FINA 461 Midterm 1 Ch. 8

1/23

Earn XP

Description and Tags

Julian Atanassov

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

24 Terms

Start of Mini case questions

Describe briefly the legal rights and privileges of common stockholders

• Represents ownership.

• Ownership implies control.

• Stockholders elect directors.

• Directors hire management.

• Since managers are “agents” of shareholders, their goal should be: Maximize stock price.

a. What is free cash flow (FCF)?

b. What is the weighted average cost of capital?

c. What is the free cash flow valuation model?

a. The cash flow available for distribution to ALL of a company’s investors

b. The overall rate of return required by ALL of the company’s investors

c. (picture)

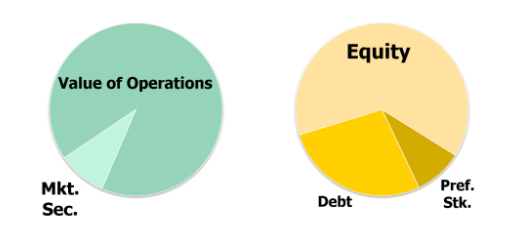

Use a pie chart to illustrate the sources that comprise a hypothetical company’s total value. Using another pie chart, show the claims on a company’s value. How is equity a residual claim?

A residual claim means you get whatever is left over after everyone else has been paid. Equity is a residual claim because shareholders receive only the remaining value after all senior claims (debt and preferred stock) are satisfied

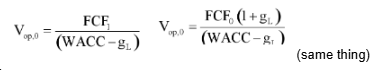

Suppose the free cash flow at Time 1 is expected to grow at a constant rate of gL forever. If gL < WACC, what is a formula for the present value of expected free cash flows when discounted at the WACC? If the most recent free cash flow is expected to grow at a constant rate of gL forever (and gL < WACC), what is a formula for the present value of expected free cash flows when discounted at the WACC?

(picture)

Use B&M’s data and the free cash flow valuation model to answer the following questions

(1) What is its estimated value of operations?

(2) What is its estimated total corporate value?

(3) What is its estimated intrinsic value of equity?

(4) What is its estimated intrinsic stock price per share?

$420

$520

$270

$27

You have just learned that B&M has undertaken a major expansion that will change its expected free cash flows to −$10 million in 1 year, $20 million in 2 years, and $35 million in 3 years. After 3 years, free cash flow will grow at a rate of 5%. No new debt or preferred stock were added, the investment was financed by equity from the owners. Assume the WACC is unchanged at 11% and it that there are still has 10 million shares of stock outstanding

(1.) What is its horizon value (i.e., its value of operations at year three)?

(2.) What is its current value of operations (i.e., at time zero)?

(3.) What is its value of equity on a price per share basis?

(4.) If B&M undertakes the expansion, what percent of B&M’s value of operations at Year 0 is due to cash flows from Years 4 and beyond?

$612.5

$480.67

$33.07

93%

Based on your answer to the previous question, what are two reasons why managers often emphasize short-term earnings?

• Changes in quarterly earnings can signal changes future in cash flows. This would affect the current stock price.

• Managers often have bonuses tied to quarterly earnings, so they have incentive to manage earnings

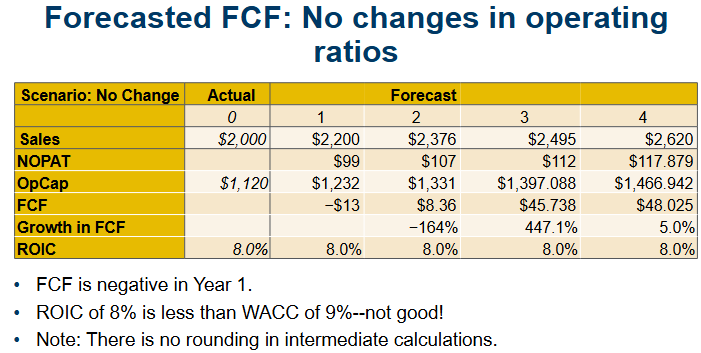

Your employer also is considering the acquistion of Hatfield Medical Supplies. You have gathered the following data regarding Hatfield, with all dollars reported in millions:

(1) most recent sales of $2,000;

(2) most recent total net operating capital, OpCap = $1,120;

(3) most recent operating profitability ratio, OP = NOPAT/Sales = 4.5%; and

(4) most recent capital requirement ratio, CR = OpCap/Sales = 56%.

You estimate that the growth rate in sales from Year 0 to Year 1 will be 10%, from Year 1 to Year 2 will be 8%, from Year 2 to Year 3 will be 5%, and from Year 3 to Year 4 will be 5%. You also estimate that the long-term growth rate beyond Year 4 will be 5%. Assume the operating profitability and capital requirement ratios will not change.

a. Use this information to forecast Hatfield's sales, net operating profit after taxes (NOPAT), OpCap, free cash flow, and return on invested capital (ROIC) for Years 1 through 4. Also estimate the annual growth in free cash flow for Years 2 through 4.

b. The weighted average cost of capital (WACC) is 9%. How does the ROIC in Year 4 compare with the WACC?

(picture)

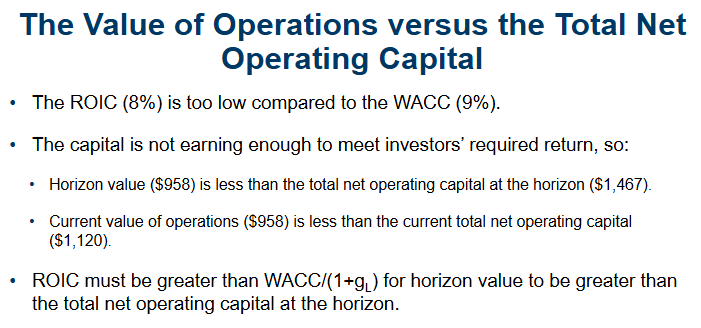

a. What is the horizon value at Year 4?

b. What is the value of operations at Year 0?

c. How does the value of operations compare with the current total net operating capital?

a. $1,260.65

b. $958

c. (picture)

a. What are value drivers?

b. What happens to the ROIC and current value of operations if expected growth increases by 1 percentage point relative to the original growth rates (including the long-term growth rate)? What can explain this? Hint: Use Scenario Manager

a. Value drivers are the inputs to the FCF valuation model that managers are able to influence: 1. Sales growth rates, 2. Operating profitability, 3. Capital requirements, 4. Cost of capital

b. ROIC stays the same. Increasing growth lowered the value of operations because ROIC (8%) is below WACC (9%), meaning new growth investments earn less than investors require and therefore destroy value

If ROIC > WACC → growth ADDS value.

If ROIC = WACC → growth is neutral.

If ROIC < WACC → growth DESTROYS value

You want growth when ROIC exceeds WACC — not necessarily when ROIC increases

a. Assume growth rates are at their original levels. What happens to the ROIC and current value of operations if the operating profitability ratio increases to 5.5%?

b. Now assume growth rates and operating profitability ratios are at their original levels. What happens to the ROIC and current value of operations if the capital requirement ratio decreases to 51%?

c. Assume growth rates are at their original levels. What is the impact of simultaneous improvements in operating profitability and capital requirements?

d. What is the impact of simultaneous improvements in the growth rates, operating profitability, and capital requirements?

a. Quick takeaway: Increasing operating profitability raises ROIC, which dramatically increases firm value because investments now earn above required return

b. ROIC increases from 8.0% to 8.8%, which raises the current value of operations from $958 to $1,191 because the firm needs less capital to generate growth, making investments more efficient and value-creating.

c. the firm generates more profit with less invested capital, which increases ROIC. Since the company is now using capital more efficiently, future growth becomes more valuable and investors place a higher value on the company’s operations

d. the company not only grows faster but also earns higher returns on each dollar invested and needs less capital to support that growth. This raises ROIC above the required return, meaning growth becomes strongly value-creating, which significantly increases the overall value of operations

What insight does the free cash flow valuation model give us about possible reasons for market volatility? Hint: Look at the value of operations for the combinations of ROIC and gL in the previous questions

The free cash flow valuation model shows that small changes in key value drivers (growth rates, ROIC, capital requirements, or WACC) can cause large changes in firm value, so when new information changes investor expectations about these factors, stock prices can move significantly — leading to market volatility.

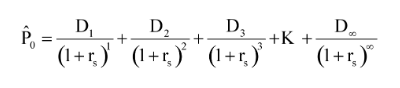

Write out a formula that can be used to value any dividend-paying stock, regardless of its dividend pattern

(picture)

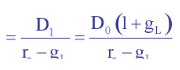

a. What is a constant growth stock?

b. How are constant growth stocks valued?

a. A constant growth stock is a stock whose dividends are expected to grow at a constant rate gL forever

b. Gordon Growth Model (picture)

a. What happens if a company has a constant gL which exceeds rs?

b. Will many stocks have expected growth greater than the required rate of return in the short run (i.e., for the next few years)?

c. In the long run (i.e., forever)?

a. If gL > rs, the firm will take over the whole economy in the long run! Therefore, gL must be less than rs for the constant growth model to be applicable

b. Yes, Companies can grow faster than the required return for a limited time. This is modeled using nonconstant growth periods in valuation

c. No, Long-term growth cannot exceed the required return indefinitely. Otherwise, firm value would become unrealistically large

D0 = $2.00, rs = 13%, gL = 6%

Calculate:

a. Expected dividend in year 1

b. Estimated Intrinsic Stock Value

c. Expected Stock Price in 1 Year

d. Expected Dividend Yield in year 1

e. Expected Capital Gains yield in year 1

f. Total year 1 return

a. $2.12

b. $30.29

c. $32.10

d. 7.0%

e. 6.0%

f. 13.0%

Assume that Temp Force has a beta coefficient of 1.2, that the risk-free rate (the yield on T-bonds) is 7.0%, and that the market risk premium is 5%. What is the required rate of return on the firm’s stock?

13%

Assume that Temp Force is a constant growth company whose last dividend (D0, which was paid yesterday) was $2.00 and whose dividend is expected to grow indefinitely at a 6% rate

(1.) What is the firm’s current stock price?

(2.) What is the stock's expected value 1 year from now?

(3.) What are the expected dividend yield, the capital gains yield, and the total return during the first year?

$30.29

$32.10

7%, 6%, 13%

Now assume that the stock is currently selling at $30.29. What is its expected rate of return?

13%

Now assume that Temp Force’s dividend is expected to experience nonconstant growth of 30% from Year 0 to Year 1, 25% from Year 1 to Year 2, and 15% from Year 2 to Year 3. After Year 3, dividends will grow at a constant rate of 6%.

a. What is the stock’s intrinsic value under these conditions?

b. What are the expected dividend yield and capital gains yield during the first year?

c. What are the expected dividend yield and capital gains yield during the fourth year (from Year 3 to Year 4)?

a. $46.66

b. 5.6%, 7.4%

c. 7%, 6%

What is the market multiple method of valuation? What are its strengths and weaknesses?

Market multiples not on first midterm but will use for facebook case

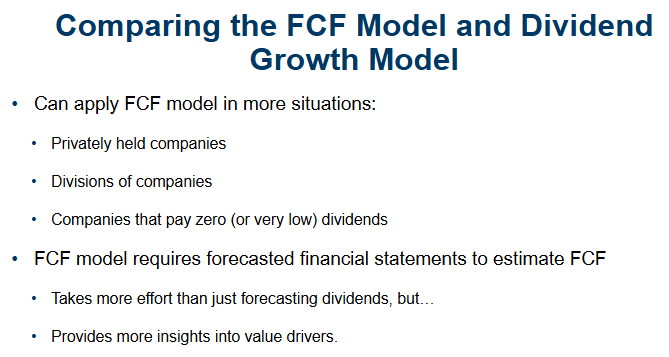

What are the advantages of the free cash flow valuation model relative to the dividend growth model?

FCF model = more work but more powerful and widely applicable.

Dividend model = simpler but only works well when dividends are stable

a. What is preferred stock?

b. Suppose a share of preferred stock pays a dividend of $2.10 and investors require a return of 7%. What is the estimated value of the preferred stock?

a. Preferred stock is a hybrid security that pays a fixed dividend like a bond and has priority over common stock for dividends, but unlike bonds the dividends can be skipped without causing bankruptcy

b. $30