transaction deposits account for nearly _____ of all commercial bank liabilities?

2/3

Time deposits include

Certificate of deposits or CDs (small <100k or large >100k)

Large CDs can be bought and sold in what kind of markets?

Wholesale money markets

Non-transaction deposits for savings are also called

Passport savings

What are the second most important source of bank funds

Borrowings

What are 3 different types of borrowings?

discount loans

banks with excess reserves

repurchase (repo) agreements

What are discount loans?

when banks borrow from Federal Reserve

How do banks borrow from banks with excess reserves?

from other banks in the federal funds markets

What is a repurchasing agreement (repo)?

Short-term collateralized loan in which a security is exchange for cash, with the agreement that the parties will reverse the transaction on a specific future date

What is the equation for net worth?

Assets - liabilities

What is the cushion that banks have against a sudden drop in the value of their assets or an unexpected withdrawal of liabilities

Bank Capital (net worth)

Bank capital provides what kind of insurance for banks?

insurance against insolvency

what is an important component of bank capital

loan loss reserves

What are loan loss reserves?

an amount the bank sets aside to cover potential losses from defaulted loans

What are the four basic measures of bank profitability

Return on assets

Return on equity

Net interest income

Net interest margin

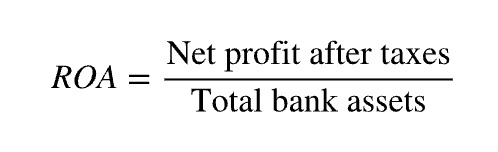

What are return on assets?

A bank’s net profit after taxes divided by its total assets

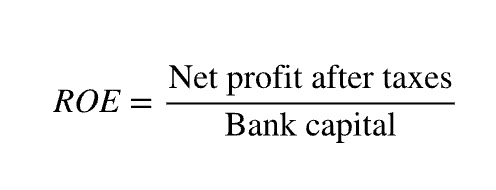

What is return on equity?

Net profits after taxes divided by Bank Capital

What questions does ROA answers?

How profitable is the bank?

How efficiently does a bank use its assets?

What questions does ROE answer?

What are the bank’s return to owners?

What is net interest income?

The difference between the interest a bank pays and what it receives

How can net interest income be expressed?

A percentage of total assets or net interest margin or bank’s interest spread

Where does a banks interest expense come from?

deposits and bank borrowing

Where does a bank’s interest income come from?

Securities and loans

What is net interest margin?

an indicator of future profitability as well as current profitability

T or F: Net interest margin is closely related to ROA

TRUE

What is the banks interest rate spread, exactly?

the Weighted average difference between the interest rate received on assets and interest paid for liabilities

What are off-balance-sheet activities?

Transactions or events that do not arise on the balance sheet (assets or liabilities)

What do off-balance sheet activities do?

generate fee income which include providing customers with lines of credit

____ __ ____ guarantee that a customer will be able to make a promised payment

“Our client will pay and are able to”

Letters of Credit

How does letters of credit work?

Banks act as guarantors for payments and enable a transaction to go forward in exchange for a fee

Should the borrower default, the bank promises that it will repay the lender by sending a

Standby letter of credit

What does it mean when a standby letter acts as a form of insurance for lenders?

“if our client screws up, we will pay”

Why have off-balance-sheet activities come under scrutiny in the recent years

they create risks for financial institutions that cannot be seen on the balance sheet

Depository institutions are highly _______.

Leveraged

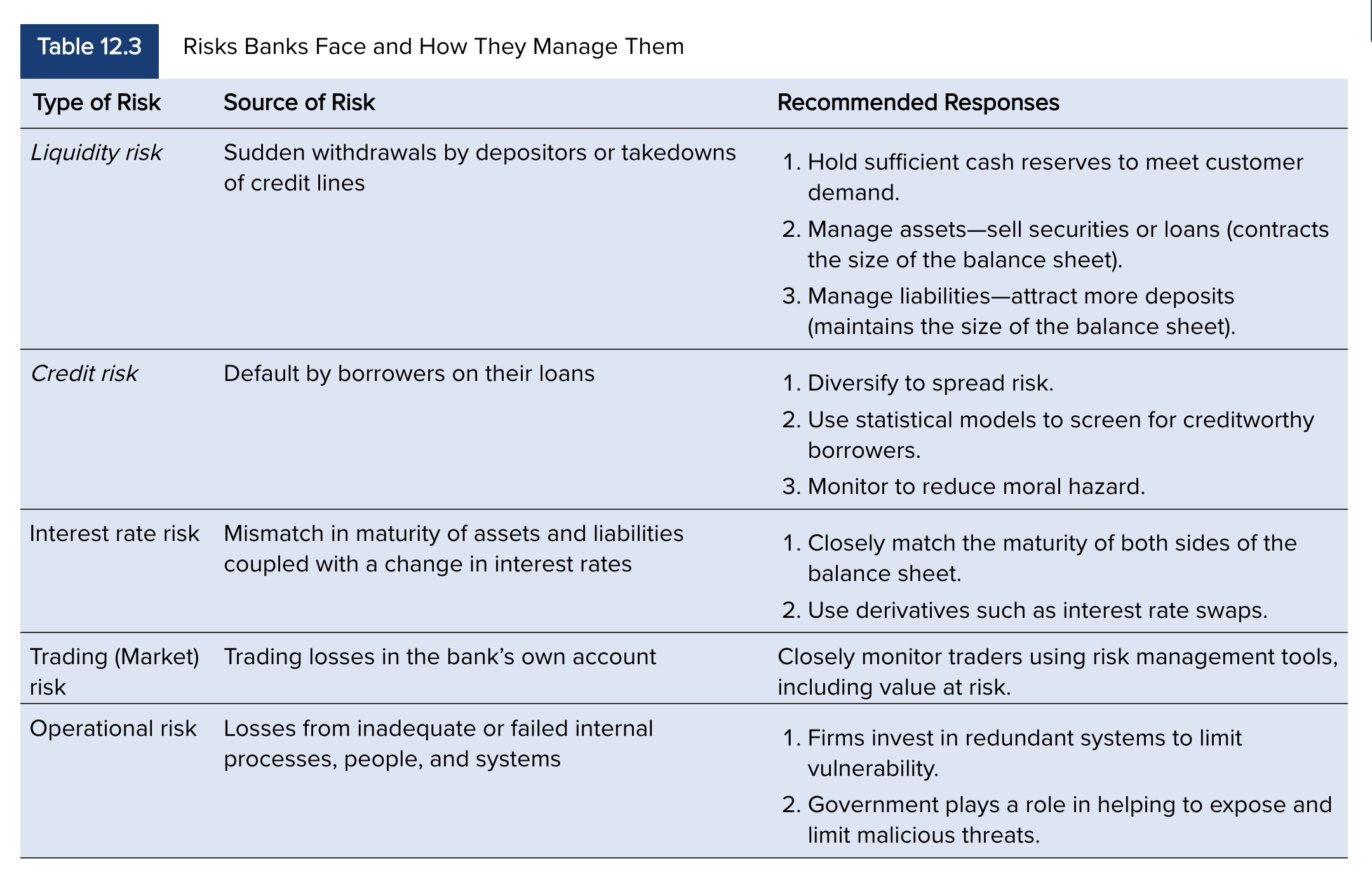

What are the different types of bank risks?

Liquidity risk

Credit risk

Interest rate risk

Trading risk

Foreign exchange risk

operational risk

What is liquidity risk?

the risk of a sudden demand for liquid funds (deposit withdrawal- liability side risk) and the risk of failure if banks cannot meet customers’ immediate needs

What are three ways to manage liquidity risk?

hold sufficient excess reserves

adjust assets

adjust liabilities

How do holding sufficient excess reserves help manage liquidity risk?

it’s like having a piggy bank for a rainy day

What are the cons of holding sufficient excess reserves to manage liquidity risk?

expense as interest is foregone

How does a bank adjusts assets help manage liquidity risk?

sell a portion of its securities or loan to another bank

refusing to renew a customer loan that has come due (to get the money they owe you rather than delaying principal payment and interest that is now due so you can have that money to give)

why is adjusting assets not a good way to manage liquidity risk?

reduces the balance sheet

The smaller the balance sheet, the lower the profits

The smaller the asset, the smaller the size of the bank

How do banks adjust liabilities to help manage liquidity risk?

Banks can use liability management to obtain additional funds by borrowing

from the federal reserve

attracting additional deposits (issuing large CDs) AKA borrowing in the wholesale money market

What is credit risk?

The risk that loans will not be repaid

What are two ways the credit risk is managed?

diversity loan (lending) portfolio

using statistical models and information specific to the loan applicant

what does it mean for a bank to diversify their lending portfolio

they are spreading risk and not putting their eggs all in one basket

Why would a bank use models and specific loan info to manage credit risk?

to examine borrower credit history to determine the appropriate interest rate to change

What is interest rate risk ?

When a bank’s liabilities are more interest rate sensitive (since they are short-term) than their assets are (since they are long-term), an increase in interest rates cuts into the bank’s profits due to this mismatch

What are two other definitions for interest rate risk?

the risk that interest rate will change, causing the price of a bond to change with it

The risk that changes in interest rates will affect a financial intermediary’s net worth.

What type of assets/liabilities are more sensitive to changes in interest rates

short term

what type of interest rates are sensitive to changes

variable interest rates

How can interest rate risk be managed?

The bank must determine how sensitive its balance sheet is to a change in interest rates via gap analysis

what is gap analysis?

highlights the gap or difference between the yield on interest sensitive assets and the yield on interest-sensitive liabilities

Gap analysis equation

Asset amount IR sensitive- Liability amount IR sensitive

how can gap analysis be further refined?

to take account of differences in the maturity of assets and liabilities

Matching the interest rate sensitivity of assets with the interest rate sensitivity of liabilities increases what

it increases credit risk

Like interest rate swaps, what can help manage interest rate risk and its one of the best options?

Derivatives

What is trading risk?

The risk that traders who work for a bank will create a loss on the banks account

How is trading risk managed?

Bank risk managers place limits on the amount of risk any individual trader is allowed to assume using standard deviations and value at risk

To remain solvent, what to banks need to do if there is more risk in their portfolio

hold more capital

What is foreign exchange risk?

the risk from unfavorable moves in the exchange rate

What is sovereign risk?

the risk from a government prohibiting the repayment of loans on international operations

How can foreign exchange risk be managed?

attracting deposits denominated in the same currency as the loans, and by using foreign exchange futures and swaps to hedge the risk

matching assets with their liabilities

How can sovereign risk be managed?

diversification

refusing to do business in a particular country or set of countries

using derivatives to hedge the risk

What is operational risk?

The risk that their computer system may fail or that their business may burn down

the risk of loss resulting from inadequate or failed internal processes, people, and systems

How is operational risk managed?

Make sure that bank computer systems and buildings are sufficiently robust to withstand potential disasters

What are the risks banks face and how they manage them?

Chart from textbook

Until what year was the there no national currency in the US

1863