Accounting 1 Ch1 & 2

1/69

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

70 Terms

Which of the following is generally not classified as a current liability?

Bonds Payable

On a classified balance sheet, short-term investments are classified as

current assets.

These are selected account balances on December 31, 2025.

Land $195000

Land (held for future use) 292500

Buildings 1560000

Inventory 390000

Equipment 877500

Furniture 195000

Accumulated Depreciation 585000

What is the total amount of property, plant, and equipment that will appear on the balance sheet?

$2242500

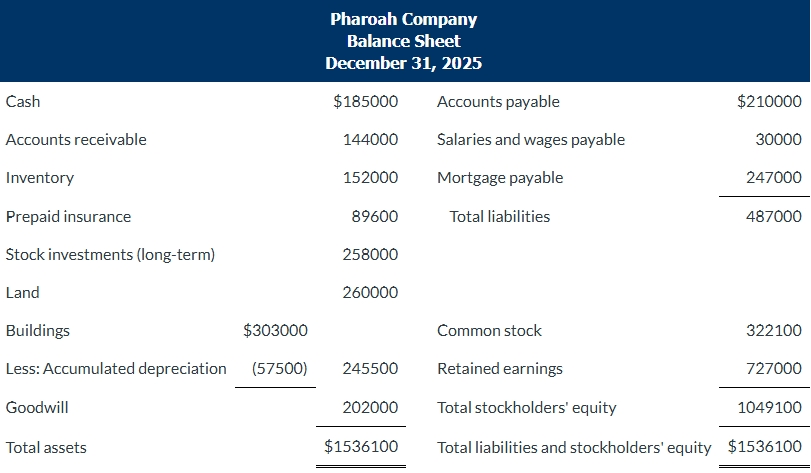

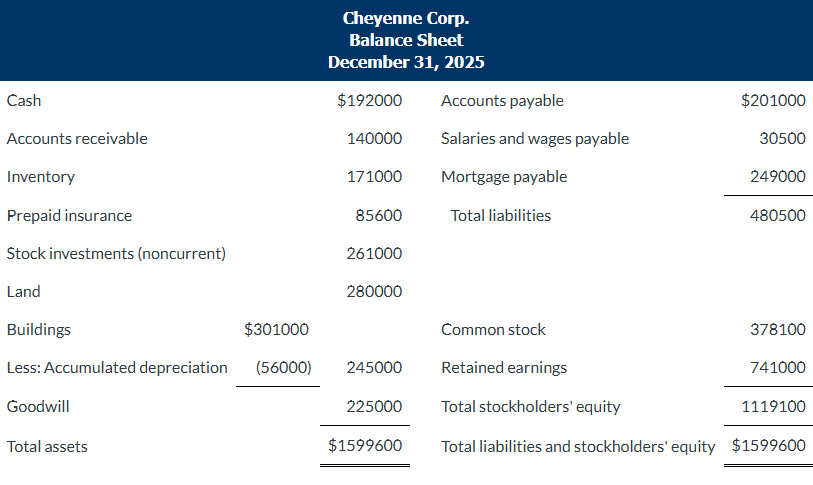

Use the following data to determine the total dollar amount of assets to be classified as current assets.

$570600

Use the following data to determine the total amount of working capital.

$357100

Based on the following data, what is the amount of working capital?

Accounts payable $57600

Accounts receivable 102600

Cash 63000

Intangible assets 90000

Inventory 124200

Long-term investments 144000

Long-term liabilities 180000

Short-term investments 72000

Notes payable (short-term) 50400

Property, plant, and equipment 1206000

Prepaid insurance 1800

$255600

Suppose that Forever 21 Corporation has total assets of $3561000, common stock of $927000, and retained earnings of $588000 at December 31, 2025. What is the balance of stockholders’ equity at that date?

$1515000

For 2025, Novak Corp. reported net income of $36500, net sales $386500, and weighted-average shares of common stock outstanding of 16000. No preferred dividends were paid. Earnings per share is

$2.28

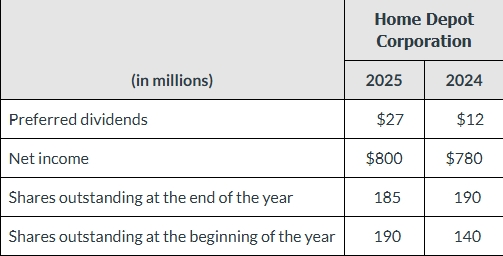

Suppose that the following information is available for Home Depot Corporation

Based on this information, the earnings per share calculations suggest

lower performance in 2025 than in 2024 for Home Depot Corporation.

The type of ratios that measure the short-term ability of a business to pay its maturing obligations is

liquidity ratios.

Using the following balance sheet and income statement data, what is the debt to assets ratio?

Current assets $23200

Net income $47300

Current liabilities 12400

Stockholders' equity 62042

Average assets 139600

Total liabilities 30558

Total assets 92600

Average common shares outstanding was 16000.

33.0%

A useful measure of solvency is the

debt to assets ratio.

Which of the following is considered a measure of liquidity?

Current ratio

Which entity(ies) is/are responsible for establishing accounting standards in the United States?

Financial Accounting Standards Board

Financial information is comparable when

different companies use the same accounting principles.

The concept that a business has a reasonable expectation of remaining in business for the foreseeable future is called the

going concern assumption.

Valuing assets at their fair value rather than at their cost is inconsistent with the

historical cost principle.

Acme Corporation hired a new accountant. Over the next four years, the accountant used four different accounting methods to record depreciation for Acme's equipment. Which of the following qualities of useful information has Acme most likely violated?

Consistency

The following items are taken from the financial statements of Blossom Company for 2025:

Accounts payable $11,900

Accounts receivable 12,500

Accumulated depreciation—equipment 38,800

Advertising expense 20,700

Cash 13,000

Common stock 92,000

Depreciation expense 13,000

Dividends on common stock 14,900

Equipment 235,000

Insurance expense 2,800

Notes payable (due in 2028) 69,500

Prepaid insurance 5,900

Rent expense 16,700

Retained earnings (beginning) 20,800

Salaries and wages expense 34,300

Salaries and wages payable 3,200

Service revenue 144,000

Supplies 4,700

Supplies expense 6,700

Calculate the net income.

$49800

The following items are taken from the financial statements of Blossom Company for 2025:

Accounts payable $11,900

Accounts receivable 12,500

Accumulated depreciation—equipment 38,800

Advertising expense 20,700

Cash 13,000

Common stock 92,000

Depreciation expense 13,000

Dividends on common stock 14,900

Equipment 235,000

Insurance expense 2,800

Notes payable (due in 2028) 69,500

Prepaid insurance 5,900

Rent expense 16,700

Retained earnings (beginning) 20,800

Salaries and wages expense 34,300

Salaries and wages payable 3,200

Service revenue 144,000

Supplies 4,700

Supplies expense 6,700

Calculate the retained earnings balance that would appear on a balance sheet at December 31, 2025.

$55700

The following items are taken from the financial statements of Blossom Company for 2025:

Accounts payable $11,900

Accounts receivable 12,500

Accumulated depreciation—equipment 38,800

Advertising expense 20,700

Cash 13,000

Common stock 92,000

Depreciation expense 13,000

Dividends on common stock 14,900

Equipment 235,000

Insurance expense 2,800

Notes payable (due in 2028) 69,500

Prepaid insurance 5,900

Rent expense 16,700

Retained earnings (beginning) 20,800

Salaries and wages expense 34,300

Salaries and wages payable 3,200

Service revenue 144,000

Supplies 4,700

Supplies expense 6,700

Prepare a classified balance sheet for Blossom Company at December 31, 2025 assuming the note payable is a long-term liability. (List Current assetsin order of liquidity.)

Liabilities and Stockholder Equity

Current Liabilities:

Accounts Payable $11900

Salaries and Wages Payable $3200

Total Current Liabilites $15100

Long Term Liabilities:

Notes Payable $69500

Total Liabilities $84600

Stockholders Equity:

Common Stock $92000

Retained Earnings $55700

Total Stockholders Equity $147700

Total Liabilities and Stockholders Equity $232300

The following items are taken from the financial statements of Blossom Company for 2025:

Accounts payable $11,900

Accounts receivable 12,500

Accumulated depreciation—equipment 38,800

Advertising expense 20,700

Cash 13,000

Common stock 92,000

Depreciation expense 13,000

Dividends on common stock 14,900

Equipment 235,000

Insurance expense 2,800

Notes payable (due in 2028) 69,500

Prepaid insurance 5,900

Rent expense 16,700

Retained earnings (beginning) 20,800

Salaries and wages expense 34,300

Salaries and wages payable 3,200

Service revenue 144,000

Supplies 4,700

Supplies expense 6,700

Prepare a classified balance sheet for Blossom Company at December 31, 2025 assuming the note payable is a long-term liability. (List Current assetsin order of liquidity.)

Assets

Current Assets:

Cash $13000

Accounts Receivable $12500

Supplies $4700

Prepaid Insurance $5900

Total Current Assets $36100

Property Plant and Equipment:

Equipment $235000

Less: Accumulated Depreciation - Equipment $(-38800) $196200

Total Assets $232300

The following items are taken from the financial statements of Blossom Company for 2025:

Accounts payable $11,900

Accounts receivable 12,500

Accumulated depreciation—equipment 38,800

Advertising expense 20,700

Cash 13,000

Common stock 92,000

Depreciation expense 13,000

Dividends on common stock 14,900

Equipment 235,000

Insurance expense 2,800

Notes payable (due in 2028) 69,500

Prepaid insurance 5,900

Rent expense 16,700

Retained earnings (beginning) 20,800

Salaries and wages expense 34,300

Salaries and wages payable 3,200

Service revenue 144,000

Supplies 4,700

Supplies expense 6,700

Compute the current ratio, debt to assets ratio, and earnings per share value. The average number of shares outstanding for 2025 was 10,000. (Round ratiosto 1 decimal places, e.g. 1.5:1 or 25.1% and earnings pershare to 2 decimal places, e.g. 2.25.)

Current Ratio

2.4 :1

The following items are taken from the financial statements of Blossom Company for 2025:

Accounts payable $11,900

Accounts receivable 12,500

Accumulated depreciation—equipment 38,800

Advertising expense 20,700

Cash 13,000

Common stock 92,000

Depreciation expense 13,000

Dividends on common stock 14,900

Equipment 235,000

Insurance expense 2,800

Notes payable (due in 2028) 69,500

Prepaid insurance 5,900

Rent expense 16,700

Retained earnings (beginning) 20,800

Salaries and wages expense 34,300

Salaries and wages payable 3,200

Service revenue 144,000

Supplies 4,700

Supplies expense 6,700

Compute the current ratio, debt to assets ratio, and earnings per share value. The average number of shares outstanding for 2025 was 10,000. (Round ratiosto 1 decimal places, e.g. 1.5:1 or 25.1% and earnings pershare to 2 decimal places, e.g. 2.25.)

Debt to Assets Ratio

36.4%

The following items are taken from the financial statements of Blossom Company for 2025:

Accounts payable $11,900

Accounts receivable 12,500

Accumulated depreciation—equipment 38,800

Advertising expense 20,700

Cash 13,000

Common stock 92,000

Depreciation expense 13,000

Dividends on common stock 14,900

Equipment 235,000

Insurance expense 2,800

Notes payable (due in 2028) 69,500

Prepaid insurance 5,900

Rent expense 16,700

Retained earnings (beginning) 20,800

Salaries and wages expense 34,300

Salaries and wages payable 3,200

Service revenue 144,000

Supplies 4,700

Supplies expense 6,700

Compute the current ratio, debt to assets ratio, and earnings per share value. The average number of shares outstanding for 2025 was 10,000. (Round ratiosto 1 decimal places, e.g. 1.5:1 or 25.1% and earnings pershare to 2 decimal places, e.g. 2.25.)

Earnings Per Share

$4.98

Solvency Ratios

Measures of the ability of the company to survive over a long period of time.

Current Ratio

Current assets divided by current liabilities.

Relevance

Information that has a bearing on a decision.

Materiality

An item important enough to influence the decision of an investor or creditor

Consistency

Same accounting principles and methods used from year to year within a company.

Faithful Representation

Information that accurately depicts what really happened.

Intangible Assets

Noncurrent resources that do not have physical substance.

Earnings per Share

(Net income – preferred stock dividends) divided by weighted average common shares outstanding.

Comparability

Different companies using the same accounting principles.

Economic Entity Assumption

Economic events can be identified with a particular unit of accountability.

Liquidity Ratios

Measures of the short-term ability of the enterprise to pay its maturing obligations.

Working Capital

The excess of current assets over current liabilities.

Which of the following is not an advantage of the corporate form of business organization?

Favorable tax treatment

An advantage of the corporate form of business is that

its ownership is easily transferable via the sale of shares of stock.

Which of the following would not be considered an internal user of accounting data for Amazon?

President of the employees' labor union

The best definition of assets is the

resources belonging to a company that have future benefit to the company.

Net income will result during a time period when

revenues exceed expenses.

Kingbird Company began the year with retained earnings of $120000. During 2025, the company issued $82500 of common stock for cash. The company recorded revenues of $739000, expenses of $638000, and paid dividends of $41000. What was Kingbird's net income for the year 2025?

$101000

Windsor Company began the year 2025 with retained earnings of $652000. During the year, the company sold additional shares of stock for $1007000, recorded revenues of $597000, expenses of $375000, and paid dividends of $136500. What was Windsor's retained earnings balance at the end of 2025?

$737500

Novak Corporation began the year with retained earnings of $325000. During the year, the company issued $412000 of common stock, recorded expenses of $1290000, and paid dividends of $77700. If Novak's ending retained earnings was $345000, what was the company’s revenue for the year?

$1387700

The total liabilities of Crane Construction Co. decreased by $81000 during the month of August 2025. Stockholders’ equity increased by $31000 during this period. By what amount and in what direction must total assets have changed during August?

$50000 decrease

Carla Vista Company compiled the following financial information as of December 31, 2025:

Service revenue $120000

Common stock 44000

Equipment 20000

Salaries and wages expense 40400

Rent expense 10100

Depreciation expense 50500

Cash 72000

Dividends 6000

Supplies 5000

Accounts payable 31000

Accounts receivable 13000

Retained earnings, 1/1/2025 22000

Carla Vista's total assets at December 31, 2025 are

$110000.

Pharoah Company compiled the following financial information as of December 31, 2025:

Service revenue $124000

Common stock 39000

Equipment 18000

Salaries and wages expense 41600

Rent expense 10400

Depreciation expense 52000

Cash 81000

Dividends 8000

Supplies 3000

Accounts payable 32000

Accounts receivable 13000

Retained earnings, 1/1/2025 32000

Pharoah's total stockholders’ equity at December 31, 2025 is

$83000.

Sandhill Services Corporation had the following accounts and balances:

Accounts payable $28500

Equipment $35700

Accounts receivable 4900

Land 34200

Buildings ?

Unearned service revenue 9900

Cash 15150

Total stockholders' equity ?

If the balance of stockholders' equity was $170000, what would be the total assets?

$208400

Notes to the financial statements include

descriptions of significant accounting policies used.

The management discussion and analysis (MD&A) section of the annual report includes

company's ability to fund operations and expansion.

An annual report includes

notes to the financial statements

Based on the following data, what are total assets?

Accounts payable $75000

Accounts receivable 66000

Cash 74000

Inventory 137000

Buildings 167000

Bonds payable 515000

Supplies 9800

Notes payable 58000

Equipment 344000

$797800

Borrowing money is an example of a(n)

financing activity.

Suppose that Forever 21 Company recorded the following cash transactions for the year:

Paid $130000 for salaries.

Paid $55000 to purchase office equipment.

Paid $14000 for utilities.

Paid $5000 in dividends.

Collected $275000 from customers.

What was Forever 21's net cash provided by operating activities?

$131000

Operating Activity

Cash receipts from customers

Cash payments to suppliers

Financing Activity

Issuance of common stock for cash

Payment of cash dividends

Investing Activity

Cash purchase of equipment

Sale of old machine for cash

Use the following information for the year ended December 31, 2025.

Prepaid insurance $900

Service revenue $18,600

Operating expenses 15,500

Cash 16,400

Accounts payable 9,400

Dividends 1,300

Accounts receivable 2,700

Notes payable 3,000

Common stock 9,500

Bonds payable 50,000

Retained earnings (beginning) 8,300

Equipment 62,000

Calculate the following: (Enter loss using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).

Net Income/ (Net Loss)

$3100

Use the following information for the year ended December 31, 2025.

Prepaid insurance $900

Service revenue $18,600

Operating expenses 15,500

Cash 16,400

Accounts payable 9,400

Dividends 1,300

Accounts receivable 2,700

Notes payable 3,000

Common stock 9,500

Bonds payable 50,000

Retained earnings (beginning) 8,300

Equipment 62,000

Calculate the following: (Enter loss using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).

Ending Retained Earnings

$10100

Use the following information for the year ended December 31, 2025.

Prepaid insurance $900

Service revenue $18,600

Operating expenses 15,500

Cash 16,400

Accounts payable 9,400

Dividends 1,300

Accounts receivable 2,700

Notes payable 3,000

Common stock 9,500

Bonds payable 50,000

Retained earnings (beginning) 8,300

Equipment 62,000

Calculate the following: (Enter loss using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).

Total Liabilities

$62400

The items for the medical practice of Donna Clark, MD, are listed below.

Retained earnings (October 1) $17,700

Common stock 31,000

Accounts payable 5,400

Equipment 31,000

Service revenue 24,000

Dividends 6,700

Insurance expense 3,800

Cash 11,100

Utilities expense 600

Supplies 2,700

Salaries and wages expense 9,600

Accounts receivable 10,500

Rent expense 2,100

Prepare an income statement for the month of October, 2025

Revenues:

Service Revenue $24000

Expenses:

Insurance Expense $3800

Utilities Expense $600

Salaries and Wages Expense $9600

Rent Expense $2100

Total Expense $16100

Net Income $7900

The items for the medical practice of Donna Clark, MD, are listed below.

Retained earnings (October 1) $17,700

Common stock 31,000

Accounts payable 5,400

Equipment 31,000

Service revenue 24,000

Dividends 6,700

Insurance expense 3,800

Cash 11,100

Utilities expense 600

Supplies 2,700

Salaries and wages expense 9,600

Accounts receivable 10,500

Rent expense 2,100

Prepare a retained earnings statement for the month of October, 2025. (List items that increase retained earnings first.)

Retained Earnings, October 1 $17700

Add: Net Income $7900

Less: Dividends $6700

Retained Earnings, October 31 $18900

Accounting Equation

Assets = Liabilities + Equity

Ending retained Earnings Equation

Beg RE+ Net income - Dividends = End RE

Earnings Per Share Equation

Net Income- Preferred Dividends / Weighted Average Common Shares Outstanding

Liquidity Ratio: Working Capital

Current Assets - Current Liabilities

Liquidity Ratio: Current Ratios

Current Assets/ Current Liabilities

Solvency Ratios: Debt to Assets Ratio

Total Liabilities / Total Assets

Net Income Equation

Revenues - Expenses