ch. 7 - incremental analysis

1/16

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

17 Terms

op cost

The amount of profit foregone because you didn't use a limited resource in the best use

differential/incremental cost

The difference in cost between two alternatives

outlay cost

A cost that requires a cash disbursement

useful info requirements

Accuracy

Timeliness

Relevancy

relevant info

Two requirements

Affects future cash flows quantitatively

Something unique between competing alternatives

If it's not then it does not matter

ex. Cash you receive from selling an asset

ex. Avoidable issues

ex. a change in a fixed cost

Exception

Opportunity costs are always relevant

irrelevant ex.

Sunk costs

Not in the future

Depreciation

Not a physical loss of money

Which is why NBV or caring amount is also irrelevant

Loss or gain on a sale

Not a physical loss of money

Allocated/common fixed costs

Not in the future

Unavoidable issues

Will be there no matter what

one time only special orders

Occurs if you are customizing a product or buying in bulk (order is only placed once)

Look at:

Incremental cash inflows v. incremental cash outflows and their opportunity cost

Accept if

Inflows> outflows

Reject if

Inflows< outflows

Indifferent if

Inflows= outflows

selling price for bulk formula

Selling price - vc = cm

Min selling price = vc costs

When you don’t know cm, use this

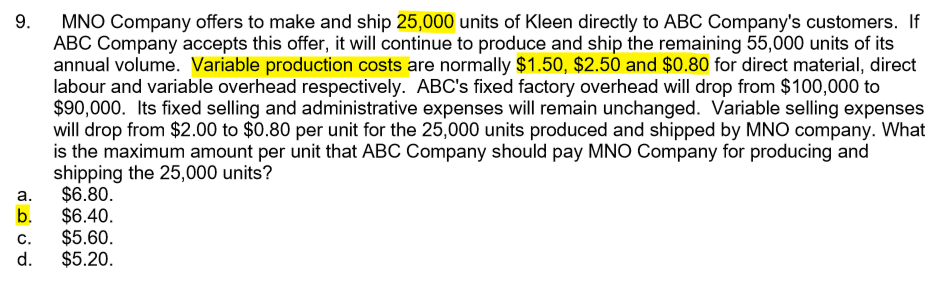

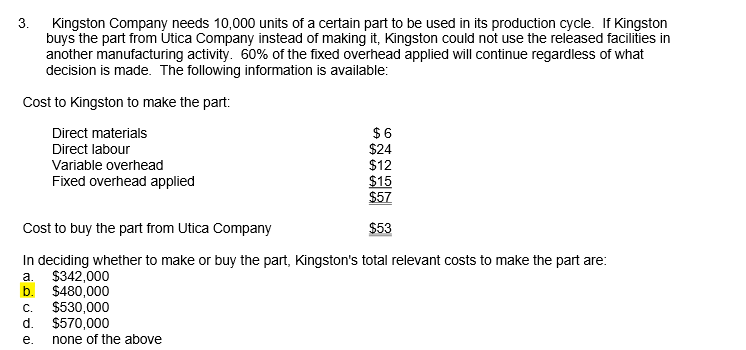

insourcing v. outsourcing

Cost to make v. Cost to buy

Incremental cash outlay + op cost of forgoing something else v. External purchase price

No opportunity cost for;

Idle machinery

Buying

ex. dealing with fixed overhead( total costs)

what you are saving by outsourcing

to deal with the fixed overhead, we need to first multiply everything by 25,000 (units) to get a total

vc = 25,000*(1.5+2.5+0.8) = 120,000

fc overhead = 10,000

selling 2-0.8 = 1.2 *25,000 = 30,000

total savings = 120,000+10,000+30,000 = 160,000

savings per unit = 160,000/25,000 = 6.4

ex. of finding relevant costs

relevant costs

6+24+12+(0.4*15) = 48

48*10,000 = 480,000

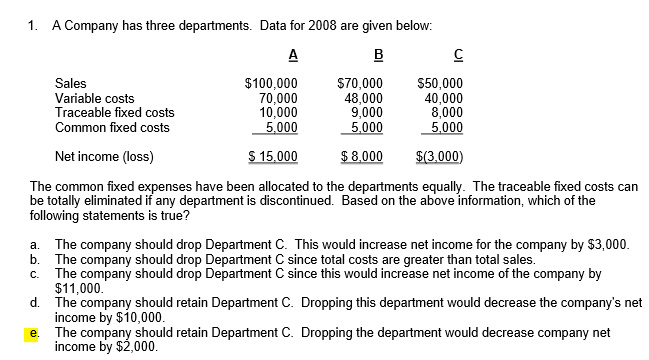

adding/dropping product lines or dept.

deciding on removing or retaining your offerings

look at qualitative aspects along with quantitative

purposely losing money in an aspect to increase money in another

printers cheap, ink expensive

if dairy is losing money you should not discontinue cuz not having it will discourage people from coming to the store in the first place, affecting you're other dept. as well

Compare inflows to ouflows

When you drop, what are you savings (costs) and losses (sales)

Saved costs included salary of line manger for ex.

ex. of comparing inflows to outflows

inflow

50,000 in sales lost = -50,000

outflow

40,000 in vc saved = +40,000

8,000 in traceable fc saved = +8,000

-50,000+40,000+8,000 = -2,000

by dropping you will lose 2,000

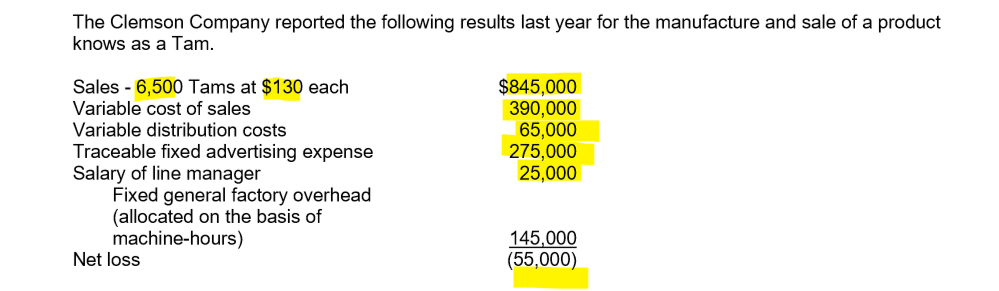

ex. comparing diff. net inc. changes resulting in changing and dropping product lines

dropping net inc. difference

-845,000+390,000+65,000+275,000+25,000=-90,000

inflow

sales

6,500*110 = 715,000

outflow

vc cost of sales =390,000

vc distribution costs =65,000

traceable fc = 275,000

salary = 25,000

so, net inc. 715,000-390,000 -65,000-275,000-25,000 -145,000 = -185,000

diff. between og and and 110 price = -185,000+55,000 = -130,000

now, find diff. between discont and 110 price = -130,000+90,000 = -40,000

If discont. = 120,000 inc in other product lines then what is net inc. diff.?

-90,000+120,000 = 30,000 inc,

to make decisions involving ltd. resources

AKA dealing with constraints

Formula

CM per unit/ units of the scarce resource

Units of the scarce resource can be DLH

joint products

You have a main larger product, should you sell it as is or process it further?

Compare cash inflows to cash outflows

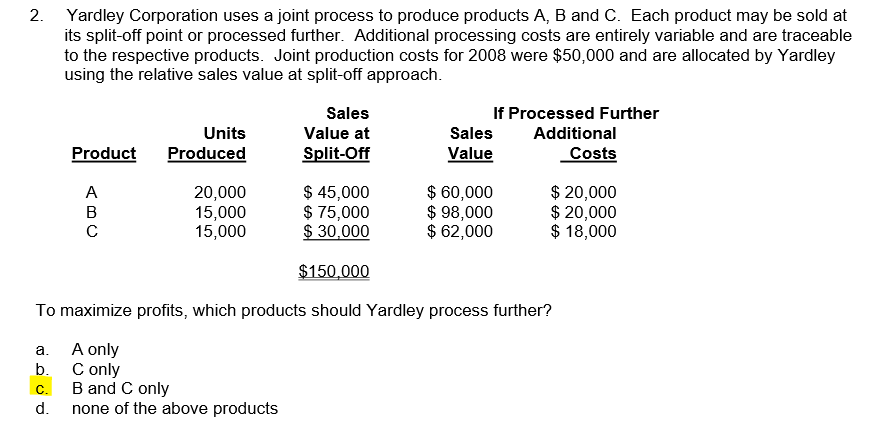

ex. of joint products

chicken (cost to kill = $2)

thighs

sell as is for $14 or make peruvian chicken for $5 and sell for $24

breast

sell as is for $15 or make kfc chicken for $3 and sell for $25

process of killing the chicken = joint production process

yields joint costs

irrelevant amongst the competing alternative of what you can sell

split off point

chicken into things and breasts etc.

can either choose to sell at this point or decide to further process

thighs and breasts = joint and main products

peruvian chicken and kfc = final products

making peruvian chicken and kfc = separable costs

for thighs | split off | further process |

relevant cash inflows | 14 | 24 |

relevant cash outflows | - | (5) |

net cash flows | 14 | 19 |

for breasts | split off | further process |

relevant cash inflows | 15 | 25 |

relevant cash outflows | - | (3) |

net cash flows | 15 | 22 |

ex. of joint products, comparing w/out a table

processing further

a

60,000-20,000 = 40,000

45,000

b

98,000-20,000 = 78,000

75,000

c

62,000-18,000 = 44,000

30,000

by comparing to the sales value at split off we should process b and c further