business finance unit 3.7, 3.8, 3.9

1/36

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

37 Terms

cash definition

money that comes into the firm through sales, borrowing and investment

cash flow definition

the amount of money that flows in and out of the business over a given period of time

cash inflow definition

money received by business

cash outflow definition

money paid out by the business over a period of time

difference between profit and cash flow

businesses may make sales on credit, they will have made profit but the cash flow position at that time will differ

net cash flow calculation

= total cash inflow - total cash outflow

first problem with differentiating profit and cash flow and its causes

insolvency

business can be profitable but have little or no cash which can be caused by allowing a long credit period, paying suppliers too early and purchasing too much stock with cash

second problem with differentiating profit and cash flow

a business can have a positive cash flow but be unprofitable as cash could be sourced from bank loans, gained from the sale of fixed assets or obtained from shareholders funds

cash flow forecast definition

future predictions of a firm’s cash inflows and outflows over a given time period

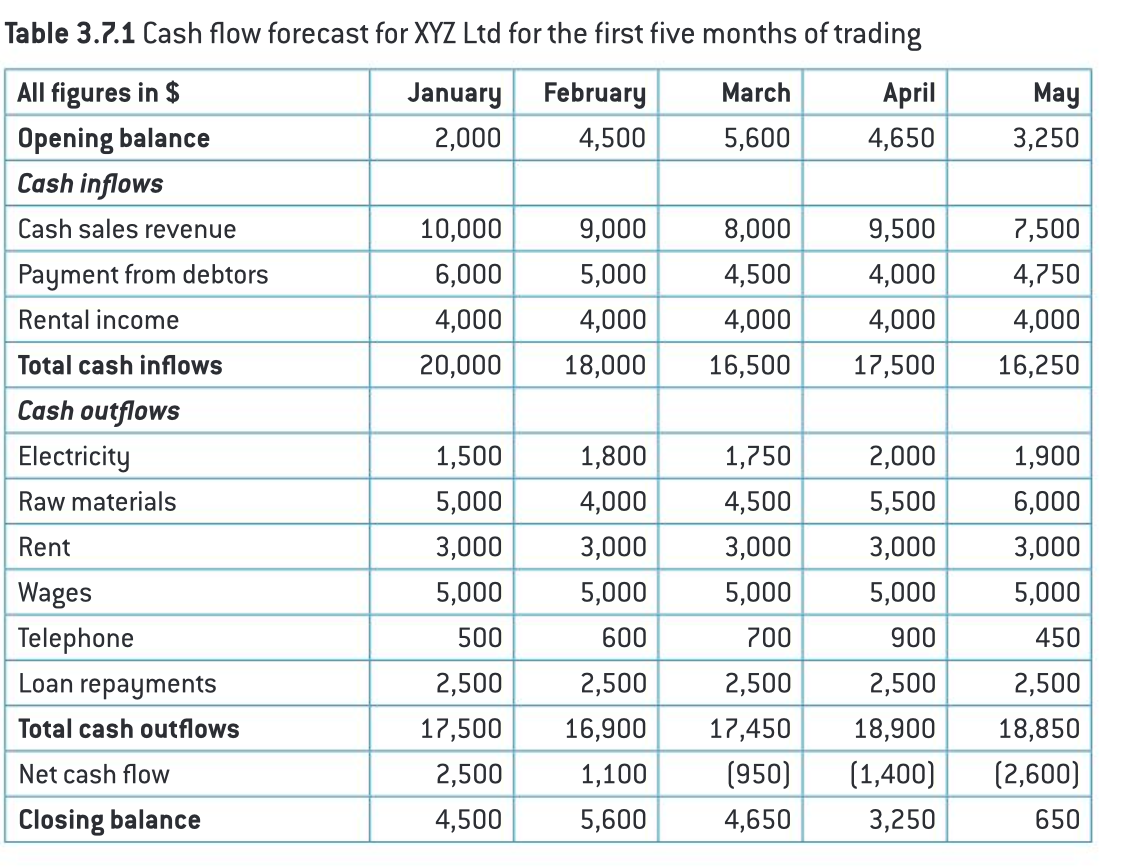

cash flow forecast first columns

opening balance

total cash inflow

total cash outflow

net cash flow

closing balance

closing balance calculation

= opening balance + net cash flow

advantages of using a cash flow forecast

see where unnecessary costs can be cut

set goals and targets for future

useful to structure budgets

can determine risks

warning of cash shortages

disadvantages of using a cash flow forecast

may be inaccurate, cannot predict unexpected changes in economy e.g. pandemic, bankruptcy

competitor may join the market

poor market research can lead to false sales forecasting

may have demotivated employees

ways to improve cash inflows

insist on customers paying with cash

offer discounts to encourage debtors to pay early

diversify its product offering

ways to reduce cash outflows

negotiate with suppliers or creditors to delay payment

→ however, it is time consuming

purchase of fixed assets can be delayed

→ however, this may lead to decreased efficiency

decrease specific expenses e.g. advertising costs

→ however, this may lower future demand

source cheaper supplies

→ however, the quality of products may be worse

relationship between investment, profit and cash flow investment

start up → has high investment, no profit and negative cash flow

growing firm → still has high investment, low profit and positive but low cash flow

established firm → minimal investment, high profit and positive cash flow

additional finance resources to improve cash flow

sales of assets

bank overdrafts

sale and leaseback

grants and subsidies

three methods of investment appraisal

payback period, average rate of return and net present value

payback period definition

estimates the length of time required for an investment project to pay back its initial cost from its net cash flows

payback period calculation

= initial investment cost/annual cash flow from investment

advantages of using payback period

simple and fast to calculate

useful for rapidly changing industries e.g. technology

helps firms with cash flow problems

disadvantages of using payback period

ignores the profitability of an investment

could be effected by unexpected external changes in demand

payback period calculation month

= extra cash inflow required / annual cash flow in year when investment is covered x 12 months

average rate of return (ARR) definition

measures the annual net return of an investment as a percentage of its capital cost, assessing its profitability

average rate of return (ARR) calculation

= net returns per annum / capital cost = (total returns - capital cost) / years of usage / capital cost x 100

advantages of using average rate of return (ARR)

shows profitability of investment project

makes use of all the cash flows in a business, unlike the payback period

allows for easy comparisons with other competing projects to better allocate funds

disadvantages of using average rate of return (ARR)

forecasting errors are likely because of longer time period

doesn’t consider the timing of cash inflows

net present value definition

the difference in the sum of present values of future cash inflows and the original cost of investment

net present value calculation

= total present values - original cost of investment

advantages of using net present value

opportunity cost and time value is taken into consideration

all cash flows including their timing are included

disadvantages of using net present value

more complicated to calculate

may be affected by inaccurate interest or inflation rate predictions

figures may be overestimated due to changes in external environment

budget

a quantitative financial plan that estimates the revenue and expenditure over a specified future time period

the difference between cost and profit centres

cost centre:

a section of a business where costs are incurred and recorded

profit centre:

a section of a business where both costs and revenues are identified and recorded

→ profit centres allow comparisons to be made to judge the performance of a firm in various sectors

the roles of cost and profit centres

aiding decision-making

better accountability for poor performance

tracking problem areas

increasing motivation (providing incentives)

benchmarking (help find areas that are most or least efficient)

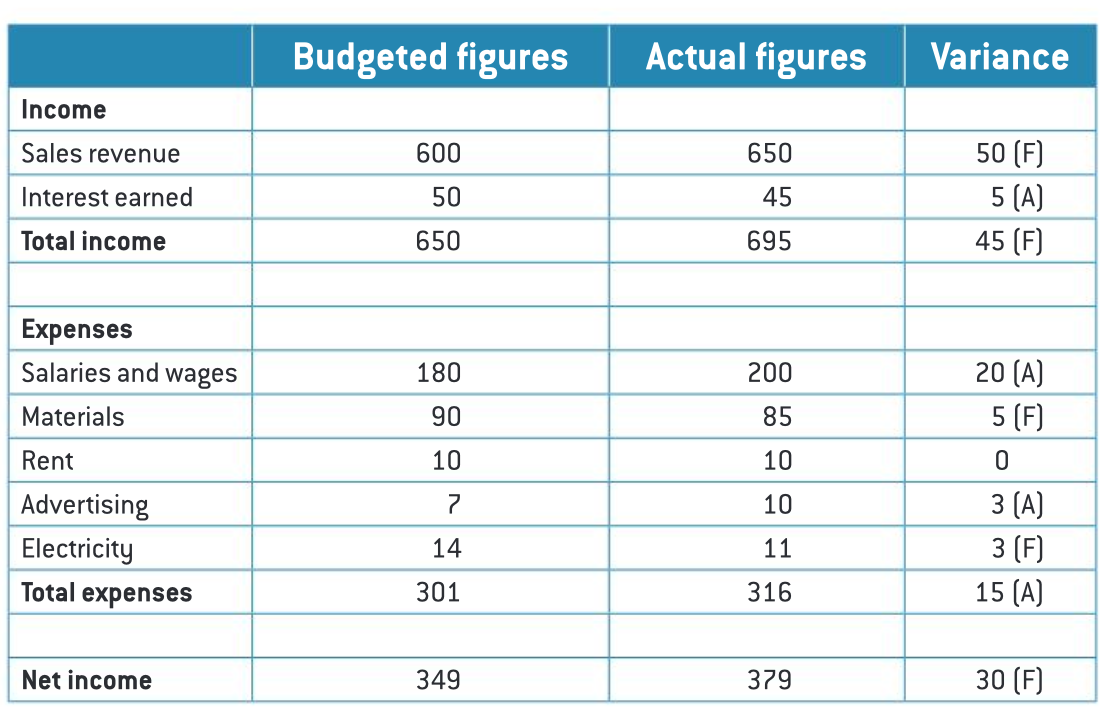

constructing a budget columns

budgeted figures actual figures variance

income

total income

expenses

total expenses

net income

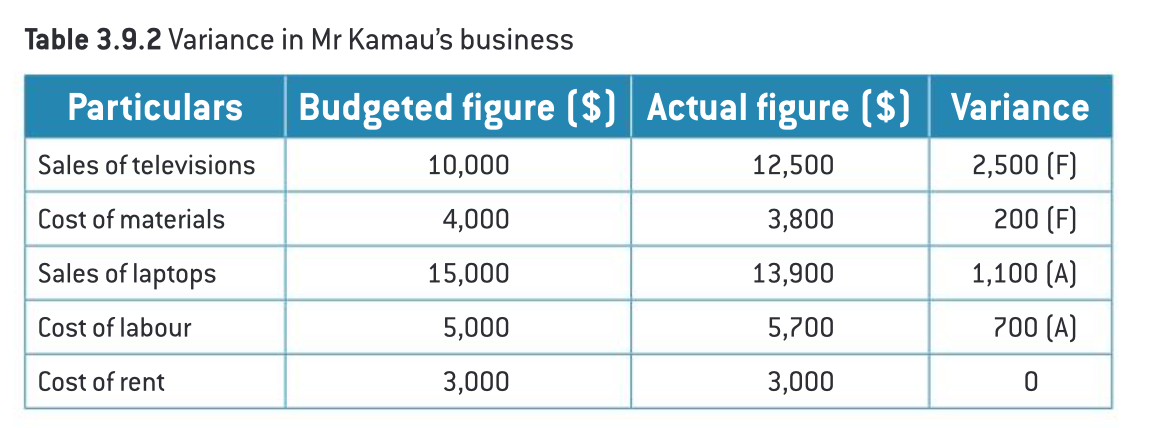

variance

the difference between the budgeted figure and the actual figure

favourable variance: when the difference between the budgeted and actual figure is financially beneficial to the firm

adverse variance: when the difference between the budgeted and actual figure is financially costly to the firm

benefits of budgets and variances in decision making

better planning

better resource allocation

increasing motivation

improving coordination

better control revenue and expenditure

allows comparison between actual performance and budgeted performance

helps detect deviations

allows for the creation of SMART goals