Week 7 (18.03.2025) - Financial Markets and Expectations

1/4

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

5 Terms

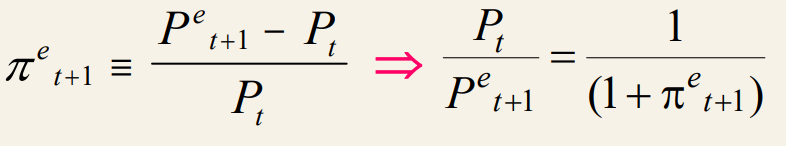

Expected inflation

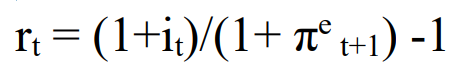

Real interest rate

The Present Value (PV) of all future payments

the sum of each future payment discounted to Present Value.

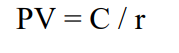

perpetuity formula

• PV = Present Value • C = Annual Payment (€1000 in this case) • r = Discount Rate

Suppose an economy is in equilibrium and central bank decides to pursue expansionary monetary policy.

a. What is the short-term effect of the policy on output, nominal and real interest rate?

b. What is the medium-term effect of the policy on output, inflation rate, nominal and real interest rate?

IS-LM model:

Y increases, nominal and real interest rate decreases:

AS-AD model gives that monetary policy does not have ay effect on output (remains on Yn), only inflation (prices) increase at the same rate as money growth rate. Fisher effect – nominal interest rate grows one-toone with money growth, no change in real interest rate (remains on rn).