econ exam 2

1/105

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

106 Terms

value to buyers ...

cost to sellers

prices are signals

guide allocations of society's resources

price ceiling

a legal maximum

price floor

a legal minimum

taxes

buyers or sellers pay a specific amount on each unit bought/sold

rationing mechanisms

lines, lottery, discrimination according to sellers' biases

how price ceilings affect market outcomes

shortage

how price floors affect market outcomes

surplus

consumer surplus

price willing to pay - price actually paid

producer surplus

price actually received - price willing to accept

social surplus/total surplus

consumer surplus + producer surplus

price ceiling attempts to help

buyer

price floor attempts to help

seller

tax incidence

how the burden of a tax is shared

true

when something is free, resources are less likely to be allocated to its production

responsiveness

elasticity for economists

welfare economics

the study of how the allocation of resources affects economic well-being

willingness to pay

max amount the buyer will pay for a given Q

consumer surplus

amount a buyer is willing to pay minus what the buyer actually pays

cost

value of everything a seller must give up to produce a good (i.e. opportunity cost)

cost is a measure of

willingness to sell

price changes affect

producer surplus

what does CS measure

value to buyers minus amount paid by buyers

what does PS measure

amount received by sellers minus cost to sellers

total surplus

CS - PS

total gains from trade in a market

value to buyers - cost to sellers

laissez faire

"allow them to do"

the notion that government should not interfere with market

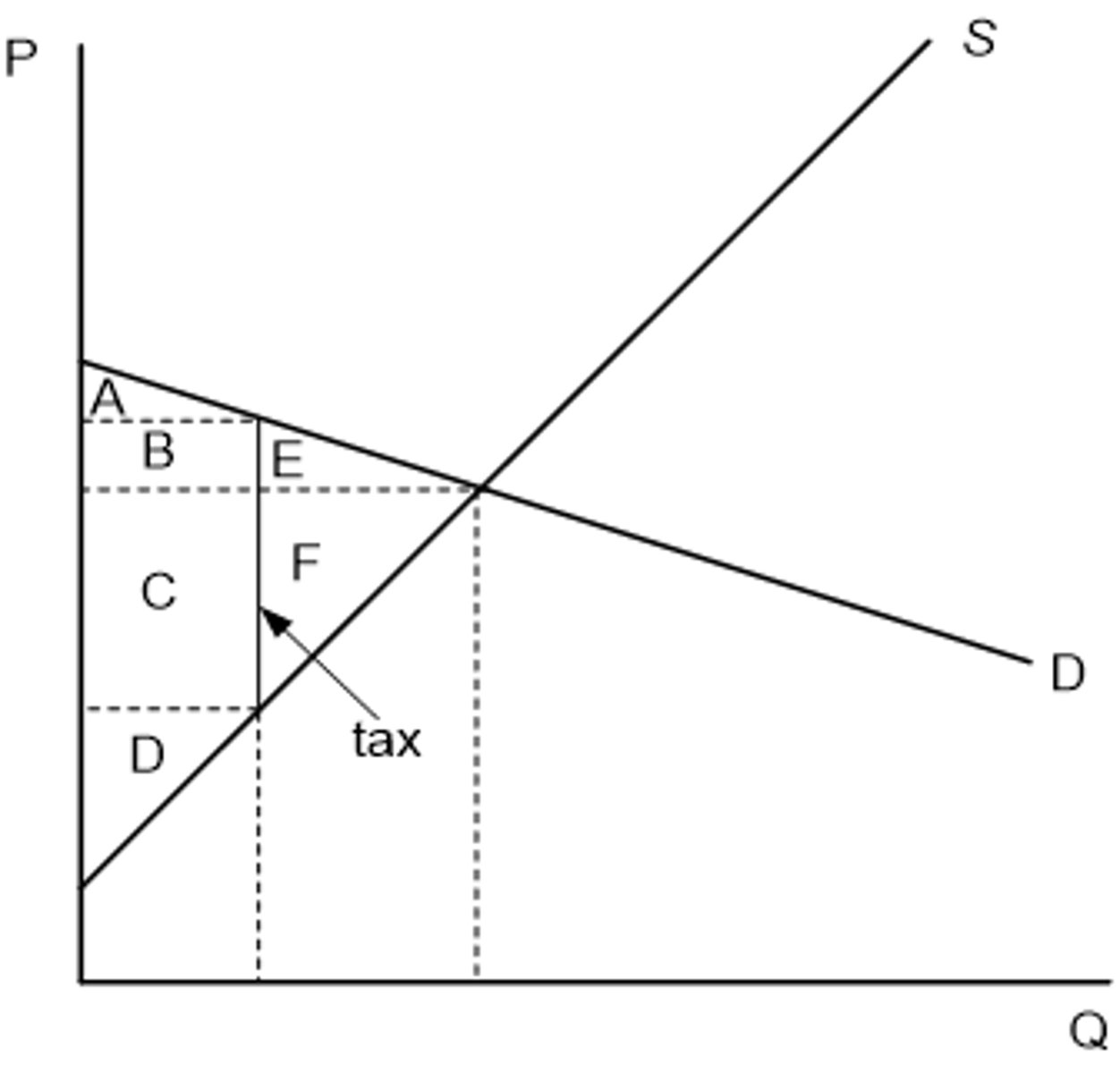

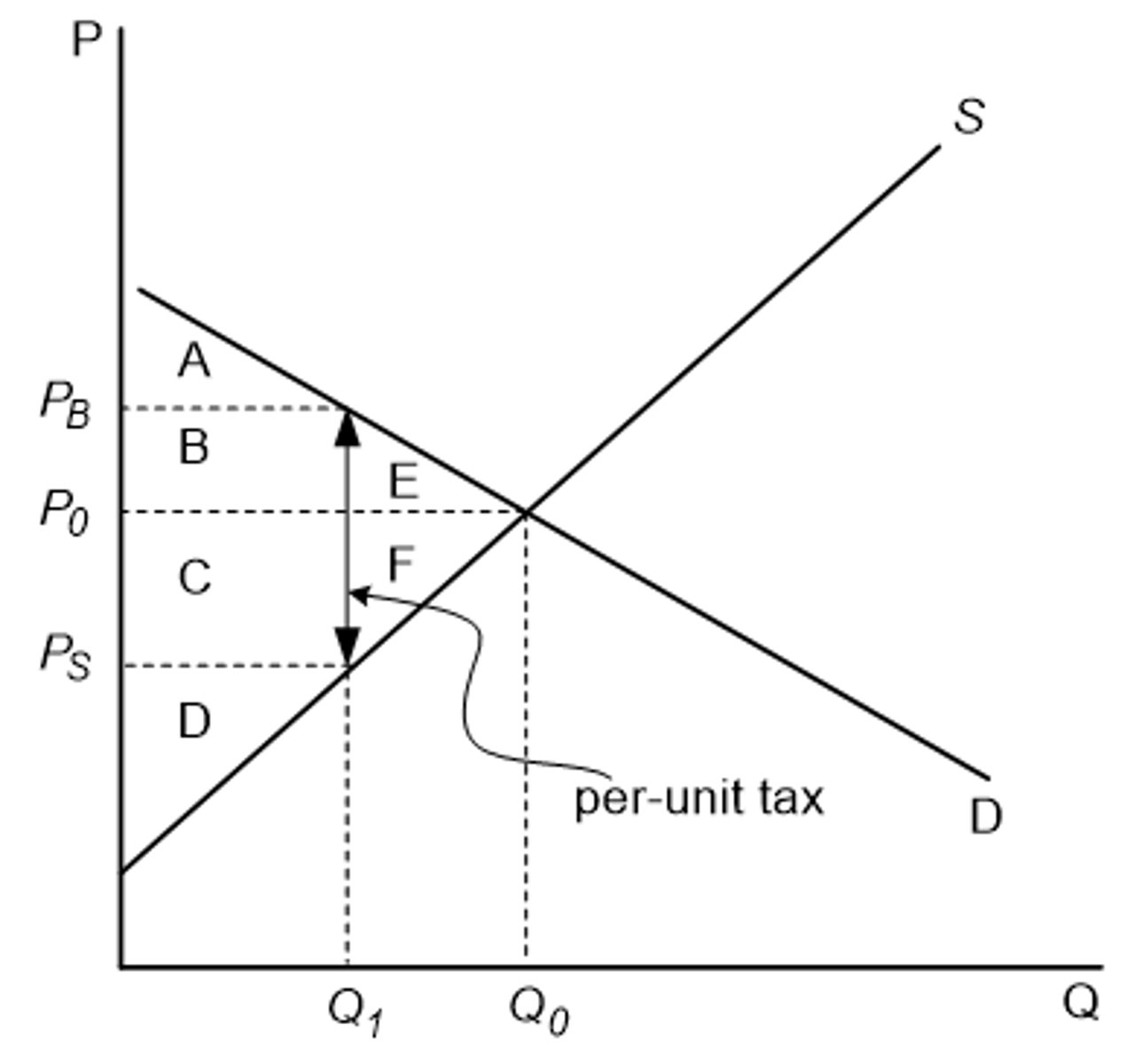

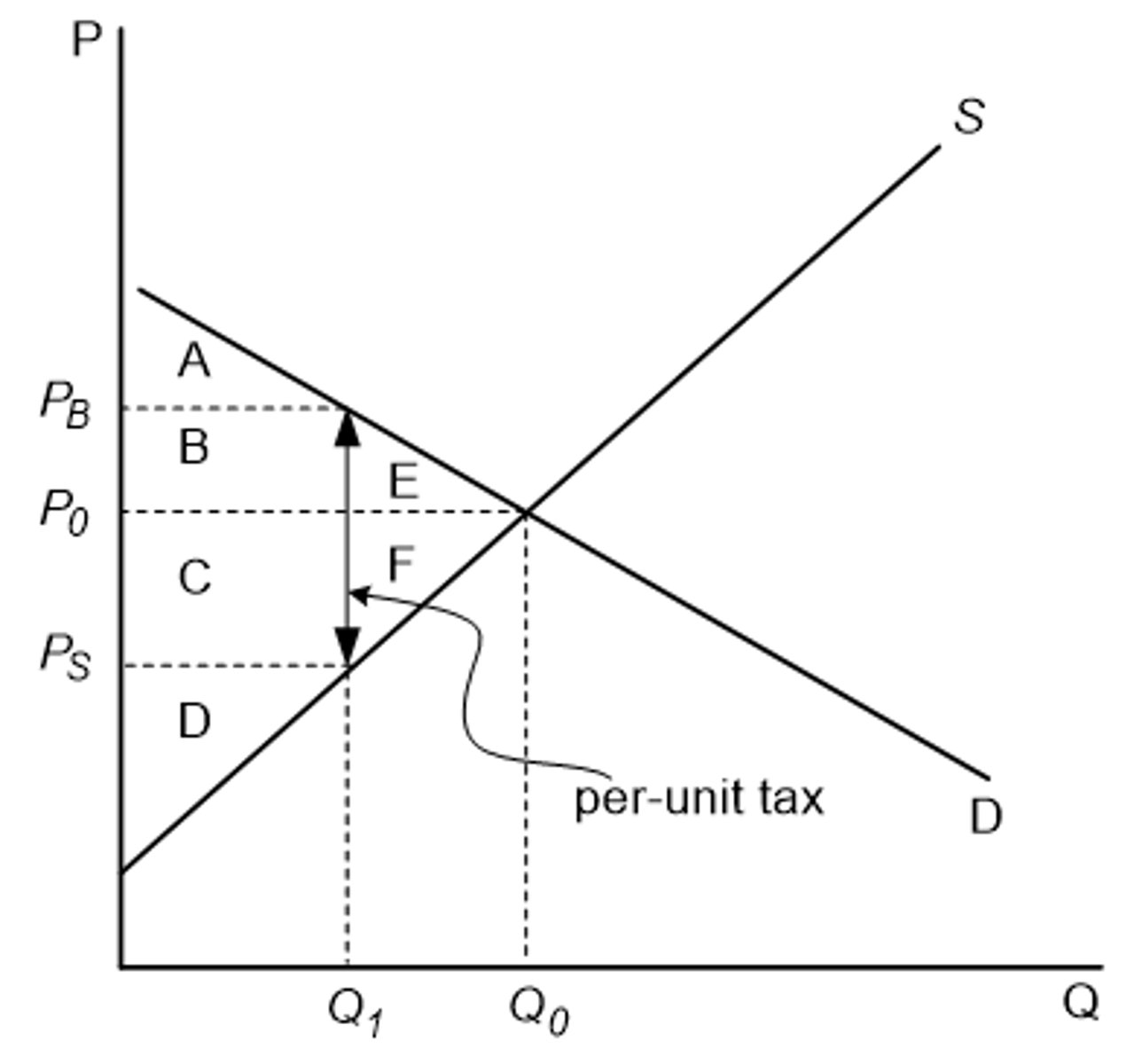

CS equals

A (on graph)

PS equals

F (on graph)

tax revenue equals

B+D (on graph)

total surplus equals

A+B+C+D+F (on graph)

dead weight loss

total surplus decline by C+E (on graph)

relatively inelastic

taller on graph

relatively elastic

wider on graph

the deadweight loss from a tax

reflects the inefficiency in resource allocation because the tax distorts the market

competitive markets

are efficient

maximize total surplus

"work" ... allocate

market failure

when the market fails to allocate society's resources efficiently

market power

a single buyer or seller has substantial influence on market price

externalities

the uncompensated impact of a market exchange on the well-being of a bystander

true

externalities can be negative or positive

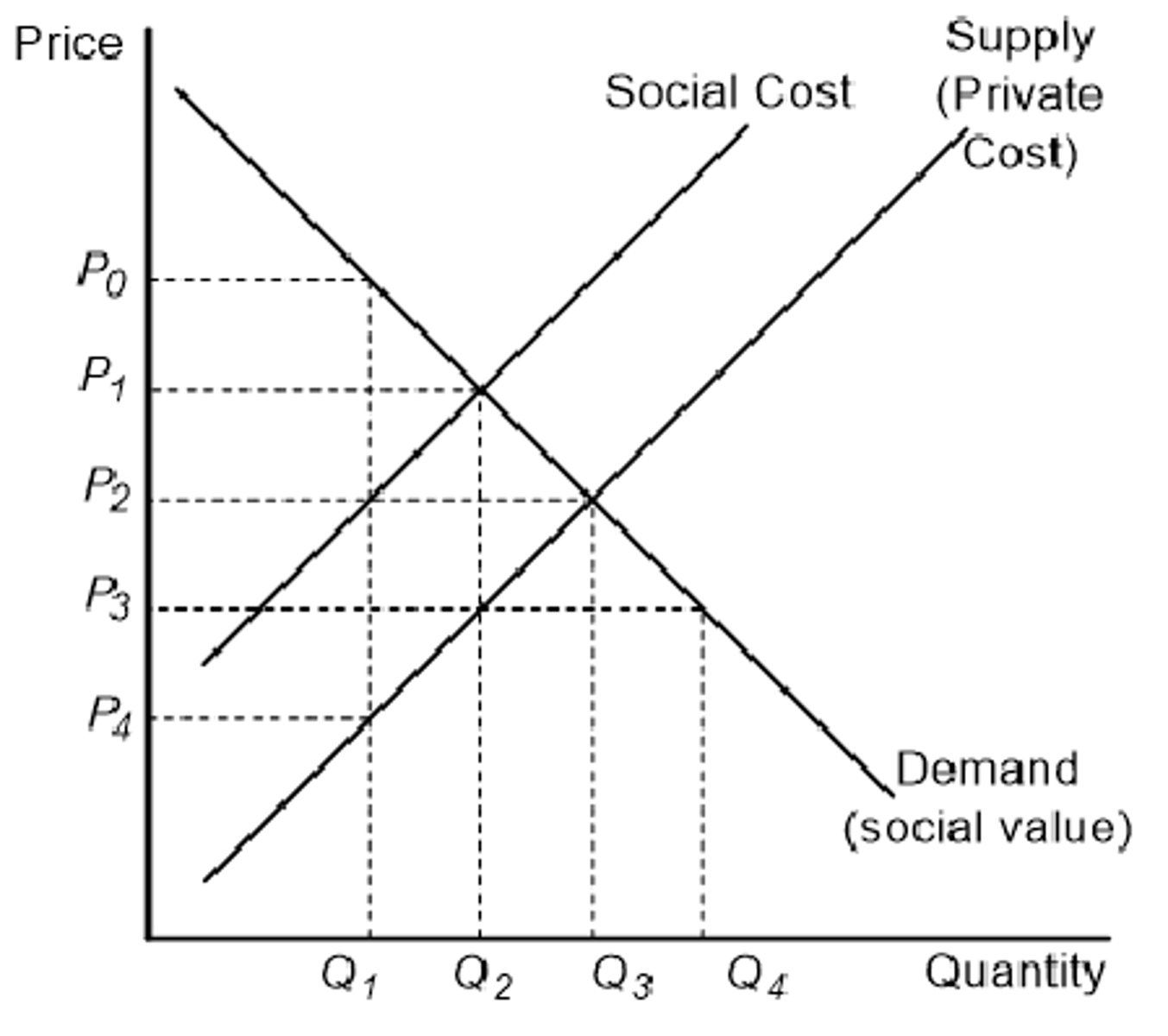

effect of externality if negative

market quantity larger than socially desirable

effects of externality if positive

market quantity smaller than socially desirable

internalizing the externality

altering incentives so that people consider the external effects of their actions

command and control policies

regulate behavior directly

limits on quantity of pollution emitted

technology requirements

require immunizations

market-based policies

provide incentives to private decision markets to change behavior

corrective taxes and subsidies

tradable pollution permits

corrective taxes and subsidies

•aligns private and social interests (incentives)

•ideal corrective tax = external cost

•ideal corrective subsidy = external benefit

•different from "other" taxes/subs which distort incentives/market

•results in more efficient market: No DWL

pollution permit system

permits are issued with a face "pollution value"

the coase theorem

if private parties can costlessly bargain over the allocation of resources, they can solve the externalities problem on their own

excludability

a person can be prevented from using a good

rivalry in consumption

on person's use diminishes other people's use

private decisions

--> inefficient outcomes

free rider

a person who receives the benefit of a good but doesn't pay for it

cost-benefit analysis

a study that compares the costs and benefits to society of providing a public good

imprecise, difficult

the tragedy of the commons

the private incentives (using the land for free) outweigh the social incentives (using carefully)

poverty

income below that needed for a "basic standard of living"

poverty line

the income one needs for a basic standard of living

poverty rate

the percentage of the population below the poverty line

poverty trap

when people are provided with food, shelter, healthcare, income, and other necessities, assistance may reduce their incentive to work

income inequality

compares the share of the total income (wealth) in society that different groups receive

how is income inequality measured

rank all houses income from lowest to highest

divide into 5 equally-sized groups (quintiles)

measure the percentage of income received by each quintile

lorenz curve

the cumulative share of income by quintile

a perfectly equal society would generate a straight line with a slope of 1

explanations for rising inequality

changing households (family structure)

changing labor markets

comparisons over time (e.g. fringe benefits)

globalizaiton

imperfect information

Buyer, seller, or both are uncertain of qualities of what is bought/sold

adverse selection

people with higher risks than "average" seek out the insurance to cover the risk

moral hazard problem

taking on risk, while believing you won't have to bear the burden of the consequences (cost) of the risk outcome

When something is free, resources are less likely to be allocated to its production.

true

A price ceiling is a legal minimum price on a good or service.

false

A binding price floor in the market for corn will cause the quantity

supplied to exceed the quantity demanded, thus creating a surplus of corn.

A binding price ceiling in a market creates a surplus.

false

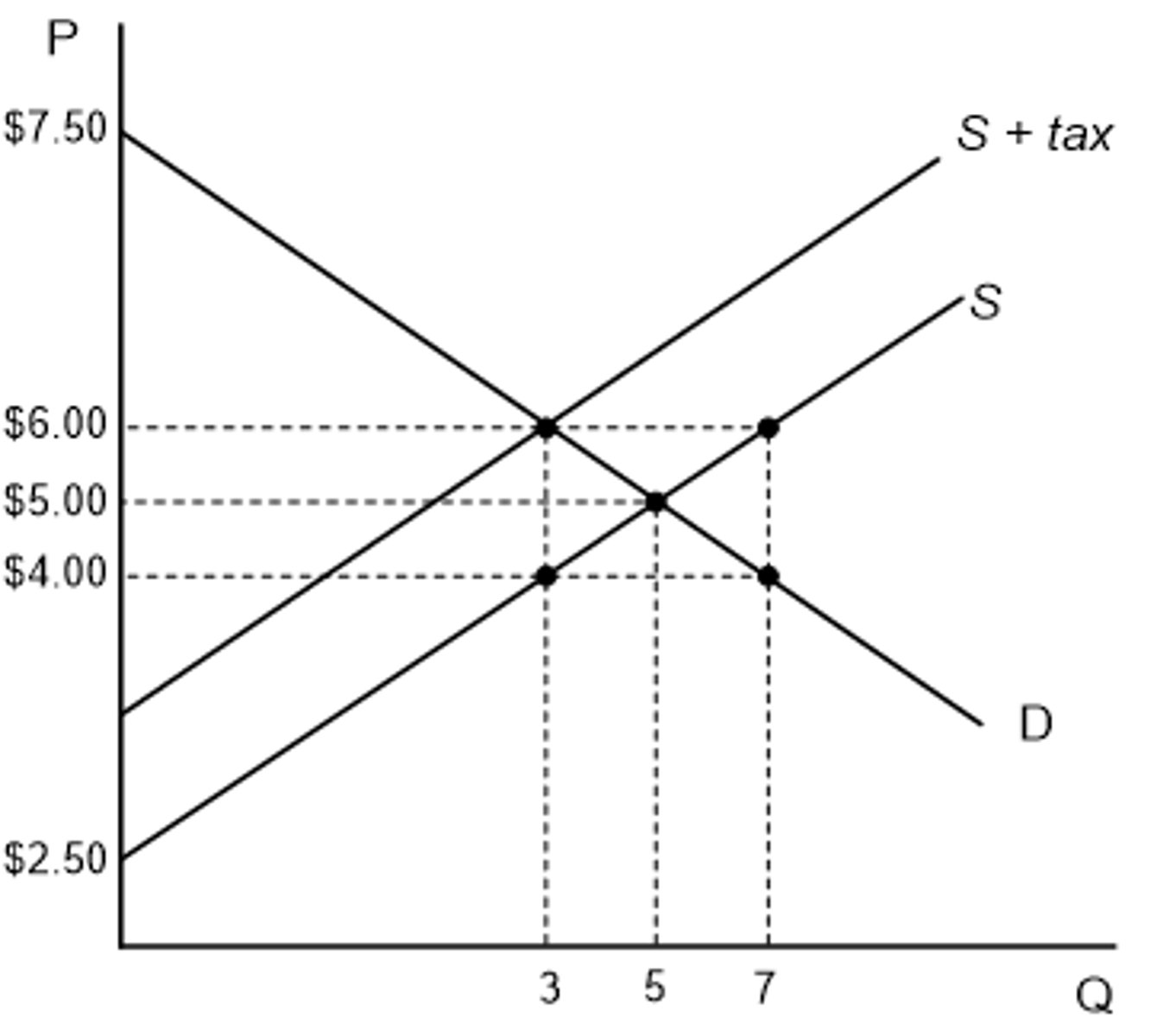

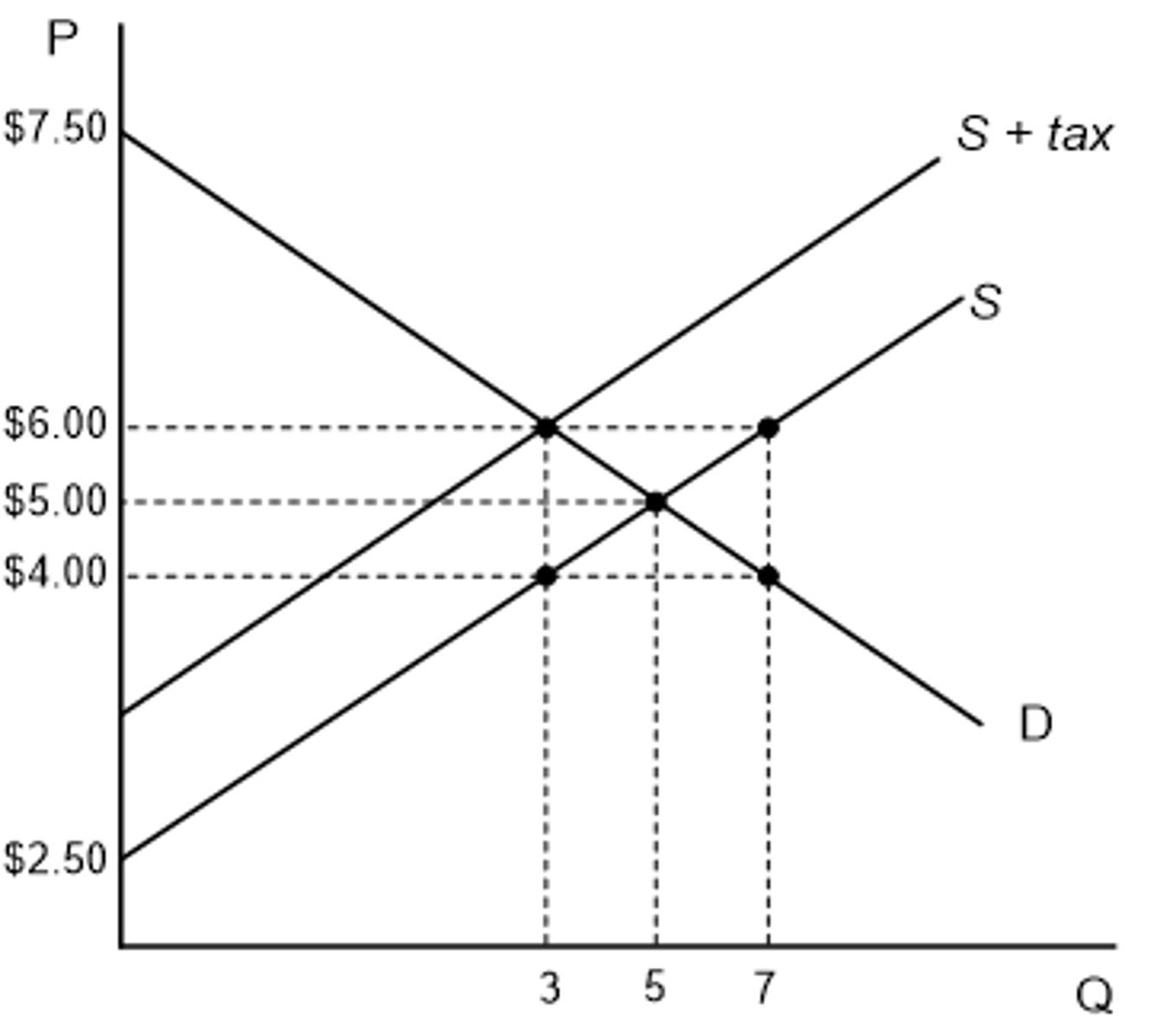

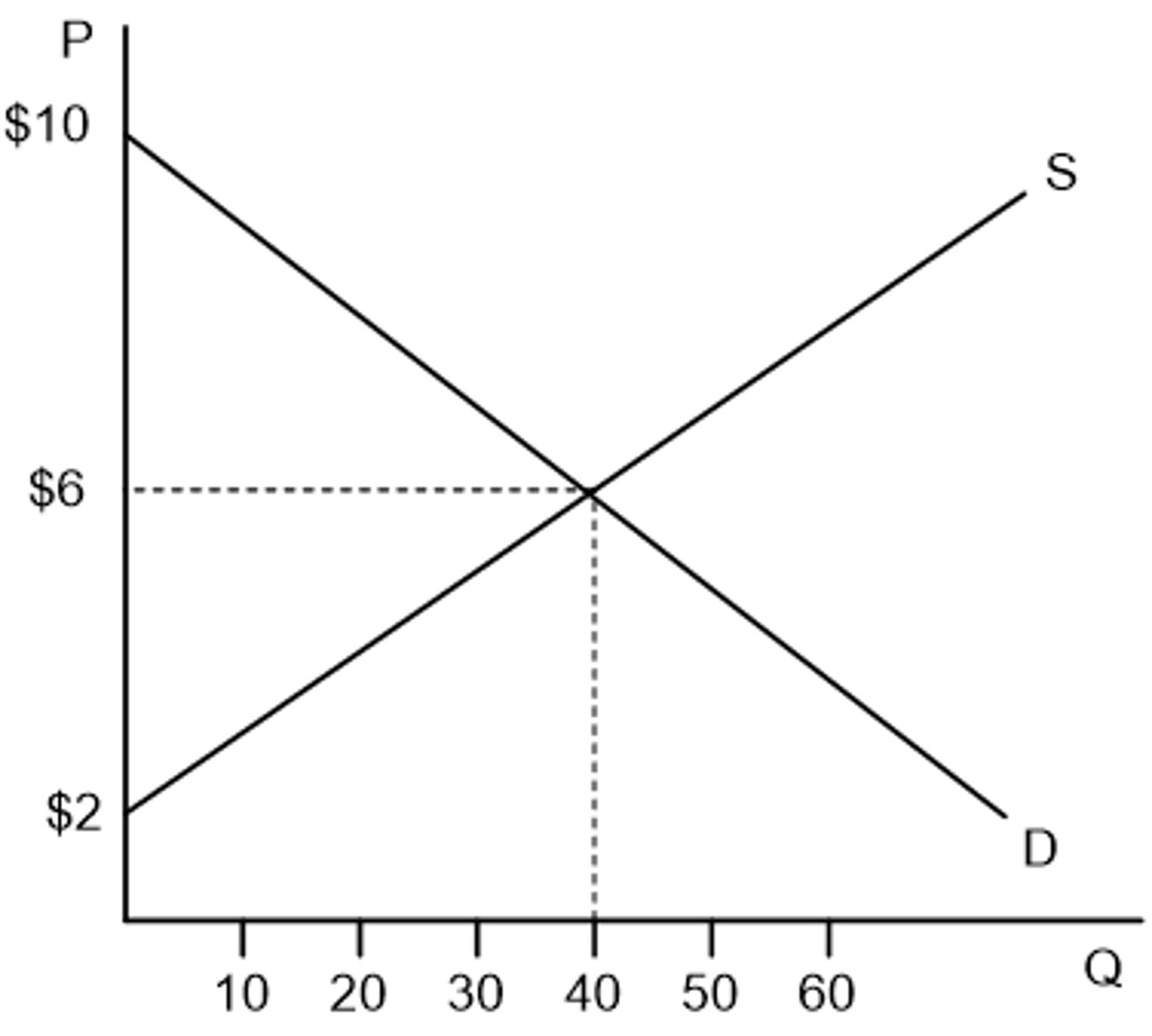

In the diagram, the amount of the tax placed in this market is

$2.00

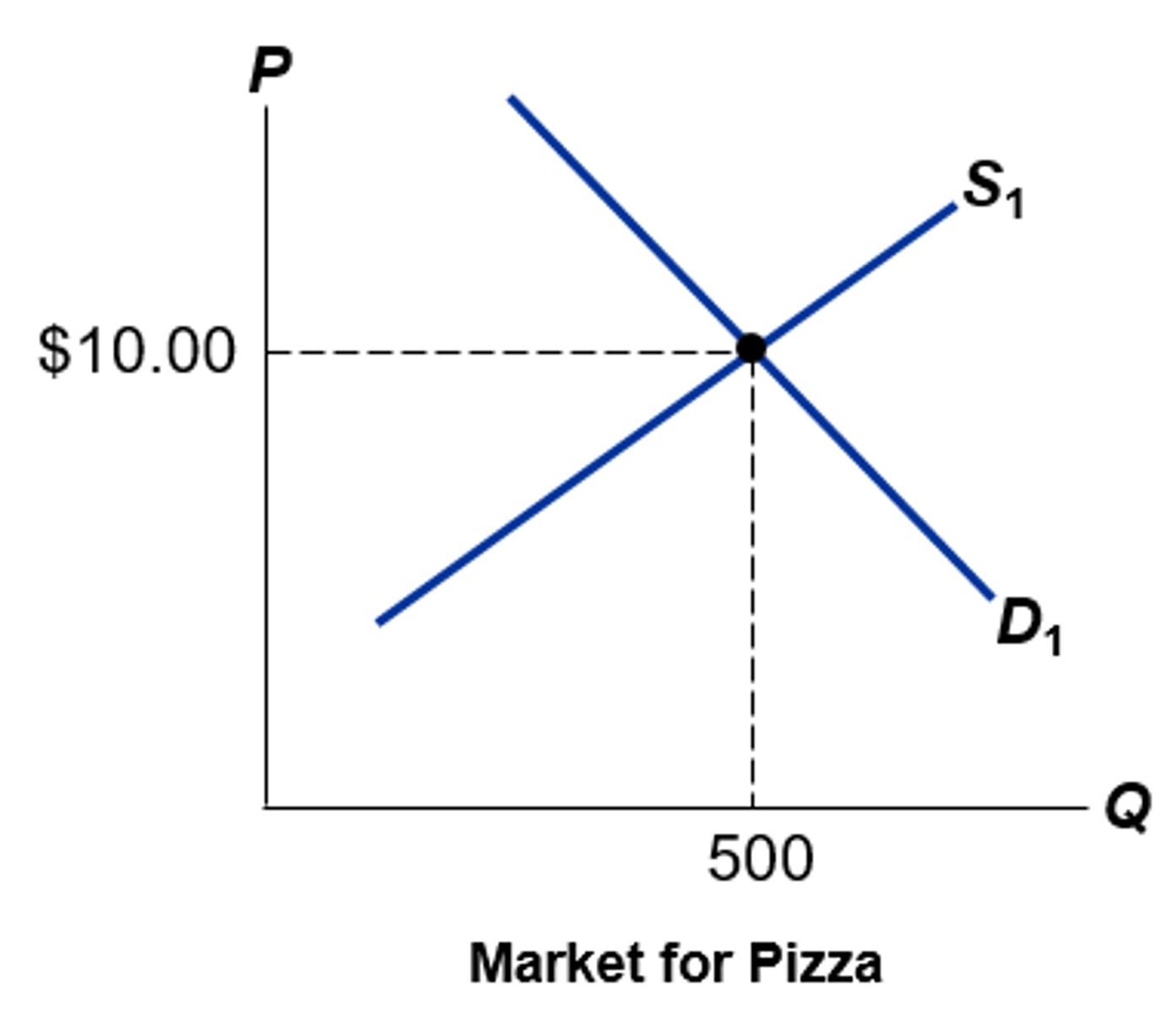

An effective price floor in this market must be

above $10.00

Assuming this graph is drawn to scale, which of the following is true regarding the burden of the tax in the market?

Sellers pay a larger share of the tax because supply is more inelastic than demand.

Suppose the government enacts a tax as shown. This policy will cause

buyers and sellers to each bear a $1 burden of the tax.

The tax incidence of items such as gasoline, tobacco, and alcohol tends to fall heavily on _____ because these goods have a _____.

Consumers; relatively inelastic demand

Refer to the graph below. Consumer surplus is __________________.

$80

Suppose you inherit an antique doll from your Great Aunt Sadie. The doll has a sentimental value of $100 to you. Jane is a collector who is willing to pay $800 for your doll. If you sell the doll to Jane for $600, your producer surplus is

$500

Private goods are excludable and nonrival.

false

Which of the following is not an example of the free rider problem?

a. Shannon catches a ride to a volleyball game with her friends but does not offer to pay for gas.

b. A student working on a group project puts forth minimal effort because the team will receive a team grade rather than individual grades.

c. Tim attends a neighborhood party with live music; the other neighbors have paid $5 each to give to the local band members, but Tim does not pay.

d. A park ranger takes a nap in his car because his boss is working hundreds of miles away and will never know about the nap.

d. A park ranger takes a nap in his car because his boss is working hundreds of miles away and will never know about the nap.

If a tax is placed on the good in this market, the tax revenue is the area

B+C

As the size of a tax increases, the size of the deadweight loss first increases, then decreases.

false

Timber companies are most likely to engage in over-logging of forests on

publicly owned land because it is a common resource.

In the case of public goods and externalities, markets

fail to allocate resources efficiently because property rights are not well established.

A public good is

a. consumable by additional users without reducing consumption by others.

b. over-produced by the market.

c. subject to rival in consumption.

d. all of these answers are correct.

consumable by additional users without reducing consumption by others.

The deep oil reserves in the Gulf of Mexico are an example of a common resource.

true

Which of the following illustrates a Tragedy of the Commons problem?

a. Commercial fishing companies over-fish Chilean sea bass.

b. Cost-benefit analysis is difficult to conduct because people often undervalue public goods.

c. People who attend local fireworks displays do not always pay for them.

d. Bakeries emit enticing aromas, which may encourage people to overeat.

a. Commercial fishing companies over-fish Chilean sea bass.

If a tax is place on the good in this market, the producer surplus after the tax is the area

D

A steel mill has 10 tradable pollution permits. Each permit allows for one unit of pollution and has a market value of $1,000. With new production technology, the firm can eliminate the first unit of its pollution at a cost of $750 and the second unit at a cost of $950. The firm can eliminate the remaining 8 units of pollution at a cost of $1,100 each. Assuming this firm wants to minimize its costs, it should

sell 2 permits & invest in new technology.

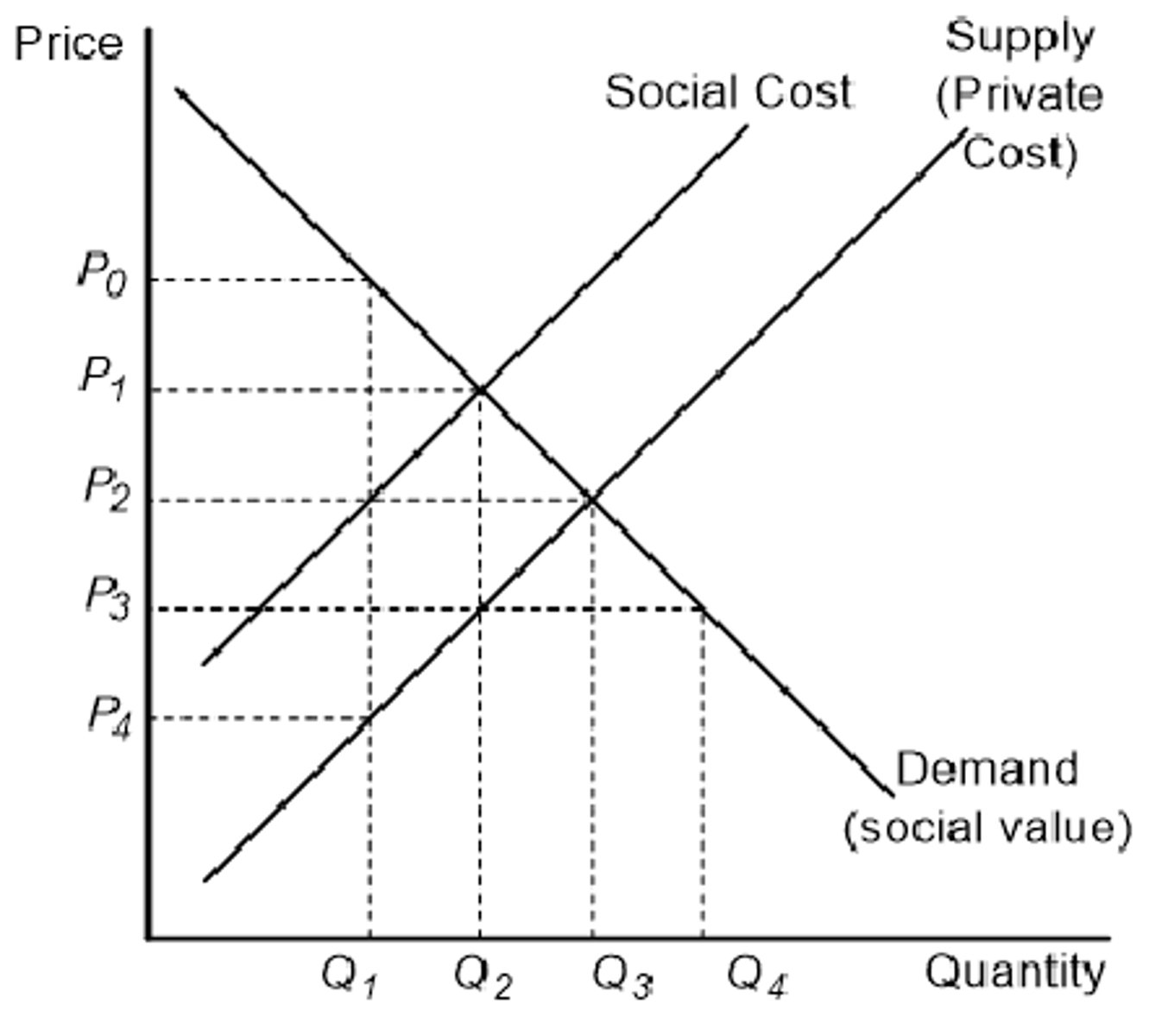

Refer to the figure. The socially optimal level of output is

Q2

Externalities can be negative or positive.

true

In the figure below, the marginal external costs of production are measured by

P1 - P3

If a positive externality exists in the market for flu shots, the private market equilibrium occurs at a price that is

too low and a quantity that is too low in comparison to the socially optimal equilibrium.

When a corrective tax is placed on a market, there is no dead weight loss from the tax.

true

Lack of excludability is the primary cause of the problem of common (open-access) resources.

true

The most efficient pollution control system would ensure that

those polluters with lowest cost of pollution abatement reduce their pollution most.

The poverty rate measures the percentage of the population living below the poverty line.

true

Typically, wealth inequality is ____________________________ income inequality.

greater than

The official poverty line in the U.S. is changed regularly to reflect changes in household expectations.

false

Global poverty rates for those living in extreme poverty around the world have been

falling despite the fact that global population is increasing.

Which statement about the Supplemental Poverty Measure (SPM) is NOT true.

a. The SPM is always lower than the official poverty rate.

b. The SPM takes into consideration expenses such as childcare and medicine.

c. The SPM considers all wages and salaries in its income calculation.

d. The SPM would add energy assistance when calculating the resources available to meet the needs of a family

a. The SPM is always lower than the official poverty rate.

The official poverty rate

was developed by an economist in the early 1960s.

The __________________________ presents inequality data in populations.

Lorenz Curve