Inflation

1/55

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

56 Terms

Consumer Price Level (CPI)

a measure of the cost of living during a particular period

measures:

the cost of a standard basket of goods and services in a given year

relative to the cost of the same basket of goods and services in the base year

base year changes periodically

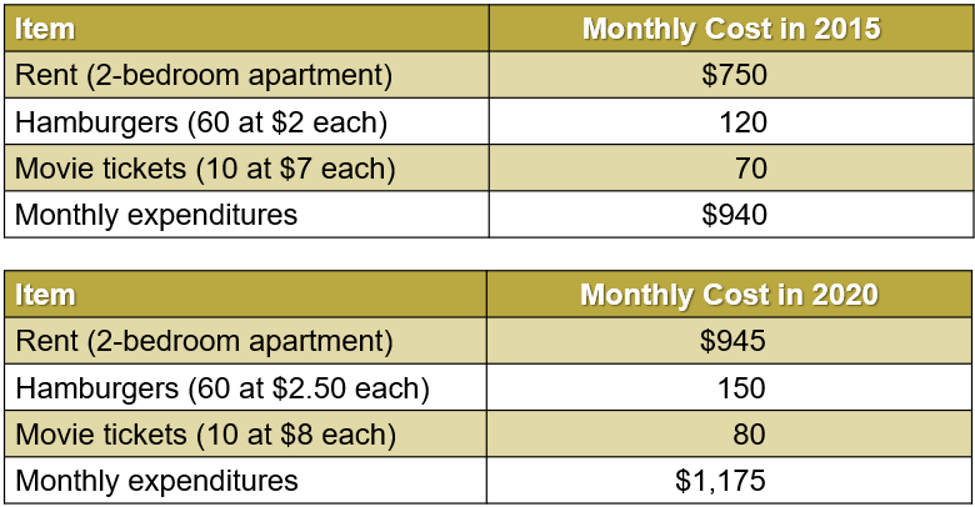

Calculating CPI

CPI = 1375/1060 = 1.30

Price Index

measures the average price of a given quantity of goods and services relative to the price of the same goods and services in a base year

Inflation

measures how fast the average price level is changing over time

Rate of Inflation

the annual percentage rate of change in the price level (as measured, for example, by the CPI)

Deflation

a situation in which most goods or services are falling over time, so that inflation is negative

Expressing a Nominal Quantity in Real Terms

divide it by its price index

Real Wages

the wage paid to the worker measured in terms of purchasing power

for any given period is calculated by dividing the nominal wage by the CPI for that period

Indexing

increases a nominal quantity each period by the percentage increase in a specified price index

prevents the purchasing power of the nominal quantity from being eroded by inflation

automatically adjusts certain values, such as Social Security payments, by the amount of inflation

if prices increase 3% in a given year, the Social Security recipients receive 3% more

no action by Congress required

sometimes included in labour contracts

Minimum Wage

congress sets it in nominal terms

Publicised debate results in periodic increases

Indexing would be simpler and less controversial

Politicians appear to benefit from the debate

Increasing minimum wage can contribute to inflation

Companies pass on their increased labour costs to consumers in the form of higher prices

Tight Labour Market

a situation where there is a low level of unemployment and a high level of job vacancies, which means that there are many job opportunities and relatively few workers to fill them in

employers have to compete for workers, which can push up wages and salaries

What can a Tight Labour Market Lead to?

increase in labour costs can be passed onto consumers in the form of higher prices for goods and services leading to inflation

increased consumer spending as workers have more disposable income

this increased demand can put upwards pressure on prices, leading to inflation

What is a Tight Labour Market a Sign of?

a strong economy, but if left unchecked can also lead to higher inflation and potential wage-inflationary spirals

Why is it a Concern that CPI may Overstate Inflation?

can lead to unnecessarily increased government spending, higher debt repayments on inflation-indexed government bonds, higher public wages due to indexation, higher benefits

Why might CPI Overstate the Cost of Living?

it’s based on a fixed basket of goods and services, which doesn’t reflect substitution or changes in consumption

What Limitation does CPI have in Terms of Product Quality?

doesn’t fully account for changes in quality over time

CPI Quality Adjustment Bias

its measurement of price changes but not quality changes

adjusting for quality is difficult

large number of goods

subjective differences

incorporating new goods is difficult

no base price for this year’s new goods

CPI Substitution Bias

Uses a fixed basket of goods and services

When the price of a good increases, consumers buy less and substitute other goods

Failing to account for substitution overstates inflation and CPI

What does the GDP Price Deflator Measure?

changes in prices for all goods and services produced in an economy

Why is GDP Price Deflator Different from the CPI?

it’s more comprehensive because it isn’t based on a fixed basket of goods

How does the GDP Price Deflator Correct for Inflation in GDP?

by using a base year and comparing current prices to that base year

How can Inflation Distort Perceptions of Economic Growth?

it can make an economy appear to grow in dollar terms even if real output hasn’t increased

GDP Price Deflator Formula

(Nominal GDP/Real GDP) x 100

captures how much of the nominal GDP increase is due to price changes (inflation/deflation) vs how much is due to actual increases in the quantity of goods and services produced

Price Level

a measure of the overall level of prices at a particular point inn time as measured by a price index such as the CPI

Relative Price

The price of a specific good/service in comparison to the prices of other goods and services

Can change markedly without corresponding changes in inflation

Inflation distorts relative prices

Consumer decisions are distorted, and markets are less able to allocate resources to their best use

What does an Increasing Relative Price do?

encourages consumers to save money on expensive products and search for their substitutes, while companies try to bring more products to the market to gain profit

The Costs of Inflation

Changes in relative price don’t necessarily imply a significant amount of inflation

Inflation can be high without affecting relative prices

To counteract relative price changes, government policy would have to affect the market for specific goods

To counteract inflation, the government must use monetary and fiscal policy

Distortion Caused by Taxes

Taxes that aren’t indexed distort the tax incentives for people to work, save and invest

Lower savings and investment means lower economic growth - a real cost of inflation

The income tax treats the nominal interest earned on savings as income, even though part of the nominal interest rate merely compensates for inflation

The after-tax real interest rate falls, making saving less attractive

Bracket Creep

inflation can push individuals into higher tax brackets even if their real income hasn’t increased

What Happens when Inflation Increases the Cost of Cash?

Manage cash balances to limit losses

More frequent, smaller withdrawals cost consumers and businesses time, travel - a real cost of inflation

Banks process more transactions, increasing costs - another real cost of inflation

Costs of Managing Cash

called ‘shoe-leather’ costs, referring to the cost of frequent trips to the bank

Unexpected Redistribution of Wealth

caused by unexpected inflation which confuses incentives

What happens if Workers Salaries aren’t Indexed and Inflation is Higher than Anticipated?

salaries lose purchasing power

employers gain at the expense of workers

How does Unexpectedly High Inflation benefit Borrowers at the Expense of Lenders?

they repay with dollars worth less than anticipated

Menu Costs

Costs of adjusting prices

During inflation times, it’s necessary to update price lists and other posted prices

This is a resource-consuming process that takes away from other productive activities

Prices are sticky and adjust with a delay; don't always move in line with changing economic conditions and outside market forces

What does Higher Interest Rates mean for Households and Firms

they spend more on interest debt payments, leaving them with less money to spend on anything else

When given a Nominal Interest Rate, the Higher the Inflation Rate…

the lower the real inflation rate

Real Interest Rate

the annual percentage increase in the purchasing power of financial assets

Nominal Interest Rate

the annual percentage increase in the dollar value of an asset

most commonly stated rates

Inflation-Protected Bonds

pay a real rate of interest plus the inflation rate

The Fisher Effect

the tendency for nominal interest rates to be high when inflation is high and low when inflation is low

The Fisher Equation

Real interest rate = nominal interest rate - inflation

R = i - 𝜋

What Happens when the Government Increases Spending?

it increases demand for goods and services, which can lead to higher prices (demand-pull inflation)

What is Demand-Pull Inflation?

inflation caused when demand exceeds the supply of goods and services, leading to price increases

How can the Government Finance its Spending?

through borrowing or ‘printing money’, which increases the money supply and borrowing costs

What is Monetary Inflation?

inflation resulting from an increase in the money supply, causing the value of money to decline

How do Transfer Payments like Welfare Benefits impact Inflation?

they increase demand without increasing supply, potentially leading to higher inflation

How can Government Spending Help Reduce Inflationary Pressures?

by investing in infrastructure and productive activities that increase the supply of goods and services

How does Inflation impact Government Budget?

can limit borrowing ability and increase the budget deficit

How does Inflation affect Government Revenue?

can reduce it and other income sources, leading to potential spending cuts or more borrowing

What Fiscal Pressure arises from Increased Welfare Payments Indexed to Inflation?

increases spending obligations, placing upward pressure on the budget unless taxes are raised

What is Stagflation?

a phenomenon in which an economy experiences both high inflation and stagnant economic growth at the same time

What Typically causes Stagflation?

supply-side shocks to the economy, such as increase in the price of oil or other important inputs, which push up prices while also reducing economic growth and increasing unemployment

Why is Stagflation difficult to address with Monetary Policy?

traditional tools like cutting interest rates are less effective because prices are already rising

How can Fiscal Policy worsen Stagflation?

increasing government spending can raise inflation further, worsening the problem

What is the challenge in reversing High Consumer Prices during Stagflation?

government must reduce demand carefully to lower inflation without triggering a recession or worsening Stagflation