Economics 1.4 - Government intervention (Previous stuff but in more detail)

1/12

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

13 Terms

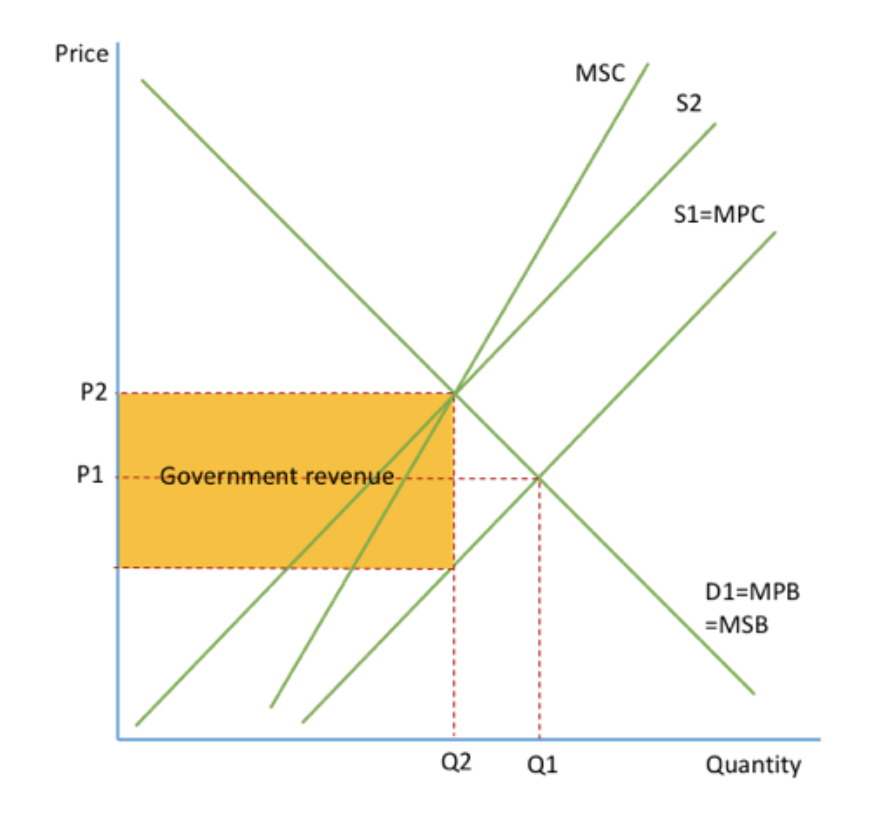

How does the government intervene against externalities in the market using taxation?

When a good has a negative externality, the government can introduce indirect taxation to cause a fall in supply and increase in costs, shifting the supply curve to the equilibrium and social optimum point.

What are the advantages and disadvantages of using taxation for government intervention?

+ Internalises the externality - The market now produces at the social equilibrium and social welfare is maximised.

+ Raises government revenue which could help the externality in other ways, such as through education.

- Difficult to know the size of the externality - Government suffers from imperfect information when setting the tax. Too high and it could lead to negative effects on the producer as well as more dependency on black markets, too low and not enough effect.

- Could lead to a black market.

How does the government intervene against externalities in the market using subsidies?

To solve positive externalities, subsidies are introduced to lower the price. Can also be used to fix information gap. Means that the supply is at the equilibrium due to the increased consumption, meaning social welfare is maximised and the market allocates resources effectively.

Advantages and disadvantages of using subsidies for government intervention?

+ Society reaches the social optimum output and welfare is maximised.

+ Can have other positive impacts, such as bringing equality.

- High opportunity cost.

- Difficult to know the exact size of the externality and therefore the size of the subsidy. Too high leads to inefficiency, too low and could lead to welfare loss.

What is a maximum price and how does it deal with positive externalities?

A maximum price is a legally imposed price for a good that suppliers can’t charge above, set below the socially optimum price. Imposed on positive externalities to ensure they are affordable and are therefore consumed enough. Shaded area represents the excess demand.

What is a minimum price and how does it deal with negative externalities?

A minimum price is a legally imposed price at which the price of a good can’t go below. Can be set on goods with negative externalities above the social optimum point to discourage consumption. Leads to excess supply, as shown by the shaded area.

Advantages and disadvantages of maximum and minimum prices.

+ A max price ensures goods are affordable, a min price producers get a fair price. Both are able to reduce poverty and increase equity.

+ Can be set at MSB=MSC (Allocative efficiency), so increases social welfare.

- Distortion of price signals which causes excess supply/demand. Excess demand will lead to question on how to allocate goods, excess supply leads to question on what to do with the surplus.

- Hard to know where to set the prices, hard to know the size of the externality.

- Both can lead to black markets.

How do tradable pollution permits deal with negative externality in production?

A pollution permit allows the owner to pollute up to a specific amount and the government control how many there are so limits the max amount of pollution. Companies have to buy permits, which could lead to companies using greener technology to avoid this in general. Companies exceeding their limit face legal action. As there is a fixed supply of permits, increased demand increases the prices, so companies have more incentive to cut emissions using green technology.

Advantages and disadvantages of tradable pollution permits

+ Government controls the number of permits, guarantees fall in pollution to the target the government wants. Maximises social welfare.

+ Governments can raise money selling permits and fining firms exceeding the limit.

- Expensive to monitor, but will only work if monitored well. Also needs to impose fines large enough to ensure firms follow regulation.

- Difficult to know how many permits the government should allow.

What is provision of public goods as a method of intervention, and what are the advantages and disadvantages?

The government provides public goods through taxation. Similarly, the government can provide merit goods.

+ This corrects market failure by providing important goods which otherwise wouldn’t be, improves social welfare.

+ Can help bring equality, ensuring everyone has access to basic goods.

- Expensive and has a high opportunity cost. Also has administration costs.

- The government may be inefficient at production due to having no incentive to cut costs.

What is provision of information as a method of intervention, and what are the advantages and disadvantages?

When there is asymmetric information, the government provides this to allow people to make informed decisions. Also force companies to provide information.

+ Helps consumers act rationally, which allows the market to work properly through efficient allocation of resources.

- Can be expensive and has a high opportunity cost.

- The government themselves may not have all the information aswell.

What is regulation as a method of intervention, and what are the advantages and disadvantages?

Governments are able to impose laws and caps to ensure that levels are set where MSB=MSC (Allocative efficiency), as well as ensuring companies provide full information on products. Can also introduce regulatory bodies to ensure firms follow regulations and don’t exploit consumers or take advantage of their market position.

+ Can prevent exploitation of consumers and ensure they are fully informed. Helps overcome market failure by allowing consumers to make rational decisions, maximising social welfare.

- Laws may be expensive for governments to monitor, opportunity cost.

- Can suffer from regulatory capture.

What are the 3 types of government failure?

Distortion of price signals - Occurs when market prices deviate from their natural equilibrium and fail to accurately reflect the true interplay of supply and demand, leading to misallocation of resources and inefficient outcomes. Examples are min/max prices. By the government intervening in the market, the market mechanism is distorted.

Unintended consequences - Some interventions cause effects which the government didn’t intend to happen. Consumers and producers may react to policies in unexpected ways and it therefore won’t have the effect it should. For example, Min wage laws leading to job losses.

Excessive adminstration costs - Excessive administrative costs refer to situations where a significant portion of allocated funds are spent on managing and overseeing a program or policy, rather than on its intended objectives. This can lead to the policy or program becoming less effective and potentially causing a net welfare loss.

Information gaps - Any decisions the government makes must be based on data, but in some situations information may be limited. Cost and benefit forecasts of investment often go wrong for example, and so the government invest in a system where the costs are higher than the benefit. It is impractical and usually impossible for the government to get every piece of information they need.