Chapter 2: Investing and Financing Decisions and the Accounting System

1/105

Earn XP

Description and Tags

JUST TEXTBOOK NOTES! Go back before final and tweak with Smartbooks and lecture notes!

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

106 Terms

Franchising

common in chain restaurants, selling the right to use/sell product/service to another; easy way for someone to start a buusiness

Acquisition Activities

often called investing activities, includes purchase of physical assets, investments in securities, or sales of securities and assets

Financing Activities

any transactions with stockholders (usually issuing additional stock and paying dividends) and transactions with includes borrowing funds from creditors or selling stock to investors to provide cash necessary to acquire assets

Three Assumptions and Measurement Concept to Consider

1. Separate entity assumption

2. Going concern assumption/Continuity assumption

3. Monetary Unit Assumption

Historical Cost

Separate entity assumption

states each business’ activities must be accounted for separately from the personal activities of its owners, all persons, and other entities

Example of separate entity assumption

When an owner purchases property for personal use, the property is not an asset of the business

Going concern assumption (continuity assumption)

unless there is evidence to the contrary, we assume the business will continue operating into the foreseeable future, long enough to meet its contractual commitments and plans

Monetary Unit Assumption

each business entity accounts for and reports its financial results primarily in terms of the national monetary unit without any adjustments for changes in purchasing power

Historical Cost

accounts measure elements of balance sheet initially at their cost; cash-equivalent value on date of transaction

Example of Historical Cost

assets are initially recorded on exchange date at cash paid and dollar value of all noncash considerations (trade-in value of a used asset)

Assets

economic resources owned or controlled by company, have measurable value and expected to benefit company by producing cash inflows/reducing cash outflows in future; listed in order of liquidity

Current Assets Include

Cash, Inventory (ALWAYS), Short-Term Investments, Accounts Receivable, Supplies, Prepaid Expenses

Prepaid Expenses

rent, insurance, and advertising paid in advance of use

Order of Liquidity

how soon an asset is expected by management to be turned into cash or used

Current Assets

resources an entity will use to turn into cash within one year (next 12 months)

Other Current Assets

summary of several smaller accounts

Noncurrent Assets

all other assets not considered current, are considered long-term and are to be used/turned into cash past 1 year (12+ months)

Noncurrent Assets Include

Land, Buildings, Equipment, Operating Lease Assets, Intangible Lease Assets

Intangible Lease Assets

nonphysical assets such as trademarks or patents

Liabilities

measurable obligations resulting from a past transaction, expected to be settled in future by transferring assets or providing services; LISTED IN ORDER OF MATURITY

Creditors

entities company owes money to

Order of maturity

how soon an obligation is to be paid

Current liabilities

liabilities company will need to pay/settle within coming year (wish cash, goods, and other current assets or services)

Current Liabilities Include

Accounts Payable, Unearned Revenue, Accrued Expenses, Current Operating Lease Liabilities, Other Current Liabilities

Unearned Revenue Example

unredeemed gift cards that have been purchased by customers

Accrued Expenses

more specifically, wages payable and utilities payable, although additional may include interest payable, among others

Current Operating Lease Liabilities

representing current amount owed on leases from renting facilities (e.g. shopping centers)

Income Tax Payable

dues to federal, state, and local governments

Noncurrent Liabilities

liabilities that company will not need to pay/settle NOT within the coming year (12 months)

Notes Payable

written promises to pay amount borrowed and interest as specified in signed agreement

Long-term operating lease liabilities

amount owed beyond the next 12 months for rent of buildings

stockholders’ equity (shareholders’ equity or owners’ equity)

residual interest in the assets of the entity after subtracting liabilities; combo of financing provided by owners and business operations

contributed capital

financing provided by owners, owners invest in business by providing cash/other assets, receiving in exchange shares of stock as evidence of ownership

Common Stock/Additional Paid-In Capital

accounts used to represent amount investors paid when they purchased stock from company

Treasury Stock

account reduces stockholders’ equity, represents amount company paid its investors when company repurchased from investors a portion of previously issued common stock

Earned Capital/Retained Earnings

financing provided by operations, when companies earn profits, can be distributed as dividends or reinvested in business

Many valuable intangible assets

trademarks, patents, and copyrights that are developed inside a company (not purchased), NOT REPORTED ON BALANCE SHEET

commitments and contingencies

heading under where other potential obligations that are not on the balance sheet are required to be disclosed in the notes to financial statement (not every company has such a note)

accounting focuses on

certain events that have an economic impact on an entity

Transaction

events recorded as part of the accounting process; includes external and internal events

External events

exchange of assets, goods, or services by one party for assets, services, or promises to pay (liabilities) from 1+ parties

External Events Example

The purchase of a machine from a supplier for cash, sale of merchandise to customers on account (store credit), borrowing of cash from bank + signing a promissory note for repayment, and investment of cash in business by owners in exchange for ownership shares

Internal Events

include certain events that are NOT exchanges between business and other parties but nevertheless have a direct and measurable effect on reality

Internal Events Example

Using up insurance paid in advance and using buildings and equipment over several years

Recordable Transaction

occurs when assets, goods, or services are either received or given; an exchange of two PROMISES does NOT count

What events to include in financial statement numbers

ONLY economic resources and obligations resulting from past transactions are recorded on balance sheet

Account

standardized format used by organizations to accumulate dollar effect of transactions on each financial statement item; resulting balances are kept separate for financial statement purposes

Chart of Accounts

used by company to facilitate recording of transactions, usually organized by financial statement element, with assets account listed first, followed by liability, stockholders’ equity, revenue, and expense accounts (in this order)

Accounts with “receivable” in the title

always assets, represent amounts owed by (receivable from) customers and others to the business

Prepaid Expenses

always an asset, represents amounts paid in advance by company to others for future benefits (i.e., future insurance coverage, rental or property, or advertising)

Accounts with “payable” in title

always liabilities, represent amounts owed by the company to be paid to others in the future

Accounts with “unearned” in title

always liabilities, represent amounts paid in the past to the company by others who expect future goods/services from company

Revenues (Chart Account)

title revenue accounts by their source followed by the word “revenue”

Expense (Chart Account)

title expense accounts by what incurred or used followed by the word “expense”, EXCEPT for inventory sold, which is titled Cost of Goods Sold (COGS)

Transaction Analysis

process for determining the economic effects of transactions on entity in terms of accounting equation

Basic accounting equation for business organized as corporation

Assets (A) = Liabilities (L) + Stockholders’ Equity (SE)

Two Principles Underlying Success in Performing Transaction Analysis Process

1. Every transaction affects at least two accounts; correctly identifying the accounts and direction of effects (increase/decrease) is critical

2. Accounting equation MUST remain in balance after each transaction

Dual Effects Concept

idea that every transaction has at least two effects on the basic accounting equation; most transactions with external parties involve an exchange by which entity both receives something and gives up something in return

Example of Dual Effects Concept

Suppose Chipotle purchased tomatoes (supplies) and paid cash. In this exchange, Chipotle would receive food supplies (an increase in an asset) and in return would give up cash (a decrease in an asset)

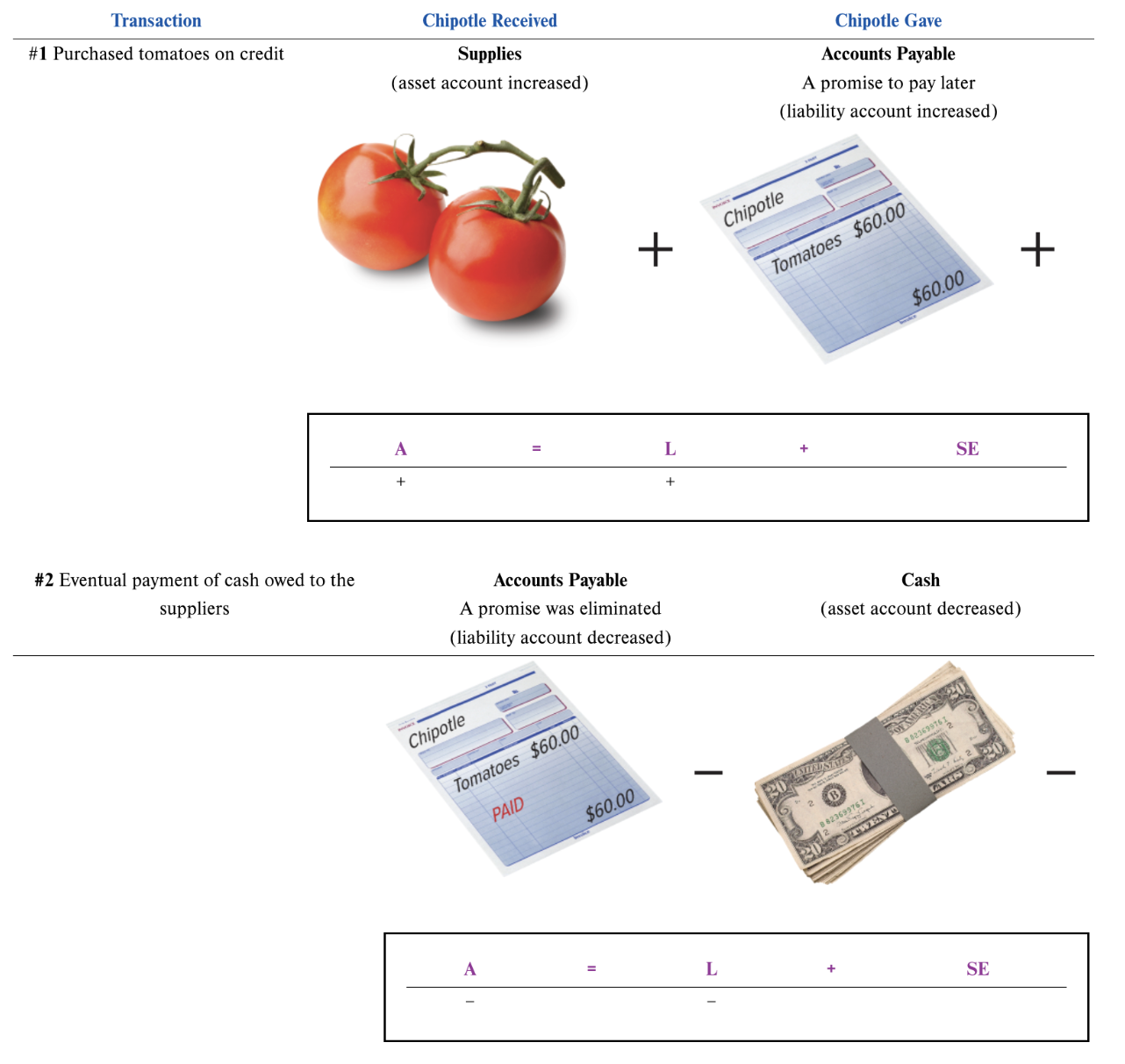

Supplies purchased on credit

business entity would engage in two separate transactions at different points in time;

first transaction (purchase of supplies): assets account (supplies) increases while liability account (accounts payable) also increases;

second transaction (eventual payment of cash owed): liability account (accounts payable) decreases while assets account (cash) decreases

Steps to Follow in Analyzing Investing + Financing Transactions

1. When transaction takes place, ask what company received

2. Ask what company gave

3. Check the accounting equation remains in balance (A = L + SE)

When transaction takes place, ask what company received

first step to follow in analyzing investing and financing transactions; identify the name(s) that were affected, classify each account received by elements (A, L, or SE), and determine how each account was affected (+/-)

Ask what company gave

second step to follow in analyzing investing and financing transactions; repeating the account identification and classification and direction on the effect of each account given

Investing Activities

company typically buys/sells noncurrent assets (growing or shrinking its productive capacity) as well as investments (current or noncurrent); DOES NOT mean buying other companies’ stocks and bonds

Financing Activities

company borrows or repays loans (typically from banks) and sells or repurchases its common stock and pay dividends (activities with stockholders)

Par Value

nominal value per share of stock as specified in the corporate charter, established by board of directors and has no relationship to market price of stock

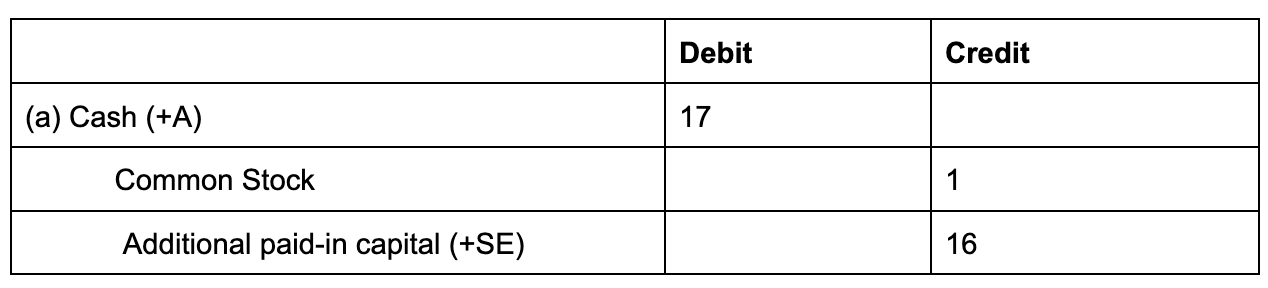

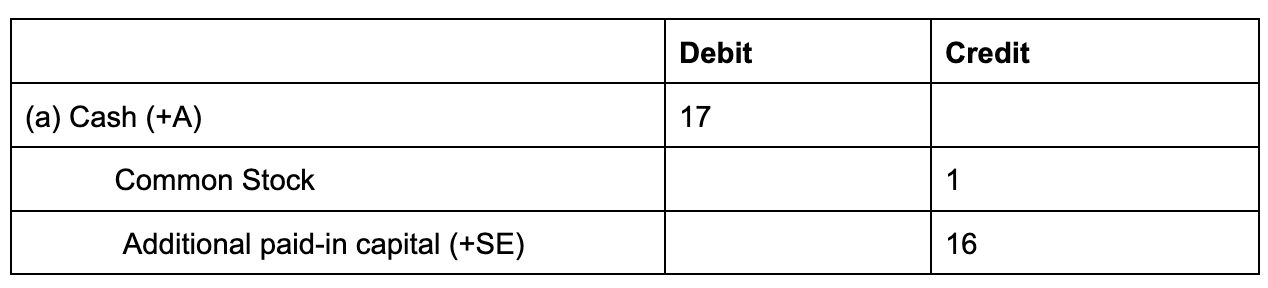

When a corporate issues common (capital stock), transaction affects separate accounts

Assets increases as cash received from shareholders and stockholders’ equity increases as common stock and additional stock share are given to shareholders

Received from Shareholders

Shares x Market Value Per Share

Additional Paid-in Capital (Paid-In Capital, Contributed Capital in Excess of Par)

the amount of contributed capital less the par value of the stock

Investing Activities

purchasing and selling property, equipment, and investments in the stock of other companies; transactions affect more than two accounts

Contra-account

when a company buys back its stock, its accounted for in a new type of account; reduces an account/section of a financial statement its related to

Contra-account Example

in this case, the account is called the Treasury stock and reduces total stockholders’ equity

Treasury Stock

reduce total stockholders’ equity

Dividends

distribution of profits (from retained earnings to shareholders)

When cash dividends declared

a liability, dividends payable, is created until cash is distributed to shareholders; example of a financing activity, but does not yet involve paying cash until next quarter

Primary Activities of Accounting Cycle Performed During the Accounting Period

1. Analyze each transaction

2. Record entries in the journal

Post effects to the ledgers

Primary Activities of Accounting Cycle Performed At End of Accounting Period

4. Prepare trial balance

Adjust revenues and expenses (uses steps 1-4)

Prepare and disseminate financial statements

Close income statement accounts (use steps 1-4)

General Journal

listing in chronological order of each transaction’s effects

General Ledger

record of effects to and balances of each account typically recorded using debits and credits; simply journal, transactions recorded in chronological order after analyzing the business documents (such as invoices, receipts, etc) that describe a transaction

General journal and general ledger

formal records based on two important tools used by accountants; journal entries and T-accounts

Transaction effects

increase and decrease assets, liabilities, and stockholders’ equity accounts

Structure of T-accounts

- increases in asset accounts are on the left

- increases in liability and stockholders’ equity accounts are on the right

Debit (dr for short)

always refers to left side of the T

Assets (T-account)

increase on left (debit) side and normally have debit balances; highly unusual to have a negative (credit) balance

Credit (cr for short)

always refers to the right side of the T

Liability and Stockholders’ Equity Accounts (T-accounts)

increase on the right (credit) side and normally have credit balances

Important Note of Credits + Debits (Transaction Effects)

the total dollar value of all debits WILL EQUAL total dollar value of all credits

Reference (Journal Entry)

letter, number, or date of transaction (i.e., “a”)

Account Titles (Journal Entry)

debited accounts on top and credited accounts on bottom, usually indented (i.e., Cash)

Debited Accounts (Journal Entry)

on top, represent what was received

Credited Accounts (Journal Entry)

on bottom, represent what was given

Amounts (Journal Entry)

debited amounts in left column, credited amounts in right column

Compound entry

any journal entry that affects more than two accounts

Limitations of Journal Entries

do not provide the balances in accounts!

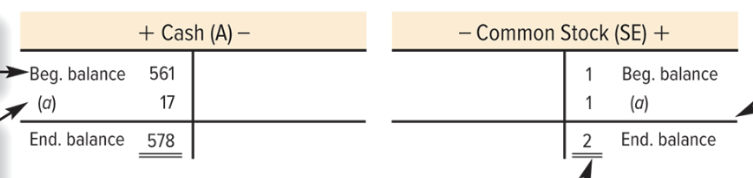

T-Account

useful tool for summarizing transaction effects and determining balances for individual accounts, simplified representation of a ledger account

Assets Increases and Decreases (T-Account)

increases are shown on the left and decreases appear on right

Liabilities/Stockholders’ Equity Increases and Decreases (T-Account)

increases are shown on right and decreases on left

T-Account General Notes on Structure

- starts with a beginning balance

- important to include reference to journal entry next to debit/credit

- when all transactions have posted to the T-Account, horizontal line drawn to signify balance to be determined

- ending balance written on appropriate side

To find account balances with T-Accounts

use T-Accounts as equations: Beginning Balance + “+” side - “-” side = Ending Balance

Uses of T-Accounts

- primarily for instructional and analytical purposes

- determine what transactions a company engaged in for a period