Week 12 - Financing Business Operations

1/6

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

7 Terms

Financing Business Operations

Generally, organizations obtain

financial resources through one of three

sources:

Borrowing (debt)

Issuing equity (stock ownership)

Internal funding

Financing Business Operations: Borrowing

Option of borrowing using bank loans by a global business

Borrow directly from a local bank

Borrow from a home country bank

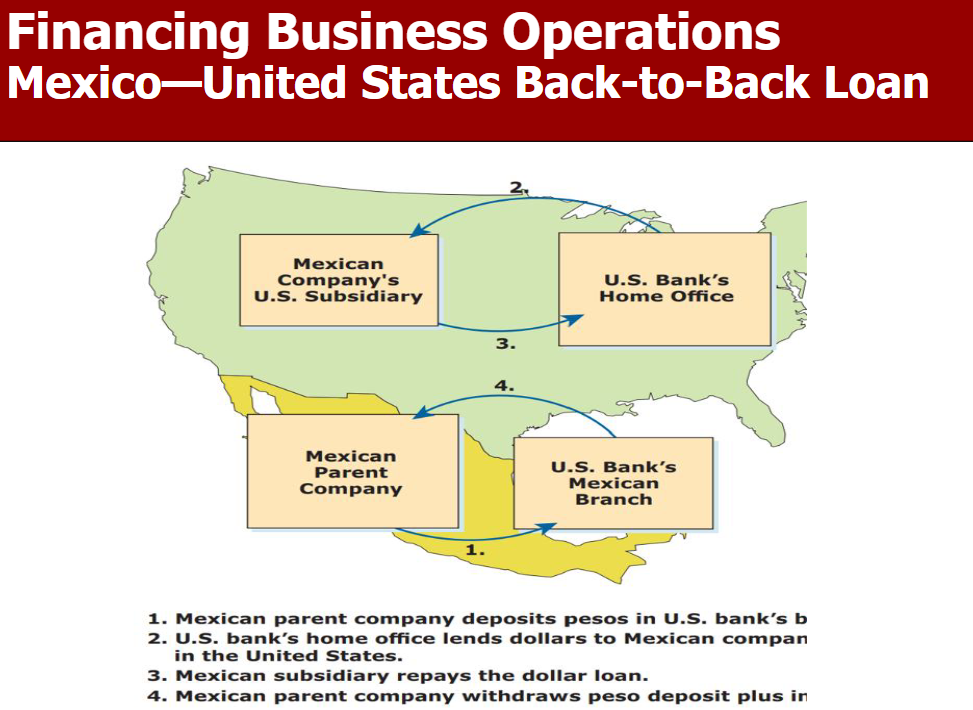

Borrow using back-to-back loans

Back-to-back loans: Loan in which a parent company deposits money with a host country’s bank in the home country, which then lends the money to the parent company’s subsidiary located in the host country.

Financing Business Operations: Issuing Equity

American Depository Receipt (ADR)

• Certificate that trades in the United States and that represents a specific number of shares in a non–U S company

Venture capital

• Financing from investors who take part ownership in a business that is expected to experience rapid growth

Financing Business Operations: Internal Funding

Internal funding

Internal equity, debt, fees

Revenue from operations

Transfer prices

Price charged for a good or service transferred among a company and its subsidiaries

Need to be arm’s length prices

Financing Business Operations: Internal Sources of Capital for International Companies