ECON 2020 Final Prep

1/75

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

76 Terms

In economics, the cost of something is:

A-the dollar amount of obtaining it.

B-always measured in units of time given up to get it.

C-what you give up to get it.

D-often impossible to quantify, even in principle.

C-what you give up to get it.

2- Consider Noah's decision to go to college. If he goes to college, he will spend $80,000on tuition, $15,000 on room and board, and $4,000 on books. If he does not go to college,he will earn $17,000 working in a store, and he will spend $13,000 on room and board.Noah's cost of going to college is:

A-$99,000.

B-$103,000.

C-$108,000.

D-$121,000.

B-$103,000.

Ella produces and sells earrings. Her total cost is zero if she doesn't produce anyearrings. If she produces one pair, her total cost is $20; If she produces two pairs, her totalcost is $50; and if she produces three pairs, her total cost is $90. Ella will produce only twopairs, if she can earn _______ for each pair she sells.

A-$21

B-$25

C-$33

D-$55

C-$33

You have driven 800 miles on a vacation, and then you notice that you are only 15 milesfrom an attraction you hadn't known about but would really like to see. In computing theopportunity cost of visiting this attraction, you had not planned to visit, you should include:

A-both the cost of driving the first 800 miles and the next 15 miles.

B-the cost of driving the first 800 miles, but not the cost of driving the next 15 miles.

C-the cost of driving the next 15 miles, but not the cost of driving the first 800 miles.

D-neither the cost of driving the first 800 miles nor the cost of driving the next 15 miles.

C-the cost of driving the next 15 miles, but not the cost of driving the first 800 miles.

Which of the following firms is likely to have the greatest market power?

A-an electric company

B-a farmer

C-a grocery store

D-a local electronics retailer

A-an electric company

Suppose Mr. A and Mr. B are running their business in offices that are located next toeach other in a building. They operate in the same industry, and everything about theirbusinesses is identical except that Mr. A pays rent to a landlord who owns the office to usehis office space, while Mr. B owns his office. Suppose that the rental rate of the offices inthe building went up from $400/month to $900/month. As a result, Mr. A's economic cost____________ and Mr. B's economic cost __________.

A-increased; did not change.

B-increased; increased.

C-did not change; increased.

D-did not change; did not change.

B-increased; increased.

Demand for Burger King meals does not increase when,

A-Buyers' income increases, and Burger King meals are normal good.

B-Burger King offers a 10% discount for its meal.

C-Pizza Hut meal prices go up, and Pizza Hut meals are substitute for Burger King meals.

D-Scientists discover that Burger King meals cure arthritis.

B-Burger King offers a 10% discount for its meal.

Two goods are complements when a decrease in the price of one good:

A-decreases the quantity demanded of the other good.

B-decreases the demand for the other good.

C-increases the quantity demanded of the other good.

D-increases the demand for the other good.

D-increases the demand for the other good.

Workers at a bicycle assembly plant currently earn the mandatory minimum wage. If thefederal government increases the minimum wage by $1.00 per hour, then it is likely that the:

A- demand for bicycle assembly workers will increase.

B-supply of bicycles will shift to the right.

C-supply of bicycles will shift to the left.

D-firm must increase output to maintain profit levels.

C-supply of bicycles will shift to the left.

Which of the following events must cause the equilibrium price to fall?

A-demand increases and supply decreases

B-demand and supply both decrease

C-demand decreases and supply increases

D-demand and supply both increase

C-demand decreases and supply increases

Suppose the demand is represented by the following equation: 𝑄𝐷 = 10 ― 𝑃, where 𝑄𝐷is quantity demanded and 𝑃 is price. Also assume that supply is given by this equation: 𝑄𝑆= 𝑃, with quantity supplied is denoted by 𝑄𝑆. If the price in this market is $7, ________.

A-There will be a shortage of 4 units.

B-The market will be in equilibrium.

C-There will be a surplus of 4 units.

D-There will be a surplus of 7 units.

C-There will be a surplus of 4 units.

Last month, the equilibrium price of orange juice was $7/gallon and 125 gallons weresold. This month, the equilibrium price of orange juice is $7.50/gallon and 100 gallons aresold. This could have been caused by _________

A-An increase buyers' income, as orange juice is a normal good.

B-The discovery of arsenic (an element toxic to humans) in orange juice bottles.

C-A tropical disease that killed a significant share of orange trees.

D-A decrease in the price of pomegranate juice (a substitute for orange juice).

C-A tropical disease that killed a significant share of orange trees.

Suppose there are always long lines of customers waiting in front of a restaurant andsome of the customers in the lines end up getting no food as the restaurant runs out ofmeals. To eliminate the lines, the restaurant:

A-must increase their prices.

B-must decrease their prices.

C-must keep their prices the same because price has nothing to do with the lines.

D-must offer a discount.

A-must increase their prices.

You lose your job and, as a result, you buy fewer iTunes music downloads. This showsthat you consider iTunes music downloads to be a(n)

A-luxury good.

B-inferior good.

C-normal good.

D-necessity.

C-normal good.

Which of the following is likely to have the most price-elastic demand?

A-lattés

B-doctor's visits

C-eggs

D-natural gas

A-lattés

Suppose demand is perfectly elastic, and the supply of the good in questiondecreases. As a result,

A-the equilibrium quantity decreases, and the equilibrium price is unchanged.

B-the equilibrium price increases, and the equilibrium quantity is unchanged.

C-the equilibrium quantity and the equilibrium price both are unchanged.

D-buyers' total expenditure on the good is unchanged.

A-the equilibrium quantity decreases, and the equilibrium price is unchanged.

Suppose an airline determines that its customers traveling for business have inelasticdemand and its customers traveling for vacations have an elastic demand. If the airline'sobjective is to increase total revenue, it should

A-increase the price charged to vacationers and decrease the price charged to businesstravelers.

B-decrease the price charged to vacationers and increase the price charged to businesstravelers.

C-decrease the price to both groups of customers.

D-increase the price for both groups of customers.

B-decrease the price charged to vacationers and increase the price charged to businesstravelers.

There are very few, if any, good substitutes for motor oil. Therefore, the

A-demand for motor oil would tend to be inelastic.

B-demand for motor oil would tend to be elastic.

C-demand for motor oil would tend to respond strongly to changes in prices of othergoods.

D-supply of motor oil would tend to respond strongly to changes in people's tastes for large cars relative to their tastes for small cars.

A-demand for motor oil would tend to be inelastic.

The income elasticity of demand for caviar tends to be:

A-low because caviar is relatively expensive.

B-low because caviar is packaged in small containers.

C-high because buyers generally feel that they can do without it.

D-low because it is almost always in short supply.

C-high because buyers generally feel that they can do without it.

The equilibrium price and quantity of a normal good were $10 and 1000 units last year.This year, after an increase in buyers' income, the equilibrium price and quantity are $20and 2000 units. Then, the price elasticity of demand _________.

A-is 1.

B-is -1.

C-is 2.

D-cannot be computed with the given information.

D-cannot be computed with the given information.

Suppose the government has imposed a price floor on the market for soybeans. Whichof the following events could transform the price floor from one that is not binding into onethat is binding?

A-Farmers use improved, draught-resistant seeds, which lowers the cost of growingsoybeans.

B-The number of farmers selling soybeans decreases.

C-Consumers' income increases, and soybeans are a normal good.

D-The number of consumers buying soybeans increases.

A-Farmers use improved, draught-resistant seeds, which lowers the cost of growingsoybeans.

If the government levies a $1,000 tax per boat on sellers of boats, then the price paid bybuyers of boats would:

A-increase by more than $1,000.

B-increase by exactly $1,000.

C-increase by less than $1,000.

D-decrease by an indeterminate amount.

C-increase by less than $1,000.

Consider the demand and supply tables below. Which of the following price ceilings would be binding in this market?

Price: Qd Qs

$20 2400 0

$30 2000 200

$40 1600 400

$50 1200 600

$60 800 800

$70 400 1000

$80 0 1200

A- $80

B- $70

C- $60

D- $50

D- $50

The willingness to pay of five possible buyers David, Laura, Megan, Mallory, and Audreyis $8.50, $7.00, $5.50, $4.00, and $3.50, respectively. If the price of Vanilla Coke is $6.90,who will purchase the good?

A- all five individuals

B- Megan, Mallory and Audrey

C- David, Laura and Megan

D- David and Laura

D- David and Laura

Eliminating a binding price ceiling _____________ and ____________.

A- generates a shortage; increases producer surplus

B- generates a shortage; increases consumer surplus

C- eliminates a shortage; increases producer surplus

D- eliminates a shortage; increases consumer surplus.

C- eliminates a shortage; increases producer surplus

The reservation prices for sellers Marcia, Jan, Cindy, Greg, Peter, and Bobby forproviding 10 piano lessons of equal quality are $200, $250, $350, $400, $700, and $800,respectively. You wish to purchase 10 piano lessons, so you take bids from each of thesellers. You will not accept a bid below a seller's cost because you are concerned that theseller will not provide all 10 lessons. What bid will you accept?

A- $351

B- $251

C- $249

D- $199

C- $249

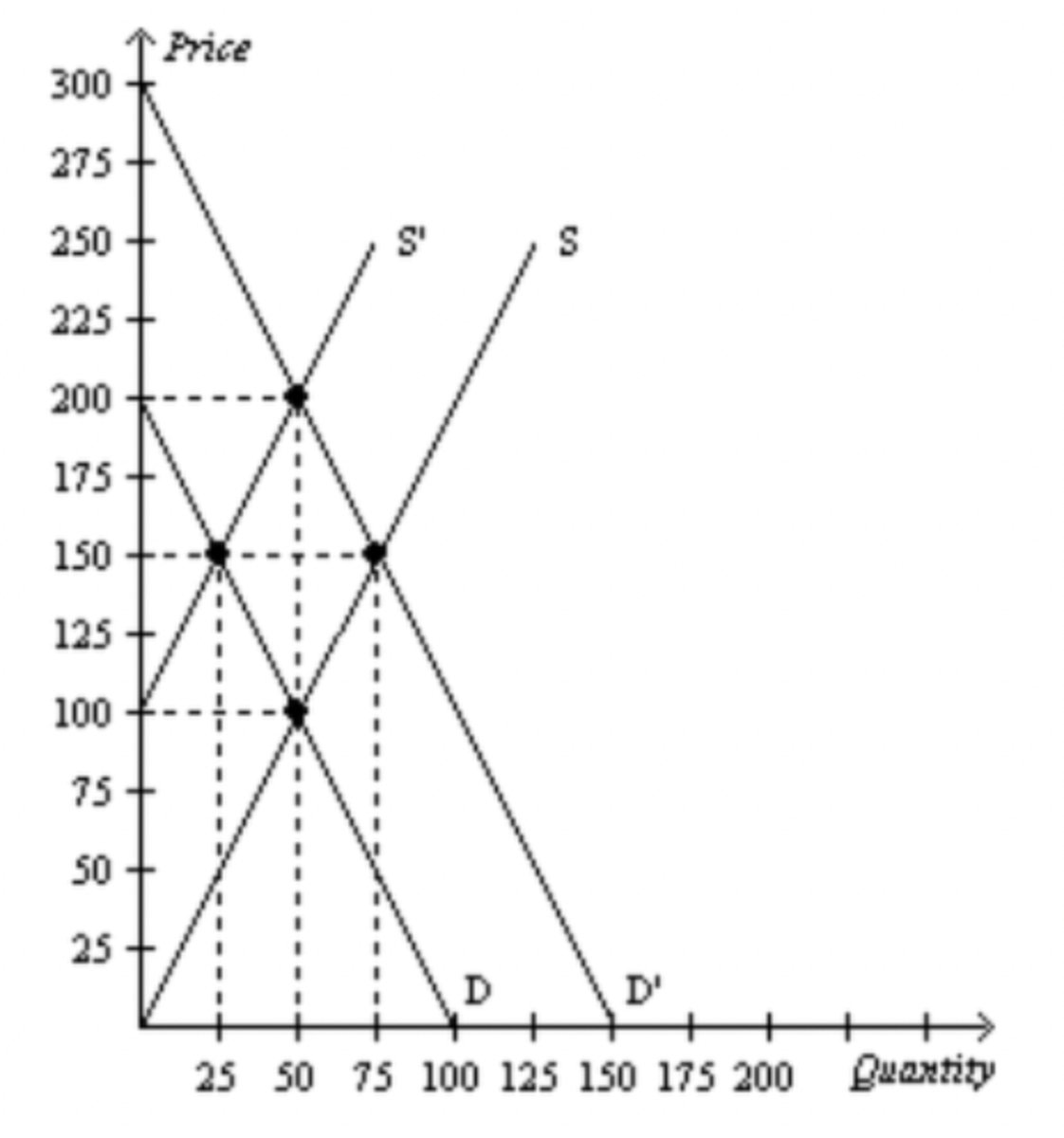

If the supply curve is S and the demand curve shifts from D to D', what is the increase inproducer surplus due to new producers entering the market?

A- $625

B- $2,500

C- $3,125

D- $5,625

A- $625

The demand curve is a straight line whose vertical (price) axis intercept is $12 andhorizontal (quantity) intercept is 18. The supply curve is also a straight line that passesthrough the origin (P=$0 and Q=0). If the equilibrium price is $4, at equilibrium, consumersurplus is:

A- $24.

B- $36.

C- $42.

D- $48.

D- $48.

A simultaneous increase in both the demand for MP3 players and the supply of MP3players would imply that the value of MP3 players to consumers has __________ and thecost of producing MP3 players __________.

A- increased; increased.

B- decreased; decreased.

C- decreased; increased.

D- increased; decreased.

D- increased; decreased.

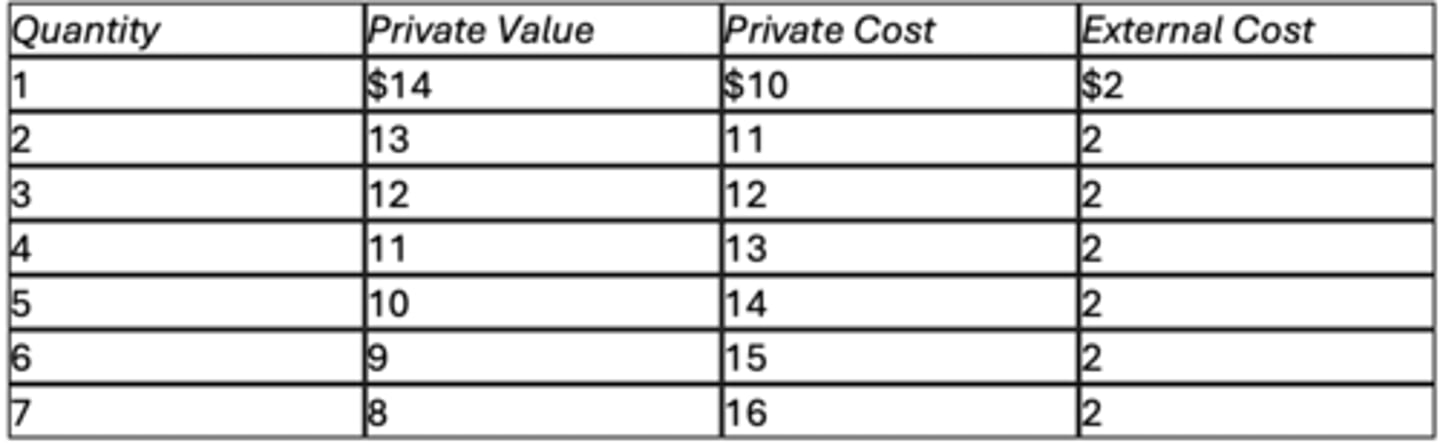

The following table shows the private value, private cost, and external cost for variousquantities of output in a market.Quantity Private Value Private Cost External Cost1 $14 $10 $22 13 11 23 12 12 24 11 13 25 10 14 26 9 15 27 8 16 2What is the socially optimal quantity of output in this market?

A- 1 unit

B- 2 units

C- 3 units

D- 4 units

B- 2 units

Which of the following is NOT an example of a negative externality?

A- air pollution from a manufacturing plant.

B- disrupted sleep from a neighbor's loud music.

C- an illness caused by secondhand cigarette smoke.

D- a decrease in your property value from neglecting your lawn and garden.

D- a decrease in your property value from neglecting your lawn and garden.

A benevolent social planner would prefer that the output of good x be decreased fromits current level if, at the current level of output of good x,

A- social value = private value = private cost < social cost.

B- private cost < social cost = private value = social value.

C- social cost = private cost = private value < social value.

D- social cost = private cost = private value = social value.

A- social value = private value = private cost < social cost.

The demand curve for gasoline slopes downward and the supply curve for gasolineslopes upward. The production of the 1,000th gallon of gasoline entails a private cost of$3.10, a social cost of $3.55, and a value to consumers of $3.70. Suppose the dollaramount of the externality, per gallon of gasoline, is constant, regardless of how muchgasoline is produced. Then the externality could be internalized if producers of gasolinewere

A- provided a subsidy of $0.25 per gallon of gasoline sold.

B- provided a subsidy of $0.45 per gallon of gasoline sold.

C- required to pay a tax of $0.45 per gallon of gasoline sold.

D- required to pay a tax of $0.30 per gallon of gasoline sold.

C- required to pay a tax of $0.45 per gallon of gasoline sold.

Suppose that cigarette smokers create a negative externality. Further, suppose that thegovernment imposes a tax on cigarettes equal to the per-unit externality. What is therelationship between the after-tax equilibrium quantity and the socially optimal quantity ofcigarettes?

A- They are equal.

B- The after-tax equilibrium quantity is greater than the socially optimal quantity.

C- The after-tax equilibrium quantity is less than the socially optimal quantity.

D- There is not enough information to answer the question.

A- They are equal.

Two firms, A and B, each currently dump 50 tons of chemicals into the local river. Thegovernment has decided to reduce the pollution and from now on will require a pollutionpermit for each ton of pollution dumped into the river. The government will sell 40 pollutionpermits for $75 each. It costs Firm A $100 for each ton of pollution that it eliminates beforeit reaches the river, and it costs Firm B $50 for each ton of pollution that it eliminatesbefore it reaches the river. Neither firm produces any less output, but they both conform tothe law. It is likely that between the cost of permits and the cost of additional pollutionabatement,

A- Firm A will spend $3,500.

B- Firm B will spend $2,500.

C- Firm A will spend $4,500.

D- Firm B will spend $3,500.

B- Firm B will spend $2,500.

Which of the following goods is nonrival in consumption and excludable?

A- Grand Canyon National Park on a rainy, cool day

B- Disney World on a rainy, cool day

C- a crowded public beach on a sunny, warm day

D- White Mountain ski resort on a sunny, mild day

B- Disney World on a rainy, cool day

Which of the following would be considered a public good?

A- an uncongested, untolled highway

B- an uncongested, tolled highway

C- a congested, untolled highway

D- a congested, tolled highway

A- an uncongested, untolled highway

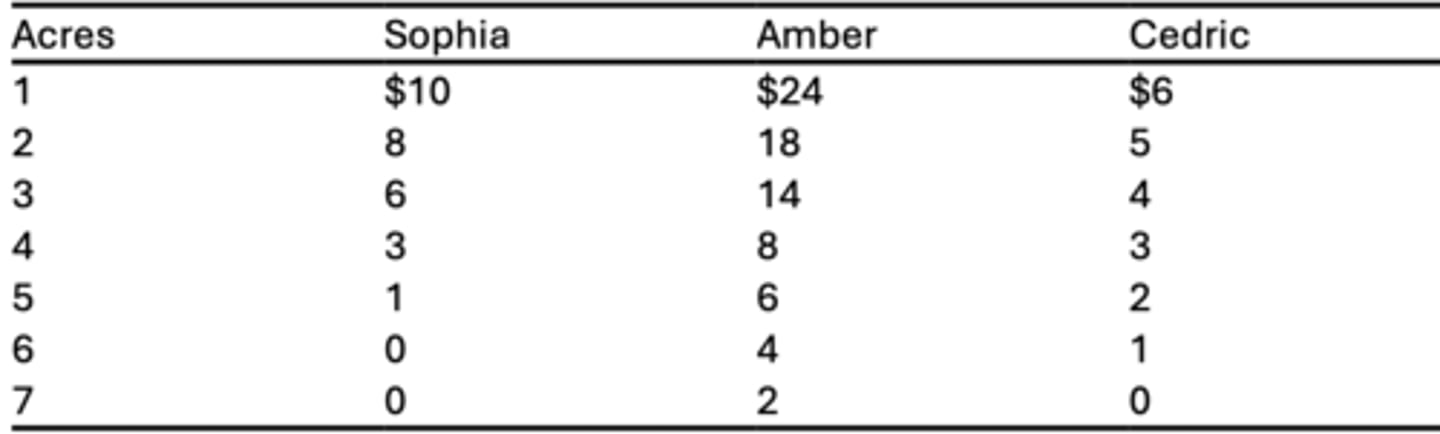

Consider the town of Springfield with only three residents, Sophia, Amber, and Cedric.The three residents are trying to determine how large, in acres, they should build the publicpark. The table below shows each resident's willingness to pay for each acre of the park. Suppose the cost to build the park is $24 per acre and that the residents have agreed tosplit the cost of building the park equally. To maximize his own surplus, how many acreswould Cedric like Springfield to build?

A- 0 acres

B- 1 acre

C- 2 acres

D- 3 acres

A- 0 acres

On holiday weekends thousands of people picnic in state parks. Some picnic areasbecome so overcrowded the benefit or value of picnicking diminishes to zero. Anovercrowded picnic area is an example of

A- a private good.

B- a club good.

C- a Tragedy of the Commons.

D- public good.

C- a Tragedy of the Commons.

Suppose the demand is represented by the following equation: 𝑄𝐷 = 10 ― 𝑃, where 𝑄𝐷is quantity demanded and 𝑃 is price. Also assume that supply is given by this equation: 𝑄𝑆= 𝑃, with quantity supplied is denoted by 𝑄𝑆. The market is currently at equilibrium. If thegovernment levies a $2 excise tax on sellers, buyers will bear ______% of the tax burden.

A- 0

B- 25

C- 50

D- 100

C- 50

Consider a firm in the short run whose only variable input is labor (L). The total cost of afirm increases at an increasing rate as output increases. Then the marginal product oflabor must be __________________.

A-increasing.

B-a non-zero constant.

C-decreasing.

D-zero.

C-decreasing.

Bev is opening her own court-reporting business. She financed the business bywithdrawing money from her personal savings account. When she closed the account, thebank representative mentioned that she would have earned $300 in interest next year. IfBev hadn't opened her own business, she would have earned a salary of $25,000. In herfirst year, Bev's revenues were $30,000, and she spent $1,000 on materials and supplies.Which of the following statements is correct?

A-Bev's total explicit costs are $26,300.

B-Bev's total implicit costs are $300.

C-Bev's accounting profits exceed her economic profits by $300.

D-Bev's economic profit is $3,700.

D-Bev's economic profit is $3,700.

Let L represent the number of workers hired by a firm, and let Q represent that firm'squantity of output. Assume two points on the firm's production function are (L = 5, Q = 125)and (L = 6, Q = 152). Then the marginal product of the 6th worker is

A-25 units of output.

B-27 units of output.

C-37 units of output.

D-162 units of output.

B-27 units of output.

In the short run, a firm incurs fixed costs

A-only if it incurs variable costs.

B-only if it produces no output.

C-only if it produces a positive quantity of output.

D-whether it produces output or not.

D-whether it produces output or not.

At Bert's Bootery, the total cost of producing twenty pairs of boots is $400. The marginalcost of producing the twenty-first pair of boots is $83. We can conclude that the

A-average variable cost of 21 pairs of boots is $23.

B-average total cost of 21 pairs of boots is $23.

C-average total cost of 21 pairs of boots is $15.09.

D-marginal cost of the 20th pair of boots is $20.

B-average total cost of 21 pairs of boots is $23.

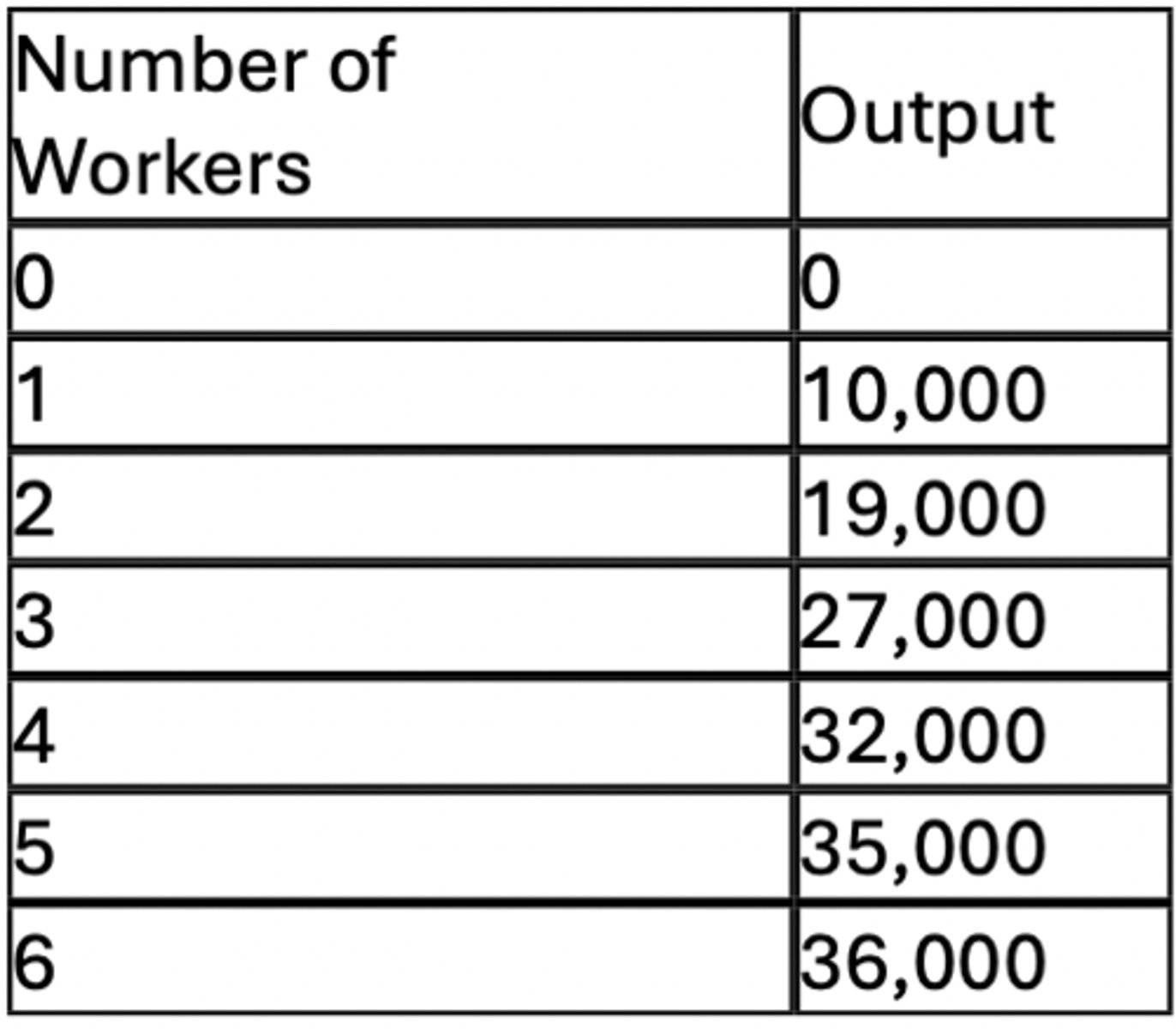

Assume that fixed costs are $500, and variable costs are $100 per worker. For this firm,what are the shapes of the production function and the total-cost curve?

A-Both the production function and total-cost curve are increasing at an increasing rate.

B-Both the production function and total-cost curve are increasing at a decreasing rate.

C-The production function is increasing at an increasing rate, whereas the total-costfunction is increasing at a decreasing rate.

D-The production function is increasing at a decreasing rate, whereas the total-costfunction is increasing at an increasing rate.

D-The production function is increasing at a decreasing rate, whereas the total-costfunction is increasing at an increasing rate.

Suppose that a firm has only one variable input, labor, and firm output is zero whenlabor is zero. When the firm hires 6 workers it produces 90 units of output. Fixed cost ofproduction are $6 and the variable cost per unit of labor is $10. The marginal product of theseventh unit of labor is 4. Given this information, what is the average total cost ofproduction when the firm hires 7 workers?

A-Less than $1

B-$76

C-$906

D-$946

A-Less than $1

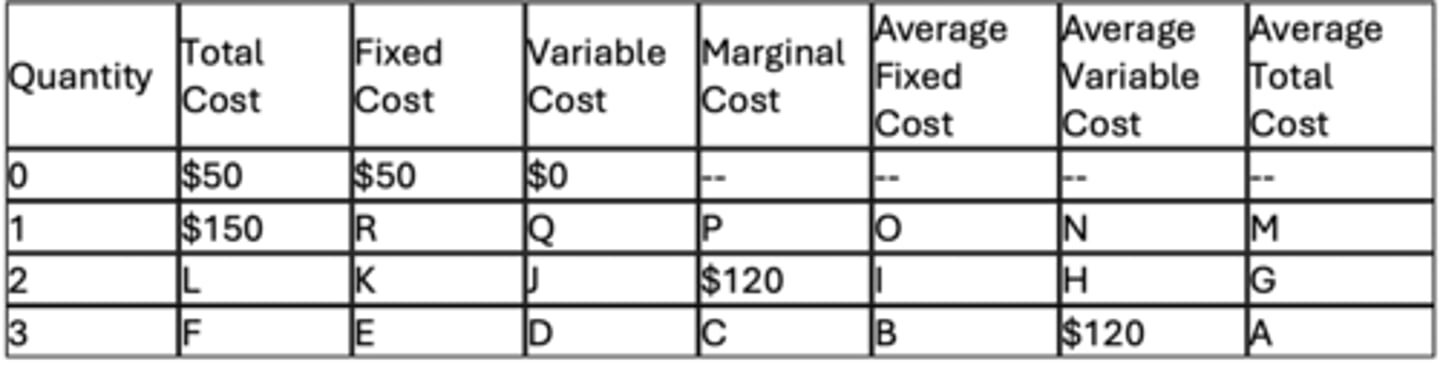

What is the value of L?

A-$60

B-$135

C-$240

D-$270

D-$270

Consider a profit-maximizing firm that produces 100 units of a good and makes $100profits. If its fixed cost increases by $500, then it will produce ___________ units and make aprofit of ______________.

A-less than 100; 100

B-less than 100; -$400

C-100; $100

D-100; -$400

D-100; -$400

If marginal cost is greater than the average total cost,

A-average variable cost must be falling.

B-average fixed cost must be rising.

C-average total cost must be increasing.

D-marginal product must be rising.

C-average total cost must be increasing.

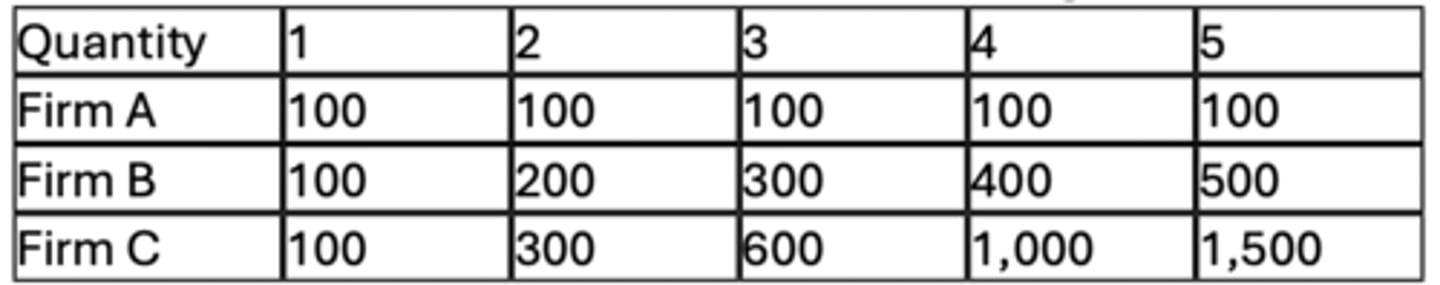

Consider the table below which lists the long-run total costs for three different firms. Which firm is experiencing constant returns to scale?

A-Firm A only

B-Firm B only

C-Firm C only

D-Firm A and Firm B only

B-Firm B only

A firm is producing 100 units of an output at an average total cost of $100. If itproduced 101 units, then its average total cost will be $101. The firm will produce the 101stunit if the price is _____________

A-50

B-101

C-200

D-250

D-250

Which of the following statements is correct?

A-For all firms, marginal revenue equals the price of the good.

B-Only for competitive firms does average revenue equal the price of the good.

C-Marginal revenue can be calculated as total revenue divided by the quantity sold.

D-Only for competitive firms does average revenue equal marginal revenue.

D-Only for competitive firms does average revenue equal marginal revenue.

If a competitive firm is currently producing a level of output at which marginal costexceeds marginal revenue, then

A-a one-unit increase in output will increase the firm's profit.

B-a one-unit decrease in output will increase the firm's profit.

C-total revenue exceeds total cost.

D-total cost exceeds total revenue.

B-a one-unit decrease in output will increase the firm's profit.

A competitive firm has been selling its output for $20 per unit and has been maximizingits profit, which is positive. Then, the price rises to $25, and the firm makes whateveradjustments are necessary to maximize its profit at the now-higher price. Once the firmhas adjusted, its

A-quantity of output is higher than it was previously.

B-average total cost is higher than it was previously.

C-marginal revenue is higher than it was previously.

D-All of the above are correct.

D-All of the above are correct.

If a profit-maximizing firm in a competitive market discovers that, at its current level ofproduction, price is less than the average variable cost, it should

A-shut down.

B-reduce its output but continue operating.

C-continue to produce at the current levels.

D-increase its output.

A-shut down.

Suppose that a firm in a competitive market is currently maximizing its short-run profitat an output of 50 units. If the current price is $9, the marginal cost of the 50th unit is $9,and the average total cost of producing 50 units is $4, what is the firm's profit?

A-$0

B-$200

C-$250

D-$450

C-$250

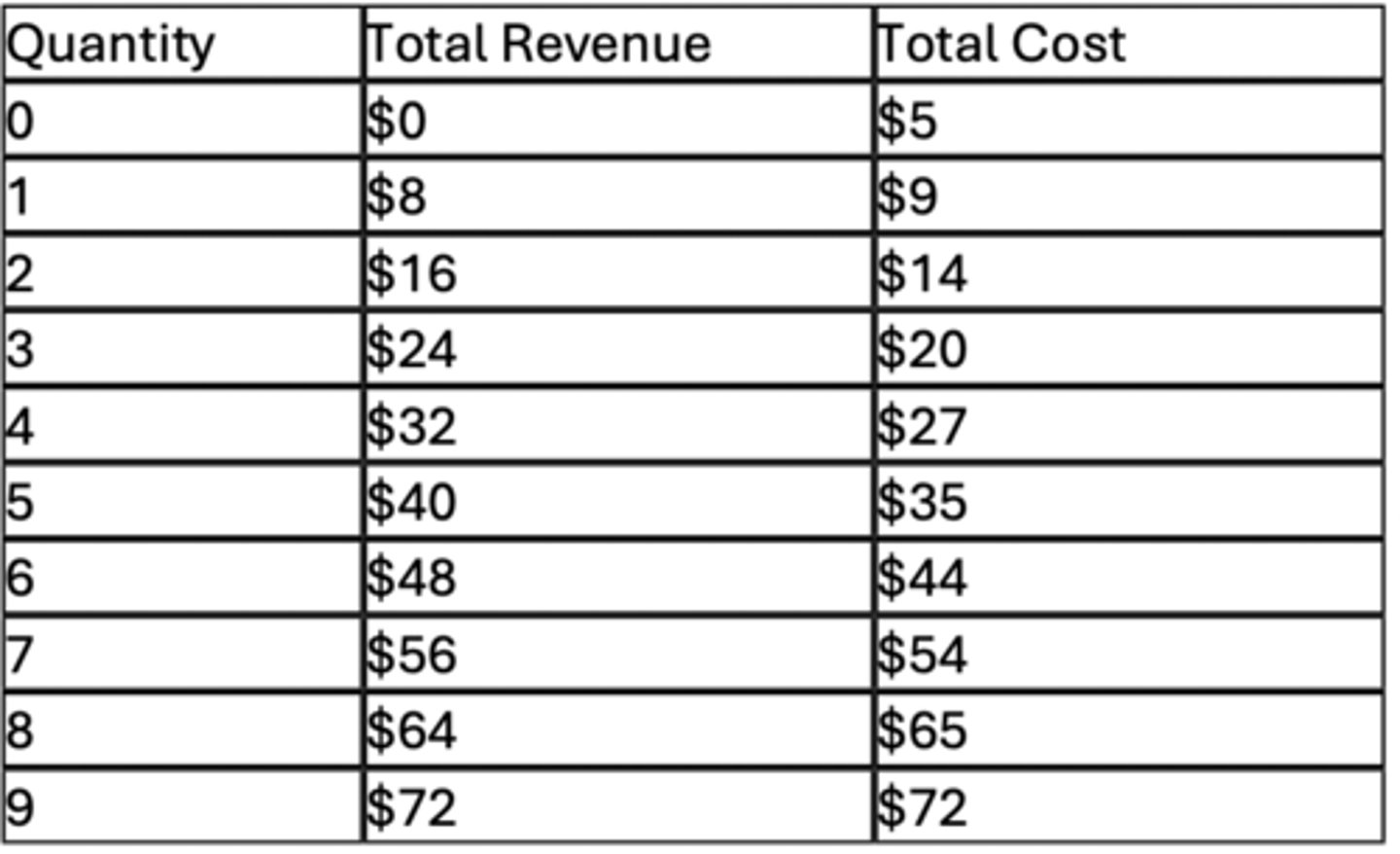

Consider the table below which lists the revenues and costs of a firm in a competitive market. If the firm produces 3 units of output,

A-marginal cost is $4.

B-total revenue is greater than variable cost.

C-marginal revenue is less than marginal cost.

D-the firm is maximizing profit.

B-total revenue is greater than variable cost.

When new firms have an incentive to enter a competitive market, their entry will

A-increase the price of the product.

B-drive down profits of existing firms in the market.

C-shift the market supply curve to the left.

D-increase demand for the product.

B-drive down profits of existing firms in the market.

In the long run, assuming that the owner of a firm in a competitive industry has positiveopportunity costs, she

A-should exit the industry unless her economic profits are positive.

B-will earn zero accounting profits but positive economic profits.

C-will earn zero economic profits but positive accounting profits.

D-should ignore opportunity costs because they are a type of sunk cost that disappears in the long run.

C-will earn zero economic profits but positive accounting profits.

A city raises bus fares by 10%. Ridership falls 5%, and total revenue rises. What followsabout demand elasticity over time if commuters adjust slowly to alternatives?

A. Becomes more inelastic

B. Becomes more elastic

C. Stays the same

D. Becomes perfectly inelastic

B. Becomes more elastic

A binding price ceiling on rental housing leads to:

A. Surplus of apartments

B. Shortage of apartments

C. Equilibrium unchanged

D. Higher rents

B. Shortage of apartments

A city places a $20 per-unit tax on a good whose demand is perfectly inelastic and whosesupply is upward-sloping. What happens to the efficiency loss, and who bears the tax burden?

A. Efficiency loss is large; producers bear the full burden

B. Efficiency loss is zero; consumers bear the full burden

C. Efficiency loss is positive; consumers bear most of the burden

D. Efficiency loss is zero; producers bear the full burden

B. Efficiency loss is zero; consumers bear the full burden

Ride-share trips currently cost $10. After a $4 tax on each trip, the price paid by riders risesto $14, and drivers receive $10 after the tax. Who bears more of the tax burden?

A. Riders

B. Drivers

C. Burden is equal

D. Depends on elasticity but cannot be determined here

A. Riders

A tax is placed on a market with a very elastic supply and inelastic demand. Which group bears most of the economic burden, and what happens to DWL (deadweight loss)?

A. Consumers bear more; DWL large

B. Producers bear more; DWL small

C. Consumers bear more; DWL small

D. Producers bear more; DWL large

C. Consumers bear more; DWL small

A factory produces a pollutant as a byproduct. The government imposes a tax equal to thesocial cost of the pollution. What happens to the factory's supply curve and output?

A. Supply shifts left, reducing output

B. Supply shifts right, increasing output

C. Demand shifts left, reducing output

D. Demand shifts right, increasing output

A. Supply shifts left, reducing output

A factory emits pollution. A tax equal to the marginal external cost is imposed. Whatresults?

A. Output increases to the efficient level

B. Output falls below the efficient level

C. Output moves to the efficient level

D. External costs rise

C. Output moves to the efficient level

Suppose a market with a negative externality is initially unregulated. If the governmentimplements a Pigovian tax but sets it below the true marginal external cost, which of thefollowing outcomes results?

A. The market will produce exactly the socially optimal quantity

B. The market will still overproduce relative to the social optimum

C. The market will underproduce relative to the social optimum

D. The market will produce the efficient quantity only if demand is perfectly elastic

B. The market will still overproduce relative to the social optimum

A competitive industry produces a good with a negative externality. A per-unit correctivetax equal to the external cost is imposed. Compared to the unregulated outcome, which isTRUE?

A. Total surplus falls due to tax distortions

B. Quantity rises to the socially optimal level

C. Deadweight loss from the externality is eliminated

D. Consumer surplus increases

C. Deadweight loss from the externality is eliminated

A factory emits pollution affecting nearby residents. If bargaining costs are high, whichpolicy best reduces deadweight loss?

A. Laissez-faire

B. Pigouvian tax

C. Rationing permits without trade

D. Private negotiation

B. Pigouvian tax

If the government provides a subsidy to encourage vaccination that has a positiveexternality, what happens to equilibrium and welfare?

A) Price rises, quantity falls, welfare decreases

B) Price falls, quantity rises, welfare increases

C) Price rises, quantity rises, welfare decreases

D) Price falls, quantity falls, welfare unchanged

B) Price falls, quantity rises, welfare increases

A town's fireworks display is funded voluntarily. After a population increase, individualcontributions fall even though total willingness to pay rises. Why?

A. Costs rose

B. Free-riding increased

C. Fireworks rival in consumption

D. Government banned donations

B. Free-riding increased

A lighthouse benefits all ships equally, and no ship can be excluded from its use. If thegovernment does not provide it, the free-rider problem implies:

A. Too much of the lighthouse

B. Efficient private provision

C. Underprovision of the lighthouse

D. Zero demand for lighting

C. Underprovision of the lighthouse

In a community relying on a common fishing lake, overfishing occurs due to the tragedyof the commons. What policy best reduces this inefficiency?

A. Assign property rights to individual fishers

B. Subsidize fishing equipment

C. Increase public advertising for fishing

D. Remove all fishing regulations

A. Assign property rights to individual fishers

Which of the following is not a way for the government to solve the problem of excessiveuse of common resources?

A. Regulation

B. Taxes

C. Turning the common resource into a public good

D. Turning the common resource into a private good

C. Turning the common resource into a public good

A fishery introduces tradable catch permits to address overfishing. What is the expectedeffect?

A. Larger total catch and lower fish stock

B. Reduced catch and improved fish stock

C. Larger catch and improved fish stock

D. No change from open access

B. Reduced catch and improved fish stock