2.1 Measures of economic performance

1/50

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

51 Terms

What is economic growth?

When there is a rise in vale of Gross Domestic Product (GDP)

Economic growth leads to higher living standards and more employment opportunities

What does GDP measure?

The quantity of goods and services produced in an economy

A rise in economic growth means that there has been an increase in national output

What is Real GDP?

The value of GDP adjusted for inflation

Eg: if an economy grew by 4% last year but inflation was 2%, the economy grew by 2%

What is nominal GDP?

The value of GDP without being adjusted for inflation

Can be misleading due to the fact that it can make GDP appear higher than it really is

What is total GDP?

The combined monetary value of all goods and services produced within a country’s borders during a specific period of time

What is GDP per capita?

The value of total GDP divided by the population of the country

It measures the average economic output per person

It is useful for comparing the relative performance of countries

Volume of GDP

GDP adjusted for inflation, it is the size of the basket of goods and the real level of GDP

What is value of GDP?

The monetary value of GDP at prices of the day

It is the nominal figure and can be calculated by volume times current price level

What are the two measures of National income?

Gross Nation Product

Gross Nation Income

What is GNP?

The market value of all products produced in an annum by the labour and property supplied by the citizens of one country

It includes GDP plus income earned from overseas assets minus income earned by overseas residents

GNP includes products produced by citizens of a country, whether inside the border or not

What is GNI?

The sum of value added by all producers who reside in a nation, plus net overseas interest payments and dividends

It includes what a country earns from overseas and removes any money that is sent back home by foreigners in that country

What is Purchasing Power Parity?

A theory that estimates how much the exchange rate needs adjusting so that an exchange between countries is equivalent according to each’s currency

It helps to minimise misleading comparisons between countries

Limitations of using GDP to compare living standards between countries over time

GDP does not give any indication of the distribution of income

GDP may need to be recalculated in terms of PPP so that it can account for international prices differences- the purchasing power is determined by the cost of living in each country and the inflation rate

Doesn’t account for hidden economies such as the black market

GDP gives no indication of welfare

Measures of national happiness

UK nation well-being: gives a wider picture of the standard of living in the UK

The UN happiness report found that the 6 factors affecting national well-being are; real GDP per capita, health, life-expectancy, having someone to count on, perceived freedom to make life choice, freedom from corruption and happiness

The relationship between real incomes and subjective happiness: The UK economy grew by 5% between 2007-2014 but no change in life satisfaction- however generally, the higher the GDP per capita, the higher the average life satisfaction score

One finding is that happiness and income tend to be related at low levels at income but once basic needs are met, higher income does not lead to increased happiness

What is inflation?

The sustained rise in the general price level over time

This means that the cost of living increase and the purchasing power of money decreases

What is deflation?

Where the average price level in the economy falls- there is a negative inflation rate

What is disinflation?

The falling rate of inflation

This is when the average price level is still rising but to a slower extent

This means goods and services are relatively cheaper than a year ago and the PP of money has increased

What is the Consumer Price Index?

A method of calculating inflation

It measures household PP with the Family expenditure survey

The survey finds out what consumers spend their income on- from this, a basket of goods is created

The goods are weighted according to how much income is spent on each item

This basket is updated annually

Limitations of using CPI

The basket is only representative of the average household so it is not accurate for all households

For example, households who do not own cars and therefore do not spend 14% of their income on motoring

Different demographics have different spending patterns

CPI is slow to respond to new goods and services

It is hard to make historical comparisons due to the vast difference in quality of product over time eg: technology now compared to 20 years ago

What is Retail price index?

An alternative method to measure inflation

Unlike CPI, includes housing costs, such as mortgage interest payments and council tax

Tends to have a higher value than CPI

What are the main causes of inflation?

Demand pull

Cost push

Growth of the money supply

Demand pull inflation

This is from the demand side of the economy, when aggregate demand is growing unsuitably- there is pressure on resources- producers increase their prices and earn more profits

The main triggers are: a depreciation in exchange rate- imports more expensive, exports cheaper- causes AD to rise

Fiscal stimulus in the form of lower taxes or more government spending- consumers have more disposable income so consumption increases

Lower interest rates makes saving less attractive and encourages borrowing so consumer spending increases

High growth in export markets mean exports increase and AD increases

Cost push inflation

This is from the supply side of the economy and occurs when firms face rising costs- this occurs when:

Raw materials or labour become more expensive

Expectations of inflation- if consumers expect prices to rise, they may ask for higher wages to make up for it and that could result in more inflation

Indirect taxes can increase their prices cost of goods and producers can chose to past this cost onto the consumer

Depreciation in the exchange rate which leads to mor expensive exports- pushes up the price of raw materials

Monopolies using their dominant market to exploit consumers with high prices

Growth of the money supply

If the Bank of England were to print more money, there would be more money flowing in the economy

Extreme increases in money supply lead to hyperinflation

The effects of inflation on consumers

Those on low and fixed incomes are affected the most due to its regressive effect because the cost of necessities increase eg: water, food

The PP of money falls which affects those with high incomes the least

If consumers have loans, the value of repayment will be lower, because the amount owed does not increase with inflation, so the real value of the debt decreases

The effects of inflation on Firms

Low interest rates means borrowing and investing is more attractive than saving profits

With high inflation, interest rates are more likely to be higher meaning the cost of investments will be higher, meaning firms are less likely to invest

Workers might demand for higher wages which could increase the costs of production for firms

Firms may be less price competitive on a global scale- this depends on what is happening in other countries

Unpredictable inflation will reduce business confidence due to not being fully aware of their costs- this could result in less investment

The effects of inflation on the government

The government will have to increase the value of the state pension and welfare payments because the cost of living is increasing

The effects of inflation on workers

Real incomes fall with inflation, so workers will have less disposable income

If firms face higher costs, people could be made redundant to try cut costs

What are the two main measures of employmeny?

The Claimant Count

The International Labour Organisation

Claimant count

Counts the number of people claiming unemployment related benefits, such as Job seeker’s allowance

They have to prove they are actively looking for work

Not every unemployed person is eligible for JSA- those with parters on high incomes will not be eligible for the benefit

Some people claim the benefit whilst they are employed

The International Labour Organisation and the UK Labour Force Survey

The LFS is taken on the ILO- it directly asks people if they meet the following criteria:

Been out of work for 4 weeks

Able and willing to start work within 2 weeks

Workers should be available for 1 hour per week- part time unemployment is included

Gives a higher unemployment rate than claimant count as the part time unemployed are less likely to claim unemployment benefits

The unemployed

Those who are able and willing to work, but are not employed- they are actively seeking work and usually looking to start within the next two weeks

The underemployed

Those who have a job, but their labour is not used to its full productive potential

Those who are in part-time work, but are also looking for a full-time job are underemployed

The significance of changes in the rates of and the effects of unemployment and employment for consumers

If consumers are unemployed, they have less disposable income and their standard of living may fail as a result

There are also psychological consequences of losing a job, which could affect the mental health of workers

The significance of changes in the rates of and effects of unemployment and employment for firms

With a higher rate of unemployment, firms have a larger supply of labour to employ from- this causes wages to fall which could help firms reduce their costs

When there are higher rates of unemployment, since consumers have less disposable income, consumer spending falls so firms may lose profits

Producers which sell inferior goods might see a rise in ssales

It might cost firms to retrain workers, especially if they have been out of work for a long time

The significance of changes in the rates of and effects of unemployment and employment for workers

With unemployment, there is a waste of workers’ resources

They could also lose their existing skills if they are not fully utilized

Those in jobs are likely to see a fall in their wages as supply of labour increases

The significance of changes in the rates of and effects of unemployment and employment for the government

If the unemployment rate increases, the government may have to spend more on JSA

This incurs an opportunity cost because the money could have been invested elsewhere

The government would also receive less revenue from income tax, and from indirect taxes on expenditure, since the unemployed have less disposable income to spend

The significance of changes in the rates of and effects of unemployment and employment for society

There is an opportunity cost to society, since workers could have produced goods and services if they were employed

There could be negative externalities in the form of crime and vandalism, if the unemployment rate increase

Inactivity

The economically inactive are those who are not actively looking for jobs

These could include carers for the elderly, disabled or children, or those who have retired

Some workers are discouraged from the labour market since they have been out of work for so long that they have stopped looking for work

If the number of the economically inactive increase, the size of the labour force may decrease which means, the productive potential of the economy could fall

What are the causes of employment?

Structural unemployment

Frictional unemployment

Seasonal unemployment

Cyclical unemployment (demand deficiency)

Real wage inflexibility

Structural employment

Occurs with a long term decline in demand for the goods and services in an industry, which costs jobs

This has included job losses in industries such as car manufacturing

This type of unemployment is worsened by the geographical and occupational immobility of labour- if workers do not have skills transferable to another industry, they are likely to remain unemployed in the long run

Globalisation contributes to structural unemployment, since production in the manufacturing sectors such as clothing or motors

Frictional unemployment

This is the time between leaving a job and looking for another job

It is common for there to always be some frictional unemployment and it is not particularly damaging due to the fact it is temporary

It could be the time between graduating from university and finding a job

This is why it is rare for 100% employment

Seasonal unemployment

Occurs during certain points in the year, usually around summer and winter

During the summer, more people will be employed in the tourist industry- when demand increases

Cyclical unemployment

This is caused by a lack of demand for goods and services, and i usually occurs during periods of economic decline or recessions

Firms are either forced to close or make workers redundant because their profits are falling due to decreased consumer spending and they need to reduce their costs

This then causes output to fall in several industries

This type of unemployment could actually be caused by increases in productivity- which means each worker can produce a higher output and therefore fewer workers are needed to produce the same quantity of goods and services

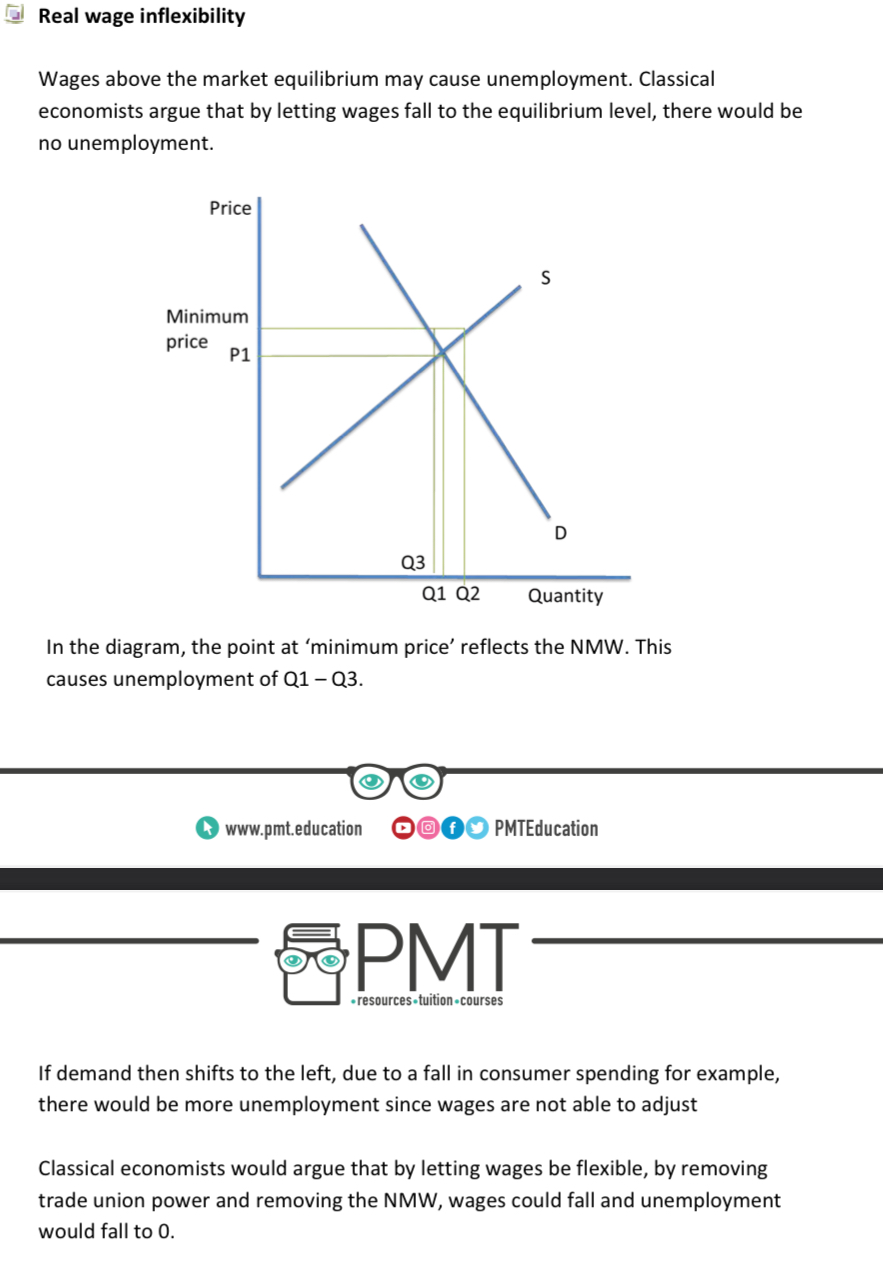

Rea wage inflexiblity

Wages above the market equilibrium may cause unemployment

Classical economists argue that by letting wages fall to the equilibrium level, there would be no unemployment

Cutting wages during times of weak consumer spending would cause further falls in consumer spending, and there would be even lower economic growth

The classical economist argument is made on the assumption of a perfectly competitive market which is not true in reality

The significance of migration for unemployment and employment

The supply of labour at all wages tends to increase with more migration due to the fact that migrants are usually of working age and many are looking fr a job

Migrants tend to bring high quality skills to the domestic workforce, which can increase productivity and increase the labour market’s skill set- this could increase global competitiveness

Migrant labour affects the wages of the lowest paid in the domestic labour market by bringing them down- this is because migrants are usually from economies with lower average wages than the UK- small impact

Balance of payments

The record of all financial transactions made between consumers, firms and he government from one country with other countries

It states how much is spent on imports, and what the value of exports is

Export are goods and services sold to foreign countries, and are positive in the balance of payments- this is because they are an outflow of money

Imports are goods and services bought from foreign countries, and they are negative on the balance of payments- they are an outflow of money

What is the balance of payments made up of?

The current account

The capital account

The official financing account

The current account on the balance of payments is the balance of trade in goods and services

Current account deficits and surpluses

A current account surplus means there is a net inflow of money into the circular flow of income

The UK has a surplus with services, but a deficit with goods

The uK has a current account deficit- this means the UK spends more on imports from foreign countries, than they earn from exports to foreign countries

If the deficit is large and runs for a long time, there could be financial difficulties with financing the deficit

The relationship between current account imbalances and other macroeconomic objectives

The UK government’s macroeconomic objectives are to have:

Full employment

Low stable inflation

A sustainable current account on the balance of payments

Sustainable economic growth

By exporting mote the UK will have a greater flow of money into the circular flow of income- this will increase AD and improve the rate of economic growth

During periods of economic decline or recession, the current account deficit falls- this is because consumer spending falls

During period economic growths, when consumers can afford to consume more and have higher incomes, there is a larger deficit on the current account

If imported raw materials are expensive, there could be cost-push inflation in the UK since there would be higher production costs for firms

The interconnectedness of economies through international trade

In theory, the sum of all countries’ trade balance should be zero, since what one country exports will be imported by another country

If the UK’s main export market, such as the EU, faces an economic downturn then demand for UK goods and services will fall, since consumers in the EU are less able to afford imports

International has meant countries have become interdependent, therefore the economic conditions in one country affect another country since the quantity the export or import will change