OMIS 327

1/69

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

70 Terms

Quantitative Analysis

scientific approach to managerial decision making

Business analytics

data driven approach to decision making that allows companies to make better decisions.

3 categories of business analytics

Descriptive - study and consolidation of historical data for a business and industry to measure how it is performing

Predictive - aimed at forecasting future outcomes based on patterns in the past data

Prescriptive - involves the use of optimization methods to provide new and better ways to operate

Quantitative Analysis Approach (QAA)-

scientific approach to managerial decision making in which raw data are processed and manipulated to produce meaningful information.

Steps to QAA -

Develop a clear, concise statement of the problem

Must be specific and measurable objectives

Develop a model (model = mathematical representation of a situation)

Model = realistic, solvable, and understandable mathematical representations of a situation.

Controllable inputs = decision variables

Uncontrollable inputs = pareteres; things outside of their control.

Deterministic models = a of the values used in the model are known with complete certainty

Probabilistic models = variables used in the model are estimates based on probabilities.

Acquiring input data

GIGO Rule - input data must be accurate.

Can come from a variety of sources

Developing a solution

Manipulating the model to arrive at the best (optimal solution)

Ex: solving equations, trial and error, complete enumeration (trying all [possible values.)

Testing the solution

Both input data and the model should be tested for accuracy and completeness before analysis and implementation.

Analyzing the results and sensitivity analysis

Determining the implications of of the solution

Sensitivity analysis - postoptimality analysis determines how much the results will change if the model or input data changes.

Implementing the results

Incorporates the solution into the company

Change takes place over time, so even successful implementations must be monitored to determine if modifications are necessary

Mathematical model-

set of mathematical relationships, expressed in equations and inequalities

Variable

a measurable quantity that may vary or is subject to change, can be controllable or uncontrollable

Parameter

a measurable quantity that is inherent in the problem

Profit

= revenue - (fixed cost + variable cost)

= (selling price per unit) (number of units sold)

= sX - [f + vX]

S = selling price price per unit

f = fixed cost

v = variable cost per unit

X = number of units sold

Advantages of mathematical modeling

Models can accurately represent reality

Models can help a decision maker formulate problems

Models can give us insight and information

Models can save time and money in decision making and problem solving

A model may be the only way to solve some large or complex problems in a timely fashion

A model can be used to communicate problems and solutions to others

Possible problems in quantitative analysis approach

Defining the problem

Conflicting viewpoints

Impact on other departments

Beginning assumptions

Solutions outdated

Developing a model

Acquiring input data

Developing a solution

Testing the solution

Analyzing teh results

6 steps in decision making

Clearly define the problem at hand

List the possible alternatives

Identify the possible outcomes or states of nature

List the payoff (typically profit) of each combination of alternatives and outcomes

Select one of the mathematical decision theory models

Apply the model and make your decision

Types of decision making environments

Decision making under certainty - decision maker knows with certainty the consequences of every alternative or decision choice

Decision making under uncertainty - the decision maker does not know the probabilities of the various outcomes

Decision making under risk - there are several possible outcomes for each alternative, and the decision maker knows the probability of occurrence of each outcome.

Decision making under uncertainty criteria

maximax - find maximum max

maximin - find the maximum of all minimum

minimax regret - (calculated by column vertically not horizontally by row)

Then pick smallest minimax by row (want the least regret)

difference between the optimal profit and the actual payoff for a decision

Decision making under risk criteria

Selecting the alternative with the highest expected monetary value

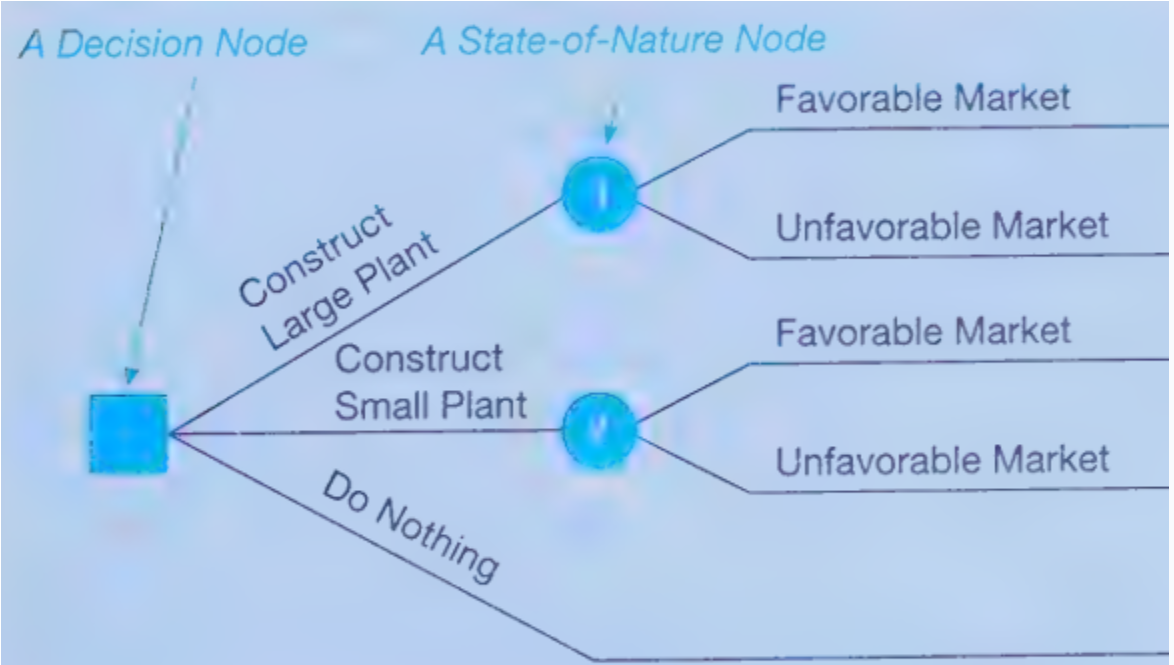

5 Steps of Decision Tree Analysis

Define the problem

Structure or draw the decision tree

Assign probabilities to the states of nature

Estimate payoffs for each possible combination of alternatives of nature

Solve the problem by compound EMVs for each state of nature node. This is done by working backwards, that is, starting at the right of the tree and working back to the decision nodes on the left. Also at each decision node, the alternative with the best EMV is selected.

All decision trees contain

Decision nodes - one of several alternatives may be chosen

Decision points

State of nature nodes - out of which one state of nature will occur

State of nature points

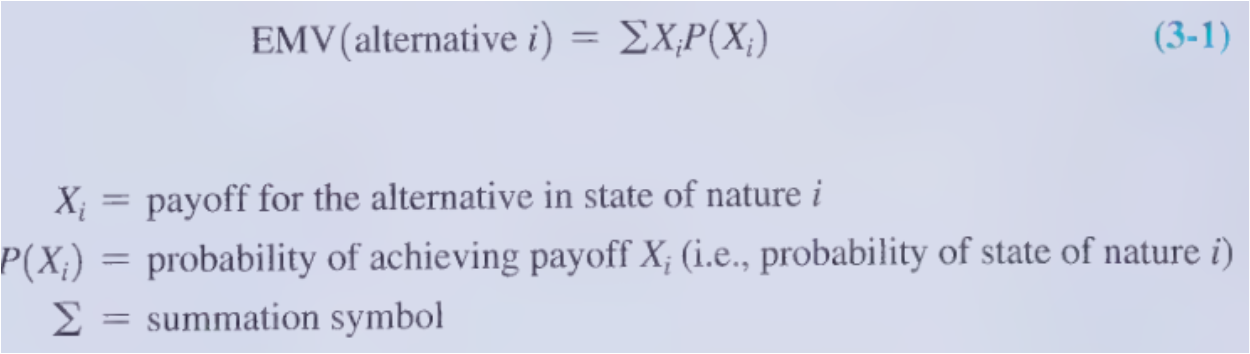

Expected monetary value (EMV)

long run average value of that decision. The sum of possible payoffs of the alternative, each weighted by the probability of that payoff occurring

EMV (alternative i)

= ΣXiP(Xi)

Xi = payoff for the alternative in state of nature i

P(Xi) = probability of achieving payoff Xi (i.e., probability of state of nature i)

Σ = summation symbol

Expected value with perfect information (EVwPI) =

Σ(Best payoff in state of nature 7 i) (probability of state of nature 7 i)

EPVI

= expected value of perfect information

EVwPI — Best EMV

Expected value of sample information (EVSI)

increase in expected value resulting from the sampling information.

= (EV with SI + cost) — (EV without SI)

Efficiency of sample information =

(EVSI/ EVPI)100%

Business Analytics

a data driven approach to decision making

Profit Function (px) =

revenue - total cost

Expected opportunity loss (EOL)

Σ(opportunity loss)*(probability)

Decision alternatives

different possible strategies the decision maker can employ

States of nature

refer to future events, not under the control of the decision maker, which may occur.

States of nature should be defined so that they are mutually exclusive and collectively exhaustive

Payoff

consequence resulting from a specific combination of a decision alternative and a state of nature

Linear programming (LP) is a widely used

mathematical modeling technique designed to help managers in planning and decision making relative to resource allocation.

Requirements of Linear programming

Problems seek to maximize or minimize an objective

Constraints limit the degree to which the objective can be obtained

There must be alternatives available

Mathematical relationships are linear

Properties of linear programs

One objective function

One or more constraints

Alternative courses of action

Objective function and constraints are linear—proportionality and divisibility

Certainty

Divisibility

Nonnegative variables

The steps in formulating a linear program follow:

Completely understand the managerial problem being faced.

Identify the objective and the constraints.

Define the decision variables.

Use the decision variables to write mathematical expressions for the objective function and the constraints.

Slack

(Amount of resource available) — (Amount of resource used)

Surplus

(Actual amount) — (Minimum amount)

Maximax (optimistic) criteria

find the maximum payoff for each alternative, pick the maximum out of the list of maximum

Locate the maximum payoff for each alternative

Select the alternative with the maximum number

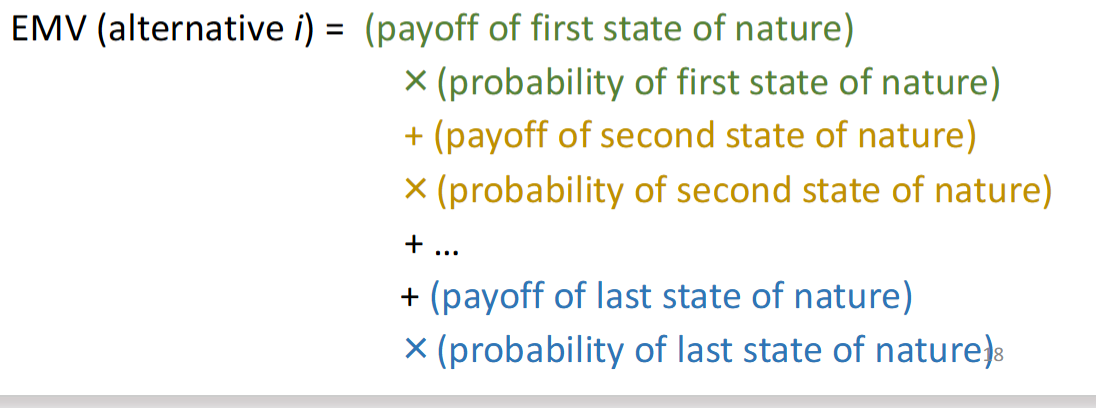

When there are several possible states of nature and

the probabilities associated with each possible state are known

Most popular method - choose the alternative with the highest expected monetary value (EMV) similar to expected value

For each alternative the emv is calculated by

EMV definition

( Expected Monetary Value) A higher, positive EMV signifies a more profitable, lower-risk decision or investment.

Minimax regret

Best payoff in each state – (x individual payoff of alternative)

(calculated by column vertically not horizontally by row)

Then pick smallest minimax by row (want the least regret)

Difference between the optimal profit and the actual payoff for a decision

How to solve for minimax regret

Calculate opportunity loss by subtracting each payoff in the column from the best payoff in the column (i.e. under each state of nature)

Find the maximum opportunity loss for each alternative and pick the alternative with the minimum number.

Optimization (mathematical) model includes:

Objective function - mathematical expression that describes the problems objective, such as maximizing profit or minimizing cost

Constraints - a set of restrictions or limitations, such as production capacities

Uncontrollable inputs - factors that are not under the control of the decision maker

Decision variables - controllable inputs, decision alternatives specified by the decision maker, such as the number of units of a product to produce

Linear programming problem -

both the objective function and the constraints are linear

Functions in which each variable appears in a separate term (ex: +, -, , *) raised to the first power and is multiplied by a constant (which could be 0)

Separate term -> x + y good, xy bad, x/y bad

Nonlinear format = bad (ex: √z) (ex: x-1)

Its okay to have a single variable ex: 1 + x

Linear constraints

linear functions that are restricted to be “≥”, “=”, “≤” or a constant

Nonnegativity constraint

X, Y ≥ 0

*basically just saying that your answer can’t be negative

Algebraic model

AX + BY ≤ 0

Ex: 20x + 30y ≤ 0

Linear constraint note-

usually (but not always) the linear function is on the left hand side of a constraint, and a constant on the right hand side

Hint phrases for linear constraint

>= constraint : at least, no less than , minimum requirement, etc

< = constraint: at most, no more than, maximum requirement, availability, capacity, budget etc

= constraint = exactly, equal to etc

Maximin

(pessimistic) - find all the minimums, find the largest minimum out of all mins

(find the max minimum)

Linear functions cannot have

variables multiplied together or raised to powers.

Limitations of LP

forces the decision maker to state one objective only

Integer programming

model that has constraints and an objective function identical to that formulated by the LP. (Only difference is that one or more of the decision variables has to take on an integer value in the final solution).

3 Types of integer programming problems

Pure integer programming problems - cases in which all variables are required to have integer values

Mixed integer programming problems - cases in which some, but not all, of the decision variables are required to have integer values

Zero-one integer programming problems - special cases in which all decision variables must have integer solution values of 0 or 1

Steps for integer programming

Defining the problem

Developing a model

Acquiring input data

Testing the solution

Analyzing the results

Implementing the results

Binary variable

0-1 decision; 0 if the condition is not met and 1 if the condition is met

In order for a break-even quantity to exist in the presence of positive fixed costs, sales price must

exceed variable cost per unit

a controllable variable is also called a:

a. decision variable.

b. mathematical model.

c. parameter.

d. measurable quantity.

a. decision variable.

A optimistic decision-making criterion is

a. decision making under certainty

b. maximax

c. maximin

d. equally likely.

b. maximax

Which of the following is not one of the steps in the quantitative analysis approach?

a. Defining the Problem

b. Observing a Hypothesis

c. Developing a Solution

d. Testing a Solution

b. Observing a Hypothesis

To be linear

all variables should be in separate terms and only raised to the power of 1.

An objective function is required for

any optimization problem, maximization or minimization.

In an LP problem

both objective function and constraints must both be linear.

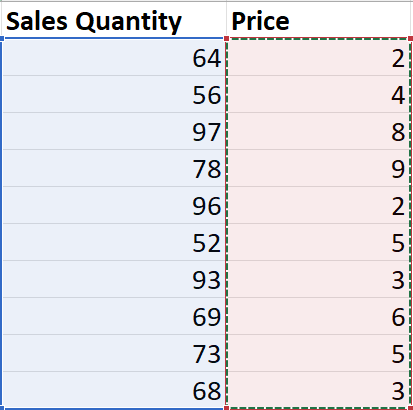

=SUMPRODUCT

multiplies 2 categories of rows (arrays) against each other

So 64 x 2, 56 x 4 etc. Need to have same number of values for both arrays so everyone gets multiplied against something

Slack

any unused resource of r an =<

Slack equation

(Any amount of resource available) -( amount of resource used)

Binding constraints

constraints with zero slack or surplus, meaning these constraints are binding at the optimality (bottleneck constraint we need to look out for)

Nonbinding constraints

constraints with non-zero slack or surplus

General build of constraint equation

Functional (actual amt) on the left side

Constant (max / min) on the right side

Ex: 5x + 7y ≤ 30

Surplus

excess amount for a >= constraint.

Surplus equation

(actual amt) - (minimum amt)

Sensitivity analysis

(aka post optimality analysis) used to determine how the optimal solution is affected by changes (w/ specific ranges in:) (used for dynamic changes)

Objective function coefficients

Right hand side (RHS) values in the constraints