Cost Volume Profit Formulas

1/17

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

18 Terms

Contribution Margin

Sales Revenue – Variable Expenses

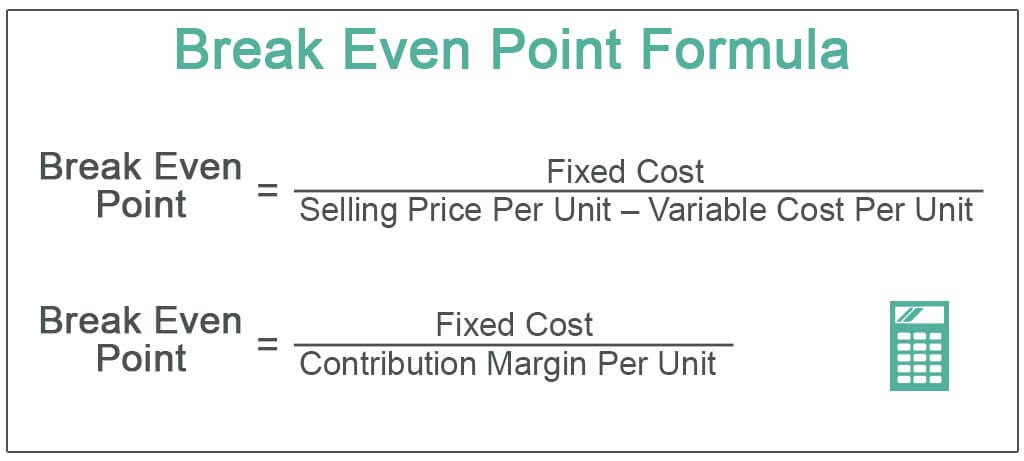

CM per Unit

Selling Price per Unit – Variable Expenses per Unit

Contribution Margin Ratio

CM / Sales Revenue

Breakeven point in Units

Fixed Expenses / CM per Unit

Breakeven point in Dollars

Fixed Expenses / CM Ratio

B/E Units x Selling Price per Unit

Target Sales in Units

(Fixed Expenses + Target Operating Income) / CM per Unit

Target Sales in Dollars

(Fixed Expenses + Target Operating Income) / CM Ratio

Operating Leverage

CM / Operating Income

Margin of Safety

Budgeted Sales – Breakeven Sales

Margin of Safety %

Margin of Safety / Budgeted Sales

Contribution margin percentage

Contribution margin ÷ Quantity of units sold = Contribution margin per unit

Revenues÷ Quantity of units sold = Selling price

Contribution margin per unit ÷ Selling price = Contribution Margin %

Operating income

Contribution margin percentage * Revenues - Fixed costs

Change in contribution margin

Contribution margin percentage * Change in revenues

Fixed costs

Contribution margin per unit * Breakeven quantity of units

Breakeven revenues

Breakeven quantity of units * Selling price

Net income

Operating income - Income taxes

Quantity of units required to be sold

(Fixed costs + Target operating income) ÷ Contribution margin per unit

Operating Income

Net Income / (1 - Tax Rate)