Ch04: Forms of Business Ownership

1/34

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

35 Terms

What is a sole proprietorship?

Someone who runs a business by themselves, has full control but takes on all of the risk

What are the advantages of being a sole propretorship?

easy n inexpensive to start

full control

minimal regulations

no special taxs

What are the disadvantages of sole proprietorship?

everything’s on u, fully liable

limited capital

limited growth

hard to find good employees

What’s a partnership?

2 or more people who run a business together

What are the 2 types of partnerships

general partnership

limited partnership

What’s general partnership?

shares responsibilities, profits equally

What’s limited partnership?

One manages the business, one invests but doesn’t manage anything

What are the 4 advantages of having a partnership?

ease of formation

shared decision making

more capital

diverse skills and expertise

What are the disadvantages of partnership?

unlimited liability

conflicts

companies dies if partner leaves

conflicts over profit

What’s a corporation?

a legal entity is separated from the owner of the business, so the debts aren’t the owners

What are shareholders?

Shareholders are owners of the companies through stocks, they have some rights

Who do shareholders elect?

board of directors

What do board of directors do?

board and directors manage the overall corperation

What are the 5 steps to register a corperation?

make a name

register it w/ papers at a state office

pay required taxes and fees

hold organizational meeting

be registered, hire directors and record important decisions

What are the advantages of corporations?

less liability

easy to transfer ownership

unlimited lifespan

can attract investment

What are the disadvantages of corporations?

double tax

complex and costly to form

more government regulations

What are the 3 types of corperations

S corporation

Limited Liability Company (LLC)

C corporation

S corporation

limited liability and is taxed like a corporation, profits go straight to owners

Limited Liability Corporation (LLC)

liability protection of a corporation tax benefits + flexibility like partnership

many small businesses do this option

C Corporation

shareholders are taxed separetly from the corporation

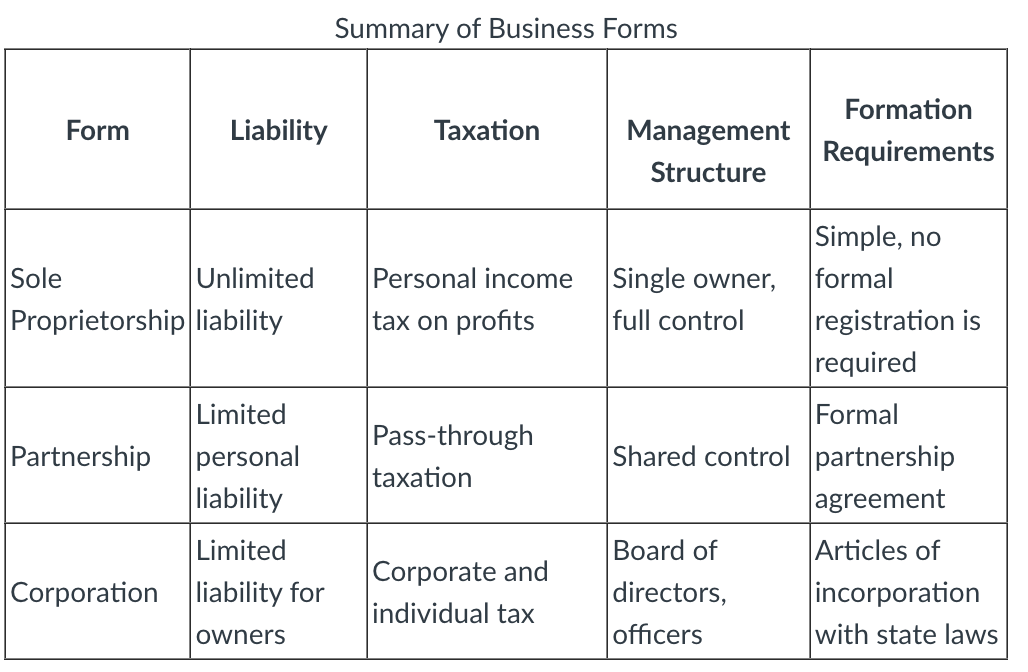

Fill out this chart about the summary of businesses

What are cooperatives?

business owned by members who share profits and get better deals

What are joint ventures?

two or more companies that form an alliance to pursue a project tgt

What’s franchising?

when a brand allows another brand to use its brand and business system

What are mergers?

when 2 companies merge into 1

What are the 3 types of mergers?

horizontal merger

vertical memrger

conglomerate merger

what is a horizontal merger?

companies at the same stage merge to reduce cost, competition and increase product

What’s vertical merger?

a company buys a firm in the same industry thats in an earlier/later stage

What's conglomerate merger?

brings together companies in different areas to reduce risk

What’s acquisition?

one company buys another company

What’s unfavorable balance of trade?

imports exceeds exports

What happens with partnerships taxation?

Partnerships file tax returns but pass profits and losses on to partners who report them on their tax returns.

which form of business is easiest to dissolve?

sole propretorship

What’s balance of exchange?

the total inflow of money into a country (from exports, investments, etc.) equals the total outflow (due to imports, payments on debt, etc.)

it typically refers to the flow of currency in international trade or the flow of foreign exchange between countries.

What’s balance of payments?

The balance of payments must always balance: If a country has a deficit (more money flowing out than in), it needs to finance this by borrowing from abroad, selling assets, or attracting foreign investment. If a country has a surplus (more money flowing in than out), it might lend money to other countries, invest abroad, or accumulate foreign reserves.