ACCT 212 Exam 2

1/51

Earn XP

Description and Tags

Chapters 1-6

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

52 Terms

process operating

mass production of similar products in a flow of sequential processes.

process costing system

measures costs per equivalent unit at period-end. Each process has a separate WIP inventory account.

conversion costs

direct + Applied factory overhead

equivalent units

number of whole units that could have been. started and compelted given the costs incurred. Compute separately for dircet materials and conversion costs.

weigthed average

combines units and costs across two periods in computing EUP

Weighterd average computations

EUP= Equivalent units completed and transferred out + Equivalent units in ending work in process

Cost per EUP (WA)

costs of beg. WIP + Costs added this period / Equivalent units of production

FIFO

based on current-period production activity

FIFO Computations

EUP = Equivalent units to complete beg. WIP + Units started and completed + Equivalent units in ending WIP

FIFO Comp.

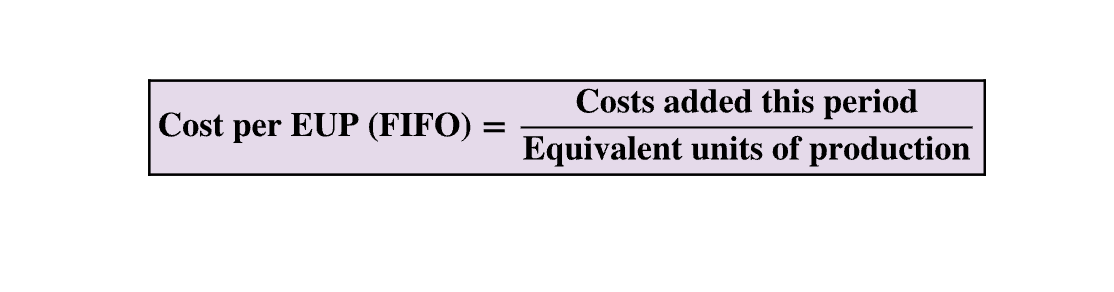

Cost per EUP (FIFO) = Costs added this period / equivalent units of production

Plantwide rate method

use one overhead rate

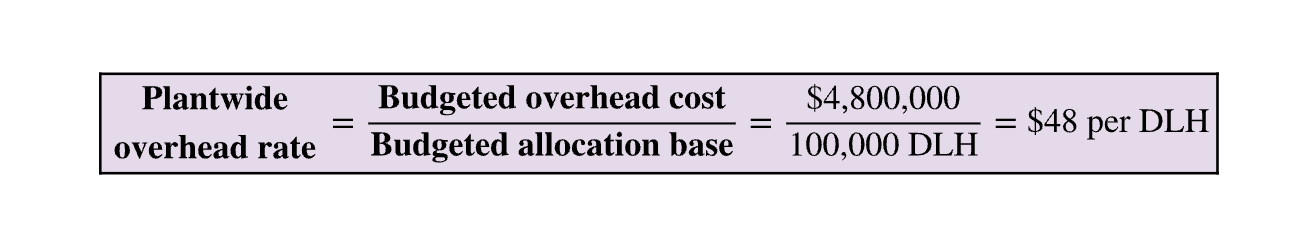

Plantwide Overhead Rate

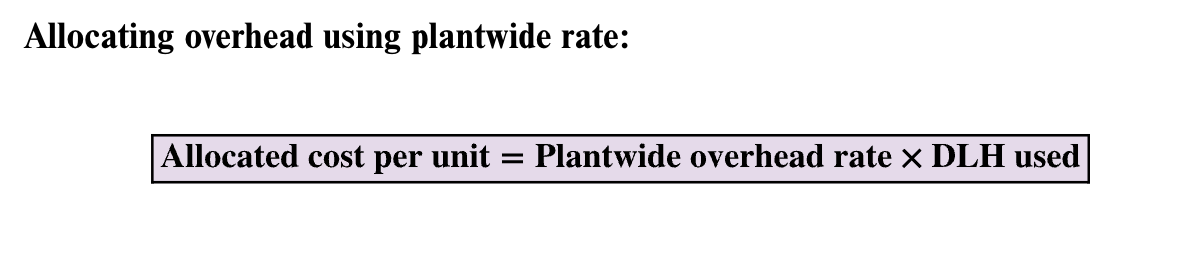

Allocating Overhead using plantwide rate

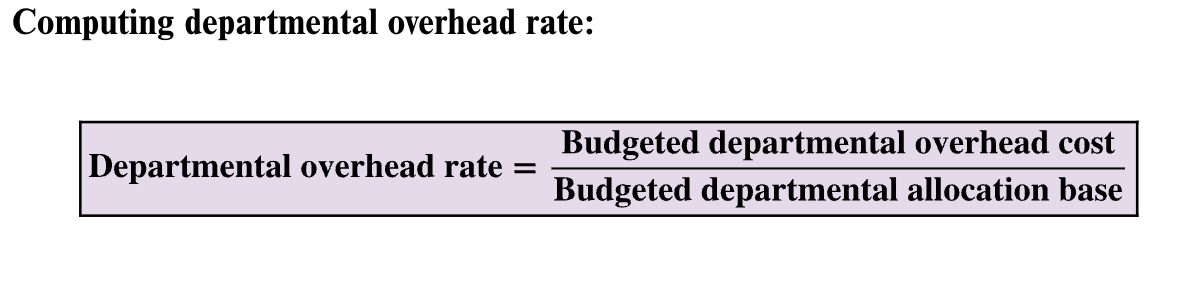

Department rate method

use a different overhead rate for each department

Activity cost pool

group of costs related to same activity

three steps to activity-based costing

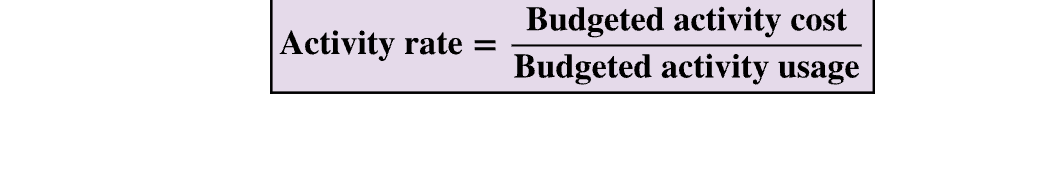

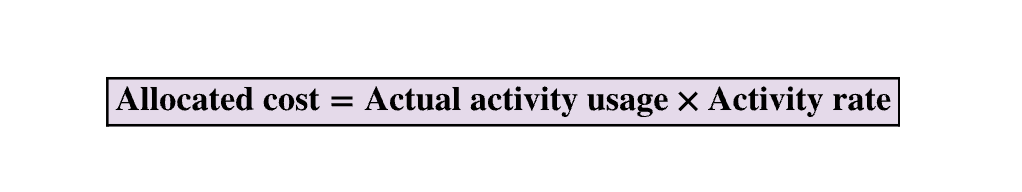

identify the activities and their budget overhead rate

compute an overhead activity rate for each activity

Allocate overhead cost to cost objects (products)

fixed costs

costs that do not change in total as volume changes

variable costs

costs that change proportionately with volume

mixed costs

costs that include both fixed and variable components

step-wise costs

costs with step pattern, but fixed in each relevant range

relevant change

normal operating range; neither near zero nor maximum capacity

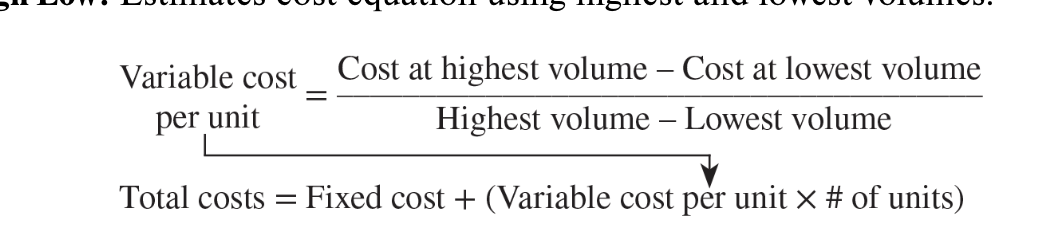

cost equation

fixed costs +(Variable cost per unit * unites produced)

High-Low

estimates cost equation using highest and lowest volumes

Regression

Statistical method using all data. Likely more accurate.

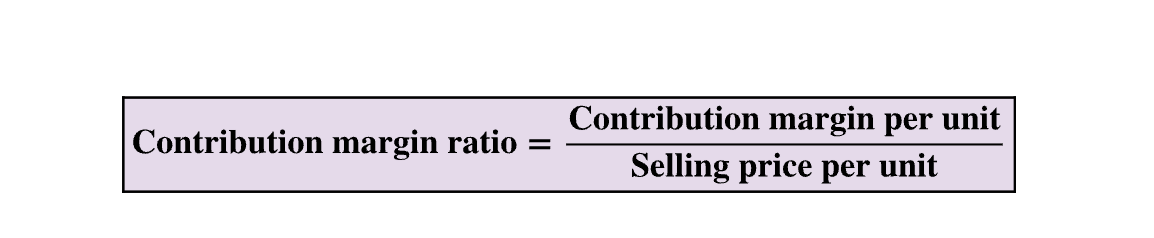

contribution margin per unit

Contribution Margin Ratio

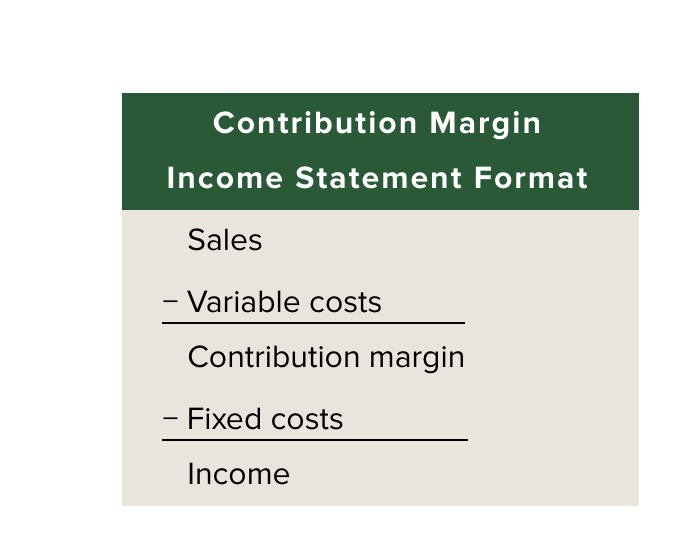

Contribution Margin Income Statement Format

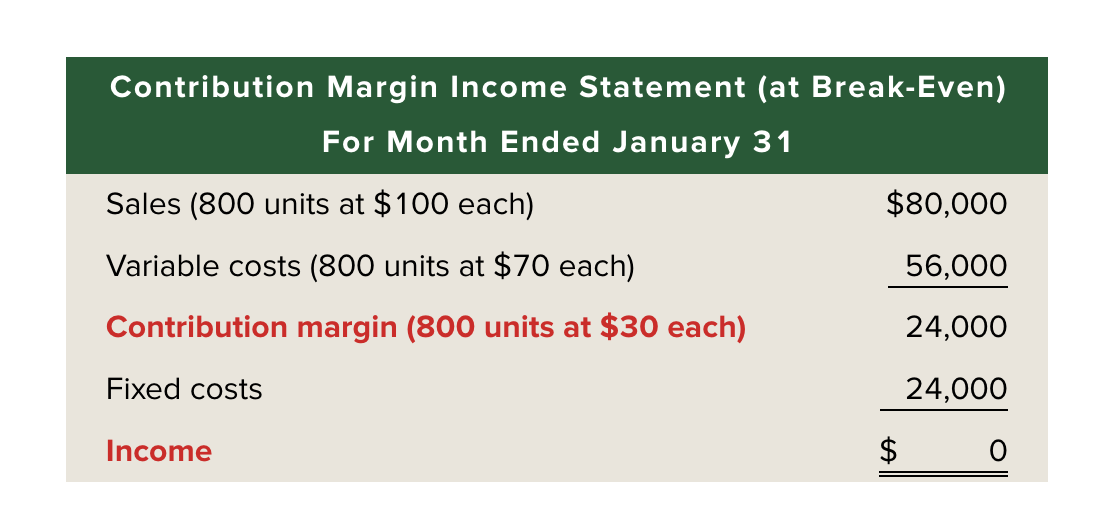

Contribution Margin Income Statement (at Break Even)

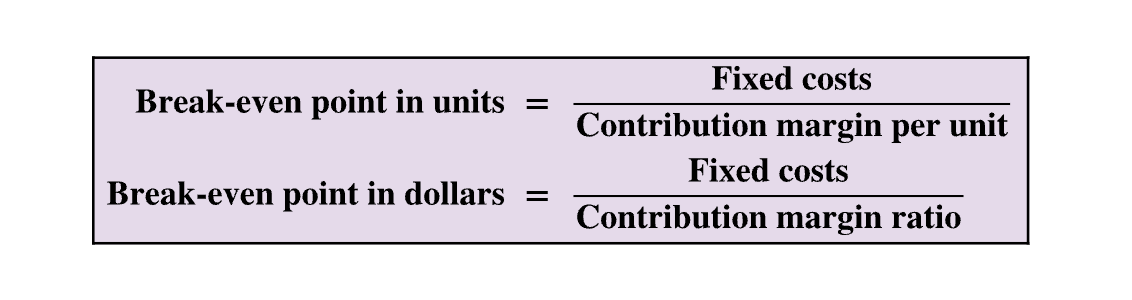

break-even point in units and in dollars

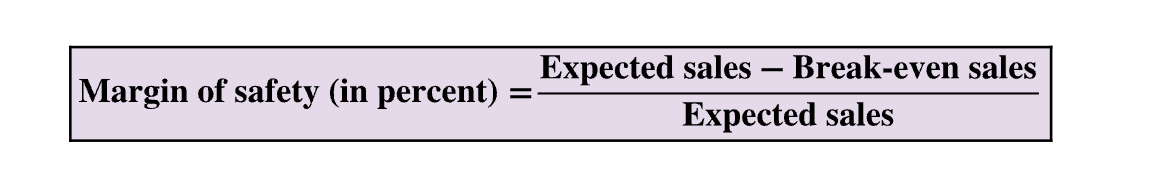

Margin of Safety

amount that sales can drop before company incurs a loss

Margin of Safety

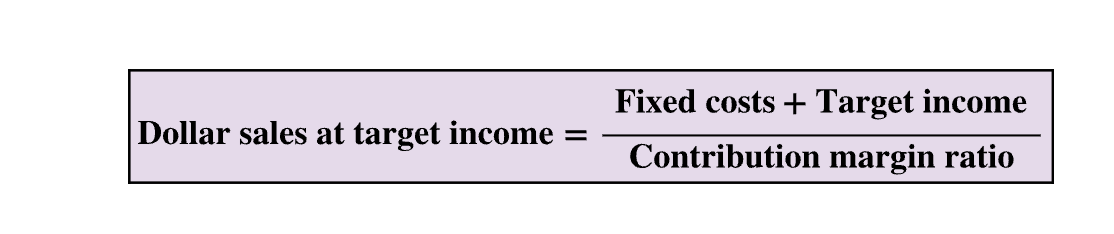

Dollar Sales for a target income

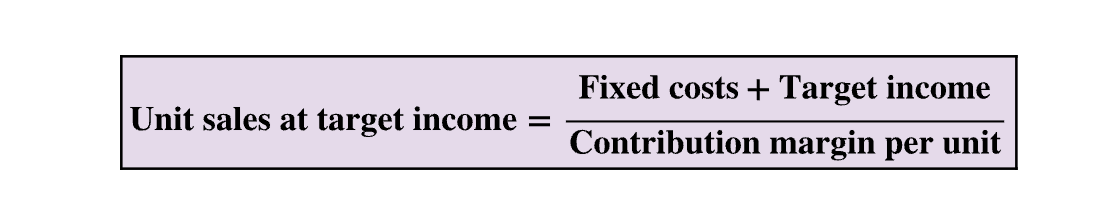

Unit sale for a target income

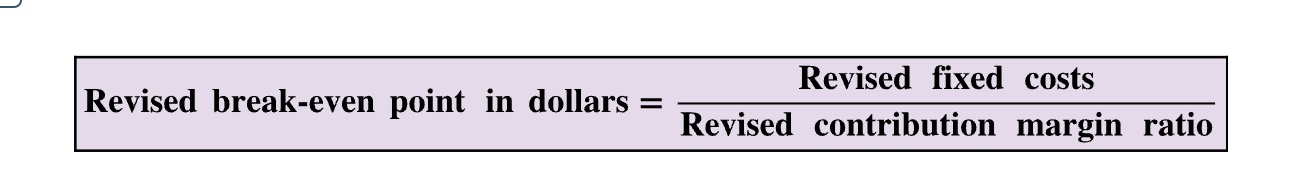

Business strategy and break-even

sales mix

proportion of sales volumes for various products or services

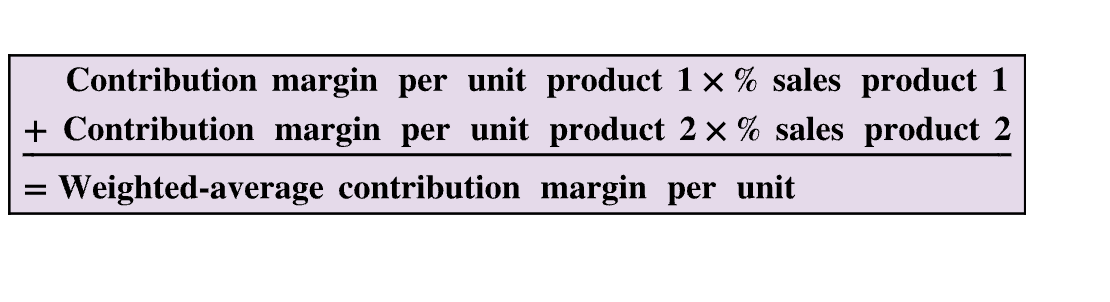

weighted average contribution margin

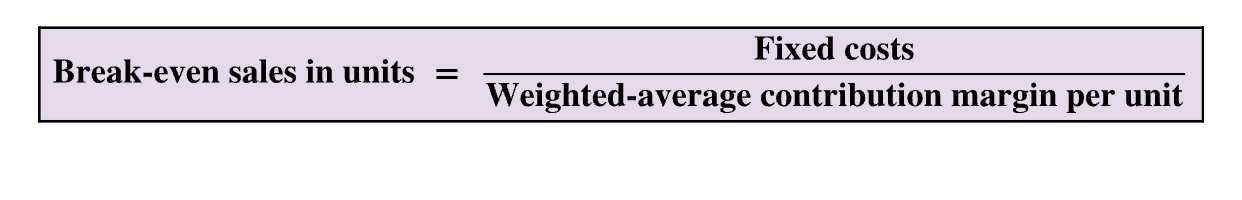

Break-even in sales units

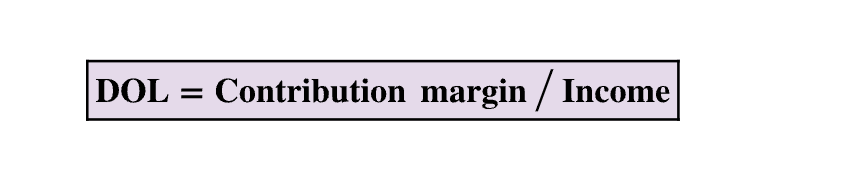

Degree of operating leverage (DOL)

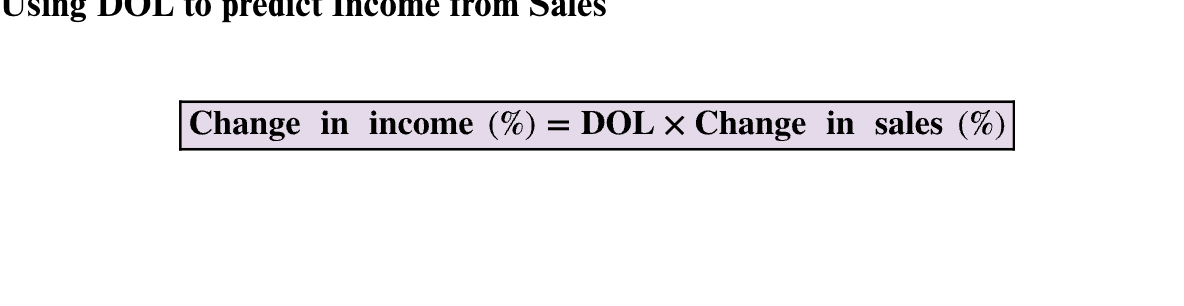

Using DOL to predict Income from sales

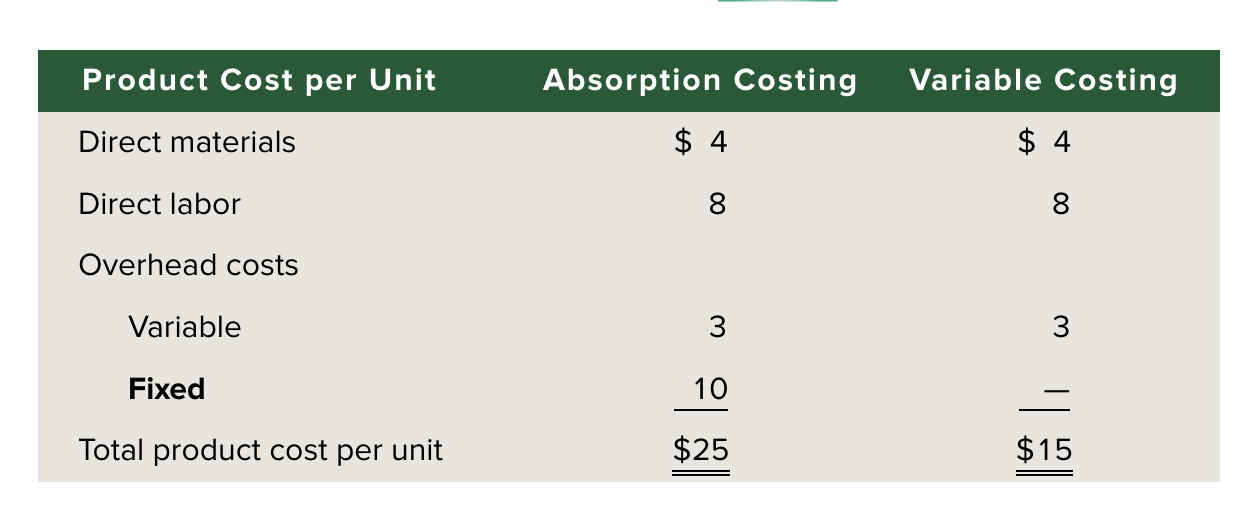

Absorption Costing

Fixed overhead is in product costs

Variable costing

fixed overhead is in period expenses

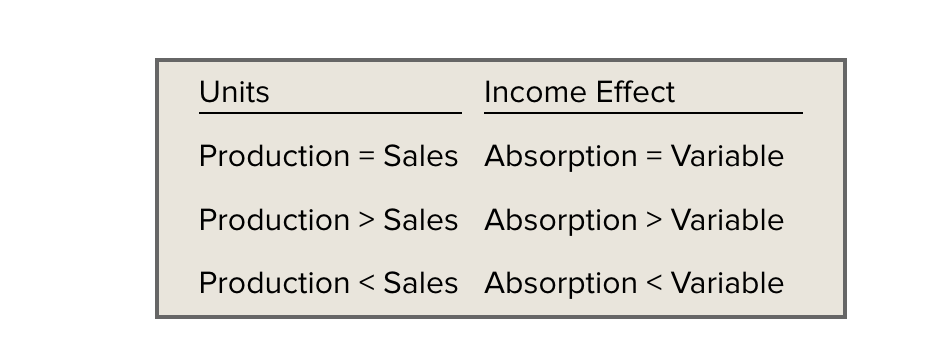

Absorption and Variable Costing

General Rule

when inventory levels change: Absorption costing income = variable costing income

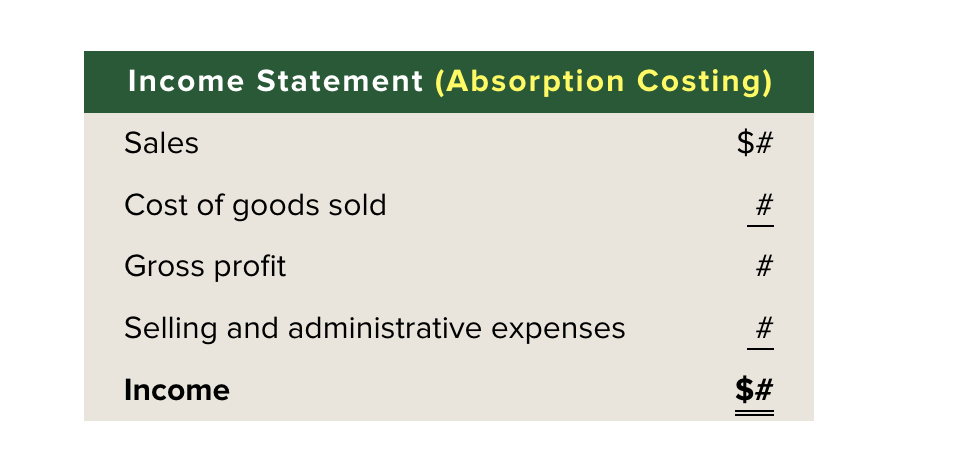

Income Statement Absorption Costing

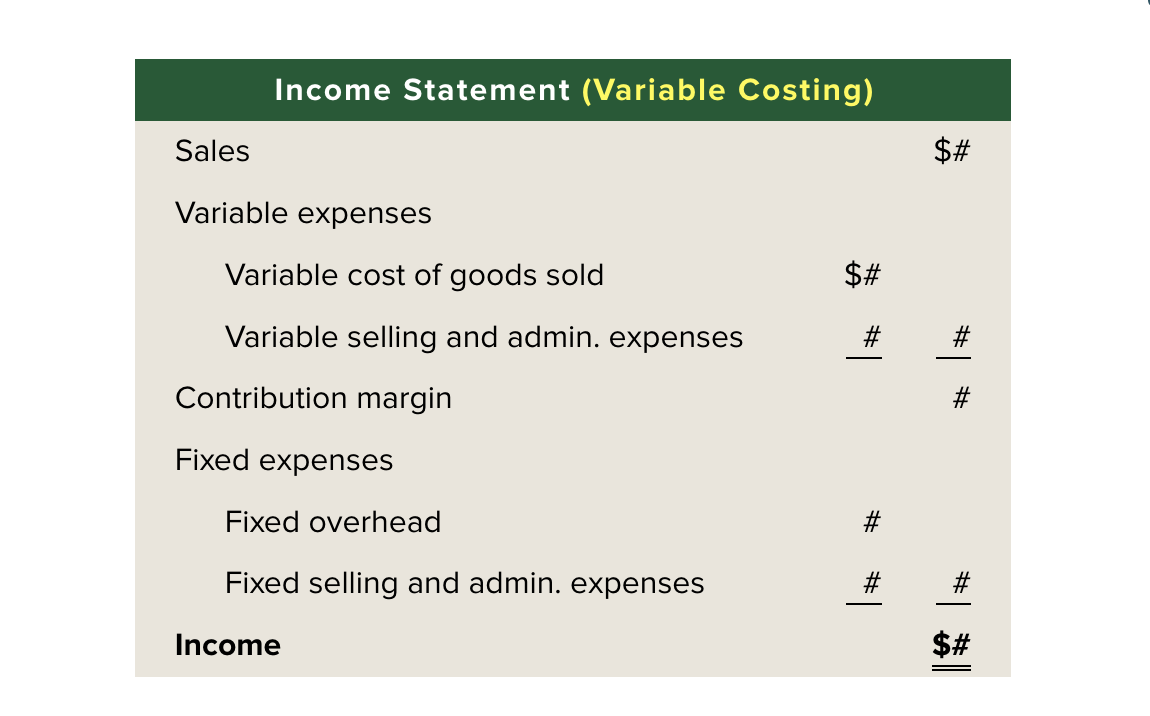

Income Statement VR Costing

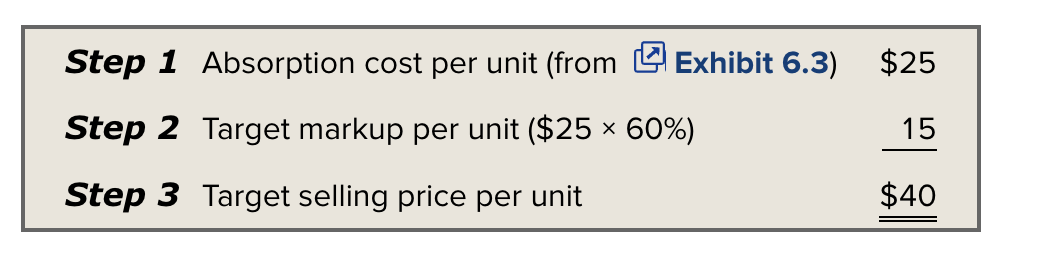

Setting target price

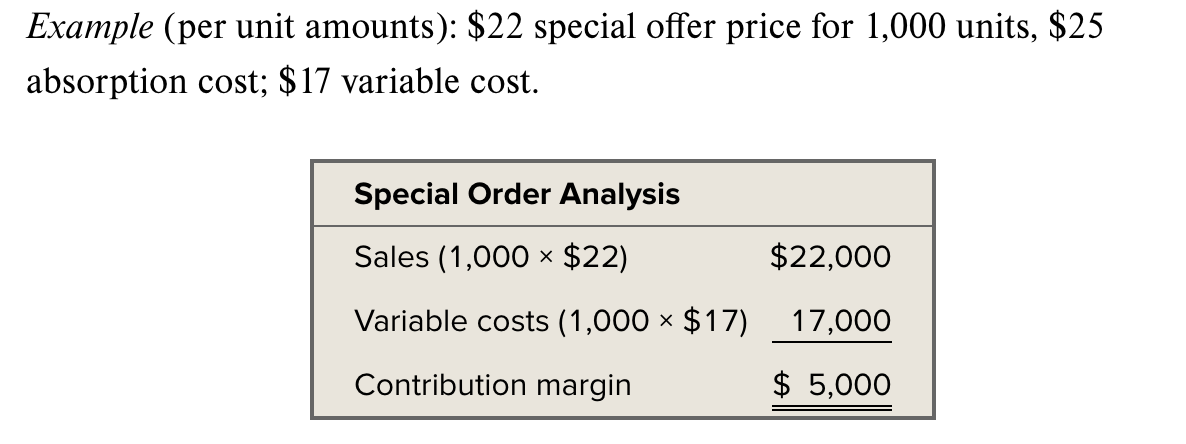

Analyzing special orders

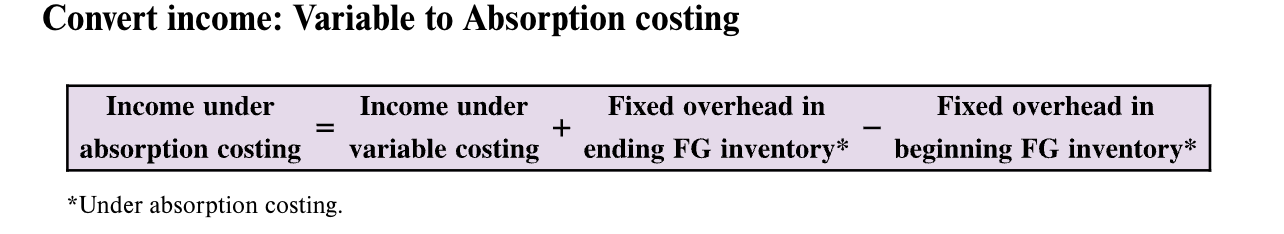

Convert Income: Variable to Absorption costing

Markup

Amount added to cost per unit in computing a selling price

Enviormental profit and loss (EP&)

A report in monetary terms of the impact on human welfare from an entity’s activities

Variable cost of goods sold

DM, DL, Variable overhead costs for units sold