MHR 322 Exam 1

1/104

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

105 Terms

Entrepreneurship is

An economic phenomena

A possible career choice

A mindset that can be used in any organizational context

Management mindsets: Given and Challenges

Given:

Resources available based on current state

Goal to achieve based on incremental steps

Challenge:

Find the most effective/ efficient path linking the resources to the goa

Entrepreneurial Mindsets: Given and Challenges

Given:

Opportunities arise from uncertainty

Resources can be acquired/ assembled

Challenge:

Utilize a flexible, adaptive process to simultaneously explore possible goals and path to those goals

In an uncertain world…

An entrepreneurial mindset will be valuable

new , complex challenges

Unequal access to resources

Changing time frames

Globalization

Increased competition, access to resources and customers

Technology- facilitated scaled up

Bocks Definition of Entrepreneurship

recognizing an opportunity and taking action to create change

Being vs. Succeeding

The traits that lead people to become entrepreneurs may not be the same traits that helps entrepreneurs succeed.

Traits of people more likely to become entrepreneurs

Greater self-esteem

Need for achievement and independence

Good on learning aptitude test (GPA not so much)

Comfortable with calculated risk-taking

Innovativeness creativity

Optimistic

Non-trait drivers of entrepreneurship

Socio-economic factors

Educational attainment

national/immigrant status

Nature v. nurture

Prior experience

Traits of Entrepreneurs: Seeking Balance

High self-esteem and optimism can lead to trouble

Need to validate your idea with customer/market feedback

The nest entrepreneurs are both determined and willing to be wrong

Failure in real learning

Learn valuable information

Build new skills

Be vulnerable

Stay on a path that can be found by trial and error

To be successful soon

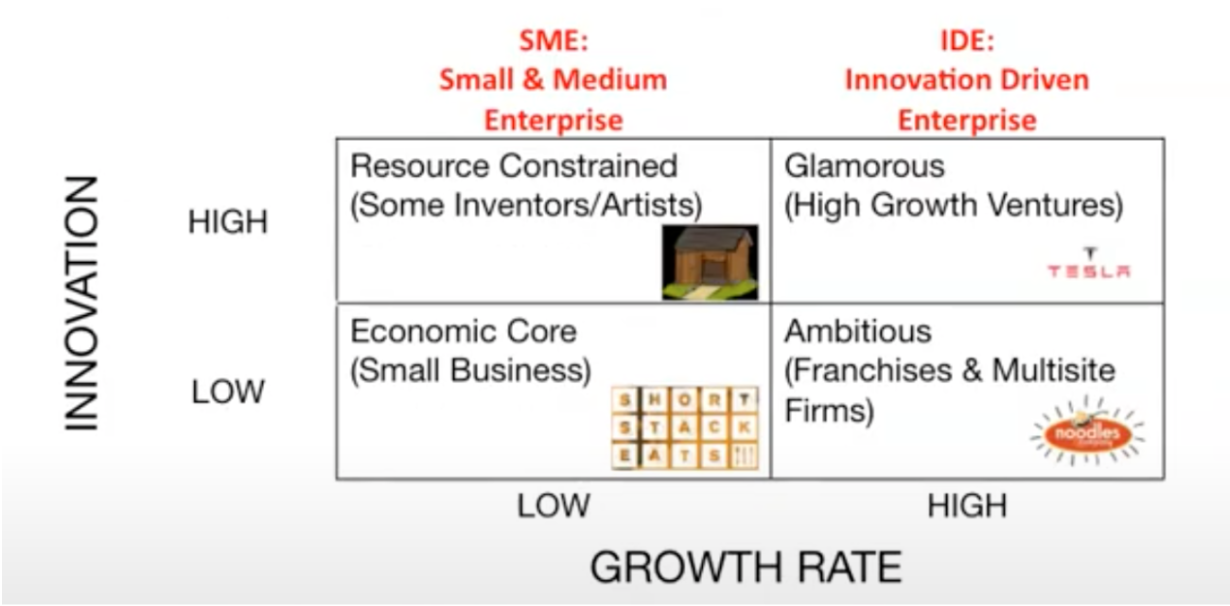

Dynamic Capitalism Typology

Separating out entrepreneurship types

Economic core: restaurants

Resource Constrained: lot of innovation but low growth rate

Ambitious: noodles and company, set of meals were created it can be replicated everywhere, low innovation

Glamorous Ventures: Tesla, significant technological change

Entrepreneurship is also:

Social entrepreneurship

Corporate entrepreneurship

Family business

Social Entrepreneurship

Innovations in non-profit management

Solving societal problems via new for-profit firms (ex. Whole Foods, TOMs Shoes)

Including non-profit maximizing metrics as goals for the firm, such as…

Reduce IT items in landfills

Donate 10% of profits to charity

Corporate and Family

Corporate entrepreneurship (Intrapreneurship)

Innovation and entrepreneurial culture in large firms

Better support structure/lower idk

Limited rewards

Family Business

Significant component of firms of all sizes

Large firms: Johnson Wax, Menards

Family issues can be very real, for good and bad

3 Motivations to start a venture (from DE reading)

Passion: I like doing X and want to build a company around it

Technology: Robot that can do X

Idea: Came up with an idea that can change the world (by solving a problem)

Passion in Entrepreneurship

Passion is great

Passion is probably required… but alone it isn't enough

Technology/Push risks lack of market demand

Great solution for a problem I don't have

Need to either pivot to new market or create demand

Key Questions-Technology

The technology is?

Why do you have a significant advantage over anyone else with regard to this technology/invention?

Compared with the most relevant current alternative, why is your technology so compelling that it will make people and industries change

Idea/Risk is that demand pull exist but no solution

Problem that has yet to be solved

Solution isn't Profitable

Real problem has been solved but not cost effectively

Key Questions-Problem/Market Pull

What is the general problem you are trying to solve or the opportunity you are looking to capitalize on?

How urgent/big of a problem is this for customers?

What makes you and your team uniquely qualified to implement your idea?

Key Questions-Hybrid

The idea is relevant to the ________ market because it will produce significant value by ____________

The enabling technology invention is? Why wasn't this solution possible 5 years ago?

What makes you and your team uniquely qualified to pursue this opportunity?

Two Key Questions for Entrepreneurship Idea

Does customer demand exist for what you are selling?

If “yes,” can I generate long-term profits in the business?

Two main Approaches in Entrepreneurship

Predictive (Forecasting)

Try to predict characteristics of ideas, or conditions, that will

Learning (Experimentation)

May Perform experiments and use results to assess future outcomes

Learning Framework

Have an idea for a product/company

Realize that your “idea” may or may not be correct

Formalize your idea into a theory

Test your theory by building an experiment

Inexpensive

As real as possible

Measure the results

change/pivot your idea in response to what you learn

Repeat

Why is failure is normal

Attractive customer segment is smaller/different than expected

Why Industry Analysis

Anticipate the most profitable industries

Enter Where profitability will increase or stay high

exit/avoid those where profit is low and will remain low.

Good manager vs. good business, who wins?

What drives profitability of a market/industry

Threat of Entry

Brand name

Patents

Network effects

High switching costs

Scale economies

Others

The Five Forces: (Reading)

determine the competitive structure of an industry, and its profitability. Industry structure together with a company’s relative position within the industry = two basic drivers of company profitability

help companies predict shifts in competition, shape how industry structures evolves, and find better strategic positions within the industry

Top-Down for calculating Total Addressable Market (TAM)

using industry research and reports

overestimates market size

Bottom-Up for calculating Total Addressable Market (TAM)

using data for early selling efforts

Value Theory for calculating Total Addressable Market (TAM)

using conjecture about buyers willingness to pay

Factors affecting adoption rate

Relative advantage

Compatibility

Trainability

Observability

Risk

Complexity

Pros and Cons of creating a Market

Pros: first-mover advantage over competitors: potential brand power, potentially high profit margins

Cons: difficult to conduct market research: cost of educating customers: high risk of getting it wrong

China Syndrome

market is huge meaning only need a small % to do well (WRONG)

“Top-down” analysis → almost always wrong

Potential Segment Characteristics

Demographics, Geographics

what drives these characteristics (loyal, sensitive)

True segments are determined by

behavior

Target Customer Segment

a group of potential customers who share many characters and who would all have similar reasons to buy a particular product.

Beachhead Market

Pick one (only one!)

Small has advantages

Most compelling value proposition

Easy access for testing

End User

person using the product

Champion

closely related and encourage the product

Primary Economic Buyer

paying for the product, but not using the product

Influencers

experts, endorsements, veto power (matters a lot)

Total Addressable Market (TAM)

Annual revenue your business would earn if it had 100% market share

As if every (realistically) possible customer made the purchase

#of potential customers x average price of the product/service calculate per year

Value Proposition

The benefits that a company offers a specific customer segment that makes a purchase worthwhile

Pains removed from customer from product

Price

Performance (time/quality)

Cost reduction

Risk reduction

convenience/usability

Accessibility to new segment

Feel better/ remove guilt

Other

Benefits Gained by customer

Customization

Newness

Design

Social status/brand

Entertained

How to confirm value proposition

take complete theory to market

test theory in smaller, quicker components

Good Value Proportions (Osterwalder)

difficult to copy

outperform competition

align with how customers measure success

focus on unsatisfied jobs

Common Value Proposition Problems

Idea is just a feature extension for someone else’s product

Nice to have but not got to have

Too small of a potential market actually cares about the V.P

Prospect Theory

people would rather avoid a loss than have a chance at a gAIN

Endowment Theory

people value what they have more than what they dont

The Innovator’s Curse

Self-Selection

Results in a clash in perspective

knowledge gap (innovator knows the need but the customer doesnt)

Degrees of Change

Incremental/Tinkering: Low Behavior Change, Low Product Change

Strike Out: high behavior change, low product change

Long Haul: high behavior change, high product change

Home Run: low behavior chnge, high product change

Intellectual Property

inventions

literacy and artistic works, symbols, names and images

protected by law

Copyright

legal protection provided to authors of creative work

doesn’t protect facts or ideas, not plagiarism

Patents

not an automatic protection

inventor and who signs the rights to invention

limit of years they can protect the invention

only in US

Types of Patents

Utility Patents: new useful and nonobvious processes, machines

Plant Patent: protect asexually reproducing plants

Design Patent: protect ornamental designs

Trademark

words, phrases, logos, shapes, colors, sounds and scents

Trade Dress

Identified a brand or product with its overall look, distinctive non-functional design element of a product, packaging

Core Competitive Advantage Potential

Quality

Network effect

Customer service

Low cost

User experience

manufacturing /design expertise

Core- Competitive Advantage Cons

Better technology’ product

First mover advantage

Locking up suppliers

Low price (careful!)

Network Effect

Value of product/service depends on number of users/customers

The value to a new user/customer increases as the size of the network increases

Ex. ebay, facebook,

High switching cost – switching to something else you lose significant value

Customer Service - Competitive Advantages

Can be a powerful advantage

Often appears easy to create and maintain, but usually not!

Requires significant investment in training, HR management and culture

Cost < or > Price

Low price = low margin

Anyone can do this and fail

Low cost = competitive advantage

Few companies do this and win

Core is NOT

First mover advantage

Despite what many entrepreneurs want to believe

May facilitate network effect but isn't sustainable by itself

Locking up suppliers (careful…)

Rare that there is a single provider

Ever rarer that they will be happy with an exclusive distributor/customer

Comparing your Offering to the competition

Define market

Define attributes you think customers will care about the most

Include status-quo

Include direct competitors

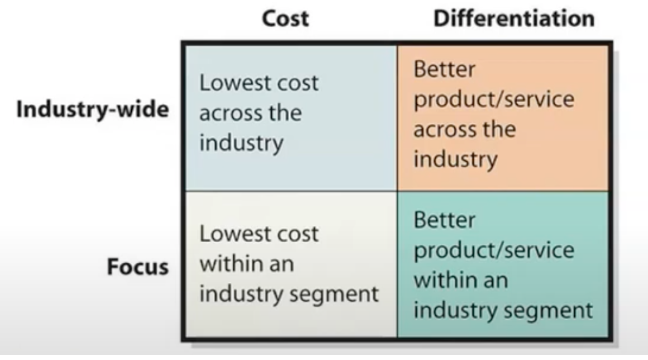

Competitive Strategy

Two sources of competitive advantage:

Cost

Differentiation

Degree of Scope:

Broad

Focused (niche)

Start-Up Competition

looks different

dont look to competition for solutions

dont respond instantly to competitive shifts

focus on competing in one event at first

Competition Factors

Be careful about assumptions

Recognize small firm advantages

Look for switching costs

High Switching Cost

switching to something else means you lose significant value

Low Switching Cost

what entrepreneurs wants,

the customer isnt losing significant value in switching to something else

Small Firm Advantages

high powered incentives

idea

speed

fit with environment

no legacy costs : costs from the past of this company that customers compare

potentially closer to customers

Switching Costs

cognitive/ user level

complementary assets

search costs

network effects

costs from switching products

time, money, knowledge, opportunity cost

lead to lock in

Overcoming Switching Costs

removes/reduces switching cost

technologically better than the others

benefits outweigh the costs, risks, and uncertainty of switching

fits customers purchase logic

Establish Switching Costs

contractual provisions

extended, exclusive

stagger purchases (durable purchases)

unique interfaces (brand specific)

acquire/ neutralize other suppliers

customize solutions (search cost)

establishing loyalty programs

Success is

execution

creating demonstrable value for customers

compared to what they have

compared to what is offered by competition

Porters Generic Strategies for gaining competitive advantage

cost leadership:

lowering prices while maintaining profitability

differentiation

offering unique features

focus

niche market

Why Porters model doesnt work

the shift of mass market to customization

consumer feedback to tailor

decline of size as competitive advantage

reduced barriers to enter and zero marginal cost of reaching consumers

size is no longer sufficient for success

Distinct vs Generic good

customers buy bother

role of social media: direct engagement

customer-centric approach

adaptability and learning

reward for moving fast

Competitive Strategy Chart

industry-wide and cost = lowest cost across country

Industry wide and differentiation = better product across country

focus and cost = lowest cost in industry

differentiation and focus = better product in industry

Why cant you do both low cost and differentiation

low cost requires, lower price and high volume for the minimum customer need while differentiation requires high price at lower volume for customers who need more than minimum

Differentiation

invest to create better products who need MORE THAN minimum

high price, low volume

reinvest profits in further improving products

Low Cost

drive down cost AND meet minimum customer need

lower price at high volume

reinvest in driving costs down further to maintain advantage

First-to-Market Challenges

High cost of _______

Building supplier network

Setting up distribution and support

Customer education

Fixing errors

Brand-building

Fast Follower Advantages

Suppliers already identified and vetted

Copy distribution and support from 1st mover

1st mover has already educated customers

Most major errors addressed by 1st mover

Brand-building compares against 1st mover

First-to-Market

not a sustainable long term competitive advantage

When can First-to-Market convert to long-term advantages?

take advantage of economies of scale

leverage network effects

build unique brand identity

create supplier/ customer lock in

use advantages to make a defensible strategic position

3 types of capital required to launch a venture

financial capital

social capital

human capital

Solo Founds

deep human and social capital

prefers to maintain control

small business or slow moving industry

Co-Founders

lacks one or more types of needed capital

needs validation

business is in a fast-moving industry

1-4 co-founders

Homophily

the tendency to form strong social connections with people who share defining characteristics

Homogenous Teams

they get work down effectively and quickly at beginning

Heterogenous Teams

outperform in long run because of diverse opinions and problem-solving processes

Phases of a New Company

jungle

dirt road

highway

“Jungle” Phase of a New Company driving forces

startups change

people change

Risk of picking a cofound similar to you

venture lacks breadth of skills needed to succeed quickly, (learning takes a long time)

Risk of picking a cofound who are students

limited business knowledge, significant potential for people to change their minds