Ch 7 - Market equilibrium, price mechanism, and market efficiency

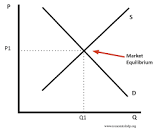

Market equilibrium: where the quantity supplied equals the quantity demanded

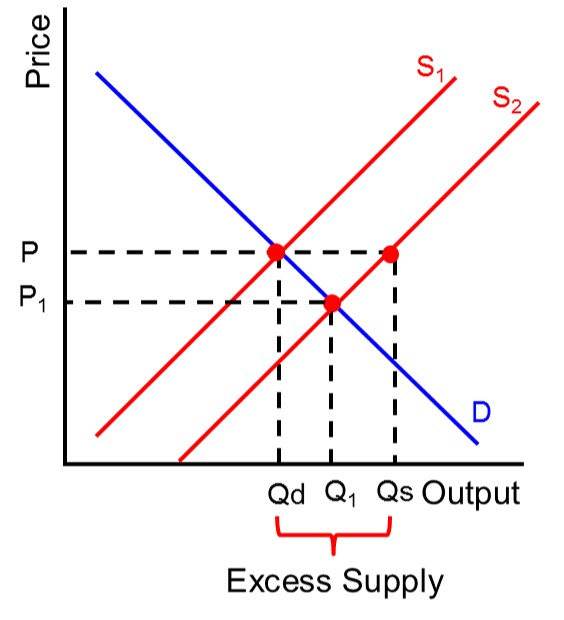

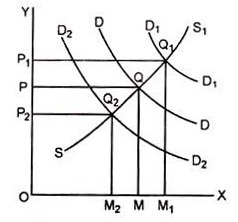

- Excess supply: more is being supplied than demanded at P1, in order to eliminate the surplus, producer must lower the price

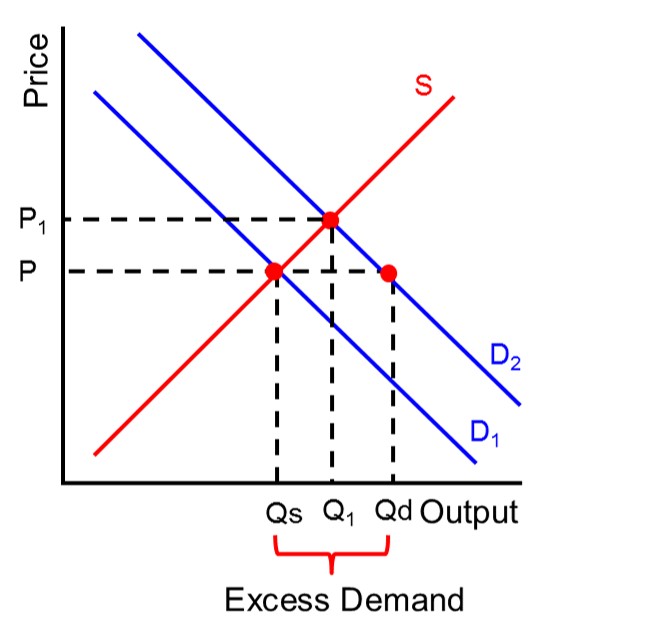

- Excess demand: more is being demanded than supplied at P2, in order to eliminate the surplus, producer must raise the price

A market consists of buyers and sellers who come together to exchange goods

- Equilibrium is when supply satisfies demand and is equal to it

- Qd = Qs

- Everything produced in the market will be sold

- Market won't change without external change

Eliminating excess supply (surplus):

- Market is in disequilibrium

- Producers will h2ave to supply at a lower rate

- Quantity demanded will increase until demand equals supply, resulting in equilibrium

- Surplus of Q1-Q2

- Decrease price to get rid of supply, demand increases

Eliminating excess demand (shortage):

- Disequilibrium due to excess demand

- Excess of Q2-Q1

- Q2 → demanded Q1 → supplied = shortage

- To eliminate shortage, prices decrease

- Quantity will decrease

- Demand and supply will be equal resulting in equilibrium

Effect of changes in demand and supply on equilibrium:

- Initially → price at equilibrium

- Q1 → supplied Q2 → demanded

- Prices need to increase for shortage to end

- Equilibrium restored at P2, new equilibrium quantity at P3

- A shift will cause demand/supply curve to adjust to a new equilibrium/market clearing price

Price mechanism moves the market into equilibrium, so that the scarce resources are reallocated.

- Opportunity cost: is the next best alternative forgone. When a choice is made, there is an opportunity cost.

- Price mechanism: forces of supply and demand:

- Resources: allocated/re-allocated in response to changes in price

- Price of a good increases, demand increases

- Products hope to maximise profit, will produce more

- Producers allocate more goods with higher demand (more profit)

- Concept: factors of production produce desired goods and services

Market efficiency

Market efficiency refers to the degree to which market prices reflect all available, relevant information.

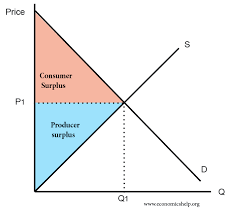

- Consumer surplus: the extra satisfaction a consumer gains from paying a price less than they were prepared to pay.

- Producer surplus: the excess of actual earnings that a producer makes from a given quantity of output, over and above the amount the producer would be prepared to accept for that output.

}}When a market is allocatively efficient, the social (community) surplus is maximised, this is made up of the consumer and producer surplus. This means that the marginal social benefit = the marginal social cost. Allocative efficiency happens when competitive market is in equilibrium, where resources are allocated in the most efficient way from society’s point of view.}}