Aggregate Demand

1/34

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

35 Terms

Aggregate demand

The total demand for all goods and services in an economy at a given price level

Components of AD

Consumption(C) + Investment (I) + Government expenditure (G) + net trade (exports(X) - imports(M))

C+I+G+(X-M)

Reak balance effect

When the general price level falls, the real value of money increases.

That means people can buy more with the same amount of money

So they increase consumption (Real GDP rises)

Why is the AD curve downwards sloping

Wealth effect

Trade effect

Interest effect

A movement along the AD curve is caused by what

When there is a change in the price level caused by factors not related to AD i.e changes in AS

E.g a fall in oil prices(decrease in COP) would lead to an expansion in AD and a fall in the GPL

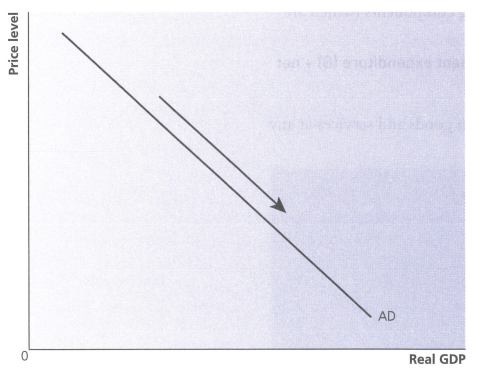

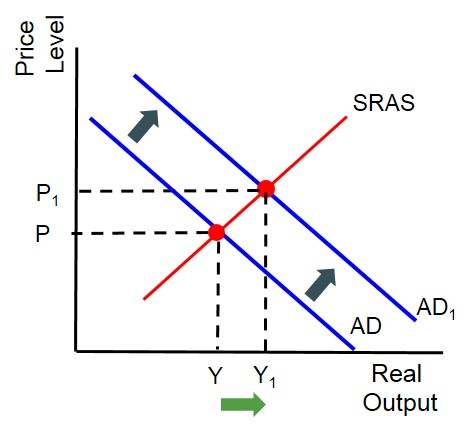

Shifts in AD curve

When any one of the components of AD changes.

If AD increases, we expect average level of prices to rise (inflation) and real output to rise (economic growth)

If AD decreases, we expect prices to fall (deflation) and real output to decrease (slowdown or recession)

Consumption

Spending by households on goods and services

(main component of AD)

Determinants of consumption

Interest rate

Consumer confidence

Wealth effects

The level of employment

Interest rate

If interest rates rise, it costs us more to borrow if we’re spending on credit

It also increases the opportunity cost of spending (saving)

Consumer confidence

If householders feel secure in jobs and future prospects in the economy, people will spend more. Because of this, what people think is going to happen in the economy has a big influence on what is actually going to happen

Wealth effects

An increase in share/ house prices mean that people are going to spend more

, For example, if my house is worth more I might take out a larger loan on my house

, and if my shares go up in value I might be more willing to book a foreign holiday

The level of employment

The higher the level of employment, the more thats spent in an economy (which might even lead to higher employment)

Investment

Defined as an increase in the capital stock (capital goods)

Influences of investment

The rate of economic growth

Confidence levels

Interest rates

Animal spirits

Risk

Access to credit

Gov decisions

Gov bureaucracy

The rate of economic growth

If there is an increase in real GDP, then firms need more capital to meet the increased demand,

So an increase in real GDP causes I to rise

And an increase in I causes GDP to rise

Animal spirits

Sometimes consumers and firms aren’t fully rational, investment doesn’t happen automatically and an additional boost may be needed by the government

Government decisions

Changes in gov decisions and rules can have a significant impact on capital spending

For example, a cut in coroporation tax would lead to more investment by firms

Government bureaucracy

If the gov relaxes planning restrictions, firms are more likely to invest in building projects

Access to credit

Low interest rates do not necessarily mean all firms can borrow cheaply, banks might not be willing to take risks in their lending

Risk

The higher the level of risk, the lower the investment

Interest rates

If interest rates rise, investment tends to fall as it costs more to borrow money to invest

Confidence levels

If firms think they will sell more in the future, they are more likely to invest today

Gross investment

Total amount of investment before any account is taken of depreciation of assets

Net investment

Takes account of the fall in value of capital assets

Fiscal policy

The governments position or set of decisions on government spending and taxation

Government expenditure

Spending by the government on goods and services that directly contribute to national output

Points about gov expenditure

If the government spends more than it earns, it is known as fiscal/budget deficit, this will increase flow of income, or Aggregate demand

If the government spends less than it earns, it is known as fiscal, or budget surplus and leads to a contraction of AD

The government automatically spends more in a recession as government spending increases on out-of-work benefits and taxation receipts fall as workers and firms earn less

The government automatically spends less in a boom as government spending decreases and taxation receipts rise as wages and employment rise.

Net trade (X-M)

Exports minus imports

Net exports

The exports of GS means money is flowing into the country, when the value of money flowing out of a country (imports) is deducted, a figure for net exports is the result

Exchange rate

The price of one currency in terms of another

Causes of changes in Net exports

Real income

Higher incomes in an economy reduces incentive for firms to export as they will sell domestically

Exchange rate

If the exchange rates rise, net exports are likely to fall as exports are less competitive abroad and imports are more competitive in the domestic economy

However in the short run, a strong ecxchange rate might increase the value of exports and decrease value of exports, because spending patterns do not change quickly

Changes in the state of world economy

Degree of protectionism

If there are high tarriffs, quotas or other restrictions on trade, firms will find it difficult to export to certain countries

Non price factors

Demand for exports and imports is determined by many things apart from price, such as quality of engineering, reliability, tarriffs, etc.

Wealth effect

As the price level decreases, people have more purchasing power, therefore increasing consumption, which therefore increases AD

Trade effect

When the price level decreases, exports become more competitive, because of lower COP, which increases X.

At the same time imports are less competitive as the domestic goods are more competitive, so there is less demand for them. This decreases M.

The increase in X and the decrease in M means that there is an increase in net trade

Interest effect

When the GPL falls, people and firms need less money for everyday transactions, so they save more

This leads to interest rates falling

This reduction in interest rates encourages greater consumption, and greater investment as it is cheaper to borrow