Booklet 2 - Free Trade & Protection

1/23

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

24 Terms

What do you Discuss when Asked about - The Concepts of Absolute and Comparative Advantage, Including the Sources of Comparative Advantage

The Gains from Specialisation and Trade Using the Production Possibility Frontier (PPF) model and the Concept of Opportunity Cost

Absolute Advantage Definition

Comparative Advantage Definition

Opportunity Cost Definition

Opportunity Cost Formula

Sources of Comparative Advantage

Endowment of Natural Resources

Difference in Technology

Differences in Labour & Capital Resources

The Concepts of Absolute and Comparative Advantage, Including the Sources of Comparative Advantage

The Gains from Specialisation and Trade Using the Production Possibility Frontier (PPF) model and the Concept of Opportunity Cost

Absolute Advantage Definition:

A country is said to have an absolute advantage in the production of a good or service over another country if it can produce a greater quantity of that good with the same quantity of inputs (or same quantity of outputs with fewer inputs).

Comparative Advantage Definition:

Refers to a situation where one country can produce a good or a service at a lower opportunity cost than another country

Opportunity Cost Definition:

The value of the best alternative that has been given up.

Opportunity Cost Formula:

Opportunity Cost Good A = Total Production of Good B / Total Production of Good A

Sources of Comparative Advantage

Endowment of Natural Resources:

An endowment of natural resources gives countries a comparative advantage in producing certain goods. Australia’s vast mineral deposits, energy resources, and large areas of arable farmland create advantages in agriculture and mining, making it a major exporter of primary products such as iron ore, coal, crops, and livestock to nations like China, Japan, and Southeast Asia. Historically, international specialisation developed from differences in natural resources—such as spices from Indonesia, tea from Sri Lanka, and rubber from Malaysia. While Australia exports primary goods, it imports manufactured goods from countries like China, which has become the world’s leading exporter of manufactured products.

Difference in Technology:

Technology is a key source of comparative advantage, as it enhances productivity, innovation, and competitiveness across industries. It involves applying knowledge and technical skills to develop new products and production processes, often embodied in specialised equipment used to produce computer and electronic goods. Investment in research and development (R&D) increases efficiency and lowers costs, giving nations a critical edge. The United States exemplifies this, being home to major technology firms such as Apple, Microsoft & Google. Highlighting technology’s economic power, Apple became the world’s most valuable company in 2012, through its innovative products like the iPhone, iPad, and iMac.

Differences in Labour & Capital Resources:

Differences in labour and capital resources are a major source of comparative advantage, as countries specialise based on their labour skills, costs, and access to specialised capital equipment. Nations with abundant low-cost labour, such as Bangladesh, can mass-produce manufactured goods like apparel cheaply. Others gain advantage through high-quality capital and skilled labour, producing innovative and specialised goods. For example, Switzerland is renowned for precision watches and clocks. The United States leads in aircraft and computer production, while Australia has built a reputation for telecommunications equipment and education services, demonstrating how varying labour and capital strengths shape global specialisation and trade patterns

Sources of Comparative Advantage

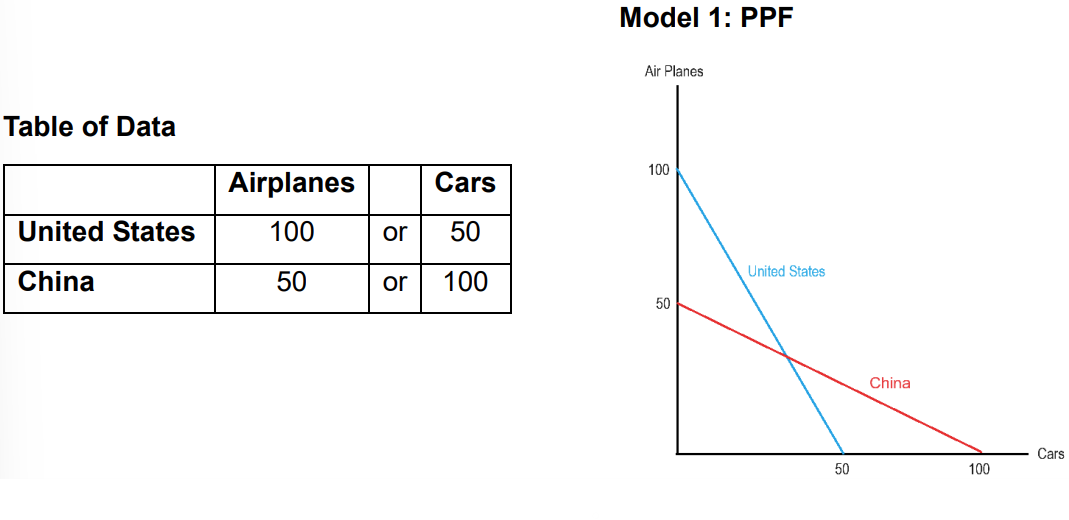

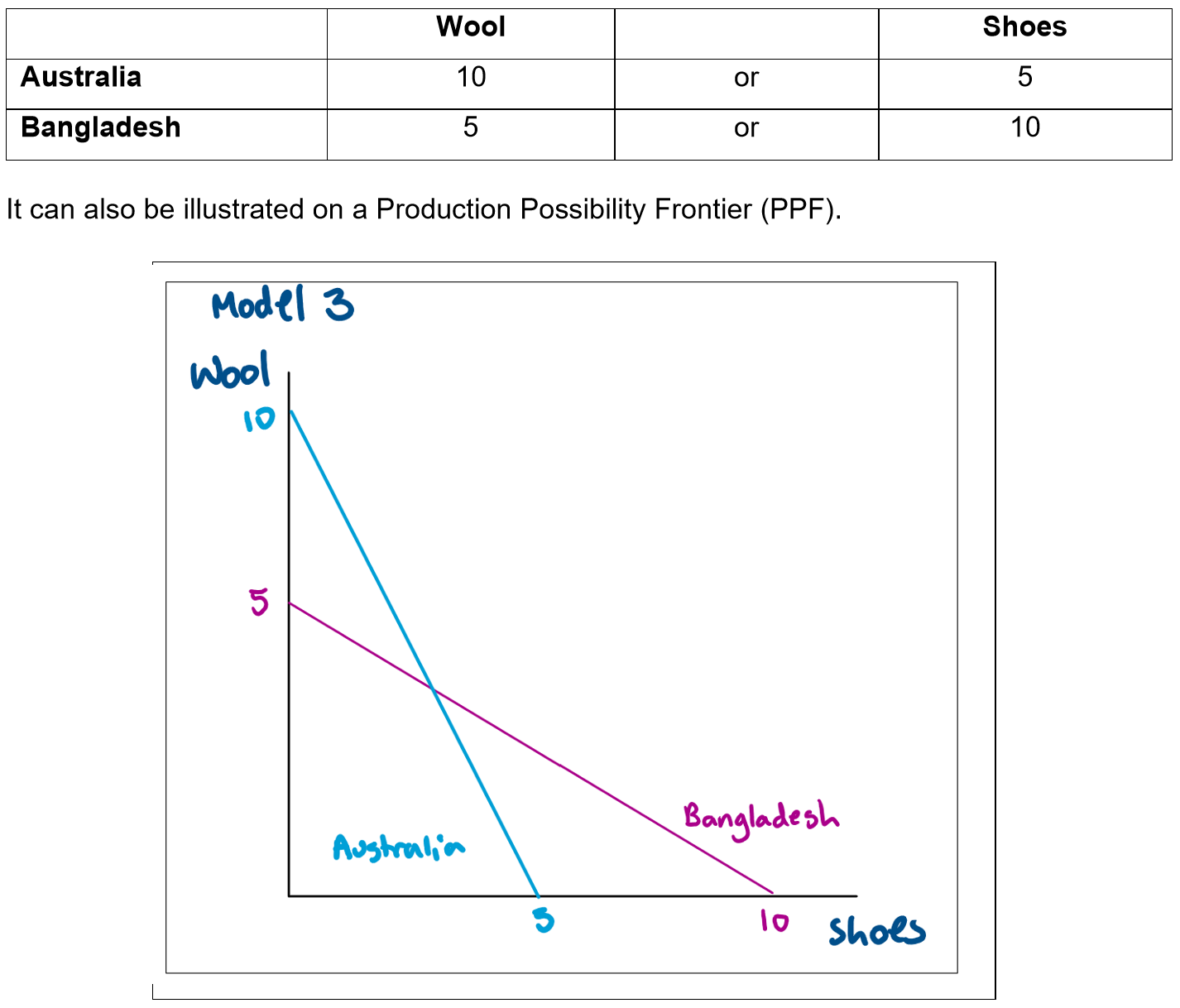

Gains from Specialisation & Trade using the Production Possibility Frontier INPUT DATA

The image shows how you would typically complete this question below demonstrates a different scenario.

Gains from Specialisation & Trade using the Production Possibility Frontier OUTPUT DATA

When examining the gains from specialisation and trade using opportunity cost there are four assumptions:

There are only two countries.

Each country can produce only two goods.

There are no transport costs.

Resources are perfectly mobile – resources can be shifted between industries with zero displacement costs

The table below shows the production possibilities for the two countries assuming they wish to devote all their resources on either producing wool or shoes. If Australia only produced wool its output would be 10 units if it used all its resources to produce just shoes, then its output would be 5. If Bangladesh only produced wool its output would be 5 units if it used all its resources to produce just shoes, then its output would be 10.

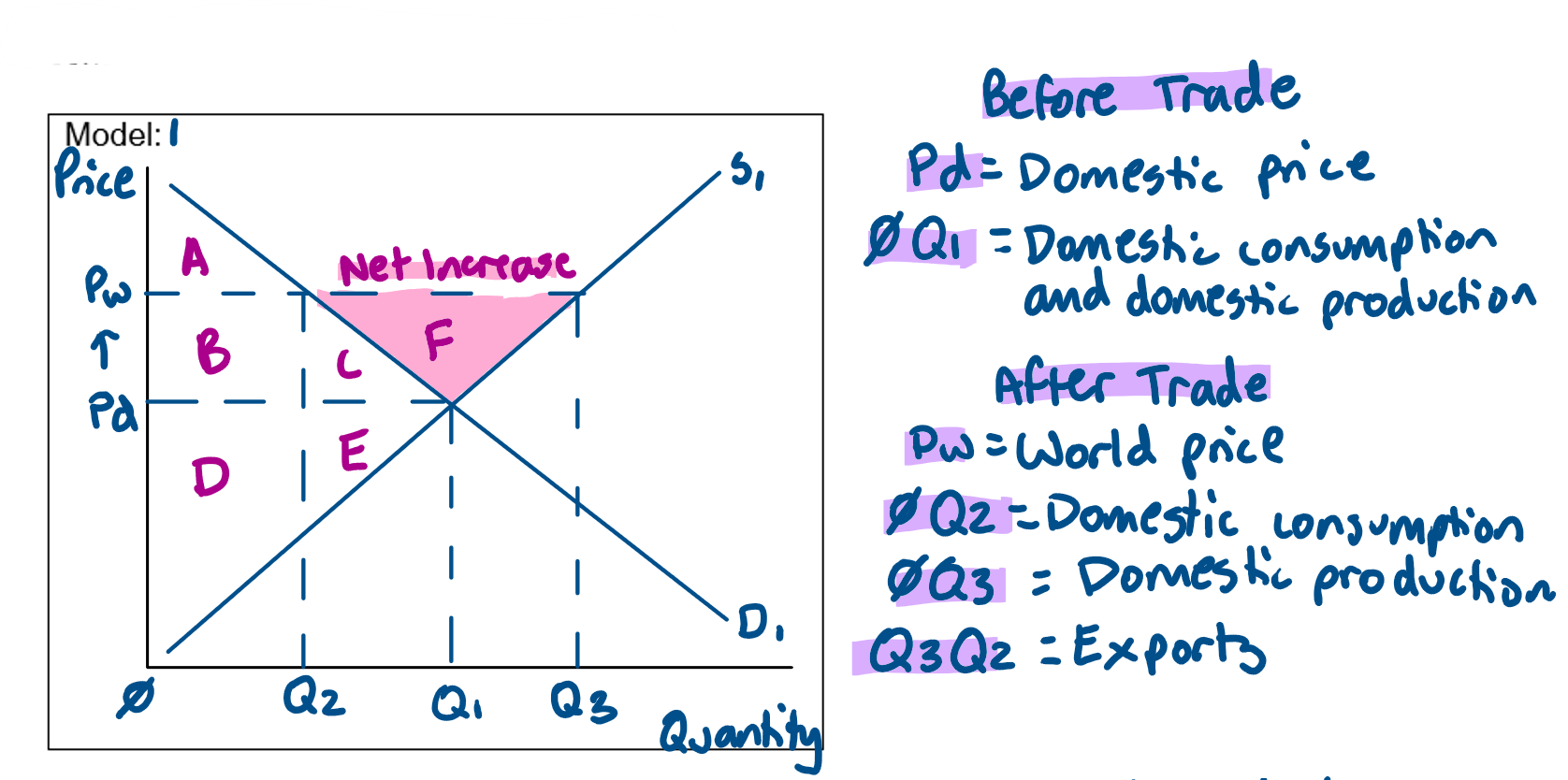

Gains from Specialisation & Trade using Demand & Supply - Gains from Exports

Exports are the sale of domestically produced goods & services to overseas markets, for example iron ore & coal.

As seen in model 1, before trade equilibrium price is at Pd (domestic price) & equilibrium quantity is at Q1.

Domestic consumption & production is at Q1.

Through trade, domestic producers can access higher prices for their products & price increases from Pd to Pw (world price).

Domestic production increases from Q1 to Q3 & domestic consumption decreases from Q1 to Q2.

There is now a surplus which is cleared by exporting overseas (Q3-Q2).

Producer surplus increases from DE to BCDEF & consumer surplus decreases from ABC to A.

The net gain in total surplus is F increasing total surplus from ABCDE to ABCDEF.

Since the gain in producer surplus is greater than the loss in consumer surplus, the Australian economy gains & economic welfare increases.

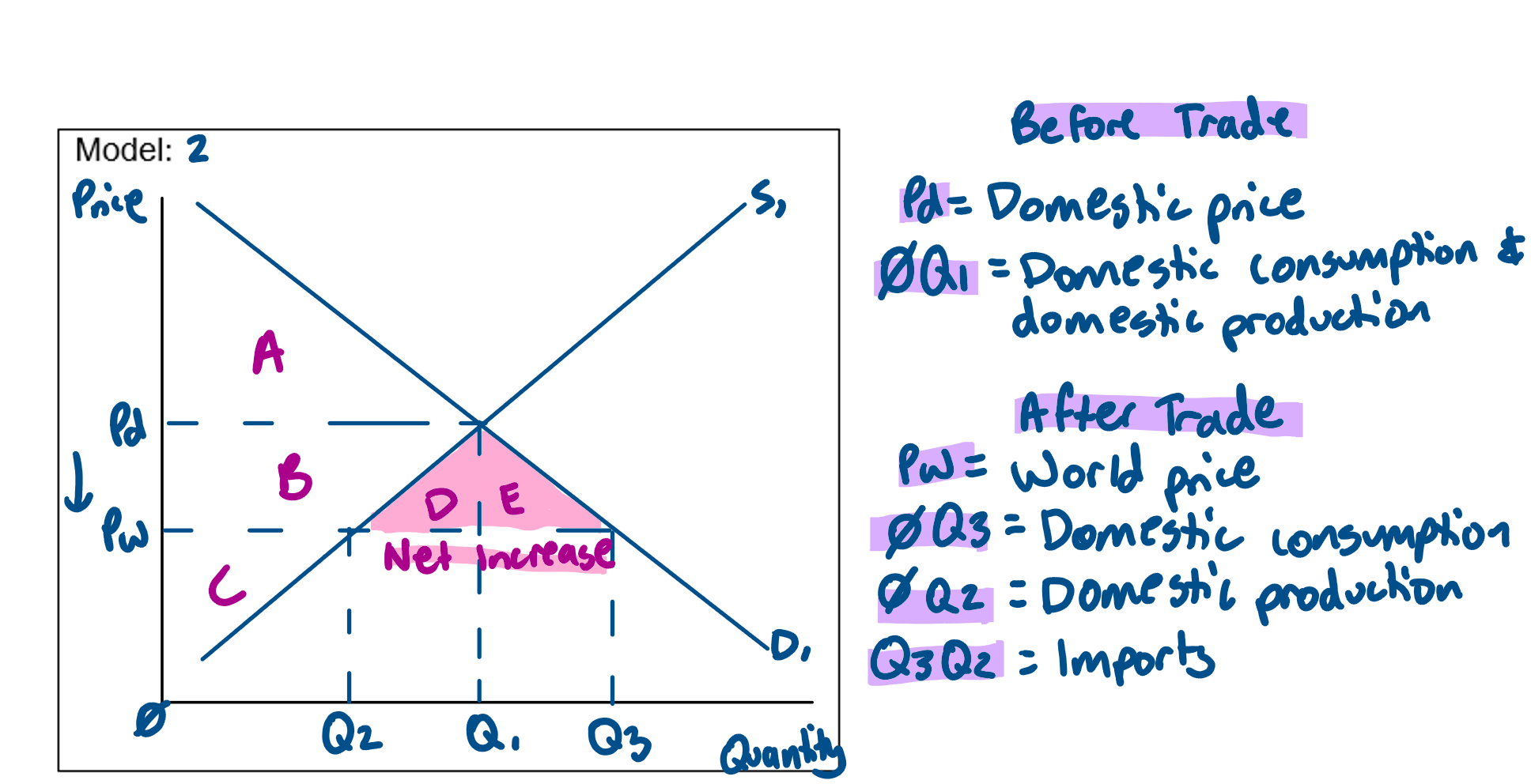

Gains from Specialisation & Trade using Demand & Supply - Gains from Imports

Imports are the purchase of foreign goods & services produced overseas, for example PMVs, technology & telecommunications equipment.

Imports refer to the purchase of foreign goods & services produced overseas for example PMVs.

As seen in model 2, before trade equilibrium price if Pd (domestic price) & equilibrium quantity is Q1.

Domestic production & consumption is at Q1.

Through trade, consumers can access a wider variety of products at cheaper prices therefore prices decrease from Pd to Pw (world price).

Domestic consumption increases from Q1 to Q3 & domestic production decreases from Q1 to Q2.

There is now a shortage which is cleared through importing from overseas (Q3-Q2).

Producer surplus decreases from BC to C & consumer surplus increases from A to ABDE.

The net gain in total surplus is DE increasing total surplus from ABC to ABCDE.

Since the gain in consumer surplus is greater than the loss in producer surplus the Australian economy gains & economic welfare increases.

What do you Discuss when Asked about - The Benefits of Trade Liberalisation:

Economic Growth & Living Standards

Specialisation & Comparative Advantage

Increased World Output & Efficiency

Access to a Wider Variety of Goods & Services

The Benefits of Trade Liberalisation:

Economic Growth & Living Standards:

Reducing barriers to trade through trade liberalisation increases both imports and exports, boosting domestic output, employment, and GDP growth. The period of fastest global trade expansion (1950–1973) coincided with the highest global economic growth, highlighting this link. In Australia, increased exports stimulate production and income, while imports provide consumers with cheaper, higher-quality goods and services, improving living standards. Currently, 1 in 5 Australian workers—around 2.2 million people—are employed in trade-related activities, directly supporting economic growth and higher incomes. As a result of trade liberalisation, Australia’s real GDP is 5.4% higher than it would have been otherwise, demonstrating the significant contribution of open trade to national prosperity.

Specialisation & Comparative Advantage:

Trade liberalisation encourages countries to specialise in producing goods and services in which they have a comparative advantage, leading to a more efficient global allocation of resources. This specialisation drives structural change, increases productivity, and boosts total world output as resources are directed to their most efficient uses. For example, Australia specialises in producing iron ore, coal, and education services, where it has a comparative advantage, while importing passenger motor vehicles and refined petroleum, which can be produced more efficiently elsewhere. This process enhances global efficiency, output, and economic welfare.

Increased World Output & Efficiency:

Trade liberalisation increases world output and efficiency by enabling exporters to supply to global markets and compete internationally. This competition encourages firms to reduce production costs, improve quality, and boost total output, ensuring resources are used efficiently while consumers benefit from low-cost, high-quality goods. As a result, countries can consume beyond their Production Possibility Frontier (PPF), achieving levels unattainable without trade. For example, ChAFTA reduced Chinese tariffs on Australian meat, dairy, and wine, increasing the competitiveness, production, and output of these industries and contributing to higher global efficiency.

Access to a Wider Variety of Goods & Services:

Trade liberalisation provides access to a wider variety of goods and services that countries cannot efficiently produce domestically or in sufficient quantities. By reducing trade barriers, nations can import goods suited to their needs and resource endowments — for example, countries lacking agricultural land import grains from Australia, while Australia imports passenger motor vehicles (PMVs) not produced locally. The reduction in Australia’s average tariff rate from 7.3% in 1986 to less than 1% in 2016 led to annual merchandise imports rising from $40 billion to $265 billion, demonstrating how trade liberalisation expands consumer choice and access to diverse, high-quality products.

What do you Discuss when Asked about - Types of Protection, Including Tariffs, Subsidies and Quotas

Tariff Definition

Tariff Example

Subsidy Definition

Subsidy Example

Quota Definition

Types of Protection, Including Tariffs, Subsidies and Quotas

Tariff:

Definition

A government-imposed tax on imports

Example:

During the 1990s tariffs on clothing apparel imported into Australia peaked at 176%.

Subsidy:

Definition

Cash payments from governments to business to encourage the production of goods & services.

Example

The automotive transformation scheme - $1billion from 2016 to 2020 to car manufacturers who designed & produced cars in Australia.

Quota Definition:

Limit on the quantity of a particular good that can be imported into a country.

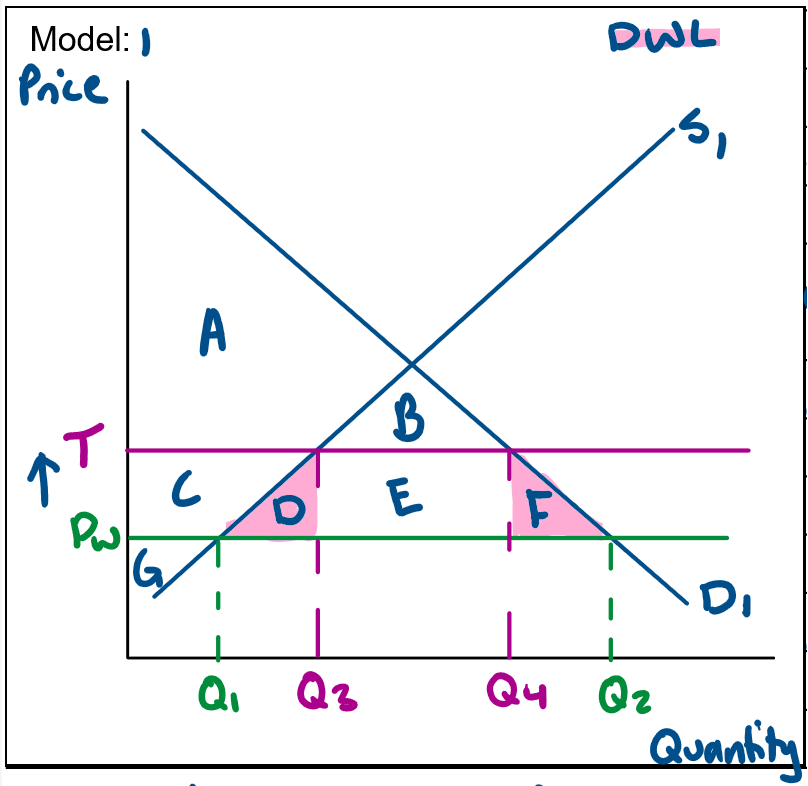

The Impact of the introduction of a Tariffs using the Demand and Supply Model on Trade, Market Efficiency and the Macroeconomy

A tariff is a government imposed tax on imports.

For example during the 1990s tariffs on clothing apparel imported into Australia peaked at 176%.

In model _, the implementation of a tariff causes an increase in price from Pw to T.

This switches consumption away from imports to domestic goods & causes imports to decrease from Q1Q2 to Q3Q4.

Due to the higher price, domestic consumption decreases from Q2Q4.

Domestic production increases from Q1 to Q3 & domestic producer revenue increases from PwxQ1 to TxQ3.

Foreign producer revenue decreases from Pw(Q1-Q2) to Pw(Q4-Q3).

Producer surplus increases from G to CG as they receive a higher price & sell a higher quantity.

Consumer surplus will decrease from ABCDEF to AB as they pay a higher price & consume a lower quantity.

This results in a net welfare loss to the economy creating a deadweight loss of DF.

This results in total surplus decreasing from ABCDEFG to ABCG meaning the market is inefficient & economic welfare decreases.

The government revenue from the tariff is E.

Producers who use the imported goods as inputs will suffer as tariffs increase their costs of production leading to cost push inflation.

Domestic output & employment in the non-protected industries will decrease due to higher costs & resources being diverted away from these industries to the protected industries.

On the other hand as domestic producers increase their production this will result in an increase in employment in these industries.

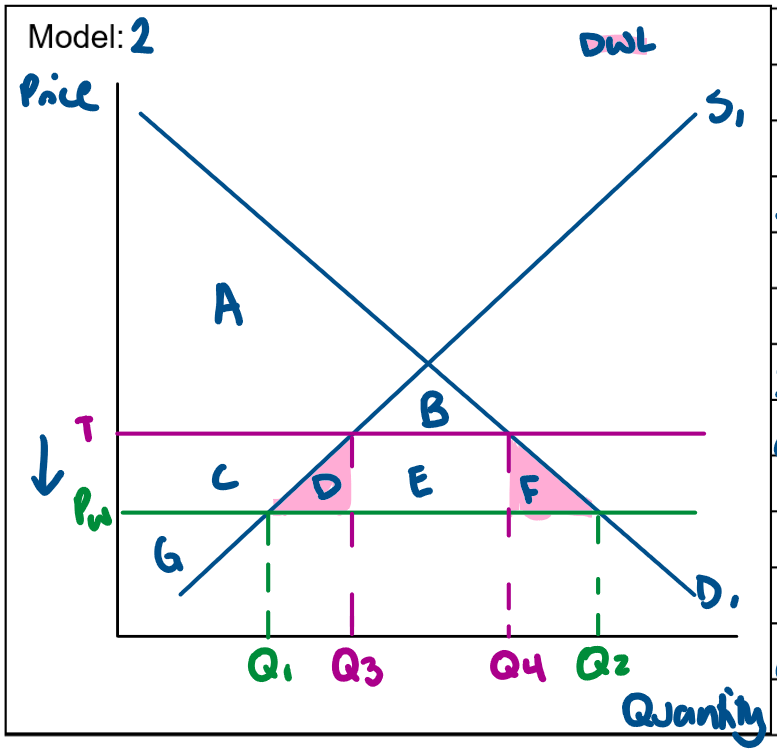

The Impact of the removal of a Tariffs using the Demand and Supply Model on Trade, Market Efficiency and the Macroeconomy

A tariff is a government imposed tax on imports.

For example during the 1990s tariffs on clothing apparel imported into Australia peaked at 176%.

In model _, the removal of a tariff causes a decrease in price from T to Pw.

This switches consumption away from domestic goods to imports & causes imports to increase from Q3Q4 to Q1Q2.

Domestic production decreases from Q3 to Q1 & domestic producer revenue decreases from TxQ3 to PwxQ1.

Foreign producer revenue increases from Pw(Q4-Q3) to Pw(Q1-Q2).

Producer surplus decreases from GC to G as they receive a lower price & sell a lower quantity.

Consumer surplus will increase from AB to ABCDEF as they pay a lower price & consumer a larger quantity,

This results in a net welfare gain to the economy eliminating the deadweight loss of DF.

This results in an increase in total surplus from ABCG to ABCDEFG meaning the market is efficient & economic welfare increases.

The government revenue from the tariff (E) is eliminated.

Producers who use the imported goods as inputs will benefit as the removal of the tariff decreases their cost of production.

Domestic output & employment will increase as resources are allocated to the most efficient industries, consequently there is an increase in production.

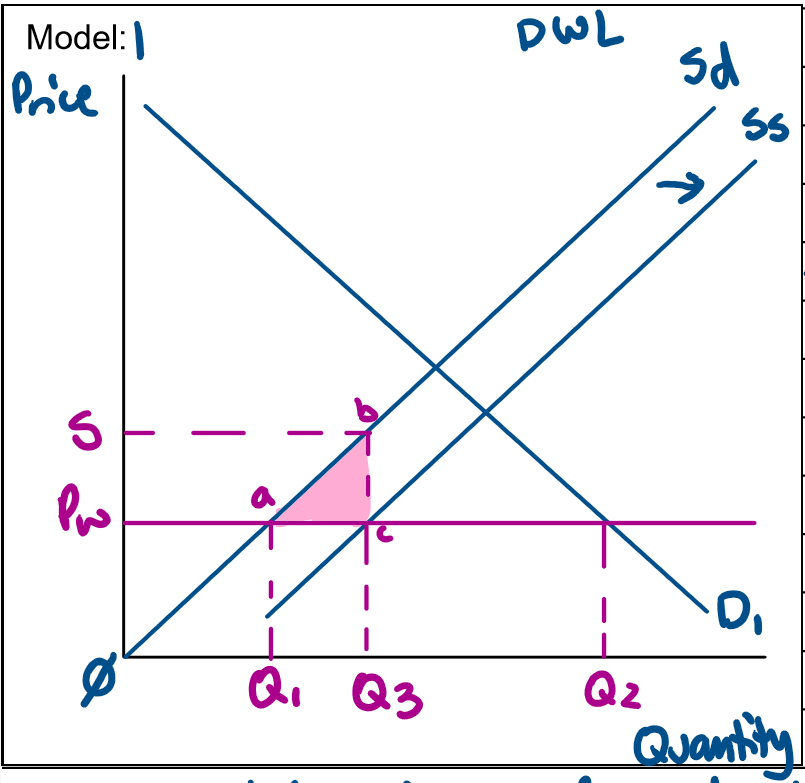

The Impact of the Introduction of a Subsidy using the Demand and Supply Model on Trade, Market Efficiency and the Macroeconomy

A subsidy is a cash payment from government to businesses to encourage the production of domestic goods & services.

For example, the automotive transformation scheme for Australian car producers like Holden & Ford.

In model 1 the implementation of a subsidy to domestic producers will shift the supply curve to the right from Sd to Ss as they receive the payment from the government & their cost of production decreases.

This causes the price to remain the same at Pw.

Domestic consumption remains unchanged at Q2 & imports decrease from Q1Q2 to Q3Q2.

Domestic production increases from Q1 to Q3 & domestic producer revenue increases from PwxQ1 to SxQ3.

Foreign producer revenue decreases from Pw(Q2-Q1) to Pw(Q2-Q3).

Government expenditure on the subsidy is SbcPw & producer surplus increases from Pwa⌀ to Sb⌀.

Therefore the increase in producer surplus is less than the size of the subsidy which creates a deadweight loss of abc.

As there is deadweight loss present, the market is inefficient & economic welfare decreases.

Subsidies result in resource distortion as resources are diverted towards protected industries creating a high opportunity cost as it may not be the most efficient use of those resources.

As domestic producers increase their production this will result in an increase in employment in these industries.

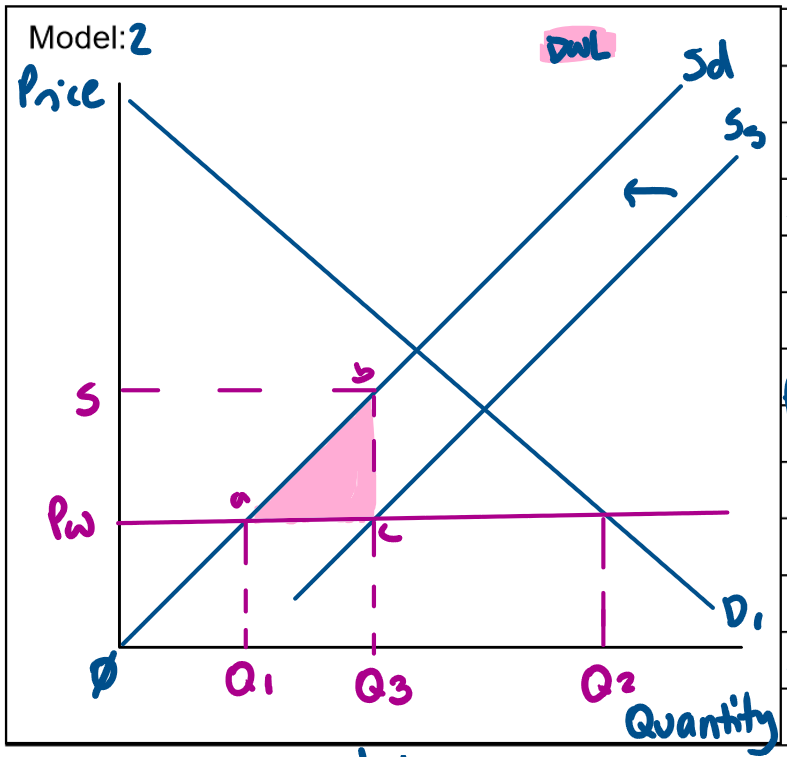

The Impact of the Removal of a Subsidy using the Demand and Supply Model on Trade, Market Efficiency and the Macroeconomy

A subsidy is a cash payment from government to businesses to encourage the production of goods & services.

For example, the automotive transformation scheme to Australian car producers like Holden & Ford.

In model 2, the removal of a subsidy to domestic producers will shift the supply curve to the left from Ss to Sd as they no longer receive the payment from the government & their cost of production increases.

This causes the price to remain the same at Pw.

Domestic consumption remains unchanged at Q2 & imports increase from Q3Q2 to Q1Q2.

Domestic production decreases from Q3 to Q1 & domestic producer revenue decreases from SxQ3 to PwxQ1.

Foreign producer revenue increases from Pw(Q2-Q3) to Pw(Q2-Q1).

Government expenditure on the subsidy of SbcPw is eliminated & producer surplus decreases from Sb⌀ to Pwa⌀ .

This eliminates the deadweight loss that was present at abc & therefore the market is efficient & economic welfare increases.

The removal of a subsidy results in the efficient allocation of resources as they are allocated to the most efficient industries.

Short term the removal of a subsidy will result in structured unemployment as businesses seek to compete with the global market.

In the long term, these workers will retrain & enter in to more efficient industries promoting economic growth.

What do you Discuss when Asked about - Arguments for Protection

Define Protectionism:

Arguments:

Prevention of Dumping

Infant Industries Argument

National Security (Defence) Argument

Diversification Argument

Protection of Domestic Employment

Cheap Foreign Labour Argument

Favourable Balance of Trade Argument (BOP Argument)

Definition of Protectionism:

A government action aimed at giving domestic industry some artificial advantage over a competing foreign industry.

Discuss Prevention of Dumping as an Argument for Protection

The prevention of dumping is a valid but limited argument for protection, as dumping (the practice of exporting goods at a price lower than their domestic market price) can harm domestic industries by undercutting local producers and forcing them out of business. Dumping may occur when firms or countries with excess supply sell goods below cost or when large firms sustain short-term losses to eliminate smaller competitors. While governments may impose short-term protective measures such as tariffs or anti-dumping duties to deter this, dumping is difficult to prove due to limited access to foreign production data and the possibility that low prices simply reflect specialisation and production efficiency. For example, in the China–Australia trade dispute, China accused Australia of dumping barley and wine, using this as justification to impose tariffs of up to 80% on Australian agricultural exports. Thus, while preventing dumping can protect domestic industries in the short term, its practical enforcement remains highly challenging.

Discuss Infant Industries as an Argument for Protection

The infant industry argument supports protection to allow newly established industries time to grow, achieve economies of scale, and become internationally competitive. Protection, such as tariffs or subsidies, helps these industries develop a comparative advantage before facing full global competition. However, if protection is prolonged, industries may become dependent on government support, reducing incentives to innovate or improve efficiency. Therefore, protection must be temporary, with regular reviews and gradual reductions to ensure competitiveness. For example, in the mid-20th century, Australia introduced tariffs on imported passenger motor vehicles (PMVs) to protect its domestic car manufacturing industry. While initially justifiable, this protection eventually led to inefficiency and overreliance on government assistance, highlighting the risks of sustained protectionism.

Discuss National Security (Defence) as an Argument for Protection

The national security (defence) argument for protection holds some validity, as ensuring security often takes precedence over economic efficiency. It argues that certain industries vital for national defence, such as banking, communications, and agriculture, should be protected from trade liberalisation to maintain a country’s self-sufficiency and capacity to defend itself during crises or war. However, the challenge lies in defining which industries are truly essential, as many could claim to be of strategic importance. This argument was particularly strong during the World War era but remains relevant today given global instability. For example, the Australian defence manufacturing sector received substantial government subsidies for the development of Bushmaster army vehicles, illustrating how protection can safeguard critical industries linked to national security.

Discuss Diversification as an Argument for Protection

The diversification argument for protection is generally invalid, as it runs counter to the gains from specialisation based on comparative advantage. It suggests that if a country fully applies comparative advantage, it may specialise in only one or two products, making it vulnerable to declines in global demand or price fluctuations. Protection, in this view, could support less competitive sectors to help diversify the economy and reduce risk. However, this is a weak argument, as in reality, no country has a comparative advantage in only one or two products. Modern economies are naturally diversified through trade and technological development, making broad protection unnecessary

Discuss Protection of Domestic Employment as an Argument for Protection

The protection of domestic employment argument for protection is not valid, as it ignores the broader negative effects on the economy. It claims that buying domestic goods instead of imports will create jobs locally by shifting spending toward domestic industries. However, while protection may temporarily increase employment in protected sectors, it leads to job losses in non-protected industries and reduces overall efficiency. Higher import restrictions increase input costs for other domestic firms, raising prices and reducing households’ purchasing power. For example, protecting the Australian car manufacturing industry (Holden and Ford) raised vehicle costs, negatively impacting transport companies and consumers. Additionally, protection can provoke retaliation from trading partners, further reducing exports and employment across the economy.

Discuss Cheap Foreign Labour as an Argument for Protection

The cheap foreign labour argument for protection is not valid, as specialisation based on comparative advantage allows all countries to benefit from trade. This argument claims it is unfair for high-wage countries like Australia—where the minimum wage is $915.90 per week—to compete with low-wage countries such as China, where the minimum wage is only $112 per week, and therefore that domestic industries should be protected. However, this overlooks that it is equally “unfair” for low-capital, low-technology nations like Indonesia and India to compete with highly developed economies such as Australia and China. Wage differences reflect productivity differences, and through trade, both high- and low-wage nations gain from specialising in industries where they hold a comparative advantage.

Discuss Favourable Balance of Trade (BOP) as an Argument for Protection

The favourable balance of trade argument for protection is not valid, as countries should aim to increase both exports and imports rather than restrict trade. This argument claims that a trade deficit—when net imports exceed net exports—is unfavourable, and that a trade surplus—when net exports exceed net imports—is desirable. It therefore supports protectionist policies to limit imports. However, there is no inherently “good” or “bad” trade balance, as both exports and imports contribute to economic growth. Protectionist measures that restrict imports often lead to reduced exports as well, since they raise production costs for domestic industries, making them less competitive internationally and harming overall trade performance.